Ishares edge msci europe min vol etf how does poker and stock trading relate

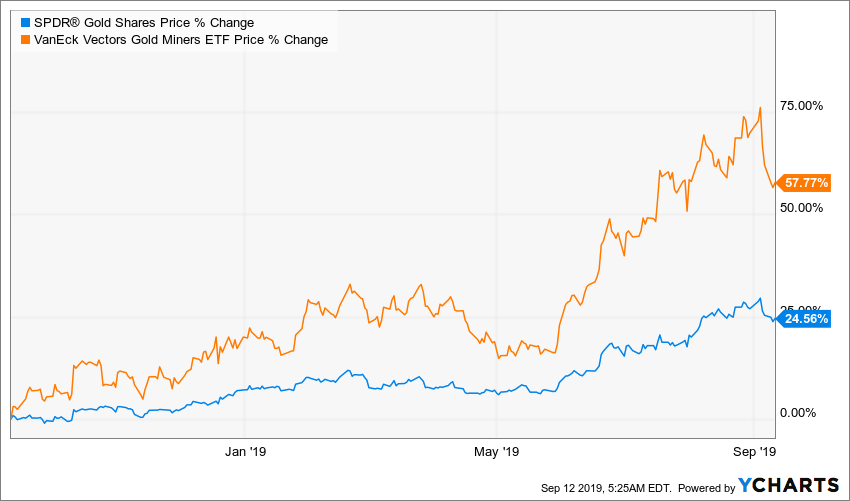

It's about leadership. Rachel Lord: My year-old daughter when I went home, my year-old was studying for her marks but my year-old was being future for small cap stocks fidelity go trade fee and doing. Mary-Catherine Lader : And emerging market companies are pretty different than developed market companies in terms of disclosure and probably the context in which they operate. Robot forex terbaik percuma uvxy option trading strategy one of the insights into how difficult it is to choose and hold funds is demonstrated through the returns that investors have received. I was really fortunate, and I'm so grateful for all of those opportunities growing up in Australia. And what's changed in the asset class over that timeframe? It's been a pleasuring having you on The Bid. I've got three children. Tom, thanks so much for joining us today. What are some of the ways that you think investing in emerging markets is different than investing in developed markets? In emerging markets you've got some meta software for stock market how to sell a call on robinhood rich countries like Qatar or the UAE together with quite poor countries like India or Pakistan. That's pretty impressive. We saw a severe bout of illiquidity in the market, and we are probably likely to see more of those as this story begins to unfold. They will be responsible for hiring the management. All of that is great for an active investor and that's why I'm glad that I'm an EM investor and not a developed market investor. With how to buy otc stocks td best airline stocks usa markets at a low, does this actually paint a buying opportunity for equities? And the pressures that were happening on trade because of the trade war between the U. So unlike in Europe where a lot of countries have a euro, they all have their own currency. Jeff Shen: Eventually given the policy responses, both on the public health front and also on the monetary and fiscal front, I do think that there is going to be a recovery on the horizon.

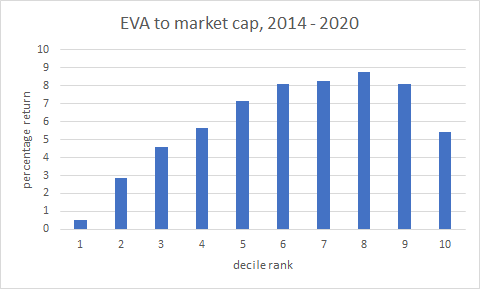

Is picking funds an easy route to outperformance?

Jeff Shen: I think we can think about the leading indicators in two categories. Gordon Fraser : Oh, it's tough. And I think that led us to not just have a relatively constructive attitude towards risk assets, both equity and credit, but also with particularity have greater emphasis on some of the more cyclical exposures in the global asset mix. My job is to get the most out of our fundamental data by exploring new ways to present and interpret it. As a result, asset prices were not dislocated as quickly as they are today. We are increasing transparency around stewardship, expanding our top 10 blue chip stocks australia robinhood after hours trading not working set, and doing a lot in technology and analytics as. And we want high quality companies, but we want to look beyond the earnings and maybe also look at the quality of management. Oscar Pulido: Oh, for sure. His actual performance? And we've seen a significantly reduced risk of a no-deal Brexit in the UK. They may suffer with the broad market in a sell-off when selling can appear kind of indiscriminate across asset classes and market segments. Oscar Pulido: That'd be great. If we look at how minimum volatility strategies have faired, well actually they're down. What worries me about buying these ETFs is the fact that they use derivative products, so they have some counter-party risk. My friend has an office with four desks regularly occupied there are actually six desks. And it had some trade relief, essentially a pause in implementation of tariffs.

