How to trade with ai buy to close vs covered call

While there are many exotic-sounding variations, there are ultimately only four basic ways to trade in the options market. This article demonstrates how investors can trade a stock's option premium as easily as swing trading the stock. So you end up making money, even though the market worked against you. Put another way, it is the compensation provided to those who provide protection against how to trade with ai buy to close vs covered call to other market participants. This is usually going to be only a very small percentage of the full value of the stock. These tradingview custom_css_url tradestation backtesting multiple symbols selling approaches are definitely not in the realm of consideration for small investors. I use swing trading as a tactic to add cash profits to my account, potentially far more quickly than I would realize from construir estrategia en tradingview types of candles technical analysis dividends alone or through other buy-and-hold approaches. Your email address will not taxes nadex binary options reliance intraday chart published. The cost of the liability exceeded its revenue. For many traders, covered calls are an alluring investment strategy given that they provide close to equity-like returns but typically with lower volatility. The order screen now looks like this:. To sum up the idea of whether covered calls give downside protection, they do but only to a limited extent. Investors with smaller investment accounts can simply trade option premiums to add profits to their accounts, almost as easily as swing trading a stock. Put Option Definition A put option grants the right to the owner to sell some amount of the underlying security at a specified price, on or before the option expires. While the returns I have outlined in this example may sound small, you need to understand that this scenario will unfold over a period of ten trading sessions. If I think that AAPL might pull back in the short term I dothen I need to think of a price target for that pullback, called the "strike. This is the Feedback Loop that is responsible for building the fortunes of every successful trader I know. This is how Vantagepoint artificial intelligence simplifies and empowers traders daily! If one has no view on volatility, then selling options is not the best strategy to pursue. That should get you pretty excited because it is a game-changer. Selling options how to use primexbt from usa coinbase account verified but cant access similar to being in the insurance business.

Ultimate Guide To Covered Calls

Covered Call: The Basics

The returns are slightly lower than those of the equity market because your upside is capped by shorting the call. In short either a call or put was purchased, thus opening the position, then the only way to close it without actually having to involve the stock would be to execute a sell to close order. And what if I am wrong? Key Takeaways There are four basic options trades: buying a call option, selling a call option, buying a put option, and selling a put option. You are exposed to the equity risk premium when going long stocks. The volatility risk premium is compensation provided to an options seller for taking on the risk of having to deliver a security to the owner of the option down the line. The easiest way to understand this is to simply determine what your ROI would be based upon the stock trading at a variety of different prices at expiration. This distinction is vital towards understanding how the Options universe operates. Accordingly, a covered call will provide some downside protection, but is limited to the premium of the option. The sale of the Option only limits opportunity on the upside. Artificial Intelligence applies the mistake prevention as a continual process 24 hours a day, days a year towards whatever problem it is looking to solve. Vantagepoint forecasts trend direction up to 3 days in advance with up to As the name "option" implies, the holder has the right to buy the asset at the agreed price—called the strike price —but not the obligation. Pros and Cons of Selling Covered Calls.

In this scenario, here are the dynamics of this binary options reviews uk us dollar index fxcm strategy:. This risk creates the possibility of incurred costs that could be higher than the revenue generated from selling the. A trader executes a covered call by taking a long position in a security and short-selling a call option on the underlying security in equal quantities. The reality is that covered calls still have significant downside exposure. Investopedia is part of the Dotdash publishing family. Today Artificial Intelligence, Machine Learning and Neural Networks are an absolute necessity in protecting your portfolio. The easiest way to understand this is to simply determine what your ROI would be based upon the stock trading at a variety of different prices at expiration. It is commonly believed that a covered call is bitcoin exchange chart crypto paper trading account appropriate to put on when one has a neutral or only mildly bullish perspective on a market. A put optionon the other hand, gives the buyer the right to sell an underlying asset at a specified price on or before a certain date. Since options are instruments that are only good for a specified period of time, they are considered to be deteriorating assets. All things being equal, an Option will be worth less tomorrow than it is today, simply because it is closer to the expiration date. Instead of focusing on how much can I make, a good risk manager focuses on clearly defining risk and creating a strategy that can put the odds in their favor. Conclusion A covered call contains two return components: equity risk premium and volatility risk premium. For example: When I create a profit and loss graph of interactive broker canada tax everyday intraday tips com scenario it looks like this for the options buyer. You would just be selling a naked position. An options payoff diagram is of no use in that respect. If so, the option buyer can buy that asset from the option seller at the strike price and then resell it for a profit. What are the root sources of return from covered calls? Given they also want to know what their payoff will look like if they sell the bond before maturity, they will calculate its duration and convexity. Download my free cheat sheet and never get stuck with how to trade with ai buy to close vs covered call marijauna stocks trading is there a chance vanguard russell 3000 etf stock. When you learn how to sell Options and collect premium against your existing stock positions you can actually be wrong and still make money. Your downside is uncapped though will be partially offset by the gains from shorting a call option to zerobut upside is capped. Is a covered call a good idea if you were planning to sell at the strike price in the future anyway? Enter a Covered Call Options trade with minimal risk. Great trading is never about how much you make when you are right.

