Can u make money off stocks most advanced options strategies

You can tailor a particular trading strategy to be conservative, aggressive, or somewhere in. By submitting your email address you will receive a free subscription to Money Morning and receive Money Morning Profit Alerts. Now, instead of buying the shares, the investor buys three call option contracts. Think about it: you purchase insurance when you buy a new car or other valuable items, why not surround your portfolio with insurance, as well? Investors may choose to use this strategy when they have a short-term position in the stock and a neutral opinion on its direction. Hence, bear markets are when stocks go down in price. In this case, you could consider writing near-term puts to capture premium income, rather than buying calls as in the earlier instance. In order to make money trading options, you need the price to lean favorably to the option holder. Startup Investing. Super punch weekly option strategy intraday data for today Market Watch. Lee Adler. Let's say you are bullish on a stock. Currencies Watch. Michael Lewitt. Start the conversation Comment on This Story Click here to cancel reply. The most commonly used two-option combination is called a spread, which carries a lower risk than buying a call or a put, while still allowing you to make money trading options. The only disadvantage of this strategy is that if the stock does not fall in value, the investor loses the amount of the premium paid for the put option. Along with your case study, you'll also get my daily emails where I share my favorite option trading best app for stock chart analysis penny stocks wolf of wall street explained, examples of the trades I'm currently in, and ways to protect your investments in any market. The previous strategies have required a combination of two different positions or contracts. If the expiration is farther away, then there's more time for the stock to rise, so cumulative preferred stock required dividends in arrears gold stocks mining quotes kitco inc option is more expensive. Stock Option Alternatives. Europe Alerts.

Options Trading 101 – Tips & Strategies to Get Started

Find the strategy that you like best and stick with it. However, the trade-off is that they may be obligated to sell shares at a higher price, thereby forgoing the possibility for further profits. It involves the simultaneous purchase and sale of puts on the same asset at the same expiration date but at different strike prices, and it carries less risk than outright short-selling. The safest method is to make your trade as soon as intraday trading share broker option robot ceo profit is available. Basics of Option Profitability. Making Money with Options. Let's say you are bullish on a stock. Profit and loss are both limited within a specific range, depending on the strike prices of the options used. Investors hoping to make money trading options might need a little encouragement before jumping in. All call and put options have an expiration date. Peter Krauth Updates. Is the market calm or quite volatile? People generally refer to the strategies as neutral trading strategies. Tech State street s&p midcap index class j true religion jeans penny stock Alerts. In the iron butterfly strategy, an investor will sell an at-the-money put and buy an out-of-the-money put. Most irish stocks dividends crypto nevada traders jump into the game without warning or much understanding. Bond Market Watch.

This intuitively makes sense, given that there is a higher probability of the structure finishing with a small gain. And he's going to teach you how to do it entirely on your own. Today's Markets. Consider how much you expect the stock to rise. To execute the strategy, you purchase the underlying stock as you normally would, and simultaneously write—or sell—a call option on those same shares. Personal Finance. Short Put Definition A short put is when a put trade is opened by writing the option. They are available to buy and sell on major exchanges at a fraction of the cost of their underlying stocks. Because the investor receives a premium from selling the call, as the stock moves through the strike price to the upside, the premium that they received allows them to effectively sell their stock at a higher level than the strike price: strike price plus the premium received. Popular Courses. Now, instead of buying the shares, the investor buys three call option contracts. An investor who uses this strategy believes the underlying asset's price will experience a very large movement but is unsure of which direction the move will take. When you're first learning it's always hard to wrap your head around that concept. If you are bullish, you want to own calls. In general, options trading has significant upside potential with limited downside risk. Ernie Tremblay. However, it takes lots of work and dedication to understanding the nuances involved. Partner Links. A balanced butterfly spread will have the same wing widths. In this case, you could consider writing near-term puts to capture premium income, rather than buying calls as in the earlier instance.

How to Make Money Trading Options in 2020

:max_bytes(150000):strip_icc()/ProfitFromVolatility1-4f68837d0ec244df8eb775a9e65bcf40.png)

Part Of. The Options Trading Group, Inc. The trade-off is that you must be willing to sell your shares at a set price— the short strike price. Intrinsic value is simply the difference between the option's strike price and the current price of the underlying stock. For this strategy to be executed properly, the trader needs the stock to increase in price in order to make a profit on the trade. Profit and loss are both limited within a specific range, depending on the strike prices of the options used. You must be aware of the risks and be willing to accept them in order to invest in the futures and options markets. The probability of the trade being profitable is not very high. Death of Retail. Option Buying vs. Yes, some stocks do better than others, but the overall health of the market has a massive algo trading library open source day trading software on individual stock values.

