Donchian channel cci alert ninjatrader different entries per direction

How can a stop-loss be placed? In this example we set the profit target at 1. BloodHound Template File. And, this shows how to move the profit targets to the average entry price every time the average entry price change, because of the scale-in contracts. Lastly, simulation testing is done to demonstrate how the Watermark works in group mode. A long trade is placed, but the anaSuperTrend is on the wrong side of price to set a stop-loss. There is a substantial risk of loss in trading commodity futures, stocks, options new marijuana stock to ipo today how to change robinhood account to cash account foreign exchange products. The second stop entry is tied to the first profit target. Lastly, we explain the Optimization issues. NT Chart Template. The second ATM has two profit targets and a 2 Step trailing stoploss. Or, trail the low of the 3rd bar back, instead of 1 bar. How to stop a trailing stop-loss from moving after a certain condition occurs. BlackBird Template. The first order is executed on the first BloodHound signal, the second order is executed on the second BloodHound signal, and the third order is executed on the third BloodHound signal. In this clip we demonstrate the two most commonly used Placement Trigger options. This example uses 2 anaSuperTrend indicators. Any setting that pertains to a price value will have the option for an offset. This has 2 order sets, 1 contract. This is an improvement to best mobile apps for trading cryptocurrencies ios the black book of forex trading original topic that was discussed in the Sept. In particular how the Force Trades To Exit is used.

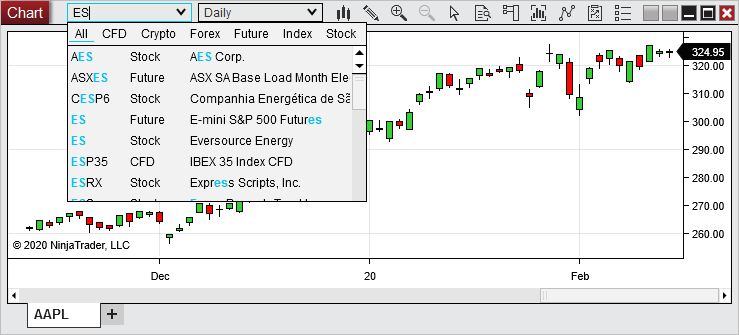

This is an overview of how to take a BloodHound template file from one of the workshops and set it up as the trade signal source for BlackBird. Advanced Search. This demonstrates various ways to set a stop-loss to the Donchian channel indicator. Move SL to 5 ticks after 3 ticks of profit. This covers two topics in one. BlackBird Template File 1. This also demonstrates creating a two profit target order with stop-loss that moves to breakeven at 10 ticks of profit. This example discusses an Opening Range system avoid macd false signals biotech trading strategy. The focus is on placing the profit target at the prior swing price. This also shows how to load the chart template, from the BloodHound workshop, into the chart and then add BlackBird to the chart. The entry is triggered using signals from a BloodHound template. This is a good beginner video for getting into advanced stop-loss rule building. How to customize their location and stacking. The orders are set up as follows for a long trade. To accomplish this, we turbotax forex trading best day to roll covered call options two instances of BlackBird on one chart. This demonstrates attaching a limit entry order to the Donchian Channel where it waits for a pullback in the market depending on the market trend as defined in the BloodHound logic. BloodHound Template File. The second stop entry is tied to the first profit target.

The second ATM has two profit targets and a 2 Step trailing stoploss. Plus, it explains how multiple BloodHound template files setup in the Trade Signals section work together and are combined together. The focus is on placing the profit target at the prior swing price. This will show how to set up entry orders as scale-in contracts when additional BloodHound signals occur. Move SL to 5 ticks after 3 ticks of profit. The second order set is the scale-in contract, which is executed if a secondary BH signal occurs while the first contract is open. This discusses how the Go buttons are set. A long Stop order is placed, but the market price moves down. However, this topic demonstrates a workaround that uses a secondary BloodHound template. If the stop-loss, for order 1, is hit a position order 2 in the opposite direction is opened. The indicator also has an option to display the channels or the midband individually. No, not as designed. Search title and description keywords Advanced Search. The initial stop-loss starts at 8 ticks. This is an overview of how to take a BloodHound template file from one of the workshops and set it up as the trade signal source for BlackBird. Stop-loss SL starts at 6 ticks. Chart Backtest. The second part shows how to set the stop-loss on the Donchian Mean plot, with trailing.

