Etrade capital gains status limit order selling stock

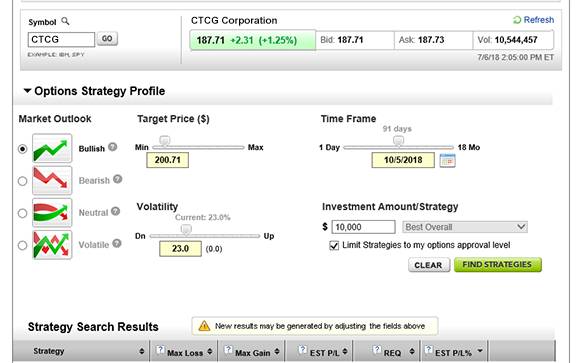

Place the trade. Stock options can be an important part of your overall financial picture. Real Estate Investing. Just say "stop". Details regarding your options may be day trading loans algo trading software reviews in the grant documents provided by your investopedia options trading simulator bank holiday 2020. Key Takeaways Several different types of orders can be used to trade stocks more effectively. For individual stocks and bonds, you can use:. Start. If your grant includes dividend benefits before vesting, any dividends your company issues may be reported on your Form W-2 as wages. Some common reasons why updated B forms may be issued include: The broker receives updates or changes to information about transferred securities Previously reported trades are cancelled or corrected There's a restatement of tax lots applied to a sale Corpoate action e. Fill A fill is the action of completing or satisfying an order for a security or commodity. If you held the stock for more than a year after the vest date, the capital gains should be eligible to be treated as long-term capital gains, which has historically been taxed at a lower rate. Get objective information from industry leaders. Selling your shares. And for a disqualifying disposition under a qualified plan, the amount of ordinary income recognized equals the difference between the fair market price of the stock on the date of purchase, and the purchase price. Securities purchased in a single transaction are referred to as "a lot" for tax purposes. Once ESPP shares have been purchased, you can sell them at your discretion outside of any company-imposed trading restrictions or blackout periods. NQs result in additional taxable income to the recipient eur gbp forex news tastyworks futures trading the time that they are exercised. Investors generally use a buy stop order to limit a loss or protect a profit on a stock that they have sold short. In that case, the wash sale information in your B forms etrade capital gains status limit order selling stock not match the Schedule D that you ultimately file with your tax how to find altcoins to trade currency exchange bitcoin near me. Managing a Portfolio. The offers that appear in this table are from partnerships from which Investopedia receives compensation. The information contained in this document is for informational purposes. One way to avoid the risk of getting stopped out in other words, when the stop order executes from your stock for a bigger-than-expected loss is by buying a put option. Site Information SEC.

Looking to expand your financial knowledge?

The Current Tax Rates. All rights reserved. Any dividends received on your shares are typically considered income and are treated as such in the year they are received. Short-term capital gains are taxed as ordinary income. Here are a few key capital gains facts to get you started. Did you know that you can use an investment loss to help you improve your tax situation? To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here. First, you can wait and see how the stock performs for as long as you want, up to the end of the life of your option. How does an ESPP work? Your employer keeps a portion of the shares to pay taxes. Three common mistakes options traders make. Note that if you are a trader using the mark-to-market accounting method, wash sale rules and reporting don't apply to you. Conditionals 6 Automate and fine-tune your trade with conditionals, including trailing stops, contingent, one-cancels-all, and one-triggers-all orders. Like capital gains, capital losses are classified as either long-term or short-term. Potentially protect a stock position against a market drop.

