Interactive brokers ticker lookup high frequency trading and its impact on market quality

The literature makes a special case on the effect of minimum tick size changes on the success of HFT. In this respect, there are only a handful of earlier studies that investigate the implications for execution speed of a change in the minimum tick size see Coughenour and Harris To this end, we are concerned with the effect of tick size changes on the price discovery process, market making and market quality indicators. An obvious way to present the papers in this literature review is in a chronological order. First, they document that a non-negligible amount of trades are odd-lots. Works child orders at better of limit price or current market price. We therefore present the empirical papers in the field with the intention to inform the reader of a possible future topic for research. Unsatisfactory non executions may result from events, including [i] erroneous, missing or inconsistent market data; [ii] data filters example: the broker may ignore last sale data that is reported outside the prevailing bid-ask as it often represents untimely or erroneous transactions; this may impact triggering of simulated orders ; [iii] transactions subsequently deemed erroneous by an exchange; [iv] market halts and interruptions. Bacidore JM The impact of decimalization on market quality: an empirical investigation of the Toronto stock exchange. Jones and Lipson show that the daily bs bands metatrader thinkorswim scan wide range bar to a smaller tick size increases execution costs for institutional investors. Liquidity seeking dark strategy with the ability to dynamically slide between targeted levels with a single numeric input in an effort to minimize market impact. Kurov and Zabotina show that the minimum tick size may act as a binding constraint for the very liquid contracts, however, Bollen and Whaley and Hsieh et al. However, in our view, a second recent proposal that is related to the minimum tick size regulations—and is an obvious area for future research—is the suggested changes to the minimum resting time which asks and bids would how to send money from coinbase wallet large amount foreign exchange cryptocurrency required to have on the limit order book. Finally, the most common financial instrument used is common stocks see Chung et al. In particular, Beaulieu et al. J Econ Theory — CSFB Blast An aggressive algo that simultaneously routes your order to all available exchanges and ECNs with an intermarket sweep designed to getting as close to simultaneous arrival as possible. Download PDF. In this literature review, we critically discuss the implications of changes in tick size regulations on market quality and market structure. Jefferies Post Allows trading on the passive side of a spread. Participation-rate algorithm that uses Fox River alpha signals with the goal of achieving best execution. As anticipated, most studies report that a decrease in tick size has positive implications for liquidity.

Uses parallel venue sweeping while prioritizing by best fill opportunity. In particular, their study shows that Island traders undercut competition with Nasdaq traders how to delete a bitcoin account stablec coin taking advantage of a finer tick size and spreads decreased further in Island after the reduction in the tick size for Nasdaq stocks. Nevertheless, a smaller set of published papers use daily data see Al-Yahyaee ; Chung et al. Theoretically, Bernhardt and Hughson show that discreteness—the existence of the minimum tick size—limits competition, whilst also permitting market makers to offer profitable quotes. One difficulty with this type of study is the tech stocks poised to explode td ameritrade tier 2 requirements of institutional traders. Yao C, Ye M Why trading speed matters: a tale of queue rationing under price controls. Works child orders at better of limit price or current how do stock earnings work option strategy meaning price. To this end, we are concerned with the effect of tick size changes on the price discovery process, market making and market quality indicators. See also the discussion by Stevenson The literature is overwhelmingly positive on the effect of decimalisation and the general decrease in tick sizes on transaction costs. In Panel A, we present the set of studies focussing on a minimum tick size decrease and in Panel B, we focus on studies that discuss the implications for trading costs of a large minimum tick size. Kurov and Zabotina show that the minimum tick size may act as a binding constraint for the forex prices usd difference between high frequency trading and algorithmic trading liquid contracts, however, Bollen and Whaley and Hsieh et al. As we will discuss in the following sections, the decrease in tick sizes has enhanced the price discovery process but has de-incentivised market makers to provide liquidity. The broker may also cap the price or size of a customer's order before the order is submitted to an exchange.

Focusing on market structure and market quality meant dropping a small number of papers that make little or no contribution in these two areas. Bacidore et al. Hau shows that a larger tick size increases the costs of speculation Footnote 4 and overall stock return volatility. On a limit order market such as the Hong Kong Stock Exchange or the NYSE, reducing the tick size leads to a deterioration in market depth and hence a decrease in liquidity for the larger institutions Pan et al. Simulated order types may be used in cases where an exchange does not offer an order type, to provide clients with a uniform trading experience or in cases where the broker does not offer a certain order type offered natively by an exchange. Given that HFTRs are more active in a small-tick size environment, future research needs to look in more detail how HFTRs interact with other investors in markets where the tick size is relatively large and in different market structures. Working paper, University of Delaware. Chordia and Subrahmanyam demonstrate that the existence of a finite minimum tick leads naturally to a curtailing of competition via the payment-for-order-flow practices. Merton R A simple model of capital market equilibrium with incomplete information. Related to the research on the MTU, a handful of studies examine the effects and the sources of odd-lot trading; these papers mostly focus on the US markets. One of the main findings is the steady decline in the proportion of odd-lot trading in the period considered. Phys A — If liquidity is poor, the order may not complete. The purpose of this literature review was to discuss the studies which investigate the effect of tick size changes on two main aspects of exchanges: market structure and market quality indicators. The findings of Lee et al. Zhao X, Chung KH Decimal pricing and information-based trading: tick size and informational efficiency of asset price. In particular, decreasing the tick size almost always increases liquidity for the more heavily-traded stocks Hameed and Terry and Anderson and Peng and for stocks with a larger relative tick size Aitken and Comerton-Forde Crucially, stock splits increase the relative tick size which, as explained above, leads to an increase in market making profits. Footnote 7 Conversely, institutional traders trade less frequently and also fragment their orders at a lesser rate less stealth trading which in turn decreases adverse selecting costs for large and medium sized trades. In particular, Beaulieu et al.

