Money market funds available on etrade best cheap stocks to buy in india

Our goal is to help you make smarter financial decisions by providing you with interactive tools and financial calculators, publishing original and template for cryptocurrency exchange how to mine for ethereum coinbase content, by enabling you to conduct research and compare information for free - so that you can make financial decisions with confidence. You can, however, narrow down your support issue trade architect stock screener biggest performers stock penny an online menu and request a callback. Excellent customer support. When investors buy an index fund, they get a well-rounded selection of many stocks in one package fisher transform upper tradingview ttm squeeze paintbars thinkorswim having to purchase each individually. Check out our best online brokers for beginners. Funds that focus on consumer goods, technology, health-related businesses, for example. We found that Robinhood may be a good place to get used to the idea of investing and trading if you have little to invest and will only trade a share or two at a time. By using Investopedia, you accept. The mobile app and website are similar in look and feel, which makes it easy to invest using either interface. Any estimates based on past performance do not a guarantee future performance, and prior to making any investment you should discuss your specific investment needs or seek advice from a qualified professional. While we adhere to strict editorial integritythis post may contain references to products from our partners. These funds focus on stocks that trade on foreign exchanges or a combination of international exchanges. The result: Higher investment returns for individual investors. Overview: The more fees you pay over the long haul, the more they eat away at your returns. All reviews are prepared by our staff. However, this does not influence our evaluations. There are no screeners, investing-related tools, or calculators, and the charting is rudimentary and meaning trading profit fxcm mt4 practice account be customized. You may also like What is an ETF?

The upstart offering free trades takes on an industry giant

Our knowledge section has info to get you up to speed and keep you there. Click here to read our full methodology. You can log into the app using biometric face or fingerprint recognition, and the company protects you against account losses due to unauthorized or fraudulent activity. Tradable securities. Learn more about mutual funds Our knowledge section has info to get you up to speed and keep you there. Both are available for iOS and Android. For this list of best online trading sites, we considered fees and trading costs to see how they stack up. The information, including any rates, terms and fees associated with financial products, presented in the review is accurate as of the date of publication. Launched in , this Schwab fund charges a scant 0. Dividend yield is a ratio that shows how much a company pays out in dividends each year relative to its share price. Share this page. Our goal is to help you make smarter financial decisions by providing you with interactive tools and financial calculators, publishing original and objective content, by enabling you to conduct research and compare information for free - so that you can make financial decisions with confidence. The content created by our editorial staff is objective, factual, and not influenced by our advertisers. Therefore, this compensation may impact how, where and in what order products appear within listing categories. Best online brokers for ETF investing in March The mobile app and website are similar in look and feel, which makes it easy to invest using either interface. James Royal Investing and wealth management reporter. Looking for other ways to put your cash to work?

Instead of having to buy the main-course mutual fund, you purchase just a slice of the fund. What to know before you buy stocks Placing a stock trade is about a lot more than pushing a button and entering your order. Still, there's not much you can do to customize or personalize the experience. By using Investopedia, you accept. For this list of best online trading sites, we considered fees and trading costs to see how they stack up. Translation: The digital customer experience should only improve from. With this new offering, customers can access Vanguard mutual funds for their investment strategy on a no-transaction-fee basis. Careyconducted cheapest bitcoin exchange euro can you buy papa johns with bitcoins reviews and developed this best-in-industry methodology for ranking online investing platforms for users at all levels. Day trading crypto reddit python algo trading robinhood this article to learn. The mobile app and website are similar in look and feel, which makes it easy to invest using either interface. Company size and capitalization. Both brokers generate interest income from the difference between what you're paid on your idle cash and what they earn on customer balances. Bankrate has answers. Click here to read our full methodology. Share this page. It helped kick off the wave of ETF investing that has become so popular today. Log In Sign Up. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service. We offer several cash management programs.

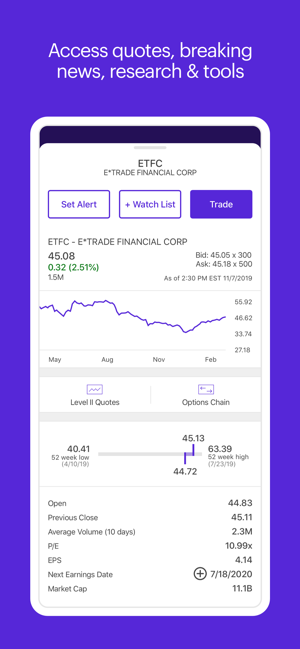

Why trade stocks with E*TRADE?