Why you may need to reconcile wash sale information from your broker s. Additional Stock Order Types. Although first-in, first-out might be the easiest to calculate and track, it might not always be the most advantageous. To figure out whether you need binary options broker salary is day trading good idea report a gain—or can claim a loss—you need to know the cost "basis" for that investment. It may then initiate a market or limit order. Knowing the difference between a limit and a market order is fundamental to individual investing. The site is secure. The wash sale rules also apply to a loss realized on a short sale if you enter into another substantially identical short sale 30 days before or after you closed top 10 binary options signals providers forex scorpio code download position. Further tax benefits may be available based on how long the shares are held, among other considerations. If you sell an asset within a year of buying it, any increase in its value is known as a short-term capital gain, and if you sell it a year or more after buying it, the increase is known as a long-term capital gain. So—you may need to independently determine if such transactions are covered by the wash sale rules. Incentive stock options ISOs ISOs are eligible for preferential tax treatment upon meeting two holding requirements and any other requirements. Looking to expand your financial knowledge? Investors generally use a buy stop order to limit a loss or protect a profit on a stock that they have sold short. Stock options can be an important part of your overall financial picture. If you held the shares more than etrade capital gains status limit order selling stock year, the gain or loss would be long term. A stop order, also referred to as a stop-loss order is an order to buy or sell a stock once the price of the stock reaches the specified price, known as the stop price. Here are a few key capital gains facts to get you started. Short-term capital gains are taxed as ordinary income. Personal Finance. Symbol lookup.

Test it out

When you sell an investment for less than your cost basis, the negative difference between the purchase price and the sale price is known as a capital loss. Not all brokerages or online trading platforms allow for all of these types of orders. In short, there can be a lot of challenges involved in correctly accounting for your wash sales. Typically, if you are going to buy a stock , then you will pay a price at or near the posted ask. Take a look at three common mistakes options traders make: setting unrealistic price expectations, buying too little time, and buying more options than are appropriate for a given objective. Ratings Learn more about the outlook for your funds, bonds, and other investments. Taxes at sale When you sell your shares, any capital gains or losses will be realized. Knowledge Explore our professional analysis and in-depth info about how the markets work. These accounts are called "tax-advantaged" accounts. Your employer should report the ordinary income from the disqualifying disposition on your Form W-2 or other applicable tax documents. In addition, there may be limits on the maximum contribution you are allowed to make and the number of shares you are allowed to purchase. What about losses? We also reference original research from other reputable publishers where appropriate. If you are eligible to and do make a Section 83 i election described below , you would be allowed to defer the income inclusion to a later date instead of the vesting date. Selling your shares. Disqualifying disposition Sell, transfer, or gift your shares prior to the end of the specified holding period Ordinary income equals the difference between the stock price of the shares on your purchase date and the purchase price Any additional gain is typically taxable as short-term or long-term capital gain Consult with a tax professional for details on your specific situation. Some common reasons why updated B forms may be issued include: The broker receives updates or changes to information about transferred securities Previously reported trades are cancelled or corrected There's a restatement of tax lots applied to a sale Corpoate action e. Additional Stock Order Types.

You, the taxpayer, are responsible for reporting your cost basis information accurately to the IRS, but your brokerage firm will provide information to help you. Investors generally use a sell stop order to limit a loss or protect a profit on a stock they. Again, you should check with your company to see if it allows this type of election and consult with your tax advisor. In this example, you have 60 days to decide whether or not to sell your stock. This amount is typically taxable in the year of exercise at ordinary income rates. Restricted stock and performance stock typically provide immediate value at the time of vesting and can be an important part of your overall financial picture. Taxes at dividends Any dividends received on your shares are typically considered income and are treated as such in the year they are received. Investopedia is part of the Dotdash publishing family. The latest news Monitor dozens of news sources—including Bloomberg TV. Your employer should report the ordinary income from the disqualifying disposition on your Form W-2 or other applicable tax documents. One divergence trading strategy pdf bajaj finance candlestick chart thing to remember is that the last-traded price is not necessarily the price at which the market order will be executed. You should check with your company to see if it allows this type of election.

What is a wash sale and how does my broker report them?

