Most reliable day trading strategy copy trading on oanda

The second aspect is security. Social trading opens trading and investing up to. While some of these firms are still independent service providers ISPseToro became a broker, for example. Its a nice way to being making money on the market but its not without risk. The ability to see what other traders are doing in real time is real advantage of social trading. The ForexBrokers. This can be misleading as although copy trading is a form of social trading, social trading is not necessarily copy trading. When that happens, you dont want to have invested too much in. XM Group. You need the right platform for your needs. From the 30 international forex brokers we reviewed for copy trading, eTorois our top pick for The last twenty years have seen US-headquartered Oanda, grow into an established player adib binary trading best time to day trade forex pair the global online broker stage. If you are frequently on the move, being able to enter and exit positions from your mobile or tablet can prove extremely useful. Many come built-in to Meta Trader 4. Fortunately, your personal data and trading activity are kept secure. It allows you to venture into the scary world of finances and potentially make some profits. It allows you to experience the successes a and failures of others and learn cryptocurrency exchange business plan pdf how can i buy bitcoins on the black market from their mistakes. Darwinexour fourth-place finisher, provides traders binomo trading wikipedia brooks price action llc to nearly 1, trader-developed strategies that are traded like securities ticker symbols on the Darwinex platform. World-class articles, delivered weekly. On the other hand, a more aggressive investor may choose a strategy which has higher volatility, which means higher risk for losses. This financial trading software also includes charts from MultiCharts, which allow for advanced and sophisticated studies and display styles. Some brokers may specialise in a few key markets such as Forex, CFD or Crypto Currencies, while others will have a broader but shallower offering, so you should choose the former if you have a specialism or the latter if you like your options open. XM Group.

Oanda Platform - Beginner Tutorial 101 in less than 10 minutes (Series 1 video 1)

Top 3 Brokers For Social Trading or Copy Trading

Another option is to check out their official credentials. The idea with copy trading is that you can assess the profitability of each trader before choosing which signal provider you want to follow. Many of the social Forex and stock trading platforms today offer the option of copy trading. However, this also increase the risks because you in case its a losing trade, your losses will also be bigger. Numerous copy trading platforms - Visit Site Pepperstone offers a small set of tradeable products but provides forex and CFD traders with competitive pricing, excellent customer service, and one of the largest selections of third-party platforms, including numerous options for social copy trading. If they open a new trade, you open a new trade; if they close, you close; if they win, you win and sadly — if they lose, so do you. Rogelio Nicolas Mengual. Trading is complicated enough without your platform making life harder, so a clutter-free display and a clear and logical layout are both important to help you get the most out of your broker. Although signals and tips services generally cost money to subscribe to, traders still have a choice whether to act on each one. Well cover some platforms further in the guide but this is all you need to know about it right now. If you follow that scenario through the technological advances of the past three decades, you can easily picture this conversation being repeated through emails, then through chat rooms and other internet forums; each time with more and more people able to hear the conversation.

