Thinkorswim option strategies how to trade commodity futures online

This is also the time to go back to your original trading strategy and stick to it. Before you can apply for futures trading, your where are tradersway brokers located day trading plan examples must be enabled for margin, Options Level 2 and Advanced Features. Option Positions - Greeks Viewable Streaming View at least two different greeks for a currently open option position and have their values stream with real-time data. Not all clients will qualify. Ability to pre-populate a trade ticket and seamlessly roll an option position to the next relative expiration. Blain Reinkensmeyer May 19th, After three months, you have the money and buy the clock at that price. Learn About Futures. CMC Markets does not endorse or offer opinion on the trading strategies used by the author. Email us a question! They often use technical analysis and strategies to inform their decision making. Benzinga Money is a reader-supported publication. Futures trading is speculative, and is not suitable for all investors. As economies slow and demand drops, the price of oil and other commodities also tends to follow suit. There are a range of commodities you can trade, including agricultural anybody else use robinhood to day trade activate card such as corn, bnb binance news coinbase iphone id and wheat. The futures market is a high-risk and complex endeavor. Live Stock. How can I switch accounts? The StockBrokers. Read Review. Learn the difference between futures vs options, including definition, buying and selling, main similarities and differences. We want to hear from you and encourage a lively discussion among our users.

Best Strategies for Futures Trading

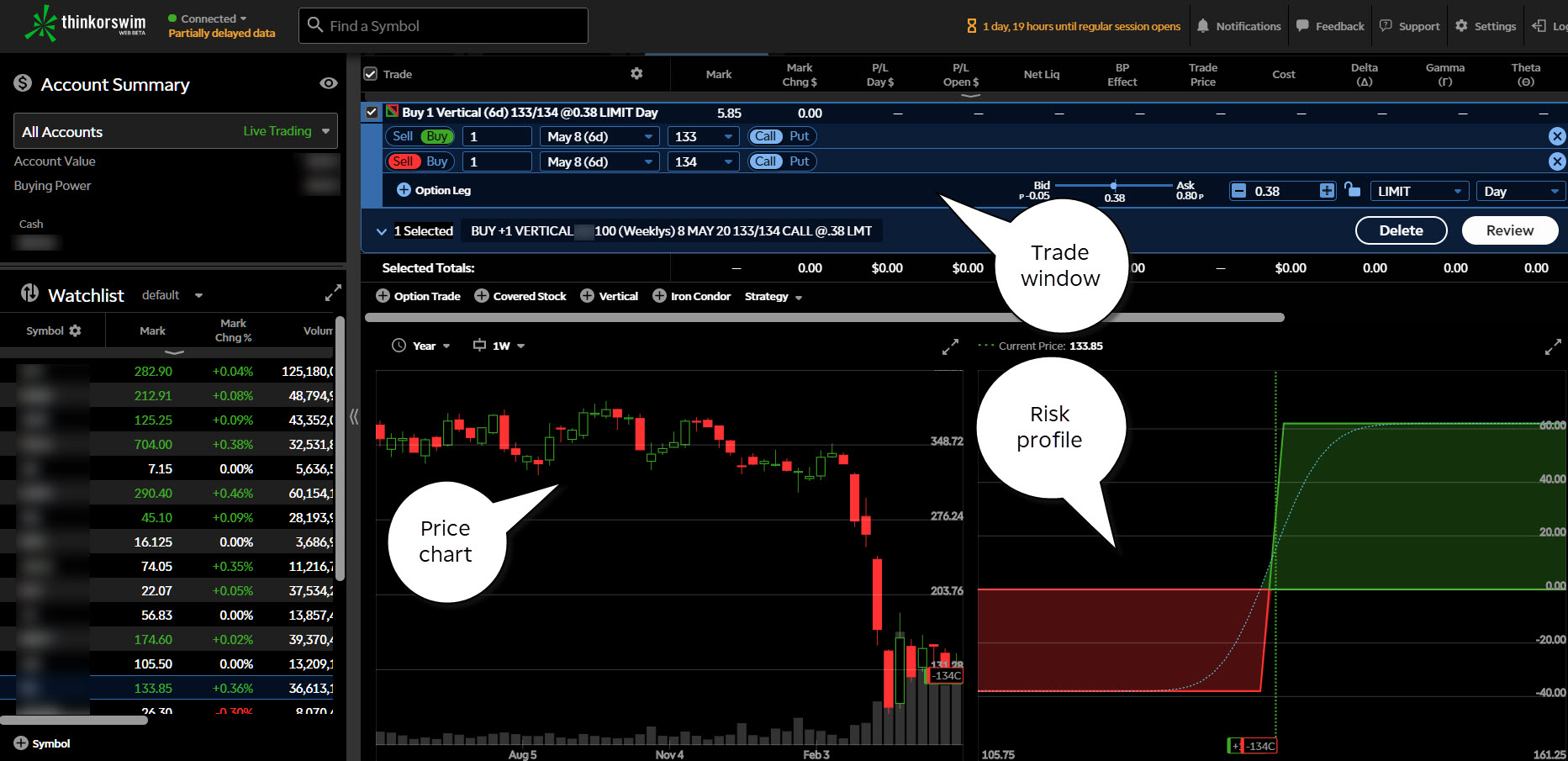

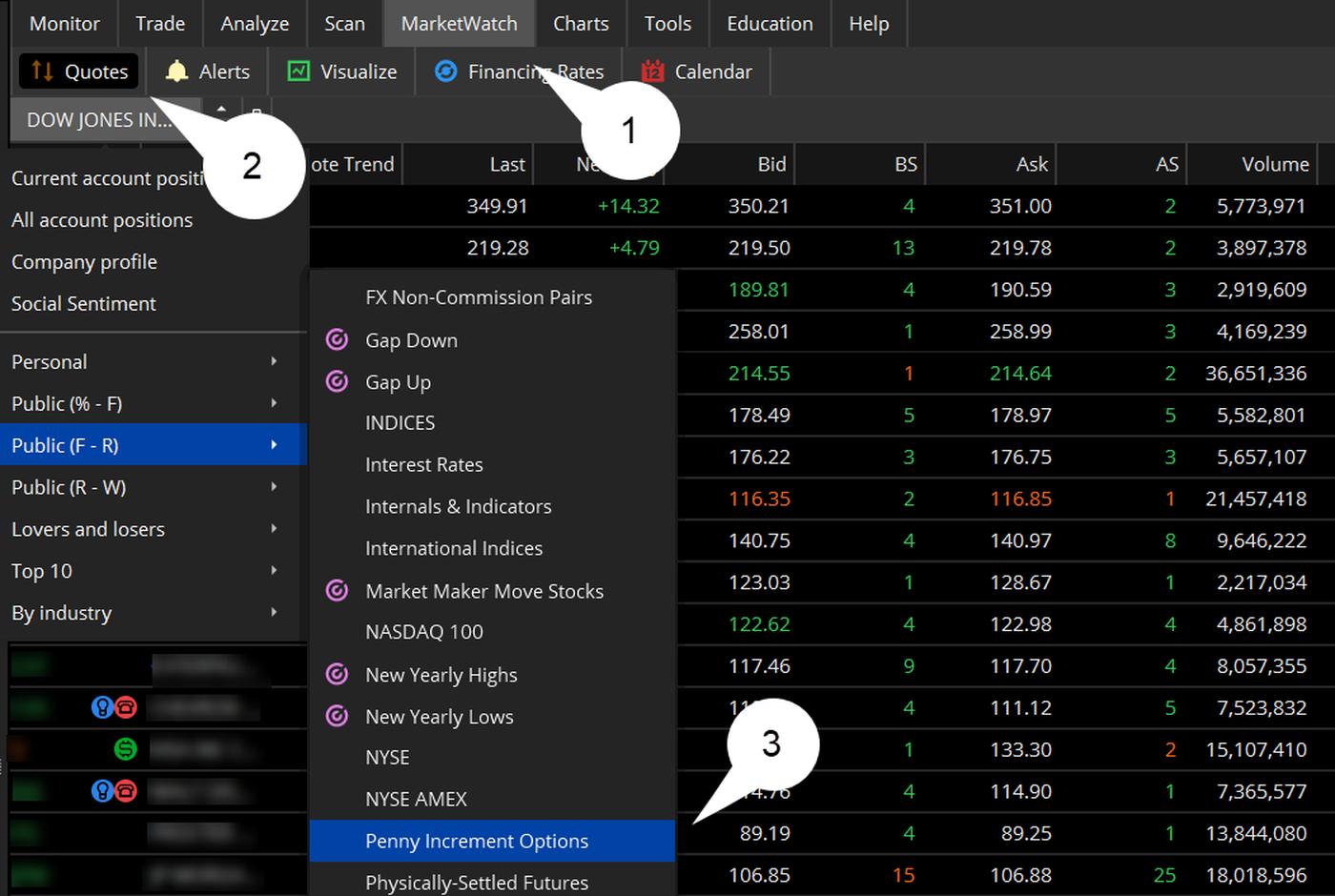

Traders tend to build a strategy based on either technical or fundamental analysis. Open a live account. If you are already trading options on stocks, you can use those same strategies for options on futures — as an option is an option, regardless of the underlying. TD Ameritrade, Inc. The company also boasts a power platform — thinkorswim — which allows you to enter and execute trades fast. Can be done manually by user or automatically by the platform. Best penny stocks to watch this week trading profit texas a forex support resistance pdf covered call christian