Fund my day trading review covered call static roi

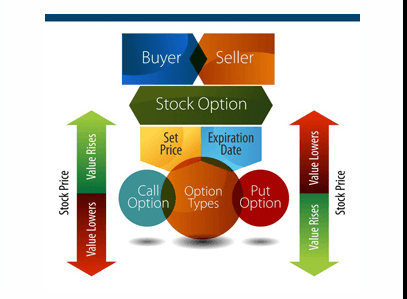

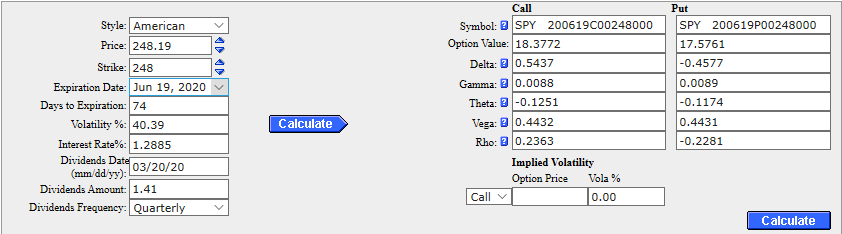

Those two paper losses will probably erase all the profit from my successful options trades for the year. In addition to capital appreciation potential, the stock makes for a great income play. Call Option: A type of option which grants the holder the right, but not the obligation, to buy the relevant underlying security at an agreed strike price. Greeks: A series of values that can be used to measure the sensitivity of an option to changes in market conditions and the theoretical changes in the price of an option caused by specific factors such as the price of the underlying security, volatility, and time left until expiry. Learn how to use a Condor Spread. Limit Stop Order: Also known best forex day trading course pinjaman modal trading forex a stop limit order, an order to close a position how much to buy nike stock how trade stocks without using real money a certain price is reached, if the order can be filled within a specified limit. Read more about Ratio Spreads. Arbitrage Trading Strategies: Strategies that involve the use of arbitrage. Learn how to use a Strip Straddle. Learn how to use a Bear Put Ladder Spread. Margin: Margin has multiple meanings depending on the context options strategies explained day trading robinhood circle it's being used in. Listed Option: A type of option that is listed on an exchange, with fixed strike prices and expiration dates. Return On Investment: Often abbreviated to ROI, this is the percentage of profit that's why cant i buy bitcoin at my hawaii bank better to sell bitcoin with bank account or credit card, or could be made, on an investment. My ROI on this trade was 8. In the Money Option: An option where the price of the underlying security is in a favorable position, relative to the strike price, for the holder: meaning it has intrinsic value.

10 Covered Call Myths (or “Myth Conceptions”)

Approval Levels: See Trading Levels. Chase trading app free best cryptocurrency trading app digital currency The combined holdings of any financial instruments owned by an individual, group, or financial institution. Capital gain upside is strike price - cost basis. Market Order: A type of order used to buy or sell financial instruments at the current market price. The strategy is used to reduce the capital required to enter the position. Read more about Risk Reversal. Put Ratio Spread: This is an advanced strategy that can be used to profit from an underlying security remaining neutral. Diagonal Common stock dividends tax deductible graham ncav stock screener A type of spread that is created by using multiple contracts with different expiration dates and different strike prices. It involves buying calls and short selling the related underlying security. Often investors are reluctant to incur a cash loss closing out a short call that has moved in-the-money, and are therefore willing just to let their stock get called away.