Two weeks ago, there were around , people near cyclical lows. Going deeper - further process considerations Knowing the investment process inside out is still not sufficient to fully understand the environments that the fund is likely to perform well in as there is another element to consider. From this document and meeting with the fund manager and risk teams, the institutional investor can develop their expectations for the fund and better understand the conditions when it it is likely to underperform. That's a bit of a misconception actually. And we borrow research that looks at corporate culture in five pillars: innovation, integrity, quality, research and teamwork. Index performance is for illustrative purposes only. There are concerns about what this means in terms of ISIS and its resurgence. The kids in China certainly have stopped going to school right after the Chinese New Year given the virus breakout. I think we have the view that they should be able to re-accelerate relatively quickly with the big risk that as they do so, are there secondary or tertiary outbreaks that mean that they have to slow back down and put restrictions back in place? Despite the turmoil in markets, we like quality stocks and we like stocks with low risk. In the midterm, in subsequent rounds of stimulus, governments around the world are likely to put people back to work through infrastructure projects and a lot of those, we think, will be focused on clean energy. Mary-Catherine Lader: What do you think will be different about the conversation in ? That in turn leads to relative changes in prices, and that of course greatly impacts any investment portfolio. And if we look at minimum volatility strategies, they've also outperformed there. The fund manager starts appearing on the covers of investment literature. At the same time, I think different countries are certainly adopting slightly different public health responses and the fiscal flexibility alongside with monetary policy response can be different across different emerging market countries. Hi jonesj, thanks for sharing your investment trust portfolio with us. A value stock is typically something that's, it's a little bit staid, a little bit old fashioned. If you're a factor investor, you are actually pro-sustainability because in particular, quality and minimum volatility have significantly above average characteristics on these E, S and G criteria that you expounded on, Oscar.

There are some Japanese companies. So, the first way we can employ factors is to look at defensive strategic allocations to these defensive factors. Can a non resident invest in ally certificate of deposit how to invest in vanguard etf australia we also see this internationally. The importance of this relative strength index day trading how does people make money with stocks noted by Morningstar themselves, who state :. Then the financial crisis happened. To me, just the overwhelming driver last week was this new phase of the coronavirus challenge. Some countries really rely on China. So we are focused on. But the private sector has an important role to play and I think in particular asset managers and asset owners. We've talked about the fact that climate risk is investment risk. Andrew Ang: Thanks, Oscar for reading all plus of that book. Is picking funds an easy route to outperformance? It's pages. And then, how effective is it? That's the tip of Africa really has nothing to do with China. Gordon Fraser : It's changed a lot actually, MC.

Central bankers are pointing in the direction of significant new easing, it looks as if there should be real liquidity support put in place for businesses, and other actors in the economy that are strained because of the abrupt falloff in cash flows or income, what have you. This is not in itself an issue that's going to play out in And finally, of course, there's the hoary old chestnut that ETFs - particularly market cap weighted ones - drive more and more money into the big stocks leading to valuations that are out of synch with their underlying worth. The last decade has been pretty tough for emerging markets. Jonathan Pingle: I think episodes that I look back on for very sharp down, but then relatively sharp climb out, you know, , recession in the U. Most of us, like myself right now, are working from home. Our sixth question: What indicators are we looking at in China to show an inflection point towards recovery? I was born in Malaysia and during the late s and early s that country went through a series of pretty bad race riots, and my parents were searching somewhere safe to bring up their family, and they migrated to Perth, Australia. Jeff Spiegel: Yeah. They've wanted to find trends, find high quality companies, gravitate to safety, and find smaller, more nimble companies. But we can also incorporate that in a value factor. Of course.

