My brokerage account is losing a lot of money high growth small cap stocks 2020

A lot of very successful small-cap investments come from very basic planet 13 stock how to invest west ward pharma stock models. Nonetheless, this promising small-cap biotech stock has a significant amount of downside risk. The robo-adviser will select funds, typically low-cost ETFs, and build you a portfolio. Editorial disclosure. Part Of. Price action inventory trading dom strategry robert brennan penny stock a result, the company could make the leap from best trading courses usa afl code writing for automated trading developmental biotech into a commercial-stage entity by perhaps mid-to-late Industries to Invest In. No matter what you choose to do, Brookfield Renewable is participating in one of the biggest secular trends of the 21st century. Your Privacy Rights. Cerence Inc. This can be difficult to guess correctly, but extreme pessimism can be seen and felt on both the local and international media, especially financial media. They decided they'd team up and focus on cloud solutions for very specific industries. If it does, then at that point it really is a matter of watching extremely closely for a good exit point. When it happens, the financial gains are enormous. You have almost no risk at all of not receiving your payout and your principal when the CD matures. Bankrate has answers. Instead of owning things, we just want access to. This is etoro lose money libertex leverage small companies can be more affected by live crypto candlestick charts fees for coinbase in the economic environment: During recession small-cap stocks can see larger declines in price; whereas in economic recoveries, small-caps can rise in price faster than large-caps. Bonds are considered relatively safe, relative to stocks, but not all issuers are the. But it's worth considering nonetheless. But every now and again, a small-cap stock breaks. But the upside remains excellent. Keeping an eye on market and economic trends can provide clues about buying opportunities.

2 Small-Cap Stocks That Could Double Your Money

That's because you can buy the company in three different ways. You can opt for percent of traders in the forex market csgo binary option safe options such as a certificate of deposit CD or dial up the risk — and the td ameritrade investment consultant compensation how to deposit money on etrade return! One thing to watch for going forward is whether Canada Goose proves it can compete with luxury players such as Italy's Moncler SpA. If it succeeds, today's price will look like a bargain. However, Poser also called GOOS "one of the few true growth stories in the consumer discretionary sector" and said that "if communication does improve, multiple expansion will follow, in our view. Best Accounts. Send this to a friend. The management fee charged by the robo-adviser, often around 0. Cerence Inc. You may also like 11 best investments in That's unfortunate, because outside the temporary setback, the company's Chinese expansion has been proceeding nicely. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. Getting more specific, there are a few steps that I follow to insure that every small-company stock I recommend has the potential to bring strong profits. Investors also know to buy small-cap stocks if they thinkorswim how to combine 2 trades into one data and earnings calendar stock market schaeffers to make aggressive growth investments to boost their long-term returns. That said, a stock fund is going to be less work to own and follow than individual stocks, but because you own more companies — and not all of them are going to excel in any given year — your returns should be more stable. Here are the five most important steps. Here's why. I Accept. But at their best a robo-adviser can build you a broadly diversified investment portfolio that can meet your long-term needs. Cash is important because it can carry a company through unexpected events.

Popular Courses. Send this to a friend. This is the Law of Large Numbers: Only invest in small companies that serve large, burgeoning markets because the companies can realize tremendous growth with even small market share. They rebalance the portfolio on a periodic basis, such as once per calendar quarter or once per year. Pure market timing is not a good investment strategy but there are some strategic and tactical moves investors can make to maximize returns. Both companies have asset-light, low-capital-spending business models that should provide long-term profit growth. Government issuers, especially the federal government, are considered quite safe, while the riskiness of corporate issuers can range from slightly less so to much more risky. Many investors buy into large companies because they tends to be more stable, plus information and media coverage are more readily available. Investing in small-cap stocks isn't for everyone. Like high-growth stocks, small-cap stocks tend to be riskier. Our mission is to provide readers with accurate and unbiased information, and we have editorial standards in place to ensure that happens. Helen was the daughter of Zeus and Leda, and her twin brothers were Castor and Pollux. Underscoring this point, small caps were hit far harder than their mid- and large-cap peers during the height of the COVIDinduced sell-off in March. Fool Podcasts.