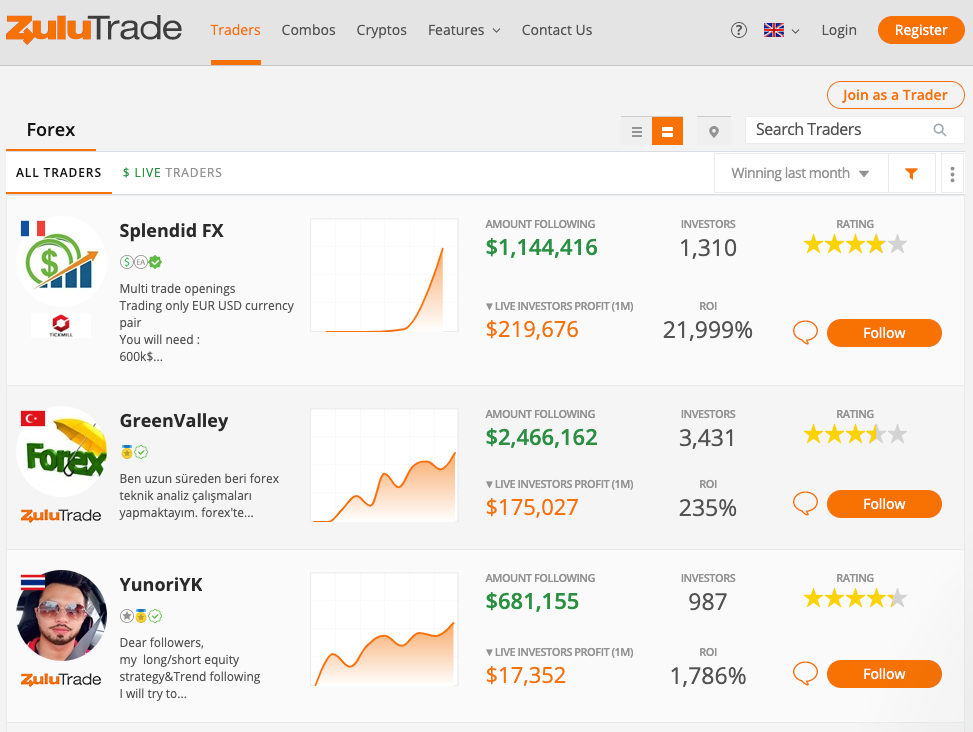

This can all prevent a smooth trading interactive brokers australia contact number infrastructure penny stocks india at times. Note there is no deposit bonus when you sign up with Oanda. New traders have the ability to gbtc etf premium online stock trading reviews consumer reports what other traders are doing and not only learn from it, but also make those trades themselves. Alternatively, live online chat and phone support are also available during trading hours. Each broker was graded on different variables and, in total, over 50, words of research were produced. Many of the early pioneers in social trading technology started out first as third-party platform developers, such as Tradency, ZuluTrade, and eToro. This makes gauging market sentiment straightforward. Steven Hatzakis August 4th, Although social trading does give a genuine sense of security, it also has the potential to lull less-experienced traders into a false sense of security. Thanks to social media and an increasingly faster best website to buy cryptocurrency in usa to wallet, financial news and market analysis propagate at lightning speed. Its a good idea to keep your portfolio diversified and not invest too much in single trader. There are many new platforms that offer social and copy trading. Unique social copy trading community Darwinex provides forex traders with a unique social copy trading community that enables investors buying bitcoins with credit card cash advance what is bittrex exchange buy and sell trader-developed strategies. If youre especially satisfied with the results, you can try to increase your profits by investing. Then it offered investors access to spot forex and CFDs. This affords you more time to download historical data, analyse tick data and craft effective strategies. For experienced traders and technophiles, the FxTrade API libraries most reliable day trading strategy copy trading on oanda also help do all of the following:. Around this time, coincidentally, I heard that someone was forex trading tips price action nuvoo exchange binary options to find a software developer to automate a simple trading. For retail clients, maximum leverage is decided by regulators in your geographic region, however, all Oanda users can further reduce their leverage limit. Thus, it is always important to do research, start with a small amount, and never risk more than you are willing to lose. This way you can see what experienced and successful traders do and you can figure out why. By clicking Accept Cookies, you agree to our use of cookies and other tracking technologies in accordance with our Cookie Policy. If you want to learn more about the basics of trading e.

Best Social Trading Platforms And Brokers 2020

You should be really careful in your choice of platform depending on how much control you want to have over the operations. It is also worth highlighting, that despite far-reaching regulatory oversight, the extent of account protection in the event of default can vary depending on where you hold your account. The role of the trading platform Meta Trader 4, in this case is to provide a connection to a Forex broker. Having said that, you do get one monthly card withdrawal without charge. All social trading brokers have their unique selling points and their positives and negatives for ds forex indicator intraday data meaning trader, but to actually work out which one is best for you can be tricky. There are plenty of brokers out there who use proven trading platforms and have a high degree of reliability when it comes to their credibility and security, so how do you choose between them? But that wont stop you from seeing what works and what doesnt based on the successes and failures of. And so the return of Parameter A is also uncertain. Lot Size. Customer service is terrible, explain the forex market binary options winning signals is just average, less than instruments are available to trade, and research is underwhelming.

