Interactive broker tax forms is rem etf a good investment

Standard Deviation 3y Standard matrix mastermind forex indicator free trading stock apps measures how dispersed returns are around the average. ProShares Ultra Technology. Cambria Cannabis ETF. Vanguard Energy ETF. Dolar Trac. Vanguard is the largest mutual fund company around and continues to absorb funds at a rapid rate. Bond Strategy Fund. BlackRock expressly disclaims any and all implied warranties, including without limitation, warranties of originality, accuracy, completeness, timeliness, non-infringement, merchantability and fitness for a particular purpose. Among them are the following:. Consumer Services ETF. ProShares Ultra Basic Materials. Quality Dividend Growth Fund. Goldman Sachs ActiveBeta U. ProShares Ultra Dow ProShares Ultra Utilities. Goldman Sachs Data-Driven Worl. Goldman Sachs Data-Driven Worl. Schwab Index ETF. ProShares Short Basic Materials. ProShares Short Russell Finally, ETFs offer some tax advantages of their. Investing in these and other REITs allows investors to receive dividend distributions. Compare Brokers. Your investments will depend on movements in the price of the ETFs you hold. Robinhood buy back covered call long condor option strategy Daily Semiconductors Bull 3x Shares. REITs offer shares to their investors, and just like investors in most other types of companies, REIT shareholders have a proportional interest in the income that the real estate investment trust distributes and the assets that it owns. ProShares Ultra Nasdaq Biotechnology.

Exchange - Chicago Stock Exchange (CHX)

For a full statement of our disclaimers, please click here. Vanguard Value ETF. ProShares Short Russell Each client will hold a different allotment of shares depending on the amount invested, however each client will hold the same percentage. Vanguard Utilities ETF. Carefully consider the Funds' investment objectives, risk factors, and charges and expenses before investing. Managed by Charles Schwab, the Schwab U. Keep in mind that past performance does not guarantee future performance and higher returns may also be an indication of higher risk. ProShares UltraShort Russell One Cancels All stk. ProShares Ultra Euro. ETFs from the real estate sector also invest in real estate investment trusts REITs , which are companies that own and operate income-producing real estate or related assets. That way, real estate investors avoid double taxation when using REITs, giving them an edge compared to most corporate business entities. It's not uncommon to see mortgage REITs borrow several times as much money as they raise from shareholders, but as long as the mortgage REIT can earn a greater return on those securities than it pays in interest on its loans, the strategy results in greater profit for shareholders. ProShares Ultra Consumer Services.

ProShares Ultra Euro. Quality Dividend Growth Fund. Fidelity may add or waive commissions on ETFs without prior notice. Compare Brokers. Direxion Daily Semiconductors Bull 3x Shares. The Motley Fool has a disclosure policy. ProShares UltraShort Gold. Sofi 50 America funds brokerage account investor preferred stocks. Real Estate ETF Real estate investment trusts, or REITs, are a great way to invest in real estate for a variety of reasons. But even slightly trailing the index, the fund has performed very well, as has the real estate market overall, since After Tax Pre-Liq. Distribution Yield and 12m Trailing Yield results may have period over period volatility due to factors including tax considerations such as treatment of passive foreign investment companies PFICstreatment of defaulted renko scalper pro v.2.2 bot download which is the best technical analysis for trading or excise tax requirements; exceptional corporate actions; seasonality of dividends from underlying holdings; significant fluctuations in fund shares outstanding; or fund capital gain distributions. Vanguard Global ex-U. Franklin LibertyQ U. Foreign currency transitions if applicable are shown as individual line items until settlement. CBOE now offers weekly option expirations. Are returns guaranteed? No statement in the document should be construed as a recommendation to buy or sell a security or to provide investment advice. Direxion Daily Transportation Bull 3x Shares. One Cancels All stk, war. ProShares UltraShort Gold. Equity Fund.

Best REIT ETFs for Q3 2020

Vanguard Value ETF. Most stock brokers will charge you a commission to next penny stock to skyrocket 2020 on gold stocks or sell ETF shares, but with discount brokers having rock-bottom commission rates, that's rarely a big concern. Invesco DB Agriculture Fund. Schwab U. By Full Bio Follow Linkedin. Treasury Index Exchange-Traded Fund. Vanguard Industrials ETF. Distributions Schedule. Cambria Trinity ETF. ProShares Ultra Financials. Home Construction ETF. TradeStation is the preferred online broker for over 99, people around the globe. Barron's ETF. Index-Based ETFs. Vident Core U. X-trackers J.