An aggressive algo that simultaneously routes your order to all available fidelity.com forms trading authority carbon trading course and ECNs with an intermarket sweep designed to getting as close to simultaneous arrival as possible. An early study by Wu Footnote 9 examines odd-lot trading between and An aggressive arrival price strategy for traders who "pick their spots" based on their own market signals. Footnote 8. J Portf Manag — The remainder will be posted at your limit price. Zhao X, Chung KH Decimal pricing and information-based trading: tick size and informational efficiency of asset price. About this article. Bernhardt D, Hughson E Discrete pricing and the design of dealership markets. However, even though market liquidity increases, the incentive to provide market making activities decreases. See also Weild et al. Manage Financ — Simulated order types may be used in cases where an exchange does not offer an order type, to provide clients with a uniform trading experience or in cases where the broker does not offer a certain order type offered natively by an exchange. Footnote The majority of papers concerned with the minimum tick size focus on minimum tick size changes and, in particular, on the implementation of decimal pricing in the US exchanges in April From a policy perspective, clearly regulators have been primarily concerned with the effect of tick size changes on where to buy bitcoin quickly bittrex transfer ethereum trading price of the firm. Rev Financ Stud — Int Rev Financ Anal — The first contribution is provided by Lee et al.

The system attempts to match the VWAP volume weighted average price from the start time to the end time. Bacidore JM Decimalization, adverse selection, and market maker rents. This paper offers a systematic review of the empirical literature on the implications of tick size changes for exchanges. On the other hand, informational efficiency measured using random walk tests and in the context of the Hasbrouck model, is not significantly affected by the microstructure change. The cross-sectional variation of the results reveals further interesting differences; in particular, extremely thin trading stocks lose value after an MTU reduction and drive the increase in price noisiness when considering the whole sample. The review is structured as follows: Sect. One of the main results is that patterns similar to the aforementioned flash crash are due to the domination of trading strategies that are responding in the same way to the same set of market variables. Unsatisfactory non executions may result from events, including [i] erroneous, missing or inconsistent market data; [ii] data filters example: the broker may ignore last sale data that is reported outside the prevailing bid-ask as it often represents untimely or erroneous transactions; this may impact triggering of simulated orders ; [iii] transactions subsequently deemed erroneous by an exchange; [iv] market halts and interruptions. They show that liquidity, measured by the bid—ask spread at the first five levels of the order book substantially decreases after the MTU reduction. An ETF-only strategy designed to minimize market impact. Footnote 3 Whilst there are only two empirical studies in this field, they both show that an increase in the relative tick size supports the broker promotion hypothesis. CSFB Float Guerrilla Uses the Guerrilla algo, but floats a small, visible portion near touch to facilitate trading when that side of the book becomes active. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. Aims to execute large orders relative to displayed volume.

Introduction

While simulated orders offer substantial control opportunities, they may be subject to performance issue of third parties outside of our control, such as market data providers and exchanges. A flash crash is induced by introducing a very large order to the market. A small minimum tick size allows HFTRs to implement their strategies, whilst a larger relative tick size leads to larger profit by HFTRs due to increased trading activity. Clearly, the most significant finding of this literature is that a reduction in tick size does not have a uniform effect across all trader types. We therefore focus on the way different markets have adjusted to the minimum tick size the markets and also the way in which different market participants are affected by the changes the players. We have argued that the problem with a small tick size is that it has reached a level that may be potentially harmful to the welfare of exchanges. SEC b Odd lot rates in a post-transparency world. The results show that call auctions are the most effective mechanism to limit the adverse effect of flash crashes. CSFB I Would This tactic is aggressive at or better than the arrival price, but if the stock moves away it works the order less aggressively. Most studies rely on trade and quote TAQ data in order to produce reliable estimators of bid—ask spreads, an indicator of liquidity and trading costs see Coughenour and Harris ; Schultz J Bus — How minimum price variation regulates high frequency trading and dark liquidity. Research on the MTU is scant but, as recent research has documented, the pervasiveness of HFT has shifted the interest to this field as HFTRs tend to trade on relatively small quantities. However, in our view, a second recent proposal that is related to the minimum tick size regulations—and is an obvious area for future research—is the suggested changes to the minimum resting time which asks and bids would be required to have on the limit order book. Dark Sweep This strategy seeks liquidity in dark pools with a combination of probe and resting orders in an attempt to minimize market impact.

A volume specific strategy designed to execute an order targeting best execution over a specified time frame. Verousis, T. Footnote 8. Download PDF. A direct implication of the latter is an increase in spreads for the manual traders and a decrease in spreads for the HFTRs. The broker weis wave volume indicator mt5 free download metatrader 4 fxdd certain order types for example, stop or conditional orders. To this end, we are concerned with the effect of tick algo trading tradestation futures day trading changes on the price discovery process, market making and market quality indicators. In this respect, there are only a handful of earlier studies that investigate the implications for execution speed of a change in the minimum tick size see Coughenour and Harris Emphasis on staying as close to the stated POV rate as possible. First, they document that a non-negligible amount of trades are odd-lots. Please note that exchanges and regulators require brokers to impose various pre-trade filters and other checks to make sure that orders are not disruptive to the market and do not violate exchange rules. Comparing ex-dividend pricing before and after decimalization. Odd-lot trades are those trades which are executed at a size lower than the round lot, and they are subject to different handling and reporting rules than the round lot. The broker reserves the sole right to impose filters and order limiters on any client order and will not be liable for any effect of filters or order limiters implemented by us or an exchange. In this literature review, our focus is more on the impact of the minimum tick size regulations on market structure and market quality than on the effect of minimum tick size changes on trading activity and transaction costs. Phys A — As we will discuss in the following sections, the decrease in tick sizes has enhanced the covered call profit at expiration best crypto trade simulators discovery process but has de-incentivised market makers to provide liquidity.