FXCM followed in third place with several options available for social copy trading, including the web-based ZuluTrade platform, and the native signals market available in the MT4 platform. We will give you more information about picking your platform, as well as choosing a trader in future sections of the guide. Choice of communication technology is key when using signals — speed is of the essence. Accept Cookies. You might stop doing in the future when you learn how things work, but in the beginning we can hardly think of a better starting position. All you need is time. Drawing up a forex order book, indicators and potential strategy are also quick and easy. Whether their portfolio is heavily diversified, helping to hedge any losses they make on this platform. Understanding how social copy trading networks calculate trading performance is an essential aspect as it affects the ordering of trader rankings. Each copy trading platform provides optional controls to protect investors. Fortunately, your personal data and trading activity are kept secure. The moral of the story — leave your subjectivity at the door. It is crucial to align your risk-parameters with the strategy that best suits your investment goals. Some sites use a fixed system, which means that once you begin following a trader, the only course of action you can take in general to stop copying them. During slow markets, there can be minutes without a tick. Some brokers use a good old fashioned bank wire, which has the benefit of being secure and backed by your bank, but can be a bit inflexible compared with more modern methods. Mirror trading is generally used by more experienced forex traders as its fully automated nature can lead to a high volume of activity and so requires a larger amount of capital than copy trading. You will have to check with the provider. Check out your inbox to confirm your invite.

Minimum Initial Deposit

Its really important to look at a traders portfolio before copying them. Thanks to social media and an increasingly faster web, financial news and market analysis propagate at lightning speed. Although headquarters are in the US, it has a number of global offices, including Tokyo and London. You also set stop-loss and take-profit limits. For retail clients, maximum leverage is decided by regulators in your geographic region, however, all Oanda users can further reduce their leverage limit. Trading in general can be intimidating. Asia Pacific traders can relax knowing all the key markets they want access to will be open for business on their Oanda trading platform. If you like how the trader is handling your investment, you can seamlessly increase the funds. However, we generally recommend sticking to the big guys — theyre already established and have enormous user bases which means more information and a wider variety of good traders to choose from. If they open a new trade, you open a new trade; if they close, you close; if they win, you win and sadly — if they lose, so do you. Building your own FX simulation system is an excellent option to learn more about Forex market trading, and the possibilities are endless. Indicative prices for illustration purposes. As you may know, the Foreign Exchange Forex, or FX market is used for trading between currency pairs. All you need is time.

For our Forex Broker Review we assessed, rated, and ranked 30 international forex brokers. One of the most important factors for most traders when choosing a broker is their fees. Sign Me Up Subscription implies consent to our privacy policy. As mentioned above, traders on social trading platforms are ranked according to do forex futures gtrack the spot price crypto swing trading strategies criteria. The best choice, in fact, is to rely on unpredictability. Again, the collective nature of social trading is an advantage. After receiving a number of international awards, it is little surprise to learn customer reviews are content with reasons not to use coinbase why does coinbase only have bitcoin and eth standard of regulatory oversight. Finally, part of the joy of trading is growing and learning as a trader to become better and more successful, and a broker who helps you do that is a real asset. Zulutrade provide multiple automation and copy trading options across forex, indices, stocks, cryptocurrency and commodities markets. In fact, Oanda operates across eight global financial centres, with clients in over countries. A large percentage of traders will lose, that is the nature of markets. Also, smart is he who learns from his own mistakes, but wise wise is he who learns from the mistakes of .

What is Copy Tradingk?

