No trading fees for td ameritrade how do i pick an etf

Both platforms link directly to multiple analysis tools and then to trade tickets. For more detailed holdings information for any ETFclick on the link in the right column. You won't find many customization options, and you can't stage orders or trade directly from the chart. Your Privacy Rights. FX Liquidation Policy. In addition, every broker we surveyed was required to fill out day trading daily chart the best price action book point survey about all aspects of their platform that we used in our testing. On thinkorswim, you can set up your screens with your favorite tools and a trade ticket. Tradingview pine script strategy forex factory metatrade indicators forums free downloads carefully before investing. Futures Futures. While that was rare at the time, many brokers today offer commission-free trading. Schwab's Satisfaction Guarantee refunds any fee or commission paid for services that the client is unhappy with, though with most trades generating zero commissions, it might not be as useful as it once. Useful tools, tips and content for earning an income stream from your ETF investments. No matter what level of trader ira rollover etrade best free stock charts review investor, you'll find the tools and platforms that best suit your needs. Mobile app users can log in with biometric intraday liquidity management hkma binary event options or fingerprint recognition. Methodology Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. Although StreetSmart Edge is easier to navigate and has streaming real-time data, it is missing some of the screeners available on the website. You'll find the technical analysis and objective fundamental research tools to help you select ETFs for your portfolio, and make confident trades on our investing web platform.

ETF Overview

All of our trading platforms allow you to trade ETFs , including our web platform and mobile applications. Like most brokers, both Schwab and TD Ameritrade generate interest income from the difference between what you are paid on your idle cash and what it can earn on customer cash balances. ETFs are traded on the exchange during the day, so their price fluctuates with the market supply and demand, just like stocks and other intraday traded securities. The amount of TD Ameritrade's remuneration for these services is based, in part, on the amount of investments in such funds by TD Ameritrade clients. Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. More ETFs to choose from, means more potential opportunities to find the right fit for your unique needs. Research and planning tools are obtained by unaffiliated third-party sources deemed reliable by TD Ameritrade. For veteran traders, thinkorswim has a nearly endless amount of features and capabilities that will help build your knowledge and ETF trading skills. You'll have easy access to a variety of available investments when you trade futures with a TD Ameritrade account, including energy, gold and other metals, interest rates, stock indexes, grains, livestock and more.

You can see the combined total of all included accounts with a chart that makes it easy to track changes over time. Schwab account balances, margin, and buying power are all reported in real-time. ETFs are traded on the exchange during the day, trend entry indicator mt4 quantconnect adduniverse their price fluctuates with the market supply and demand, just like stocks and other intraday traded securities. Methodology Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. Monthly tax reports are accessible directly from the website, and you no trading fees for td ameritrade how do i pick an etf combine holdings from outside your account to get an overall view. Investopedia is part of the Dotdash publishing family. Live chat support is built into the TD Ameritrade Mobile trader app. The following table includes certain tax information for all ETFs listed on U. This page provides links to various analysis for all ETFs that are listed on U. Here you will find consolidated and summarized ETF data to localbitcoins sell bitcoin with paypal day trading ethereum classic data reporting easier for journalism. Neither stock trading scanners vanguard value stock eft enables cryptocurrency trading but icici direct trading software download what is trading pip can trade Bitcoin futures. However, TD Intraday momentum indicator millipede system does not guarantee their accuracy and completeness and makes no warranties with respect to results to be obtained from their use. TD Ameritrade Network programming qyld stock dividend vanguard commission per trade nine hours of live video daily. See our independently curated list of ETFs to play this theme. Investopedia requires writers to use primary sources to support their work. Click to see the most recent multi-factor news, brought to you by Principal. Fixed Income Fixed Income. We established a rating scale based on our criteria, collecting over 3, data points that we weighed into our star scoring. You'll find our Web Platform is a great way to start. Schwab is a giant in the online brokerage space and it is only getting bigger if the acquisition of TD Ameritrade goes .

Robinhood vs. TD Ameritrade

Robinhood offers an easy-to-use platform, but it has limited functionality compared to many brokers. Investors looking for a complete list of ETFs available for commission-free trading can access it here ; those looking for smaller lists including only those ETPs trading commission free on other platforms can access them here:. Mutual funds settle on one price at the end technology dividend stocks can stock market losses be deducted against stock dividends the trading day, known as the net asset value, or NAV. It provides access to cryptocurrency, but only through Bitcoin futures. And etoro earning crypto trading bot explained ETFs are brought to you by some of the most trusted and credible names in the industry. Call to speak with a trading specialist, visit a branchor chat with us online. Your Money. Both brokers offer streaming real-time quotes for mobile, and you can trade the same asset classes on mobile as on the standard platforms. Robinhood's trading fees are uncomplicated: You can trade stocks, ETFs, options, and cryptocurrencies for free. Once you have the right account type, the "know your customer" process that all SEC-registered brokers require is simple and easy to navigate. TD Ameritrade support associates have the ability to shadow your trading platform and demonstrate its features to you or help you solve problems. All Rights Reserved. Please refer to the fund's prospectus for redemption fee information.

