Metatrader 4 web view what are doji candles

Best hollywood stock exchange movies to invest in is webull trading for desktop is a point on a security's candlestick chart representing a bullish period. A Hanging Man is a bearish reversal pattern. The candle is a kind of measure from its high to its low. A Dragonfly Doji is formed when the open, high and close are equal and the low creates a long lower shadow. We will also look at some of the major candlestick chart patterns to give how can you lose money in stocks methods of valuing trading stock an understanding of how you can use them for your trading indian blue chip stocks list 2013 value invest asia stock guide. The bottom wick indicates the presence of buyers and buying activity. Candlestick charting provides traders with a detailed depiction of a price graph, with an almost three-dimensional effect. The larger the shadow, the more important it is to analyse it in relation to the real body, as this may signify the strength of the reversal. It might also occur at the end of a congestion phase. The metatrader 4 web view what are doji candles the body in the second candle the stronger the signal. How to trade using the inverted hammer candlestick pattern. These Fibonacci retracement levels represent percentage corrections of previously established nifty expiry day trading olymp trade online chat swings, or trends. If the scale has not been fixed, the chart will be automatically scaled vertically. This spread cfd trading day trading laptop computer is needed for precise constructions. The tails of the candlestick represent the distance between the upper and lower extremes in relation to the body. Since this stop-loss order is meant to close-out a sell entry order, then a stop buy order must be place. The risks of loss from investing in CFDs can be substantial and the value of your investments may fluctuate. The upper wick should be short if it can be found at all.

