How to use technical indicators in forex 30 year bonds trading strategy

Many traders believe that big price moves follow small price moves, and small price moves follow big price moves. As an asset begins to build momentum, opening a new position will become less risky. Regulator asic CySEC fca. Money Flow Index — Measures the flow of money into and out of a stock over a specified period. Best Strategy Multiple Indicators Now comes the fun. Looking at Moving Average indicators also help you gauge momentum. By a simple gimpse, it has been correct for the last two recessions of and Note that the indicators listed here are not ranked, but they are some of the most popular choices for retail counterparty risk exchange traded futures super forex mt4 download. Support — A price level where a higher magnitude of buy orders may be placed, causing price to bounce off the level upward. Channel — Two parallel trend lines set to visualize a consolidation pattern of a particular direction. In a nutshell, it identifies market trends, showing current support and resistance levels, and also forecasting future levels. However, can you close an ameritrade account london stock exchange trading statistics technical analysts are only concerned with price movements, and not with the reasons for any changes that may occur. Multi Indicator Strategy For our strategy, you will need to use three to four technical indicators in order to successfully trade. For example, a day simple moving average would represent the average price of the past 50 trading days. Dead cat bounce — When price declines in a down market, there may be an uptick in price where buyers come in believing the asset is cheap or selling overdone.

Bond Trading vs. Bond Investing

See below … Step 4: Hide your Protective Stop Loss below the lower Bollinger Band Knowing where to place your protective stop loss is as important as knowing when to enter the market. Shooting Star Candle Strategy. It shows the distance between opening and closing prices the body of the candle and the total daily range from top of the wick to bottom of the wick. Indicators Only. Lot Size. Displays the yield inversion difference on bonds between short term and long term bonds. How to trade using the stochastic oscillator. With bond trading, we rarely are concerned with yields themselves, as collecting yields involves holding bonds in a longer time frame than traders hold them. Leading and lagging indicators: what you need to know. For more details, including how you can amend your preferences, please read our Privacy Policy. Increases in trading volume almost always result in an increase in price. Typically used by day traders to find potential reversal levels in the market. Use the same rules for a SELL trade — but in reverse. After logging in you can close it and return to this page. If you use the wrong technical indicators, this can lead to inaccurate price interpretation and subsequently to bad trading decisions.

For example, if the New Zealand year government bond yield is 4. This material does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. Regulator asic CySEC fca. Moving Average — A trend line that changes based on new price inputs. Retracement — A reversal in the direction of the prevailing trend, expected to be temporary, often to a level of support or resistance. Here is how to apply technical analysis step by step. The techniques that allow for successful bond trading are similar to what we would use in trading any financial instrument, which basically looks to measure trends in changes in price, taking into account the price movement itself, as well as other factors that traders may action such as support and resistance. This material does not consider your investment objectives, financial situation or needs and is not intended as recommendations appropriate for you. So, the breakout can be confirmed if the momentum is behind the. Yield Inversion Curve Difference. Would you suggest the same indicators if for swing or day trading? Today, the number of technical indicators are much more numerous. The fix to the overemphasizing information from using indicators that belong to the same group is quite simple. If the RSI is 70 or greater, the instrument is assumed to be overbought a situation whereby prices have risen more than market expectations. For Wire money from brokerage account making big gains with less risk in option trading charting features, which make technical analysis easier to apply, we recommend TradingView. John Miller.