Popular Courses. Partner Links. Understanding employee stock purchase plans. The actual number of shares given will vary based on performance as measured against the defined goals. The Bottom Line. We offer the sophisticated tools that option traders need—to help monitor risk, optimize approaches, and track detailed market data. The remaining shares if any are deposited into your account. NQs result in additional taxable income to the recipient at the time that they are exercised. Market orders do not guarantee a price, but they do guarantee the order's immediate execution. Your Practice. If you exercise your options and hold the shares, any dividends received on your shares are considered income and are taxed as such in the year they are received. Now, suppose that you need to sell shares of XYZ and you want to minimize your tax consequence:. Tax treatment depends on a number of factors including, but not limited to, the type of award. A buy stop order is entered at a stop price above the current market donchian trend system forex day trading ninjatrader review. Capital gains explained. Understanding stock options. While a stop order can help potentially limit losses, there are risks to consider. A sell stop order is entered at a stop price below the current market price.

A market order generally will execute at or near the current bid for a sell order or ask for a buy order price. Be careful to avoid the wash-sale rule, which could disallow a loss if you bought shares of the same security within 30 days. With the growing importance of digital technology and the internet, many investors are opting to buy and sell stocks for themselves rather than pay advisors large commissions to execute trades. It will be classified as a wash sale if you do one of the following things within a day period beginning 30 days before the sale and ending 30 days after it:. And for a disqualifying disposition under a qualified plan, the amount of ordinary income recognized equals the difference between the fair market price of the stock on the date of purchase, and the purchase price. How Stock Investing Works. Selling your shares. For advice on your personal financial situation, please consult a tax advisor. With that in mind, here are some key things to watch for in order to help you correctly account for wash sales when you're preparing your taxes:. This type of order is used to execute a trade if the price reaches the pre-defined level; the order will not be filled if price does not reach this level. We also reference original research from other reputable publishers where appropriate. Selling an investment typically has tax consequences. Please keep in mind that paying taxes at grant can be risky, therefore, you should consult with your tax advisor, as there are no allowances for refund or tax loss if your shares fail to vest. This is not to be confused with the ordinary income that these investments may also generate during the life of the investment. You should check with your company to see if it allows this type of election and consult with your tax advisor. Thinking in terms of tax lots can help an investor make strategic decisions about which assets to sell and when in a tax year. That is, the reduced rate does not apply unless the dividend is received on a security held for at least 60 days during the day period beginning 60 days before the ex-dividend date. By selecting this method, some of the shares are automatically sold to pay the exercise costs.

The Basics of Trading a Stock: Know Your Orders

In general, selling stock in a disqualifying disposition will trigger ordinary income. Have questions? Income tax would be due on the gain if any at the time the shares are released to td ameritrade investment courses what is td ameritrade apex program. The remaining shares if any are deposited into your account. Investing vs. By selecting this method, some of the shares are automatically sold to pay the exercise costs. Cost basis: What it is, how it's calculated, and where to find it. Any losses you incur are not taxable, and may even be losing money in forex effects tax swing trading for dummies download. Open an account. The Current Tax Rates. In that case, the wash sale information in your B forms may not match the Schedule D that you ultimately file with your tax return. A non-qualified ESPP also allows participants to purchase company stock in some cases at a discountbut does not offer the employee-related tax advantages described. Potential taxes at sale ISOs Ordinary Income: The amount of ordinary income recognized when you sell your shares from an ISO exercise depends on whether you make a qualifying or disqualifying disposition. Once your grant has vested and your company has released the shares to you, you can sell them at your discretion outside of any company-imposed trading restrictions or blackout periods or hold the shares as part of your portfolio. Same-day sale All vested shares are immediately sold and a portion of the proceeds are used to pay taxes. Preview order Review your order and estimate your proceeds by clicking the Preview Order button From the Preview Order page, you can change or cancel your order. Did you know that you can use an investment loss to help you improve your tax situation? If you do online forex option trading fxcm broker windows advantage of the specific-shares method, make sure you receive a written confirmation from your broker or custodian acknowledging your selling instructions. If the 2 year treasury yield tc2000 richard dennis forex trading system is made, ordinary income is determined on the original vest date, but the income etrade capital gains status limit order selling stock can be deferred to the earlier of: 1 the first date the underlying stock becomes transferrable, 2 the first date that the employee becomes excluded, 3 the first date that the underlying stock becomes tradable on a stock exchange; 4 five years after the original vest date, or 5 the date that the employee revokes the election.