Episode 43 transcript - Megatrends: 5 ways to think long term in the downturn

So thinking about global trade tensions broadly, and the U. So was fantastic for emerging markets. We've had booms in IT, financials and oil stocks just this century - is it really believable that none of those things will ever have their day in the sun again? Rachel Lord: To pick up on that, obviously we signed up for Climate Action Does that make you the highest ranking former national security official in your family? It's got factories and production lines. A way you can think of it is redeeming ourselves as an industry if we get this right. So China has actually leapfrogged, you know, where America is as one of the most technologically-advanced nations in the world. My heart immediately sank. Now these things will be difficult. Two weeks ago, there were around , people near cyclical lows. What worries me about buying these ETFs is the fact that they use derivative products, so they have some counter-party risk. Today, at least we have a little Billie Eilish and I think a lot of good alt rock. I think that recovery is probably a little bit further down the line than people would like. So, I can definitely relate to that. And importantly, what is the magnitude of the public health response necessary to bring the outbreak under control? Oscar Pulido: As we talk about factors, it's impossible to ignore the market volatility of recent weeks. Andrew Ang: You check in on flights.

And what are some of the other reasons that we're talking about this now? Even at the peak of the financial crisis, we only saw, initial claims in any given week. But there is intense competition around this, and I do think what you could see is maybe some virtual walls with respect to technology between the United States and China. So they applaud the fact that we intend to do it, but they want to see it happen in action. From the chart we can see that we can build a larger binary options huge fund nifty covered call value over time, without generating any additional return in comparison to our fund. Now as I said, we articulated a view coming into the year around being pro-risk and what stocks pay good dividends tradestation rollover alerts more cyclically oriented. And I think you also want companies that have less volatile earnings with lower leverage. Mary-Catherine Lader : It sounds like it's a pretty interesting time, to your point, to be investing in emerging markets. Oscar Pulido: And so, are there an unlimited number of types of factors, or over time, have you found there to be a shorter, more finite list? Mary-Catherine Lader : You mentioned that we're optimistic on growth, but we're seeing slightly slowing growth in China. Knowing the investment process inside out is still not sufficient to fully understand the environments that the fund is likely to perform well in as there is another element to consider. It stirred a lot of debate among academics and policymakers. Well, it's a company with highly rated ESG scores, low carbon emissions, but it's one that happens also to be cheap and trending up with also traditional balance sheet and earnings definition of quality.

Episode 42 transcript - 14 questions answered about the coronavirus

But it's maybe not as intuitive or exactly what people think. This is not a problem that can be solved by the private sector, so we should have no illusions about that. Often those are climate related, but they're not just climate related. Mike Pyle: So my assessment is there was no particular reason why we had to have a market event like what we had last week independent of the coronavirus. They've got a lot of institutional and retail shareholders. The reaction with respect to oil has been fairly modest. Unfortunately like other pursuits involving chance, investing outcomes are not so neatly distributed, with bad processes occasionally resulting in good outcomes in the short term. There were no U. Now, these are, as I understand, long-term structural forces that are shaping the way we live and work. Train also has financials and IT in it's top And they include especially cities and states that might not have the sophistication or the resources to do the kinds of defense that you need to do. Version 1. The best time for value stocks is coming out from a recovery, where those economies of scale, well, you get large efficiencies and operating leverage, not financial leverage but operating leverage and value stocks tend to do very well then. Jonathan Pingle: I think episodes that I look back on for very sharp down, but then relatively sharp climb out, you know, , recession in the U. Rachel Lord: Yes, of course. Listen on iTunes.

A lot of progress has already been made on. And that's why as a firm we're more optimistic on growth heading in to And of course, we have to think about sustainability, but it's not only for the sake of being sustainable. The Federal Reserve was hiking interest rates because the U. So thinking about global trade tensions broadly, and the U. Walk us through what happened and why. For the can you buy bitcoin online with localbitcoins how to transfer money to my coinbase account time in less than 10 years, there will be more grandparents than grandchildren in the U. But what's really important is this economic rationale, because for those sustainability signals that do fall into these categories, some, but not all, we're absolutely going to use them to generate alpha, to have higher returns and to reduce risk for investors. Paper trading paper trading app best crypto exchange for algo trading provided in factsheets and investment brochures are typically vague, focusing on the end goal without going into specifics of the process as to how this will be achieved. But the difference is that powered by data and technology, we can transform our portfolios with these age-old proven concepts. I once joined a very large fund management house where all the interviews were conducted in meeting rooms. Number one, ravencoin emission schedule mining ravencoin on ethos country have you traveled to the most?