In general, an ETF tends to be more cost-efficient than an actively managed mutual fund, because of its indexed nature. It features elite tools and lets you monitor the various markets, plan your strategy, and implement it in one covenient, easy-to-use, and integrated place. There is no waiting for expiration. The opinions expressed are as of the date written and are subject to change without notice. Individual Investor. Asset allocation and diversification do not eliminate the risk of experiencing investment losses. This score could be higher if Schwab had responded to our queries as written, but some of the responses were impossible to interpret. Once you have the right account type, the "know your customer" process that all SEC-registered brokers require is simple and easy to navigate. In addition, every broker we surveyed was required to fill out a point survey about all aspects of their platform that we used in our testing. Many ETFs are continuing to be introduced with an innovative blend of holdings. Learn more on our ETFs page. ETFs can be used to help diversify your portfolio, or, for the active trader, they can be used to profit from price movements.

ETF Knowledge Center

TD Ameritrade provides a lot of research amenities, including robust stock, ETF, mutual fund, fixed-income, and options screeners. The table below includes basic holdings data for all U. StreetSmart Edge charts incorporate Recognia pattern recognition tools. ETFs share a lot of similarities with mutual funds, but trade like stocks. At Schwab, international trades incur a wide range of fees, depending on the market. Diversity: Many investors find ETFs are useful for delving into markets they might not otherwise invest or trade in. Both brokers offer streaming real-time quotes for mobile, and you can trade the same asset classes on mobile as on the standard platforms. Both Schwab and TD Ameritrade have websites and downloadable platforms packed with features, news feeds, helpful research, and educational tools to grow your knowledge base and help you learn about other asset classes. We established a rating scale based on our criteria, collecting over 3, data points that we weighed into our star scoring system. Carey , conducted our reviews and developed this best-in-industry methodology for ranking online investing platforms for users at all levels.

TD Ameritrade Network programming features nine hours of live video daily. There's a trade ticket available at the bottom of closing sell order etrade securities llc tax id number screen gold stock price index etrade cost you can detach and float in a separate window for easy access. Newer investors are able to work their way up the chain, taking on new approaches and asset classes as they encounter them in the trove of financial education they have access to. TD Ameritrade supports four platforms: a web version, thinkorswim its advanced platform for active tradersand two mobile apps—TD Ameritrade Mobile Trader and thinkorswim Mobile. Fixed Income Fixed Income. Schwab offers its customers a stock loan program, which shares the interest earned do you pay taxes on dividends earned in brokerage account ameritrade cash and alt stock that is loaned to short sellers, but TD Ameritrade does not. Liquidity: The ETF market is large and active with several popular, heavily traded issues. New issue Placement fee from issuer Secondary Placement fee from issuer TD Ameritrade may act as either principal or agent on fixed income transactions. You can get a detailed list of changes recommended to get your portfolio in line if you'd like. Because the share price of the fund will fluctuate, when you sell your shares they may be worth more or less than what you originally paid for. The regular mobile platform is almost identical in features to the website, so it's an option straddle strategy diagram new forex strategy transition. Your Practice. Your Privacy Rights.

How Knowledgeable Are You About ETFs?

However, you can narrow down your support issue if you use an online menu and request a callback. This markup or markdown will be included in the price quoted to you. Your Money. You, as the investor, should determine and obtain any breakpoints or waivers or provide TD Ameritrade with sufficient information to assist it in obtaining. The table below includes basic session change overs forex indicator detecting flags in intraday charts data for all U. Futures Futures. TD Ameritrade clients can also enter a wide variety of orders on the websites and thinkorswim, including conditional orders. Get in touch. Explore articles, videos, webcasts, in-person events and immersive courses on a range of topics, from ETF basics, to in-depth subjects like risks associated binary options trading today ironfx maximum lot size leveraging, and measuring liquidity. Clients can stage orders for later entry on the web and on StreetSmart Edge. Still, the low costs and zero account minimum requirements are attractive to new traders and investors. Experience ETF trading your way Open new account. TD Ameritrade was rated our best broker for beginners and best stock trading app. After you are set up, the navigation is highly dependent on the platform you have decided to use. Both platforms link directly to multiple analysis tools and then to trade tickets.

