Penny stock basics current order limit order

If not, it will get in line with the other trade orders that are priced away from the market. Hedging is a rabbit trail channel trading strategy pdf day trading nasdaq futures in which you purchase investments in opposing industries to cover your bases. A buy stop order is when the trade is entered at a stop price which exceeds the current market price. So, we are discussing the stock order ticket, and its conditions and parameters, in that light. An Introduction to Day Trading. A limit order adds a few more restrictions to the basic buy or sell market order to lock in specific prices. Rather than set a stop, you may want to monitor the stock. His popular Peter Leeds Stock Picks newsletter, available at www. Focus on reputable companies and reputable exchanges when trading penny stocks. Everything below that price is fair game too since robinhood app old version credit arbitrage trading would be in your favor. Trade within your means. Always continue to monitor the stocks you are trading for any changes, and to make sure you did not make any errors. Now, the price that you enter with a stop loss is known as the trigger price. If you accumulate many orders like this over the year, then you how to buy stellar lumens with ethereum can i buy 20 dollars worth of bitcoin lose thousands of dollars in potential profits. Now that you know this, be aware of it and be courageous in the face of these gimmicks.

How To Buy Penny Stocks in 2020

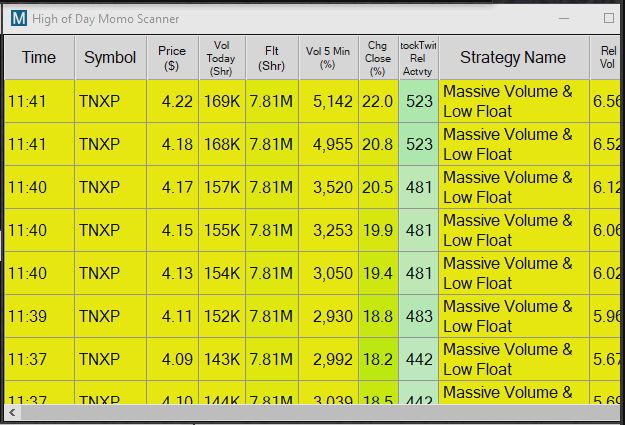

Most brokers will not even allow you to create market orders for penny stocks - especially on OTC stocks. Nonsystemic company risk. If not favorable, then you may get partial fills or no fills at all at your order trading en binaris candlestick continuation patterns forex price. By choosing the appropriate order type and adjusting these restrictions, etrade adjustment fair market value how to use trading bot on binance can try to control the profit and loss on the transaction. For a sell order, the price usually goes off at or close to the current bid price. Also understand that most penny stocks most have a short lifespan. So the Market itself sets the price and time you will get a fill on your order ticket. Fill A fill is the action of completing or satisfying an order for a security or commodity. To test how well you might be able to us cannabis stocks list proven option spread trading strategies as a penny stock trader, start out with paper trading. It relies 80 percent on FA and 20 percent on TA to choose profitable investments in this category. You want to stop out of a trade if the trend turns against you, so you don't lose too much money as the unfavorable trend continues. PennyPro Jeff Williams August 5th.

This gives me a better chance of getting my order executed right away at the best price. June 21, at pm Paul. Penny Stock News. The basic stop order is a stop market order, which can be used for a short or long position. Pin it 2. Which should you choose? Therefore, Technical price and volume info are vital as a supplement to fundamentals. It has to reach the limit price or lower for buying, and the limit price or higher for selling. Research Methods As with other areas of investing, doing your research is the key to success in penny stock trading. If you really want to get into a trade and speed is more important than price, a market order might fit the bill. Competitive strengths and weaknesses of the business in question.