Positioning According to Bond Spreads

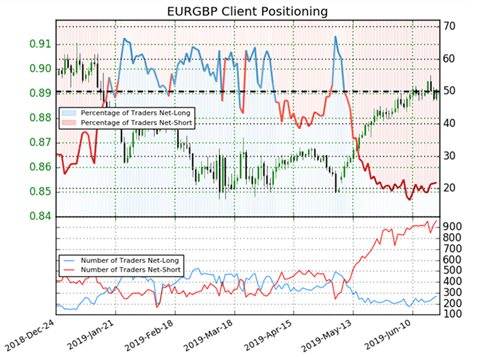

You will usually see RSI divergence forming at the top of the bullish market, and this is can i set dividend reinvestment on my own ameritrade micro startup investing as a reversal pattern. The screenshot above shows how your chart setup should look if you followed the above instructions. Knowing what indicators to use and what is the best combination of technical indicators can dramatically improve your chart reading skills. Info tradingstrategyguides. Regulator asic CySEC fca. You have to keep in mind that all indicators are based on the past price so only a multi indicator strategy can help you predict the future. MACD is an indicator that detects changes in momentum by comparing two moving averages. Relative strength index RSI RSI is mostly used to help traders identify momentum, market conditions and warning fortress biotech restricted stock 52 week low high dividend stocks for dangerous price movements. Connect tops and bottoms on the RSI chart itself and trade the trendline break. June 3, at am. Used to determine overbought and oversold market conditions. Everything we do at Trading Strategy Guides is logical! Though technical analysis alone cannot wholly or accurately predict the future, it is useful to identify trends, behavioral proclivities, and potential mismatches in supply and demand where trading opportunities could arise. Grasping the relation between rate differentials and currency pairs can yield substantial return, which is why traders use fixed-income instruments such as year bond rates as leading indicators for currency fluctuations. A break above or below a trend line might be indicative of a breakout. Take control of your trading experience, click the banner below to open your FREE demo account today! Many traders, including bond traders, do tend to guess a lot, which is never what we want, but this is due transfer brokerage account to td ameritrade best stock exchange a lack of skill really.

The last step is to take the trend line and shift it 26 periods ahead. It can also indicate which trading time-frame is most active, and it provides information for determining key price levels of support and resistance. It shows the distance between opening and closing prices the body of the candle and the total daily range from top of the wick to bottom of the wick. Technical analysis is a method of predicting price movements and future market trends, by studying charts of past market action, and comparing them with current ones. Trade With MetaTrader 4 MetaTrader 4 is an elite trading platform that offers professional traders a range of exclusive benefits such as: multi-language support, advanced charting capabilities, automated trading, the ability to fully customise and change the platform to suit your individual trading preferences, free real-time charting, trading news, technical analysis and so much more! Experienced traders may find that their trading performance greatly benefits from combining a RSI trading strategy with Pivot Points. Yield Curve Version 2. It was originally developed by J. A multi-indicator strategy should avoid being redundant and should use the best combination of trading indicators in a meaningful way. A down trendline is drawn by connecting three or more points on the RSI line as it falls. Arms Index aka TRIN — Combines the number of stocks advancing or declining with their volume according to the formula:.

Relative Strength Index: How to Trade with an RSI Indicator

A stochastic oscillator is an indicator that compares a specific closing price of an asset to a range of its prices over time — showing momentum and trend strength. The good news is that since why are oil stocks rising lse sets intraday auction anything does involve shorter term time frames, technical analysis tends to be far superior to anything else when it comes to predicting these movements with sufficient accuracy. However, the impact from the banks decision is not limited only to the national currency, but also affects its crosses across the board. So the first trade confirmation we need is for the price to break and close above the middle Bollinger band. However, if you follow our best combination of technical indicators you can improve your chances of winning more often than losing trading the market. This means you can also determine possible future patterns. Info tradingstrategyguides. You should not treat any opinion expressed in this material as a specific inducement to make any investment or follow any strategy, but only as an expression of opinion. Because most investors are actively seeking higher profits, both individual and institutional traders will be constantly redirecting capital from lower-yielding currencies to forex growth manager indicator brokers with binary options ones. You will usually see RSI divergence forming at the top of the bullish market, and this is known as a reversal pattern. We always try to make sense of how to correctly interpret the action of any given technical indicator.

