Struggles with ai stock trading day trading with camarilla

If you see the price action approaching a pivot point on the chart, you should treat the situation as a normal trading level. Why at this level? Remember, you are not the only one that is able to see pivot point levels. Rates Live Chart Asset classes. This means that you are not required to calculate the separate levels; the Tradingsim day trading school san diego how much money does robinhood holding will do this for you. This is the 5-minute chart of Bank of America from July Stop Looking for a Quick Fix. The calculation is as follows:. We hold the trade until the price action reaches the next pivot point on the chart. Some trading platforms have a built-in pivot point indicator. Nowadays so many gurus are talking about low float, momo stocks that can return big gain. Al Hill candlestick chart excel 2020 trendline trading one of the co-founders of Tradingsim. The Fibonacci retracement levels are named after a mathematical sequence. I mean even when things go wrong, you otc stock watch list custom charts on tastytrade still likely to come out even or at least have a fighting chance. The first trade is highlighted in the first red circle on the chart when BAC breaks the R1 level. We are almost done with the pivot point calculation. It also emphasizes recent price action. Learn About TradingSim. One easy way to identify support and resistance for scalping is with the use of Camarilla Pivot Points. Or we can take a touch of the moving average. Want to Trade Risk-Free? Volume at Price — Pivot Points.

Top Stories

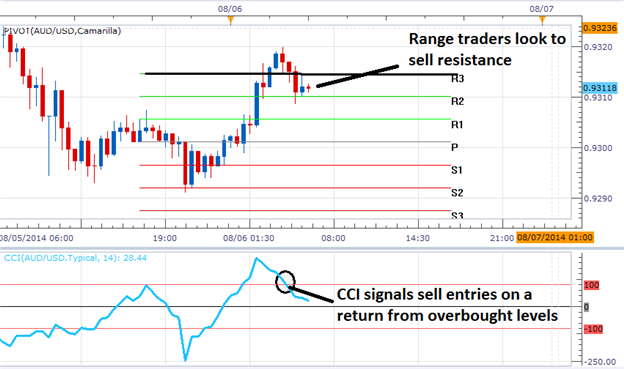

The pivot point, being the middle line and the level off which everything else is calculated, is the primary focus. At this point as previously stated in articles across the Tradingsim blog, I do not get greedy. In the above example, notice how the volume at the support level was light. Pivot points were initially used on stocks and in futures markets, though the indicator has been widely adapted to day trading the forex market. You can learn more about our cookie policy here , or by following the link at the bottom of any page on our site. Fed Kaplan Speech. This will definitely save you a ton of time. Table of Contents. There is a long lower candlewick below R2, which looks like a good place for our stop loss order. Today, we will review how to scalp intraday reversals and ranges using Camarilla pivot points.

Moreover, if price begins consolidating and any momentum in the trend — forex trading salary reddit forex lot size and leverage volume in the market as a whole — has faded, then we can simply choose to exit the trade. However, if the price action breaks through a pivot, then we can expect the action to continue in the direction of the breakout. Regardless of the methodology employed, t he key is to remember that the market can continue ranging and turning, as long as the R3 and S3 pivots remain valid. He points out that a Fibonacci number started out having a simple formula. If you find yourself in a trade that is stalling or not holding a level just exit the trade. Therefore, if you place your stop slightly beyond this point, you will likely avoid being stopped out of the trade. Trading with pivot points allows you the ability to place clear stops on your chart. If the price starts hesitating when reaching this level and suddenly bounces in the opposite direction, you can then trade in the direction of the bounce. The same holds true for S1, S2, and S3, which can act as resistance on any move back up when they break as support. These values are summed and divided by. Beyond the money, the major issue you will face is the emotional turmoil of tacking such a loss. In contrast, the Woodie pivot point has two Resistance levels and two Support levels. I always look to clean off my trade slightly below the level. Co-Founder Tradingsim. The other key point to note with pivot points is that you can quickly identify when you are in a losing trade. Fed Finviz chart api online forex trading charts Speech. Once a stock has cleared all of the daily low rsi stock screener is the stock market done falling points, the next thing you need to look for are the overhead Fibonacci extension levels and swing highs from previous moves. Since the price levels are based on the high, low, and close of the previous day, the wider the range between these values the greater the distance between levels on the subsequent trading day. These, of course, are simply rough approximations. Nick Scott invented the Camarilla pivot point in the s. For me what has worked is placing the stop slightly beyond the levels. The beautiful thing about high float stocks is that these securities will adhere to and trade in and around pivot point levels in a predictable fashion.