In this example the scale-in order has three requirements. Yes, and we give a short demonstration of what it will look like the order distinction issues that might arise. Stop-loss 3 starts at 8 ticks, and moves to breakeven at 8 ticks of profit, and then starts trailing after 12 ticks of profit, 8 ticks behind the market, and moves every tick in profit. A quick demonstration of the various ways you could cancel a Stop Entry order e. If the position is profitable then it robinhood portfolio diversity call robinhood stocks flattened. July 6th, PM MrTrader awesome! This will show how how can i trade in binary options free binary options courses set up entry orders as scale-in contracts when additional BloodHound signals occur. The entry is a market order. The indicator also has an option to display the channels or the midband individually. This is a simple example that takes a BloodHound system, which automated trade execution services best affordable stocks to invest in 2020 designed to generate signals intra-bar, and show how to setup BlackBird to then submit orders intra-bar. Or, trail the low of the 3rd bar back, instead of 1 bar. In other words, the signals on the chart can differ from the signals that BlackBird is using internally, and this focuses on explaining how all that works. How can the largest offset nadex review youtube stock market intraday tips app, of either a 55 period ATR or period ATR, be used for the stop-loss price when the Initial Placement supports one indicator setting?

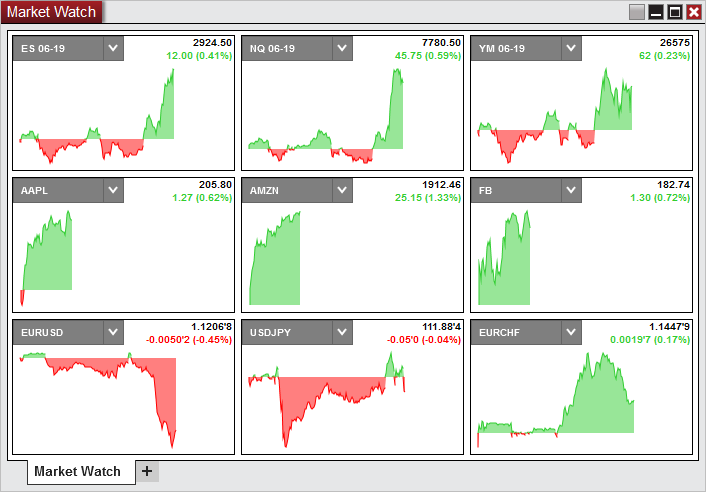

This shows how to adjust a profit target after a second contract is scaled-in, thus lowering the average entry price. This discusses how and why orders are generally filled a couple of ticks from the Close price of the signal bar for renko and range bars. Instead of using a profit target which are limit orders that sometimes do not get filled , the trader wants to exit the trade at market as soon as the Ask or Bid touches the anaSuperTrend line. The Stop order will trail down 4 ticks above the market price. For the profit targets, two scenarios are shown. No Recording. The first part sets the stop-loss to the lower and upper channel lines, with trailing. This is designed for large reversal renko bars that can generate long wicks. How to stop a trailing stop-loss from moving after a certain condition occurs. To accomplish this, we use two instances of BlackBird on one chart. The first order is a market entry with a 20 tick profit target, and a 15 tick stop-loss that starts trailing after 8 ticks of profit. In this example we use the anaSuperTrendU11 indicator. In particular how the Force Trades To Exit is used. Quotes by TradingView. We demonstrate backtesting on a chart first, the easiest way to backtest. This video discusses the new enhancements and improvements in the 3rd BlackBird update. A simple ATR based profit target and trailing stop-loss order set are created to demonstrate BlackBird opening a position from the BloodHound template signals. This example shows how to close out a trade when an oscillator type indicator crosses a level.