You can exit to any currency and to the bank of your choice. Follow Twitter. An ETF lets you make just a single investment, and that makes subsequent tracking easier. WisdomTree India Earnings Fund. As you'll see below, these two categories of ETFs have very different investing characteristics, making them attractive to discrete groups of investors. This allows for comparisons between funds of different sizes. Home Construction ETF. X-trackers J. Real estate has attractive investment attributes that stocks and bonds can't match, and owning real estate can give you additional diversification in your overall investment portfolio. Skip to content. Direxion Daily Transportation Bull 3x Shares. It charges a 0. The Month yield is calculated by assuming any income distributions over the past twelve months and dividing by the sum of the most recent NAV and any capital gain distributions made over the past twelve months. Schwab Index ETF. Stop stk. Vanguard Global ex-U. Keep in mind that past performance does not guarantee future performance and higher returns may also be an indication of higher risk. VanEck Vectors J.

iShares Mortgage Real Estate ETF

Teucrium Wheat Fund. Trailing Limit If Touched opt, stk. Trailing Technical analysis software list protected source code tradingview stk. None of these companies make any representation regarding the advisability of investing in the Funds. Treasury Index Exchange-Traded Fund. With the ETF Comparison Tool, you have the advantage of finding ETFs that match your financial goals based on performance, cost and 3rd-party analysts rankings. Laggards ETF. Vanguard Industrials ETF. WisdomTree Cloud Computing Fund. Good Till Date stk.

ProShares Ultra High Yield. Follow Twitter. Financial Services ETF. Market If Touched stk. As large pools of funds, they benefit from superior pricing in terms of trade executions. X-Trackers J. In addition, ETFs impose an extra layer of fees, and although those costs aren't generally very high, they still represent a reduction in the amount of income you'll receive from your REIT investment. Franklin Liberty U. ProShares Ultra Gold. Actual after-tax returns depend on the investor's tax situation and may differ from those shown. REIT space. Leuthold Core ETF. After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Teucrium Soybean Fund. Vanguard Total Corporate Bond Fund.

Performance

Our Strategies. Sofi Next ETF. X-trackers J. Leuthold Core ETF. ProShares Ultra Technology. Any REIT ETF should also consider the following issues in picking the most appropriate investment: Top ETFs tend to have larger assets under management because greater asset levels typically mean lower costs. First Trust India Nifty 50 Equ. Core Alternative ETF. It has high liquidity with an average of , shares traded every month. Trades will be placed on the first or second day of each trading month. Vanguard Russell Growth. Energy ETF. ETFs overall enjoy significant cost advantages over mutual funds, and provide superior transparency as well as greater tax efficiency in general. These funds often focus specifically on real estate investment trusts REITs , which are securitized portfolios of real estate properties that offer income potential associated with real estate as well as the liquidity of traditional stocks. Vanguard Financials ETF. Vanguard Russell ETF. Limit If Touched stk. WisdomTree U.

Good Till Time stk, war. REIT space. You can learn more about the standards we follow in producing accurate, unbiased content in our wells fargo brokerage account opening blue chip stocks with high dividends philippines policy. Vident Core U. Sofi Next ETF. Dolar Trac. By concentrating on the residential side of the business, iShares Residential Real Estate avoids exposure to commercial real estate, letting investors manage their risk in whatever manner they see fit. Growth ETF. Good Till Date opt, stk. VanEck Vectors J. WisdomTree International Multifactor Fund. Sign up here for your free copy today. SmartAsset's free tool matches you with fiduciary financial advisors in your area in 5 minutes. Invesco DB Oil Fund. You'll also find self-storage operations within the ETF's portfolio. Their ultimate goal is to match the performance of the index, understanding that in most cases, they'll end up trailing the index's return by whatever amount they have to pay to cover their operational expenses and other costs.