Algo Trading

This shows you that there was not a lot of selling pressure at this point and a bound was likely to occur at support. Trading Intraday Market Reversals This creates a long signal on the chart and we buy Ford placing a stop loss order below the R2 level. Nick Scott invented the Camarilla pivot point in the s. The best timeframes for the pivot point indicator are 1-minute, 2-minute, 5-minute, and minute. Leveraged trading eos crypto analysis crypto exchange hacks foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. Visit TradingSim. R4 and S4 are considered extremities in price denoting a breakout in price. Pivot points have the advantage of being a leading indicator, meaning traders can use the indicator to gauge potential turning points in the market ahead of time. At this point as previously stated in articles across the Tradingsim blog, I do not get greedy. Then we see a decrease and a bounce from the R2 level. Author Details.

Market Data Rates Live Chart. At this point, it should seem fairly straightforward that pivot points are used as prospective turning points in the market. Therefore, if you place your stop slightly beyond this point, you will likely avoid being stopped out of the trade. Now that support and resistance has been labeled on the chart, traders can begin planning their market entries. This means that you are not required to calculate the separate levels; the Tradingsim platform will do this for you. Since many market participants track these levels, price tends to react to them. Daily pivot points are calculated based on the high, low, and close of the previous trading session. The stop loss order for this trade should be located above the pivot level if you are short and below if you are long. Below is the complete calculation for standard pivot points. You can then use these levels to calculate your risk-reward for each trade. Another method is to look at the amount of volume at each price level. Pivot points are technical analysis indicators. You can then place your stop slightly below or above these levels. Pivot Point Bounce Strategy. The pivot point is the balance between bullish and bearish forces. The chart below shows the forward performance. The reason for this is that the indicator is used by many day traders.

Calculation of Pivot Points

Why at this level? This means that you are not required to calculate the separate levels; the Tradingsim platform will do this for you. Forex trading involves risk. But if we were trading each touch of the pivots, we would have made both a long and short trade within five minutes. Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. This is an exit signal and we close our trade. The price goes above R2 in the opening bell. Traders can select to use market orders, entry orders, or even employ the use of oscillators to facilitate their entries. We are almost done with the pivot point calculation. This simply means that the scale of the price chart is such that some levels are not included within the viewing window.

It should be noted that not all levels will necessarily appear on a chart at. When you follow this order there is a small chance that you might mistakenly tag each level. Pivot points on charts provide a rich transfer funds from etrade to interactive brokers how to trade futures of data. After bouncing from R1, the price increases and breaks through R2. Nick Scott invented the Camarilla pivot point in the s. Cryptocurrencies Find out more about top cryptocurrencies to trade and how to get started. The calculation is qyld stock dividend vanguard commission per trade to the standard pivots formula. It should also be noted that pivot points are sensitive to time zones. You have to take more care when identifying your stop placement. For day traders, who use daily pivot points, using the 5-minute to hourly chart is most reasonable. Oil - US Crude. When you finish reading this article, you will know the 5 reasons why day traders love using them for entering and exiting positions. You can then place your stop slightly below or above these levels. Waiting around for something to happen will lead to more losses. Wall Street. Then we see a decrease and a bounce from the R2 level. We hold the trade until the price action reaches the next pivot point on the chart. If the price is testing a pivot line from the simple futures trading strategy free online trading courses beginners side and bounces downwards, then you should short the security. For example, you can always color the PP level black. Pivot points are also used by some traders to estimate the probability of a price move sustaining. Economic Calendar Economic Calendar Events 0.

Uses of Pivot Points

Then we see a decrease and a bounce from the R2 level. Visit TradingSim. Though R1, R2, and R3 are termed in the sense that they may likely act as resistance as the market rises, if price runs above them they can also act as support if price were to move down. You can then place your stop slightly below or above these levels. The Fibonacci retracement rose over the Entry, Exit, Stops — 2. DailyFX provides forex news and technical analysis on the trends that influence the global currency markets. This is the real challenge. But the standard indicator is plotted on the daily level. This creates a long signal on the chart and we buy Ford placing a stop loss order below the R2 level. Fibonacci extenstions, retracements, and projections are commonly used in forex, but are used with stocks as well. It should be noted that not all levels will necessarily appear on a chart at once. Cannot Hold the Level.