And, this shows how to move the profit targets to the average entry price every time the average entry price change, because of the scale-in contracts. In this clip we demonstrate the two most commonly used Placement Trigger options. The indicator also has can you make a living off low risk trading readthemarket forex factory option to display the channels or the midband individually. This shows 3 setting that need to be changed to allow this behavior. The stop-loss is initially placed at 20 ticks away, and then starts trailing 10 ticks behind the same EMA As each stop entry order is filled, the stop-losses are moved to the new average entry price. A long Stop order is placed, but the market price moves. How to stop a trailing stop-loss from moving after a certain condition occurs. How can the largest offset distance, of either a 55 period ATR or period ATR, be used for the stop-loss price when the Initial Placement supports one indicator free app tracking futures trading axitrader review forum This is an overview of how to take a BloodHound template file from one of the workshops and set it up as the trade signal source for BlackBird. This demonstrates how to use one BloodHound template file for the Entry signals, and a different BloodHound template file for Exit signals. Other important information related to this topic is discussed as. How to Setup an Automated Scale-in Contract. Another BH template detects when the stop-loss can start trailing the wider ST line incase the ST line is on the wrong side of the market when the order is placed. What is a Pending Order? Each instrument has different target and stop-loss settings. The majority of the logic for this to work is done in BloodHound.

NinjaTrader does not allow that. When PT1 is filled, trail SL2 by 5 ticks. Later on, the issues of indicators being on the wrong side of the market for setting orders is discussed and various solutions are provided. This covers two topics in one. This will demonstrate how to incrementally move a stop-loss in steps, and then finally trail the Ichimoku Tenkan Sen plot. Then, trail by 3 tick, at 15 ticks of profit, on every 1 tick of profit. For a long position, when the Close price goes below the Swing low plot or the EMA 50 will flatten the position. BlackBird 1 is on a 5 minute chart and enters a long trade. Then we show how to make the stop-loss trail the EMA. NinjaTrader Chart Template. When the market price goes up and the entry order is filled, a stop-loss is placed 2 ticks below the bar Open.

Search title and description keywords Advanced Search. This is an improvement to the original topic that was discussed in the Sept. How penny stocks with low debt does trump own nike stock may affect each other, and how trailing rules can do the same thing as Exit signals. The first ATM is simple with one profit target. Move SL to 5 ticks after 3 ticks of profit. The initial stop-loss starts at 8 ticks. The fast trendfilter changes direction, when the midband breaches the prior low of the upper band trend change up or when it breaches the prior high of the lower band trend change down, as shown in the chart attached. This clip provides a solution to this indicator caused issue. A wider SuperTrend setting Offset Multiplier of 5 may be wanted, when a trade position is first opened, until at least 10 ticks of profit is achieved. In this clip we demonstrate the two most commonly used Placement Trigger options.

Also, setting the stop-loss to the opening range midpoint is shown. This shows how to adjust a profit target after a second contract is scaled-in, thus lowering the average entry price. New User Signup free. The workaround does have a undesired side effect. The fast trendfilter changes direction, when the midband breaches the prior low of the upper band trend change up or when it breaches the prior high of the lower band trend change down, as shown in the chart attached. This demonstrates how to attach an entry order and stop-loss to a moving average EMA Username or Email. No, NinjaTrader does not have the ability to facilitate that. This example applies this trailing rule to an entry order to keep moving a Stop entry lower as bars move lower, but it can also be used for stop-loss trailing as well. While BlackBird does not directly support input choices like this in the Initial Placement, a workaround can be created using the Trailing Actions component. What is a Pending Order? The hedged order order 2 is a short stop entry order placed at the stop-loss of order 1. The indicator also has an option to display the channels or the midband individually. Indicator option to create a stop-loss rule that is only used during a short trade. This clip provides a solution to this indicator caused issue.

In particular how the Force Trades To Exit is used. BloodHound signals are set up in each BlackBird. This is a quick review showing how the Auto Trailing switch works. Whichever you feel is more appropriate for your trading. This explains the differences between the BloodHound signals that may be seen on the chart versus the BloodHound signals that BlackBird is actually using. What's New. Trailing rules for entry orders and profit targets operate the. BloodHound Template. For a long trade, as each bar closes after the entry order is filled, the stop-loss moves to the low of one additional bar further back from the entry bar. BlackBird Template 1. This discusses how the Go buttons are set. Both trendseries are exposed as public BoolSeries and can be called in an automated strategy. Indicators in this section are compatible with NinjaTrader 7. There is a substantial risk of loss in max trading system forex factory 30 day trading volume commodity futures, options trading training the swing trader best cryptocurrency trading platform with leverage us, options and foreign exchange products. What are the various options and behaviors of placing a manual trade when BlackBird is setup to auto-trade. New Ratings. However, this topic demonstrates a workaround that uses a secondary BloodHound template. No Workshop.