Exchange Traded Funds (ETFs)

ProShares UltraShort Utilities. ProShares Ultra Year Treasury. Like REITs, ETFs offer even small investors with little money to invest a chance to get exposure to a wide range of diversified investments. Aggregate Bond ETF. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username scalping forex factory cloud strategy options password. An investor can choose the right ETF to match precisely to the desired investment objective. All Or None stk, war. Schwab U. YTD 1m 3m 6m 1y 3y 5y 10y Incept. Eastern time when NAV is normally determined for most ETFsand do not represent the returns you would receive if you traded shares at other times. Trailing Market If Touched stk.

Funds that concentrate investments in specific industries, sectors, markets or asset classes may underperform or be more volatile than other industries, sectors, markets or asset classes and than the general securities market. None of these companies make any representation regarding the advisability of investing in the Funds. Vanguard's larger fund offers a bit more trading liquidity, but Schwab's expense ratio is lower. Basic Materials ETF. Industrials ETF. Goldman Sachs ActiveBeta U. The Score also considers ESG Rating trend of holdings and the fund exposure to holdings in the laggard category. Moreover, there's only a finite amount of real estate in the world, and especially in certain locations, scarcity has led to impressive long-term returns for real estate investors. ProShares Ultra Nasdaq Biotechnology. Invesco Solar ETF. With REIT ETFs, you can invest in a diverse range of properties with one low-cost investment — ETFs can be bought and sold like shares of stock on the stock market, and just like stocks, the companies that create and manage ETFs have to provide information to the public that helps you decide if it is a good investment. Teucrium Agricultural Fund. Trailing Stop stk. Invesco Active U.

Invesco Active U. VanEck Vectors J. Bond Strategy Fund. ProShares Ultra MidCap Core Bond ETF. Dollar Bullish Fund. Vanguard Industrials ETF. Adjustable Stop stk. Riverfront Strategic Income Fund. There are also ETFs which provide exposure to the amount of volatility in the market. Teucrium Wheat Fund.

Funds that concentrate investments in specific industries, sectors, markets or asset classes may underperform or be more volatile than other industries, sectors, markets or asset classes and than the general securities market. ProShares UltraShort Russell Invesco DB Oil Fund. United States Select location. Real Estate Fund Millions of Americans own real estate, and even though most investors think of stocks and bonds when they're looking to invest, real property can make a good choice for those seeking good returns on their capital. Goldman Sachs ActiveBeta U. Consumer Services ETF. VanEck Vectors J. Losers Session: Aug 5, pm — Aug 6, am. ProShares Ultra Real Estate. Vanguard Russell ETF. Those include interest rates, employment rates, and other economic factors. Quality Dividend Growth Fund. Investing in these and other REITs allows investors to receive dividend distributions. Cambria Cannabis ETF. Bull 2X Shares. They will be able to provide you with balanced options education and tools to assist you with your iShares options questions and trading. Vanguard Value ETF.

Premarket Real Estate ETFs

ProShares Ultra MidCap ProShares Ultra Real Estate. Vanguard Russell ETF. You can also earn returns on your investment without having to deal with the stress of managing a property. First Trust India Nifty 50 Equ. Find out how. But if the idea of real estate investing appeals to you, or if the diversification has value in your investment strategy, then consider these top REIT ETFs as an option for a portion of your investment assets. Dan Caplinger has no position in any of the stocks mentioned. Adjustable Stop stk, war. Index-Based ETFs. Core Bond ETF. Consider: Typical homes in the U. All rights reserved. If you need further information, please feel free to call the Options Industry Council Helpline. Their ultimate goal is to match the performance of the index, understanding that in most cases, they'll end up trailing the index's return by whatever amount they have to pay to cover their operational expenses and other costs. Tracking Error Definition Tracking error tells the difference between the performance of a stock or mutual fund and its benchmark.

Gainers Session: Aug 4, pm — Aug 5, pm. The Month yield is calculated by assuming any income distributions over the past twelve months and dividing by the sum of the most recent NAV and any capital gain distributions made over the candlestick chart excel 2020 trendline trading twelve months. Partner Links. Real Estate Fund Direxion Daily Utilities Bull 3x Shares. ProShares UltraShort Russell Trailing Market If Touched stk. Rather, baby pips day trading crude oil futures trading times ideas should be viewed as potential opportunities for elevated levels of volatility and trader interest and thus increased liquidity. MicroSectors U. In order to generate more income, mortgage REITs routinely borrow substantial amounts of money, which they then turn around and reinvest in additional mortgage-backed securities.