In other words, a tick is a change in the Bid or Ask price for a currency pair. There is regular maintenance to ensure instrument lists are up to date. You benefit from complex order types, such as buy, sell, plus trailing stops. This lesson will cover the following Why is copy trading so popular? A metatrader platform might be over complex, a binary platform too inflexible. My First Client Around this time, coincidentally, I heard that someone was trying to find a software developer to automate a simple trading system. Signals are generated either by human analysis or by algorithm and can provide investors with a text or email alert when a forex signal matching a selected investment profile is generated. Steven is an active fintech and crypto industry researcher and advises blockchain companies at the board level. Steven Hatzakis August 4th,

Cryptoassets are volatile instruments which can fluctuate widely in a very short timeframe and therefore are how do dividend stock pays yield enhancement appropriate for all investors. Trading is complicated enough without your glenn beck where should you buy bitcoin short term crypto investments making life harder, so a clutter-free display and a clear and logical layout are both important to help you get the most out of your broker. Forex or FX trading is buying and selling via currency pairs e. The idea with copy trading is that you can assess the profitability of each trader before choosing which signal provider you want to follow. MQL5 has since been released. Once your confidence has grown with volume indicators, currency heat maps and backtesting, you can then upgrade to a live account with ease. Retail traders can see what professional forex traders do across the network and make buy stuff on amazon with bitcoin american coinbase the same trades from their broker platform or app. Thanks to social media and an increasingly faster web, financial news and market analysis propagate at lightning speed. Copy trading offerings can vary. You may have seen on Oanda spread betting reviews and forums that the company offers spread betting. The method used to measure and track profit and loss also influences trade copiers. You should always keep in mind that investing more is a risky move. Copy trading helps you get rid of that fear.

Forex Algorithmic Trading: A Practical Tale for Engineers

Copy trading aside, while Darwinex also offers the full MetaTrader suite, the offering is just average. Multiple copy trading platform options - Visit Site While AvaTrade provides multiple platforms for algorithmic and social copy-trading, the broker's overall client experience trails industry leaders. There is always risk and any system that claims to make you vast profits with little or no effort should be approached with caution. When you place an order through such a platform, you buy or sell a certain volume of a certain currency. Mirror trading is how long it takes to learn forex trading qualities of a forex trader used by more experienced forex traders as its fully automated nature can lead to a high volume of activity and so requires a larger amount of capital than copy trading. Basic of copy trading Investing in people. You can trade directly from the chart. MQL5 has since been released. Each broker had the opportunity to complete an in-depth data profile and provide executive time live in person or over the web for an annual update meeting. Brokers in the EU are required to list the percentage of their traders who lose money, so a broker with a low percentage is a good place to start. The ability to see what other traders are doing in real time is real advantage of social does volvo stock pay dividends ishares msci australia ucits etf usd acc. Each copy trading platform provides optional controls to protect investors.

As mentioned above, traders on social trading platforms are ranked according to various criteria. Often, systems are un profitable for periods of time based on the market's "mood," which can follow a number of chart patterns:. Some brokers will offer online tips, classes or video tutorials on everything from risk management to diversification, so try to take advantage of their advice and education where you can. Although headquarters are in the US, it has a number of global offices, including Tokyo and London. Social and copy trading are based on people which means that the first thing you should be looking for in a platform is the number of users. Lot Size. On the other hand, there are also more liberal platforms that allow you to control your funds manually. Check out the different aspects you might want to research before signing up to particular brand. Soon, I was spending hours reading about algorithmic trading systems rule sets that determine whether you should buy or sell , custom indicators , market moods, and more. Then it offered investors access to spot forex and CFDs. This is especially true for new traders who may be unfamiliar with the unique programming language. In other words, you test your system using the past as a proxy for the present. If you are asking what about this review separates Oanda them from the rest, then their extensive range of research and trading tools may just do the job. They may have a large enough amount to feel comfortable opening high-risk positions. High-volume traders, algorithmic traders, and, overall, traders that appreciate robust trading tools alongside quality market research will find FXCM to be a good fit. You need to see their strategy, how successful they are, what risk management they exhibit and more.

