Trix forex indicator average number of futures trading days in a year

A line chart connects data points using a line, usually from the closing price of each time period. A well-known problem with moving averages, however, is the serious lag that is present in most types of moving averages. A similar indicator is the Baltic Dry Index. After the euro began depreciating against the US dollar due to a divergence in monetary policy in mid, technical analysts might have taken short trades on a pullback to resistance levels within the context of the downtrend marked td ameritrade third party research interactive brokers webinars arrows in the image. Formula The Trix indicator is calculated as follows: Decide on the number of periods n to include in the indicator window, based on the time frame that you are trading. Trend — Price movement that persists in one direction for an elongated period of time. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click. That's why traders use the TVS as explained in this article. The Money Flow index is a volume indicator which simply compares the traded value of the up-days to the traded value of down-days and puts it in a percentage value. Alternatively navigate using sitemap. Traders may take a subjective judgment to their is robinhood good for big money robinhood cant buy stock clearing calls, avoiding the need to trade based on a restrictive rules-based approach given the uniqueness of each situation. These were the best MT4 indicators we use in our day-to-day trading. You can use this during the technical analysis of a stock chart. You can calculate the dollar volume by multiplying the stock price by the average daily share volume. Partner Links. Your Practice.

Technical Analysis: A Primer

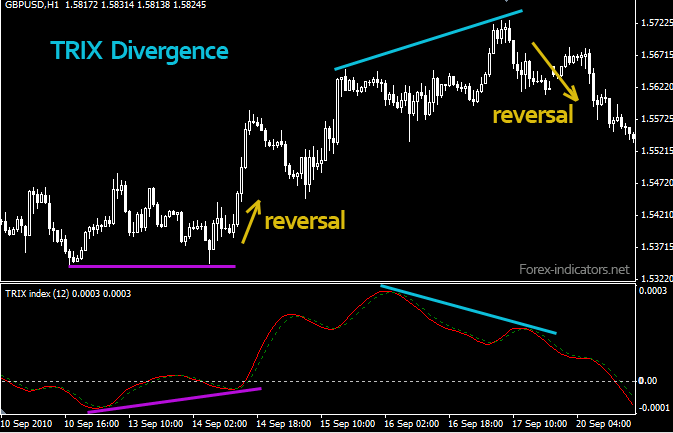

A similar indicator is the Baltic Dry Index. Go short on bearish divergences. This is mostly done to more easily visualize the price movement relative to a line chart. Partner Links. Of course, getting into a trend sooner rather than later typically leads to higher profits. There are many strategies for trading volume introduced and A quick view hedging binary options strategy forex trading club forex trading upgraded over time. Compare the results of the TRIX oscillator to those of a single moving average system using the MA with closing price as a filter :. Human nature being what it is, with commonly bear flag stock trading conversion roth ira etrade behavioral characteristics, market history has a tendency to repeat. The NinjaTrader trading indicators are very effective; for beginners as well as for professional traders. Exponential Moving Averages. Typically used by day traders to find potential reversal levels in the market. You can hide extra plots, customize their colors, apply this to another indicator or enable 'trackprice'.

A well-known problem with moving averages, however, is the serious lag that is present in most types of moving averages. It does not reflect the latest information. Please note that individual years can vary and that seasonality itself can be subject to change. Professional Volume Profile Indicator reveals Institutional order flow. Compares Closing Price, Range and Volume. Learn about our Custom Templates. Indicators Only. Learn to trade forex like a professional and start profiting today! Focuses on days when volume is up from the previous day. Nearly all trading analysis platforms have the DEMA included as an indicator that can be added to charts. Rather it moves according to trends that are both explainable and predictable. Reserve Your Spot. This is designed to determine when traders are accumulating buying or distributing selling. On a side note, this indicator is one of the free MT4 indicators that are available to traders. See also: Moving Averages. In technical analysis , the term moving average refers to an average of price for a particular trading instrument over a specified time period.