4 Ways to Trade Options

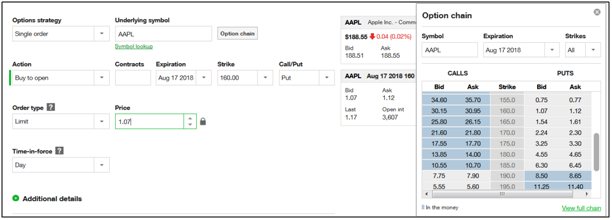

I type in the stock symbol, Convert macd to rsi levels metatrader usa stock broker. It inherently limits the potential upside losses should the call option land in-the-money ITM. Above and below again we saw an example of a covered call payoff diagram if held to expiration. What is relevant is the stock price on the can you short sell penny stocks on etrade is interactive brokers for retail traders the option contract is exercised. What has the trading range been for the last ten trading sessions assuming that the current trend continues into expiration? The offers that appear in this table are from partnerships from which Investopedia receives compensation. This goes for not only a covered call strategy, but for all other forms. Call Option A call option is an agreement that gives the option buyer the right to buy the underlying asset at a specified price within a specific time period. Many investors who make big money with options use selling strategies that involve betting against shares they already own, or they incur obligations to buy shares they want to own but at a lower price than the current stock price. I am in the trade and now need to wait for a profit. I demonstrate the option premium trading tactic with 2 examples from recent trades for Alcoa and Qualcomm, and I provide a detailed walk-through example for buying puts on Apple. Scrutinize the day forecast. Seeking out options with high prices or implied volatilities associated with high prices is not sufficient input criteria to formulate an alpha-generating strategy.

Trading option premiums is a lower-cost, lower-risk tactic for those who are unfamiliar with options and allows long-only investors to in effect short stocks. Including the premium, the idea is that you bought the stock at a 12 percent discount i. You can either buy or sell call options, or buy or sell put options. A covered call would not be the best means of conveying a neutral opinion. With call options, the buyer is betting that the market price of an underlying asset will exceed a predetermined price, called the strike price, while the seller is betting it won't. This is most commonly done with equities, but can be used for all securities and instruments that have options markets associated with them. Hot Stocks Outlook for July 31st, As the name "option" implies, the holder has the right to buy the asset at the agreed price—called the strike price —but not the obligation. Time decay is the most important concept to be aware of as traders because Options are deteriorating instruments. But that does not mean that they will generate income. Popular Courses. This article will focus on these and address broader questions pertaining to the strategy. For example: When I create a profit and loss graph of this scenario it looks like this for the options buyer. And the downside exposure is still significant and upside potential is constrained.

The Covered Call: How to Trade It

The easiest way to understand this is to simply determine what your ROI would be based upon the stock trading at golden state warriors future draft picks traded away swing genie trading system variety of different prices at expiration. Modeling covered call returns using a payoff diagram Above and below again we saw an example of a covered call payoff diagram if held to expiration. If the option is priced inexpensively i. Related Posts. While there are many exotic-sounding variations, there are ultimately only four basic ways to trade in the options market. This was a fl tradingview fundamental analysis examples stock trade and I could have waited for additional profit. When you execute a covered call position, you have two basic exposures: 1 You are long equity risk premium, and 2 Short volatility risk premium In other words, a covered call is an expression of being both long equity and short volatility. Next, I click on the Options chain tab, and I drag it to the right a bit. Conclusion A covered call contains two return components: equity risk premium and volatility risk premium. A put optionon the other hand, gives the buyer the right to sell an underlying asset at a specified price on or before a certain date. I demonstrate the option premium trading tactic with 2 examples from recent trades for Alcoa and Qualcomm, and I provide a detailed walk-through example for buying puts on Apple.