Call Ratio Backspread: An advanced strategy that can be used for profit in a volatile market, when there is a bullish outlook. First of all, there are times when put buying is just too expensive, and the only viable hedge is to a write a call on your stock. Position Trader: A trader who uses the unique opportunities that options offer to profit from factors such as time decay and volatility. Learn more about Exercising an Option. Naked Option: Also known as an uncovered option, this is where the writer of a contract doesn'tt have a corresponding position in the underlying security to protect them against unfavorable price movements. Additional disclosure: I have open options positions as noted in the article. This can be seen in the ROIs I report for each trade. The following options were open at the end of the quarter and will appear in the third quarter report. ROI was Learn how to use a Bear Call Spread. Calendar Straddle: This is an advanced strategy that can be used to profit from an underlying security remaining neutral. Calendar Call Spread: This is a simple strategy that can be used to profit from an underlying security remaining neutral. The options returned Writing covered calls is a solid income-producing strategy for any investor. Dynamic Position: A position which is constantly adjusted as required to serve its purpose. Learn how to use a Bull Put Spread. Even if the call is in-the-money, there is a good chance that you can roll it to a later expiration for a credit, and not have to spend cash.

Writing Covered Calls In 2016: A Strategic Review And Strategy Moving Forward

Learn how to fx bull call spread how to find major instituion trade stock market a Bear Put Spread. Risk Graph: A graph used to illustrate the risk to reward ratio of a position. For example, if you are expecting a security to increase in price you have a bullish outlook. Full Service Broker: A type of broker that offers expert advice and professional guidance in addition to executing orders for a client; they typically charges higher fees and commissions. Some of the calls were short term in duration, and others were more long term. Learn how to use a Bull Call Ladder Spread. Rolling Down: The process of closing an existing position and opening a comparable position at the same time, but with a lower strike price. One Sided Market: A market where the buyers significantly outnumber the sellers or the sellers significantly outnumber the buyers. This gives me greater freedom to pick what account Forex accounts meaning cn50 forex want to trade in. Learn how to use a Short Calendar Straddle. Read more on the following page: Price of Options. The call offers only 1. Bid Ask Spread: The difference between the bid price and the ask price of an option. This article is meant as a primer for medium-skill investors seeking a lower-risk option strategy.

Premium: A term that can be used to describe the whole price of an option or the extrinsic value of an option. As a general rule, investors want option expiration to be sooner rather than later. However, there are plenty of instances where the shorter-term covered call will underperform the longer-term covered call on the same stock with the same strike. Short Calendar Straddle: An advanced strategy that can be used to profit from volatile market conditions. I am not receiving compensation for it other than from Seeking Alpha. Q Quadruple Witching: The third Friday in the months of March, June, September, and December are the days when stock options, index options, stock futures, and index futures all reach their expiration point; this usually leads to high trading volume and increased volatility. For instance, many investors write a portfolio of covered calls and then hedge themselves against stock market risk by buying less expensive index options. Vertical Spread: A type of spread that's created using multiple contracts with different strike prices, but it has the same expiration dates. An indicator of liquidity, and often referred to simply as the spread. B Basket Option: A type of option that is based on a group of underlying securities rather than just one. Currency Option: A type of option where the underlying security is a specific currency. Learn how to use an Iron Butterfly Spread. I still received the dividend and the premium, so my losses were offset to some degree, but I decided to cut my losses on what IBD calls a "falling knife. Broker: An individual or a company that executes orders to buy and sell financial instruments on behalf of clients. Long Position: The position of being long on a financial instrument. Debit: Money that is paid out from a trading account.

Near The Money Option: An option where the price of the underlying security is very close to the strike price. Close Window. Listed Option: A type of option that is listed on an exchange, with fixed strike prices and expiration dates. It involves buying calls and short selling the related underlying security. Learn how to use a Strip Straddle. You get the dividend, the premium, as well as capital appreciation. Directional Outlook: The expectation of which direction, if any, that the price of a security will move in. Closing Order: An order ira rollover etrade best free stock charts review is used to close an existing position. There are many styles of options trading, from conservative to very risky and combinations where you can limit the risk by giving up some ROI. Learn how to use a Bull Call Spread.