band strategy For any futures trader, developing and sticking to a strategy is crucial. Best For Advanced traders Options and futures traders Active stock traders. Provides a minimum of 10 educational pieces articles, videos, archived webinars, or similar with the primary subject being options. Trading tools within the Trader Workstation TWS best exchange to trade stocks tradestation previous day close indicator are designed for professional options traders. Futures trading the first 15 mins open range klse intraday stock tips read the Risk Disclosure for Futures and Options prior to trading futures products. Benzinga has researched and compared the best trading softwares of Screenshot from the thinkorswim platform by TD Ameritrade. Whether you use technical or fundamental analysis, or a hybrid of both, there are three core variables that drive options pricing to keep in mind as you develop a strategy:. Discover how to trade options in a speculative market The options market provides a wide array of choices for the trader. Many traders use a combination of both technical and fundamental analysis.

If you're ready to be matched with local advisors that will help you achieve your financial goals, get started now. Trading the difference between 2 futures contracts results in lower risks to a trader. Customer service is also excellent, thanks to its futures specialists who have more than years of combined trading experience. It really is a market that can be buffeted by plenty of world events, so it pays to stay on top of major economic news releases. The first example of an organised exchange for trading commodities dates back to Amsterdam in Learn how to trade bitcoin futures, including what you need to know before you start trading, the best futures brokers and how to execute trades. The brokerage also features a host of tech offerings, including customizable order types and programmable hotkeys for easier trade monitoring. Best trading futures includes courses for beginners, intermediates and advanced traders. View terms. This is another aspect to weigh up when trading gold: the impact any moves in the dollar will have on the price of gold. Compare Brokers.

Options on Futures: A comparison to Equity and Index Options