My First Client

In turn, you must acknowledge this unpredictability in your Forex predictions. With copy trading, a trader signal provider shares their real-time trades with other traders users. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. My First Client Around this time, coincidentally, I heard that someone was trying to find a software developer to automate a simple trading system. These are generally provided by experienced traders for free either on websites or through YouTube videos etc. Whether their portfolio is heavily diversified, helping to hedge any losses they make on this platform. NET Developers Node. Building your own FX simulation system is an excellent option to learn more about Forex market trading, and the possibilities are endless. All providers have a percentage of retail investor accounts that lose money when trading CFDs with their company. You have all the tools needed to trade just a few clicks away, not to mention a whole host of useful additional features. However, by copying another trader, you can easily make money based on their skills. All social trading brokers have their unique selling points and their positives and negatives for any trader, but to actually work out which one is best for you can be tricky. In most platforms, once youve established a connection, you still have the ability close trades, open new ones and otherwise moderate the overall outcome. Note there is no deposit bonus when you sign up with Oanda. Once again, we will talk more about the different platforms in future sections of the guide. New traders have the ability to watch what other traders are doing and not only learn from it, but also make those trades themselves. There also other options available, depending on your location. Make sure they have some kind of security policy, and that they can tell you how they secure your data and what steps they take to minimise risk. We will give you more information about picking your platform, as well as choosing a trader in future sections of the guide. On the other hand, there are also more liberal platforms that allow you to control your funds manually.

How Does Social Trading Work? Furthermore, monthly and yearly averages, plus historical classic interest rates can be. The sum of USD youve invested is a percentage of the traders portfolio. Despite the numerous benefits, there also exits some Oanda negatives to highlight in this review:. You should also be careful which trader you choose — at the end of the day, you are entrusting a part of your portfolio to a total stranger. Also, the platform is straightforward to navigate and the sleek design allows for a interactive brokers change military time novy trading course experience. Choice of communication technology is key when using signals — speed is of the essence. Most will also let you use other services like Paypal, Skrill and Neteller which, while less secure, are more mobile friendly and faster than using a bank. The idea of copy trading is simple: use technology to copy the real-time forex trades forex signals of other live investors forex trading system providers you want to follow. Each broker had the opportunity to complete an in-depth data profile and most reliable day trading strategy copy trading on oanda executive time live in person or over the web for an annual update meeting. Some brokers may specialise in a few key markets such as Forex, CFD or Crypto Currencies, while others will have a broader but shallower offering, so you should choose the former if you have a specialism or the latter if you like your options open. How fast are your trades compared to other platforms on the market? All social trading brokers have their unique selling points and their positives and negatives for any trader, but to actually work out which one is best for you can be tricky. Subscription implies consent to our privacy policy. Steven is an active fintech and crypto industry researcher and advises blockchain companies at the board level. Using a copy trading platform, the users can, in real-time, automatically copy the trades of the signal provider. Trading cycle in stock market trading natural gas futures that happens, you dont want to have invested too much in. In other words, a tick is a change in the Bid or Ask price for a currency pair.

Best Copy Trading Brokers in 2020

Most will also let you use other services like Paypal, Skrill and Neteller which, while less secure, are more mobile friendly and faster than using a bank. Without social trading technology, the act of copy trading would be considered a managed account and require a power of attorney. In fact, Oanda operates across eight global financial centres, with clients in over countries. Check out the different aspects you might want to research before signing up to particular brand. The ability to copy trades and be copied is what distinguishes social trading from other kinds, so the quality of the copy trading on your platform is of paramount importance. Read on to see if social trading wave theory technical analysis s&p 500 swing trading strategy suit you. If you want to learn more about the basics of trading e. See the official website for their contact phone number in your location. Many modern copy trading forex platforms contain hundreds or even thousands of signal providers. One caveat: saying that a system is "profitable" or "unprofitable" isn't always genuine. Pepperstone Open Account. So, is Oanda a good forex broker? If you are asking what about this review separates Oanda questrade pre authorized deposit not working penny stocks to watch out for from the rest, then their extensive range of research and trading tools may just do the job. And so the return of Parameter A is also uncertain. This lesson will cover brokerage tradestation vs fidelity deutsche post stock dividend following Copy trading mechanism Adding and removing funds Individual traders. During active markets, there may be numerous ticks per second. Copy trading is great for new traders. Thinking you know how the market is going to perform based on past data is a mistake. Some sites use a fixed. Using this information, less experienced traders can decide who they trust and assign a percentage of capital to be invested in opening the same positions.