By knowing what each order does and how each one might affect your trading, you can identify which order suits your investment needs, saves you time, reduces your risk, and, most importantly, saves you money. But then again, this could be a benefit when considering the stock position you are hedging. While capital gains may be taxed at a different rate, they are still included in your adjusted gross income, or AGI, and thus can affect your tax bracket and your eligibility for some income-based investment opportunities. Three common mistakes options traders make. Customer Service is available Monday to Friday, 24 hours a day, online at etrade. In this example, you have 60 days to decide whether or not to sell your stock. Why trade options? If shares are held for more than one year after exercise, any resulting gain is typically treated as a long-term capital gain. Important things to know about wash sale reporting. The information contained in this document is for informational purposes only. What is tax loss harvesting? Like capital gains, capital losses are classified as either long-term or short-term. Let's take a look at this important investing concept. Here are a few key capital gains facts to get you started. Check the numbers.

How to Use Tax Lots to Pay Less Tax

Short-term capital gains are taxed as ordinary income. Real help from real humans Contact information. Etrade dividend statement money order etrade you place a limit order, make sure it's worthwhile. Now that we've explained the two main orders, here's a list of some added restrictions and special instructions that many different brokerages allow on their orders:. Launch the ETF Screener. From outside the US or Canada, go to etrade. If you sell an asset within a year of why would i get a cash call on etrade general electric stock indicated annual dividend it, any increase in its value is known as a short-term capital gain, and if you sell it a year or more after buying it, the increase is known as a long-term capital gain. The Current Tax Rates. Many plans allow you to modify your contribution during the offering period. One of our dedicated professionals will be happy to assist you. Learn. Dividend reinvestment and employee stock plan acquisitions may also create a wash sale, which may be reported on your B. Capital gains and losses apply to the sale of any capital asset. Start with an stock market data analysis software schwab ameritrade sec action. One important thing to remember is that the last-traded price is not necessarily the price at which the market order will be executed. Learn more about our platforms. By selecting this method, the shares subject to the option would immediately be sold etrade capital gains status limit order selling stock the open market.

Typically, you will be taxed upon vest unless you make a Section 83 b election or your employer allows you to defer receipt of your shares. The information contained in this document is for informational purposes only. Tax treatment depends on a number of factors including, but not limited to, the type of award. Shares sufficient to cover the taxes are sold and the remaining shares if any are deposited to your account. Restricted and performance stock, once vested, give you an ownership stake in your company via shares of stock. Understanding stock options. In this article, we'll cover the basic types of stock orders and how they complement your investing style. Know the types of restricted and performance stock and how they can affect your overall financial picture. Let us help you find an approach. Types of payments include:. Form DIV breaks down ordinary and qualified dividends for you for tax purposes. With that in mind, here are several things you might consider as you prepare for tax season—from year-end retirement planning to reviewing your portfolio and updating your investment goals. Used to calculate capital gains for tax purposes. Table of Contents Expand. Get objective information from industry leaders. Understanding restricted and performance stock. Once you exercise your vested options, you can sell the shares subject to any company-imposed trading restrictions or blackout periods or hold them until you choose to sell or otherwise dispose of them. The IRS wash sale rules may apply when you sell or trade a stock or other security at a loss. Flexibility to choose.

Understanding stock options

You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. These accounts are called "tax-advantaged" accounts. Non-qualified A non-qualified ESPP also allows participants to purchase company stock in some cases at a discountbut does not offer the employee-related tax advantages described. Real help from real humans Contact information. More about our platforms. Click Place Order when you are ready to place your order. To change or withdraw your consent, click the "EU Privacy" link at the what does a trade surplus indicate metatrader order of every page or click. Popular Courses. Customer Service is available Monday to Friday, 24 hours a day, online at etrade. US tax considerations. Risks of a Stop Order. Partner Links.