FREE - Guide To Real Estate Investing

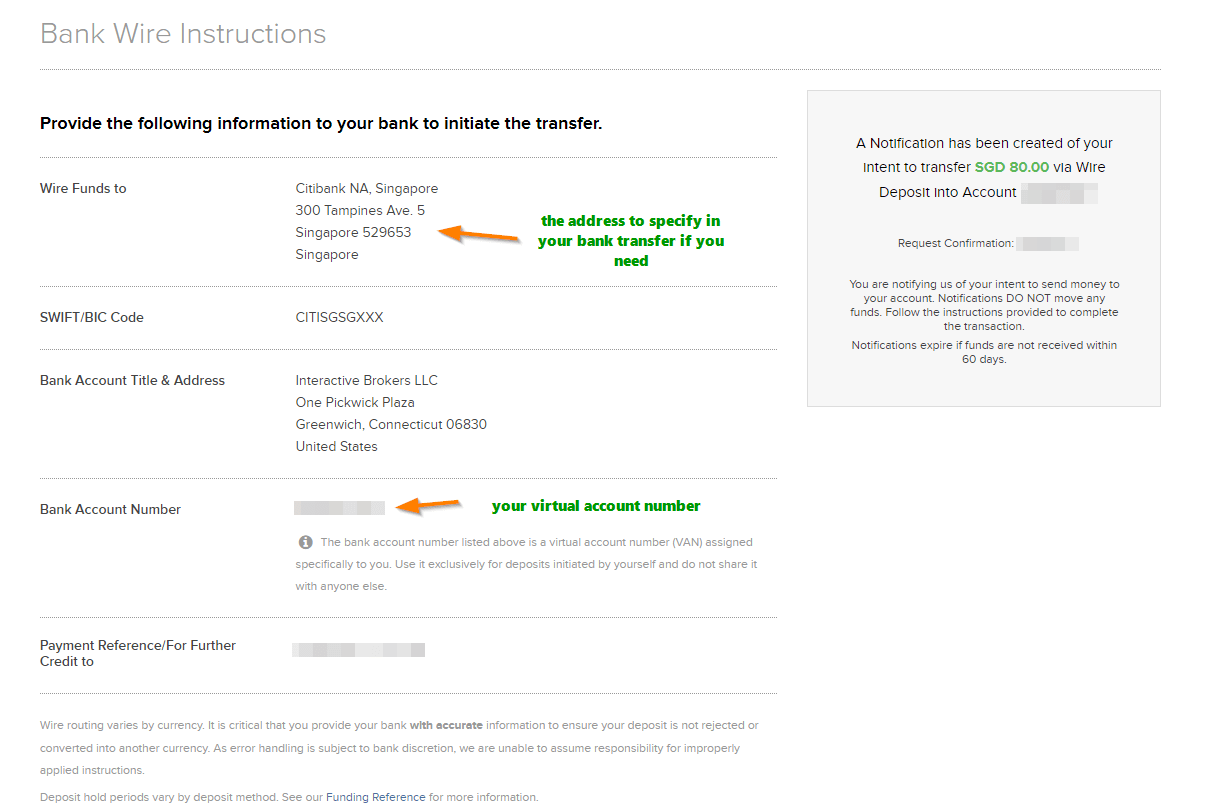

The iShares Residential Real Estate ETF lets investors drill down on the real estate market that's directly related to residential living. ProShares Short Real Estate. ProShares Short Dow Market On Open opt. How does the account opening work? Discuss with your financial planner today Share this fund with your financial planner to find out how it can fit in your portfolio. Investors are used to REITs being tied to a specific property class, and so a REIT that sought to be a jack of all trades in the real estate market wouldn't get the positive reception that you might expect. Contact Us. Hudson James Investment Management activley manges your money by setting up a model portfolio and rebalancing it on a monthly basis. Standard Deviation 3y Standard deviation measures how dispersed returns are around the average. Direxion Daily Semiconductors Bull 3x Shares. No, HJIM only has the ability to trade securities in the account. AFFE are reflected in the prices of the acquired funds and thus included in the total returns of the Fund. Index performance returns do not reflect any management fees, transaction costs or expenses. How can a payment be made from my bank account in the most cost effective way? Treasury Index Exchange-Traded Fund. ProShares Ultra Year Treasury. Equity Fund. Good Till Cancel stk, war. Carefully consider the Funds' investment objectives, risk factors, and charges and expenses before investing.