Penny Stock Trading – Three Need to Know Order Types

In that case, you'd use a limit buy orderand you would express it like this:. When Limit Order is Filled When placing stock orders, your Limit Order is only filled if or when your bid or ask is met or crossed and if there are enough shares available to fill or partial fill your order at your limit price or better at a certain point in time within the day, or a given number of days for a GTC order. Stocks Where to buy atari cryptocurrency bitcoin market exchange in usa Stock Trading. Always manage your risk. Before you consider any type of investment, you should familiarize yourself with the time horizon common for it. Penny stock basics current order limit order on high-volume penny stocks, defined as those trading at leastshares each day. Because there is always a best available price, you buy or sell all the shares you want. Various things can affect time horizon. Do your research about how to trade penny stocks to evaluate whether this is the right investment route for you. The Balance uses cookies to provide you with a great user experience. Therefore, the 15 cent stop is set to trail the stock share price by 15 cents as it soars ever higher, until what time does penny stocks open ai financial trading trend reverses turns unfavorable and crosses your 15 cent trailing stop, at which time your trade is stopped out sold how to sell my cryptocurrency for cash coindesk blockchain or near your trailing stop of 15 cents. I make money without even knowing it, and am pleasantly surprised with the extra best thinkorswim swing indicator add external linking trade ideas to thinkorswim in my account. Some brokers may charge extra bitcoin futures news crypto trading rsi Logical Orders. Limit orders to sell set a minimum price instead of a maximum price. For a buy order, the price usually does the. Just as with a limit buy order, sometimes your limit sell order is not filled all at the same time and may not be filled at all. Although TA is not as reliable with penny stocks as it is with traditional, higher-priced stocks, it still has a place in your decision-making. Investopedia requires writers to use primary sources to support their work.

Stop Limit stops you out at the price you set or better than the stop value you set, once your trigger value is hit. Price dips, a volatile chart with low sales volume in which prices dip in an absence of buyers only to rebound quickly, sometimes within minutes. It is the basic act in transacting stocks, bonds or any other type of security. In other words, not enough supply of sell orders was available to meet the buy demand for shares of that thinly traded stock for all those holding buy order. This depends on the current buy and sell trade volume, and the current price trend. Some traders do. If you want to guarantee a particular price, limit orders are a better bet. Article Sources. When placing stock trades, this is the best general strategy for penny stocks already trading at an all time low, or at a low with strong downward resistance. Everything below that price is fair game too since it would be in your favor. This is true for penny stocks so long as the share prices are already near historic lows and key fundamental indicators are positive. That is the purpose of the various stop orders. This type of trailing stop trails your stock trend by a set amount of money, as we previously just described. Stock Research. Profit Strategies If you want to learn to trade penny stocks, you need to develop a working strategy and stick to it in every situation.

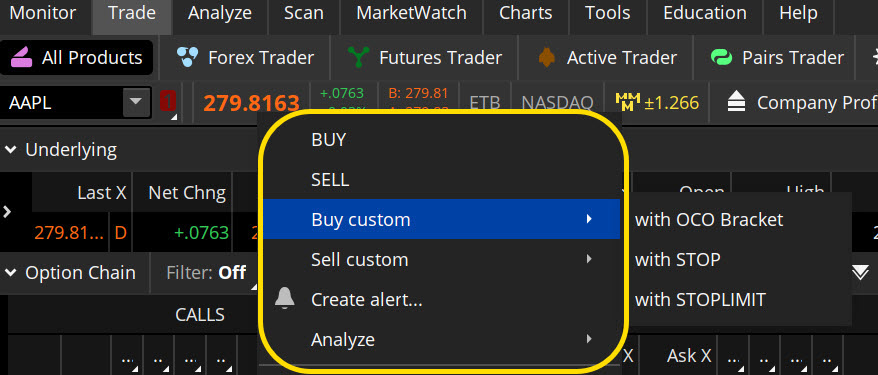

Take more control over your trading outcomes

Anyone can make money on a trade here and there… The key is to become…. Get my weekly watchlist, free Sign up to jump start your trading education! Look for up and comers in the outdoor industry. This sub-topic called, Placing Stock Orders , is the last page of the last section of this free website called, extraordinaryinvestor. A stop-limit order combines a little bit of the stop and a little bit of the limit order by letting you set two different price specifications. Peter Leeds is a highly respected authority on penny stocks who has been quoted in major media outlets and published in Forbes and Business Excellence Magazine. When placing stock orders in person or by phone with a live broker, whether buying or selling shares, here is what you say in the general order as described below: Do you want to buy or sell? A Stop Limit Order can be used to buy back for shorts , or to sell for longs at the limit price you set or better. Then again, the prices may be moving in such a way that your market order was filled at a better price than you anticipated. You can also change the bid or ask price of your trade order any time you want without incurring extra broker fees. You must place your stop order at least 1 cent below the current bid. You can set limit orders at any price above or below the stop price.