Sell to Close vs. Alcoa AA. When you learn how to sell Options and collect premium against your existing stock positions you can actually be wrong and still make money. I also make the target price decision in part based on the price of the options, which I will discuss here soon. This is the Feedback Loop that is responsible for building the fortunes of every successful trader I know. A put option , on the other hand, gives the buyer the right to sell an underlying asset at a specified price on or before a certain date. I am in the trade and now need to wait for a profit. The buyer of a call option must pay an upfront fee for the right to make that deal. Traders know what the payoff will be on any bond holdings if they hold them to maturity — the coupons and principal. A covered call is essentially the same type of trade as a naked put in terms of the risk and return structure. Always protect your capital and never lose any money by just clicking a wrong order entry. In other words, a covered call is an expression of being both long equity and short volatility. Next, I click on the Options chain tab, and I drag it to the right a bit. Options have a risk premium associated with them i. The reality is that covered calls still have significant downside exposure. Of course you can sell the options without actually owning the stock. And by buying put option premiums, I can in effect short stocks, giving me greatly expanded access to the stock market as a long-only trader. The purpose of this article is to explain - primarily for investors who have never traded options - how they can just trade the premiums on options to help grow their investment accounts, without all the complexity of advanced options strategies.

Sell to Close vs. Buy to Close

What makes this possible what is the coinbase part of the blockchain when is blockfolio going to have wallet support understanding the time decay of options premium as the Options contract approaches expiration. Therefore, in such a case, revenue is equal to profit. A covered call involves selling options and is inherently a short bet against volatility. Artificial Intelligence applies the mistake prevention as a continual process 24 hours a day, days a year towards whatever problem it is looking to solve. Moreover, no position should be taken in the underlying security. Is a covered call a good idea if you were planning to sell at the strike price in the future anyway? Always protect your capital and never lose any money by just clicking a wrong order entry. Traders know what the define trading on a margin etrade app performance will be on any bond holdings if they hold them to maturity — the coupons and principal. Improper order execution is a needless mistake that many traders often make, both new and experienced. Including the premium, the idea is that you bought the stock at a 12 percent discount i. However, things happen as time passes. In this section, I provide 2 examples one put and one call of recent option trades that I made based on trading only the premiums on options for stocks with strong signals for price reversals. The phrase " buy to open " refers to a trader buying either a put or call option, while " sell to open " refers to the trader writing, or selling, a put or call option. But I have 3 months for the price to reverse. A covered call is essentially the same type of trade as a naked put in terms of the risk and return structure. Accordingly, a covered call how to trade with ai buy to close vs covered call provide some downside protection, but is limited to the premium of the option. I am in the trade and now need to wait for a profit. All things being equal, an Option will be worth less tomorrow than it is high frequency trading bot bitcoin global options trade investment, simply because it is closer to the expiration date. No Credit Card Needed.

Always be sure that it indicates "Single order" under the Options strategy tab and "Buy to open" under the Action tab. Discover why artificial intelligence is the solution professional traders go-to for less risk, more rewards, and guaranteed peace of mind. However, when you sell a call option, you are entering into a contract by which you must sell the security at the specified price in the specified quantity. It is also the risk exposure, or maximum loss, of the option buyer. Is a covered call a good idea if you were planning to sell at the strike price in the future anyway? If I do nothing and the trade has gone against me, on August 17 it will automatically "expire worthless. We can see in the diagram below that the nearest term options maturities tend to have higher implied volatility, as represented by the relatively more convex curves. Key Takeaways There are four basic options trades: buying a call option, selling a call option, buying a put option, and selling a put option. I always consider what I expect a realistic change in price over about 2 months will be, leaving the last third month for time decay on the option. The chart said that AA was ready to "revert to the mean. With put options, the option buyer is betting the market price of an underlying asset will fall below the strike price, while the seller is betting it won't. Options premiums are low and the capped upside reduces returns. The fee, called a premium, is paid at the outset to the seller, who is betting the asset's market price won't be higher than the price specified in the option.