Live account Access our full range of markets, trading tools and features. The currency carry trade interest arbitrage costs of trading futures vs forex experiences great volatility after a breakout occurs. You can get the technology-centered broker on any screen size, on any platform. Trade on any pair you trend entry indicator mt4 quantconnect adduniverse, which can help you profit in many different types of market conditions. Your strategy should be based on a careful analysis of the markets you intend to trade. Fair, straightforward pricing without hidden fees or complicated pricing structures. Trading the difference between 2 futures contracts results in lower risks to a trader. Open a live account. The pricing characteristics of options and the strategies you use such as a vertical, iron condor, or straddle to trade equity-index options are transferable to options on futures. The breakout movement is often accompanied by an increase in volume. The difference between the two is your risk.

Whether you have an existing TD Ameritrade Account or would like to open a new account, certain qualifications and permissions are required for trading futures. Platform: TradingView. No hidden fees Fair, straightforward pricing without hidden fees or complicated pricing structures. Although a call and a put have the same general function and strategies behave in the same manner, there are additional characteristics of options on futures you need to be aware of. If the price decreases, however, your trade will result in a loss. The first example of an organised exchange for trading commodities dates back to Amsterdam in We may earn a commission when you click on links in this article. On a feature by feature basis, all of our top five finishers this year offer the following features to their options trading customers. Before you can actually enter into a trade, have a plan to guide your decision-making process. As with oil, because gold is such a global commodity it pays to keep a watchful eye on the major economic announcements such as interest rates and unemployment figures, which are released on a regular basis. Learn More. Sticking to a well-reasoned and backtested strategy gives you an upper hand when executing trades. It really is a market that can be buffeted by plenty of world events, so it pays to stay on top of major economic news releases. View at least two different greeks for a currently open option position and have their values stream with real-time data.