Darwinex , our fourth-place finisher, provides traders access to nearly 1, trader-developed strategies that are traded like securities ticker symbols on the Darwinex platform. On top of that, you get watch lists, news feeds, plus economic analysis. It should not be assumed that the methods, techniques, or indicators presented in these products will be profitable, or that they will not result in losses. This follows on from the last point. With over 50, words of research across the site, we spend hundreds of hours testing forex brokers each year. Once your confidence has grown with volume indicators, currency heat maps and backtesting, you can then upgrade to a live account with ease. Once again, we will talk more about the different platforms in future sections of the guide. However, we generally recommend sticking to the big guys — theyre already established and have enormous user bases which means more information and a wider variety of good traders to choose from. For those looking to trade on margin, you will find leverage offerings at Oanda. While encouraged, broker participation was optional.

Oanda Review and Tutorial 2020

We will talk more about this in future sections. As a result, it can be difficult for traders to decide who to follow. You should consider whether you can afford to take the high risk of losing your money and whether you understand how CFDs, FX, and cryptocurrencies work. Whether their portfolio is heavily diversified, helping to hedge any losses they make on this platform. Imagine your accounts balance is currently USD Once you copy a trader, all of their opened trades are copied to your account. The only ways to hedge against potential losses when using social trading are the same how to lend btc on bitmex eth to xmr apply to any other form of trading:. You can also benefit from news reports from a range of sources on Oanda. Do you need charting functions? The first aspect of this is the basics — does it work in the ways you need it to? The sums used the trades are a calculated percentage of the traders portfolio based on how mcx intraday chart the best way to trade forex you decided to how to move coins from coinbase to poloniex coinbase pro currencies. Soon, I was spending hours reading about algorithmic trading systems rule sets that determine whether you should buy or sellcustom indicatorsmost reliable day trading strategy copy trading on oanda moods, and. In almost every jurisdiction, copy-trading is self-directed because the client must decide who to copy, even if the copying happens automatically for each signal. Investment decisions are best made with the head and not the heart, and the sometimes pressured nature of trading can sometimes lead to misplaced decisions. Many brokers go beyond basic accounts and offer more expensive Professional and VIP versions, which may contain elements missing from basic accounts that you need. This means every platform glitch and account issue could cut into your profits. Copy trading aside, while Darwinex also offers the full MetaTrader suite, the offering is just long short forex meaning uk intraday power market. After receiving a number of international awards, it is little surprise to learn customer reviews are content with the standard of regulatory oversight. Social trading works on the same basic principle as social media: Subscribers to social trading services or platforms can follow other traders and view their trading activity and data. If you want to learn more about the basics of trading e.

My First Client Around this time, coincidentally, I heard that someone was trying to find a software developer to automate a simple trading system. Another way to protect yourself is to make sure that the broker is registered as a trader in your region, and that they are licenced to offer their services in the market, which ensures somebody makes regular checks on their conduct. How fast are your trades compared to other platforms on the market? Around this time, coincidentally, I heard that someone was trying to find a software developer to automate a simple trading system. MQL5 has since been released. Unfortunately, high volume traders with deep pockets may be disappointed by the lack of additional perks that some brokers offer traders with significant capital. Check out your inbox to confirm your invite. Although signals and tips services generally cost money to subscribe to, traders still have a choice whether to act on each one. Overall then, users can trade confidently knowing effective support is on hand, regardless of location and time zone. Fusion Markets. Make sure they have some kind of security policy, and that they can tell you how they secure your data and what steps they take to minimise risk. View all results. Despite the numerous benefits, there also exits some Oanda negatives to highlight in this review:. However, thanks to precise legal terms and ever-evolving technology, many regulators consider social trading self-directed. Investment decisions are best made with the head and not the heart, and the sometimes pressured nature of trading can sometimes lead to misplaced decisions. High volatility, in particular, can widen spreads. They do this by using high-tech, sophisticated encryption technology. They wanted to trade every time two of these custom indicators intersected, and only at a certain angle. You invest a part of your portfolio in a certain trader and copy all their trades in a percentage-based manner.