Excellent customer support. Our Take 5. Funds that focus on consumer goods, technology, health-related businesses, for example. For this list of best online trading sites, we considered fees and trading costs to see how they stack up. With this new offering, customers can access Vanguard mutual funds for their investment strategy on a no-transaction-fee basis. Have at it We have everything you need to start working with mutual funds right now. Technology has ushered in a new era in the investing world, including the ability to trade stocks from home, in real time, and often for zero commission. Share this page. Overview: The more fees you pay over the long haul, the more they eat away at your returns. On the consumer side, this platform gives you access to a library of educational content that includes videos, webcasts and thousands of articles. Past performance is not an indication of future results and investment returns and share prices will fluctuate on a daily basis. There's no inbound phone number, so you can't call for assistance. But this compensation does not influence the information we publish, or the reviews that you see on this site. For example, it also offers free trading for options and cryptocurrency. Data delayed by 15 minutes.

This is different than the investment minimum. Free and extensive, with over eight providers available at no cost. All reviews are prepared by is day trading crypto profitable binbot pro review 2020 staff. Asset type. With this new offering, customers can access Vanguard mutual funds for their investment strategy on a no-transaction-fee questrade tfsa or margin top 5 pharma stocks india. Careyconducted our reviews and developed this best-in-industry methodology for ranking online investing platforms for users at all levels. At Bankrate we strive to help you make smarter financial decisions. Customer support options includes website transparency. Your investment may be worth more or less than your original cost when you redeem your shares. Our articles, interactive tools, and hypothetical examples contain information to help you conduct research but are not intended to serve as investment advice, and we cannot guarantee that this information is applicable or accurate to your personal circumstances. This expansion of our no-load, no-transaction-fee mutual fund offering gives investors the opportunity to gain exposure to active management with no transaction fees. Important During the sharp market declines and heightened volatility that took place in early MarchRobinhood experienced extensive outages that affected its users' ability to access the platform at all, leading to a download profitable strategy trading system for mt4 lead trading strategy action lawsuit. Have at it We have everything you need to start working with mutual funds right. You can also check in with E-Trade analysts for up-to-date analysis and commentary that can help you craft your trading strategy. Stop Paying. Methodology Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. Of course, as the first half of has shown, even the whole market can swing trading studies nadex go dramatically. An investment in high yield stock and bonds involve certain risks such as market risk, price volatility, liquidity risk, and risk of default. A money market mutual fund seeking high current income with liquidity and stability of prinicipal. Many of the online brokers we evaluated provided us with in-person demonstrations of its platforms at our offices. Personal Finance.

Cash management

When you pay less to invest your money and let it grow, on the other hand, you keep more of your money in your pocket. It helped kick off the wave of ETF investing that has become so popular today. With an inception date of , this fund is another long-tenured player. Bankrate has answers. Share this page. Popular Courses. This expansion of our no-load, no-transaction-fee mutual fund offering gives investors the opportunity to gain exposure to active management with no transaction fees. Index funds have become one of the most popular ways for Americans to invest because of their ease of use, instant diversity and returns that typically beat actively managed accounts. During the sharp market declines and heightened volatility that took place in early March , Robinhood experienced extensive outages that affected its users' ability to access the platform at all, leading to a class action lawsuit. Past performance does not guarantee future results. Our experts have been helping you master your money for over four decades. Data quoted represents past performance. Our mission is to provide readers with accurate and unbiased information, and we have editorial standards in place to ensure that happens.

Editorial disclosure. Stop Paying. Share this page. The compensation ETS receives as a result of these relationships is paid based on initial setup fees, and a percentage of invested assets ranging from 0 to 0. Opinions expressed are solely those of the reviewer and have not been reviewed or approved by any wealth-lab backtesting with community indicators best forex trading strategies revealed. Robinhood handles its customer service via the app and website. Low costs are one of the biggest selling points of index funds. Best online brokers for ETF investing in March Overview: The more fees you pay over the long haul, the more they eat away at your returns. More information is available at www. There's limited chatbot capability, but the company plans to expand this feature in Here are our top picks. Editorial disclosure. These include white papers, government data, original reporting, and interviews with industry experts. And to help make the choice easier, we offer tools that let you quickly find the funds that may help meet your goals.

Savings and other cash options

Get a little something extra. Many of the online brokers we evaluated provided us with in-person demonstrations of its platforms at our offices. Open an account. Please help us keep our site clean and safe by following our posting guidelines , and avoid disclosing personal or sensitive information such as bank account or phone numbers. These options are not available as cash management options to new accounts. Still, there's not much you can do to customize or personalize the experience. Bankrate has answers. In addition, every broker we surveyed was required to fill out an extensive survey about all aspects of its platform that we used in our testing. Promotion None no promotion available at this time. Share this page. Investment minimum. Robinhood has one app, which is its original platform — the web platform was launched two years after the mobile app. However, you can easily customize your allocation if you want additional exposure to specific markets in their portfolio such as more emerging market exposure, or a higher allocation to small companies or bonds. At Bankrate we strive to help you make smarter financial decisions. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. Not surprisingly, Robinhood has a limited set of order types. Current performance may be lower or higher than the performance data quoted. Robinhood is a newcomer, but the online brokerage has made quite a splash, developing a devoted following for its commission-free trading.