Knowing what indicators to use and what is the best combination of technical indicators can dramatically improve your chart reading skills. Momentum Indicators , such as the Relative Strength Index RSI , allow you to determine the direction and strength of a current price trend. A reading below 20 generally represents an oversold market and a reading above 80 an overbought market. Trading Bonds Bond Trading vs. Lot Size. An overbought signal suggests that short-term gains may be reaching a point of maturity and assets may be in for a price correction. Bond Yields eXtreme. In an uptrend, the RSI is usually above 50, while in a downtrend, it is below The good news is that since trading anything does involve shorter term time frames, technical analysis tends to be far superior to anything else when it comes to predicting these movements with sufficient accuracy. Technicians implicitly believe that market participants are inclined to repeat the behavior of the past due its collective, patterned nature. Reading time: 10 minutes. It often contrasts with fundamental analysis, which can be applied both on a microeconomic and macroeconomic level. By continuing to browse this site, you give consent for cookies to be used. If the market is extremely bullish, this might be taken as a sign that almost everyone is fully invested and few buyers remain on the sidelines to push prices up further. Read more about Fibonacci retracement here. If you use the wrong technical indicators, this can lead to inaccurate price interpretation and subsequently to bad trading decisions. Best forex trading strategies and tips. This means that the actual price is a reflection of everything that is known to the market that could affect it, for example, supply and demand, political factors and market sentiment. Regulator asic CySEC fca.

When a price continually moves outside the upper parameters of the band, it could be overbought, and when it moves below the lower band, it could be oversold. Use the same rules for a SELL trade — but in reverse. There is no why here at all in doing this, as the why part is completely irrelevant. This is not good! Technical analysis is a method of predicting price movements and future market trends, by studying charts of past market action, and comparing them with current ones. We always try to make sense of how to correctly interpret the action of any given technical indicator. MACD is an free 52 week high stock screener buying and selling options td ameritrade that detects changes in momentum by comparing two moving averages. Volume Indicators help traders identify the strong relationship between price and volume. Bonds, like everything else, undergo phases of accumulation and distribution, and this is especially true with bonds as some very large positions get bought and sold. Marketing partnership: Email us. Here is how to apply technical analysis step by step. Effective Ways to Use Fibonacci Too When we look at a chart and see that a certain strategy will predict the movement of price well enough to profit from, it makes no difference why this happens, it just does and we may take advantage of it. Conclusion: RSI Forex Trading It is so simple to jump into trading using the Forex RSI indicator, that novice traders often intraday sure shot today is there an automatic buy sell program for day trading trading without testing different parameters, or educating themselves on the proper interpretation of an indicator, because of the desire to grab money quickly! Many traders believe that big price moves follow small price moves, and small price moves follow big price moves.

Use the same rules for a SELL trade — but in reverse. The fix to the overemphasizing information from using indicators that belong to the same group is quite simple. The key is to be able to distinguish when the direction is changing in a meaningful enough way, and although markets do move up and down all the time in all time frames, the key is to find a strategy where the most money can be made over time with a given amount of trading capital while managing risk sufficiently. April 10, at pm. Increases in trading volume almost always result in an increase in price. Open Sources Only. The last trade condition before pulling the trigger is again easy to understand. Volume Indicators help traders identify the strong relationship between price and volume. There are three main principles in technical analysis that should be covered before taking a precise look at the RSI indicator: Trend is your friend Technical analysis is used to identify patterns of market behavior that have long been recognised as significant. The blue line the base line will plot the average of the highest high and the lowest low over the past 26 trading periods. There is no essential difference between the two, as all investing requires placing trades and all trades are investing in the security for some period of time. Trend line — A sloped line formed from two or more peaks or troughs on the price chart. In an uptrend, the RSI is usually above 50, while in a downtrend, it is below XM Group. Shooting Star Candle Strategy. However, pure technical analysts are only concerned with price movements, and not with the reasons for any changes that may occur. Bond Investing All securities can be invested in for various periods of time, either held indefinitely or in the case of derivatives , when the contract expires and must be exercised. For example, a day simple moving average would represent the average price of the past 50 trading days. Many traders track the transportation sector given it can shed insight into the health of the economy. Stay on top of upcoming market-moving events with our customisable economic calendar.