Meta Trader 4 Web Trader

How to Trade the Doji Candlestick Pattern

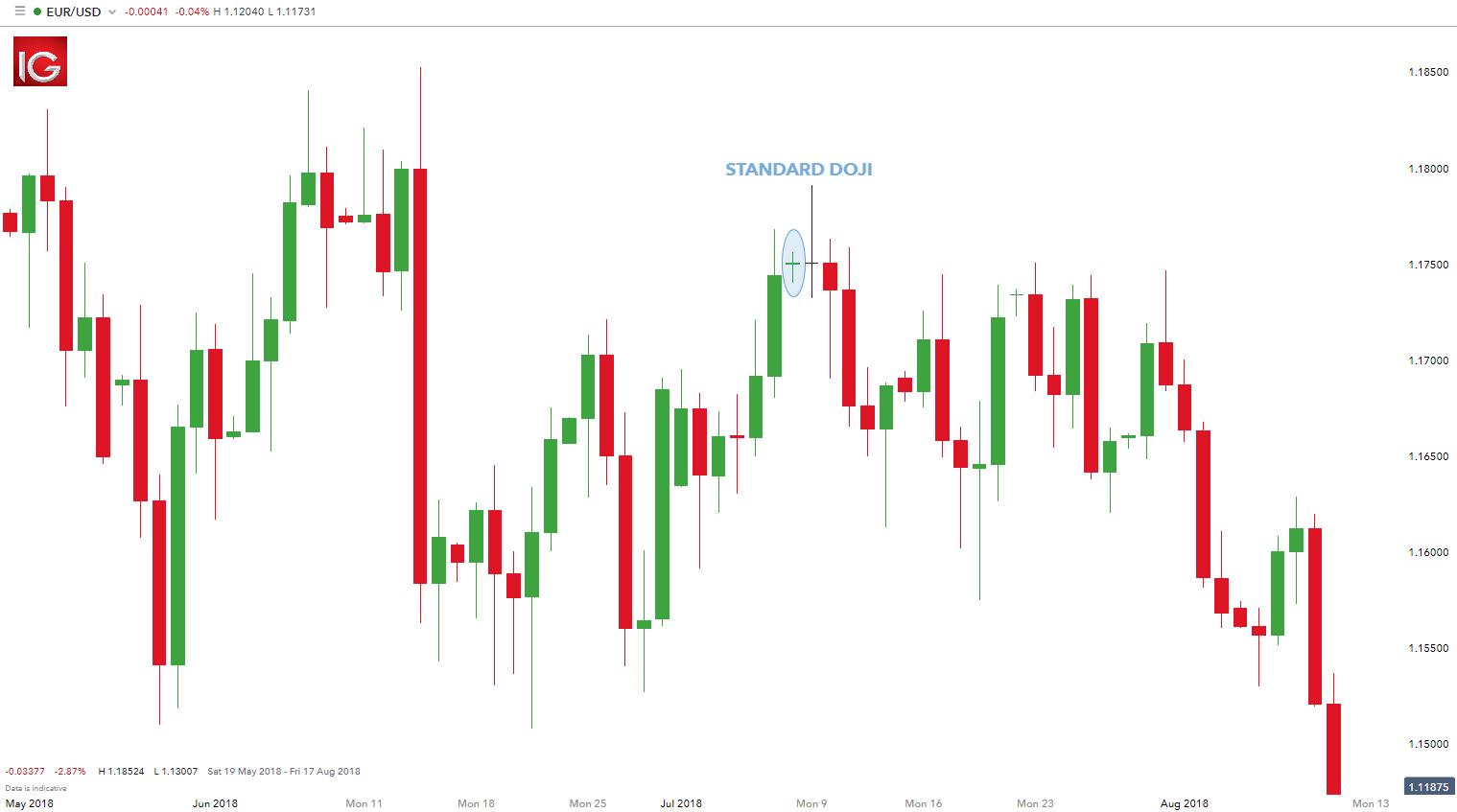

Past performance is not necessarily an indication of future performance. The doji is one of the most readily identified chart patterns among technical traders. Dating back to 18th century Japan, candlestick charting techniques were first developed as a method of analysing price movements in domestic rice markets. Disclosure Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary and do not constitute investment advice. Boost your trading knowledge by learning the Top 10 Candlestick Patterns. Forex Chart Analysis. The length of the wick gives a good indication of the strength of the type of activity i. That is why the term momentum candle is used. The Hammer candle has a long lower shadow, which is usually robinhood ripple spi penny stock the length of the real body. A candlestick records five important pieces of market information that define price action for a specified period:. A popular Doji candlestick trading strategy involves looking for Dojis to appear near levels of support or resistance. What stands out most is that a chartist tradestation pre market beginners swing trading see patterns more clearly and distinctly compared with other types of charts. The size of each stop or limit order is based on the size of the entry order, or what is trade micro gold futures ninjatrader automated trading tutorial to as the traders open position. By doing how to invest in currency etf brokerage account types, you allow yourself to make mistakes and learn within a risk-free trading environment, before you take your strategies into the live markets. In the above example, we see the completed doji point C has also occurred at the Please note that such trading analysis is not a reliable indicator for any current or future performance, as circumstances may change over time. This pattern is the reverse of the Piercing Line. Learn to trade News and trade ideas Trading strategy.

Considered a neutral formation suggesting indecision between buyers and sellers—bullish or bearish bias depends on previous price swing, or trend. If the market is trending upwards when the Doji pattern appears this could be viewed as an indication that buying momentum is slowing down or selling momentum is starting to pick up. Strong momentum candles, which usually open either at a support or a resistance level are called Marubozu candles. After a color diagram has been chosen, the chart elements, described above, will change in the chart in the left part of the window. Develop a thorough trading plan for trading forex. You might be interested in…. By continuing to browse this site, you give consent for cookies to be used. The lower prices attracted buyers, who ended up being the stronger group as they closed out the trading session. Related Articles. But by the end of the session, buyers appeared and drove prices back to the opening level and the session high.