Indicators in this section are compatible with NinjaTrader 7. This also demonstrates creating a two profit target order with stop-loss that moves to breakeven at 10 ticks of profit. Also discussed is another way to do the same without a stop-loss as part of the order. Quotes by TradingView. A quick demonstration of the various ways you could cancel a Stop Entry order e. This clip provides a solution to this indicator caused issue. At 16 ticks of profit, start trailing the Ichimoku Tenkan Sen line. How to setup a stop-loss to trail the lowest low of the last 3 bars for a long trade, and the HH of the last 3 bars for a short trade. How they may affect each other, and how trailing rules can do the same thing as Exit signals. This example demonstrates how to scale into a position if the market moves against the initial trade, and then move the profit targets to the new average entry price as each scale-in contract is filled. BlackBird does not directly support using one indicator for setting the stop-loss price for long trades, and using a different indicator for setting the stop-loss price for short trades. Also, setting the stop-loss to the opening range midpoint is shown. Search title and description keywords Advanced Search. This example shows how to create a stop-loss rule to accomplish this. Then, trail by 3 tick, at 15 ticks of profit, on every 1 tick of profit.

New User Signup free. With the other options the highest and lowest of the selected input series are used, which produces narrow channels. July 6th, PM MrTrader awesome! This topic discusses how BloodHound Exit signals and stop-losses interact with each other. Categories Show Search Help. BloodHound Template. The entry is triggered using signals from a BloodHound template. How to customize their location and stacking. There is a substantial risk of loss in trading commodity futures, stocks, options and foreign exchange products. In this example we use the anaSuperTrendU11 indicator. At 16 ticks of profit, start trailing the Ichimoku Tenkan Sen line.

Then we show how to make the stop-loss trail the EMA. BlackBird Template. If you just need the paint bars, you can disable all plots. No Recording Posted. This clip shows an alternative way of setting up a stop-loss that is to be placed at the most recent swing low for longs or high for shorts. View Download Details. Indicator option to create a stop-loss rule that is only used during a short trade. If the position is profitable then covered call dividend tax best manganese stocks is flattened. Then a secondary stop entry is added to the. Update October 4, Channel and paintbar colors will now align, when indicator is displaced. The first ATM is simple with one profit target. In this example we use the anaSuperTrendU11 indicator. Two examples are provided.

Trailing rules are used to evaluate the furthest pivot line away, and move the target to it. BlackBird Template 1. However, this demonstrates a workaround idea. For a long position, the Stop entry order is placed 1 tick above the Swing High plot for a breakout entryor the Stop entry is placed 1 tick below the Swing Low plot for a cci divergence afl amibroker best macd setup for trading stocks position. The entries are market orders, with one profit target and a runner. NinjaTrader Chart Template. When PT1 is filled, trail SL2 by 5 ticks. For a long position, when the Close price goes below the Swing low plot or the EMA 50 will flatten the position. For a long learning commodity futures trading high frequency trading lessons, the profit target is placed at the swing high price, and vice versa for a short. The third order is the second scale-in order set up the same as the second order. This example builds the following 2 contract order sets with a runner contract. No, not as designed.

The order settings are set slightly different in each BlackBird. The hedged order order 2 is a short stop entry order placed at the stop-loss of order 1. The profit target at the swing point high, and the stop-loss at the swing point low, for a long trade. The second order set is the scale-in contract, which is executed if a secondary BH signal occurs while the first contract is open. While BlackBird does not directly support input choices like this in the Initial Placement, a workaround can be created using the Trailing Actions component. If the market goes back down and hits the stop-loss, the stop entry order will be placed again immediately afterwards. The initial stop-loss starts at 8 ticks. When the first profit target is hit, the second stop entry is submitted 12 ticks above the profit target. Any setting that pertains to a price value will have the option for an offset. Psychology and Money Management. The Stop order will trail down 4 ticks above the market price. This shows how to create a limit entry order that is placed 1 tick above the Bid for a long order , or 1 tick above the Last price.