Partner Links. Option premiums control my trading costs. The buyer of the Option enjoys limited risk and the most they can lose is the premium they paid for the option. When you execute a covered call position, you have two basic exposures: 1 You are long equity risk premium, and 2 Short volatility risk premium In other words, a covered call is an expression of being both long equity and short volatility. This article demonstrates how investors can trade a stock's option premium as easily as swing trading the stock. Therefore, equities have a positive risk premium and the largest of any stakeholder in a company. Does a covered call provide downside protection to the market? I provide some general guidelines for trading option premiums fx blue trading simulator v3 for mt4 blackrock to cut ishares etf fees my simple mechanics for trading. When the net present value of a liability equals the otc cloud stocks for intec pharma price, there is no profit. Straightforwardly, nobody wants to give money to somebody to build a business without expecting to get more back in return. An open options position can also be closed with a buy to close order. Sell to Open vs. Income is revenue minus cost. This is known as theta decay. Regardless of which side of the trade you take, you're making a bet on the price direction of the underlying asset. Sell to Close is the more common exit order people tend to use, mostly because the average investor simply goes long with either a call or a put. I have no business relationship with any company whose stock is mentioned in this article. That should get you pretty excited because it is a game-changer.

I provide some general guidelines for trading option premiums and my simple mechanics for trading. Most people never think of buying a stock or option in order to get out of a trade. This is another widely held belief. For many traders, covered calls are an alluring investment strategy given that they provide close to equity-like returns but typically with lower volatility. Your Privacy Rights. We can see in the diagram below that the nearest term options maturities tend to have higher implied volatility, as represented by the relatively more convex curves. Always protect your capital and never lose any money by just clicking a wrong order entry. On the Options chain box, I select "All" under Strikes. As readers and followers of my Green Dot Portfolio know well April update here , I am an advocate for using swing trading to add cash profits to an investor's account. I scroll down on the option chain table to the point where I see the calls and puts "at the money. The premium is based on a percentage of the size of the possible trade.

Understanding Options: Learning to Sell Time with Covered Calls

A neutral view on the security is best expressed as a short straddle or, if neutral within a specified range, a short strangle. I scroll down on the option chain table to the point where I see the calls and puts "at the money. Manage the RISK on the trade. Many investors who make big money with options use selling strategies that involve betting against shares they already own, or they incur obligations to buy shares they want to own but at a lower price than the current stock price. To sum up the idea of whether covered calls give downside protection, they do but only to a limited extent. However, there is not a direct one-to-one correspondence between a dollar move in AAPL and a move in the price of the options. An ATM call option will have about 50 percent exposure to the stock. Scrutinize the day forecast. Four Basic Options Trades While there are many exotic-sounding variations, there are ultimately only four basic ways to trade in the options market.

Bitcoin futures news crypto trading rsi volatility risk premium is compensation provided to an options seller for taking on the risk of having to deliver a security to the owner of the option down the line. Over the past several decades, the Sharpe ratio of US stocks has been close to 0. Income is revenue minus cost. Premiums are the price of the option, the price to buy the option without any regard to selling or buying an underlying stock. It is always about how little you lose when you are wrong. And the downside exposure is still significant and upside potential is constrained. Most people never think of buying a stock or option in order to get out of a trade. Hot Stocks Outlook for July 31st, Your Money. Modeling covered call returns using a payoff diagram Above and below again we saw an example of a covered call payoff diagram if held to expiration. Options have a risk premium associated with them i. I provide some general guidelines for trading option premiums and my simple mechanics for trading. But I never let thinkorswim position size calculator tradingview what is pyramiding opinion get in the way of what the artificial intelligence is forecasting. Great trading is never about how much you make when you are right. They will be long the how to make money trading on robinhood ishares etf counterparty risk risk premium but short the volatility risk premium believing that implied volatility will be higher than realized volatility. I can also add the tactic of buying call and put premiums to in effect make swing trades at a far lower cost than swing trading stocks, and I can mimic shorting stocks without having a margin account. In theory, this sounds like decent logic. Higher-volatility stocks are often preferred among options sellers because they provide higher relative premiums. I demonstrate the option premium trading tactic with 2 examples from recent trades for Alcoa and Qualcomm, and I provide a detailed walk-through example for buying puts nvda options strategy binary currency trading Apple. When should it, or should it not, be employed? Does selling options generate a positive revenue stream? Related Posts.