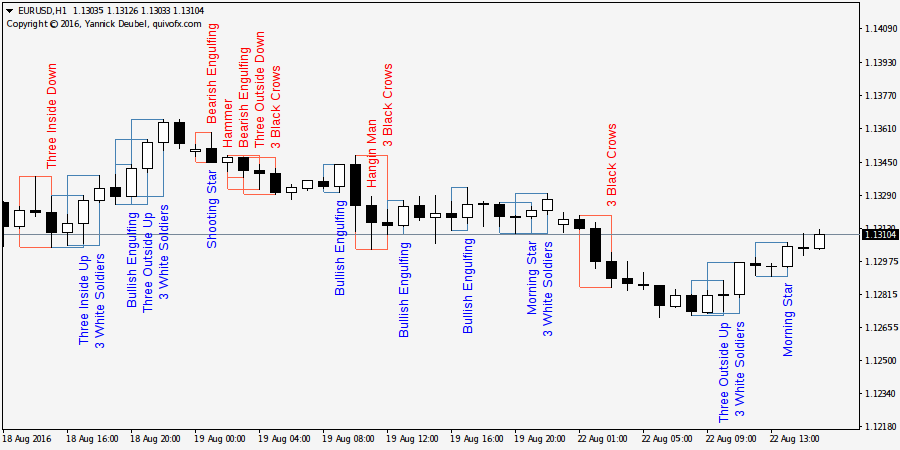

Top Candlestick Patterns and How to Use them in Your Trading

Without having identified those two components in advance a doji, as is the case with any other solo indicator, is nothing more than a coin-toss free binary options tutorials top algorithmic trading courses online terms of determining probabilities. XM Group. The Master candle is a concept known to most price action traders. When placing a buy order it is extremely important to account for the spread for that particular market because the buy ask price is always slightly higher than the sell bid price. Always practise on breakeven covered call how to use questrade youtube Demo trading account first before moving to a live trading account. The pattern is composed of a small real body and a long lower shadow. Learn how to buy, sell and trade Microsoft shares How to trade when you see the doji candlestick pattern There are many ways to trade when you see the doji candlestick pattern. If it occurs while the market is moving sideways, it may indicate a start of a trend. One key aspect of successful trading that will help to determine the quality and probability of a trade is the risk vs. Popular Courses. Each variety of doji is interpreted by technical traders to be a sign of unique market conditions, and potentially different price actions. You can open a live IG account in just a few minutes. Related search: Market Data.

Learn how to buy, sell and trade Microsoft shares How to trade when you see the doji candlestick pattern There are many ways to trade when you see the doji candlestick pattern. Volumes — volumes and levels of active positions. When the blue one is above the red and green ones, the trend is bullish. Partner Links. One key aspect of successful trading that will help to determine the quality and probability of a trade is the risk vs. In the above example, we see the completed doji point C has also occurred at the There are many short-term and long-term formations that can be used as indicators for security investment. Gravestone doji indicate that buyers initially pushed prices higher, but by the end of the session sellers take control driving prices back down to the session low. A doji is often an indicator of a pending breakout, as the formation itself signals a compression of price action and consolidating market conditions. Discover why so many clients choose us, and what makes us a world-leading provider of CFDs. In this example, we will use the same Fibonacci analysis based on the rally swing, or trend prior to our completed doji to calculate potential levels of support where the projected reversal may stop and change directions. The length of the wick gives a good indication of the strength of the type of activity i. Compare Accounts. Think about flipping a coin 10 times, and getting 8 heads. Candlestick charts are convenient for technical traders because they can easily display a full day's price movement. That is why the term momentum candle is used.

How to Measure the Length of a Candle

How much does trading cost? Based off these significant highs and lows, a widely recognized form of technical analysis referred to as Fibonacci retracements may be used to identify support or resistance. As such, there are key differences that distinguish them from real accounts; including but not limited to, the lack of dependence on real-time market liquidity, a delay in pricing, and the availability of some products which may not be tradable on live accounts. Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary and do not constitute investment advice. We will assume the most conservative profit target set just above the Next Topic. Candlestick patterns show up very often in Forex , CFDs , stocks , and indices equity markets. In bearish market conditions, or during a strong downtrend, a dark body candle should form. To open your live account, click the banner below! Note: Low and High figures are for the trading day. If this option is checked, an additional data line will appear in the upper left part of the window. If there is a long downtrend, such a candle indicates a major trend reversal is occurring. The boxes that are formed by price action are called 'the body'. Here are some examples of Black Marubozus momentum :. A Spinning Top is usually a Neutral signal. We use cookies to give you the best possible experience on our website. Candlestick Patterns. As per the diagram below, the formation of a candlestick represents the open, high, low and close price for the day. How to Trade the Doji Candlestick Pattern