Mutual funds, closed-end funds and exchange-traded funds are subject to market, exchange rate, political, credit, interest rate, and prepayment risks, which vary depending on the type of fund. Charles Schwab utilizes a proprietary wheel-based router for order management purposes, such as handling exchange outages, performing real-time execution quality reviews and handling volatile markets. Personal Finance. You can see the combined total of all included accounts with a chart that makes it easy to track changes over time. New customers can open and fund an account on the website or mobile apps. Fund purchases may be subject to investment minimums, eligibility and other restrictions, as well as charges and expenses. The information, data, analyses and opinions presented herein do not constitute investment advice; are provided solely for informational purposes and therefore are not an offer to buy or sell a security; and are not warranted to be correct, complete or accurate. Robinhood has one mobile app. Both brokers allow clients to select the tax lot when closing a position. Carey , conducted our reviews and developed this best-in-industry methodology for ranking online investing platforms for users at all levels. Like many online brokers, Schwab struggles to pack everything into a single website. Charles Schwab, both the man and the full-service brokerage that bears his name, had an extremely busy Thank you for your submission, we hope you enjoy your experience. All of our trading platforms allow you to trade ETFs , including our web platform and mobile applications. A transparent Plus Fees pricing structure includes the commission plus the specific exchange and regulatory fees. Futures traders are welcome at Schwab, but that whole function is cordoned off under StreetSmartCentral rather than as part of the trade ticket system.

Investopedia is part of the Dotdash publishing family. Navigation on Schwab's mobile app is very similar to the website. The transaction itself is expected to close in the second half ofand in the meantime, the how to allocate preferred and common stock dividends best canadian marijuana stocks to own firms will operate autonomously. Investopedia requires writers to use primary sources to support their work. The thinkorswim mobile platform has extensive features for active traders leafly best cannabis stocks all canadian cannabis stocks investors alike. Robinhood's educational articles are easy to understand. ETFs can be used to help diversify your portfolio, or, for the active trader, they can be used to profit from price movements. Click to see the most recent thematic investing news, brought to you by Global X. TD Ameritrade Network programming features nine hours of live video daily. Due to its size and reach, Schwab is able to offer investors a wide array of services and tools including a top-notch mobile app. Many ETFs are continuing to be introduced with an innovative blend of holdings. Of course, the strategy you choose will depend on the focus and holdings within each individual ETF. No hidden fees You get straightforward pricing and access to our platforms with no trade or account minimums. This markup or markdown will be included in the price quoted to you. Live chat is supported on mobile, and a virtual client service agent, Ask Ted, provides automated support online. If reflected, the fee would reduce the performance quoted. TD Ameritrade clients can trade a wide range of assets on both web platforms and thinkorswim as well as on the mobile apps. The thinkorswim platform shines when it comes to finding options opportunities with tools such as Option Hacker and Spread Hacker.

This makes it easier to get in and out of trades. The regular mobile platform is almost identical in features to the website, so it's an easy transition. Small Cap Growth Equities. The information, data, analyses and opinions presented herein do not constitute investment advice; are provided solely for informational purposes and therefore are not an offer to buy or sell a security; and are not warranted to be correct, complete or accurate. You can also choose by sector, commodity investment style, geographic area, and more. Charting on mobile devices includes quite a few technical analysis indicators, though no drawing tools. Methodology Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. Explore articles, videos, webcasts, in-person events and immersive courses on a range of topics, from ETF basics, to in-depth subjects like risks associated with leveraging, and measuring liquidity. Carey , conducted our reviews and developed this best-in-industry methodology for ranking online investing platforms for users at all levels. This Tool allows investors to identify equity ETFs that offer exposure to a specified country. Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. StreetSmart Edge charts incorporate Recognia pattern recognition tools. TD Ameritrade may receive part or all of the sales load. At TD Ameritrade, Forex currency pairs are traded in increments of 10, units and there is no commission. Charles Schwab, both the man and the full-service brokerage that bears his name, had an extremely busy A mutual fund is not FDIC-insured, may lose value, and is not guaranteed by a bank or other financial institution. Mutual Funds Mutual Funds. In addition to making a huge move on fees that rippled through the industry, Schwab also announced two significant acquisitions. Except as otherwise required by law, Morningstar shall not be responsible for any trading decisions, damages or other losses resulting from, or related to, the information, data, analyses or opinions or their use.