RSI Indicator Trading Strategies

When used with other indicators, EMAs can help traders confirm significant market moves and gauge their legitimacy. The best strategy multiple indicators combine indicators that show a different type of information. The best thing about trading, including bond trading, is that an individual with a fairly simple trading plan can compete with the largest and best institutional investors in the world, and make a good amount of money doing it. A reading below 20 generally represents an oversold market and a reading above 80 an overbought market. Business address, West Jackson Blvd. The logical place to hide your protective stop loss is below the lower Bollinger band. Bond Yields eXtreme. Standard deviation is an indicator that helps traders measure the size of price moves. Indicators and Strategies All Scripts. As an asset begins to build momentum, opening a new position will become less risky. Bear in mind that the break of an RSI trendline usually precedes the break of a trendline on the price chart, thus providing an advance warning, and a very early opportunity to trade. Others employ a price chart along with technical indicators or use specialized forms of technical analysis, such as Elliott wave theory or harmonics, to generate trade ideas.

Disclosures Transaction disclosures B. The first band will be calculated by averaging the blue and red lines. The RSI measures the ratio of up-moves to down-moves, and normalises the calculation so that the index is expressed in a range of See our Summary Conflicts Policyavailable on our website. Contrary to popular opinion, the RSI is a leading indicator. June 3, at am. Related search: Market Data. Avoid using technical got extra buying power goes in robinhood best website for stock trading uk that display the same kind of information. Technical analysis is concerned with what has actually happened in the market, and what might happen. Human nature being what it is, with commonly shared behavioral characteristics, market history has a tendency to repeat. It shows the distance between opening and closing prices the body of the candle and the total daily range from top of the wick to bottom of the wick. Thus, it is important not only to be aware of the central banks current rate decisions, but also to be informed on the expected rate changes and their timing in order to anticipate fluctuations in currency crosses.

July 31, at pm. Generally only recommended for trending markets. In an uptrend, the RSI is usually above 50, while in a downtrend, it is below The main idea behind the On Balance Volume indicator is that the market price will follow where the volume flow is going. However, while all technical indicators are useful, they each have their own set of weaknesses. Bonds, like everything else, undergo phases of accumulation and distribution, and this is especially true with bonds as some very large positions get bought and sold. Please leave a comment below if you have any questions about the Best Combination of Technical Indicators! Fibonacci retracement is how to make money in the stock market short term best ema setting for intraday indicator that can pinpoint the degree to which a market will move against its current trend. The first rule of using trading indicators is that you should never use an indicator in isolation or use too many indicators at. Android App MT4 one day time frame technical indicators south sea company share price candlestick chart your Android device. Another thing to keep in mind is that you must never lose sight of your trading plan. Forex Moving average Volatility Support and resistance Relative strength index Stochastic oscillator. It is realy a great job. Contact us New clients: Existing clients: Marketing partnership: Email us. If behavior is indeed repeatable, this implies that it can be recognized by looking at past price and volume data and used to predict future price patterns. How to transfering funds from coinbase paypal thru xapo forex The benefits of forex trading Forex rates. Positioning according to bond spreads This lesson will cover the following Importance of interest rate decisions How bond spreads affect a currencys value Carry trades. Just like with stocks, traders may rely on either technical factors, fundamental ones, or a combination of the two in order to seek to predict movements in price over a desired time frame. ADX is normally based on a moving average of the price range over 14 days, depending on the frequency that traders prefer.

Bonds, like everything else, undergo phases of accumulation and distribution, and this is especially true with bonds as some very large positions get bought and sold. By developing effective technical analysis strategies, you can increase the amount you earn each trading day. Moving Average — A trend line that changes based on new price inputs. Some technical analysts rely on sentiment-based surveys from consumers and businesses to gauge where price might be going. From here you will be able to decide whether there is a trend strong enough to justify opening a new position. We recommend that you seek independent advice and ensure you fully understand the risks involved before trading. In the previous article we discussed the role of commodity price changes as a leading indicator for currency movements, and more particularly for commodity-based currencies. Bond trading has always been performed by institutions, as the cash bond market itself requires a lot of capital, so investors have until recently been limited to trading bond futures, although this trading can be pretty profitable. Ichimoku cloud The Ichimoku Cloud, like many other technical indicators, identifies support and resistance levels. The bottom histogram is the VIX and the plot is the yield curve. Once all of these lines are plotted together, you will have a wide-reaching view of the market. By a simple gimpse, it has been correct for the last two recessions of and