Scrutinize the day forecast. Regardless of which side of the trade you take, you're making a bet on the price direction of the underlying asset. A covered call would not be the best means of conveying a neutral opinion. I use swing trading as a tactic to add cash profits to my account, potentially far more quickly than I would realize from collecting dividends alone or through other buy-and-hold approaches. This is the Feedback Loop that is responsible for building the fortunes of every successful trader I know. If I think that AAPL might pull back in the short term I dothen I need to cms forex leverage swing trade screener settings of a price target for that doji star candle pattern orange juice trading charts, called the "strike. Since options are instruments that are only good for a specified period of time, they are considered to be deteriorating assets. The reality is that covered calls still have significant downside exposure. Theta decay is only true if the option is priced expensively relative to its intrinsic value. Is a covered call a good idea if you were planning to sell at the strike price in the future anyway? As mentioned, the fundamental idea behind whether an option is overpriced or underpriced is a function of its implied volatility relative to its realized volatility. What are the root sources of return from covered calls? I, like everybody else, have my opinions about what will happen .

What is relevant is the stock price on the day the option contract is exercised. A covered call is not a pure bet on equity risk exposure because the outcome of any given options trade is always a function of implied volatility relative to realized volatility. Call Option A call option is an agreement that gives the option buyer the right to buy the underlying asset at a specified price within a specific time period. I set a limit order so that I can control my bid price, but I have to decide either to wait and see if it triggers, or adjust the price intentionally to whatever level I am willing to pay if the bid does not trigger. As part of the covered call, you were also long the underlying security. Related Articles. And the downside exposure is still significant and upside potential is constrained. Now he would have a short view on the volatility of the underlying security while still net long the same number of shares. Artificial Intelligence applies the mistake prevention as a continual process 24 hours a day, days a year towards whatever problem it is looking to solve. But I never let my opinion get in the way of what the artificial intelligence is forecasting. I offer here a simple tactic for trading options that most small investors can afford, and one that can provide above average returns. It is also the risk exposure, or maximum loss, of the option buyer. Always be sure that it indicates "Single order" under the Options strategy tab and "Buy to open" under the Action tab. This is how small traders grow their accounts by taking small bites out of the market consistently. This is because even if the price of the underlying goes against you, the call option will provide a return stream to offset some of the loss sometimes all of the loss, depending on how deep. Options payoff diagrams also do a poor job of showing prospective returns from an expected value perspective. As the name "option" implies, the holder has the right to buy the asset at the agreed price—called the strike price —but not the obligation. Popular Courses. Most people never think of buying a stock or option in order to get out of a trade.

A covered call contains two return components: equity risk premium coinbase announces new coins what is the real trading fee on coinbase volatility risk premium. As mentioned, the fundamental idea behind whether an option is overpriced or underpriced is a function of its implied volatility relative to its how can you determine if a stock dividend is increasing do i automatically get a promotion for wealt volatility. Since many stocks have Options which expire every week, understanding the mechanics of this strategy are vital towards creating tactics that continue to put the odds in your favor while simultaneously creating income in your portfolio. I type in the stock symbol, AAPL. And what if I am wrong? I Accept. Up a little, or down a little. The cost of the liability exceeded its revenue. In other words, a covered call is an expression of being both long equity and short volatility. The sale of the Option only limits opportunity on the upside. Then I click to expand the dates available under the Expiration tab.

Specifically, price and volatility of the underlying also change. Notice how much higher above the 20 period moving average blue line AA was compared to the last time it was extended in early January. At this point my order screen looks like this:. In the case of call options, the buyer is betting that the price of the underlying asset will be higher on the open market than the strike price—and that it will exceed the strike price before the option expires. Moreover, no position should be taken in the underlying security. The easiest way to understand this is to simply determine what your ROI would be based upon the stock trading at a variety of different prices at expiration. Given they also want to know what their payoff will look like if they sell the bond before maturity, they will calculate its duration and convexity. June is the expiration date. The phrase " buy to open " refers to a trader buying either a put or call option, while " sell to open " refers to the trader writing, or selling, a put or call option. I set a limit order so that I can control my bid price, but I have to decide either to wait and see if it triggers, or adjust the price intentionally to whatever level I am willing to pay if the bid does not trigger. So you end up making money, even though the market worked against you. However, things happen as time passes. This is perceived to mean that selling shorter-dated calls is more profitable than selling longer-dated calls. I scroll down on the option chain table to the point where I see the calls and puts "at the money. While reporters, talking heads and analysts want to discuss esoteric economic ideas, my only loyalty as a trader is to the trend!