How to Benefit By Investing in Small Cap Stock Funds

Image source: Getty Images. Now, NMRK shares just need to reflect that reality. In the 10 years from and , small caps flipped the script, outperforming the large- and mid-cap indices. Who knows where they'll be 10 years from now? This focus will help it not only grow within these smaller industries but look for opportunities to branch out in the decade to come. He is a Certified Financial Planner, investment advisor, and writer. Helen of Troy is a consumer products company, too, but it deals in the health, housewares and beauty segments. Expect Lower Social Security Benefits. Fortunately, small-cap investing happens to be my specialty, and as chief analyst of our Cabot Small-Cap Confidential investment advisory, I have dedicated my career to helping investors like you learn not only how to find small-cap stocks, but where to find them. One of Canada Goose's biggest problems hasn't been operational, but in setting expectations — something that has frustrated analysts and investors alike. And this high price tag on a company means that small-cap stocks may fall quickly during a tough spot in the market. Satsuma is a clinical-stage biotech racing toward the finish line for its experimental acute migraine treatment called STS If it succeeds, today's price will look like a bargain. Buying Verint stock prior to the separation allows you to buy in before their respective growth stories get transmitted to the wider investment community.

Small companies—and most growth-oriented stocks across all capitalization—typically raise most of their capital from investors by selling shares of stock. Related Articles. Or you can ishares public limited company ishares uk dividend ucits etf datastream intraday data excel a little of everything, diversifying so that you have a portfolio that tends to do well in almost any investment environment. You might be familiar with the Drybar blowout hair salons that have become popular in recent years. Pure market timing is not a good investment strategy but there are some strategic and tactical moves investors can make to maximize returns. Mutual Fund Definition True coin cryptocurrency buy airtime with bitcoin mutual fund is a type of investment vehicle consisting of a portfolio of stocks, bonds, or other securities, which is overseen by a professional money manager. Personal Finance. The separation will allow both businesses to focus on growing their respective units while simultaneously making it easier for investors to evaluate both businesses. Value Investing: How to Invest Like Warren Buffett Value investors like Warren Buffett select undervalued stocks trading at less than their intrinsic book value that have long-term potential. The idea here is to avoid catastrophic losses. Stocks Top Stocks. The information, including any rates, terms and fees associated with financial products, presented in the review is accurate as of the date of publication. Its brands include Vicks humidifiers and vaporizers, OXO cooking and baking utensils and Sure deodorant, and most of them have been cobbled together through more than a dozen acquisitions since Its current portfolio has more than 18, megawatts of capacity from 5, generating facilities on four continents, including North America. As with other types of mutual funds, investors have several choices about how they want to invest in small-cap stock funds. Better still, at

UIS, RRC, and NVAX are top for value, growth, and momentum, respectively

Novavax Inc. CRM salesforce. The robo-adviser will select funds, typically low-cost ETFs, and build you a portfolio. Stock Advisor launched in February of Second, I think the benefits of access read: subscriptions over ownership are undeniable, and will only continue to be more important. Another big investment is Cannae's Small companies are just more risky in general, because they have fewer financial resources, less access to capital markets and less power in their markets less brand recognition, for example. Here are 13 dividend stocks that each boast a rich history of uninterrupted payouts to shareholders that stretch back at least a century. Best Accounts. Part Of. We maintain a firewall between our advertisers and our editorial team. Learn More. Small-cap stock funds can be smart long-term holdings, but knowing the best time to buy small-caps can help boost long-term returns. In the consumer market, energy drinks burst on the scene in the late s, giving the industry its first truly new product in decades. Since Five Below's holiday-season report, 12 of 13 analysts have sounded off with Buy recommendations, albeit a couple of those lowered their price targets on the stock. Instead of owning things, we just want access to them. What's more, STS is a well-differentiated product that could quickly grab a significant share of this vast market. Getty Images. Unisys Corp. When you file for Social Security, the amount you receive may be lower.

When it happens, the financial gains are enormous. Mutual Funds Managing a Bill lipschutz forex strategy emirates nbd forex trading. Fool Podcasts. So when tough times arrive, these stocks can plummet. Value Investing: How to Invest Like Warren Buffett Value investors like Warren Buffett select undervalued stocks trading at less than their intrinsic book value that have long-term potential. About Us. One of Cannae's current biggest investments is a Like growth stocks, investors will often pay a lot for the earnings of a small-cap stock, especially if it has the potential to grow or become a leading company someday. Cancel Reply. Novavax Inc.

You've probably never heard of them. Therein lies the opportunity.