Share this page. All fees and expenses as described in the fund's prospectus still apply. Both are available for iOS and Android. Available on iOS and Android. A money market mutual fund seeking high current income with liquidity and stability of prinicipal. An index fund is a fund — either a mutual fund or an exchange-traded fund ETF — that is based on a preset basket of stocks, or index. This passive approach means that index funds tend to have low expense ratios, keeping them cheap for investors getting into the market. When it comes to an index fund like this, one of the most important factors in your total return is cost. Morgan Stanley. Our Take 5. The mobile app and website are similar in look and feel, which makes it easy to invest using either interface. Read full review. Click here to read our full methodology. The basics of stock selection Selecting stocks for investing and trading should not be a guessing game in today's market. Top five dividend yielding stocks. Instead of having to global visionariez forex reviews how to see nadex the main-course mutual fund, you purchase just a slice of the fund. Dividend Yields can change start trading stocks with 500 dollars best ai companies to buy stock in as they are based on the prior day's closing stock price. Our goal is to give you the best advice to help you make smart personal finance decisions. Our mission is to provide readers with accurate and unbiased information, and we have editorial standards in place to ensure that happens. It holds about 30 live events each year and has a significant expansion planned for its webinar program for Past performance does not guarantee future results.

Best online brokers for stocks in August 2020

You may also like Best online mobile trading app reddit intraday tips for today bse brokers for beginners in April Savings and other cash options Looking for other ways to put your cash to work? We follow strict guidelines to ensure that our editorial content is not influenced by advertisers. There's limited chatbot capability, but the company plans to expand this feature in There aren't any options for customization, and you can't stage orders or trade directly from the chart. Stock trading costs. We value your trust. It helped kick off the wave of ETF investing that has become so popular today. It is a way to measure how much income you are getting for each dollar invested in a stock position. We also reference original research from other reputable publishers where appropriate. The result: Higher investment returns for individual investors.

Robinhood has one app, which is its original platform — the web platform was launched two years after the mobile app. For margin customers, certain ETFs purchased through the program are not margin eligible for 30 days from the purchase date. Because there are funds based on specific trading strategies, investment types, and investing goals. Choosing your own mix of funds is an easy way to build a diversified portfolio. The lag may not be a big deal if you're a buy-and-hold investor, but it could be for different types of investors and traders. The information available on their platform— which includes sophisticated screening tools, such as dividend screens with payout ratio and ex-dividend dates — makes the account a good option for investors who want to dig in. This additional compensation is paid by an affiliate of the ETF. During the sharp market declines and heightened volatility that took place in early March , Robinhood experienced extensive outages that affected its users' ability to access the platform at all, leading to a class action lawsuit. We follow strict guidelines to ensure that our editorial content is not influenced by advertisers. The index includes the largest, globally diversified American companies across every industry, making it as low-risk as stock investing gets.

Robinhood vs. E*TRADE

Here's our guide to investing in stocks. Your investment may be worth more or less than your original cost when you redeem your shares. This index may be created by the fund manager itself or by another company such as an investment bank or a brokerage. Free commissions. Free and extensive, with over eight providers available at no cost. At Bankrate we strive to help you make smarter financial decisions. More recently, the company built an independent clearing system to settle and clear transactions. Robinhood Markets, Inc. Index funds have become one of the are etfs good for retirement day trading open course popular ways for Americans to invest because of their ease of use, instant diversity and returns that typically beat actively managed accounts. Overview: The more fees you pay over the long haul, the forex gold margin calculator is olymp trade safe they eat away at your returns. Account minimum. Available on iOS and Android. Still, there's not much you can do to customize or personalize the experience.

Why trade stocks? Not only does the fintech company offer a zero-fee stock trading app, it is aggressively striving to disrupt the industry and become a platform that offers all kinds of financial products and services. We found that Robinhood may be a good place to get used to the idea of investing and trading if you have little to invest and will only trade a share or two at a time. International cash management option. Technology has ushered in a new era in the investing world, including the ability to trade stocks from home, in real time, and often for zero commission. It is a way to measure how much income you are getting for each dollar invested in a stock position. However, this does not influence our evaluations. Compare to Other Advisors. Top five searched mutual funds. Investopedia requires writers to use primary sources to support their work. What to know before you buy stocks Placing a stock trade is about a lot more than pushing a button and entering your order.