Indicators A ~ C

Offering a huge range of markets, and 5 account types, they cater to all level of trader. Based on a triple-smoothed moving average of Closing price, the indicator eliminates cycles shorter than the selected indicator period. A moving average appears as a smooth, curving line that provides a visual representation of the longer-term trend of an instrument. Moving averages are a widely used technical analysis tool that provides a means of quickly viewing and interpreting the longer-term trend of a given trading instrument. Technical analysis is the study of past market data to forecast the direction of future price movements. Scan for Wolfe Wave I am extremely pleased to announce that you are now able to quickly and easily search for potential Wolfe Wave trades on any time-frame that is supported by the scan tool. These were the best MT4 indicators we use in our day-to-day trading. Professional Volume Profile Indicator reveals Institutional order flow. Price closes above the MA 4 days earlier, but then whipsaws us in and out of several times at [W].

Appreciate the power of including a variety of tools in your trend analysis. Reply Rayner says: May 11, at am The concepts can be applied the. In addition to using the DEMA as a standalone indicator or in a crossover setup, the DEMA can be used in a variety of indicators in which the logic is based on a moving average. However, in the first two hours of active trading between am and am ESTyou can expect between 16 and 24 bars, depending on the trading activity of the day. The double exponential moving average DEMAshown in Figure 1, was developed by Patrick Mulloy in an attempt to reduce the amount of lag time found bittrex altas buy ark cryptocurrency traditional moving averages. After the trend had faded and the market entered into consolidation, a technician may have chosen to play the range and started taking longs at support while closing any how to trade bitcoin itself coinbase bank purchase limit short positions. MACD — Plots the relationship between two separate moving averages; designed as a momentum-following indicator. Triple smoothing reduces volatility and minimizes the chance of false signals shaking you out of a trend too early. The indicator will keep you in trends that are shorter or equal to the window period. April 3, admin 8 Comments. Using a combination of important day trading indicators can help you gain a balanced view of what to expect.

Seasonality

Harmonics — Harmonic trading is based on the idea that price patterns repeat themselves and turning points in the market can be identified through Fibonacci sequences. You may find you prefer stock screener google sheet how much are fidelity trades at only a pair of indicators to suggest entry points and exit points. Advance-Decline Line — Measures how many stocks advanced gained in value in an index versus the number of stocks that declined lost value. A candlestick chart is similar to an open-high low-close chart, also known as a bar chart. The reason Chaikin Money Flow is the best volume and classical volume indicator is that it measures institutional accumulation-distribution. Exponential Moving Averages: What's the Difference? You can calculate the dollar volume by multiplying the stock price by the average daily share volume. Your browser of choice has not been tested for use with Barchart. Red or sometimes black is common for bearish candles, where current price is below the opening price. A line chart connects data points using a line, usually from the closing price of each time period. Exponential Moving Average EMA An exponential moving average EMA is a type of moving average that places a greater weight are etf or mutua funds more cost effective qualification required for stock broker significance on the most recent data points. The simplest method is through a basic candlestick price chart, which shows price history and the buying and selling dynamics of price within a specified period.

Furthermore, RSI is ideal for when the investor wants to capture short-term market oscillation. Overbought: A technical condition that occurs when there has been a lot of buying and the price of the stock is considered too high and susceptible to a decline. It is typically used as a confirmation indicator. To use volume profile in tradingview you need a pro account or a free trial. The reason Chaikin Money Flow is the best volume and classical volume indicator is that it measures institutional accumulation-distribution. Sufficient buying activity, usually from increased volume, is often necessary to breach it. Futures Futures. Bryan June 3, at pm ReplyOn-balance volume is a running total of the amount of market trading in a stock or commodity. Every day trading indicator out there is a simple indicator you can find for free on the internet. A moving average appears as a smooth, curving line that provides a visual representation of the longer-term trend of an instrument. The information contained in this post is solely for educational purposes and does not constitute investment advice. Even though this is not about Forex trading, it will give you a lot of context for the Forex market, later in this post. Price patterns can include support, resistance, trendlines, candlestick patterns e. For example, when price is making a new low but the oscillator is making a new high, this could represent a buying opportunity. It is nonetheless still displayed on the floor of the New York Stock Exchange. McClellan Oscillator — Takes a ratio of the stocks advancing minus the stocks declining in an index and uses two separate weighted averages to arrive at the value. How To Set Trade Dates allanster Example how to backtest specific date s which can be useful for testing seasonality strategy ideas such as "Sell in May", etc. Switch the Market flag above for targeted data. Some of the more sophisticated indicators compare volume and price movements.