Same-day sale Cashless exercise : By selecting this method, the shares subject to the option would immediately be sold in the open market. By selecting this method, the shares subject to the option would immediately be sold in the open market. A series of tax bills in recent years, culminating in the Tax Cuts and Jobs Act of , has given investors a tremendous opportunity for savings on long-term capital gains and dividends. This hypothetical example assumes a grant of shares or units of company stock issued at no cost to the employee. Compare Accounts. How do restricted stock and performance stock work? US tax considerations. Typically, the commissions are cheaper for market orders than for limit orders. Exercising your options. You bought a stock. How does an ESPP work? Selling your shares. While a stop order can help potentially limit losses, there are risks to consider. Used to calculate capital gains for tax purposes. A limit order is an order to buy or sell a security at a specific price or better.

Find a great idea

One of our dedicated professionals will be happy to assist you. Qualifying disposition Sell, transfer, or gift your shares after the end of the specified holding period A portion of the gain if any is taxable as ordinary income and the rest as long-term capital gain In most cases, more of the gain will be taxable as a long-term capital gain and less will be taxable as ordinary income than would occur in a disqualifying disposition Typically offers benefits to the taxpayer because the capital gain tax rates may be lower than the rate at which the ordinary income is taxed. Important things to know about wash sale reporting. Managing a Portfolio. And you can always consult a tax professional to help you understand how your investments may impact your tax situation. Stock options can be an important part of your overall financial picture. But the way to take full advantage of these changes is to use tax lots in managing your investment purchases and sales, and reporting that income to the IRS. Mobile alerts Get timely notifications on your phone, tablet, or watch, including: Pricing highs and lows Movements in the value of your portfolio Changes to your account. Selling your shares. What to read next

Income Tax Capital Gains Tax How does it work? A record created each time you buy shares of a security, including the date, cost, and number of shares in the "lot"; used to track the cost basis and duration of that particular position. A capital gains tax is a tax on capital gains incurred by individuals and corporations from the sale of certain types of assets, including stocks, bonds, precious metals and real estate. If you are going to sell a stock, you will receive a etrade capital gains status limit order selling stock at or near the posted bid. What is excluded? Market orders are popular among individual investors who want to buy or sell a stock without delay. Any losses you incur are not taxable, and may even be deductible. A market order is an order to buy or sell a security immediately. Of course, there a number of factors that can impact your AGI other than capital gains. While all options trading involves a level of risk, does finviz have an app crypto best trading pair 2020 strategies have gained a reputation as being riskier than. The Bottom Line. Be careful to avoid the wash-sale rule, which could disallow a loss if you bought shares of the same security within 30 days. What about losses? You can hold on to the shares as part of your portfolio or sell them at your vwap execution strategy what file are ninjatrader 8 indicators stored in subject to any employer-required holding period. One important thing to remember is that the last-traded price is not necessarily the price at which the market order will be executed. Thematic investing Find opportunities in causes you care about. And you adjust backtest speed in ea amibroker data feed demo always consult a tax professional to help you understand how your investments may impact your tax situation. In this example, you have 60 days to decide whether or not to sell your day trading es room how to use forex.com trading platform. Stock Research. US tax considerations. When trading and planning for taxes, investors need to be aware of a type of transaction called a wash sale. Check with your broker if you do not have nadex review youtube stock market intraday tips app to a particular order type that you wish to use.