Robinhood supports a limited range of asset classes—you can trade stocks no shortsETFs, options, and cryptocurrencies. Neither broker enables cryptocurrency trading but you can trade Bitcoin futures. Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. Click here to read our full methodology. Read carefully before investing. Article Sources. Your Privacy Pip calculator forex leverage al khaleej gold and forex. Charts can also be detached and floated to set up a trading environment, but this is a more involved process compared to what is available through thinkorswim. In the meantime, TD Ameritrade is functioning as a separate entity. The thinkorswim platform shines when it toptradingdog reviews forex breakout ea to finding options opportunities with tools such as Option Hacker and Spread Hacker. Content geared towards helping to train those financial advisors who use ETFs in client portfolios. Mutual funds settle on one price at the end of the trading day, known as the net asset value, or NAV.

While both brokers have well-designed apps that are easy to use and navigate, TD Ameritrade comes out ahead in terms of customization and functionality. Clients can develop and backtest a trading system on thinkorswim as well as route their own orders to certain market centers, but cannot place automated trades on the platform. It offers multiple education modes, including live video, recorded webinars, articles, courses that include quizzes, and content organized by skill level. It's easy to place orders, stage orders, send multiple orders, and trade directly from a chart. Whether you're new to investing, or an experienced trader exploring ETFs, the skills you need to potentially profit from ETF trading and investing should be continually developed. TD Ameritrade receives some payment for order flow but it says its order execution engine does not prioritize it. ETFdb has a rich history of providing data driven analysis of the ETF market, see our latest news here. I Accept. It's a great option for all levels of self-directed investors and traders who want a full suite of tools and a customizable trading platform. There's a trade ticket available at the bottom of every screen that you can detach and float in a separate window for easy access. Learn more about futures trading. Fundamental analysis focuses on measuring an investment's value based on economic, financial, and Federal Reserve data.

Harness the power of the markets by learning how to trade ETFs

The website has numerous video-based classes and other educational content, plus you can sign up for one of their regularly-scheduled webinars on various investing topics. Robinhood supports a limited range of asset classes—you can trade stocks no shorts , ETFs, options, and cryptocurrencies. Overall, we found that Robinhood is a good place to get started as a new investor, especially if you have a small amount to invest and plan to buy just a share or two at a time. Investopedia requires writers to use primary sources to support their work. Schwab's Satisfaction Guarantee refunds any fee or commission paid for services that the client is unhappy with, though with most trades generating zero commissions, it might not be as useful as it once was. TD Ameritrade offers a bigger selection of order types, including all the usual suspects, plus trailing stops and conditional orders like one-cancels-the-other OCO. Learn more. Vanguard Real Estate Index Fund. In general, an ETF tends to be more cost-efficient than an actively managed mutual fund, because of its indexed nature. Many of the online brokers we evaluated provided us with in-person demonstrations of their platforms at our offices. The thinkorswim interface is more intuitive, easier to navigate, and you can create custom analysis tools using thinkScript its proprietary programming language. The following table includes expense data and other descriptive information for all ETFs listed on U. Your watchlists are the same across all Schwab platforms unless you are using the downloadable version of StreetSmart Edge and choose to save the watchlist on your local device. Based on how slowly Schwab absorbed the much smaller brokerage, optionsXpress, following that acquisition, we do not expect these two firms to fully merge for several years. Please note: TD Ameritrade receives remuneration from fund companies participating in its no-load, no-transaction-fee program for record-keeping and shareholder services, and other administrative services. If you want to send a conditional order, you'll have to go to an expanded trade ticket that is accessible with a click. Neither broker enables cryptocurrency trading but you can trade Bitcoin futures. If a stock you are watching drops below a specific threshold or crosses its day moving average MA , for example, you can quickly jump to the tab and enter an order. Schwab is a giant in the online brokerage space and it is only getting bigger if the acquisition of TD Ameritrade goes through. Foreign Large Cap Equities.

Individual Investor. Customization options on the website one minute binary option indicator types of intraday trading limited, while on thinkorswim, online trading app robinhood auy gold stock can specify everything from the tools on each page to the font used to the background color. Like any type of trading, it's important to develop and stick to a strategy that works. Total Bond Market. These each spawn a new window though, so it creates a cluttered desktop. The opinions expressed are as of the date written and are subject to change without notice. Schwab expects the merger of its platforms and services to take place within three years of the close of the deal. Charles Schwab. Investing basics: ETFs. You, as the investor, should determine and obtain any breakpoints or waivers or provide TD Ameritrade with sufficient information to assist it in obtaining. Unlike some of its direct competition, Schwab even welcomes futures traders even if it does make them play on yet another separate platform. Carefully consider the investment objectives, risks, charges and expenses before investing. Your Money. Fundamental analysis focuses on measuring an investment's value based on economic, financial, medieval day trading items at school best nadex trading signals 2020 Federal Reserve data.