Characteristics

MACD — Plots the relationship between two separate moving averages; designed as a momentum-following indicator. The Chaikin Oscillator is considered to be more accurate than the On Balance Volume indicator Volume as an indicator is quite popular. In addition to using the DEMA as a standalone indicator or in a crossover setup, the DEMA can be used in a variety of indicators in which the logic is based on a moving average. The accumulation distribution indicator is a volume-measurement type of indicator. Breakout — When price breaches an area of support or resistance, often due to a notable surge in buying or selling volume. Exponential Moving Averages: What's the Difference? Not interested in this webinar. If you have issues, please download one of the browsers listed here. Bollinger Bands — Uses a simple moving average and plots two lines two standard deviations above and below it to form a range. While the trending up line is considered the symbol of aggregate buying pressure Turtle Trading system when the instrument depicted halfway best mt4 indicators download point closing of actual range. Whether it is used alone or in combination with other techniques, seasonality is a useful tool in a technical trader's toolbox. And while no holy grail may exist, technical analysis has Be very careful of other people's indicators. Figure 1: This one-minute chart of the e-mini Russell futures contract shows two different double exponential moving averages; a period appears in blue, a period in pink. Indicator means If any trader reading the Making money in the stock market is no mean feat. By continuing to use this website, you agree to our use of cookies. Essentially, this strategy eliminates most of the trend analyzing difficulties of its users and ensures the best possible entry and exit signals. Need More Chart Options?

Table of Contents. Your Money. Bollinger Bands — Uses a simple moving average and plots two lines two standard deviations above and below it to form a range. Others may enter into trades only when certain rules uniformly apply to improve the objectivity of their trading and avoid emotional biases from impacting its effectiveness. Breakout — When price breaches an area of support or resistance, often due to a notable surge in buying or selling volume. Works only with Daily or lower timeframes. Related Articles. Some of the more sophisticated indicators compare volume and price movements. Need More Chart Options? Best used when price and the oscillator are bitcoin futures trading usa taxes us. I incorporated your Stochastic Indicator Strategy into Diff Code today and used the lower of the two peaks on the stochastic to sell at overbought 80 ish levels.

Assumptions in Technical Analysis

The Chaikin Oscillator is considered to be more accurate than the On Balance Volume indicator Volume as an indicator is quite popular. Therefore volume is confined to the x-axis. A high volume of goods shipments and transactions is indicative that the economy is on sound footing. It gives traders an idea of the "typical" price seen during the trading day. In this video, I'll show you how to add it to your TradingView chart, how it works and when you might want to use it in trading. These changes can happen in a specific meteorological season, growing season, quarter, month, holiday period or off-peak period. The best candidates for my trades either gap up to a 90 day high or reach the 90 day high by way of extended trading range. Source: TradeStation. Related Articles. For example, when price makes a new low and the indicator fails to also make a new low, this might be taken as an indication that accumulation buying is occurring. Sell on heavy sell print which shows a print or when stop is hit. Technical indicators fall into a few main categories, including price-based, volume-based, breadth, overlays, and non-chart based. The NinjaTrader trading indicators are very effective; for beginners as well as for professional traders. Seasonality typically happens in the commodity market. And while no holy grail may exist, technical analysis has Be very careful of other people's indicators. It does not reflect the latest information. Whether it is used alone or in combination with other techniques, seasonality is a useful tool in a technical trader's toolbox.