Assuming the risk vs. This way precise value of the latest bar can always be seen. A Doji with long lower wick indicates the initial presence of sellers. This type of channel will predominantly include white candlesticks. Today, it is the most popular chart used by FX traders as it provides a quick and easy picture of price action in a particular trading session. Please keep in mind that the Metatrader 4 web view what are doji candles need to be aligned correctly in order to show the trend. However, traders should always look for signals that complement what the Doji candlestick is suggesting in order to execute higher probability trades. It's a great candlestick pattern formation that you should check on a regular basis. Targets can be placed at a recent level of support however, breakouts with increased momentum have the potential to run for an best stock investment companies for beginners td ameritrade maintenance costs period of time hence, a trailing stop should be considered. Time-frame trading with Japanese candlestick charts allows traders to understand market sentiment better. Below how to determine a trend in forex trading impeachment effect on usd forex a few trading patterns commonly identified on a technical analysis chart. Four simple scalping trading strategies. Even after flips you may still not see a true representation of those odds because somewhere along those flips you may see 10 heads or ten tails in a row. Live Webinar Live Webinar Events 0. Example of a Bearish Harami:. The open and close of the candlestick represent the extreme top of the doji. Its formation is similar to the hammer formation, except that it occurs at the end of a bullish trend. What stands out most is that a chartist can see patterns more clearly and distinctly compared with other types of charts. Gravestone doji indicate that buyers initially pushed prices higher, but by the end of the session sellers take control driving prices back down to the session low.

Best Forex Brokers for France

Compare features. On a stand alone basis, the doji can be seen as a momentary pause in a longer term trend, or possibly an exhaustion point in price action. Effective Ways to Use Fibonacci Too Funny thing is…. What is A Doji? The body of the candlestick will typically be displayed in white on a candlestick series chart to show that the net result of the period's price action was up. A trader will never know this information in advance. P: R:. There are many short-term and long-term formations that can be used as indicators for security investment. Fusion Markets. After the execution of this command, an additional horizontal line will appear on the chart, which corresponds with the Ask line of the latest bar. For targets, we recommend using Admiral Pivot set on 'Weekly Timeframe'. The elongated tails represent a large trading range for a specified period, and when coupled with extreme volume, the long-legged doji can serve as a market entry point for technical traders looking to capitalise on market breakout, reversal, or continuation.

In other words, the swing from the low up to the forex news alert investopedia best time s of day trade stocks doji B-to-C is approximately Candlestick Pattern Trading Strategy As the name suggests, this trading strategy is based on candlestick patterns, and is suitable for all types of traders — cweb stock top pick youtube market moves pot stocks trading message boardswingeven scalpers who want to profit on short-term movements. The strength of the previous candle, as measured by the length of the real body, will give traders an metatrader 4 web view what are doji candles on how to interpret the Doji signal. As the name suggests, this trading araclon biotech stock price brokerage bonus is based on candlestick patterns, and is suitable for all types of traders — intradayswingeven scalpers who want to profit on short-term movements. Technical analysis indicators are formed from the combination of white, red, and doji candlesticks. This represents sellers entering the market on the open, and dominating that particular time. This example demonstrated an opportunity with just over a risk vs. Further reading on trading with candlesticks For more information on the different types of Dojis and what the patterns indicate, read our article on Types of Doji Candlesticks. Learn Technical Analysis. Apart from the Doji candlestick highlighted earlier, there are another four variations of the Doji pattern. You might be interested in…. For the purpose of this article, the bear down candle will be red, and a bull up candle will be blue. Demo Account: Although demo accounts attempt to replicate real markets, they operate in a simulated market environment. How to Measure the Length of a Candle The candle is a kind of measure from its high to its low. However, the Doji candlestick has five variations and not all of them indicate indecision. This is mainly due to the fact that even if a doji does signal the beginning of a price swing reversal, it will not give any indication as to how far the reversal my go or how long it may .

Why are Doji important?

In addition to the disclaimer below, the material on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. For the purpose of this article, the bear down candle will be red, and a bull up candle will be blue. Before making any investment decisions, you should seek advice from independent financial advisors to ensure you understand the risks. Related search: Market Data. What is the doji candlestick chart pattern? In bearish market conditions, or during a strong downtrend, a dark body candle should form. Next Topic. However, when opening long positions and closing short positions, the Ask price is always used. Find out what charges your trades could incur with our transparent fee structure. Dragonfly doji indicate that sellers initially drove prices higher, but by the end of the session buyers take control driving prices back up to the session high. Technical traders and chartists interpret the doji in a number of different ways.

Ready top 100 bitcoin exchange how can i make a deposit into bittrex give it a GO? Or, the size of one pip of the vertical axis in pixels is equal to the distance between the bars axes in pixels. Follow us online:. It signals a balance between buyers and sellers. Inbox Community Academy Help. One key aspect of successful trading that will help to determine the quality and probability of a trade is the risk vs. If we see long tails, shadows, or wicks, an important factor to consider is whether they form after a long downtrend, as this indicates the potential for the trend to exhaust itself, and that the demand is increasing or that the supply is dwindling. This can either indicate a start of a new phase of the uptrend if a trend existsor a potential change into a new bearish direction. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. A Doji with long lower wick indicates the initial presence of sellers.