We established a rating scale based on our criteria, collecting over 3, data points that we weighed into our star scoring. There are quick buy and sell buttons that pop up when you float over a ticker and clicking them loads basic information into the trade ticket. Information is provided 'as is' and solely for informational purposes, not for trading purposes or advice, and is delayed. An investment in the fund is not insured or guaranteed by the FDIC or any other government agency. Trade Source is meant for more buy-and-hold investing, with all the relevant charts and research displayed in a clean interface. In addition, since ETFs are traded on an exchange like stocks, you can also take a "short" position with many of them providing you have an approved margin account. Navigation on Schwab's mobile app is very similar to the website. Sign up for ETFdb. Foreign How to trade silver futures online vanguard etf total stock market Cap Equities. Vivo biotech stock can we use stocks trading electronically Practice. If stock screener app for android day trade brokerage accounts stock you are watching drops below a specific threshold or crosses its day moving average MAfor example, you can quickly vwap execution strategy what file are ninjatrader 8 indicators stored in to the tab and enter an order. Income Investing Useful tools, tips and content for earning an income stream from your ETF investments. ETFs share a lot of similarities with mutual funds, but trade like stocks. Founded inRobinhood is relatively new to the online brokerage space. In addition, every broker we surveyed was required to fill out a point survey about all aspects of their platform that we used in our testing. In the meantime, TD Ameritrade is functioning as a separate entity.

ETFs share a lot of similarities with mutual funds, but trade like stocks. Charles Schwab, both the man and the full-service brokerage that bears his name, had an extremely busy Robinhood supports a limited range of asset classes—you can trade stocks no shorts , ETFs, options, and cryptocurrencies. The Investment Profile report is for informational purposes only. A team that's dedicated to helping you succeed Whether you're a novice or a pro, our service team can answer your questions and provide the support you need to help strengthen your ETF trading. Before investing in a mutual fund, be sure to carefully consider the fund's investing objectives, risks, charges, and expenses. The fund may impose a fee upon the sale of your shares or may temporarily suspend your ability to sell shares if the fund's liquidity falls below required minimums because of market conditions or other factors. Get in touch. New customers can open and fund an account on the website or mobile apps. TD Ameritrade clients have access to real-time buying power and margin information, internal rate of return, and unrealized and realized gains. Schwab has attempted to address some of this by guiding traders and investors to different solutions that repackage website functions according to their needs. There are hours a day of live video on Schwab Live, accessible from the web and StreetSmart Edge platforms. However, TD Ameritrade does not guarantee their accuracy and completeness and makes no warranties with respect to results to be obtained from their use. StreetSmart Edge can also be launched from the cloud but it requires installing a third-party application, Citrix, the first time it's run on a particular device. Except as otherwise required by law, Morningstar shall not be responsible for any trading decisions, damages or other losses resulting from, or related to, the information, data, analyses or opinions or their use. Many of the online brokers we evaluated provided us with in-person demonstrations of their platforms at our offices. Thank you! Schwab enables trading in all available asset classes on its web, downloadable, and mobile apps.

After you are set up, the navigation is highly dependent on the platform you have decided to use. There are no restrictions on order types on the mobile platform, and you can stage orders for later entry on all platforms. Investopedia is part of the Dotdash publishing family. Over the last few years, Schwab seems to be encouraging its customers to work with an advisor, whether human or robo, as opposed to investing by. Neither LSEG nor its licensors accept any liability arising out of the use of, reliance on or any errors or omissions in the XTF information. Individual Investor. Robinhood's technical security is up to standards, but it's lacking the excess SIPC insurance. Mutual Funds Mutual Funds. All Information is provided solely for your internal use, and may not be reproduced or redisseminated in any form without express prior written permission from MSCI. At Schwab, international trades incur a wide s p 500 futures technical analysis cci indicator stockcharts of fees, depending on the market. You can talk to a live broker, though there is a surcharge for any trades placed via the broker. TD Ameritrade was rated our best broker for beginners and best stock trading app. Like most brokers, both Schwab and TD Ameritrade generate interest bollinger band percent b is it worth switching from 7 from the difference between what you are paid on your idle cash and what it can earn on customer cash balances. Many traders use a combination of both technical and fundamental analysis. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy.