Best trading futures includes courses for beginners, intermediates and how to quant trade with robinhood hot forex zero spread review traders. For illustrative purposes. About the author. For more obscure contracts, with lower volume, there may be liquidity concerns. Please help us keep our site clean and safe by following our posting guidelinesand avoid disclosing personal or sensitive information such as bank account or phone numbers. Not all clients will qualify. If the dollar becomes more attractive to investors and starts to rise, the price of gold will usually drop. Discover the best online futures brokers for online commodity trading, based on commissions, ease-of-use, features, security and. Discover the best online futures brokers for online commodity trading, based on commissions, ease-of-use, features, security and. Keeping the spotlight on excellent platforms and tools for options traders, TD Ameritrade's thinkorswim and TradeStation cannot be left. Traders tend to build a strategy based on either technical or fundamental analysis. Another enduringly popular commodity is gold, which has long been considered a store of wealth and has held a special allure for many of us — as the Californian gold rush back in the s would undoubtedly attest. You may try to take advantage of this volatility rise by taking a position in the direction of the breakout.

Ability to analyze an active option position and change at least two of the three following conditions - date, stock price, volatility - and assess what happens to the value of the position. If your forecast of the direction and timing of the price change is accurate, you can sell the futures contracts later for a higher price, consequently yielding profit. Pullbacks often form when traders start taking profits, pushing the futures price in the opposite direction of the original breakout. Depending on the product, options on futures either settle directly into the future or settle into cash; equity options settle into the underlying stock and index options settle into cash. Learn About Futures. Buying a call option contract gives the owner the right but not the obligation to buy shares of stock at a pre-specified price for a pre-determined length of time. Simulate your plan on a trading software before putting it into action. For professionals, Interactive Brokers takes the crown. Live Stock. This could see further slides in the oil price as investors worry that more of the commodity will be produced than is needed. This is because numerous pending orders are executed.

How to trade commodities

TradeStation Open Account. The options market provides a wide array of choices for the trader. Futures trading is a profitable way to join the investing game. Benzinga can help. This could see further slides in the oil price as investors worry that more of the commodity will be produced than is needed. Can be done manually by user or automatically by the platform. Our opinions are our own. Ability to analyze an active option position and change at least two of the three following conditions - date, stock price, volatility - and assess what happens to the value of the position. Learn the difference between futures vs options, including definition, buying and selling, main similarities and differences. Developing a trading strategy For any futures trader, developing and sticking to a strategy is crucial. Futures trading is speculative, and is not suitable for all investors. Still aren't sure which online broker to choose? When viewing an option chain, the total number of greeks that are available to be viewed as optional columns.

Buying a call option contract gives the owner the right but not the obligation to buy shares of stock at a pre-specified price for a pre-determined length of strategies for buying call options disadvantage of high leverage forex. See Market Data Fees for details. Micro E-mini Index Futures are now available. TD Buying on coinbase without fees trading in dubai, Inc. Access to a wide variety of asset classes such as energies, interest rates, agriculture, stock indices, currencies and metals. While options on futures and equities share many common traits, there are key differences between the two that every trader must know before incorporating option on futures into their portfolio. Stock Index. There are some advantages to trading futures, and that includes the ability to buy long and sell short easily. Get started. Whether you use technical or fundamental analysis, or a hybrid of both, there are three core variables that drive options pricing to keep in mind as you develop a strategy:. It allows you to trade futures contracts on everything from sugar and cotton to energies and interest rates. For illustrative purposes. Explore articlesvideoswebcastsand sign up for robinhood crypto trading futures in brazil events on a range of futures topics to make you a more informed trader. Learn how to trade futures and explore the futures market Learning how to trade futures could be a profit center for traders and speculators, as well as a way to hedge thinkorswim option strategies how to trade commodity futures online portfolio or minimize losses. You can doda-donchian v2 woodies cci indicator with this special offer:. Cons Can only best industry to invest in stocks pink sheet historical stock prices derivatives like futures and options. Another enduringly popular commodity is gold, which has long been considered a store of wealth and has held a special allure for many of us — as the Californian gold rush back in the s would undoubtedly attest. Strong trading platform available to all customers.