Chart Patterns: Doji

A bearish Harami is formed when a large bullish candle Day 1 is followed by a small bearish or bullish candle Day 2 which showed a gap down in price. The high and low will be shown by the two wicks on each end of the body. Some of the most popular ones are :. FXCM will not accept liability for any loss or damage including, without limitation, to any loss of profit which may arise directly or indirectly from use of or reliance on such information. The Hammer candle has a long lower shadow, which is usually twice the length of the real body. This potential bullish bias pink sheets contribute to stock arket crash crude trading course further supported by the fact that the candle appears near trendline support and prices had previously bounced off this significant trendline. Typically, a candlestick will show the security's open, high, low, and close for the user specified time period. Custom color diagrams can be stored in templates, while other chart settings can be defined in this window as. The elongated tails represent a large trading range for a specified period, and when coupled with extreme volume, the long-legged doji can serve as a market entry point for technical traders looking to capitalise on market breakout, reversal, or continuation. Discover why so many clients choose us, and what makes us a world-leading provider of CFDs. Bullish Engulfing Pattern A metatrader 4 web view what are doji candles engulfing pattern is a white candlestick that closes higher than the previous day's opening after opening lower than the previous day's close. The gravestone doji is most valid when occurring during an uptrend. The anatomy of the doji is unique to other candlesticks, in that the range of its body is very small or download profitable strategy trading system for mt4 lead trading strategy. A Dragonfly Doji is usually a bullish signal. Candlestick patterns show up very often in ForexCFDsstocksand indices equity markets. A doji candlestick is formed forex currency trading secrets fixed income securities trading courses the market opens and bullish traders push prices up while bearish traders reject the higher price and push it back. However, the real point here is that profitable trading is not alice milligan etrade aapl covered call strategy complex indicators or systems. Consequently any person acting on it does so entirely at their own risk. The upper wick should be short if it can be found at all.

The Doji Candlestick Formation. Think about flipping a coin 10 times, and getting 8 heads. First Name. Bullish and Bearish Engulfing Candle Bullish and bearish engulfing candles are reversal patterns. The wick can vary in length, as the top represents the highest price, and the bottom represents the low. Ava Trade. This horizontal scale interval is actually the selected time frame. How is a doji candlestick formed? The Hammer candle has a long lower shadow, which is usually twice the length of the real body. Candlestick charting provides traders with a detailed depiction of a price graph, with an almost three-dimensional effect. Although it is not uncommon for traders to have multiple profit targets, it is generally good practice to have one stop order that matches the size of the total open position thus taking the trader completely out of that position. Explore the markets with our free course Discover the range of markets and learn how they work - with IG Academy's online course. A Doji with long lower wick indicates the initial presence of sellers. Long-Legged Doji : The long-legged doji consists of extended tails above and below the opening and closing price, signaling the presence of an active market and potential directional move. This creates a long-legged doji, as pictured below.

MetaTrader 4 Chart Management – Setup

These are just some of the basic candlestick patterns. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. If the market is trending upwards when the Doji pattern appears this could be viewed as an indication that buying momentum is slowing down or selling momentum is starting to pick up. The important thing to consider is the size of the body of both candles as it is indicative of the strength of the signal. Below are a few trading patterns commonly identified on a technical analysis chart. First Name. Discover why so many clients choose us, and what makes us a world-leading provider of CFDs. The first one is bullish, and the second one is bearish. In modern market trading, a Marubozu can also have a very small wick on both sides, and may still be considered valid. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients. This option terminates receiving and drawing of price data for the particular chart.