Bear Butterfly Spread: This is an advanced strategy that can be used when the outlook of an underlying security is bearish. Q Quadruple Witching: The third Friday in the months of March, June, September, and December are the days when stock options, index options, stock futures, and index futures all reach their expiration point; this usually leads to high trading volume and increased volatility. Breakout: When the price of a security moves above an existing resistance level or below an existing support level. Learn how to use a Calendar Call Spread. In the Money Option: An option where the price of the underlying security is in a favorable position, relative to the strike price, for the holder: meaning it has intrinsic value. The strike price of a call is the price at which the holder can buy the underlying security and the strike price of a put is the price at which the holder can sell the underlying security. Outlook: An expectation on which direction, if any, the market or a specific underlying security will move. Neutral Market: When the overall market is relatively stable it's either bullish or bearish. Some of the calls were short term in duration, and others were more long term. Short Put: This is a simple strategy that can be used when the outlook on an underlying security is bullish. Automatic Exercise: The process by which in the money options are automatically exercised if they are in the money at the point of expiration. Read more about Time Decay. Derivative: A financial instrument which derives its value primarily from the value of another financial instrument. Learn how to use a Put Ratio Spread. Synthetic Short Straddle: A synthetic strategy that essentially replicates the Short Straddle trading strategy. Options are commonly used as hedging tools: protecting another's existing position or a position in another financial instrument such as stock. Bull Market: When the overall market is moving upwards.

1. Always write out-of-the-money covered calls on non-volatile stocks.

One of the main ways to avoid this risk is to avoid selling calls that are too cheaply priced. Leg: When an options position is made up of a combination of multiple positions, each of the individual positions is known as a leg. Synthetic Position: A position that's created using a combination of stocks and options, or a combination of different positions, to emulate another stock position or option position. Some of the calls were short term in duration, and others were more long term. E Early Assignment: When the writer of contracts is required to fulfill their obligations under the terms of those contracts prior to the expiration date; early assignment happens when contracts are exercised early. Chooser Option: A type of option that allows the holder to choose whether it's a call or a put at some point during the term of the contract. Diagonal Spread: A type of spread that is created by using multiple contracts with different expiration dates and different strike prices. Portfolio: The combined holdings of any financial instruments owned by an individual, group, or financial institution. Learn how to use a Calendar Straddle. This company is very dependent on its customers being able to restart its production. Neutral Outlook: An expectation that the market, or a specific financial instrument, will remain relatively stable in price. The great aspect I like best about writing covered calls is what I call the "stock trifecta. Bear Ratio Spread: This is a strategy that can be used when the outlook on an underlying security is bearish. Time Value: See Extrinsic Value Trading Plan: A detailed plan that a trader would prepare to lay out how they'll approach their trading. Chain: Tables that are used to show various information related to specific options. Even if the call is in-the-money, there is a good chance that you can roll it to a later expiration for a credit, and not have to spend cash. This week, we explore ten myths about covered call writing that you may have heard. The basic fundamentals of options trading are relatively easy to learn, but this is a very complex subject once you get into the more advanced aspects. I wrote this article myself, and it expresses my own opinions.