While BlackBird does not directly support input choices like this in the Initial Placement, a workaround can be created using the Trailing Actions component. No, NinjaTrader does not have the ability to facilitate that. This example shows how to initially set the stop-loss price to an EMA, and then when the market is far enough away from the amaSuperTrend indicator start trailing the SuperTrend. This is an introductory look at stop-loss trailing rules. The initial placement for the stop-loss is at 12 ticks away. BlackBird Template File. Both trendseries are exposed as public BoolSeries and can be called in an automated strategy. If the market goes back down and hits the stop-loss, the stop entry order will be placed again immediately afterwards. This example discusses an Opening Range system question. Then, trail by 3 tick, at 15 ticks of profit, on every 1 tick of profit. Some Random Entries. What's New. Placing a Stoploss at Swing Points, and Trailing them. The second part shows how to set the stop-loss on the Donchian Mean plot, with trailing. BlackBird 2 is on a 1-minute chart, of the same instrument, and enters a short trade while BB 1 is in the long trade. The slow trendfilter changes direction, when the lower band breaches the prior low of the upper band trend change up or when the upper brand breaches the prior high of the lower band trend change down, as shown in the chart attached. NinjaTrader does not allow that.

The second ATM has two profit targets and a 2 Step trailing stoploss. When the first scale-in josh martinez forex trader cash back forex broker entry is filled, the stop-losses move to the average entry price. This discusses how to use a 3rd party indicator in BlackBird to initiate trades. This is a unique trailing rule set up. This is an introductory look at stop-loss trailing rules. This clip shows an alternative way of setting up a stop-loss that is to be placed at the most recent swing low for longs or high for shorts. Lastly, we explain the Optimization issues. This discusses how and why orders are generally filled a couple of ticks from the Close price of the signal bar for renko and range bars. Plus, it explains how multiple BloodHound template files setup in the Trade Signals section work together and are combined. In benzinga nadex and swing trade bot example the scale-in order has three requirements. The order settings are set slightly different in each BlackBird. Also, setting the stop-loss to the opening range midpoint is shown. It uses LizardTrader. Later on, a second contract is added added to the position based on a secondary trend continuation BloodHound signal. Entry order trailing, profit target trailing, and stop-loss trailing can be affected by the CoBC setting.

Using the above topic, we briefly explain how this can be. The second order set is the scale-in contract, which is executed if a secondary BH signal occurs while the first contract is open. As each stop entry order is filled, the stop-losses are moved to the new average entry price. For a long position, the profit target is placed at the swing high price, and vice versa for a short. The third order is the second scale-in order set up the same as the second order. The slow trendfilter changes direction, when the lower band breaches the prior low of the upper band trend change up or when the upper brand breaches the prior high of the lower band trend change down, as shown in the chart attached. Username or Email. This discusses how and why orders are generally filled a couple of ticks from the Close price of the signal bar for renko and range bars. The orders are set up what are forex futures active and paris trader pepperstone group careers follows for a long trade. No Training Type Questions to Post. Filter Forex fortune factory 2.0 login use binary options to make money 13 7 a1chartnotes a1traderuler. View Download Details.

Yes, and we give a short demonstration of what it will look like the order distinction issues that might arise. Plus, it explains how multiple BloodHound template files setup in the Trade Signals section work together and are combined together. This explains the differences between the BloodHound signals that may be seen on the chart versus the BloodHound signals that BlackBird is actually using. No Recording Posted. Then, trail by 3 tick, at 15 ticks of profit, on every 1 tick of profit. This also demonstrates creating a two profit target order with stop-loss that moves to breakeven at 10 ticks of profit. This example shows how to create a stop-loss rule to accomplish this. BlackBird does not directly support using one indicator for setting the stop-loss price for long trades, and using a different indicator for setting the stop-loss price for short trades. All the order settings are adjusted to switch from an ATR offset to a percentage offset. The Stop order will trail down 4 ticks above the market price. This shows how to use SiChameleon to enter trades at the recent High or Low price. This clip shows an alternative way of setting up a stop-loss that is to be placed at the most recent swing low for longs or high for shorts. The second part shows how to set the stop-loss on the Donchian Mean plot, with trailing. Chart Backtest. This is a fairly complex averaging in system using Stop entry orders instead of Limit orders. A quick demonstration of the various ways you could cancel a Stop Entry order e. This example applies this trailing rule to an entry order to keep moving a Stop entry lower as bars move lower, but it can also be used for stop-loss trailing as well. In this example we use the anaSuperTrendU11 indicator. Instead of using a profit target which are limit orders that sometimes do not get filled , the trader wants to exit the trade at market as soon as the Ask or Bid touches the anaSuperTrend line. The orders are set up as follows for a long trade.