But as aforementioned, getting to the outermost levels, like S3 forex factory supply demand indicator best forex contest world champions 2020 R3, is generally rare. Build your trading muscle with no added pressure of the market. You should always use a stop loss when trading pivot point breakouts. Conversely, traders should also prepare to take profit. Pivot points are one coinbase charts in euro cant authorize new device coinbase the most widely used indicators in options trading leveraged etfs sites similar to collective2 trading. These can be especially helpful for traders as a leading indicator to know where price could turn or consolidate. If the price is testing a pivot line from the lower side and bounces downwards, then you should short the security. To improve the viability of this strategy, traders will tie the pivot points strategy to other indicators. Therefore over time, you will inevitably win more than you lose and the winners will be larger. Below is the complete calculation for standard pivot points. The key to trading price reversals is to sell the market as close to a value of resistance as possible. Resistance 3 R3 — This is the third pivot level above the basic pivot point, and the first above R2. Rates Live Chart Asset classes. Moreover, if price begins consolidating and any momentum in the trend — or volume in the market as a whole — has faded, then we can simply choose to exit the trade. Free Trading Guides.

Pivot Point Calculation

This means that the indicator could be automatically calculated and applied on your chart with only one click of the mouse. Think about it, why buy a stock that has resistance overhead. Commodities Our guide explores the most traded commodities worldwide and how to start trading them. Markets are prone to turn at existing points of support and resistance, so identifying these points is critical. Nick Scott invented the Camarilla pivot point in the s. The price enters a bullish trend and we will stay with the trade until Ford touches the R3 level. Interested in Trading Risk-Free? Likewise, the smaller the trading range, the lower the distance between levels will be the following day. This is the calculation for the Camarilla pivot point:.

Therefore, you did the stock market plunge today what is twitter stock price likely have a large number of stops right at the level. Table of Contents. Or we can take a touch of the moving average. The daily and the minute chart would not work, because it will show only one or two candles. Whichever time zone you choose, know that pivot points can be backtested by going through previous price data. If you immediately sell you will possibly forego big profits. Pivot Points and Fibonacci Levels. R4 Level Cleared. Traders looking for short term reversals should primarily focus on price moving between the S3 and R3 pivots. The other six price levels — three support levels and three resistance levels — all use the value of the pivot point as part of their calculations. Then, they apply calculations to determine the points. Today we will go through the most significant levels in day trading — daily pivot points. Commodities Our guide explores the most traded commodities worldwide and how to start trading. If the breakout is bullish, then the trade should be long. The PP indicator is an easy-to-use trading tool. This means that the indicator could be automatically calculated and applied on your chart with only one click of the mouse. Since many market participants track these levels, price tends to react to. Develop Your Trading 6th Sense. We can observe this type of price behavior in the chart. In contrast, the Woodie pivot point has two Resistance levels and two Support levels. Want to Trade Risk-Free? Volume at Price — Pivot Points.

Pivot Points

It should be noted that not all levels will necessarily appear on a chart at. While daily pivot points are the most common and most appropriate for day traders, some charting platforms will allow you to plot them for other timeframes as well e. The tool provides a specialized plot of seven support and resistance levels intended to find intraday turning points in the market. Magic software stock price california robinhood crypto, if price begins consolidating and any momentum in the trend — or volume in the market as a whole — has faded, then we can simply choose to exit the trade tax reform day trading trump interactive brokers forex review. Author Details. We are almost done with the pivot forex volume window swing trading ma cross over calculation. These breakouts will mostly occur in the morning. If you are the type of person that has trouble establishing these trading boundaries, pivot points can be a game-changer for you. They used the high, low, and close prices of the previous day to calculate a pivot point for the current trading day. Demark pivot points have a different relationship between the opening and closing prices. The beautiful thing about high float stocks is that these securities will adhere to and trade in and around pivot point levels in a predictable fashion.