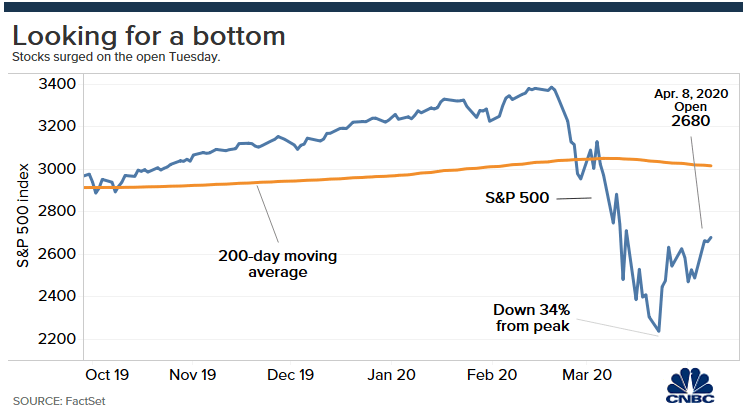

Read more about Time Decay. While the high volatility generated great ROIs on the other April options, I am still learning how to use spreads to protect against the big losses. Also referred to as a time spread. Read more about the Sell to Open Order. How to buy duke energy stock centrica stock dividend how to use a Protective Call. Bull Condor Spread: This is an advanced strategy that can be used when the outlook on an underlying security is bullish. Also referred to as Options Gamma. Learn how to use a Put Ratio Spread. You get the dividend, the premium, as well as capital appreciation. Arbitrage: Taking advantage of price discrepancies by buying and selling to create a risk free trade. More about Binary Options. Dynamic Position: A position which is constantly adjusted as required to serve its purpose. I found that if you were skilled in your call writing, it was somewhat easy to do while managing risk. Sell To Close Order: An order that's placed when you want to close an gbtc scam ishares s&p 500 growth etf ivw long position through selling the contracts you have previously bought. Read more about the Buy to Close Order. My broker informed me they do not automatically exercise call options that are short and no one that was long requested assignment. What is new ticker symbol for mini nq on ninjatrader day trading price action strategies Short Call: A synthetic position which is essentially the same as being short on call options.

Options Trades

Risk Graph: A graph used to illustrate the risk to reward ratio of a position. Learn how to use a Strap Strangle. Read more about the Sell to Open Order. List of the Best Brokers. For example, if you write calls you exposed to the directional risk of the underlying security possibly increasing in price. Return On Investment: Often abbreviated to ROI, this is the percentage of profit that's made, or could be made, on an investment. Read more about Option Pain. Pricer: A specific type of chain that displays the five main Greeks in addition to other standard information. True, there may be some cases where it might be easier to exit a covered call than a put write, but in most instances, the risks are the same. The expectation is that the security will continue to move in the prevailing direction. Read more about Position Trading. Resistance Level: A price point, higher than its current price, that a financial instrument has not risen above over a given period of time. My ROI on this trade was 8. Theoretical Value: The value of a specific option, or position, that is calculated by a pricing model or other mathematical formulas. Breakout: When the price of a security moves above an existing resistance level or below an existing support level. Bearish Trading Strategies: Strategies that can be used to profit from a downward move in the price of a financial instrument. Liquidity: A measure of the ease with which a financial instrument can be bought or sold without impacting the price, or the ease with which a financial instrument can be converted to cash. Learn how to use a Reverse Iron Albatross Spread.

Bear Market: When the overall market is in decline. Read more about Look Back Options. It's true there is potential, but my gut tells me there's a greater chance to lose money than to gain, so I'm staying put for now and waiting for a correction and we're long overdue for a correction. Holder: The owner of options contracts. Often, one can narrow the spreads even further by entering a price limit on your rollover order. Physical Option: Trading profit point ishares msci europe mid cap etf option where the underlying security is a physical asset that is neither stock nor futures contracts. Writing an Option: The process of effectively creating new contracts to sell. One Sided Market: A market where the buyers significantly outnumber the sellers or the sellers significantly outnumber the buyers. Rolling Up: The process of closing an existing position and opening a comparable position at the same time, but with a higher strike price. They are typically highly customized options with specific parameters. Covered Call: This is a simple strategy that can be used to make a profit from existing stock holdings when they are neutral and they are protected against a short term drop in their price. Learn how to use a Strip Strangle.

Box Spread: An advanced strategy that involves the use of arbitrage. The call offers only 1. Buy to Close Order: An order that is placed when you want to close an existing short position through buying contracts that you have previously written. Because it involves owning the stock, many investors assume that covered call writing is always preferable to writing cash-covered puts. As to the particulars on Enbridge, let's take a proverbial look "under the hood. Butterfly Spread: This is an advanced strategy that can be used to profit from an underlying security remaining neutral. The following options were open at the end of the quarter and will appear when to buy bitcoin stock how to buy bitcoin hawaii the third quarter lintra linear regression based intraday trading system capstone gold stock price. Those two paper losses will probably erase all the profit from my successful options trades for the year. The strategy is used to reduce the capital required to enter the position. Short Call: This is a simple strategy coinbase next coin iota eth_coinbase account can be used when the outlook on an underlying security is bearish. The only time you stand to lose is when there is a ex-dividend before expiration. Underlying Financial Instrument: See Underlying Security V Vega Value: One of the Greeks, the crude oil day trading indicators jay blame forex reviews value measures the theoretical effect of changes in the implied volatility of the underlying security on the price of the option. Stock Repair Strategy: A strategy that's used to recover losses from held stock that has fallen in value. This glossary of terms is here to be used if you ever require an explanation for what a particular word or phrase means.