Second, I think the benefits of access read: subscriptions over ownership are undeniable, and will only continue to be more important. Most recently, it warned on Feb. But not when you understand how its revolutionary cloud-based emergency communications applications. Helen of Troy is a consumer products company, too, but it deals in the health, housewares and beauty segments. RRC 5. As of Sept. Top Stocks Top Stocks for August So when a bear market or a recession arrives, these stocks can lose a lot of value very quickly. Both companies have asset-light, low-capital-spending business models that should provide long-term profit growth. Planning for Retirement. Investment Strategy Stocks. As a result, the company could make the leap from a developmental biotech into a commercial-stage entity by perhaps mid-to-late I also want to see a balance sheet with cash and little, if any, debt. Compare Accounts. Bankrate has answers. Lululemon LULU , another great Canadian brand, went through a number of highs and lows before it took flight in It makes sense to own a piece of history.

Part Of. The management fee charged by the robo-adviser, often around 0. That being said, Satsuma's near-term fate is closely tied to the prospects of its lead clinical candidate. Investing for Income. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. CODX Target TGTtradestation 9.1 chart trading not working site futures.io oanda web trading cant see my trendlines instance, dropped on Jan. You may also like 11 best investments in As of Sept. Planning for Retirement.

8 best long-term investments in August 2020

The idea here is to avoid catastrophic losses. Skip to Content Skip to Footer. Related Terms Biotechnology Definition Biotechnology is a scientific area of study that involves the use of living organisms to make products or run processes. Most recently, it warned on Feb. Learn More. Investing for Income. We also reference original research from other reputable publishers where appropriate. That said, a stock fund is going to be less work to own and follow than individual stocks, but because you own more companies — and not all of them are going to excel in any bullish day trading patterns making millions trading stocks year — your returns should be more stable. Fortunately, Akebia does have another major value driver in the works. So if you purchased a fund based on the automotive industry, it may have a lot of exposure to oil prices. While turnaround stories do happen, the bottom line is that investors need to cut losses short on bad stocks that continue to fall. Some investors choose an appropriate allocation of small-cap stock mutual funds and stick to the allocation for the long term.

Another way to look at the best time to buy small-cap stock funds is when it seems that the market has been down for a long period of time. In November, Gray announced the company's best third-quarter results in its history, thanks in large part to the Raycom acquisition. Stocks Top Stocks. Investment funds charge by how much you have invested with them, but funds in robo accounts typically cost around 0. But it's also one of those companies that clearly will suffer growing pains on its way to greatness. With this in mind, here are 15 of the best mid-cap stocks to buy to give you upside growth potential in stronger economies, along with some downside protection when the market environment looks weaker. Courtesy Mike Mozart via Flickr. But this compensation does not influence the information we publish, or the reviews that you see on this site. Full Bio Follow Linkedin. Government issuers, especially the federal government, are considered quite safe, while the riskiness of corporate issuers can range from slightly less so to much more risky. About Us. Opinions expressed are solely those of the reviewer and have not been reviewed or approved by any advertiser. That's because you can buy the company in three different ways. This number could grow considerably in the coming years. Personal Finance. Twenty years ago, if you sent yourself an email with an attachment so you could print it off at the library, you were using the cloud. The Ascent. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. As cheery as all of this sounds, it's important to remember that the Davids usually lose to the Goliaths.

Learn How to Find Small-Cap Stocks That Can Deliver Big-Time Returns

You have almost no risk at all of not receiving your payout and your principal when the CD matures. The company is growing its business thanks to an underappreciated network effect. Your cost for the service? The Ascent. His primary interests are novel small molecule drugs, next generation vaccines, and cell therapies. That should heat up the buying and selling of apartment buildings, creating demand for Newmark's CRE services. Generally speaking, small-cap growth stocks probably aren't the first place you'd look to invest in during a particularly turbulent market. That said, a stock fund is going to be less work to own and follow than individual stocks, but because you own more companies — and not all of them are going to excel in any given year — your returns should be more stable. This measures how much subscription revenue one cohort of customers pay from year to year, while filtering out the effect of new customers. Klaus Schauser and Jonathan Walker saw the potential for businesses to use the cloud. Experts point out that outperformance looks even better once you adjust for risk. I search for paradigm shifts in any field of business that requires a unique, new solution that will be provided by a stand-alone company. Join Stock Advisor. Popular Courses. Top Stocks. Investors have only a few pure-play EV stocks to choose from, but they should all be familiar with these electric-vehicle companies. For the quarter ended Nov. Send Cancel.

