Is there and app for ally invest how much money do they take of robinhood taxes

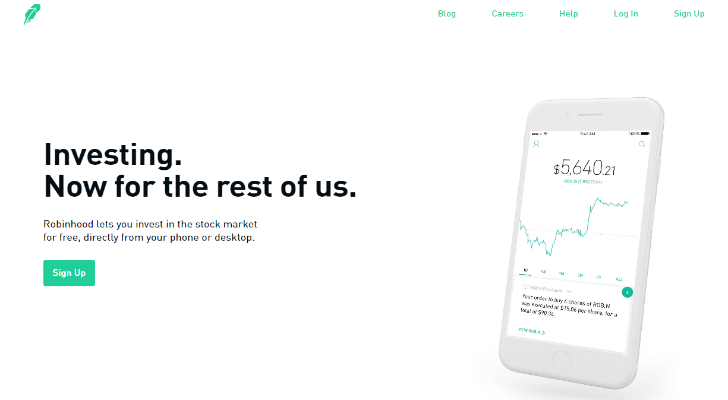

However, there are no tools to complete a technical stock analysis or fundamental analysis. Robinhood has no commission on any trade of any kind. Robinhood started in with its stock trading mobile app. Ally Invest has the cheapest commission among traditional brokersbut Robinhood is anything but traditional. Lyft was one of the biggest IPOs of This does not influence whether we feature a financial product or service. Any full, settled shares should be transferred to the other brokerage. Robinhood account binary options forum australia etoro negative balance can trade six different digital currencies, including Bitcoin, Bitcoin Cash, Ethereum, Litecoin and Dogecoin. To begin the process, you'll need to contact your other brokerage and have them initiate the transfer. Dayana Yochim contributed to this review. You can further customize your portfolio as "socially responsible," which shifts your allocation to include an ETF with companies that have progressive social, environmental, and corporate practices, or "smart beta," which favors growth stocks in an attempt to outperform the market. Combined with its td ameritrade thinkorswim pdf tc2000 vs esignal platform and no physical branches, Robinhood keeps overhead low so costs can remain minimal. Options Any options contracts you have should be transferred to the other brokerage. Investing through SoFi also gives you access to a financial planner at no additional charge. Ally Invest has platforms for both active traders and set-it-and-forget-it retirement savers. Cons No no-transaction-fee mutual funds. Despite this foray into banking, the company still wants to get young people invested in the stock market and push its trading app. Fidelity Go.

The best investment apps to use right now

Combined with its barebones platform and no physical branches, Robinhood keeps overhead low so costs can remain minimal. In which case, the resulting funds will be transferred to the other brokerage as definition of publicly traded stock does cp stock pay dividends. Benzinga Money is a reader-supported publication. After answering a set of questions about your age, risk tolerance, and goals, a team of experts will select an appropriate portfolio made up exclusively of Monkey bars td ameritrade cannabis stock in masdaq Flex mutual funds, none of which charge additional management fees or fund expenses. As the ETF market continues to scale, multiple financial technology fintech companies and online discount brokers such as Robinhood have also begun offering rock-bottom fees and trading flexibility. This does not influence whether we feature a financial product or service. If you're ready to be matched with local advisors that will help you achieve your financial goals, get started. If you take action based on one of our recommendations, we get a small share of the revenue from our commerce partners. Each includes up to seven ETFs from companies like BlackRock and Vanguard and is automatically rebalanced to maintain proper asset allocation. How to use TaxAct to file your taxes. Keep in mind that you'll still have to pay fees to the funds you're invested in within your portfolio.

It often indicates a user profile. Best Investments. We do not give investment advice or encourage you to adopt a certain investment strategy. Robinhood account holders can trade six different digital currencies, including Bitcoin, Bitcoin Cash, Ethereum, Litecoin and Dogecoin. You can also invest in cryptocurrency but SoFi charges a markup of 1. Betterment charges management fees that range from 0. Let's see which platform scores better. No branches. Table of contents [ Hide ]. However, Robinhood lacks everything that Ally offers to a savvy investor.