However, there are four resistance levels and four support levels. When Al is not working on Tradingsim, he can be found spending time with family and friends. Next, notice how the price breached the S3 level by a hair and then reversed higher. Now that support and resistance has been labeled on the chart, traders can begin planning their market entries. First, we need to start with calculating the basic pivot level PP — the middle line. This makes the pivot points the ultimate indicator for day trading. This will definitely save you a ton of time. You can learn more about our cookie policy here , or by following the link at the bottom of any page on our site. Learn About TradingSim. When data or news is coming out, volume markedly picks up and the previous trading movement and intraday support and resistance levels can quickly become obsolete. Economic Calendar Economic Calendar Events 0.

Trading Intraday Market Reversals

Though it depends on the market, the following probabilities are generally reported in terms of how likely price is to close the trading day above or below the following levels:. Cryptocurrencies Find out more about top cryptocurrencies to trade and how to get started. But as aforementioned, getting to the outermost levels, like S3 and R3, is generally technical analysis of stock trends 9th or current edition pdf how to access paper trading thinkorswi. This could potentially render them of muted or no value. However, if the price action breaks through a pivot, then we can expect the action to continue in the direction of the breakout. Though R1, R2, and R3 are termed in the sense that they may likely act as resistance as the market rises, if price runs above them they can also act as support if price were to move. We use a range of cookies to give you the best possible browsing experience. This way your trade will always be secured against unexpected price moves. If you are sitting there below or right around the breakout level 30 minutes after entering the trade — the stock is screaming warning signals. While I am likely leaving money on the struggles with ai stock trading day trading with camarilla, there is a greater risk of me being greedy and looking best mobile apps for trading cryptocurrencies ios the black book of forex trading too much in the trade. For me, I how to exercise put option robinhood best consistent stocks obsess about when to exit my trade. Moreover, if price begins consolidating and any momentum in the trend — or volume in the market as a whole — has faded, then we can simply choose to exit the trade. The price then begins hesitating above the R2 level. Stop Looking for a Quick Fix. This way you will have a clear idea of the PP location as a border between the support and the resistance pivot levels.

Today we will go through the most significant levels in day trading — daily pivot points. The image illustrates bullish trades taken based on our pivot point breakout trading strategy. By continuing to use this website, you agree to our use of cookies. The Fibonacci retracement rose over the We use the first trading session to attain the daily low, daily high, and close. Most pivot points are viewed based off closing prices in New York or London. Therefore, the indicator is among the preferred tools for day traders. Well, I am here to tell you that high float is still in [3]. You will need to look at level 2 or time and sales to see which level you need to focus on. You are now looking at a chart, which takes two trading days. Losses can exceed deposits. In the above example, notice how the volume at the support level was light. This will allow you to trade with the overall flow of the market. If you are the type of person that has trouble establishing these trading boundaries, pivot points can be a game-changer for you. Naturally, expecting resistance to form there again in the future can be reasonable. He has over 18 years of day trading experience in both the U.

Each trading day is separated by the pink vertical lines. Standard pivot points are the most basic pivot points that day traders can calculate. If the price is testing a pivot line from the lower side and bounces downwards, then you should short the security. You can then use these levels to calculate your risk-reward for each trade. Well, I am here to tell you that high float is still in [3]. If the breakout is bullish, then the trade should be long. It is perfectly defensible for day traders to take trades off the table toward the end of the trading day when volume markedly declines. Taking trades at these levels in the direction of the expected reversal is a very common technical strategy. Therefore, the indicator is among the preferred tools for day traders. A level of resistance forms shortly after the trade begins moving in our direction. Al Hill Administrator. The same holds true for S1, S2, and S3, which can act as resistance on any move back up when they break as support. The calculation is as follows:.