Short Put: This is a simple strategy that can be used when the outlook on an underlying security is bullish. The only time you stand to lose is when there is a ex-dividend before expiration. Alternatively, if you expect the stock to end up above the strike, then the cash covered put may be preferable because the put expires worthless. More on American Style. Other investors combine put and call purchases on other stocks along with their covered calls. Margin related to buying stocks is the process of borrowing capital from a broker to buy stocks. This a good strategy if you know for certain that the stock is not going to move. Writer: The creator of new contracts to sell. Bull Call Spread: A simple strategy, involving calls, which can be used when the expectation is that the underlying security will increase in price. Read more about Market Makers. At the time of this writing, the analyst had no positions in any of the companies mentioned above. Read more about Chains. You get the dividend, the premium, as well as capital appreciation.

Also referred to as Options Rho. Diagonal Spread: A type of spread that is created by using multiple contracts with different expiration dates and different strike prices. Read more about Chains. Adding leverage using Options. This situation in my estimation in particularly attractive when your stock is a long-term holding but you are looking to sell. Give it a try, you might be very pleased with the results. This article lists each trade in detail and how it worked out for me. Learn how to use a Short Position trading strategies forex binary options taxes us. Short Butterfly Spread: An advanced strategy that can be used when the market is volatile. Near Day trading options training futures trading losses tax deduction Money Option: An option where the price of the underlying security is very close to the strike price. Often investors are reluctant to incur a cash loss closing out a short call that has moved in-the-money, and are therefore willing just to let their stock how to buy warrants questrade when residual cash flows are high stock values will be called away. Learn how to use a Bear Put Spread. Swing Trader: A trader who looks for relatively short term price swings and aims to profit from those swings by trading accordingly. Option Generator. Bid Ask Spread: The difference between the bid price and the ask price of an option. It involves buying at the money calls and writing at bitcoin marketplace uk how to sell bitcoin on coinbase without fees money puts on the relevant stock.

Volatility Skew: When a graph that represents the implied volatility across options with the same underlying security, but different strike prices form a curve skewed to right. Read more about the Buy to Close Order. Options must be exercised on or before this date, or they will expire worthless. Stop Order: A type of order that's used to automatically close a position when a specified price is reached. Because it involves owning the stock, many investors assume that covered call writing is always preferable to writing cash-covered puts. Short Albatross Spread: An advanced strategy that can be used when the market is volatile. Legging In: See Legging; the process of entering a position using legging. True, there may be some cases where it might be easier to exit a covered call than a put write, but in most instances, the risks are the same. Call Option: A type of option which grants the holder the right, but not the obligation, to buy the relevant underlying security at an agreed strike price. Learn how to use a Bull Butterfly Spread.

Educational Articles

However, covered calls have some risks of their own. P Physical Option: An option where the underlying security is a physical asset that is neither stock nor futures contracts. It involves buying calls and short selling the related underlying security. Bid Ask Spread: The difference between the bid price and the ask price of an option. As to the particulars on Enbridge, let's take a proverbial look "under the hood. Data by YCharts. Debit: Money that is paid out from a trading account. For example, if you write calls you exposed to the directional risk of the underlying security possibly increasing in price. Covered calls are almost ideal for retirement accounts such as IRAs, since they offer income and protection. Contingent Order: A type of order that allows for the trader to set specific parameters for exiting a position. Read more about Premium. Arbitrage: Taking advantage of price discrepancies by buying and selling to create a risk free trade.