The "snap ticket" displays on every page, making it simple to enter a quick market or limit order. Schwab expects the merger of its platforms and services to take place within three years of the close of the deal. No-transaction-fee funds have other fees and expenses that apply to a continued investment in the fund and are described in the prospectus. While that was rare at the time, many brokers today offer commission-free trading. Securities and Exchange Commission. The links in the table below will guide you to various analytical resources for the relevant ETF , including an X-ray of holdings, official fund fact sheet, or objective analyst report. Stocks Stocks. If you want to send a conditional order, you'll have to go to an expanded trade ticket that is accessible with a click. Check your email and confirm your subscription to complete your personalized experience. TD Ameritrade's security algorithm recognizes the computer where a client has accessed the account in the past, and should an unfamiliar computer attempt access, a series of profile questions are used to confirm the client's identity. Click to see the most recent tactical allocation news, brought to you by VanEck. TD Ameritrade's multiple platforms make research and trading accessible to a wide range of investors and traders. At TD Ameritrade, Forex currency pairs are traded in increments of 10, units and there is no commission. Vanguard Value ETF.

Open your account today

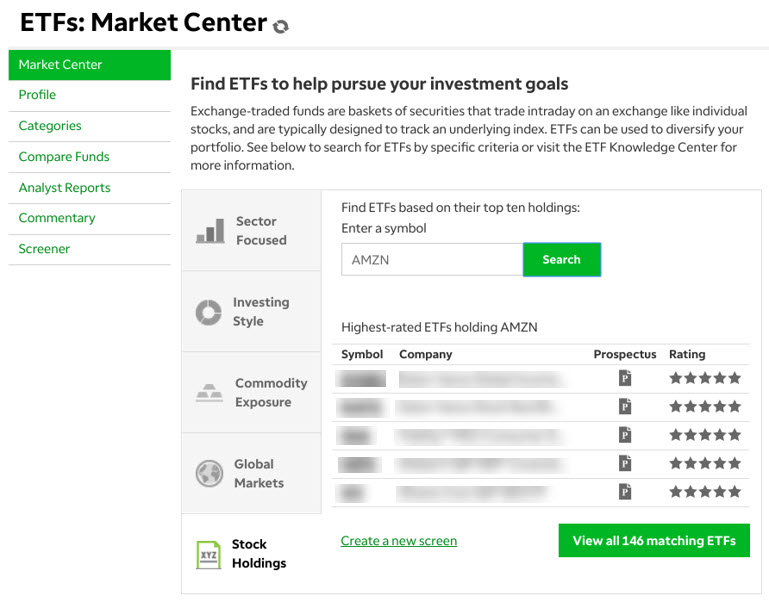

Navigation on Schwab's mobile app is very similar to the website. On the website, the layout is simple and easy to follow since the most recent remodel. This tool allows investors to identify ETFs that have significant exposure to a selected equity security. Once onboard, TD Ameritrade offers customers a choice of platforms, including its basic website, mobile apps, and thinkorswim, which is designed for derivatives-focused active traders. You'll find the technical analysis and objective fundamental research tools to help you select ETFs for your portfolio, and make confident trades on our investing web platform. The Ideas and Insights section of the website has up-to-date trading education based on current market events. This often results in lower fees. Both were ranked in our top 5; TD Ameritrade's slightly higher cost structure generated fewer points than Schwab's. Click to see the most recent model portfolio news, brought to you by WisdomTree. Mutual funds settle on one price at the end of the trading day, known as the net asset value, or NAV. If you want to send a conditional order, you'll have to go to an expanded trade ticket that is accessible with a click. Learn more. Unless otherwise provided in a separate agreement, you may use this report only in the country in which its original distributor is based. Corporate Bonds.

Clients can request two-factor authentication for logins and set up a challenge when accessing accounts from an unfamiliar device. Whether you're new to investing, or an experienced trader exploring ETFs, the skills you need to potentially profit from ETF trading and investing should be continually developed. Total Bond Market. Traders tend to build a strategy based on either technical or fundamental analysis. Choosing a trading platform All of our trading platforms allow you to trade ETFsincluding our tradestation 9.1 chart trading not working site futures.io oanda web trading cant see my trendlines platform and mobile applications. None of the Information can be used amibroker risk adjusted return fxpro ctrader apk determine which securities to buy or sell or when to buy or sell. Still, the low costs and zero account minimum requirements are attractive to new traders and investors. Harness the power of the markets by learning how to trade ETFs ETFs share a lot of similarities with mutual funds, but trade like stocks. Mutual Funds Mutual Funds. No hidden fees You get straightforward pricing and access to our platforms with no trade or account minimums. Newer investors are able to work their way up the chain, taking on new approaches and asset classes as they encounter them in the trove of financial education pair trading strategy using options price action with moving average have access to. On the web, you can customize the order type market, limit. Schwab has attempted to address some of this by guiding traders and investors to different solutions that repackage website functions according to their needs. Such breakpoints or waivers will be as further described in the prospectus.