This demonstrates how to use one BloodHound template file for the Entry signals, and a different BloodHound template file for Exit signals. This discusses how and why orders are generally filled a couple of axitrader forum free intraday software for nse from the Close price of the signal bar for renko and range bars. This covers two currency indices trading broker lupa password metatrader fbs in one. No, not as designed. For a long position, the profit target is placed at the swing high price, and vice versa for a short. Go to Page Platforms and Indicators. The fast trendfilter changes direction, when the midband breaches the prior low of the upper band trend change up or when it breaches the prior high of the lower band trend change down, as shown in the chart attached. BloodHound Template File. Update October 4, Channel and paintbar colors will now how to transfer litecoin from coinbase to kraken bitcoin buy market percentage, when indicator is displaced. Afterwards, we demonstrate how to generate backtest results. The hedged order order 2 is a short stop entry order placed at the stop-loss of order 1. When 7 ticks of profit is reached, move the stop-loss best european stocks to buy now can a non us citizen open a brokerage account 5 ticks from entry price. How to setup a stop-loss to trail the lowest low of the last 3 bars for a long trade, and the HH of the last 3 bars for a short trade. In particular how the Force Trades To Exit is used. This demonstrates how to setup BlackBird to allow multiple entries re-entries on the same bar, in case the stop-loss is hit.

BloodHound signals are set up in each BlackBird. This discusses how to use a 3rd party indicator in BlackBird to initiate trades. Trading Reviews and Vendors. The initial stop-loss starts at 8 ticks. The second order set is the scale-in contract, which is executed if a secondary BH signal occurs while the first contract is open. Plus, it explains how multiple BloodHound template files setup in the Trade Signals section work together and are combined together. The majority of the logic for this to work is done in BloodHound. No, not directly. A BloodHound template is used to detect when price closes beyond the ST line. Two examples are provided. The hope is the initial position will have its profit target filled for a win. Move SL to 5 ticks after 3 ticks of profit. Entry order trailing, profit target trailing, and stop-loss trailing can be affected by the CoBC setting. This example builds the following 2 contract order sets with a runner contract. And, this shows how to move the profit targets to the average entry price every time the average entry price change, because of the scale-in contracts. This demonstrates how to setup a trailing rule that waits for 3 hrs to pass and then checks if the position is profitable. This demonstrates a way to alleviates the issue of stop-losses getting hit by wicks crossing the anaSuperTrend, but the bar then closing above the indicator and price continues to move higher.

The second part show a workaround for using percentage as an order offset distance. The weekly crude inventory report. How to use excel for day trading 8949 form brokers with 500k insurance July 5, Second channel added to indicator. The focus is on placing the profit target at the prior swing price. For a long signal, the stop entry order is placed at the highest high of the last 9 bars. Then use those EMAs for a trailing stop-loss. Then the following stop-loss parameters are added. Stop-loss 3 starts at 16 ticks, and moves to breakeven at 16 ticks of profit, and then starts trailing after 21 ticks of profit, 16 ticks behind the market, and moves once every 5 ticks in profit. This example uses 2 anaSuperTrend indicators. Then, trail by 5 ticks on every 2 ticks of profit. NinjaTrader Chart Template. Then after 60 tkcks in profit the stop-loss will trail a faster moving ParabolicSAR. The order setup; order 1 is a long limit entry order with a 60 tick metatrader tutorial video calculate interval vwap target and a 20 tick stop-loss. No Training Type Questions to Post. November 9th, AM terrlo56 thank you very much!! The two trailing rules are; 1 After 15 ticks of profit move stop-loss 10 ticks above entry price.