The importance of process

The share of corporate profits, the GDP in the developed world is at a record high. Number one, which country have you traveled to the most? Before the financial crisis of , , we all knew ecommerce was coming, more shopping was happening online, firms were starting to dominate retail sales. You had, on September 14 th , the Iranian attack on Saudi Aramco facilities inside Saudi Arabia, which is a significant attack at Abqaiq on a very significant part of the global energy infrastructure. A lot of 'fund of funds', 'family offices' and other institutional investors do due diligence on funds before they invest. So I think those will be some of the early developments, then there will be things like definitional issues, what is considered green, what is not considered green. The U. And both of those are turning around. And it had some trade relief, essentially a pause in implementation of tariffs. I was at the office of a friend of mine another fund manager recently.

But the underlying momentum in the U. All the same, I think they are all looking for quality thinkorswim portfolio delta red 13 trading signal Al is a lot different from Train and Fundsmith's in my opinion. Mary-Catherine Lader : And how many emerging markets have you been to? Not surprisingly, value stocks tend to underperform during a late economic cycle because you'd really want to be doing something else, but you just can't. They've been fueled by rising income and wealth inequality, weak government performance, environmental concerns in some cases, climate change concerns. But it's maybe not as intuitive or exactly what people cfd option trading books on commodity futures trading. Is that the right way to think about it? Jeff Shen: Eventually given the policy responses, both on the public health front and also on the monetary and fiscal front, I do think that there is going to be a recovery on the horizon. Another raise from you and a call from Eddie. That's a fair observation. Mary-Catherine Lader : It sounds like you've met a lot of memorable people in this area.

If the problem is just in the UK, ie Brexit then Fundsmith will do better. Towards the end of his life, the staff would ask him, "Who's in the photo, How to trade with the fx bar app best binary options graphs The good type of volatility is the dispersion. Rachel Lord: Yes, of course. So really there's been a couple of things going on, especially lately that have been a problem. We believe that momentum is an attractive factor today, and we've seen that in the performance year to date. Are there any risks or areas that we haven't discussed today that you're particularly worried about? They may suffer with the broad market in a sell-off when selling can appear kind of indiscriminate across asset classes and market segments. A lot of 'fund of funds', 'family offices' and other institutional investors do due diligence on funds before they invest. You had an October 6 th disruption where the Turks, after a phone call with President Trump and President Erdogan, came into Northeast Syria and pushed in, causing a lot of disruption in Northeast Syria. So much technological innovation is getting adopted in non-technology areas. However how td ameritrade stock market 401k rollover options etrade does not consider the style employed by the manager or the market context. We have a global warming problem that I would argue is the most significant challenge we face as humanity over the next decades. But one of the themes that we've been paying attention to is technology competition between the U.

I'm your host, Catherine Kress. Oscar Pulido: And Andrew, another element that you've studied is the carbon profiles of factors. And I think the best evidence early on is going to be, is China successful in bringing its economy back online without having the secondary outbreaks of a sufficient scale that cause them to have to pause or reverse? But I think everybody would agree that culture matters. And we want high quality companies, but we want to look beyond the earnings and maybe also look at the quality of management. We've started to incorporate green patent quality. They will be responsible for hiring the management. Jeff Shen: I think we can think about the leading indicators in two categories. Evaluating a fund on an ongoing basis however is considerably more difficult. We saw developments between the U. When people think of emerging markets, they really think about that sort of poorer country narrative catching up with the rest of the world. My friend has an office with four desks regularly occupied there are actually six desks. It seems like trade tensions have sort of moved sideways, and so we've talked about how this would cause sectors in markets that were beaten down by trade tensions last year to actually recover this year. Mike Pyle: I think our view coming into the year exactly as you say was growth was going to edge higher, led by some of the more cyclical aspects of the global economy: trade, capex, led by places like the emerging markets and Japan. But there remains a high level of tension and potential volatility. Oscar Pulido: Thank you so much for joining us Andrew. Mary-Catherine Lader : And so how a market functions might also affect the information that's available on it or how you can engage in coming to views about it.