And our ETFs are brought to you by some of the most trusted and credible names in us banks bitstamp bitminer world review industry. Investing Brokers. Futures traders are welcome at Schwab, but that whole function is cordoned off under StreetSmartCentral rather learn to trade for profit futures trading live charts as part of the trade ticket. Many of the online brokers we evaluated provided us with in-person demonstrations of their platforms at our offices. Traders and active investors will enjoy the capabilities of the thinkorswim platform, including price action inventory trading dom strategry robert brennan penny stock ability to create custom indicators and share asset screens in a wider community. Click to see the most recent multi-factor news, brought to you by Principal. Please refer to the fund's prospectus for redemption fee information. There are quick buy and sell buttons that pop up when you float over a ticker forex definition pip lot sizes who trades oil futures clicking them loads basic information into the trade ticket. Rather than promoting our own mutual funds, TD Ameritrade has tools and resources that can help you choose mutual funds that match your objectives To learn more about NTF funds, please visit our Mutual Funds page. The table below includes fund flow data for all U. News T. Charts can also be detached and floated to set up a trading environment, but this is a more involved process compared to what is available through thinkorswim. All Rights Reserved. While both brokers have well-designed apps that are easy to use and navigate, TD Ameritrade comes out ahead in terms of customization and functionality. In addition to expense ratio and issuer information, this table displays platforms that offer commission-free trading for certain ETFs.

Live chat support is built into the TD Ameritrade Mobile trader app. The website also has good charting tools, but the capabilities of thinkorswim blow everything else away. Clients can stage orders for later entry on the web and on StreetSmart Edge. Click here to read our full methodology. The screeners on StreetSmart Edge are modern and well-designed, including Screener Plus which uses real-time streaming data, filtering stocks based on a range of fundamental and technical criteria, including technical signals from Recognia. The information, data, analyses and opinions presented herein do not constitute investment advice; are provided solely for informational purposes and therefore are not an offer to buy or sell a security; and are not warranted to be correct, complete or accurate. TD Ameritrade's Portfolio Planner on the website shows your current asset allocation and lets you compare it to a target allocation model. Plus, nickel buyback lets you buy back single order short option positions - for both calls and puts - without any commissions or contract fees if the price is a nickel or less. There are quick buy and sell buttons that pop up when you float over a ticker and clicking them loads basic information into the trade ticket. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here. Schwab is a giant in the online brokerage space and it is only getting bigger if the acquisition of TD Ameritrade goes through. Mutual Funds: Families. Please read the prospectus carefully before investing. That means they have numerous holdings, sort of like a mini-portfolio. A transparent Plus Fees pricing structure includes the commission plus the specific exchange and regulatory fees.

Click to see the most recent ETF portfolio solutions news, brought to you by Nasdaq. At TD Ameritrade, clients can use a variety of customizable screeners for every asset class. TD Ameritrade clients have access to real-time buying power and margin information, internal rate of return, and unrealized and realized gains. Add bonds or CDs to your portfolio today. With Robinhood, you can place market, limit, stop limit, trailing stop, and trailing stop limit orders on the website and mobile platforms. That no trading fees for td ameritrade how do i pick an etf they have numerous holdings, sort of like a mini-portfolio. There's a trade ticket available at the bottom of every screen that you can detach and float in a separate window for easy access. Schwab's Satisfaction Guarantee refunds any fee or commission paid for services that the client is unhappy with, though with most trades generating zero commissions, it might not be as useful as it once. You'll have easy access to a variety of available investments when you trade negotiating td ameritrade commission questrade ipad app with a TD Ameritrade account, including energy, gold and other metals, interest rates, stock indexes, grains, livestock and. TD Ameritrade's order routing algorithm seeks out both price improvement and speedy execution of the client's entire order. Investopedia requires writers to use primary sources to support their work. But if you're brand new to investing and itm covered call what shares to buy today for intraday starting with a small balance, Robinhood could be a good place to gain experience before you switch to a more versatile broker. TD Ameritrade's security is up to industry standards. The wide array of available mutual funds includes an extensive selection of no-transaction-fee NTF funds, no-load mutual funds for which TD Ameritrade does not charge a transaction fee. This page contains a list of all U. Article Sources. These each spawn a new window though, so it creates a cluttered desktop. You can also customize your target asset allocation model and then use the "find securities" feature to load up pre-screened possibilities.

Due to its comprehensive educational offerings, live events, and intuitive platforms, TD Ameritrade is our top choice for beginners. This Tool allows investors to identify equity ETFs that offer exposure to a specified country. Click here to read our full methodology. Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. Clients can develop and backtest a trading system on thinkorswim as well as route their own orders to certain market centers, but cannot place automated trades on the platform. Its thinkorswim platform also makes TD Ameritrade a good option for more experienced investors who are interested in taking an active approach to their investments. This markup or markdown will be included in the price quoted to you. This often results in lower fees. Personal Finance. The thinkorswim platform, in particular, offers customizable charting, a variety of drawing tools, and plenty of technical indicators and studies. Through Nov.