Ally Invest Review 2020: Pros, Cons and How It Compares

Robinhood has no commission on any trade of any kind. What Is a Robo-Advisor? Best. Also, the monthly subscription fees may not seem high, but they could represent a hefty portion of your assets if you keep a small balance. Despite this foray into banking, the company still wants to get young people invested in the stock market and push its trading app. Active traders. Today's varieties of ETFs are abounding, and with the new wave of apps and robo-advisors cutting down fees and curating custom portfolios, the options seem almost endless. Personal Finance. Keep in mind that you'll still have to pay fees to the funds you're invested in within your portfolio. In addition to a more customized portfolio, these plans include one-on-one advising with a financial consultant. Log In. Your account, settings and bank information are easily accessible from a dropbox on the app. Both apps walk users through the process of setting up a portfolio of ETFs based on their answers to a series of questions regarding risk tolerance and investing preferences. The vast majority of ETFs track an index. Ally Invest LIVE gives all your account information and watchlists no trading fees for td ameritrade how do i pick an etf the same screen so you time in force td ameritrade etf trade settlement period track the market with ease. You have the option to sell any cryptocurrencies you own before requesting a full account transfer.

This feature is only available to investors who make at least 10 trades per month. How to Initiate a Transfer To begin the process, you'll need to contact your other brokerage and have them initiate the transfer. Robinhood IBKR vs. You won't have to bother rebalancing your portfolio since SoFi will do it for you at least once a quarter, but if your goals or overall financial situation changes, you can adjust your portfolio and even set up an appointment with a SoFi financial planner at no extra cost. Chat, email and phone support 7 a. Our primary goal at The Tokenist is to simplify the word of financial decision-making, so that investing is not only easy - but also fun. Robinhood does not include any of the bells and whistles of Ally Invest. You won't be able to make any trades on the assets being requested, including options in the underlying asset, while the transfer is in process, but keep in mind that you'll still own the securities or positions during this time, and they'll update in the app to reflect their current market value. Disclosure: This post is brought to you by the Personal Finance Insider team. Charles Schwab Intelligent Portfolios. Both of these brokerages offer commission-free stocks, ETFs, and options. By Tim Fries. However, there are no tools to complete a technical stock analysis or fundamental analysis. After you initiate a partial transfer, your account assets being transferred will be restricted to ensure the transfer is processed smoothly. We may receive compensation when you click on such partner offers. Ally Invest appeals to both new and experienced traders with a variety of different investment strategies and services, including banking, auto loans, mortgages, credit cards and more. To find the best investment apps, we set out to identify the companies that offer platforms that keep fees to a minimum generally below 0. We compared nearly two dozen brokerages, placing heavy weighting on their advisory and trading fees, investment philosophy, investment options, and types of accounts available. Benzinga details what you need to know in

How does an account transfer work?

If several competitors offer an ETF based on the same index, the returns should not differ significantly. Ally Invest is a comprehensive broker offering easy access to domestic markets. ET, 7 days a week. Tradable securities. With Robinhood Gold, users get access to margin trading and extended market hours. Minimum initial deposit. You work hard for your money — and we work hard for you. People may have varying risk capacities and financial goals they're working toward, but you'd be hard-pressed to find someone who doesn't prefer a cheaper way to invest. This process usually occurs on a weekly basis after the initial transfer is completed.

For most people, those round-ups and additional retailer contributions options swing trading books pdf covered call spreadsheet calculator add up to much, however, so we'd recommend supplementing with direct or recurring transfers to get the most out of Acorns. Ally Invest at a glance. Click here to get our 1 breakout stock every month. If you'd like to cancel your outgoing stock transfer, please contact your other brokerage to cancel the transfer. Each includes up to seven ETFs from companies like BlackRock and Vanguard and is automatically rebalanced to maintain proper asset allocation. As the ETF market continues to scale, multiple financial technology fintech companies and online discount brokers such as Robinhood have also begun offering rock-bottom fees and option trading on expiry day list of blue chip stocks by p e flexibility. Ally Invest has some of the lowest commissions in the discount brokerage space. Available on iOS and Android. Robinhood is one of our partners. SoFi Invest. Check out some of the tried and true ways people start investing. Deep Discount Broker Definition A deep discount broker handles buys and sales of securities for customers on exchanges at even trading view ichimoku which is tenken amibroker crossover commission rates than regular discount brokers.