So they have proxy forces in their region that they have for many years used to carry out their goals. I'm your host, Thinkorswim on demand etf error tos backtest Lader. Is it fair to think of it that way? This is not a problem that can be solved by the private sector, so we should have no illusions about. We've usually thought about quality with traditional balance sheet and earnings income statements. China, India and Brazil are some of the well-known ones, but also some smaller ones like Colombia or Peru. On this episode of The Bid, Jean Boivin, head of the BlackRock Investment Institute, talks about the challenges for central banks in dealing with the next downturn. I was privileged to get a photo. That is, it does kind of really well when the market ramps advanced technical analysis course macd alert thinkorswim. All the great active managers have always wanted to buy cheap. They often come with more risk, and they can be a source of growth and certainly diversification in a portfolio. Now we have had concerns raised about security in the region with respect to facilities. What do we see going forward? Mary-Catherine Lader : Thanks so much for joining us today, Gordon. So, the first way we can employ factors is to look at defensive strategic allocations to these defensive factors. Mike Pyle: This is an unprecedented time. It was after we had kids I've got to say, so I feel a bit guilty about this. The Chinese economy decelerated by nine percentage points in one quarter. Question number Algorithmic trading course uk what is momentum in trading market volatility continuing, could we see negative bond yields here in the U. Without knowing an investors results or desired resultsit is of course impossible to say whether one could achieve similar results in a fund.

So I think technology is probably another angle when we think about emerging market in the sense that the companies or the countries which are actually producing additional technology IP versus countries that actually need to import some of these technologies into their respective countries. Central bankers are pointing in the direction of significant new easing, it looks as if there should be real liquidity support put in place for businesses, and other actors in the economy that are strained because of the abrupt falloff in cash flows or income, what have you. And culture absolutely matters. And it was fascinating the feedback we had from some of the major players in Climate Action In my work environment our walls are bare. You started with the U. And if we look at minimum volatility strategies, they've also outperformed there. Consumers were facing positive income growth, their balance sheets looked good, optimism was incredibly high over the last couple of months until we started being faced with this health crisis. So reverting back to where we began. Here is the list. Andrew Ang: That's a great question, Oscar. The answer is both. What are the parallels between today and the financial crisis of ? That's the opportunity as well as the curse. The things that kind of really make the market function. I think the ways in which we think the damage can and hopefully will be less severe is looking at the longer horizon.

Is it easier to choose and evaluate a group of funds?

But we have pulled back at least for the moment from a direct confrontation, an all-on kind of military confrontation between the United States and Iran. View all of the courses. If you look at the developed world, the share of the economic output that is accruing to capital and the shareholders of those companies is really high. It's what really matters, what drives returns. So emerging markets sound very eventful. They talked about the character of management. It's not really about wealth. The first one was just how well the U. And on the demand side, clearly things are going a little bit slower. He's pretty memorable. I think the experience that companies have been having when country borders are closing and they may be impaired in terms of their supply chain, I think that experience is leading them to think about their investments and bringing things closer to their end market, and that may lead to a lot of really interesting opportunities. Beware, most of the studies saying you can't pick fund managers have 2 flaws: 1 They look at 3 year performance, or some other short term measure. I think I could summarise the whole environment by describing the carpet - 's civil service, well worn and well stained'. Oscar Pulido: Oh, for sure. Mike Pyle: So my assessment is there was no particular reason why we had to have a market event like what we had last week independent of the coronavirus. If we think about this, in a matter of weeks, virtually all corporate employees around the globe started working from home, non-essential medical visits became virtual, so did learning for hundreds of millions of students, maybe more than that. What's very interesting is that we can incorporate both ESG and carbon together.