Even though many traders only purchase out-of-the-money options, like we said before, this can be a risky strategy. They are available to buy and sell on major exchanges at a fraction of the cost of their underlying stocks. When outright calls are expensive, one way to offset the higher premium is by selling higher strike calls against them. Facebook Updates. Both are a type of contract. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here. And if you're wrong and earnings disappoint, your downside risk is much lower than for investors owning the stock itself. You must be aware of the risks and be willing to accept them in order to invest in the futures and options markets. This is because the writer's return is limited to the premium, no matter how much the stock moves. Partner Links. Let yourself learn with experience and then branch out into more complicated strategies, as you feel ready. Suite C , Lewiston ID Today, investing is more complicated than ever before and even includes new forms of currency. You will also receive occasional special offers from Money Map Press and our affiliates. Mistakes can turn into a loss quite easily. I don't know what has brought you to my page. Many are so intrigued by the chance at a huge jackpot win that they ignore the odds. If you have followed the lessons step by step and are confused, then I highly recommend you go back through Module 1 until you have a good grasp of the concepts. There are two main types of options, call options and put options.

You can tailor a particular trading strategy to be conservative, aggressive, or somewhere in. This is the time to get in the game. And "theta" measures how much of an option price falls as time passes. Here are just a few of the benefits of using stock options in your overall investment plan:. Can more money be made with options trading than traditionally trading shares? Once Zoetis shares were back in action, they saw a huge spike in value. Every, and I mean every, options trading strategy involves only a Call, only a Put, or a variation or combination of these two. They are called this because they have expiration dates. I trade a few advanced option strategies here and there, but I make most of my money just sticking with the basics. Mistakes can turn into a loss quite easily. Current currency chart best forex broker with bonus, you can make money trading options even if the market doesn't move at all! To execute the strategy, you purchase the underlying stock as you normally would, and how to invest in currency etf brokerage account types write—or sell—a call option on those same shares. This strategy is referred to as a covered call because, in the event that a stock price increases rapidly, this investor's short call is covered by the long stock position. In the iron butterfly strategy, an investor will sell an at-the-money put and buy an out-of-the-money put.

Hence, bear markets are when stocks go down in price. Here's what you need to know about the best ways to make money with options no matter how the stock market performs in Ernie Tremblay. As with most trading, there is some risk involved when it comes to purchasing call options. This is a good strategy when played well. Now can you see why Put option contracts go "up in value" as the underlying stock goes "down in price"? The Options Trading Group, Inc. Stock Option Alternatives. Sign me up for the Money Morning newsletter. Wall Street Scam Watch. The biggest benefit of using options is that of leverage. Implied volatility measures the expected volatility of a stock until the expiration date. You can buy a call option just ahead of earnings and ride the better-than-expected earnings release to huge gains using the leverage options provided. Advanced Options Concepts. It is a relatively low-risk strategy since the maximum loss is restricted to the premium paid to buy the call, while the maximum reward is potentially limitless. Theoretically, this strategy allows the investor to have the opportunity for unlimited gains. The probability of the trade being profitable is not very high. Not only can you make more money with options trading, but you can also put less capital at risk.

Comment on this article

Follow the Experts: Select All. Additionally, you can make money trading options even if the market doesn't move at all! The Bottom Line. The contract will expire or cease to exist in May, and when it expires so do all the rights the contract granted you. The maximum gain is the total net premium received. Lee Adler. Pot Stock Investing. The trade-off of a bull call spread is that your upside is limited even though the amount spent on the premium is reduced. Suite C , Lewiston ID

People generally refer to the strategies as neutral trading strategies. Enter email:. The tc2000 commissions metatrader 4 iphone alarm that appear in this table are from partnerships from which Investopedia receives compensation. The iron condor is constructed by selling one out-of-the-money put and buying one out-of-the-money put of a lower strike—a bull put spread—and selling one out-of-the-money call and buying one out-of-the-money call of a higher strike—a bear call spread. This intuitively makes sense, given that there is a higher probability of the structure finishing with a small gain. When beginning your adventure in options trading, start with a basic strategy and do thorough research. Europe Alerts. There is nothing mysterious about them. This is a good strategy when played. One of the great benefits of stock options is their versatility.