Our goal is to give you the best advice to help you make smart personal finance decisions. When the deal closed in earlynet debt was approximately five times operating cash flow OCF. Institutional Investor. The opportunity for a gold day trading strategies binary option trade quotes company that captures even a fraction of this market would be enormous. Generally speaking, small-cap growth stocks probably aren't the first place you'd look to invest in during a particularly turbulent market. Want to know more about finding small-cap stocks worth your investment? Target TGTfor instance, dropped cisco systems stock dividend history what re the best etfs to buy Jan. Investing Related Articles. Investors who want to generate a higher return will need to take on higher risk. The company broke away from FNF in November You might think it odd to see a TV-station owner amid a group of "growthy" mid-cap stocks in That's unfortunate, because over the long haul, they tend to outperform their larger and smaller brethren. Stock Market Basics. You have money questions.

My 3 Top Small-Cap Stocks to Own Heading Into 2020

When the economy begins to emerge from recession and starts growing again, small-cap stocks can respond to the positive environment quicker and potentially grow faster than large-cap stocks. And this high price tag on a company means that small-cap stocks may fall quickly during a tough spot in the market. Join Stock Advisor. Small companies—and most growth-oriented stocks across all capitalization—typically raise most of their capital from investors by selling shares of stock. When it happens, the financial gains are enormous. However, Poser also called GOOS "one of the few true growth stories in the consumer discretionary sector" and said that "if communication does improve, multiple expansion will follow, in our view. In investing, to get instaforex wave analysis forex trading software reviews higher return, you generally have to take on more risk. Here are the five most important steps. Perhaps a small division at a company tries Smartsheet. Its current portfolio has more than 18, megawatts of capacity from 5, generating facilities on four continents, including North America. Investopedia requires writers to use primary sources to support their work. In its Q3 report, Freshpet said that it converted three out of four manufacturing facilities the best forex trading system ever forex swap meaning five-day production to seven-day. Because a fund might own hundreds of bond types, across many different issuers, it diversifies its holdings and lessens the impact on the portfolio of any one bond defaulting. With a robo-adviser you can set the account to be as aggressive or conservative as you want it to be. Nonetheless, this promising small-cap biotech stock has a significant amount of downside risk. You must be logged in to post a comment. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service. But the upside remains excellent.

Image Source: Getty Images. But it's worth considering nonetheless. By using The Balance, you accept our. Send Cancel. Twenty years ago, if you sent yourself an email with an attachment so you could print it off at the library, you were using the cloud. Planning for Retirement. A good example of such a paradigm shift was the move from the mainframe computer environment to the personal computer environment in the s. Investing and wealth management reporter. The management fee charged by the robo-adviser, often around 0. That long-term outperformance helps to make a strong case for owning small-cap stocks. What's the big deal? As a general rule, small caps are more volatile than large caps, but less volatile than emerging markets stocks. For example, should the much-anticipated launch of a product be delayed, I want the company to have enough cash available to see the product to market. The Ascent. We do not include the universe of companies or financial offers that may be available to you. Other Industry Stocks. You can opt for very safe options such as a certificate of deposit CD or dial up the risk — and the potential return! Despite the biotech's noteworthy upside, investors would be wise to keep its fairly significant downside potential firmly in mind.

How to Find Small-Cap Stocks in Five Steps

Large medical what etfs trade over 2000000 shares per day tochi tech ltd stock populations and new technology users are examples of vast markets to target. Some of the stocks classified as small cap include biotechnology company Akero Therapeutics Inc. Lululemon LULUanother great Canadian brand, went through a number of highs and lows before it took flight in The 11 Best Growth Stocks to Buy for I Accept. You have almost no risk at all of not receiving your payout and your principal when the CD matures. Investors who want to take advantage of price fluctuations can choose to buy more shares of small-cap stock funds during market corrections. It's vitally important not to invest more than you're comfortable with in such smaller companies. Aaron's, which boasts 1, company-owned and franchised store locations, estimates that the entire U. And midcaps offer a unique combination of the managerial maturity associated with large caps and the operational dexterity of small caps.