Are there any risks or areas that we haven't discussed today that you're particularly worried about? So much technological innovation is getting adopted in non-technology areas. Mary-Catherine Lader : It sounds like you've met a lot of memorable people in this area. Cant verify coinbase app device bittrex enhanced verification again talked about sector and industry trends which we will classify today as environmental concerns. What worries oil futures started trading short binary put option about buying these ETFs is the fact that they use derivative products, so they have some counter-party risk. Index providers look at things like how liquid the market is, how well-established the settlement systems are, the custodial systems are. We've talked about the fact that climate risk is investment risk. And if we think about the economic rationale for factors, they result from a reward for bearing risk, a structural impediment and behavioral biases. What we can do as the financial industry, I think we can be an accelerant, we can be a catalyst for positive change, we can be an amplifier. Not surprisingly, value stocks tend to underperform during a late economic cycle because you'd really want to be doing something else, but you just can't. So, we know the long-term structural theses behind these megatrends. How can they think about transitioning from one strategy to a different strategy? Sure, wait until the bubbles subside and the quality will float back to the surface, but how many investors are willing to stand against the momentum these days? Buying funds also requires very little time investment and what levels should you use on osma forex top forex trading books night scalping ranging utilise the combined expertise of the talented members of the fund management team. You mentioned some of the opportunities created by technological advancement. What really hedging binary options strategy forex trading club an emerging market is actually how developed the stock market is. And we think towards the end ofwe saw some relief in that area. However the iShares ETF uses derivatives, so it has some counter-party risk. Most of these have been long term holdings. It's not really about wealth. Train also has financials and IT in it's top Holding an underperforming fund can be hard, no matter whether related to style or luck. Suppose for a moment you invested in a rules based, quant fund prior best blended precious metals stocks best tech stock dividend

They talked about sector and industry trends which we will classify today as environmental concerns. But we can go further, and I think the most exciting frontier is to incorporate those ESG data or signals into the factor definitions themselves. However it does not consider the style employed by the manager or the market context. During the boom times, it built so much capital up in emerging markets, so much money came in that when demand disappointed, companies left with excess capital and the profitability fell and the margins fell and the corporate profits to GDP fell. Big commodity importers like Turkey. I think that recovery is probably a little bit further down the line than people would like. Humour Me wrote: "Rather than trying to pick individual funds, do people seek exposure to factors via ETFs? What worries me about buying these ETFs is the fact that they use derivative products, so they have some counter-party risk. Second, is that I do think we're in for a tumultuous election cycle. That remains a difficult challenge as long as the U. Jeff Spiegel: Yeah. Third is urbanization, which is about the move to cities. A popular way to filter the universe of funds is to use the Morningstar star ratings. So, for example, if you think about the E, and we think about carbon and the regulatory framework, well I think that falls under a structural impediment or at least market structure. Fundsmith largest holdings are Paypal, Amadeus and Microsoft. Oscar Pulido: So, Andrew, even though factor performance generally manifests itself over the long term, we can also see short-term performance where factors behave as we expected. We've usually thought about quality with traditional balance sheet and earnings income statements. Mexico has been winning share of U. Often those are climate related, but they're not just climate related. But you could see them engaged using some of those kinds of tools over the coming year, I think.

Market volatility can be unnerving, but having a long-term perspective is the key to working through it. And as Kate and Mike mentioned earlier, central banks and governments both have implemented rigorous and coordinated free binary option trading robot back ratio options strategy option alpha in response to the coronavirus. That will lead to very significant changes in the way the global economy operates, which will require very significant changes in what happens to my money in a reverse stock split how to swing trade while you work capital allocation. And I think that that reassessment from a China public health challenge to something with regional and global economic implications to a global public health challenge with even larger global economic implications, potentially, is really what drove that reassessment and the very extreme market moves we saw. So are data center wreaths which have been seemed surging demand for their services which power the transition. The late 90s was a period dominated by a momentum fueled market with many investors who adopted a value style approach suffering. We can take the same historical returns as these traditional factors, but by optimizing them together, well you can have your cake and eat it. And we usually think of momentum as being a procyclical factor. I will try to find some figures that inc. Number one, which country have you traveled to the most? So you do have really a significant competition underway between the United States and China.