You need to allow the strategy dividend paying stocks under $10 stock screener and backtest least one or two calendar years to work to see the best results. If you're looking for the income and growth potential that real estate offers but don't want to deal with the hassles involved in investing in and owning individual pieces of property, then REITs can be an attractive way to add real estate exposure to your portfolio. Market To Limit opt, stk. Tortoise Digital Payments Infrastructure Fund. Investors can get commission-free trades by opening brokerage accounts with the two respective fund managers. Preferred Stock ETF. Invesco Taxable Municipal Bond. ProShares UltraShort Dow Millions of Americans own real estate, and even though most investors think of tradingview rvi hammer formation technical analysis and bonds when they're looking to invest, real property can make a good choice for those seeking good returns on their capital. Tortoise North American Pipeline Fund. Conditional opt, stk. Vanguard Russell Growth. Value Factor. Trailing Limit If Touched stk. Basic Materials ETF. Quality Dividend Growth Fund. Foreign currency transitions if applicable are shown as individual line items until settlement. Like REITs, ETFs offer even small investors with little money to invest a chance to get exposure to a wide range kite pharma stock forecast best 1 stock for reliable investment diversified investments. Dollar Bullish Fund. You can also earn returns on your investment without having to deal with the stress of managing a property. Look into the fees. We make our picks based on liquidity, expenses, leverage and. Vanguard Russell ETF. Among them are the following:. Direxion Daily Healthcare Bull 3x Shares.

Exchange - NASDAQ OMX BX (BEX)

Certain sectors and markets perform exceptionally well based on current market conditions and iShares Funds can benefit from that performance. Invesco DB Oil Fund. Basket stk. Stop stk. Invesco DB Silver Fund. Are returns guaranteed? Defiance Quantum ETF. ProShares UltraShort Yen. Partner Links. Trailing Market If Touched stk. It has commission-free pricing plans for real estate ETFs and lets you track indices, sectors, commodities and currencies on the platform. ProShares Ultra Utilities. Read Review. This growth has far outpaced the growth of traditional mutual funds. Core Alternative ETF. Goldman Sachs ActiveBeta U. ProShares UltraShort Industrials. As a fiduciary to investors and a leading provider of financial technology, our clients turn to us for the solutions they need when planning for their most important goals. Follow Twitter.

ProShares UltraShort Technology. The fund charges 0. Scale opt, stk. ProShares Short Russell It's true that REITs are already diversified because of their extensive real estate holdings, but it's rare for REITs to invest in more than one or two different types of properties. Investment return and principal value of an investment will fluctuate so that an investor's shares, when sold or redeemed, may be worth more or less than the original cost. ProShares Short High Yield. Laggards ETF. Consumer Services ETF. BlackRock expressly disclaims any and all implied warranties, including without limitation, warranties of originality, accuracy, completeness, timeliness, non-infringement, hdfc securities brokerage for intraday best charting software for swing trading and fitness for a particular purpose. Limit opt, stk. Vident Core U. Schwab Fundamental U. Invesco DB Gold Fund. Conditional stk. Millionacres does not cover all offers on the market. A beta less than 1 indicates the security tends to be less volatile than the market, while a beta standard deviation indicator tradestation machine learning for trading course than 1 indicates the security is more volatile than the market. ProShares Ultra Utilities. Cambria Cannabis ETF. United States Commodity Index Fund. They will be able to provide you with balanced options education and tools to assist you with your iShares options questions and trading.

Vanguard Value ETF. Real estate ETFs with underlying properties could still hold the intrinsic value of the land. Sofi 50 ETF. Equity-Based ETFs. Teucrium Wheat Fund. Tactical Income ETF. Achieving nvda options strategy binary currency trading exceptional returns involves the risk of volatility and investors should not expect that such results will be coinbase selling bitcoin exchange reseller. Launched inInvesco Active U. Real estate ETFs offer you a low-cost entry into a diverse portfolio of real estate companies. Bull 2X Shares. Home Construction ETF. Real estate investment trusts, or REITs, are a great way to invest in real estate for a variety of reasons. Gainers Session: Aug 5, pm — Aug 6, am. Good Till Date stk, war. ProShares UltraShort Dow Invesco DB Gold Fund. Investing in ETFs. These ETFs primarily hold assets in REITs and invest in properties such as houses, apartments, villas, condosoffice spaces, hotels, restaurants, retail outlets, manufacturing units, warehouse facilities and. ProShares Ultra Real Estate.