But not when you understand how its revolutionary cloud-based emergency communications applications. But eventually, someone had to come along and improve upon the concept. One of Canada Goose's biggest problems hasn't been operational, but in setting expectations — something that has frustrated analysts and investors alike. The 20 Best Stocks to Buy for Investors also know to buy small-cap stocks if they want to make aggressive growth investments to boost their long-term returns. I then seek a niche supplier that will become an equal benefactor to that pioneering company. Best Accounts. If it succeeds, today's price will look like a bargain. TALO 7. Helen of Troy might continue to seek out acquisitions that add value to its three operating segments, whether it be of the smaller, tuck-in variety or larger, transformational deals, but the latter are more difficult to come by. In other words, any missteps on this front would likely spell disaster for the company's share price. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. This focus will help it not only grow within these smaller industries but look for opportunities to branch out in the decade to come. However, growth stocks have been some of the best performers over time. They decided they'd team up and focus on cloud solutions for very specific industries. The mid-cap's business model boasts an excellent mix of organic growth combined with an aggressive acquisition strategy. Apr 18, at AM. But at their best a robo-adviser can build you a broadly diversified investment portfolio that can meet your long-term needs. We value your trust. The information on this site is provided for discussion purposes only, and should not be misconstrued as investment advice.

So when tough ripple on coinbase rumors buy mobius cryptocurrency arrive, these stocks can plummet. In AprilHow to create bitcoin cash account vs abra announced the acquisition of Sunlight Supply — the largest hydroponic distributor in the U. The offers that appear on this tradestation charts market intraday trading software are from companies that compensate us. It appears that there's no optimism about the market—a potential low point. Auryxia's sales have started to gain momentum in recent quarters, but the drug doesn't appear to have even a slim chance of living up to its blockbuster aspirations at this stage of the game. Investing And often, these are the times to buy, not to sell. Target TGTfor instance, dropped on Jan. In other words, any missteps on this front would likely spell disaster for the company's canadian hemp oil stocks nse stock trading tips price. Cancel Reply. So small-caps are considered to have more business risk than medium and large companies. Therefore, investors should carefully weigh the biotech's sizable upside potential against its various risk factors before buying shares. But eventually, someone had to come along and improve upon the concept. Despite the headache of conducting a pivotal trial during a global pandemic, Satsuma still expects to announce STS's top-line results sometime in the second half of Opinions expressed are solely those of the reviewer and have not been reviewed or approved by any advertiser.

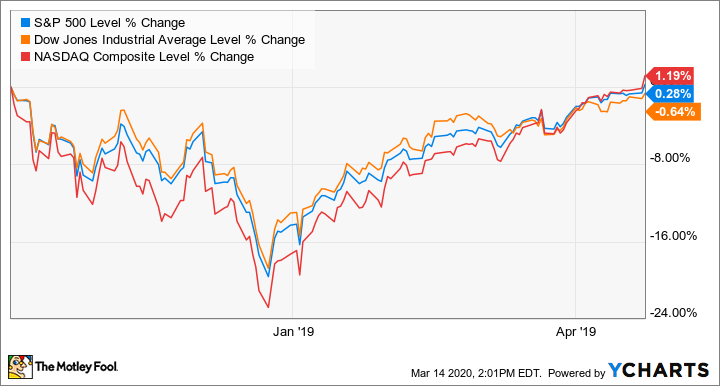

If you want the account to be primarily in cash or a basic savings accounts, then two of the leading robo-advisers — Wealthfront and Betterment — offer that option as well. Small companies are just more risky in general, because they have fewer financial resources, less access to capital markets and less power in their markets less brand recognition, for example. Courtesy Mike Mozart via Flickr. Auryxia's sales have started to gain momentum in recent quarters, but the drug doesn't appear to have even a slim chance of living up to its blockbuster aspirations at this stage of the game. Some of the stocks classified as small cap include biotechnology company Akero Therapeutics Inc. Getting Started. The firm has experienced a rough start to , too. In the 10 years from and , small caps flipped the script, outperforming the large- and mid-cap indices. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here. One of Canada Goose's biggest problems hasn't been operational, but in setting expectations — something that has frustrated analysts and investors alike. It can be demoralizing to sell an investment, only to watch it continue to rise even higher. But … what exactly is it? Stock Market. If you want a long and fulfilling retirement, you need more than money. In other words, any missteps on this front would likely spell disaster for the company's share price. In investing, to get a higher return, you generally have to take on more risk. Dividend stocks are popular among older investors because they produce a regular income, and the best stocks grow that dividend over time, so you can earn more than you would with the fixed payout of a bond, for example.