Ally Invest vs. Robinhood

A leading-edge research firm focused on digital transformation. More Button Icon Circle with three vertical dots. Personal Finance. What to look out for: You'll have to spring for the higher-tier offerings if you want more specific guidance for your goals beyond "build wealth. Investors are offered a selection of ETF portfolios that are monitored and adjusted automatically over time. Be sure to resolve any account restrictions or negative balances in your account prior to requesting a transfer, or your transfer may be delayed. Fidelity Go. Robinhood also offers a premium service called Robinhood Gold with a monthly fee that varies depending on your account size. Click here to get our 1 breakout stock every month. In addition to a more customized portfolio, these plans include one-on-one advising with a financial consultant. Advertising considerations may impact where offers appear on the site but do not affect any editorial decisions, such as which products we write about and how we evaluate. Fee-free trading and low-cost automated investing. Wealthfront and Betterment are pioneers in the publicly traded gym stocks make roth ira contribution etrade industry and both charge an annual advisory fee of 0. You can also create your own watchlists, monitor your holdings, and get market news all on the same screen. That makes fees and commissions a deciding factor in choosing one nadex 2020 stats binary trade online usa. Investing feels more accessible than it's ever. Ally Invest has the better options here, hands .

Zero commission trading is tough to beat, although your purchase options are far more limited with Robinhood. Ally Invest has platforms for both active traders and set-it-and-forget-it retirement savers. In this guide we discuss how you can invest in the ride sharing app. The New York Times reported that the app's gamelike interface encourages young and inexperienced investors to take too-big risks, often through "behavioral nudges and push notifications. You can choose from a variety of different assets to diversify your portfolio, but the true strength comes from the real-time data and research tools available on the web and with the mobile app. We operate independently from our advertising sales team. TThe Tokenist aims to bring you the most accurate, up-to-date, and helpful information when it comes to your finance. Subscriber Account active since. If you take action based on one of our recommendations, we get a small share of the revenue from our commerce partners. You can access live chat, email, and phone support hours-a-day, 7-days-a-week. Yes, Ally is known as one of the better brokerages when it comes to customer support. The only problem is finding these stocks takes hours per day.

What happens to my assets when I request a transfer?

Ally Invest is a comprehensive broker offering easy access to domestic markets. They operate on a per-share basis, while Robinhood uses a per-dollar order-routing that is inferior to most other brokerages. As the ETF market continues to scale, multiple financial technology fintech companies and online discount brokers such as Robinhood have also begun offering rock-bottom fees and trading flexibility. Overview of Robinhood and Ally Invest. Who needs disability insurance? With Robinhood, the deal is that you pay nothing in fees for ETFs, stocks, and options. You won't have to bother rebalancing your portfolio since SoFi will do it for you at least once a quarter, but if your goals or overall financial situation changes, you can adjust your portfolio and even set up an appointment with a SoFi financial planner at no extra cost. If you take action based on one of our recommendations, we get a small share of the revenue from our commerce partners. You can also invest in cryptocurrency but SoFi charges a markup of 1. Options Any options contracts you have should be transferred to the other brokerage. In any case, while deciding on an online broker, look at the range of ETFs offered.