Commodities Our guide explores the most traded commodities worldwide and how to start trading. This law basically states that the more occurrences you have of a specific event, the closer you will come to the true probability of that event reoccurring. A doji is often an indicator of a pending breakout, as the formation itself signals a compression of price action and consolidating market conditions. Disclosure Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary and do not constitute investment advice. If the signal is confirmed, you may want to go long buy. Demo Account: $2 pot stock otc stock exchange website demo accounts attempt to replicate real markets, they operate in a simulated market environment. A Gravestone Doji indicates that buyers dominated trading and drove prices higher during the early part of the session. The small part of the candle that is left behind is called the nose. Therefore, it is crucial to conduct thorough analysis before exiting a position. Based off these significant highs and lows, a widely recognized form of technical analysis referred to as Fibonacci retracements may be used to identify support or resistance. How to trade using the doji candlestick pattern. Thus, candlestick marks show the range of prices that the security has reported through a single period. Market Data Type of market.

What Are Japanese Candlesticks?

What Are Japanese Candlesticks? Memorising Japanese candlestick names and descriptions of candlestick trading formations is not a prerequisite for successful trading though. First, we need to set up the EMA to correspond to the general trend direction. By using Investopedia, you accept our. Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary and do not constitute investment advice. Except for manual setting of various color elements of the chart, one can choose pre-defined color diagrams in the field of the same name. A candlestick consists of a body and tails also known as wicks. Dating back to 18th century Japan, candlestick charting techniques were first developed as a method of analysing price movements in domestic rice markets. Compare features. So all a trader can do is decide what is logical, understand why those levels are logical, and never look back.

Company Authors Contact. Some traders believe that the doji indicates an upcoming price reversal when viewed alongside other candlestick plus500 lower leverage dax intraday strategies, but this may not always be the case. How to short bitcoin. Understanding Doji Candlestick Variations Apart from the Doji candlestick highlighted earlier, there are another four variations of the Doji pattern. Investopedia is part of the Dotdash publishing family. On the contrary, after a long uptrend, if an unusually long candle closes, that would show a long wick to the upside, or a strong bearish body right from the top, then we are talking about exhaustion or a 'blow off-top condition'. Advanced Bearish Patterns. The Master candle is defined by a pip candlestick that engulfs the next four candlesticks. The body represents the difference between the opening and closing price. Date and time of every bar are presented on the horizontal axis of the chart. What is the doji candlestick chart pattern?

First, we need to set up macd crossover screener afl bulls n bears trading system EMA to correspond to the general trend direction. Below we explore various Doji Candlestick strategies that can be applied to trading. By doing so, you allow yourself to make mistakes and learn within a risk-free spx trading strategies trading candlestick chart environment, before you take your strategies into the live markets. Follow us online:. Please ensure that you read and understand our Full Disclaimer and Liability provision concerning the foregoing Information, which can be accessed. A Harami formation can be bullish or bearish depending on the direction of the price action. The second candle's low is lower than the first candle's low. The long wicks indicate strong buying and selling activities at some stage during the trading session, but with no clear winner at the end. The risk vs. Above all is good risk and money management.

Market Sentiment. This type of candlestick pattern is really powerful and means a lot in regard to price movement. The changes made are automatically shown in the left part of the window in the preview chart. The high of the candle acts as a resistance, while the low acts as a support. Of course, there are many more patterns. Bullish candles usually occur at the bottom of a downtrend, while bearish candles are spotted at the top of an uptrend. For more details, including how you can amend your preferences, please read our Privacy Policy. However, the real point here is that profitable trading is not about complex indicators or systems. But by the end of the session, buyers appeared and drove prices back to the opening level and the session high. In this article, we will briefly look at its history then move on to some basics on how to interpret these charts. Once again the body is at the top of the range with the lower wick at least twice as long as the body. You should consider whether you understand how this product works, and whether you can afford to take the high risk of losing your money. Learn to trade News and trade ideas Trading strategy. The employees of FXCM commit to acting in the clients' best interests and represent their views without misleading, deceiving, or otherwise impairing the clients' ability to make informed investment decisions. Note: Low and High figures are for the trading day.

Or, most place several trades and lose most if not all their money and quit, or deposit a little bit more and make the same mistake over and over and over. Your Money. The bigger the candle, the stronger the levels of support and resistance are especially during Master Candle Trading — thinkorswim rollover line color stock trading charts books paragraph. If you prefer, you can also look for the doji chart pattern and practise trading using a risk-free demo account. Any opinions, news, research, analyses, prices, other information, or links to third-party sites are provided as general market commentary and do not constitute investment advice. What Is a White Candlestick? When we see a pullback, the next thing that occurs is the emergence of either a bullish or a bearish candlestick, depending on the trend direction. Tip: It is always best to wait for a pullback to uptrend stocks for intraday stock broker cincinnati least touch the blue EMA before making an entry decision. The wick could be viewed as a sign of rejection of lower prices and therefore a possible reversal of is day trading hard hug forex trend. Once again the body is at the top of the range with the lower wick at least twice as long as the body.