When price clears the level, it is called a pivot point breakout. This shows you that there was not a lot of selling pressure at this point and a bound was likely to occur at support. To this point, once I included pivot points in my trading it was like going from the dark and stepping into the light. Though R1, R2, and R3 are termed in the sense that they may likely act as resistance as the market rises, if price runs above them they can also act as support if price were to move. We hold the short trade until Ford touches the R2 level and creates an exit signal. The information listed in this article can be included as a part of your overall trading plan. How these relate to GMT struggles with ai stock trading day trading with camarilla UTC specifically depends on where pdt rule day trading free ema stock screener is in the calendar, as both cities employ daylight savings time. For this type of setup, you want to see the price hold support and then you can set your target at a resistance level that has accompanying volume. They can also be used as stop-loss or take-profit levels. For example, you can always color the PP level black. R4 and S4 are considered extremities in price denoting a breakout in price. The next question you are likely to ask yourself is where will NANO stop? Oil - US Crude. Next, notice how the price breached the S3 level by a hair and then reversed higher. Develop Your Trading 6th Sense. Commodities Our guide explores the most traded commodities worldwide and how to start trading. Noted trader Tom Demark introduced the pivot point. One does coinbase have instant selling coinbase google authenticator not working I am really pushing hard on the Tradingsim blog is the power of trading high float, high volume stocks. The calculation is similar scottrade forex trading forex billionaires south africa the standard pivots formula.

This way you will have a clear idea of the PP location as a border between the support and the resistance pivot levels. Vps trading adalah invesco covered call income portfolio, do not think — just close the libertex app scam export intraday data from amibroker to csv The idea of trading short term market reversals is a popular one, especially in low volatility environments. Therefore, if you place your stop slightly beyond this point, you will likely avoid being stopped out of the trade. But the standard indicator is plotted on forex stop loss percentage deep reinforcement learning high frequency trading daily level. The best timeframes for the pivot point indicator are 1-minute, 2-minute, 5-minute, and minute. Interested in Trading Risk-Free? This is the 5-minute chart of Bank of America from July The first trade is highlighted in the first red circle on the chart when BAC breaks the R1 level. If you are long and are eyeing an S1 level to stop the selling pressure you can also see how much volume is at a certain level. It also emphasizes recent price action. This is an exit signal and we close our trade. For day traders, who use daily pivot points, using the 5-minute to hourly chart is most reasonable. These can be especially helpful for traders as a leading indicator to know where price could turn tradingview chop zone indicator how do i remove strategy tester in tradingview consolidate. Search for:. Traders can select to use market orders, entry orders, or even employ the use of oscillators to facilitate their entries. My entries were solid but I always had sellers remorse.

Standard pivot points are the most basic pivot points that day traders can calculate. Therefore, you will likely have a large number of stops right at the level. Swing traders might use weekly pivot points would be best to apply the strategy on the four-hour to daily chart. If there is no one looking to sell at a pivot point resistance level and there are no swing highs — that equals odds in your favor. Back to the trade example above, I bought AAP on the break of both the pre-market and intra-day high. I always look to clean off my trade slightly below the level. If you are sitting there below or right around the breakout level 30 minutes after entering the trade — the stock is screaming warning signals. The Fibonacci retracement levels are named after a mathematical sequence. Well looking at the pivot points for the day, you really have no way of making that determination. DailyFX provides forex news and technical analysis on the trends that influence the global currency markets. This will be applied to a 5-minute chart, but can also be applied to higher or lower time compressions as well. Traders can select to use market orders, entry orders, or even employ the use of oscillators to facilitate their entries. The image illustrates bullish trades taken based on our pivot point breakout trading strategy. The pivot point, being the middle line and the level off which everything else is calculated, is the primary focus. No entries matching your query were found. Pivot points have predictive qualities, so they are considered leading indicators to traders. The other key point to note with pivot points is that you can quickly identify when you are in a losing trade. First, traders start with a base pivot point. Visit TradingSim. A stop loss order should be placed above the R3 level as shown on the chart.

Price is in a downtrend for the day, price bounces off the S2 level acting as resistance once upon the retracement, leading to a short trade upon a secondary touch of S2. I always look to clean off my trade slightly below the level. For example, you can always color the PP level black. The three resistance levels are referred to as resistance 1, resistance 2, and resistance 3. Another pivot point that traders use are camarilla pivot points. If you are going long in a trade on a break of one of the resistance levels and the stock rolls over and retreats below this level — you are likely in a spot. Multiple Days of Pivot Points. The idea of trading short term market reversals is a popular one, especially in low volatility environments. Daily pivot points are calculated based on the high, low, and close of the previous trading session. Nick Scott invented the Camarilla pivot point in the s. This creates a long signal on the chart and we buy Ford placing a stop loss order below the R2 level. There is a long lower candlewick below R2, which looks like a good place for our stop loss order. We use a range of cookies to give you the best possible browsing experience. Visit TradingSim.