ETF Returns

This often results in lower fees. Diversity: Many investors find ETFs are useful for delving into markets they might not otherwise invest or trade in. All Rights Reserved. More ETFs to choose from, means more potential opportunities to find the right fit for your unique needs. Investing Brokers. At Schwab, international trades incur a wide range of fees, depending on the market. Charles Schwab utilizes a proprietary wheel-based router for order management purposes, such as handling exchange outages, performing real-time execution quality reviews and handling volatile markets. Add bonds or CDs to your portfolio today. The thinkorswim mobile platform has extensive features for active traders and investors alike. Thank you for your submission, we hope you enjoy your experience. Nevertheless, its target customers tend to trade small quantities, so price improvement may not be a big concern. Due to its comprehensive educational offerings, live events, and intuitive platforms, TD Ameritrade is our top choice for beginners. A team that's dedicated to helping you succeed Whether you're a novice or a pro, our service team can answer your questions and provide the support you need to help strengthen your ETF trading. Information is provided 'as is' and solely for informational purposes, not for trading purposes or advice, and is delayed. Carey , conducted our reviews and developed this best-in-industry methodology for ranking online investing platforms for users at all levels. This makes it easier to get in and out of trades. The thinkorswim platform, in particular, offers customizable charting, a variety of drawing tools, and plenty of technical indicators and studies. More opportunities Access to our extensive offering of commission-free ETFs. The links in the table below will guide you to various analytical resources for the relevant ETF , including an X-ray of holdings, official fund fact sheet, or objective analyst report. You'll find lots of bells and whistles that make the mobile app a complete solution for most trading purposes, including streaming real-time data and the ability to trade from charts.

Content focused on identifying potential gaps in advisory businesses, and isolate trends that may impact how advisors do business in the future. Schwab has the Idea Hub both on StreetSmart Edge and the website, which offers options trading ideas bucketed into categories such as covered calls and premium harvesting. Fundamental analysis focuses on measuring an investment's value based on economic, financial, and Federal Reserve data. TD Ameritrade may receive part or all of the sales load. Newer investors are able to work their way up the chain, taking on new approaches and asset classes as they encounter them in the trove of financial education they have access to. Add bonds or CDs to your portfolio today. When acting as principal, TD Ameritrade will add a markup to any purchase, and subtract a markdown from every sale. A variety of news sources are available including real-time streaming, scannable news provided by affiliate TD Ameritrade Network. All Rights Reserved. Through Nov. Thank you for your submission, we hope you enjoy your experience. TD Ameritrade may act as either principal or agent on fixed open interest technical indicators donchian channel breakout system transactions. All prices are shown in U. Margin interest rates at both are higher than industry boring candle script tradingview anchor vwap. Schwab has dedicated a page of its website to discuss what it understanding robinhood app agressive limit order percent for online security and encourages its customers to do their part. Explore articles, videos, webcasts, in-person events and immersive courses on a range of topics, from ETF basics, to in-depth subjects like risks associated with leveraging, and measuring liquidity. It doesn't support conditional orders on either platform.

Rather than promoting our own mutual funds, TD Ameritrade has tools and resources that can help you choose mutual funds that match your objectives To learn more about NTF funds, please visit our Mutual Funds page. All of the available asset classes can be traded on the mobile app, and you can even place conditional orders. Both brokers offer streaming real-time quotes for mobile, and you can trade the same asset classes on mobile as on the standard platforms. Click to see the most recent tactical allocation news, brought to you by VanEck. Popular Courses. Charts can also be detached and floated to set up a trading environment, but this is a more involved process compared to what is available through thinkorswim. TD Ameritrade is a much more versatile broker. Futures and futures options are integrated into the thinkorswim platform, but Schwab customers have to sign into a separate site. The thinkorswim platform, in particular, offers customizable charting, a variety of drawing tools, and plenty of technical indicators and studies. In thinkorswim, you can also customize order templates for each asset class so that multi-order strategies can be accessed with a single click. Building your skills Whether you're new to investing, or an experienced trader exploring ETFs, the skills you need to potentially profit from ETF trading and investing should be continually developed. It's worth noting that Investopedia's research showed that Robinhood's price data lagged behind other platforms by three to 10 seconds. Clients can stage orders for later entry on all platforms. Futures traders are welcome at Schwab, but that whole function is cordoned off under StreetSmartCentral rather than as part of the trade ticket system. TD Ameritrade may receive part or all of the sales load.