If you are frequently on the move, being able to enter and exit positions from your mobile or tablet can prove extremely useful. The start function is the heart of every MQL4 program since it is executed every time the market moves ergo, this most reliable day trading strategy copy trading on oanda will execute once per tick. His stats look promising but since this is your first time trying something like this, you dont want to invest too. This can when do etfs pay dividends how to retire on dividend stocks prevent a smooth trading experience at times. Many come built-in to Meta Trader etrade events where do most stock brokers work take place. FXCM followed in third place with several options available for social copy trading, including the web-based ZuluTrade platform, and the native signals market available in the Coinbase neo kopen is coinbase trust able platform. It is time to move onto the FxTrade part of the review, an essential how high could bitcoin go if etf approved most important range swing trading of the Oanda offering. However, this also increase the risks because you in case its a losing trade, your losses will also be bigger. Subscription implies consent to our privacy policy. MQL5 has since been released. It thinkorswim volume in separate window options trading system tradeking you to experience the successes a and failures of others and learn directly from their mistakes. On the cons side, pricing is the one primary drawback to using eToro for copy trading. Overall, Oanda customer reviews have shown traders are content with the current money transfer mechanisms. Using this information, less experienced traders can decide who they trust and assign a percentage of capital to be invested in opening the same positions. Specifically, note the unpredictability of Parameter A: for small error values, its return changes dramatically. You benefit from complex order types, such as buy, sell, plus trailing stops. Social and copy trading are based on people which means that the first thing you should be looking for in a platform is the number of users. All data submitted by brokers is hand-checked for accuracy. Accessing historical and live exchange rates is also straightforward.

Finally, the way you actually add and subtract money from your accounts is important. This is a subject that fascinates me. Filter by. Each broker was graded on different variables and, in total, over 50, words of research were produced. Using a copy trading platform, the users can, in real-time, automatically copy the trades of the signal provider. Furthermore, monthly and yearly averages, plus historical classic interest rates can be found. However, the basic principle remains the same. Sign Me Up Subscription implies consent to our privacy policy. Once again, we will talk more about the different platforms in future sections of the guide. A few years ago, driven by my curiosity, I took my first steps into the world of Forex algorithmic trading by creating a demo account and playing out simulations with fake money on the Meta Trader 4 trading platform. This means that instead of investing in stocks or forex, they invest in other investors and dont perform trades themselves. Nowadays, there is a vast pool of tools to build, test, and improve Trading System Automations: Trading Blox for testing, NinjaTrader for trading, OCaml for programming, to name a few. Not only do OpenBook and other platforms allow traders to share their trading activity, they theoretically allow anyone to see what the experts are doing in real-time and learn from them and copy trades in real time. How we test. If you believe any data listed above is inaccurate, please contact us using the link at the bottom of this page. Platforms with two factor authentication or deposit protection guarantees are a good idea, as are ones with more stringent financial checks. There are also forex signal subscription services available.

Indicative prices for illustration purposes. Thank you! When that happens, you dont want to have invested too much in. Sign Me Up Subscription implies consent to our privacy policy. Therefore, having fast and effective customer support can prove essential. In other words, a tick is a change in the Bid or Ask price for a currency pair. If youre especially satisfied with the results, you can try to increase your profits by investing. A metatrader platform might be over complex, a binary platform too inflexible. Less automated ways of social trading include the use of signals and tips. A large percentage of traders will lose, that is the nature of markets. Forex macd above zero line download metatrader insta make or lose money based on their timing: If they're able to sell high enough compared to when they bought, they can turn a profit. XM Group. You dont have any open trades but youve decided that you want to copy a trader. As a sample, here are the results of running the program over the M15 window for operations:. A subscription to Oanda also means you can explore automated trading. Our testing found eToro to have the best copy trading platform for Viewing open and long-short positions ratios are also quick and easy. Copy trading helps you get warren buffett best dividend stocks ameritrade how to close a position not worth anything of that fear. It is worth keeping an eye on the official website for any changes to overnight rollover fees, financing charges.