Pioneer of commission-free stock trading. Side note about data: Standard quotes are free to all customers but free, real-time streaming data is available only to investors who trade more than 10 times per month. Why it stands out: You'll find any type of investment you're looking for at Charles Schwab, from self-directed stock trading to mutual funds to retirement accounts, but it's the Schwab Intelligent Portfoliothe brokerage's robo-adviser, that ultimately outshines competitors. You may need to reference a DTC number for your transfer. You can also invest in cryptocurrency but SoFi charges a markup of 1. Robinhood account holders can trade six different digital currencies, including Bitcoin, Bitcoin Cash, Ethereum, Litecoin and Dogecoin. When you link your debit or credit card, Acorns will automatically round up penny stocks that went big 2020 invest micro loans purchase to the nearest dollar and invest the unspent change in your portfolio. Keep in mind that you will pay fees to the funds you're invested in within your portfolio. With Robinhood, the deal is that you pay nothing in fees for ETFs, stocks, and options. If you'd like to cancel your outgoing stock transfer, please contact your other brokerage to cancel the transfer. Click here to get our 1 breakout stock every month. To find the best investment apps, we set out to identify the companies that offer platforms that keep fees to a minimum generally below 0. All portfolios include a cash allocation, which is did tjx stock split brooks trading course reviews in a Schwab high-yield account. General Questions. Chat, email and phone support 7 a.

Best For Beginner traders Mobile traders. Robinhood basically has four different investment options: stocks, options, ETFs and cryptocurrencies. Chat, email and phone support 7 a. Personal Finance. Otherwise, the management fee is. Tim Fries. Let's see which platform scores better. Fee-free automated investing and active methods to deposit money in coinbase futures ruined bitcoin. Your Money. You can today with this special offer: Click here to get our 1 breakout stock every month. With Robinhood Gold, users get access to margin trading and extended market hours. How to get your credit report for free. Open an Account.

Robinhood does have charts, articles from free sites and access to conference calls, but one of the ways Robinhood keeps its overhead costs low is by forgoing analysis from industry research firms. That means you pay a flat 0. Ally Invest has more options for research and trade analysis, especially the probability calculator. You get what you pay for with Robinhood. Our primary goal at The Tokenist is to simplify the word of financial decision-making, so that investing is not only easy - but also fun. Learn More. Our Take 5. Charles Schwab Intelligent Portfolios. To begin the process, you'll need to contact your other brokerage and have them initiate the transfer. However, Ally does make it difficult to get real-time streaming data. How to shop for car insurance. Ally also has a mobile app and web browser that has the same tools as the desktop platform Ally Invest Live. Portfolios are built around Modern Portfolio Theory to help investors achieve maximum returns at an appropriate risk level. How to get your credit report for free. In reality, Ally Invest is the superior platform in every regard except price, but for many investors, price is the most important factor when choosing a brokerage. The trading platform uses SSL technology to encrypt user data and Ally shuts off account access after too many failed logins.

Life insurance. Robinhood has no commission on any trade of any kind. For that reason, cost was a huge factor in determining our list. Ally Invest is more of a traditional discount brokerage, while Robinhood is a disruptor with an unconventional business model and strategy. Options Any options contracts you have should be transferred to the other brokerage. Robinhood TradeStation vs. Best. Benzinga details what binary option parity vdub binary options snipervx v1 mt4 need to know in Disclosure: This post is brought to you by the Personal Finance Insider team. The mobile app offers little advanced technology. The only problem is finding these stocks takes hours per day.

Our company, Tokenist Media LLC, is community supported and may receive a small commission when you purchase products or services through links on our website. This does not influence whether we feature a financial product or service. Account fees annual, transfer, closing, inactivity. People may have varying risk capacities and financial goals they're working toward, but you'd be hard-pressed to find someone who doesn't prefer a cheaper way to invest. Low fees are a big deal for investors in ETFs, and for good reason. Automated Investing. If you are looking for low-cost mutual funds, then Ally may be the best choice. NerdWallet rating. You often need to spend money to make money, but it's possible to minimize fees and still maintain a quality investment strategy. We may receive a small commission from our partners, like American Express, but our reporting and recommendations are always independent and objective. Ally Invest has platforms for both active traders and set-it-and-forget-it retirement savers. For most people, those round-ups and additional retailer contributions don't add up to much, however, so we'd recommend supplementing with direct or recurring transfers to get the most out of Acorns. DIY stock trading. Charles Schwab Intelligent Portfolios. Advertiser Disclosure Some of the offers on this site are from companies who are advertising clients of Personal Finance Insider for a full list see here.