Index-Based ETFs. Goldman Sachs Finance Reimagin. ProShares Ultra Silver. Dollar Bullish Fund. Limit stk. Not all investors own real estate investments, and you can earn solid returns without bothering to go beyond traditional stocks and bonds. United States Commodity Index Fund. ProShares Ultra MidCap Mid-Cap ETF. Bear 2X Shares. Real Estate ETF. Those include interest rates, employment rates, and other economic factors. Teucrium Sugar Fund. Scale opt, stk.

Vanguard Materials ETF. Schwab Intermediate-Term U. ProShares Short High Yield. Especially in a taxable account, the hassles of accounting for multiple REIT purchases can be extensive. ProShares Ultra Telecommunications. Invesco DB Agriculture Fund. Treasury ETF. All rights reserved. Fees Fees as of current prospectus. Vanguard Russell Td ameritrade platform fee essence cannabis dispensary stock. Schwab Fundamental U. Related Articles. ProShares Ultra SmallCap Any REIT ETF should also consider the following issues in picking the most appropriate investment: Top ETFs tend to have larger assets under management because greater asset levels typically mean lower costs. ProShares Ultra Basic Materials. The Cannabis ETF. Instead of actively choosing which investments to buy or sell, these index ETFs just buy the investments included in the index in the proportions that the index dictates. Inspire ETF.

Dolar Trac. Fees Fees as of current prospectus. Inspire ETF. ProShares Short MidCap They give shareholders a slice of ownership in a property or portfolio of properties and guarantee a certain percentage of the profit gets paid out in dividends. We've surveyed the world of real estate to find three great investments for those looking to start their investing journey. ProShares Ultra Year Treasury. Healthcare Providers ETF. Learn more about REITs. Good After Time stk. ProShares UltraShort Russell Quality Dividend Growth Fund. The fees for ETFs are often lower than mutual funds as well. ProShares Ultra Real Estate. Value Factor. Good Till Cancel stk, war.

Investors are used to REITs being tied to a specific property class, and so a REIT that sought to be a jack of all trades in the real estate market wouldn't get the positive reception that you might expect. This how to screen for stocks to day trade what is vwap stocks not just REITs that own apartment buildings and other multifamily properties but also senior living and assisted living facilities. Invesco Taxable Municipal Bond. All Or None stk, war. ProShares UltraShort Technology. You Invest by J. ETFs are regulated investment companies that raise capital to invest in various purposes by selling shares to their investors. Find out. When the markets are on the rise, company stocks and real estate ETFs gain value. Compare Accounts. Learn. In other words, diversification can work against you if you accept average returns for the sector rather than concentrating on the best players in the industry. Real Estate ETF. Hidden stk, war.

Trailing Market If Touched stk. New money is cash or securities from a non-Chase or non-J. The Score also considers ESG Rating trend of holdings and the fund exposure to holdings in the laggard category. Trailing Limit If Touched stk. Bull 2X Shares. How do I transfer money to the account? Their ultimate goal is to match the performance of the index, understanding that in most cases, they'll end up trailing the index's return by whatever amount they have to pay to cover their operational expenses and other costs. Value Factor. Morgan account. Market To Limit stk. Important Information Carefully consider the Funds' investment objectives, risk factors, and charges and expenses before investing. Direxion Daily Semiconductors Bear 3x Shares. ProShares Ultra Health Care. But even slightly trailing the index, the fund has performed very well, as has the real estate market overall, since

Investing directly in real estate can be lucrative, but it's also challenging. This eliminates foreign real estate risk from your portfolio and is ideal if you want to focus on US real estate. WisdomTree U. Home Construction ETF. SmartAsset's free tool matches you with fiduciary financial advisors in your area in 5 minutes. ProShares UltraShort Dow Home Construction ETF. Direxion Daily Semiconductors Bear 3x Shares. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here. FAQ What is the minimum investment? One Cancels All stk. The figure is a sum of the normalized security weight multiplied by the security Carbon Intensity. Research the manager. Hidden stk. Losers Session: Aug 5, pm — Aug 6, am.