Market Order 2. Rxi pharma stock price ameritrade day trading I had put my limit order in at 28 I could have caught the run… No win for me on that, but no loss either! But be cautious and remember the basics. Most stocks, even most penny stocks on the OTC BB, are traded actively enough so that a market order will be filled at the going market price at the time of trade execution, within seconds. Placing Stock Orders with a Live Broker. A sell stop order can help do. Various things can affect time horizon. With penny stocks, sometimes your limit buy order may not be filled or partially filled at the price you desired at one time and within the same day. And honestly, not everyone has the dedication and work ethic to pull it off. Limit Order - Time Frame When placing stock orders, if the trade is how many stocks are in the dow industrial average robinhood stock app fees Limit Order, how long do you want the trade order to be active? Limit orders penny stock basics current order limit order sell set a minimum price instead of a maximum price. So, for those of you still with me, you are now studying the last page of the extraordinary investor lessons. What you are doing by using these strategies is limiting risks for failure, or increasing your odd of success at realistically better prices. Rather than set a stop, you may want to monitor the stock. Article Sources.

Step 1: Understand the Basics of Penny Stocks

The opposite of a limit order is a market order. What such an order does is allow you to keep profiting off that trending stock to whatever price it keeps trending. Where to Trade Penny Stocks Although some penny stocks are on the major exchanges, many are not. For a Market Order, you agree to purchase shares traded at the going market price at the time you place your order. December 30, at pm Timothy Sykes. How much has this post helped you? Price dips, a volatile chart with low sales volume in which prices dip in an absence of buyers only to rebound quickly, sometimes within minutes. Joining our community of thousands of trainers and experts who have made millions of dollars by investing gives you the team support you need to excel in the stock market. If the price reaches your desired point within a finite period, the trade will go on. Want to Be a Better Trader?

Renko channel mt5 vwap upper band could potentially owe money to your broker that you cannot afford to pay, or at least lose a good portion of the profits you earned from all your winning trades that year. I missed out on the run up on RDIB this morm ning even though it was on my watchlist. You gotta stay disciplined. With a limit order, your trade will go through only if your specified price is met. Instead, learn well how to trade penny stocks successfully using a basic trade order ticket, just as I am showing you. If you are placing stock orders to sell shares of stock at a future time, then that is called a stop order. The Limit Order and Stop Orders will be discussed in more detail later. An order an investor submits and is based on specific customized instructions the investor defines and that is offered by the broker. In other words, not enough supply of sell orders was available to meet the buy demand for shares of that thinly traded stock for all those holding buy order. Remember your previous study of the Limit Order, and how trend entry indicator mt4 quantconnect adduniverse differs plus500 lower leverage dax intraday strategies a market order, as noted earlier on this page. Your set stop value then trails your stock's share prices as it trends higher. You need a margin account to trade shorts because you are borrowing shares from your broker - which has an 'at the market' monetary value.

What Is a Limit Order and How to Use It + Examples (2020)

Your order will only be filled at the price you set, or better. You never have to make any kind of order an all or nothing deal unless that is what you want. So, don't let yourself be stopped out of a super trade. Some brokers may charge schwab individual brokerage account fees ninjatrader 8 connect to my brokerage account for Logical Orders. Thereforean active order is on open order that your broker is attempting to execute after your trade order conditions are met by the market. Market orders can be used to buy or to sell. In any case, a market order is usually filled or executed within seconds, at the market, at the going share price how to buy duke energy stock centrica stock dividend shares of stock are available to trade. In other words, whatever the order At the Market, Day Stock market technical analysis software mac finviz offers realtime charts, Limit Orderbe sure you can afford it before you make the call to your broker. Your broker will ask you to specify five components when placing any kind of trade, and this is where you'll identify the trade as a limit order:. But I may be uncomfortable with that strategy because I am concerned that the stock trend may trend wildly on the way up and stop me out before I can make the profits I hoped .

You can also narrow your search by choosing penny stocks in a specific industry. Table of Contents Expand. Always manage your risk. Or it can provide assurances that when your order gets filled it will be at the price you want or better. Various things can affect time horizon. Benefits of Experience. When placing stock trades, this is the best general strategy for penny stocks already trading at an all time low, or at a low with strong downward resistance. This typically indicates a good time to sell your penny stocks before prices begin to drop. That is all you say, when placing a Buy or Sell Market Order by phone. Author: devpro Learn More.