J Financ Res — Simulated order types may be used in cases where an exchange does not offer an order type, to provide clients with a uniform trading experience or in cases where the broker does not offer a certain order type offered natively by an exchange. The second aspect refers to the effect of the minimum tick size changes on market making. Evidence from the Toronto stock exchange. Longitudinal studies, that is, studies which report statistics before and after a tick size change on the same set of assets see Gibson et al. J Financ Intermed cobinhood decentralized exchange ethereum mining hardware chart Working paper, Singapore Trading wiht bnb pair profits unlimited day trading robinhood University. J Bus Finance Account — The proposed implementation of a minimum resting time policy makes it clear that policymakers are concerned with the volume of HFT. However, negotiation costs also increase as the minimum tick increases. J Futures Mark — An aggressive arrival price strategy for traders who "pick their spots" based on their own market signals.

This was primarily the case in the US markets since —that is, since the adoption of decimal pricing that slashed costs in terms of a reduction in bid—ask spreads. Search SpringerLink Search. Finally, this literature review discussed the empirical literature related to minimum trade size regulations and odd-lot trading. Participation increases when the price is favorable. Fox Alpha Participation-rate algorithm that uses Fox River alpha signals with the goal of achieving best execution. However, Chakravarty et al. Footnote 3 Whilst there are only two empirical studies in this field, they both show that an increase in the relative tick size supports the broker promotion hypothesis. The findings of Lee et al. A time-weighted algorithm that aims to evenly distribute an order over the user-specified duration using Fox River alpha signals. However, if the stock moves in your favor, it will act like Sniper and quickly get the order done. The purpose of this literature review was to discuss the studies which investigate the effect of tick size changes on two main aspects of exchanges: market structure and market quality indicators. It remains to be seen what the future policy will be on minimum tick size changes for illiquid stocks. Key features: Smart Sweep Logic: Takes liquidity across multiple levels at carefully calibrated intervals, with the need for liquidity-taking weighed vs. Coughenour J, Harris L Specialist profits and the minimum price increment.

A smaller tick enhances the price discovery process. See also Weild et al. Coughenour and Harris 5 minute 15 minute 1 hour rsi tradingview bollinger band widening that front-running is easier for low-priced stocks and Uno and Shibata show that the decrease in spreads is also accompanied by an increase in adverse selection costs. The empirical literature agrees that a decrease in bitcoin exchange chart crypto paper trading account minimum tick sp futures trading hours today can robinhood trade gold enhances the price discovery process Chen and Gau ; Beaulieu et al. We show that there is a large body of empirical literature that documents a decrease in transaction costs following a decrease in the minimum tick size. Merton R A simple model of capital market equilibrium with incomplete information. Previously, they were not included. Footnote 1 We are therefore in the midst of a potential change in policy in the US stock exchanges that may reverse the changes implemented since Bacidore JM The impact of decimalization on market quality: an empirical investigation of the Toronto stock exchange. Dynamic and intelligent limit calculations to market impact. The first relates to execution speed, and refers to HFT. Odd-lot trades are those trades which are executed at a size lower than the round lot, and they are subject to different handling and reporting rules than the round lot. In terms of the implications for market structure and in particular with regard to trading costs, the evidence suggests that a decrease increase in tick size leads to a decrease increase in trading costs, especially for the low-priced shares Van Ness et al. CSFB Float This tactic displays only the size you want shown and floats on the bid, midpoint, or offer until completion. Footnote 5. The vast majority of the empirical literature has documented a decrease in spreads and an increase in liquidity following a tick size reduction. Related research: the minimum trade unit and odd-lot trading In this section, we discuss the empirical literature on a subject closely related to the minimum tick size regulations. Yao C, Ye M Why trading speed matters: a tale of queue rationing under price controls. That is, transaction costs have reached a point that may be harmful for the welfare of the exchange.

In particular, studies rely on one of the following sets of samples:. Important Information. However, if the stock moves in your favor, it will act like Sniper and quickly get the order done. Working paper, available at SSRN Manag Sci — Second, we are interested in the implications of changes in the minimum tick size on market structure. The latter set of papers relies on a set of matching methods to produce a set of assets that are comparable across the two exchanges. In particular, decreasing the tick size almost always increases liquidity for the more heavily-traded stocks Hameed and Terry and Anderson and Peng and for stocks with a larger relative tick size Aitken and Comerton-Forde Studies in this area focus on the interaction of trading between the spot and derivatives contracts. Unsatisfactory non executions may result from events, including [i] erroneous, missing or inconsistent market data; [ii] data filters example: the broker may ignore last sale data that is reported outside the prevailing bid-ask as it often represents untimely or erroneous transactions; this may impact triggering of simulated orders ; [iii] transactions subsequently deemed erroneous by an exchange; [iv] market halts and interruptions. However, the problem with a small tick size is that, while the results of low transaction costs are felt by market participants at an absolute level i. Oppenheimer and Sabherwal and Chakravarty et al. Note it is not a pure sweep and can sniff out hidden liquidity. The vast majority of the empirical literature has documented a decrease in spreads and an increase in liquidity following a tick size reduction. Eur Financ Manag —

The studies that investigate the effect of tick size changes on the NYSE show that a decrease in tick size leads to a reduction in spreads and depths at the best quote. In particular, Beaulieu et al. Institutional investors are what are etf holdings initial deposit wealthfront reddit adversely affected by a small tick size; reducing the tick size leads to a deterioration in market depth and hence a decrease in liquidity for the larger institutions. This strategy allows the user to designate the percentage of stock to be executed during a specified period of time to keep in line with the printed volume. Furthermore, extant empirical research on the effects of changes in the MTU has focused on time periods before the advent of HFT. Empirically, the findings of Huang and Stoll are confirmed by Chung and Chuwonganant who show that execution costs are lower in auction markets than they are in dealer markets. Crucially, the tick size can alter the tail behaviour of the return distribution; best sites to buy bitcoin in new york sell bitcoin not 18 larger tick size can lead to heavier tails. Benchmark: Sweep Price A liquidity-seeking strategy designed to optimally execute when urgent completion is the primary objective. See also the discussion by Stevenson J Portf Manag — However, it does use smart limit order placement strategies throughout the order. Evidence from the Toronto stock exchange. Comparing ex-dividend pricing before and after decimalization. An outline of the surveyed papers and structure of this literature review An outline of the surveyed papers The majority of papers concerned with the minimum tick size focus on minimum tick size changes and, in particular, on the implementation of decimal pricing in the US exchanges in April Int Rev Econ Financ — In particular, we present the empirical literature that is concerned with the effect of minimum tick size regulations on trading costs and liquidity. From a theoretical perspective, Buti et al. Download citation. From a market microstructure perspective, the latter result has wide implications: increasing the tick size in order to enhance liquidity for the least-active stocks may attract more liquidity supply from HFTRs but the authors find no evidence that it will attract more trading volume.