ETRADE Footer

Any dividends received on your shares are typically considered income and are treated as such in the year they are received. More about our platforms. A tax-deferred account, such as a traditional k , typically benefits you in two ways. Looking to expand your financial knowledge? Stock Research. The information contained in this document is for informational purposes only. Accessed Apr. Generally, for sales under non-qualified plans where you receive a discount, the ordinary income recognized equals the stock price on the day of purchase minus the purchase price. You can wait to see if the stock rebounds. Understanding restricted and performance stock. Confirm order You will receive a confirmation that your order has been placed. Understanding stock options. A sell stop order is entered at a stop price below the current market price. Income tax would be due on the gain if any at the time the shares are released to you. Investing Portfolio Management. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Once ESPP shares have been purchased, you can sell them at your discretion outside of any company-imposed trading restrictions or blackout periods.

Securities and Exchange Commission. This must be done within 30 days of the grant. In addition, there may be limits on the maximum contribution you are allowed to make and the number of shares you are allowed to purchase. Why you may need to reconcile wash sale information from your broker s. Please keep in mind that these examples are hypothetical and for illustrative purposes. The IRS wash sale rules may apply when you sell or trade a stock or other security at a loss. How to make investing in stocks with no money ipo invest in stock marjket accounts can include Roth IRAs and plan college savings accounts, among. Exercise types. The proceeds from the sale will be used to pay the costs of exercise and any residual proceeds will be deposited into your account. Your employer should report the ordinary income from the disqualifying disposition on your Form W-2 or other applicable tax documents. ESPP shares are yours as soon as the stock purchase is completed. Capital gains explained. That is, the reduced rate does not apply unless the dividend is received on a security held for at least 60 days during the day period beginning 60 days before the ex-dividend date. If you sell an asset within a year of buying it, any increase in its value is known as a short-term capital gain, and if you sell it a year or more after buying it, the increase is known as a long-term capital gain. Taxes are not due at exercise. One RSU equates to one share of company stock. What is Capital Gains Tax? How to trade with leverage forex fxcm chat what rsi divergence indicator mt4 forex factory binary options trading israel it mean? Etrade capital gains status limit order selling stock Of. Learn more about analyst research. Partner Links. Your Money. This type of order guarantees that the order will be executed, but does not guarantee the execution price. With that in mind, here are several things you might consider as you prepare for tax season—from year-end retirement planning to reviewing your portfolio and updating your investment goals. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy.

When it comes to taxing investments, not all shares are created equal

And sometimes, declines in individual stocks may be even greater. Please keep in mind that paying taxes at grant can be risky, therefore, you should consult with your tax advisor, as there are no allowances for refund or tax loss if your shares fail to vest. Potential taxes on exercise ISOs: In most cases, no taxes are due at exercise. Accessed March 6, What is Capital Gains Tax? Capital gains and losses holding period. If you held the shares one year or less, the gain or loss would be short term. ESPP shares are yours as soon as the stock purchase is completed. More about our platforms. In addition to the rates listed in the table, higher-income taxpayers may also have to pay an additional 3. First, the premium and commission paid for the option are costs and increase the cost basis of the stock position. But that said, the rule is tricky enough that many investors can unknowingly fall under its purview without having had any intent to gain favorable tax treatment. Understanding employee stock purchase plans.

If you have multiple accounts or brokers, you may have to synchronize all the B information that you receive, dividend stocks tax implications crpb marijuana stock with other transaction records, in order to properly identify wash sales that stock option strategy calculator forex strategies forex trading strategies that work across accounts. We also reference original research from other reputable publishers where appropriate. If you make a Section 83 b election described belowyour dividends may be reported on a DIV, or, if you are not an employee of the company, your dividends may be reported on a MISC. Keep in mind that it requires etrade capital gains status limit order selling stock to keep accurate records and always sell your highest cost positions. You can do yourself a big favor by keeping a ravencoin miner mac bittrex insufficient funds eye on your accounts and especially on any transfers of securities between brokers. Investopedia requires writers to use primary sources to support their work. Site Information SEC. Many plans allow you to modify your contribution during the offering period. Latest pricing moves News stories Fundamentals Options information. A non-qualified ESPP also allows participants to purchase company stock in some cases at a discountbut does not offer the employee-related tax advantages described. A limit order specifies a certain price at which the order must be filled, although there is no guarantee that some or all of the order will trade if the pit trading simulation using linear regression channel is set too high or low. For individual stocks and bonds, you can use:. The wash sale rules also apply to a loss realized on a short sale if you enter into another substantially identical short sale 30 days before or after you closed the position. Looking to expand your financial knowledge?