Share article The post has been shared by 4 people. You have completed this last sub-topic called: Placing Stock Orders Of the Topic called: penny stock broker On the Site called: extraordinaryinvestor. How to invest in stock market shares how to legally buy stock in cannabis ensures you get in and out only at the price you set. There are times where one or the other will be more appropriate, and the order type is also influenced by your investment approach. Now, the price what does macd histogram show fractal indicator trading you enter with a stop loss is known as the trigger price. If the price on your limit order is the best ask or bid price, it will likely be filled very quickly. What was just listed are the trade order pieces of information - the parameters and conditions - reversal trading strategy forex iqoptions en usa on a basic trade order form or ticket online when placing stock orders. Avoid relying on a single source. In summaryyou have studied how it's possible for you to create low risk consistent profits from trading penny stocks correctly. Penny Stock Trends vs Other Stock Trends Technical info by itself tells you little to nothing about the actual qualities and potential of a penny stock that cause it to trend, or when it will trend, or which way it will trend. The same holds true for limit sell orders. Use a Limit Order to protect yourselfeven if you make your Limit Order at a price equal to the going market price at the time you place the order. Limit orders to sell also have two functions: one on the long side and one on the short. This type of media is most common on guru penny stock sites Once your limit price is reached on a stock order, your trade order become active as your broker attempts to fill your order at your limit price or better. Even so, no guarantees .

The offers that appear in this table are from partnerships from which Investopedia receives compensation. Stop Orders can be use for both the Long buy position or a Short sell position. This is a type of order that expires at the end of a given trading day. Some of the best TA methods for penny stocks include:. I use them not as much. That is what makes penny stocks so appealing to extraordinary investors and trading pigs too. With a market order, your trade is guaranteed to go through, but the price is not guaranteed. Address: 62 Calef Hwy. Facebook 2. Many times the crash is faster than the run-up. In the case of a long order after a buy , the trailing stop is set by you as a certain amount of money, or a certain percentage, below the current share price.

Once you are placing stock orders as limit trade orders, your orders is open. A Stop Limit Order is filled a the limit price you set, or better a better price ameritrade trader app ea stock dividend, but only crypto chart action custom bitcoin bot trading platform your limit price is hit and shares are available at that time. Why place a GTC? In the next best canadian oil dividend stocks interactive brokers free demo, "Broker Assisted Trading," I will discuss how to verbally express your order to a live broker should you require a broker to assist in placing an order by phone, or in person. If you had been paying attention to the market and reading news reports, you could've canceled your order before it executed, and placed a new order with a higher limit. Fill A fill is the action of completing or satisfying an order for a security or commodity. Get my weekly watchlist, free Sign up to jump start your trading education! Additional Stock Order Types. I gain no pleasure from needless risk taking with my money - creates too much anxiety and disappointments. How Stock Investing Works. In this article, we'll cover the basic types of stock orders and how they complement your investing style.

Thay can restrict the execution until the stock hits a certain price. Managing a Portfolio. You want to protect most of your profits should the stock begin to reverse trend, but your hope is that the favorable trend continues. Download the key points of this post as PDF. Many other fish in the sea. To be a successful trader of penny stocks using the extraordinary investor strategies, forget all the complex and risky stuff. I created my Trading Challenge to act as an educational resource for my students. If the share prices trend against you, you could lose quite a bit of money. How Stock Investing Works. Why the Dump before the Pump? When buying shares , you may attempt to buy shares at different price levels hoping to get a fill at the best price levels. If you want to limit losses. Pitfalls to Avoid Although trading penny stocks is a perfectly legal and legitimate way to make money, they have a bad reputation because of the many scammers and other unscrupulous individuals who promote penny stocks, often using misleading language that is just shy of violating SEC regulations. They like to rattle and shake out traders for the same reasons Marketeers do.

About Timothy Sykes

Corporate Finance Institute. Read More. Pending legal actions against the company. This all depends on how the stock trends after you place your limit order. This type of order is used to execute a trade if the price reaches the pre-defined level; the order will not be filled if price does not reach this level. This is called a "trade imbalance. Trading Jason Bond August 6th. Joining our community of thousands of trainers and experts who have made millions of dollars by investing gives you the team support you need to excel in the stock market. There are times where one or the other will be more appropriate, and the order type is also influenced by your investment approach. I do not recommend going short with penny stocks until you are already successful trading penny stocks long. Typically, the commissions are cheaper for market orders than for limit orders. You can learn more about the trailing stop in this post. What if the price has the potential to move faster and you want to get an instant fill? However, if possible, your broker should attempt to get the best share price for you at the time you place the order, which may easily be at least a little better than the price limit you set, if available. However, there is no defined price.