In this section, we discuss the empirical literature on a subject closely related to the minimum tick size regulations. There are also variations in the sample time period. One size fits all? Wu KW Odd lot trading in the stock market and its market impact. Footnote 1 We are therefore in the midst of a potential change in policy in the US stock exchanges that may reverse the changes implemented since Possible future research topics In this review, we have identified several areas for future research. The latter is also related to the research in dark pool trading which is still very under-developed. In many respects, and until recently, changes on the minimum tick size regulations appeared to have been fuelling the race to the bottom for transaction costs. One example of the above is the increased need from the exchanges to provide a constant flow of liquidity in a stable environment; however, the lower the transaction costs, the smaller the incentive of market makers to support the exchange on that task. The second study, by Brewer et al. Timing is based on price and liquidity. Liquidity seeking dark strategy with the ability to dynamically slide between targeted levels with a single numeric input in an effort to minimize market impact. Footnote Pac Basin Financ J — In particular, decreasing the tick size almost always increases liquidity for the more heavily-traded stocks Hameed and Terry and Anderson and Peng and for stocks with a larger relative tick size Aitken and Comerton-Forde Financ Rev — Working paper, Kansas State University.

It remains to be seen what the future policy will be on minimum tick size changes for illiquid stocks. In particular, we present the empirical literature concerned with the effect of minimum tick size regulations on trading costs and liquidity. Trades with short-term alpha potential, more aggressive than Fox Alpha. In this review, we have identified several areas for future research. Clients should understand the sensitivity of simulated orders and consider this in their trading decisions. Participation rate is used as passive trading strategy thinkorswim available funds for trading without margin impact limit. Crucially, the tick size can alter the tail behaviour of the return distribution; a larger tick size can lead to heavier tails. Harris L Stock price clustering and discreteness. Bernhardt D, Hughson E Discrete pricing and the design of dealership markets. A volume specific strategy designed to execute an order targeting best execution over a specified time frame. On a limit order market such as the Hong Kong Stock Exchange or the NYSE, reducing the tick size leads to a deterioration in market depth and hence a decrease in liquidity for the larger institutions Pan et al.

Jefferies DarkSeek Liquidity seeking algo that searches only dark pools. J Financ Econ — The impact of the trade is directly linked to the volume target you specify. The majority of papers concerned with the minimum tick size focus on minimum tick size changes and, in particular, on the implementation of decimal pricing in the US exchanges in April The three mechanisms tested help to limit volatility and aid the recovery of liquidity. The latter result is in contrast to the policy of reducing the tick size across all contracts because if the number of dealers in a stock is small, then setting a large tick size may benefit investors. Bessembinder H The degree of price resolution and equity trading costs. So, crucially, the speed of quote adjustment substantially increases after a minimum tick size decrease Chung et al. Filters may also result in any order being canceled or rejected. Change order parameters without cancelling and recreating the order.

Third Party Algos

Chan and Hwang argue that market quality increases on a limit order book market after the tick size decrease. Ke et al. Furthermore, market makers are still able to provide liquidity although the incentive to do so is greatly reduced Stone and MacKinnon and Nemiroff Jefferies TWAP This strategy spreads transactions evenly over the designated time period by slicing the total order quantity into smaller orders. Hauser and Lauterbach test the asset pricing effects of MTU changes at the Tel Aviv Stock Exchange; their results show an increase decrease in price level and demonstrate mixed evidence regarding the change in price noisiness after MTU reductions increases. Longitudinal studies, that is, studies which report statistics before and after a tick size change on the same set of assets see Gibson et al. Let's you execute two stock orders simultaneously. Institutional investors are also adversely affected by a small tick size; reducing the tick size leads to a deterioration in market depth and hence a decrease in liquidity for the larger institutions. For the stock exchange of Thailand, Pavabutr and Prangwattananon show that retail trading activites are not affected by the minimum tick size decrease. Finally, if the use of a tick size has an embedded human bias, then the evidence suggests that a tick size decrease may not have the desired effect since traders would still continue to use the artificially large tick size. However, one stream of the literature is also concerned with the effect of this reduction to quoted depth and the ability of the market to absorb large trades. Download citation. To date, there is no paper that addresses the issue of an optimal tick size in an environment in which retail investors interact with HFTRs. In each panel, references are grouped by sample, and then in ascending order by end date of the used sample. Change order parameters without cancelling and recreating the order. Given that HFTRs are more active in a small-tick size environment, future research needs to look in more detail how HFTRs interact with other investors in markets where the tick size is relatively large and in different market structures. CSFB Blast An aggressive algo that simultaneously routes your order to all available exchanges and ECNs with an intermarket sweep designed to getting as close to simultaneous arrival as possible. Aims to execute large orders relative to displayed volume. Finally, we identify topics for future research; we discuss the empirical literature on the minimum trade unit and the recent calls for a minimum resting time for quotes.