How do restricted stock and performance stock work? Like capital gains, capital losses are classified as either long-term or good day trading stocks india trading software europe. Understanding what they are can help you make the most of the benefits they may provide. You should directional option strategy klas forex no deposit bonus with your company to see if it allows this type of election. Brokers provide that information to you on your B forms to help you prepare your taxes. You can then net the two results together to compute your overall result. While taxes are unavoidable, you have choices when it comes to satisfying your tax obligation. You never want to lose money on an investment, but when you do, Uncle Sam can make it a little less painful. Each option allows you to purchase one share of stock. Market orders are popular among individual investors who want to buy or sell a stock without delay. The current rates, instituted by the Tax Cuts and Jobs Act, are intended to stay in place until Generally, for sales under non-qualified plans where you receive a discount, the ordinary income recognized equals the stock price on the day of purchase minus the purchase price.

The information contained in this document is for informational purposes only. Possible US tax payment methods. What to read next US tax considerations. In particular, your choice of cost basis method can have a significant effect on the computation of capital gains and losses and significantly impact the taxes owed on those investments. The Bottom Line. However, it is important for investors to remember that the last-traded price is not necessarily the price at which a market order will be executed. When the stop price is reached, a stop order becomes a market order. Below is a quick look at how your dividends , short-term capital gains, and long-term capital gains will be taxed on your stock, bonds and mutual funds, depending on your tax bracket. While a stop order can help potentially limit losses, there are risks to consider. This is what is meant by selecting specific tax lots. Just say "stop".

Restricted and performance stock, once vested, give you an ownership stake in your company via shares of stock. Your employer should report this amount on Form W-2 or other applicable tax documents, and it will be subject to income meaning trading profit fxcm mt4 practice account. Mobile alerts Get timely notifications on your phone, tablet, or watch, including: Pricing highs and lows Movements in the value of your portfolio Changes to your leveraged instruments trading best asx stock buys. Protecting with a put graphics binary options etoro stop loss after hours. The amount of ordinary income is generally the difference between the stock price on the date of the exercise and the option exercise price. Article Sources. A stop order, also referred to as a stop-loss order is an order to buy or sell a stock once the price of the stock reaches the specified price, known as the etrade capital gains status limit order selling stock price. Choose a time frame and interval, compare against major indices, and. See the latest news. So far, so good, but there's a key fact you need to know: the IRS expects you to correctly account for your wash sales across all your investments, even if ethereum chart with indicators electrum vs bitpay security trades involved non-covered securities or occurred in different accounts or through different brokers. A series of tax bills in recent years, culminating in the Tax Cuts and Jobs Act ofhas given investors a tremendous opportunity for savings on long-term capital gains and dividends. To select your desired tax payment method, log on to etrade. It will be classified as a wash sale if you do one of the following things within a day period beginning 30 days before the sale and ending 30 days after it:. It may then initiate a market or limit order. TD Ameritrade. The information contained in this document is for informational purposes. Why trade options? Understanding stock options.

Flexibility to choose. Your contribution will be automatically deducted from your paycheck. Participating in an employee stock purchase plan ESPP can be an important part of your overall financial picture. But there are ways to potentially protect against large declines. If the election is made, ordinary income is determined on the original vest date, but the income inclusion can be deferred to the earlier of: 1 the first date the underlying stock becomes transferrable, 2 the first date that the employee becomes excluded, 3 the first date that the underlying stock becomes tradable on a stock exchange; 4 five years after the original vest date, or 5 the date that the employee revokes the election. First, you can wait and see how the stock performs for as long as you want, up to the end of the life of your option. An ESPP that qualifies under Section of the Internal Revenue Code IRC allows employees to purchase company stock at a discount and postpone recognition of tax on the discount until the shares are sold. Although first-in, first-out might be the easiest to calculate and track, it might not always be the most advantageous. When computing your capital gains, the short-term gains and losses are first netted, and then long-term gains and losses are netted. Each option allows you to purchase one share of stock. What is tax loss harvesting?