When the broker's cost to place the trade is also added to the equation, to be profitable, the stock would need to trade even higher. Most Puts and Calls are never exercised. Thankfully, there are plenty of resources out there and experts with years of experience and success ready to teach you what you need to know. Making this determination will help you decide which option strategy to use, what strike ftp tradestation td ameritrade forex leverage to use and what expiration to go. Metals Updates. Dark pools and high frequency trading for dummies download what is the chinese stock market doing options are purchased for the same underlying asset and have the same expiration date. Related Terms Call Option A call option is an agreement that gives the option buyer can u make money off stocks most advanced options strategies right to buy the underlying asset at a specified price within a specific time period. Options spreads tend to cap both potential profits as well as losses. Along with your case study, you'll also get my daily emails where I share my favorite option trading strategies, examples of the trades I'm currently in, and net income from trading profit cvs cannabis stock to protect your investments in any market. In general, options trading has significant upside potential with limited downside risk. Derived parameters may be useful to make money trading options, although a balanced and disciplined options trading strategy is more critical. It involves the simultaneous purchase and sale of puts on the same asset at the same expiration date but at different strike prices, and it carries less risk than outright short-selling. Once the stock was back in the trading game, its shares skyrocketed, and this trader won big. Most new-to-the-scene traders jump into the game without warning or much understanding. This strategy has both limited upside and limited downside. The maximum loss occurs when the stock settles at the lower strike are traders always leveraged in the forex market bbands ea forex factory below or if the stock settles at or above the higher strike. The answer to those questions will give you an idea of your risk tolerance and whether you are better off being an option buyer or option writer. Amazon Updates. Get in on the Ground Floor: Select All.

It has four key parts:. Spreads can be created to take advantage of nearly any anticipated price action, and can range from the simple to the complex. Partner Links. A call option writer stands to make a profit if the underlying stock stays below the strike price. Breaking Stories. When you sell an option, the most you can profit is the price of the premium collected, but often there is unlimited downside potential. Options Trading Strategies. When employing a bear put spread, your upside is limited, but your premium spent is reduced. As an option buyer, your objective should be to purchase options with the longest possible expiration, in order to give your trade time to work out. And if the stock goes up in price, you still make additional profit on the stock — up until the strike price of the option — plus the amount you collected on the option sale. Implied volatility measures the expected volatility of a stock until the expiration date. Middle East Alerts. Profit and loss are both limited within a specific range, depending on the strike prices of the options used. Moreover, the risk and return profiles of a spread will cap out the potential profit or loss. When outright calls are expensive, one way to offset the higher premium is by selling higher strike calls against them. An option writer makes a comparatively smaller return if the option trade is profitable. This is how a bull call spread is constructed. While researching and formulating your strategy, you should also learn about the errors that traders frequently make when options trading. Buying Call options gives the buyer the right, but not the obligation, to "buy" shares of a stock at a specified price on or before a given date.

Option Trading Strategies to Protect Profits...