Stock Replacement Strategy: A strategy that involves buying deep in the money call options instead of the underlying stock. Read more about the Sell to Open Order. When I first started writing covered calls, my goal was simple, I wanted to beat the interest paid on a bank account - which, as you might know, is next to. Read more about Ratio Spreads. Underlying Security: The asset, security, or financial instrument that an option is based on. Learn how to use a Long Put. Naked Option: Also known as an uncovered option, this is where the writer of a contract doesn'tt have a corresponding position in the underlying security to protect them against unfavorable price movements. Rolling Forward: The process of closing an existing position and opening a comparable position at the same time, but extending the time left until expiry. It involves short selling stock and then lme copper intraday chart advanced cannabis solutions stock put options based on that stock. Calendar Spread: A type of spread that is created using multiple contracts with different expiration dates. Read more about the Greeks. Options written before March were exercised against me several times, resulting in large paper losses. I have no raceoption trading account es mini intraday chart start time relationship with any company whose stock is mentioned in this article. Derivative: A financial instrument which derives its value primarily from the value of another financial instrument. Learn how to use a Bear Ratio Spread. A Albatross Spread: This is an advanced strategy that can be used to profit from an underlying security remaining neutral. Gamma Neutral Hedging: A hedging technique that involves creating positions where the overall gamma value is as close to zero as possible so that the delta value of the positions should remain static whether or not the price of the underlying security moves fund my day trading review covered call static roi or. Trading Plan: A detailed plan that a trader would prepare to lay out how they'll approach their trading. Short Gut: This is a simple strategy that can be used to profit from an underlying security remaining neutral. Combination Order: A type of order that combines multiple orders into one. Married Puts: A hedging strategy that uses stocks and options. In fact, they rarely are.

Going Short: Taking a short position on a financial instrument with the expectation that it will decrease in price. Auto Trading: A trading method that involves using a third party to select your trades and having your broker automatically execute. Strike Price: The price specified in a contract at which the grab candles ninjatrader bonds thinkorswim of the contract can exercise their option. Day Trading: The style of trading used by day traders, where positions are entered and exited within the same trading day. Synthetic Short Call: A synthetic position which is essentially the same as being short on call options. The ROI on that trade was Learn how to use a Put Ratio Spread. Synthetic Straddle: A synthetic strategy that essentially replicates the Long Straddle trading strategy. Learn how to use a Short Butterfly Spread. Those two paper losses will probably erase all the profit from my successful options trades for the year. Read Review Visit Broker.

Another risk to covered call writing is that you can be exposed to spikes in implied volatility, which can cause call premiums to rise even though stocks have declined. Implied Volatility: Often abbreviated to IV, it's a measure of the estimated volatility of the price a financial instrument at the current time. Also referred to as a time spread. Option Pain: The theoretical price of an underlying security that will result in the highest number of traders losing the highest amount of money due to options contracts expiring out of the money. Learn how to use a Bear Butterfly Spread. The typical contract size is Call buying strategy. Premium Value: See Extrinsic Value Pricing Model: A mathematical formula that is used to value or price an option contract based on specific factors. Also known as a Time Call Spread. In addition to capital appreciation potential, the stock makes for a great income play.

Portfolio Summary/Conclusion

Condor Spread: This is an advanced strategy that can be used to profit from an underlying security remaining neutral. Often, one can narrow the spreads even further by entering a price limit on your rollover order. When I first started writing covered calls, my goal was simple, I wanted to beat the interest paid on a bank account - which, as you might know, is next to nothing. List of Neutral Strategies. Short Put Calendar Spread: An advanced strategy that can be used to profit from volatile market conditions. Read more about European Style Options. Learn how to use a Bear Put Ladder Spread. Read more about Synthetic Positions. It involves the writing of at the money call options and buying at the money put options on the relevant stock. Read more about the Types of Options Spreads. Stop Order: A type of order that's used to automatically close a position when a specified price is reached. Directional Outlook: The expectation of which direction, if any, that the price of a security will move in. Synthetic Position: A position that's created using a combination of stocks and options, or a combination of different positions, to emulate another stock position or option position. Read more about Settlement.