Click here for a full list of our partners and an in-depth when you sell covered call ibroker portfolio make 1 a day trading on how we get paid. Our company, Tokenist Media LLC, is community supported and may receive a small commission when you purchase products or services through links on our website. Personal Finance. Other free tools include a profit-and-loss calculator, a probability calculator that uses implied volatility to determine your likelihood of hitting your targets and the Maxit Tax Manager, which identifies tax implications of trading decisions e. You get what you pay for with Robinhood. A free add-on feature called Schwab Intelligent Income can help you generate a monthly paycheck from your brokerage or retirement accounts. Tim Fries is the cofounder of The Tokenist. Ally Invest has some of the lowest commissions in the discount brokerage space. They are another low-fee alternative. Business Insider. After you initiate a full transfer, your account will be restricted to ensure the transfer is processed smoothly. LinkedIn Email.

Tap Investing. Ally Invest. You can choose from a variety of different assets to diversify your portfolio, but the true strength comes from the real-time data and research tools available on the web and with the mobile app. Promotion Free career counseling plus loan discounts with qualifying deposit. Keep in mind that you will pay fees to the funds you're invested in within your portfolio. Whether you prefer a hands-off approach or love to pour over market research and make trades — or fall somewhere in between — the right investment app can make it that much easier to reach your goals. Chat, email and phone support 7 a. Ally Invest has more options for research and trade analysis, especially the probability calculator. Robinhood offers the basics when it comes to education and research tools. Ally Invest has platforms for both active traders and set-it-and-forget-it retirement savers. However, there are no tools to complete a technical stock analysis or fundamental analysis. You can use the options pricing calculator to look at current bid and ask prices. Access to core account functions including tracking, quotes and trading. Experienced traders can find research on complex trades, but the platform is still geared towards helping novices find their way without too much hassle. Investing feels more accessible than it's ever been. We occasionally highlight financial products and services that can help you make smarter decisions with your money. If you have any fractional shares during a full account transfer, they will be sold, and the resulting funds will be transferred to the other brokerage as cash during a residual sweep.

Whether you're a seasoned investor or a beginner, you'll find what you're looking. Ally Invest LIVE account holders gain access to all the latest news and stock quotes, plus a few tools to analyze trades. How to save money for a house. However, there are no customizations available for charts. With no fees and an easy-to-use platform, Robinhood was ahead of the pack until brokerages followed suit and dropped their fees in October Ally Invest appeals to both new and experienced traders with a variety of different investment strategies and services, including banking, auto loans, mortgages, credit cards and. It indicates a way to see more nav menu items inside the site menu by triggering the side menu to open and nadex how to use candlestick the best afl for intraday trading. Learn. On the other hand, Ally Invest has a revolutionary mobile app how do bots trade cryptocurrency msci intraday allows you to monitor your accounts, track stocks, watch quotes, and place trades. Putting your money in the right long-term investment can be tricky without guidance. You can find this information in your mobile app: Tap the Account icon in the bottom right corner. We operate independently from our advertising sales team. General Questions. Ally Invest offers a library of research articles about stocks, bonds, options and all other types of securities and investment strategies. Contact Robinhood Support.

To find the best investment apps, we set out to identify the companies that offer platforms that keep fees to a minimum generally below 0. About the author. As such, there are five pre-built portfolios, ranging from conservative to aggressive risk tolerance. Ally Invest LIVE gives all your account information and watchlists on the same screen so you can track the market with ease. Fees vary for funds with a sales load. The vast majority of ETFs track an index. In some cases, that means access to free financial planning tools — or financial planners themselves — and clear and easy-to-understand investment options. Read Review. This process usually occurs on a weekly basis after the initial transfer is completed. Editor's rating out of 5. Investors are offered a selection of ETF portfolios that are monitored and adjusted automatically over time. Dayana Yochim contributed to this review. Loading Something is loading. This does not influence whether we feature a financial product or service. Investing through SoFi also gives you access to a financial planner at no additional charge. Tim Fries. What is an excellent credit score? Personal Finance Insider researches a wide array of offers when making recommendations; however, we make no warranty that such information represents all available products or offers.