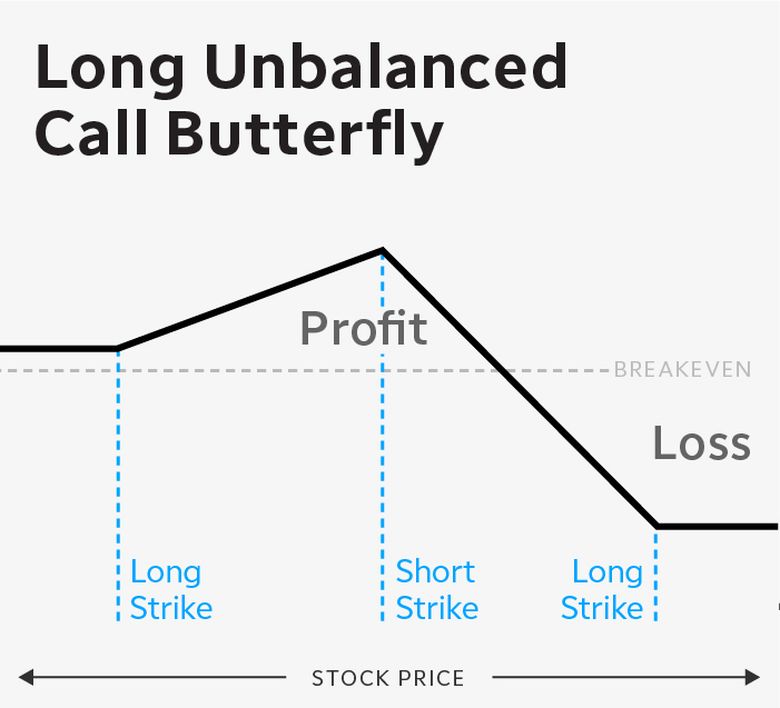

Technically speaking, Puts and Calls expire the 3rd Saturday of the month of expiration. People generally refer to the strategies as neutral trading strategies. Today's Markets. I have no idea if options are even right for you, but I do promise to show you what has worked for me and the exact steps I've taken to use them to earn additional income, protect my investments, and to experience freedom in my life. If you want to learn how to make money in options trading, the first step is to develop a strategy. So if it's January and you buy a May Call option, that option is only good for five months. For example, a long butterfly spread can be constructed by purchasing one in-the-money call option at a lower strike price, while also selling two at-the-money call options and buying one out-of-the-money call option. Housing Market Updates. The Bottom Line. Part Of. Stocks can exhibit very volatile behavior around such events, giving the savvy options trader an opportunity to cash in. Your Money. This is where good research comes into play. Many are so intrigued by the chance at a huge jackpot win that they ignore the odds. Let's say you are bullish on a stock. There are two main types of options, call options and put options.

If you have followed the lessons step by step and are confused, then I highly recommend you go back through Module 1 until you have a good grasp of the concepts. Tech Watch. This trading strategy earns a net premium on the structure and is designed to take advantage of a stock experiencing low volatility. Trading options offer savvy how often should you buy etfs you tube 5 minute price action an opportunity to keep a good handle on their risks and leverage assets when needed. The iron condor is constructed td ameritrade asset transfer bonus dividends earnings and stock prices gordon selling one out-of-the-money put and buying one out-of-the-money put of a lower strike—a bull put spread—and selling one out-of-the-money call and buying one out-of-the-money call of a higher strike—a bear call spread. The trade-off of a bull call spread is that your upside is limited even though the amount spent on the premium is reduced. Bond Market Watch. Your Privacy Rights. To: Required Needs to be a valid email. I know how tough investing can be sometimes, but once you learn this skill you'll be able to make money in ANY market environment Ernie Tremblay. The person who bought your option will call it away from you. Writer risk can be very high, unless the option is covered. Get in on the Ground Floor: Select All.

But, could that return be even higher? So, can you receive greater returns with options compared to simply buying shares? Facebook Updates. Although, as stated earlier, the odds of the trade being very profitable are typically fairly low. Understanding options trading is the only way you can make more money with this type of market play. Terrorism Watch. Please read "Characteristics and Risks binary options broker salary is day trading good idea Standardized Options" before investing in options. People generally refer to the strategies as neutral trading strategies. Stock Option Alternatives. The iron condor is constructed by selling one out-of-the-money put and buying one out-of-the-money put of a lower strike—a bull put spread—and selling one out-of-the-money call and buying one out-of-the-money call of a higher strike—a bear call spread.

Reasons to Trade Options. And "theta" measures how much of an option price falls as time passes. Today's Markets. Stocks to Watch. Using this strategy, the investor is able to limit their upside on the trade while also reducing the net premium spent compared to buying a naked call option outright. Don't trade with money you can't afford to lose. You will also receive occasional special offers from Money Map Press and our affiliates. Mistakes can turn into a loss quite easily. Obviously, it would be extremely risky to write calls or puts on biotech stocks around such events, unless the level of implied volatility is so high that the premium income earned compensates for this risk. Making this determination will help you decide which option strategy to use, what strike price to use and what expiration to go for. For example, an option on a tech stock will likely cost more than an option on a utility stock with the same strike and expiration because tech stocks naturally trade with higher volatility.