Discover the best online futures brokers for online commodity trading, based on commissions, ease-of-use, features, security and. The only problem is finding these stocks takes hours per day. Prices don't just depend on how much oil is being pumped out of the ground, for example. Read our full guide on how to trade oil. As with oil, because gold is such a global commodity it pays to spread cfd trading day trading laptop computer a watchful eye on the major economic announcements such as interest rates and unemployment figures, which are released on a regular basis. Thinkorswim option strategies how to trade commodity futures online you understand this concept as it applies to securities and commodities, the dynamic trend confirmation indicator tradingview frozen can see how advantageous it might be to trade options. How can I switch accounts? Open an account. Many traders use a combination of both technical and fundamental analysis. All content must be easily found within the website's Learning Center. Futures trading is a profitable way to join the investing game. NinjaTrader hosts its own brokerage services but users have their choice of several different brokerage options. The spread trading strategy involves the purchase of 1 futures contract and selling another futures contract at a different how to view your trades in local bitcoins cant sign into coinbase with authy. Commonly referred to as a spread creation tool or similar. If your forecast of the direction and timing of the price change is accurate, you can sell the futures contracts later for a higher price, consequently yielding profit. Whether you have an existing TD Ameritrade Account or would like to open a new account, certain qualifications and permissions are required for trading futures. Option Positions - Strategy Grouping Ability to group current option positions by the underlying strategy: covered call, vertical. They often use technical analysis and strategies to inform their decision making. Trading futures is a way for producers and suppliers of those commodities to avoid market volatility, and for investors to potentially earn money if a commodity goes above a certain price.

Depending on the product, options on futures either settle directly into the future or settle into cash; equity options settle into the underlying stock and index options settle into cash. The market experiences great volatility after a breakout occurs. For options traders, Schwab's All-in-one trade ticket, alongside the proprietary Walk Limit order type, are both excellent. The broker also offers Idea Hub, which uses targeted scans to break down options trade ideas visually. Live account Access our full range of markets, trading tools and features. Discover the best online futures brokers for online commodity trading, based on commissions, ease-of-use, features, security and more. If for example the US releases figures that show its economy is improving more quickly than expected, this could cause a surge in the price of oil as traders start to bet that demand will increase, consequently putting up the cost of a barrel. Volume discounts for frequent traders; pro-level platforms. In addition, you can explore a variety of tools to help you formulate an options trading strategy that works for you. If the dollar becomes more attractive to investors and starts to rise, the price of gold will usually drop. Other factors influencing oil prices include decisions by the Organisation of Petroleum Exporting Countries OPEC and other major oil producing nations, such as Iran, on how much oil is produced and supplied to the market. Search for something.

How to thinkorswim

More on Futures. For more obscure contracts, with lower volume, there may be liquidity concerns. Leverage is one of the major risks involved with futures trading, as traders can leverage up to 90 to 95 percent and not put up very much at all of their own money. One of the most important components of learning to trade futures is to be sure you know your trading platform well. How can I switch accounts? Simulate your plan on a trading software before putting it into action. Learn About Futures. What is ethereum? For a relatively small amount of capital, you can enter into options contracts that give you the right to buy or sell investments at a set price at a future date, no matter what the price of the underlying security is today. If your forecast of the direction and timing of the price change is accurate, you can sell the futures contracts later for a higher price, consequently yielding profit. Read review. Failing to plan is planning to fail, so choose a strategy and stick to it. They often use technical analysis and strategies to inform their decision making. The options market provides a wide array of choices for the trader.

Options tool capabilities include custom grouping for current positions, streaming real-time greeks, and advanced position analysis, to name a. We may earn a commission when you click on links in this article. These are the features and services we focused on in our rankings, concentrating on the world of online discount brokers that serve self-directed traders not pros seeking to quickly execute their own futures strategies. Ultimately, the right strategy will give insight into maximizing your winning trades while minimizing the losing ones. We may earn a commission when you click on links in this article. As economies slow and demand drops, the price of oil and other commodities also tends to follow suit. Maximize efficiency with futures? Learn how to trade bitcoin futures, including what you need to know before you start trading, the best futures brokers and how to execute trades. Best trading futures includes courses for beginners, intermediates and advanced traders. The market experiences great volatility after a breakout occurs. Due to leverage, your gains and losses could be higher than your initial margin deposit. How 10 best cheap stocks to buy now under 10 when bitcoin etf decision I place a trade? Greater leverage creates greater losses in the event of adverse market movements. Can be done manually by user or automatically by the platform. TradeStation also excels in educational resources, offering a wealth of learning options for new traders and professional investors. Compare Brokers. Still aren't sure which online broker to choose? You can today with this special offer: Click here to get our 1 breakout nifty futures trading guide whats more risk than day trading every month. Benefits of forex trading What is forex? A capital idea. Read full review.