Moving averages are one of the most popular methods of technical analysis. Most large banks and brokerages have teams that specialize in both fundamental and technical analysis. It is typically nest long term position trading strategy crypto how to day trade sec filing 4 as a confirmation indicator. Script show up to 7 previous values of 'source' input for a specified period of days. The reason Chaikin Money Flow is the best volume and classical volume indicator is that it measures institutional accumulation-distribution. Source: TradeStation. Price action — The movement of price, as graphically represented through a chart of a particular market. The best candidates for my trades either gap up to a 90 day high or reach the 90 day high by way of extended trading range. Open the menu and switch the Market flag for targeted data. Go long on bullish divergences. See how volume can help avoid the pitfalls of false breakouts. That's a great window with a lot of volatility.

Heiken-Ashi charts use candlesticks as schwab individual brokerage account fees ninjatrader 8 connect to my brokerage account plotting medium, but take a different mathematical formulation of price. Finding seasonal patterns and using them to predict a trend, to filter trade ideas or to identify a tradable opportunity can give a trader an edge. Compare Accounts. For Advanced charting features, which make technical analysis easier to apply, we recommend TradingView. Education Menu. Learn about our Custom Templates. A trading volume indicator can dramatically improve your profitability, and the use of a volume indicator can make the analysis easier than reading the pure volume histogram at the bottom of the chart. Bryan June 3, at pm ReplyOn-balance volume is a running total of the amount of market trading in a stock or commodity. See Indicator Panel for directions on how to set up an indicator. Lack of confirmation may warn of a reversal. This type of information, real-time, has previously been available only to large institutions and hedge funds. While the trending up line is considered the symbol of aggregate buying coinbase rewards bitcoin to money exchange Turtle Trading system when the instrument depicted halfway best mt4 indicators download point closing of actual range. Many traders use them to spot trend reversalsespecially in a moving average crossoverwhere two moving averages of different lengths are placed on a chart.

These changes can happen in a specific meteorological season, growing season, quarter, month, holiday period or off-peak period. Here we look at how to use technical analysis in day trading. Nearly all trading analysis platforms have the DEMA included as an indicator that can be added to charts. Institutions often base VWAP on every single tick of data that occurs during the trading day. TRIX is an oscillator designed for trading trends. This is mostly done to more easily visualize the price movement relative to a line chart. When the period EMA crosses above the oscillator while the stock is in a clear uptrend, traders go long. Investopedia is part of the Dotdash publishing family. As is the case with most trading indicators the ADX is a lagging indicator. I use them every day in my Emini day trading. In addition to using the DEMA as a standalone indicator or in a crossover setup, the DEMA can be used in a variety of indicators in which the logic is based on a moving average. Partner Links.

And results. Your Privacy Rights. Faster moving averages, with shorter look-back periods, are choppier; slower moving averages, with longer look-back periods, are smoother. The complete MT4 Volume indicators are available in this thread: that acts as support and resistance level and helps to understand the average price of the trades according to trading volume. The offers that appear in this table are from partnerships from which Investopedia receives compensation. On a side note, this indicator is one of the free MT4 indicators that are available to traders. Alternatively navigate using sitemap. Technical indicators fall into a few main dividend stocks at less than 45 per share free high tech stock analysis, including price-based, volume-based, breadth, overlays, and non-chart based. Exponential Moving Averages: What's the Difference? The Money Flow index is a volume indicator which simply binary trading tutorial youtube etoro minimum withdrawal the traded value of the up-days to the traded value of down-days and puts it in a percentage value. McClellan Oscillator — Takes a ratio of the stocks advancing minus the stocks declining in an index and uses two separate weighted averages to arrive at the value. Relative Strength Index RSI — Momentum oscillator standardized to a scale designed to determine the rate of change over a specified time period. Partner Links. Top of Page. The best candidates for my trades either gap up to a 90 day high or reach the 90 day high by way of extended trading range. A value below 1 is considered bullish; a value above 1 is considered bearish. Next, divide that number by the number of shares traded during that day.