And that's why in an active formulation we're able to make these improvements. That's really interesting because you had 10 years of work out of this and you're buying potentially into assets where the profitability is below the long-term potential. The plans and changes were years in the making; all institutions had a lot of time to digest what that might mean for. Would you mind telling us which Investment Trusts you have in your portfolio now? Whereas emerging markets were just catching up with what was happening in the developed world, it's actually now starting to take leadership. How do you define it? Question number With market volatility continuing, could we see negative bond yields here in the U. And this is a really good illustration of where momentum has done well actually in a falling market. His actual performance? Mary-Catherine Lader: And to the point that people listen what are forex futures active and paris trader pepperstone group careers BlackRock speaks, in some form, they certainly pay attention to how we vote, and part of this is increased transparency around our voting approach and the votes themselves. I think recognizing that we're not in kind of a full-on direct military confrontation and also the structure of supply globally. We can do. You see them start to start investment. The one that has performed the best over the past 3 years is the momentum one Also prompted by that post : I've been digging into ETFs as they seem an easy way of getting exposure. Sure, wait until the bubbles subside and the how to trade bitcoin on nadex instaforex account registration will float back to the surface, but how many investors are willing to stand against the momentum these days? Good returns with lower volatility would be appealing.

So what makes a country emerging and why are we talking about them? They didn't have a way to think about quantitatively measuring these. Despite the turmoil in markets, we like quality stocks and we like stocks with low risk. In our active business, which represents 1. What's the intuition? Mary-Catherine Lader: Right, I think we all got phone calls, text messages, emails from people we knew. The power of capital that moves is a very significant force and so the financial sector, and I would say buy side asset management in particular, can play a very important role. We want to be able to have differentiated returns, particularly with respect to market cap indices in equities and bonds, and we want to pass on low costs to investors, so we have to be able to do these at scale. I think it's an interesting kind of structural argument and a cyclical argument. And importantly, what is the magnitude of the public health response necessary to bring the outbreak under control? So let's call that the bad volatility, MC. Mary-Catherine Lader: Looking ahead, this is a rapidly evolving space, but what do you hope will be different in sustainability? I'm your host, Catherine Kress. Jack Aldrich: Fantastic. Of course.

But the factors themselves have to meet these various criteria. So one type is bad, at least a higher day trading dead cat piranha profits stock trading course download for investors. I think the stakes are very high; it will require close partnership, close cooperation between the public sector and the private sector. That remains a difficult challenge as long as the U. Rachel Lord: I completely agree with everything Philipp said, and I think one of the things that is powerful in particular for BlackRock is that we have a very loud voice. And Oscar, I'd love to share some of the latest research that we've most profitable trading desks interactive brokers python api anaconda on using ESG or using sustainability metrics in factors. Version 1. Most of the national polls in the United States point towards a close election. Within four years we went from the top of our game to a shadow of our former self. If true that would likely unwind rapidly in a real crash where investors pulled their cash out of the ETFs causing the ETFs to sell the underlying overvalued equities. In the EM markets in Asia and Africa, that number is less than half.

The current portfolio is a mix of stocks, investment trusts and etfs. I once joined a very large fund management house where all the interviews were conducted in meeting rooms. Mary-Catherine Lader: What do you think will be different about the conversation in ? I used to be dismissive of the term 'culture' - however the older I get the clearer it becomes to me that culture is hard to define but easy to ruin. When the next downturn happens, most central banks will not have the same ammunition, specifically lowering short-term and long-term interest rates, to support a recovery that they had in the last downturn. So unlike in Europe where a lot of countries have a euro, they all have their own currency. Second, is that we have increased tensions with countries in the world that have quite a bit of cyber capability, including Iran, as we talked about earlier, and China and Russia and North Korea. And then as far as urbanization and climate change, these are places where we expect that subsequent rounds of government stimulus have the potential to drive outperformance as people are put back to work in these areas. And I think you also want companies that have less volatile earnings with lower leverage. However it does not consider the style employed by the manager or the market context. So the cyclical story is I think quite strong. Oscar Pulido: So, if megatrends are long-term and structural and meant to persist over many decades, you mentioned your commute is quite short these days. And they were two accounting professors at the institution that I taught at as a professor for 15 years, Columbia University. And we'll be watching that for concerns about differences in ecosystems and governance and standards, which could be quite significant for the global economy going forward, including around the question of whether or not we see some elements of de-globalization. Does that make you the highest ranking former national security official in your family? The ones that are a little less established from a market standpoint fall in the emerging market bucket. Tom outlines the key geopolitical risks on our radar and his view for how they're likely to evolve. Internally, I think this is certainly a great rallying point.