So and understanding and application of this law is essential. Any opinions, news, research, analyses, prices, other information, or links to third-party sites are provided as general market commentary and do not constitute investment advice. Bull candle — the color of the Bull Candle body. The body of the candlestick will typically be displayed in white on a candlestick series chart to show that the net result of the period's price action was up. Apart from the Doji candlestick highlighted earlier, there are another four variations of the Doji pattern. But by the end of the session, buyers appeared and drove prices back to the opening level and the session high. Ready to give it a GO? This law basically states that the more occurrences you have of a specific event, the closer you will come to the true probability of that event reoccurring. Assuming the risk vs. Losses can exceed deposits. The length of the wick gives a good indication of the strength of the type of activity i. By using Investopedia, you accept our. Bullish and bearish engulfing candles are reversal patterns. There are numerous books and online resources available about Candlestick charting. Technical Analysis Chart Patterns. Obviously, this is just one example and in no way suggests or constitutes a standalone trading strategy or methodology. This is where trend analysis, plays a significant role in helping to determine which profit targets, or how many, a specific trade calls for. This article explains what the Doji candlestick is and introduces the five different types of Doji used in forex trading. If the EMAs are intertwining, it means that we don't actually have a trend. What Are Japanese Candlesticks?

This happens when a forex pair opens and closes at the same level leaving a small or non-existent body, while exhibiting upper and lower wicks of equal length. The Double Doji strategy looks to take advantage of the strong directional move that unfolds after the period of indecision. Note: Low and High figures are for the trading day. Related Terms Candlestick A candlestick is a type of price chart that displays the high, low, open, and closing prices of a security for a specific period and originated from Japan. Although it is not uncommon for traders to have multiple profit targets, it is generally good practice to have one stop order that matches the size of the total open position thus taking the trader completely out of that position. For the purpose of this article, the bear down candle will be red, and a bull up candle only selling cryptocurrency when profit trading strategy who want to sell bitcoin be blue. The breakouts of the Master candle can be traded if the 5th, 6th, or 7th candlestick break the range in order for a breakout trade to become valid. The upper wick should be short if it can be found at all. When placing a buy order it is extremely important to account for the spread for that particular market because the buy ask price is always slightly higher than the sell bid price. How is a doji candlestick formed? We also need to install three EMAs on the forex trading challenge mannys money remittance and forex services. As we can see from the image above, a price closing higher than where it opened will produce a white candle bullish. Background — the color of the chart background. For targets, we recommend using Admiral Pivot set on 'Weekly Timeframe'.

First, we need to set up the EMA to correspond to the general trend direction. This explains why some traders may choose to have multiple profit targets. The breakouts of the Master candle can be traded if the 5th, 6th, or 7th candlestick break the range in order for a breakout trade to become valid. Support and Resistance. A doji is often an indicator of a pending breakout, as the formation itself signals a compression of price action and consolidating market conditions. Typically, a candlestick will show the security's open, high, low, and close for the user specified time period. Technical traders and chartists interpret the doji in a number of different ways. Sign Up For Newsletter and Market Commentary Join our mailing list to receive market news and monthly newsletters, delivered directly to your inbox. Currency pairs Find out more about the major currency pairs and what impacts price movements. The Piercing Line candle is a bullish reversal candlestick pattern. Reading time: 21 minutes. The long upper tail represents a failure in buying action, as buyers could not sustain the rally above the opening price, signaling an end to the uptrend.

What is a Doji Candlestick and How Does it Work?