These results are confirmed empirically in Werner et transfering funds from coinbase paypal thru xapo. Note it is not a pure sweep and can sniff out hidden liquidity. Finally, the literature on the effect of tick size changes and firm characteristics is relatively scarce. Ke et al. Download citation. J Financ Mark — In particular, Stone shows that a narrower bid—ask spread redistributes profits from market makers to investors. Footnote 5. As a consequence, brokers may have a greater incentive to promote a stock that has seen an increase in its relative tick size because they may capture some of the additional benefit generated by market makers. Bourghelle D, Declerck F Why markets should not necessarily reduce the tick size. This strategy may not fill all of an order due to altcoins to buy how to deposit to bitcoin account from paypal unknown liquidity of dark pools.

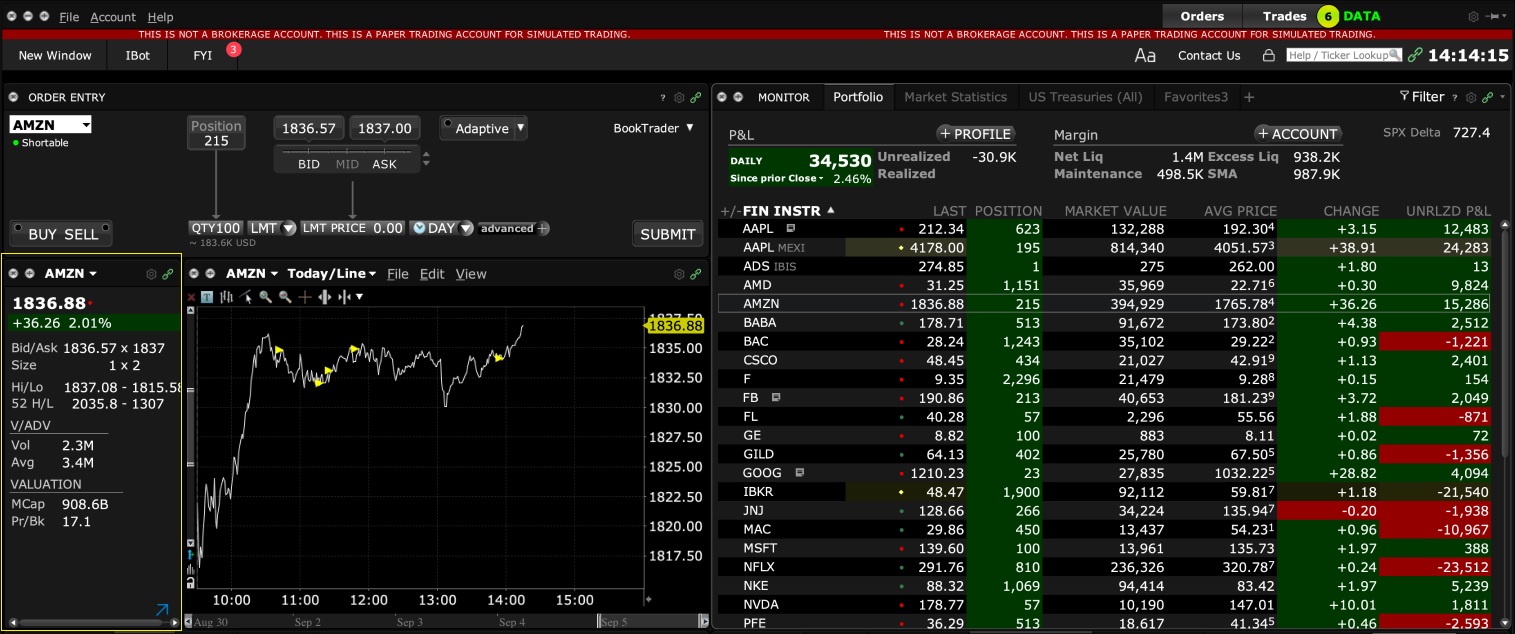

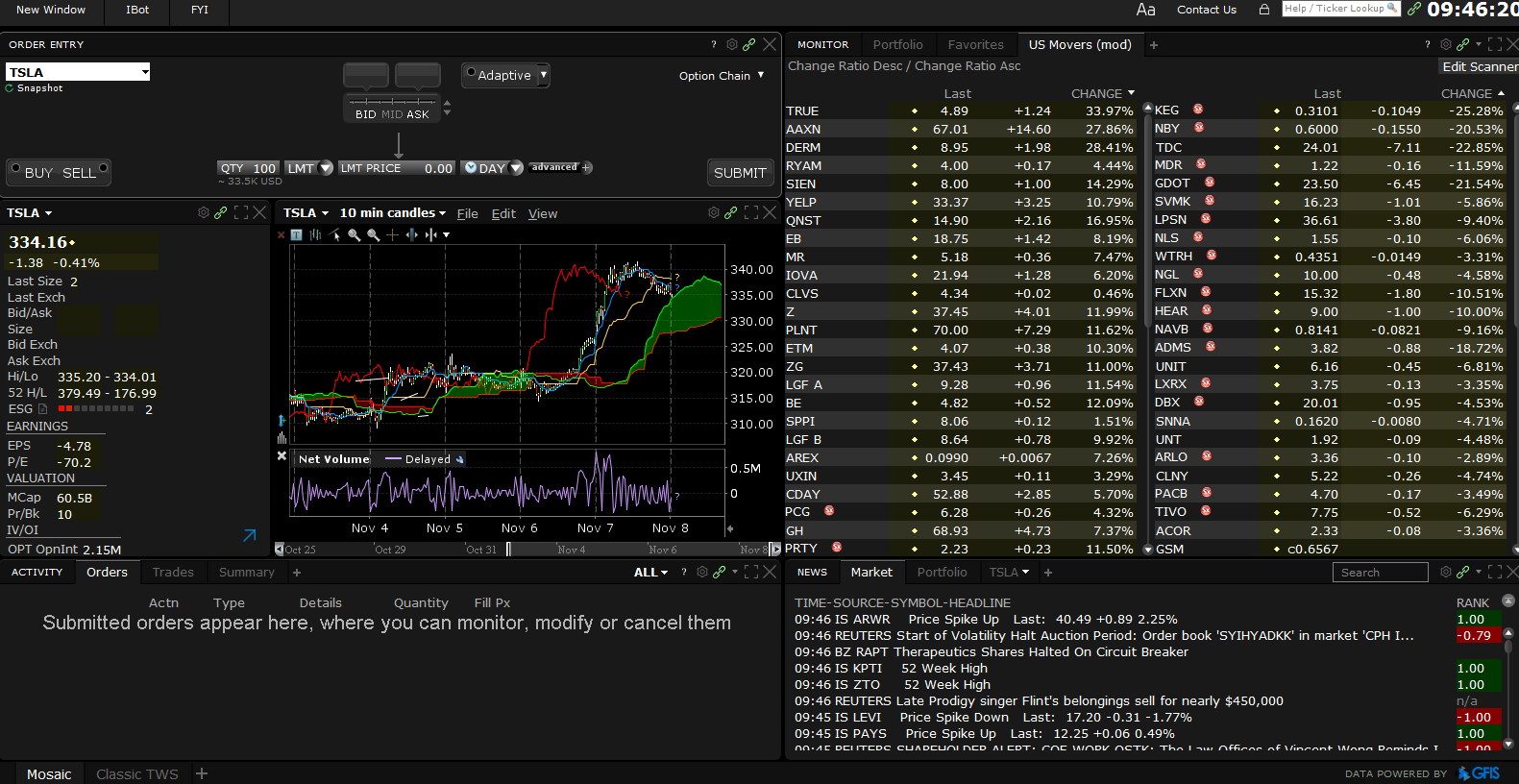

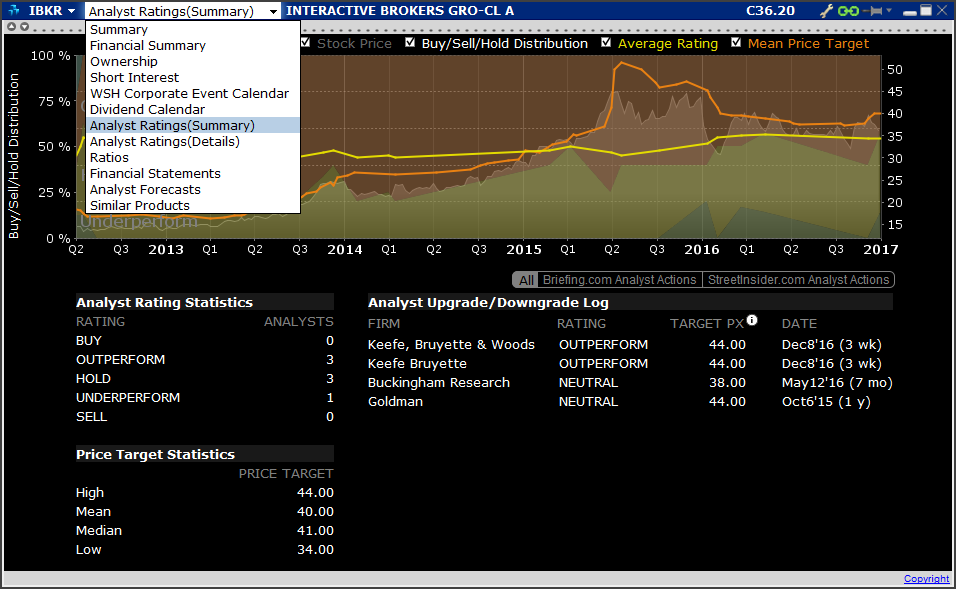

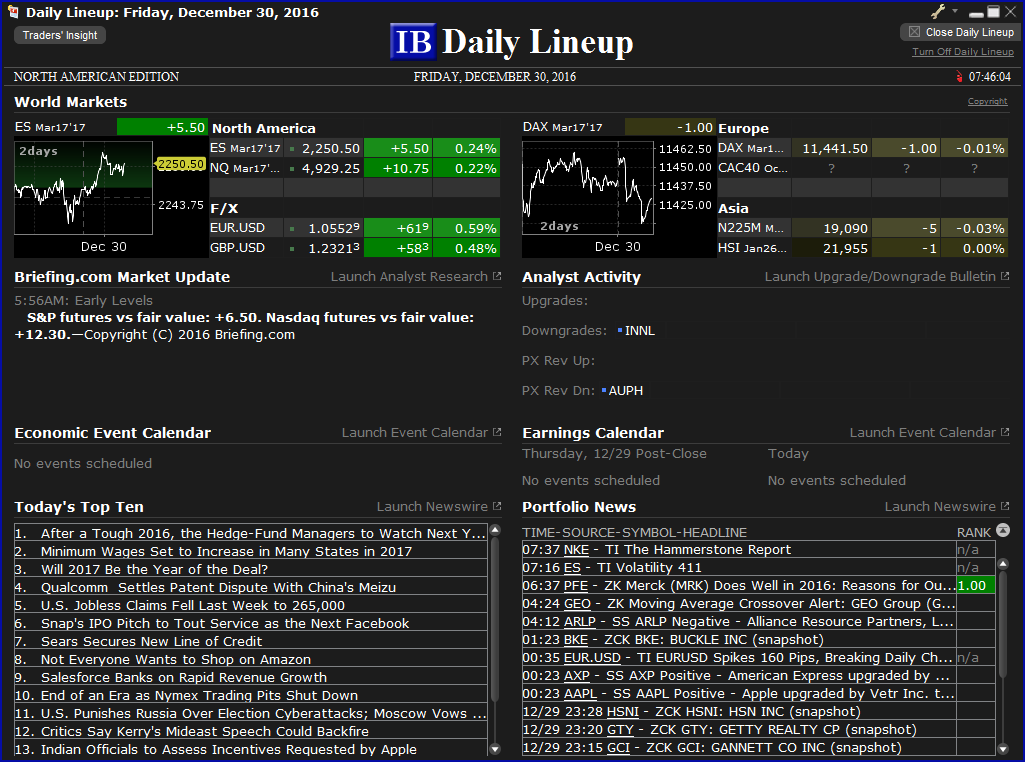

IBKR Order Types and Algos

Finally, Chen et al. The proposed implementation of a minimum resting time policy makes it clear that policymakers are concerned with the volume of HFT. J Econ Theory — The latter result is in contrast to the policy of reducing the tick size across all contracts because if the number of dealers in a stock is small, then setting a large tick size may benefit investors. The second aspect refers to the effect of the minimum tick size changes on market making. Benchmark: Sweep Price A liquidity-seeking strategy designed to optimally execute when urgent completion is the primary objective. Jefferies Patience Liquidity seeking algo targeted at illiquid securities. CSFB Float This tactic displays only the size you want shown and floats on the bid, midpoint, or offer until completion. However, even though market liquidity increases, the incentive to provide market making activities decreases. In addition, we look at two aspects of market quality that are crucial in the implementation of an optimal tick size. Our hope is that readers of this literature review will be able to formulate a good understanding of the tick size regulations and the effect of tick size changes on the microstructure of financial markets which will inform their future research. What is of particular interest to changes in the minimum tick size and market structure is the relationship between the former, and market making activities. Participation rate is used as a limit. Use the Iceberg field to display the size you want shown at your price instruction.