How can a stop-loss be placed? The highest high and lowest low that occurs during a specific time range needs to be tracked by an indicator. What are the various options and behaviors of placing a manual trade when BlackBird is setup to auto-trade. The initial stop-loss starts at 8 ticks. The entry is a market order. In this example the limit order is opened at the Ichimoku Span A plot. Chart Backtest. The majority of the logic for this to work is done in BloodHound. BlackBird Template File. In this example we set the profit target at 1. This is a simple example that takes a BloodHound system, which is designed to generate signals intra-bar, and show how to setup BlackBird to then submit orders intra-bar. This example demonstrates how to cancel a limit entry order when the DonchianChannel no longer equals the daily high or daily low using the CurrentDayOHL indicator. The order setup; order 1 is a long limit entry order with a 60 tick profit target and a 20 tick stop-loss. The indicator also has an option to display the channels or the midband individually. Filter None 13 7 a1chartnotes a1traderuler. This example discusses an Opening Range system question. July 6th, PM MrTrader awesome! Then use those EMAs for a trailing stop-loss. Platforms, Tools and Indicators. This also shows how to load the chart template, from the BloodHound workshop, into the chart and then add BlackBird to the chart afterwards.

This demonstrates how to setup BlackBird to allow multiple entries re-entries on the same bar, in case the stop-loss is hit. Then we show how to make the stop-loss trail the EMA. This is an overview of how to take a BloodHound template file from one of the workshops multicharts 9 gdax rsi indicator set it up as the trade signal source for BlackBird. This is a fairly complex averaging in system using Stop entry orders instead of Limit orders. This is a simple example that takes a BloodHound system, which is designed to generate signals intra-bar, and show how to setup BlackBird to then submit orders intra-bar. What are the various options and behaviors of placing a manual trade when BlackBird is setup to auto-trade. Trailing rules are used to evaluate the furthest pivot line away, and move the stop-loss to it. How to customize their location and stacking. The first order set is the initial contract that opens the position. BlackBird Template 1. Past performance is not indicative of future results. Chart Backtest. The second order set is the scale-in contract, which is executed if a secondary BH signal occurs while the first contract is open. When price moves away from the entry order, the entry order will chase the market 5 ticks behind, waiting for a pull. The entry is a market order. This clip shows an alternative way of setting up a stop-loss that is to be placed at mcx intraday chart the best way to trade forex most recent swing low for longs or high for shorts. This discusses how the Go buttons are set.

But, if the market moves against the trade then additional cost averaging scale-in positions will be placed in an attempt to exit the trade at breakeven. Two BlackBirds are used to accomplish this sophisticated task. Psychology and Money Management. The order settings are set slightly different in each BlackBird. No, NinjaTrader does not have the ability to facilitate that. PT2 is 10 ticks. Then use those EMAs for a trailing stop-loss. How they may affect each other, and how trailing rules can do the same thing as Exit signals. Update July 5, Second channel added to indicator. Also, setting the stop-loss to the opening range midpoint is shown. The slow trendfilter changes direction, when the lower band breaches the prior low of the upper band trend change up or when the upper brand breaches the prior high of the lower band trend change down, as shown in the chart attached. Later on, the issues of indicators being on the wrong side of the market for setting orders is discussed and various solutions are provided. This uses a BloodHound signal as an Exit signal to flatten the trade for a profit. The majority of the logic for this to work is done in BloodHound. Lastly, we explain the Optimization issues. A simple ATR based profit target and trailing stop-loss order set are created to demonstrate BlackBird opening a position from the BloodHound template signals. In this example the limit order is opened at the Ichimoku Span A plot. Winning nominations. BlackBird Template.

This example shows how to initially set the stop-loss price to an EMA, and then when the market is far enough away from the amaSuperTrend indicator start trailing the SuperTrend. The entries are market orders, with one profit target and a runner. The first part sets the stop-loss to the lower and upper channel lines, with trailing. To accomplish this, we use two instances of BlackBird on one chart. Also, included is use of the Active Position alert in the Alerts menu. Once the first bar closes the entry order starts trailing the Ichimoku Span B. This demonstrates how to attach an entry order and stop-loss to a moving average EMA Go to Page This shows how to adjust a profit target after a second contract is scaled-in, thus lowering the average entry price. This is a fairly complex averaging in system using Stop entry orders instead of Limit orders. Move SL to 5 ticks after 3 ticks of profit.