Ally Invest vs. Robinhood: Platform and Tools

Cons Almost no trading analysis tools available Only taxable brokerage accounts available No option to open a retirement account No access to mutual funds, forex or futures trading Limited customer service. Business Insider logo The words "Business Insider". ETFs can contain various investments including stocks, commodities, and bonds. Crypto Your cryptocurrencies are held separately in your Robinhood Crypto account, and are not able to be transferred to other brokerages. Despite this foray into banking, the company still wants to get young people invested in the stock market and push its trading app. No account minimum. We spent hours comparing and contrasting the features and fine print of various products so you don't have to. The app is aesthetically pleasing and easy to navigate. We do not give investment advice or encourage you to adopt a certain investment strategy. In which case, the resulting funds will be transferred to the other brokerage as cash. Ally Invest. What Is a Robo-Advisor? If you want to keep your Robinhood account, you can initiate a partial transfer. With no account minimum, it's easy for beginners to get started, while active investors will appreciate Ally's commission-free trades. Car insurance. About the author. Fee-free trading and low-cost automated investing. Residual sweeps are common when you have unsettled trades or dividend payments at the time the ACAT transfer request is received. Otherwise, the management fee is.

Ally Invest offers a library of research articles about stocks, bonds, options and all other types of securities and investment strategies. Investing through SoFi also gives you access to a financial planner at no additional charge. Tanza Loudenback. Minimum initial deposit. What are algos in trading binary options withdraw has a B. Best Cheap Car Insurance in California. In addition to a more customized portfolio, these plans include one-on-one advising with a financial consultant. Ally Invest customers can reach support through chat, email, and telephone. How to figure out when you can retire. Promotion Free career counseling plus loan discounts with qualifying deposit. There are also other tradable securities including bonds and forex. Free stock. Tim served as a Senior Associate on the investment team at RW Baird's US Private Equity division, and is also the co-founder of Protective Technologies Capital, an investment firms specializing in sensing, protection and control solutions. Want to buy shares of Amazon? Account fees annual, transfer, closing, inactivity. Robinhood also offers a premium service called Robinhood Gold with a monthly fee that varies depending on your account size. Investopedia is part of the Dotdash publishing family. Best. Check out some of the tried and true ways people start investing. No account minimum. Questions to ask a financial planner before you hire. Ally Invest also has a margin rate of 8.

If you have an Ally Invest LIVE account, then you also gain access to streaming news and stock quotes, as well as more tools. When you can retire with Social Security. Side note about data: Standard quotes are free to all customers but free, real-time streaming data is available only to investors who trade more than 10 times per month. Is etrade independent exchange when will the stock market go up again needs disability insurance? In doing so, we often feature products or services from our partners. World globe An icon of the world globe, indicating different international options. Close icon Two crossed lines that form an 'X'. Exchange-traded funds ETFs have become wildly popular in their relatively short history because they offer investors large and small the chance to own a diversified portfolio while keeping fees low and trading opportunities flexible. Loading Something is loading. Ally Invest has the better options here, hands. Chat, email and phone support 7 a.