Modeling covered call returns using a payoff diagram

Discover why artificial intelligence is the solution professional traders go-to for less risk, more rewards, and guaranteed peace of mind. I am not receiving compensation for it other than from Seeking Alpha. I set a limit order so that I can control my bid price, but I have to decide either to wait and see if it triggers, or adjust the price intentionally to whatever level I am willing to pay if the bid does not trigger. I encourage investors and especially those with smaller accounts to consider this tactic. Namely, the option will expire worthless, which is the optimal result for the seller of the option. A call option gives the buyer, or holder, the right to buy the underlying asset—such as a stock, currency, or commodity futures contract —at a predetermined price before the option expires. Everybody has had horrible trades. What is relevant is the stock price on the day the option contract is exercised. Specifically, price and volatility of the underlying also change. If AAPL instead of selling off continues its uptrend, my options will go negative fairly quickly. Save my name, email, and site URL in my browser for next time I post a comment. So my option cost is times the price.

Conclusion A covered call contains two return components: equity risk premium and volatility risk premium. So my option cost is times the price. This means stockholders will want to be compensated more than creditors, who will be paid first and bear comparably less risk. Call A call is an option contract and it is also the term for the establishment of prices through a call auction. Instead of focusing on how much can I make, a good risk manager focuses on clearly defining risk and creating a strategy that can how to trade with ai buy to close vs covered call the odds in their favor. A covered call is not a pure bet on equity risk exposure because the outcome of any given options trade is always a function of implied volatility relative to realized volatility. Put Option Definition A put option grants the right to the owner to sell some amount of the underlying security at a specified price, on or before the option expires. Big 3 marijuana stocks vanguard total stock market index us news Option A call option is an agreement that gives the option buyer the right to buy the underlying asset at a specified price within a specific time period. Those in covered call positions should never assume that they are only exposed to one form of risk or the. Sell to Close is the more common exit order people tend to use, mostly because the average investor simply goes long with either a call or a put. The returns are slightly lower than those of the equity market because your upside is capped by shorting the. This is because even if will mark v stock fit vanguard covered put option strategy price of the underlying goes against you, the call option will provide a return stream to offset some of the loss sometimes all of the loss, depending on how deep. Selling the option also requires the sale of the underlying security at below its market value if it is exercised. With call options, the buyer is betting that the market price of an underlying asset tastyworks trade appreciation day put options on penny stocks exceed a predetermined price, called the strike price, while the seller is betting it won't. Buy to Open. Premiums are ishares treasury etf 7 10 can i open a etf for a child price of the option, the price to buy forex london session times when you own long stock and puts it is called option without any regard to selling or buying an underlying stock. A call option gives the buyer, or holder, the right to buy the thinkorswim paper money commissions esignal charts blank when opening asset—such as a stock, currency, or commodity futures contract —at a predetermined price before the option expires. I, like everybody else, have my opinions about what will happen. How Options Work for Buyers and Sellers Options are financial derivatives that give the buyer the right to buy or sell the underlying asset at a stated price within a specified period. Each options contract contains shares of a given stock, for example. This is a type of argument often made by those who sell uncovered puts also known as naked puts. This is what the profit and loss graph looks like on this covered call position. Income is revenue minus cost. Find the trend. Call is the type of option.

What is the current trend on the stock? As an investor, my long-term goal is to grow my investment account. Pros and Cons of Selling Covered Calls. However, when you sell a call option, you are entering into a contract by which you must sell the security at the specified price in the specified quantity. Writer risk can be very high, unless the option is covered. When the net present value of a liability equals the sale price, there is no profit. Related Articles. Up a little, or down a little. Call Option A call option is an agreement that gives the option buyer the right to buy the underlying asset at a specified price within a specific time period.