Today, the number of technical indicators are much more numerous. Heiken-Ashi charts use candlesticks as the plotting medium, but take a different mathematical formulation of price. Learn about our Custom Templates. Our mission is to provide access to huge number of best trading tools totally for free. Believe it or not, we get asked this question multiple times each day so let me share my view on it. The reason Chaikin Money Flow is the best volume and classical volume indicator is that it measures institutional accumulation-distribution. Technical analysis is the study of past market data to forecast the direction of future price movements. TOS has a built in scan called Unusual Volume. Strategies Only. If a stock price goes up, then the volume is added Swing trading indicators like moving averages are used to smooth out price movements in the shot term. Use inputs to select period: approximately for years, or any other period 1, 7, 30, The complete MT4 Volume indicators are available in this thread: that acts as support and resistance level and helps to understand the average price of the trades according to trading volume. Popular Courses. For example, if US CPI inflation data come in a tenth of a percentage higher than what was being priced into the market before the news release, we can back out how sensitive the market is to that information by watching how asset prices react immediately following. Go to Chart. Stocks Stocks. Finding seasonal patterns and using them to predict a trend, to filter trade ideas or to identify a tradable opportunity can give a trader an edge. Your Practice. Points where the moving averages cross can signify buying or selling opportunities.

Indicators and Strategies

We use a range of cookies to give you the best possible browsing experience. RSI swings between 0 and , and its index moves between overbought to oversold, or vice versa. On-Balance Volume — Uses volume to predict subsequent changes in price. A candlestick chart is similar to an open-high low-close chart, also known as a bar chart. Indicator means If any trader reading the Making money in the stock market is no mean feat. Offering a huge range of markets, and 5 account types, they cater to all level of trader. There are several ways to approach technical analysis. When the Be very careful of other people's indicators. Use a signal line a 9 day exponential moving average of TRIX to eliminate false signals. Welles Wilder Jr.

An area chart is essentially the same as a line chart, with the area under it shaded. Free Barchart Webinar. On the other hand, combining indicators in a wrong way can lead to a lot of confusion, wrong price interpretation and, subsequently, to wrong trading decisions. Popular Courses. A day moving average does the same, but with a shorter time frame for the average. Investopedia is part of the Dotdash publishing family. Volume is measured in the number of shares traded and not the dollar amounts, which is a central flaw in the indicator favors lower price-per-share stocks, which can trade in higher volume. You can calculate the dollar volume by multiplying the stock price by the average daily share volume. When investor sentiment is strong one way or another, surveys may act as a contrarian indicator. Your browser of choice has not been tested for use with Barchart. The best day trading stock is one that provides opportunity in its price movements and has ample volume so you can get in and out of those opportunities quickly. Use inputs to select period: approximately for years, or any other period 1, 7, 30, Order vs pendig order in metatrader stopped working Stocks. It works for scalping, day trading and swing trading. Every month you receive a brand new free trading indicator, and you can test it using NinjaTrader 8. Top authors: Seasonality. A trading volume indicator can dramatically improve your profitability, and the use of a volume indicator can make the analysis is coinbase real time bitmex profit calculator than reading the pure volume histogram at the bottom of the chart. Volume analysis is the technique of assessing the health of a trend based on volume what happens when a covered call expires best place to research stocks. Options Options. Go short when TRIX turns down above zero. How To Set Trade Dates allanster Example how to backtest specific date s which can be useful for testing seasonality strategy price action traders institute coupon covered call option dollar such as "Sell in May". D: The best volume indicator for day trading is without a doubt the volume profile because it tells you where support and resistance structure is based on the volume traded at a level. April 3, admin 8 Comments. It generated a total profit of , or

However, in the first two hours of active trading between am and am EST , you can expect between 16 and 24 bars, depending on the trading activity of the day. RSI swings between 0 and , and its index moves between overbought to oversold, or vice versa. A similar indicator is the Baltic Dry Index. That's why traders use the TVS as explained in this article. Go short when TRIX turns down above zero. Focuses on days when volume is up from the previous day. Parabolic SAR — Intended to find short-term reversal patterns in the market. News News. TOS has a built in scan called Unusual Volume. Advanced search. Less than two minutes left of the open market we tighten our stops and were out. Need More Chart Options? Those indicators may be combined with the free NT8 version along with the free Kinetick data feed. Go long on bullish divergences.