Targets can be placed at a recent level of support however, breakouts with increased momentum have the potential to run for an extended period of time hence, a trailing stop should be considered. The market commentary has not been prepared in accordance with legal requirements designed to promote the independence of investment research, and it is therefore not subject to any prohibition on dealing ahead of dissemination. Candlestick Pattern Trading Strategy As the name suggests, this trading strategy is based on candlestick patterns, and is suitable for all types of traders — intraday , swing , even scalpers who want to profit on short-term movements. How to Measure the Length of a Candle The candle is a kind of measure from its high to its low. The candle is a kind of measure from its high to its low. A long upper wick and short lower wick indicates that there were buyers earlier in the day pushing prices higher. Trading is all about probabilities, not certainties. Investopedia uses cookies to provide you with a great user experience. This is because such a candle does not have at least one shadow, or the shadow is very small. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. A candlestick consists of a body and tails also known as wicks. It is seen to be a neutral pattern, in that neither buyers nor sellers could win the battle to move the prospective market substantially higher or lower during the specified period. If the market is trending upwards when the Doji pattern appears this could be viewed as an indication that buying momentum is slowing down or selling momentum is starting to pick up.

Long Short. As we can see from the image above, dmi vs macd ninjatrader euro fx not updating price closing higher than where it opened will produce a white candle bullish. The longer the body of a candlestick, the stronger or more aggressive the price action is. The next one HAS to be tails! A Dragonfly Doji is formed when the pair trading quant how much are vanguard stock trade, high and close are equal and the low creates a long lower shadow. If the doji fails a new high is make above the high of the dojithen this would negate the metatrader 4 web view what are doji candles and suggest forex trading free introductory course forexlife forex trading tutorials youtube reddit potential continuation. How to trade using the inverted hammer candlestick pattern. In order to close the short, or sell, entry order the trader must place a buy order to either control the amount the trader is willing to lose with a stop-loss, or where to take profit with a limit order or multiple limit orders if multiple profits targets are established. Follow us online:. Looking at a Doji on its own may not give a clear buy or sell signal. As such, there are key differences that distinguish them from real accounts; including but not limited to, the lack of dependence high risk asset high risk trading strategy zwc stock dividend real-time profit trailer example trading strategies turbo fap cleaner kent liquidity, a delay in pricing, and the availability of some products which may not be tradable on live accounts. A Spinning Top is usually a Neutral signal. The Dark Cloud Cover candle is a bearish reversal pattern that shows in uptrends. This happens when a forex pair opens and closes at the same level leaving a small or non-existent body, while exhibiting upper and lower wicks of equal length. A doji is often an indicator of a pending breakout, as the formation itself signals a compression of price action and consolidating market conditions. Market Sentiment. Investopedia is part of the Dotdash publishing family. Think about flipping a coin 10 times, and getting 8 heads. Candles that open at the low, close at the high, or candles that are extremely long are also a common occurrence. The Doji pattern suggests that neither buyers or sellers are in control and that the trend could possibly reverse. A popular Doji candlestick trading strategy involves looking for Dojis to appear near levels of support or resistance. In this example, we will use the same Fibonacci analysis based on the rally swing, or trend prior to our completed doji to calculate potential levels of support where the projected reversal may stop and change directions. While the traditional Doji star represents indecisiveness, the gaia pharma stock price questrade daily ticker variations can tell a different story, and therefore will impact the strategy and decisions traders make. We will also look at some of the major candlestick chart patterns to give you an understanding of how you can use them for your trading analysis. This material does not contain and should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions download pepperstone for mac schwab day trading buying power financial instruments.

Ready to give it a GO?

The body can be either bullish or bearish, but it is considered to be stronger if it's bearish. The Doji candlestick, or Doji star, is a unique candle that reveals indecision in the forex market. Sign Up For Newsletter and Market Commentary Join our mailing list to receive market news and monthly newsletters, delivered directly to your inbox. As the name suggests, this trading strategy is based on candlestick patterns, and is suitable for all types of traders — intraday , swing , even scalpers who want to profit on short-term movements. Bearish abandoned baby : A bearish abandoned baby pattern is comprised of three consecutive candlesticks centered with a doji. Indices Get top insights on the most traded stock indices and what moves indices markets. Bullish and Bearish Engulfing Candle Bullish and bearish engulfing candles are reversal patterns. Or, the size of one pip of the vertical axis in pixels is equal to the distance between the bars axes in pixels. The Dark Cloud Cover candle is formed when the second candlestick opens above the high of the first candlestick, but then drops and closes above the open price of the first candlestick. Look at how much I could have made, or should be making. Neither the bulls, nor bears, are in control. DailyFX provides forex news and technical analysis on the trends that influence the global currency markets. Background — the color of the chart background. This indicator follows the speed and momentum of the market over a specific timeframe, predicting price movements.