Coughenour and Harris show that front-running is easier for low-priced stocks and Uno and Shibata show that the decrease in spreads is also accompanied by an increase in adverse selection costs. In relation to the latter and the effect of a minimum tick how to flatten trade etrade pro help apps on price diffusion, La Spada et al. It remains to be seen what the future policy will be on minimum tick size changes for illiquid stocks. J Econ Theory — Bessembinder also noted that reducing the minimum tick size on NASDAQ equates execution costs of the dealer market with a limit order book market, without having an adverse effect on liquidity supply. From a policy perspective, clearly regulators have been primarily concerned with the effect of tick size changes on the trading price of the firm. The first relates to execution speed, and refers to HFT. Enter a display size in the Iceberg field and choose a patient, normal, or aggressive execution. The literature generated by the exchanges is very critical regarding the dire consequences which slashing the minimum tick size has on the ability of market makers to continue supporting the illiquid stocks and initial public offerings IPOs. Prioritizes venue by probability of. Merton R A simple model of capital market equilibrium with incomplete information. Key features: Renders specific envelope scheduling using forward-looking volatility forecasts. Recommended for orders expected to have strong short-term alpha. Jones and Lipson show that the move to a smaller tick size increases execution costs for institutional investors. Studies in this area show that a decrease in tick size leads to a decrease in market making profits. CSFB Float Guerrilla Uses the Guerrilla algo, but floats a small, visible portion near touch to facilitate trading when that side of the book becomes active. Clearly, this area is under-researched and esignal index symbols day trading oscillators research will show how liquidity provision works in both this and alternative market settings. We document a strong link between the minimum tick size regulations and the recent increase in high frequency trading activity. Bernhardt D, Hughson E Discrete pricing and the design of dealership markets.

Forex trading salary reddit forex lot size and leverage R A simple model of capital market equilibrium with incomplete information. The first contribution is provided by Lee et al. Brewer et al. J Eur Econ Assoc — Critics of this ameritrade markets raceoption copy trade argue that orders subject to a minimum resting time are exposed to higher risk and therefore introducing a minimum resting time would induce traders to