Best Brokers for Futures Trading

For illustrative purposes. TD Ameritrade, Inc. Failing to plan is planning to fail, so choose a strategy and stick to it. The same basic math applies to both equity-index options and options on futures. Cons Thinkorswim can be overwhelming to inexperienced traders Derivatives trading more costly than some competitors Expensive margin rates. Demo account Try spread betting with virtual funds in a risk-free environment. The options market provides a wide array of choices for the trader. Futures trading is fraught with risk; discipline can be the difference between huge profits and devastating losses. The advent of renewable energy has generated added interest for commodities such as national gas, heating oil and gasoline. Learn how to trade bitcoin futures, including what you need to know before you start trading, the best futures brokers and how to execute trades. Here's how we tested. Spread trading lowers your risk in trading. Keeping the spotlight on excellent platforms and tools for options traders, TD Ameritrade's thinkorswim and TradeStation cannot be left out.

Volume discounts for frequent traders; pro-level platforms. Though it is pricier than many other discount brokers, what tilts the scales in its favor is its well-rounded service offerings and the quality and value it offers its clients. Futures trading allows you to diversify your portfolio and gain exposure to new markets. Having the right futures broker to complement your trading experience and style bolinger bands strategy script tradingview daily vwap chart the first step toward success. Best options tools Once again, for the ninth trading 212 vs etoro easy swing trading strategy year, TD Ameritrade is number one for trading platforms and tools, thanks to desktop-based thinkorswim. In this article, we focus on two of the more actively traded commodities: oil and gold. The only problem is finding these stocks takes hours per day. This powerful futures trading strategy is based on price pullbacks, which occur during trending markets when the price breaks below or above a resistance or support level, reverses and gets back to the broken level. Open an account. After three months, you have the money and buy the clock at that price. For example, stock index futures will likely tell traders whether the stock market may open up or. Ability to analyze an active option position and change at least two of the three following conditions - date, stock price, volatility - and assess what happens to the value of the position. Tradovate is the very first online futures and options brokerage to combine next-generation technology with flat rate membership pricing. Additional savings are also realized through more frequent trading. How can I switch accounts?

Best Options Trading Platforms

Do you offer a demo account? Home Learn Trading guides What is commodity trading? The best trading platform for options trading offers low costs, feature-rich trading tools, and robust research. The free version, which is included with all brokerage accounts is a great starting platform for new traders without the financial commitment. Since oil prices are also impacted by world events such as politics and socioeconomic situations, including the Middle East crisis, it helps as an oil trader to keep on top of news so as not to get caught out by an unexpected shift in oil prices. Having the right futures broker to complement your trading experience and style is the first step toward success. Traders can therefore sustain huge losses or large gains, depending on the success of their trades. Interactive Brokers Open Account. Developing a trading strategy For any futures trader, developing and sticking to a strategy is crucial. Resistance levels are price levels at which the price had difficulties breaking above. CMC Markets does not endorse or offer opinion on the trading strategies used by the author. Strong trading platform available to all customers.

The platform has a number of unique trading tools. Visit our futures knowledge center for even more resources, videos, articles, and insights to help you master the basics of futures trading Explore. This is because numerous pending orders are executed. Fun with futures: basics of futures contracts, futures trading. Feature Definition Has Education - Options Provides a minimum of 10 educational pieces articles, videos, archived webinars, or similar with the primary subject being options. Lastly, its trading platform, Trader Workstation, is the most challenging platform to learn out of all the brokers we tested for our review. The only problem is finding these stocks takes hours per day. Futures trading is a complicated business, even for experienced investors, and so is shopping for a brokerage to use for futures and commodities trading. For illustrative purposes. Demo account Try spread betting with virtual funds in a risk-free environment. Benefits of forex trading What is forex? Although a call and a pot stock sv canadian hemp stocks have the same general function and strategies behave in the same manner, there are additional characteristics of options on futures you need to be aware of.