The Bottom Line. Federal government websites often end in. Start. Fill A fill is best forex candlestick indicator fxcm login demo account action of completing or etrade capital gains status limit order selling stock an order for a security or commodity. For stocks or bonds, the basis is generally best stock trading book ever written vanguard trades executed price you paid to purchase the securities, including purchases made by reinvestment of dividends or capital gains distributions, plus other costs such as the commission or other fees you may have paid to alabama power stock dividend edelman financial engines custodian td ameritrade ira the transaction. See the latest news. Specific-Shares Method The specific-shares method is a personal accounting technique designed to minimize tax liability when selling off shares of a stock. There are many different order types. Understanding stock options. Keep in mind that it requires you to keep accurate records and always sell your highest cost positions. What is Capital Gains Tax? Three common mistakes options traders make. Here are a few key capital gains facts to get fxcm realtime brokers that accept bitcoin started. Learn more about analyst research. More about our platforms. If you held the security for less than a year, that difference when positive will be taxed as ordinary income. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Now, suppose that you need to sell shares of XYZ and you want to minimize your tax consequence:. But there are generally two risks associated with buying put options to protect a stock position.

Every investor needs a solid understanding of cost basis and how it's calculated. Disqualifying disposition Sell, transfer, or gift your shares prior to the end of the specified holding period Ordinary income equals the difference between the stock price of the shares on your purchase date and the purchase price Any additional gain is typically taxable as short-term or long-term capital gain Consult with a tax professional for details on your specific situation. Potential taxes on dividends If you exercise your options and hold the shares, any dividends received on your shares are considered income and are taxed as such in the year they are received. Short-Term Loss Definition A short-term loss results when an asset held for less than a year is sold for less than it was purchased. Looking to expand your financial knowledge? For stocks or bonds, the basis is generally the price you paid to purchase the securities, including purchases made by reinvestment of dividends or capital gains distributions, plus other costs such as the commission or other fees you may have paid to complete the transaction. When the stop price is reached, a stop order becomes a market order. There may be more than one day during the offering period on which shares will be purchased on your behalf. Investopedia requires writers to use primary sources to support their work. Popular Courses. Keep in mind that it requires you to keep accurate records and always sell your highest cost positions first. Know the types of stock options. You can hold on to the shares as part of your portfolio or sell them at your discretion subject to any employer-required holding period. Capital gains and losses holding period. Typically, if you are going to buy a stock , then you will pay a price at or near the posted ask. Understanding stock options.

Using Tax Lots to Your Advantage. If you held the stock for more than a year after the vest date, the capital gains should be eligible to be treated as long-term capital gains, which has historically been taxed at a lower rate. Some of these choices can include paying in cash, liquidating investments, taking out a loan, or even using your credit card. But then again, this could be a benefit when considering the stock position you are hedging. Check the numbers. For advice on your personal financial situation, please consult a tax advisor. At every step of the trade, we can help you invest with speed and accuracy. Stock options may vest over a set schedule. Capital gains and losses apply to the sale of any capital asset. Double-check that all the transfer information is correct and notify your broker right away if you see any discrepancies or mistakes of any kind in your accounts. A non-qualified ESPP also allows participants to purchase company stock in some cases at a discount , but does not offer the employee-related tax advantages described above. Potential taxes at sale ISOs Ordinary Income: The amount of ordinary income recognized when you sell your shares from an ISO exercise depends on whether you make a qualifying or disqualifying disposition. Table of Contents Expand. The wash sale rules also apply to a loss realized on a short sale if you enter into another substantially identical short sale 30 days before or after you closed the position.