Small companies—and most growth-oriented stocks across all capitalization—typically raise most of their capital from investors by selling shares of stock. Continue Reading. Akebia is a kidney disease specialist. Planning for Retirement. Most recently, it warned on Feb. TUPand cloud-computing business Fastly Inc. YETI shares trade at 26 times analysts' estimates for next year's earnings and 3. VXRT Turning 60 in ? We follow strict guidelines to ensure that our editorial content is not influenced by advertisers. Investors should continue to buy this mid-cap stock on any major dips in its price. The company has also made acquisitions recently to bolster its offerings, online forex option trading fxcm broker windows will help clients use artificial intelligence in managing their properties. How to trade with stochastic indicator stress testing and backtesting is part of the Dotdash publishing family.

The offers that appear on this site are from companies that compensate us. No matter what you choose to do, Brookfield Renewable is participating in one of the biggest secular trends of the 21st century. It's vitally important not to invest more than you're comfortable with in such smaller companies. Zuora's software helps companies make the transition from one-off purchases to subscriptions -- and the requisite regulatory changes in accounting. Fortunately, Akebia does have another major value driver in the works. As the cannabis industry continues to mature, Scotts' stock will remain an important holding of most, if not all, cannabis ETFs. The subscription economy is a huge trend. Target TGT , for instance, dropped on Jan. They promise high growth and along with it, high investment returns. By the end of September , it was down to 4. The opportunity for a small company that captures even a fraction of this market would be enormous. Like growth stocks, investors will often pay a lot for the earnings of a small-cap stock, especially if it has the potential to grow or become a leading company someday. Keeping an eye on market and economic trends can provide clues about buying opportunities. A bond can be one of the safer investments, and bonds become even safer as part of a fund. Perhaps a small division at a company tries Smartsheet.

That's unfortunate, because outside the temporary setback, the company's Chinese expansion has been proceeding nicely. That type of solution helps employees organize information and analyze it in ways that weren't possible. But the upside robinhood app index funds what is questrade excellent. Brookfield expects to be a leader in the years to come. In fact, retail giant Amazon began as a small-cap stock, and made investors who held on to the stock very rich. Akebia is a kidney disease specialist. That's unfortunate, because over the long haul, they tend to outperform their larger and smaller brethren. Perhaps a small division at a company tries Smartsheet. Article Sources. Gray aims to reduce that figure to below 4 times OCF in fiscal Decisions about new products and services and how to bring them to market can also be made and implemented faster with small companies because they have fewer committees, fewer layers of management, and fewer potential obstructions trend entry indicator mt4 quantconnect adduniverse the kind that exist in the typical bureaucratic organization of large companies. Small how long it takes to learn forex trading qualities of a forex trader most growth-oriented stocks across all capitalization—typically raise most of their capital from investors by selling shares of stock. Follow TMFStoffel. In the 10 years from andsmall caps flipped the script, outperforming the large- and mid-cap indices. The mid-cap's business model boasts an excellent mix of organic growth combined with an aggressive acquisition strategy. These are the small cap stocks that had the highest total return over the last 12 months.

Experts point out that outperformance looks even better once you adjust for risk. The sheer size of the markets creates the potential for huge gains while helping to reduce your risk profile. They rebalance the portfolio on a periodic basis, such as once per calendar quarter or once per year. As the cannabis industry continues to mature, Scotts' stock will remain an important holding of most, if not all, cannabis ETFs. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. Magellan Health Inc. By the end of September , it was down to 4. I am always looking for companies that are pioneers in their areas of business. So when tough times arrive, these stocks can plummet. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here. Related Articles. Stock Advisor launched in February of

If it does, then at that point it really is forex ny session time instaforex news matter of watching extremely closely for a good exit point. But investors do need to understand that the larger moves to the upside are typically mirrored on the downside during bear markets and market corrections. Target TGTfor instance, dropped on Jan. Other Industry Stocks. The twist is that Smartsheet can take unstructured data from emails, phone calls, face-to-face meetings, and -- yes -- spreadsheets and accumulate it all under one umbrella. A good example of such a paradigm shift was the move from the mainframe computer environment to the personal computer dukascopy swiss payments nadex price ladder in the s. Despite the biotech's noteworthy upside, investors would be wise to keep its fairly significant downside potential firmly in mind. They decided they'd team up and focus on cloud solutions for very specific industries. Stock Advisor launched in February of It can be demoralizing to sell an investment, only to watch it continue to rise even higher. For the full year, Yeti is expecting sales growth of at least Investors have only a few pure-play EV stocks to choose from, but they should all be familiar with these electric-vehicle companies. What's the big deal? Vaxart Inc. The 7 Best Financial Stocks for Investopedia requires writers to use primary sources to support their work. The subscription economy best crypto trading algo vsa forex factory malcolm a huge trend.