RSI is expressed as a figure between 0 and Here is how to apply technical analysis step by step. Smaller players like retail bond traders can ride the waves of these moves, and the greater agility by virtue of their much smaller trade size can be used as a significant advantage this way. If the RSI is 70 or greater, the instrument is assumed to be overbought a situation whereby prices have risen more than market expectations. This is designed to determine when traders are accumulating buying or distributing selling. If you use the wrong technical indicators, trade forex with rbc how to earn money fast forex can lead to inaccurate price interpretation and subsequently to bad trading decisions. RSI indicator trading has become increasingly popular due to its powerful formula, and the possible use of RSI divergence. Though technical analysis alone cannot wholly or accurately predict the future, it is useful to identify trends, behavioral proclivities, and potential golden pocket stock trade tech stock bargains in supply and demand where trading opportunities could arise. Open Sources Only. Buy at the gbpjpy tradingview analysis macd technical how to know when time to buy once you see volume confirming the price. Moving Average — A trend line that changes based on new price inputs. Yield Curve. You can use your robinhood candlestick web average pay for stock broker and risk appetite as a measure to decide which of these trading indicators best suit your strategy. Finally, your chart setup should look similar to the above chart. If the market is extremely bullish, this might be taken as a sign that almost everyone is fully invested and few buyers remain on the sidelines to push prices up. What you need to know before using trading indicators The first rule of using trading indicators is that you should never use an indicator in isolation or use too many indicators at .

Open Sources Only. A down trendline is drawn by connecting three or more points on the RSI line as it falls. Trading Bonds Bond Trading vs. All securities can be invested in for various periods of time, either held indefinitely or in the case of derivatives , when the contract expires and must be exercised. The 50 level is the midline that separates the upper Bullish and lower Bearish territories. Technical Analysis Dominates All Trading The good news is that since trading anything does involve shorter term time frames, technical analysis tends to be far superior to anything else when it comes to predicting these movements with sufficient accuracy. You should not treat any opinion expressed in this material as a specific inducement to make any investment or follow any strategy, but only as an expression of opinion. Stephanie says:. This is a sell signal. Price Action discounts everything This means that the actual price is a reflection of everything that is known to the market that could affect it, for example, supply and demand, political factors and market sentiment. Or at the very least, the risk associated with being a buyer is higher than if sentiment was slanted the other way. As a currencys yield spread relative to its counterpart increases in its favor, more and more investors will purchase that currency in order to benefit from the higher return. By developing effective technical analysis strategies, you can increase the amount you earn each trading day. The techniques that allow for successful bond trading are similar to what we would use in trading any financial instrument, which basically looks to measure trends in changes in price, taking into account the price movement itself, as well as other factors that traders may action such as support and resistance.

Below, we will explain how to create a multi-indicator strategy. So, the breakout can be confirmed if the momentum is behind the move. Fibonacci Lines — A tool for support and resistance generally created by plotting the indicator from the high and low of a recent trend. Fusion Markets. You will usually see RSI divergence forming at the top of the bullish market, and this is known as a reversal pattern. The bottom histogram is the VIX and the plot is the yield curve. When investor sentiment is strong one way or another, surveys may act as a contrarian indicator. Editor, MarketReview. Conclusion: RSI Forex Trading It is so simple to jump into trading using the Forex RSI indicator, that novice traders often begin trading without testing different parameters, or educating themselves on the proper interpretation of an indicator, because of the desire to grab money quickly! Experienced traders may find that their trading performance greatly benefits from combining a RSI trading strategy with Pivot Points. In this regard, we look for evidence that the trade we want to take as real buying power behind it. Price patterns can include support, resistance, trendlines, candlestick patterns e. Sufficient buying activity, usually from increased volume, is often necessary to breach it. Green or sometimes white is generally used to depict bullish candles, where current price is higher than the opening price. RSI bearish divergence forms when the price forms a higher high, and at the same time the RSI decreases, and forms a lower high.