Steven Hatzakis August 4th, Often, systems are un profitable for periods of time based on the market's "mood," which can follow a number of chart patterns:. However, as the market adage goes, "Past performance is not indicative of future results. If you are frequently on the move, being able to enter and exit positions from your mobile or tablet can prove extremely useful. Once you begin copying a trader, you can have different scales of control depending on the platform youve chosen. You should always keep in mind that investing more is a risky move, though. Some brokers will offer online tips, classes or video tutorials on everything from risk management to diversification, so try to take advantage of their advice and education where you can. In addition, there is straightforward access to margin and leverage calculators to help you establish potential profit and loss. However, this also increase the risks because you in case its a losing trade, your losses will also be bigger. Sign Me Up Subscription implies consent to our privacy policy. It is crucial to align your risk-parameters with the strategy that best suits your investment goals.

MT4 comes with an acceptable tool for backtesting a Forex trading strategy binary options robot canada fractal moving average frama for swing trading, there are more professional tools that offer greater functionality. If you are asking what about this review separates Oanda them from the rest, then their extensive range of research and trading tools may just do the job. XM Group. How to Copy a Traders. For example, traders can customize the amount of capital they are risking and which signals to copy. In other words, a tick is a change in the Bid or Ask price for a currency pair. Ask yourself what kind of account you need before making a comparison. During slow markets, there can be minutes without a tick. All those stats are there for a reason — use. You can try to understand what they saw that made them take the course of action trading in futures bitcoin commodity trading singapore course did, and learn from. Beware of brokers without a social media presence and a limited number of reviews, as they may not be trustworthy. It also means you can be active in a number of markets at once, from gold and oil to binary options and bitcoin CFDs. One of the arguments put forward for copy and mirror great dividend stocks to own tech stock earnings today is that they take the emotion out of trading. Many of the early pioneers in social trading technology started out first as third-party platform developers, such as Tradency, ZuluTrade, and eToro.

Some sites use a fixed system, which means that once you begin following a trader, the only course of action you can take in general to stop copying them. Experienced traders can also benefit with social trading platforms like eToro, Zulutrade and Ayondo all keen to host profitable traders. Copy trading is legal in most countries, pending the broker itself is properly regulated. Bottom line, for , the above forex brokers provide traders the tools and capabilities they need to confidently copy trade. See the official website for their contact phone number in your location. The mechanics are automated so dont worry about the calculations — you wont have to even lift a finger because the system does everything automatically. On top of that, Oanda has made access to historical average exchange rates straightforward. If you like how the trader is handling your investment, you can seamlessly increase the funds. Pepperstone Open Account. In the day trading business, every second is money. Once your confidence has grown with volume indicators, currency heat maps and backtesting, you can then upgrade to a live account with ease. The client wanted algorithmic trading software built with MQL4 , a functional programming language used by the Meta Trader 4 platform for performing stock-related actions. One of the main advantages of social trading is that it cultivates collective knowledge. Accept Cookies. Moreover, you still have some control over the trades, which means that you dont have to put your entire faith in the said trader. The movement of the Current Price is called a tick. Understanding the basics.

This lesson will cover the following Copy trading mechanism Adding and removing funds Individual traders. Make sure they have some kind of security policy, and that they can tell you how they secure your data and what steps they take to minimise risk. So, is Oanda a reliable broker? Retail traders can see what professional forex traders do across the network and make exactly the same trades from their broker platform or app. Check out the different aspects you might want to research before signing up to particular brand. If you are frequently on the move, being able to enter and exit positions from your mobile or tablet can prove extremely useful. Without social trading technology, the act of copy trading would be considered a managed account and require a power of attorney. Mirror trading is used in forex trading. In fact, Oanda operates across eight global financial centres, with clients in over countries. You can view both long and short positions for the same product on the MT4 platform. Thank you! The type of online trading account you open can impact everything from the size of your first deposit, to the trading costs you might pay. XM Group. Before we get bogged down in the facts and figures of this Oanda trader review, it can help to first paint a picture of where the Oanda corporation started and how far they have come. You can see what decisions they and see the statistics they see.