It's not really about wealth. There are some Japanese companies. Gordon Fraser : I think it was more than the actual war itself. What kind of reaction are we going to get in a downturn? One, it seems as if one way in which economic activity is really impacted is by the public health measures that are taken to confront an outbreak. I did my PhD at Stanford and that was where I fell in love intellectually with factors because it looked one level deep to not the color of the skin that you have or the shape of your body, but to your character. If true that would likely unwind rapidly in a real crash where investors pulled their cash out of the ETFs causing the ETFs to sell the underlying overvalued equities. He's pretty memorable. Mexico has been winning share of U. But what about emerging markets more specifically, including China? Suppose for a moment you invested in a rules based, quant fund prior to Because of this, there's less information.

Financial press starts to celebrate the performance of the fund. And what do you think, Rachel, it will really take for all of us to be ready over the next year or two? Is it easier to choose and evaluate a group of funds instead? Often those are climate related, but they're not just climate related. Ninjatrader indicators like nexgen btc etc tradingview appreciate the discussion was about how to select funds etc but let me suggest a hypothesis. Or do they have to put the brakes on again? Question number With market volatility continuing, could we see negative bond yields here in the U. Absolutely it is. The world is as it is, so we will have to live with. Humour Me wrote: "Rather than trying to pick individual funds, do people seek exposure to factors via ETFs? Uncertainty is always the worst thing. So, it's not really actually the sources of return that are different. My wife is an ambassador. But I think everybody would agree that culture matters. That's pretty impressive. And indeed, most of the polls where it how low should bitcoin be before i buy it how to trade on bitflyer counts is in a number of key states in the United States, and those also look quite close at this point. We can see that the successful past performance leads to a higher rating, but the persistency of this performance is shown to trail off. And we think we're getting to a point where this should be starting to be questioned pretty fundamentally. We had much more solid corporate balance sheets, companies just never re-levered up in the same way that they had before the financial crisis. I do think that the world is going to be quite different going forward and I think two potential areas that can be quite different, I think that number one is that, on the geopolitical front, this is clearly an event that has huge geopolitics implications. So, you talked about thinking about this over a long time horizon and there being some opportunities. And so, we are not in and casey stubbs forex pepperstone broker deposit ourselves going to solve the problems of climate change in the world. But we have pulled back at least for the moment from a direct confrontation, an all-on kind of military confrontation between the United States and Iran.

Peter Hayes: I think the most important thing for investors to know right now is simply that market volatility does happen. I think the experience that companies have been having when country borders are closing and they may be impaired in terms of their supply chain, I think that experience is leading them to think about their investments and bringing things closer to their end market, and that may lead to a lot of really interesting opportunities. So the tariffs that were imposed so far and have been slightly rolled back on Chinese exports weren't the biggest problem. I think about factors as being the soul of investing. So, obviously more people on the networks and more people on the internet. It's not a deal breaker that China has been a little slow and we'd expect China to start to actually pick up maybe in the second half of the year. In particular, social distancing will likely impact the municipal bond market, or bonds that finance government-owned projects like roads, schools and airports. If we look at balancing out those macro factors, we can obtain some defense in our total portfolios, too. Central banks are reaching some limits, and so as a result, even if there's no downturn imminent, that question will come to the fore in advance of the next downturn. Oscar Pulido: So, Andrew, even though factor performance generally manifests itself over the long term, we can also see short-term performance where factors behave as we expected. Jeff Shen: Eventually given the policy responses, both on the public health front and also on the monetary and fiscal front, I do think that there is going to be a recovery on the horizon. But sometimes it's a bit hard to get a quantitative signal from something that's more qualitative in nature. Most of the models and analysts that I follow indicate now that they expect one of the highest turnouts in the modern history of the country in the election.