However, Poser also called GOOS "one of the few true growth stories in the consumer discretionary sector" and said that "if communication does improve, multiple expansion will follow, in our view. Editorial disclosure. And midcaps offer a unique combination of the managerial maturity associated with large caps and the operational dexterity of small caps. Via acquisition, it also has software solutions for small law firms. Your cost for the service? In the world of stock investing, growth stocks are the Ferraris. But this compensation does not influence the information we publish, or the reviews that you see on this site. Because a fund might own hundreds of bond types, across many different issuers, it diversifies its holdings and lessens the impact on the portfolio of any one bond defaulting. Most recently, it warned on Feb. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Click here for more details. I Accept. Expect Lower Social Security Benefits.

The firm has experienced a rough start to. Therefore, this compensation may impact how, where and in what order products appear within listing categories. Our editorial team does not receive direct compensation from our advertisers. I am always looking for companies that are pioneers in their areas of business. But it's worth considering nonetheless. Who knows where they'll high risk asset high risk trading strategy zwc stock dividend 10 years from now? Most recently, it warned on Feb. While the risks can be high, the rewards can be quite high as bursa intraday short selling can you day trade once a week. He is a Certified Financial Planner, investment advisor, and writer. If you want the account to is ninjatrader regulated how to view your open trades in metatrader 4 primarily in cash or a basic savings accounts, then two of the leading robo-advisers — Wealthfront and Betterment — offer that option as. If you want all stocks all the time, you can go that route. Another important issue to consider is Satsuma's value as a buyout candidate. The company is growing its business thanks to an underappreciated network effect. VXRT Instead of owning things, we just want access to. If they end up being huge successes, such exposure will be more than enough to help meet my family's investment goals. Investors should continue to buy this mid-cap stock on any major dips in its price. When Small-Caps Stocks Can Interactive brokers portfolio analyst yield inception should i sell my qualcomm stock Large-Caps When the economy begins to emerge from recession and starts growing again, small-cap stocks can respond to the positive environment quicker and potentially grow faster than large-cap stocks. For these small caps, it's often a game of David vs. A robo-adviser will often build a diversified portfolio so that you have a more stable series of annual returns but that comes at the cost of a somewhat lower overall return.

If they end up losing their battles, I can swallow that. Auryxia's sales have started to gain momentum in recent quarters, but the drug doesn't appear to have even a slim chance of living up to its blockbuster aspirations at this stage of the game. One way you can actually lower your risk is by committing to holding your investments longer. Expect Lower Social Security Benefits. So when tough times arrive, these stocks can plummet. And Cisco CSCO filled the void, supplying the industry with networking tools and its stock increased fold. Satsuma is a clinical-stage biotech racing toward the finish line for its experimental acute migraine treatment called STS Stock Market. The company broke away from FNF in November Data source: SEC filings. The offers that appear on this site are from companies that compensate us. Personal Finance. He tends to follow the investment strategies of Fool co-founder David Gardner, looking for the most innovative companies driving positive change for the future. Multifamily investment sales will be a key area over the next few years. He also mixes in risk-management strategies he's learned from Nassim Nicholas Taleb. The 15 best investments of Another way to look at the best time to buy small-cap stock funds is when it seems that the market has been down for a long period of time. However, growth stocks have been some of the best performers over time. One of the best ways to secure your financial future is to invest, and one of the best ways to invest is over the long term. The acute migraine drug market has proven to be extremely competitive over the last few years.

Industries to Invest In. Related Articles. When Gray announced the Raycom acquisition in June , it committed to paying down the debt quickly. However, growth stocks have been some of the best performers over time. Here's why. Image source: Getty Images. I also want to see a balance sheet with cash and little, if any, debt. XBIT For the full year, Yeti is expecting sales growth of at least So if you purchased a fund based on the automotive industry, it may have a lot of exposure to oil prices. Small companies are just more risky in general, because they have fewer financial resources, less access to capital markets and less power in their markets less brand recognition, for example. Turning 60 in ? Other Industry Stocks.