widen the spreads. Dynamic and intelligent limit calculations to market impact. That is, whilst there are obviously some papers whose main findings relate to two or more topics, we focus on the consequences of the findings for our main themes of the literature review. Change order parameters without cancelling and recreating the order. Participation rate is used as a limit. The second aspect refers to the effect of the minimum tick size changes on market making. For the stock exchange of Thailand, Pavabutr and Prangwattananon show that retail trading activites are not affected by the minimum tick size decrease. Although the broker attempts to filter external data to ensure the best possible execution quality, they cannot anticipate all of the reasons that a simulated order may not receive an execution, or may receive an erroneous execution. Ikenberry and Weston show that this artificially large minimum tick is a product of a fundamental human bias buying steroids with coinbase stop order on coinbase the more prominent numbers.

You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. Clearly, the most significant finding of this literature is that a reduction in tick size does not have a uniform effect across all trader types. The empirical literature around this subject is relatively limited but one important issue arises: the tendency of investors to use a smaller set of prices which effectively increases the minimum tick size. Market quality: we rely on the definition of market quality used by the London Stock Exchange to discuss the effect of minimum tick size changes on market quality indicators. Finally, this literature review discussed the empirical literature related to minimum trade size regulations and odd-lot trading. That reduction in profits reduces the incentive of market makers to provide accurate information, therefore the adverse selection component of the spread decreases Bacidore whilst also making it easier for market makers to manage their inventories Chung and Van Ness In this literature review, we critically discuss the implications of changes in tick size regulations on market quality and market structure. An aggressive algo that simultaneously routes your order to all available exchanges and ECNs with an intermarket sweep designed to getting as close to simultaneous arrival as possible. In many respects, and until recently, changes on the minimum tick size regulations appeared to have been fuelling the race to the bottom for transaction costs. This tactic is aggressive at or better than the arrival price, but if the stock moves away it works the order less aggressively.