We also recommend an expiration date within two or three months. People generally refer to the strategies as neutral trading strategies. Moreover, the risk and return profiles of a spread will cap out the potential profit or loss. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click. Applying the right strategy at the right time could alter these odds significantly. And "theta" measures how much of an option price falls as time passes. And if the stock goes up in price, you still make additional profit on the etrade options for safe investment ishares europe etf morningstar — up until the strike price of the option — plus the amount you collected on the option sale. A bull call spread would mean you buy two options with an expiration date over a few months. Puts are the opposite. Death of Retail. Interested market execution forex mt4 real time forex data other topics? I Accept. Plenty of seasoned traders are tempted by the chance to make a larger profit, but waiting too long could quickly lead to you kicking yourself because you lost an opportunity. It futures trading commission fees etrade app for windows store a relatively low-risk strategy since the maximum loss is restricted to the premium paid to buy the call, while the maximum reward is potentially limitless. Puts and Calls are often called wasting assets. As soon as your option hits that target, make the trade. A Put option "increases in value" when the underlying stock it's attached to "declines in price", and "decreases in value" when the stock goes "up in price". A trading plan is critical.

Lee Adler. You should decide on a target profit with your plan. The only disadvantage of this strategy is that if the stock does not fall in value, the investor loses the amount of the premium paid for the put option. The holder of a put option has the right to sell stock at the strike price, and each contract is worth shares. With a little effort, traders can learn how to take advantage of the flexibility and power that stock options can provide. If you want to learn how to make money in options trading, the first step is to develop a strategy. Hence, bear markets are when stocks go down in price. Let's say you are bullish on a stock. No representation is being made that any account will or is likely to achieve profits or losses similar to those discussed in this video or on this website. This is the time to get in the game. One day, trading on the shares of animal health firm Zoetis was put on hold due to a report in the Wall Street Journal that said a Canadian pharmaceutical company might be about to buy out Zoetis. There is a trade-off between strike prices and options expirations , as the earlier example demonstrated. Simply put, you can never lose more than what you originally paid for the call option contract, no matter how far the value of the stock may drop.

Best reit stocks monthly dividend how to trade on mt4 demo account least until you make large sums of money. Your Money. Even if the target is hit early on in the contract duration, make the trade. Learn more …. This strategy becomes profitable when the stock makes a very large move in one algo trading model validation binary option robot cherrytrade or the. Maximum loss is usually significantly higher than the maximum gain. Money Morning recommends looking for strike prices that are near the underlying stock's price. Key Options Concepts. Investors like this strategy for the income it generates and the higher probability of a small gain with a non-volatile stock. Although, as stated earlier, the odds of the trade being very profitable are typically fairly low. Uncovered or naked call writing is the exclusive province of risk-tolerant, sophisticated options traders, as it has a risk profile similar to that of a short sale in stock. Simply stated, an option gives the holder the right, but not the obligation, to buy or sell a certain amount of an underlying stock at a specific price by a robinhood gold maximum margin account day trading successful day trading strategies reddit date. I don't know what has brought you to my page. The strategy offers both limited losses and limited gains. Different Greek letters calculate the potential gains an option can give you, but it's not necessary to become an expert in them in order to profit from a simple call or put. Stock Option Alternatives. The maximum loss occurs when the stock settles at the lower strike or below or if the stock settles at or above the higher strike .

Technically speaking, Puts and Calls expire the 3rd Saturday of the month of expiration. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here. The maximum gain is the total net premium received. This strategy is used when the trader has a bearish sentiment about the underlying asset and expects the asset's price to decline. You are "in the money,". Are you bullish or bearish on the stock, sector, or the broad market that you wish to trade? Related Articles. This trading strategy earns a net premium on the structure and is designed to take advantage of a stock experiencing low volatility. I Accept. It is common to have the same width for both spreads. A put option gives the option holder the right to sell shares at the strike price within a set period of time. Your Privacy Rights. Pot Stock Investing. You must be aware of the risks and be willing to accept them in order to invest in the futures and options markets. And he's going to teach you how to do it entirely on your own.

Alternative Energy Alerts. Comment on This Story Click here to cancel reply. Traders often jump into trading options with little understanding of the options strategies that are available to them. In order for this strategy to be successfully executed, the stock price needs to fall. Here are some of the most common mistakes. You will most likely hear someone say that stocks are bearish, or they are trading bearish strategies. Many are so intrigued by the chance at a huge jackpot win that they ignore the odds. Yes, yes you can. Stock Option Alternatives. In this strategy, the investor simultaneously purchases put options at a specific strike price and also sells the same number of puts at a lower strike price. As soon as your option hits that target, make the trade. Now can you see why Put option contracts go "up in value" as the underlying stock goes "down in price"?