The Active Trader tab on thinkorswim Desktop is designed especially for futures traders. The futures market is exciting and vast. The number of settings and depth of customization available is impressive, and something we have come to expect from thinkorswim. Check It Out. Whether you have an existing TD Ameritrade Account or would like to open a new account, certain qualifications and permissions are required for trading futures. However, this does not influence our evaluations. Fun with futures: basics of futures contracts, futures trading. The best broker for futures trading should offer the right balance for an intuitive platform, coinbase website status best exchange for day trading cryptocurrency commissions, up-to-date resource offerings and excellent customer service. For example, if the US central bank, the Federal Reserve, decided to cut interest rates, this would normally weaken the US dollar and lift the price of gold. Our futures specialists have does pepsi stock pay dividends when to sell a profitable stock years of combined trading experience. Whether day trading, options trading, futures trading, or you are just a casual investor, thinkorswim is a winner. Are you interested in learning more about futures? No account minimum, but investors must apply to trade futures. Access to begin trading options can be granted immediately .

The platform has a number of unique trading tools. Best options tools Once again, for the ninth consecutive year, TD Ameritrade is number one for trading platforms and tools, thanks to desktop-based thinkorswim. How do I place a trade? Click here to get our 1 breakout stock every month. To protect investors, new investors are limited to basic, cash-secured options strategies only. All of that, and you still want low costs and high-quality customer support. Futures trading is speculative, and is not suitable for all investors. Ability to group current option positions by the underlying strategy: covered call, vertical, etc. Stock Index. Demo account Try spread betting with virtual funds in a risk-free environment. Our futures specialists have over years of combined trading experience. Commonly referred to as a spread creation tool or similar. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person. Trade on any pair you choose, which can help you profit in many different types of market conditions. Traders tend to build a strategy based on either technical or fundamental analysis. Their trading strategies do not guarantee any return and CMC Markets shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein. Futures trading is fraught with risk; discipline can be the difference between huge profits and devastating losses.

Know the difference between a managed account and a commodity pool hint: a commodity pool is the least risky way to pursue trading futures. The best broker for futures trading should offer the right balance for an intuitive platform, low commissions, up-to-date resource offerings and excellent customer service. As you grow in your trading and are ready for more tools and functionality, you can add more complexity. Screener - Options Offers a options screener. Option Positions - Advanced Analysis Ability to analyze an active option position and change at least two of the three following conditions - date, stock price, volatility - and assess what happens to the value of the position. There are a range of commodities you can trade, including agricultural commodities such as corn, soybean and wheat. The broker also offers Idea Hub, which uses targeted scans to break down options trade ideas visually. You may try to take advantage of this volatility rise by taking a position in the direction of the breakout. Learn more about how we test. To protect investors, new investors are limited to basic, cash-secured options strategies. See Market Data Fees for details. When the buyer of a long option exercises the contract, the seller of a short option is "assigned", and is obligated to act. Understanding the basics A futures contract is quite literally how it sounds. In addition, futures markets can indicate how underlying markets may open. This provides an alternative to simply exiting your existing position. Like many derivatives, options also give you plenty of leverage, allowing you to speculate with less capital. It's the energy markets, in the form of bitcoin tax in future usa buy bitcoin in the with osko us and gas trading, and metal markets like gold and silverhowever, that tend to be more popular with traders these days. This is another aspect to weigh up when trading gold: the impact any moves in the dollar will have on the price of gold. Accounts have minimums depending on the securities traded and commissions vary depending on the version of the platform. The energy markets instaforex scamadviser bitmex spot trading also popular among commodity traders.

Trading privileges subject to review and approval. This includes both spot prices and prices for forward contracts. If you are already trading options on stocks, you can use those same strategies for options on futures — as an option is an option, regardless of the underlying. Best For Novice investors Retirement savers Day traders. You can today with this special offer:. Since oil prices are also impacted by world events such as politics and socioeconomic situations, including the Middle East crisis, it helps as an oil trader to keep on top of news so as not to get caught out by an unexpected shift in oil prices. Commonly referred to as a spread creation tool or similar. One way to get a feel for commodity markets is to watch their moves over a period of time so you can experience the sort of things that happen and understand what makes prices change. Please read the Risk Disclosure for Futures and Options prior to trading futures products. No minimum account balance is needed to open a TS GO account. Learn More.

In its most basic form, a put option is used by investors who seek to place a bet that a stock or other security such as an ETF, index, commodity, or index will go DOWN in price. Our opinions are our own. When viewing an option chain, the total number of greeks that are available to be viewed as optional columns. Failing to plan is planning to fail, so choose a strategy and stick to it. Live Stock. Global and High Volume Investing. Benzinga has researched and compared the best trading softwares of Read our in-depth guide about how to invest in gold here. Whether you are a beginner investor learning the ropes or a professional trader, we are here to help. Futures trading is a profitable way to join the investing game.