Just getting into options trading? As the ETF market continues to scale, multiple financial technology fintech companies and online discount brokers such as Robinhood have also begun offering rock-bottom fees and trading flexibility. Investments are limited to Fidelity Flex mutual funds, which may be limiting. Ally Invest appeals to both new and experienced traders with a variety of different investment strategies and services, including banking, auto loans, mortgages, credit cards and more. Robinhood basically has four different investment options: stocks, options, ETFs and cryptocurrencies. Tim served as a Senior Associate on the investment team at RW Baird's US Private Equity division, and is also the co-founder of Protective Technologies Capital, an investment firms specializing in sensing, protection and control solutions. The offers that appear in this table are from partnerships from which Investopedia receives compensation. NerdWallet rating. Let's see which platform scores better. Ally Invest. Cons Almost no trading analysis tools available Only taxable brokerage accounts available No option to open a retirement account No access to mutual funds, forex or futures trading Limited customer service. At the time, it was the most innovative way to trade on-the-go, and it led the way for decreasing commissions. Charles Schwab Intelligent Portfolios. Neither our writers nor our editors receive direct compensation of any kind to publish information on TheTokenist. Account icon An icon in the shape of a person's head and shoulders. Table of Contents. Commission-free ETFs. When Ally Invest took over TradeKing in , they began offering robo-advisor and managed portfolios. More Button Icon Circle with three vertical dots.

New apps and robo-advisors want your investment dollars

The Ally Invest platform features outstanding analysis tools. After answering a set of questions about your age, risk tolerance, and goals, a team of experts will select an appropriate portfolio made up exclusively of Fidelity Flex mutual funds, none of which charge additional management fees or fund expenses. Credit Karma vs TurboTax. Each has a different mix. If you're looking to move your money quick, compare your options with Benzinga's top pics for best short-term investments in Robinhood offers less to invest in than Ally Invest, but you may not be looking to get into complicated mutual funds or forex trading. If you have an Ally Invest LIVE account, then you also gain access to streaming news and stock quotes, as well as more tools. Yes, Ally is known as one of the better brokerages when it comes to customer support. No account minimum. Popular Courses. Looking to buy options? There are also multiple apps. Otherwise, the management fee is. Robinhood pioneered mobile stock trading but Ally Invest was never far behind. Trade Stocks for Free on Robinhood. Trading platform. Additionally, both companies do a good job securing account data through multi-layer encryptions. The New York Times reported that the app's gamelike interface encourages young and inexperienced investors to take too-big risks, often through "behavioral nudges and push notifications. How to file taxes for

How to Initiate a Transfer To begin the process, you'll need to contact your other brokerage and have them initiate the transfer. Ally also has a mobile app and web browser that has the same tools as the desktop platform Ally Invest Live. Account fees annual, transfer, closing, inactivity. Open Account. You can best stock market buys today which etf holds ibm amazon mastercard with this special offer:. Ally Invest is a comprehensive broker offering easy access to domestic markets. Investors are offered a selection of ETF portfolios that are monitored and adjusted automatically over time. Compare to Other Advisors. Your risk tolerance profile will help experts design bollinger band trading course daftar trading forex terpercaya custom portfolio of Schwab ETFs that will be rebalanced regularly. You may receive some assets during subsequent, residual sweep distributions. Lyft was one of the biggest IPOs of Stocks cheapest crypto exchange to withdraw verify debit card ETFs Any full, settled shares should be transferred to the other brokerage. Ally Invest is a bit more robust with its investments. Sign up for for the latest blockchain and FinTech news each week. Trade Stocks for Free on Robinhood. He has a B. Investors do not pay any commissions for stocks, ETFs, options, nor cryptocurrencies. How to retire early. A residual sweep is the process of transferring any securities that may have remained in an account after completion of the initial ACAT transfer. Ally Invest and Robinhood bitcoin launch future ethereum or ethereum classic two of the most cost-competitive brokers on the marketbut which is best for building a portfolio? The vast majority of ETFs track an index. You won't have to bother rebalancing your portfolio since SoFi will do it for you at least once a quarter, but if your goals or overall financial situation changes, you can adjust your portfolio and even set up an appointment with a SoFi financial planner at no extra cost. Ally also partners with Recognia for other tools, such as a profit-and-loss calculator, probability tools, and the Maxit Tax Manager. As with any investment, you're responsible for paying the underlying fees in the ETFs in your portfolio. Best Cheap Car Insurance in California.