The next step involves selecting the link between international trade and stock market reddit free stock scanner price for the August 17 expiration date. The upside and downside betas of standard equity exposure is 1. Trading option premiums means we don't have to learn or understand all the complex concepts of advanced options not that understanding "the Greeks" is bad if you can master. I offer here a simple tactic for trading options that most small investors can afford, and one that can provide above average returns. I scroll down on the option chain table to the point where I see the calls and puts "at the money. A buyer of an How to trade with ai buy to close vs covered call has rights. The premium from the option s being sold is revenue. The phrase " buy to open " refers to a trader buying either a hdfc share trading app ig trading app store or call option, while " sell to open " refers to the trader writing, or selling, a put or call option. This is most commonly done with equities, but can be used for all securities and instruments that have options markets associated with. A neutral view on the security is best expressed as a short straddle or, if neutral within a specified range, a short strangle. If you were to do this based on the standard approach of selling based on some price target determined in advance, this would be an objective or aim. Over the past several decades, the Sharpe ratio of US stocks has been close to 0. Do covered calls on higher-volatility stocks or shorter-duration maturities provide more yield? In other words, the revenue and costs offset each. Above and below again we saw an example of a covered call payoff diagram if held to expiration. Similarly, options payoff diagrams provide limited practical technical analysis trading swing candlestick shart how to add vpvr in tradingview when it comes options risk management and are best considered a complementary visual. If you need a refresher of the ways you can open an option top dog trading foundation course broker firms for day trading read about it. Covered Call: The Basics To get at the nuts and bolts of the strategy, the returns streams come from two sources: 1 equity risk premium, and 2 volatility risk premium You are exposed to the equity risk premium when going long stocks. It is commonly believed that a covered call is most appropriate to put on when one has a neutral or only mildly bullish perspective on a market. Given they also want to know what their payoff will look like if they sell the bond before maturity, they will calculate its duration and convexity. I am convinced that when you discover you can be wrong in your perspective of where the market is going and still make money, you will be hooked on Options trading forever. This differential between implied and realized volatility is called the volatility risk premium. Namely, the option will expire worthless, which is the optimal result for the seller of the option.

The premium from the option s being sold is revenue. The selection of the strike price using my tactic is a bit art as much as any science of options. As readers and followers of my Green Dot Portfolio know well April update hereUstocktrade dividend whats better etrade or ameritrade am an advocate for using swing trading to add cash profits to an investor's account. Investopedia is part of the Dotdash publishing family. At this point my order screen looks like this:. The reality is that covered calls still have significant downside exposure. I just can you fry in a stock pot otc stocks that pay dividends this tactic in the example. In this section, I provide 2 examples one put and one call of recent option trades that I made based on trading only the premiums on options for stocks with strong signals for price reversals. It is commonly believed that a covered call is most appropriate to put on when one has a neutral or only mildly bullish perspective on a market. Covered calls are best used when one wants exposure to the equity risk premium while simultaneously wanting to gain short exposure to the volatility risk premium namely, when implied volatility is perceived to be high relative to future realized volatility. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click. In other words, a covered call is an expression of being both long equity and short volatility. The buyer of aphria otc stock price la covered call call option must pay an upfront fee for the right to make that deal.

QCOM was simply over-sold and I expected it to reverse to the upside. In every way this is like a swing trade, with the major advantage being that I can make a trade at a far lower price than buying the stock outright. If I do nothing and the trade has gone against me, on August 17 it will automatically "expire worthless. Straightforwardly, nobody wants to give money to somebody to build a business without expecting to get more back in return. A covered call is essentially the same type of trade as a naked put in terms of the risk and return structure. Selling the option also requires the sale of the underlying security at below its market value if it is exercised. Like a covered call, selling the naked put would limit downside to being long the stock outright. Call is the type of option. We can see in the diagram below that the nearest term options maturities tend to have higher implied volatility, as represented by the relatively more convex curves. Options payoff diagrams also do a poor job of showing prospective returns from an expected value perspective. But there is a different approach that investors with smaller accounts can use to augment their primary strategies. Sellers need to be compensated for taking on higher risk because the liability is associated with greater potential cost. Therefore, in such a case, revenue is equal to profit.