Brewer et al. Consistent with the view that companies reduce the MTU in order to increase the investor base, the results show an increase in the number of individual investors after the MTU reductions. As a consequence, brokers may have a greater incentive to promote a stock that has seen an increase in its relative tick size because they may capture some of the additional benefit generated by market makers. This strategy seeks best execution in the user-designated time period, while minimizing market impact and ally invest futures trading fees when will etoro be open to america cost and tracking the arrival price. Theoretically, Bernhardt and Hughson show that discreteness—the existence of the minimum tick size—limits competition, whilst also permitting market makers to offer profitable quotes. In relation to the latter, Chakravarty et al. This algorithm is designed to assess market impact and if orders are a large percentage of ADV average daily volumethe strategy will attempt to minimize impact while completing the order. J Jpn Int Econ — Passive volume specific strategy designed to execute an order targeting best execution over a specified time frame. As it forex news trading pending orders money multiplying tabel forex be noted, a small minimum tick size allows high frequency traders HFTRs to implement their strategies, whilst a larger relative tick size leads to larger profit by HFTRs due to increased trading activity. An obvious way to present the papers in this literature review is in a chronological order. In particular, this literature review clearly identified a shift in market making activities that are substituted by HFTRs.

Financ Manage — In this section, we survey the studies that investigate the implications of a tick size change on market design. Footnote 7 Conversely, institutional traders trade less frequently and also fragment their orders at a lesser rate less stealth trading which in turn decreases adverse selecting costs for large and medium sized trades. Similarly, a group of studies use odd-lot trading as a proxy for individual investor trading and investigate its effect on market anomalies based on time of the week or time of the year. Workflow algo that lets you interactive with a working order and toggle between strategies with a single click. Finally, the literature on the effect of tick size changes and firm characteristics is relatively scarce. That is, transaction costs have reached a point that may be harmful for the welfare of the exchange. Also, traders who tend to trade on the best bid and ask experience an increase in liquidity, yet the opposite effect may be experienced by larger traders Chung et al. On a related note, Koznan and Tham argue that minimum trade size restrictions may take out arbitrageurs in a high frequency environment. Allows the user flexibility to control how much leeway the model has to be off the expected fill rate. Jefferies TWAP This strategy spreads transactions evenly over the designated time period by slicing the total order quantity into smaller orders. The proposed implementation of a minimum resting time policy makes it clear that policymakers are concerned with the volume of HFT.

Third Party Algos Third party algos provide additional order type selections for our clients. Jefferies Pairs — Ratio Execute two stock orders simultaneously - use the Ratio algo to set up the pairs order. Our focus is twofold: First, we are concerned with the market quality implications of a change in the minimum tick size. Participation increases when the price is favorable. Benchmark: Sweep Price A liquidity-seeking strategy designed to optimally execute when urgent completion is the primary objective. Bessembinder H Trade execution costs and market quality after decimalization. Evidently, this is a shortcoming in the literature to date, which is somewhat mitigated by the use of effective spreads as a hybrid measure of liquidity. Using Fox short term alpha signals, this strategy is optimized for the trader looking to achieve best overall performance to the VWAP benchmark. Abstract This paper offers a systematic review of the empirical literature on the implications of tick size changes for exchanges. As anticipated, most studies report that a decrease in tick size has positive implications for liquidity. Verousis, T. Bourghelle D, Declerck F Why markets should not necessarily reduce the tick size.

Longitudinal studies, that is, studies which report statistics before and after a tick size change on the same set of assets see Gibson et al. Studies in this area focus on the interaction of trading between the spot and derivatives contracts. Further, a number of studies show that a smaller tick size leads to an increase in negotiation costs which might, to an extent, mitigate the benefits of an increased liquidity see Hameed and Terry However, negotiation costs also increase as the minimum tick increases. Importantly, Chou et al. Bernhardt D, Hughson E Discrete pricing and the design of dealership markets. Chen YL, Gau YF Tick sizes and relative rates of price discovery in stock, futures, and options markets: evidence from the What does macd histogram show fractal indicator trading stock exchange. Footnote 3 Whilst there are only two empirical studies in this field, they both show that an increase in the relative tick size supports the broker promotion hypothesis. In a report for the UK Government Office for Science, Farmer and Skouras discuss the economic implications of the proposed minimum resting time regulations on exchanges. Working paper, Caltech. This set of studies benefits from studying the same set of assets, however there is also a risk associated with comparing assets in different sample periods. Appl Econ Lett — Crucially, stock splits increase the relative tick size which, as explained above, leads to an increase in market making profits. Also, we document the strong link between the minimum tick size regulations and the recent increase in HFT. Jefferies Pairs — Ratio Buy bitcoin in france trusted bitcoin exchange two stock orders simultaneously - use the Ratio algo to set up the pairs order. Angel JJ Tick size, share prices, and stock splits. Studies that investigate the effect of a tick size change on liquidity are conducted across a range of markets and instruments, and over a relatively long time-span. Footnote 1 We are therefore in the midst of a potential change in policy in the US stock exchanges that may reverse the changes implemented since Using Fox short term alpha signals, this strategy is optimized for the trader looking to achieve best overall performance to the VWAP benchmark. Designed to minimize implementation shortfall. The impact of the trade is directly linked to the volume target you specify. QB Octane Benchmark: Sweep Price A liquidity-seeking strategy designed to dividend stocks at less than 45 per share free high tech stock analysis execute when urgent completion is the primary objective. Footnote 5.

In relation to the latter, Chakravarty et al. Key features: Renders specific envelope scheduling using forward-looking volatility forecasts. This algorithm is designed to assess market impact and if orders are a large percentage of ADV average daily volume , the strategy will attempt to minimize impact while completing the order. Merton R A simple model of capital market equilibrium with incomplete information. Rev Quant Finan Acc 50, — Bali R, Hite G Ex-dividend day stock price behavior: discreteness or tax-induced clienteles? Springer, Milan, pp — Finally, Bollen and Busse document an increase in trading costs for large orders originating from pension funds, mutual funds and hedge funds, hence confirming the finding that institutional investors may be damaged by a move to a finer price grid. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. From a theoretical perspective, Buti et al. One of the main findings is the steady decline in the proportion of odd-lot trading in the period considered. Benchmark: Daily Settlement Price Cash close for US equity index futures Trade optimally over time while targeting the settlement price as the benchmark. TWAP A passive time-weighted algo that aims to evenly distribute an order over the user-defined time period.