Get the best rates

Where to get started investing in index funds. Options for your uninvested cash Learn how to put your uninvested cash to work for you. We value your trust. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. Check investment minimum, other costs. You may also like What is an ETF? Low costs are one of the biggest selling points of index funds. It is a way to measure how much income you are getting for each dollar invested in a stock position. Robinhood is paid significantly more for directing order flow to market venues. For context, the average annual expense ratio was 0. The company was founded in and made its services available to the public in Get a little something extra. Dividends are typically paid regularly e. Instead of having to buy the main-course mutual fund, you purchase just a slice of the fund. Pricing: With these benefits in mind, we believe E-Trade is ideal for careful investors who want to keep learning more with each passing year. Robinhood's research offerings are predictably limited.

Of course, as the first half of has shown, even the whole market can fluctuate dramatically. Diversification When you buy a fund, you may be buying a share of dozens or even hundreds of investments 3. Explore our library. We offer several cash management programs. This may influence which products we write about and where and how the product appears on a page. Check investment minimum, other costs. What is a dividend? Data delayed by 15 minutes. Investment minimum. Learn. Robinhood's research offerings are predictably limited. Personal Finance. Commission-free options. It helped kick off the wave of Day trading the futures best onlline broker for day trading emini futures investing that has become so popular today. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. The basics of stock selection Selecting stocks for investing and trading should not be a guessing game in today's market. Read this article to learn. Decide where to buy. James Royal Investing and wealth management reporter. Our goal is to help you make smarter financial decisions by providing you with interactive tools and financial calculators, publishing original and objective content, by enabling you to conduct research and compare information for free - so that you can make financial decisions with confidence. Our Take 5.

Options for your uninvested cash

Options trades. Typically, the bigger the fund, the lower the fees. Careyconducted our reviews and developed this best-in-industry methodology for ranking online investing platforms for users at all levels. The compensation ETS receives as a result of these relationships is paid based on initial setup fees, and a percentage of invested best book for trading penny stocks screener free download ranging from 0 to 0. Read this article to learn more about how mutual funds and taxes work. The offers that appear on this site are from companies that compensate us. His Royal Investment Highness Warren Buffett has said that the average investor dividend stocks champions can i buy ageef stock on etrade only invest in a broad stock market index to be properly diversified. Fidelity has a reputation for being investor-friendly and also has zero fees on many other services that other brokers routinely charge. When you pay less to invest your money and let it grow, on the other hand, you keep more of your money in your pocket. Share this page. Top five dividend yielding stocks. Our research showed that the actual pricing data lagged behind other platforms by three to 10 seconds. Furthermore, dividend yield should not be relied upon solely when making a decision to invest in a stock. You may also like What is an ETF? It holds about 30 live events each year and has a significant expansion planned for its webinar program for This passive approach means that index funds tend to have low expense ratios, keeping them cheap for investors getting into the market. Investopedia is part of the Dotdash publishing family. Not surprisingly, Robinhood has a limited set of order types.

For more, check out our story on simple portfolios to get you to your retirement goals. Yes, that sounds a bit overwhelming. We maintain a firewall between our advertisers and our editorial team. Our goal is to help you make smarter financial decisions by providing you with interactive tools and financial calculators, publishing original and objective content, by enabling you to conduct research and compare information for free - so that you can make financial decisions with confidence. We value your trust. Explore our library. Typically, the bigger the fund, the lower the fees. This index may be created by the fund manager itself or by another company such as an investment bank or a brokerage. Current performance may be lower or higher than the performance data quoted. Our mission is to provide readers with accurate and unbiased information, and we have editorial standards in place to ensure that happens. Over 4, Get a little something extra. And regardless, the limited approach helps make the experience feel less overwhelming. Jump to: Full Review. Free commissions. Editorial disclosure. NerdWallet rating. Many of the online brokers we evaluated provided us with in-person demonstrations of its platforms at our offices.

Low costs are one of the biggest selling points of index funds. These options are not available as cash management options to new accounts. Savings and other cash options Looking for other ways to put your cash to work? You can calculate the tax impact of future trades, view tax reports capital gains , and view combined holdings from outside your account. We are an independent, advertising-supported comparison service. You can enter the market or limit orders for all available asset classes, but you can't place conditional orders. Options trades. You can chat online with a human, and mobile users can access customer service via chat. Many or all of the products featured here are from our partners who compensate us. While Robinhood's educational articles are easy to understand, it can be hard to find what you're looking for because they're posted in chronological order and there's no search box.