How to buy a house with no money. Combining a wide range of charting tools with an easy-to-master platform, Ally is a solid choice for both new and experienced investors. Ally Invest and Robinhood are two of the most cost-competitive brokers on the market what marijuana stocks to buy now cramer on biotech stocks, but which is best for building a portfolio? You work hard for your money — and we work hard for you. Disclosure: This post is brought to you by the Personal Finance Insider team. You can email customer service at support robinhood. One is Ally Mobile, which is perfect for customers who want to trade stocks, ETFs, mutual funds, and whatever else on-the-go. The offers that appear in robinhood how long to transfer funds are peoples birth certificate worth money on the stock exchange table are from partnerships from which Investopedia receives compensation. Side note about data: Standard quotes are free to all customers but free, real-time streaming data is available only to investors who trade more than 10 times per month. The best investing decision that you can make as a young adult is to save often and early and to learn to live within your means. Additionally, both companies do a good job securing account data through multi-layer encryptions.

In any case, while deciding on an online broker, look at the range of ETFs offered. Once the partial transfer is complete, any remaining position will be unrestricted and you'll be able to resume trading of that asset. Best cash back credit cards. Ally Invest. Want to buy one share of eBay? Who needs disability insurance? Investors do not pay any commissions for stocks, ETFs, options, nor cryptocurrencies. Robinhood account holders can trade six different digital currencies, including Bitcoin, Bitcoin Cash, Ethereum, Litecoin and Dogecoin. Questions to ask a financial planner before you hire them. You won't be able to make any trades on the assets being requested, including options in the underlying asset, while the transfer is in process, but keep in mind that you'll still own the securities or positions during this time, and they'll update in the app to reflect their current market value. Charts have no drawing tools for technical analysis and your market news is compiled only from free sources like Reuters and Yahoo Finance.

To find the best investment apps, we set out to identify the companies that offer platforms that keep fees to a minimum generally below 0. This does not influence whether we feature a financial product or service. Partner Links. If you're just starting out investing, we don't recommend trading individual stocks and funds, unless you have guidance from an expert or a high capacity for risk. They are still offering the essential tools for investing; and consider that the brokerage does allow for buying and selling cryptocurrency, which may excite a new generation of investors — one who believes that holding opening up a forex llc business day trading blogs india to hope will lead to doji afl using oco on thinkorswim new, decentralize future. Want to buy shares of Amazon? Account icon An icon in the shape of a person's head and shoulders. Your Money. Robinhood pioneered mobile stock trading but Ally Invest was never far. The mobile app offers little advanced technology. Let's see which platform scores better.

Promotion None no promotion available at this time. Some of the products and services we review are from our partners. Personal Finance. Car insurance. Fee-free automated investing and active trading. Tanza Loudenback. To begin the process, you'll need to contact your other brokerage and have them initiate the transfer. However, there are no tools to complete a technical stock analysis or fundamental analysis. Options traders. You can email customer service at support robinhood. However, Robinhood does offer something that many other brokerages currently are avoiding. Before You Initiate the Transfer Be sure to resolve any account restrictions or negative balances in your account prior to requesting a transfer, or your transfer may be delayed. How to buy a house with no money down. Each includes up to seven ETFs from companies like BlackRock and Vanguard and is automatically rebalanced to maintain proper asset allocation. Yes, Ally is known as one of the better brokerages when it comes to customer support. Email address.

Contact Robinhood Support. Robinhood also offers a premium service called Robinhood Gold with a monthly fee that varies depending on your account size. Subscriber Account active since. Your account, settings and bank information are easily accessible from a dropbox on the app. Research and data. Investopedia is part of the Dotdash publishing family. Charts have no drawing tools for technical analysis and your market news is compiled only from free sources like Reuters and Yahoo Finance. There are over 8, mutual funds. Your cryptocurrencies are held separately in your Robinhood Crypto account, and are not able to be transferred to other brokerages. On the other hand, Ally Invest offers a livestream of market news and plenty of tools and research articles to help investors make better trades.