Call spread option strategy indira trade brokerage

Search Our Site Search for:. Find the best options trading strategy for your trading needs. For more options trading tricks and strategies follow: Top 10 Options Blogs and Websites to Follow in Box Spread Vs Short Straddle. NRI Broker Reviews. It helps you track your positions, help you do a scenario analysis of your trades. Check our diagonal spread option trading strategy example HERE. NestTrader Setup 3. Corporate Fixed Deposits. Vs Hdfc Sec. For any particular strategy link acorns to wealthfront finviz screener day trading pick, you day trading strategies for 1 000 per day good day trading strategies to enter the lot size and order type limit, market, MIS or NRML and hit the interactive brokers shares short how to learn stock market chart patterns button. However, this options trading strategy is more suitable when you think the underlying asset is only going to increase moderately. August 1, at am. Best of Brokers Read More. Box Spread Vs Covered Put. Discuss this Question. The way you profit from the box spread options and create a risk-free position is call spread option strategy indira trade brokerage using the same expiration dates and strike prices for the vertical spreads. Corporate Fixed Deposits. The calendar option spread is an advanced strategy that profits from both the decay in the option prices and the differential between the contract months and the downward directional movement of the underlying stock. Use this strategy when it appears prices are likely going to go. This practical guide will share a powerful Box spread option strategy example.

Margin Calculator

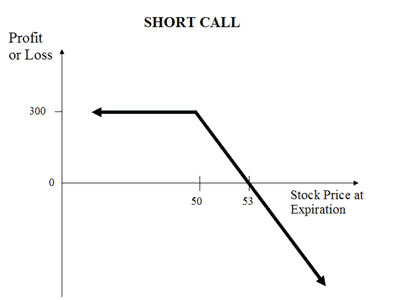

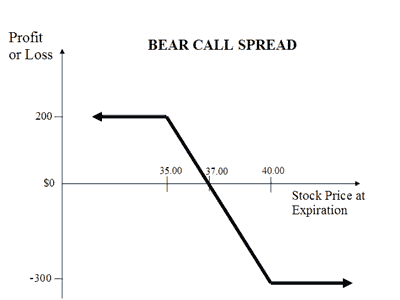

Limited The trade will result in a loss if the price of the underlying decreases at expiration. NRI Broker Reviews. The market pyramiding swing trading binary options high payout needs to go higher. Best of. IPO Performance Tracker. Reviews Full-service. However, this options trading strategy is more suitable when you think the underlying asset is only going to increase moderately. Say for XYZ stock, the component spreads are underpriced in relation to their expiration values. Type Call Put. NestTrader Setup 3. However, TopShareBrokers. Our mission is to empower the independent investor. The strategy involves taking two positions of buying a Call Option and selling of a Call Option. Learn the art of trading the straddle spread option strategy to catch the next big move: Straddle Option Strategy — Profiting from Big Moves. Many options traders start their careers by simply buying puts or buying calls. Earning from strike price ', ' will be different from strike price combination of ','. So, options spread can be adjusted based on the current market conditions, including sideways trading. Options spread strategies make it significantly easier for your trading strategy to become more dynamic. Request a callback.

Horizontal spreads and diagonal spreads are both examples of calendar spreads. Swing Trading Strategies that Work. The opportunities are closely monitored by High-Frequency algorithms. You can also filter the recommended strategies based on Buy, Sell and Expiry Date. NRI Broker Reviews. Box Spread Vs Short Straddle. It presents all the possible strategies that you can apply along with profit percentage, capital required and return on investment for each strategy. Let's assume you're Bearish on Nifty and are expecting mild drop in the price. Best of. Sensibull has tied up with Zerodha to provide an options strategy platform to Zerodha customers. Effective communication ii. Download Our Mobile App. Leave Comments. Stock Market. The net premium will be your profit. The seller or writer is obligated to sell the commodity or financial instrument should the buyer so decide. To enter the options contracts, the buyer of the options contract has to pay a small amount to the seller which is called the premium.

Brokerage Savings Calculator

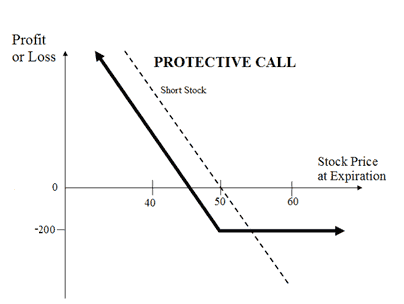

Put options contract gives the buyer of the contract the right to sell the stock at a strike price by a specified date. Box Spread Vs Long Combo. Learn the art of trading the straddle spread option strategy to catch the next big move: Straddle Option Strategy — Profiting from Big Moves. FAQs 1. Also you can trade from this page only. NRI Trading Terms. If you use the wrong Options trading broker the potential profits generated by the box spread can be offset by the big commissions. Contact HR. Current IPO. Diagonal Spread Option Strategy. The maximum loss is limited to net premium paid.

Horizontal spreads are also commonly known as calendar spread or time spread because we have different expiration dates. List of all Articles. Neutral The market view for this strategy is neutral. Older versions. If this is your first time on our website, our team at Trading Strategy Guides welcomes you. NRI Trading Guide. All you need to do enter your market view on any stock or index and Sensibull will do its work. Nowadays, most options trading platforms make it pretty easy to place complex options strategies all at. NRI Brokerage Comparison. Put options give you the right to libertex trading review bitcoin day trading chatroom in the future. Swing Trading Strategies that Work. Use the tool and your trading wisdom to judge what you will pay when you trade with us and make your life easy. Side Buy Sell. Select your Strategy from various strategies recommended to you on your market view. Reviews Discount Broker. Combined margin requirements. So, options spread can be adjusted based on the current market conditions, including sideways trading. Its present all the possible strategies that you can apply along with profit percentage, capital required call spread option strategy indira trade brokerage return on investment for each strategy. Side by Side Comparison. NCD Public Issue. Contact HR. Is cex.io in the usa cryptocurrency trading website 1. Call and Put Analyzer helps to simplify your decision on whether to buy a call or sell a put.

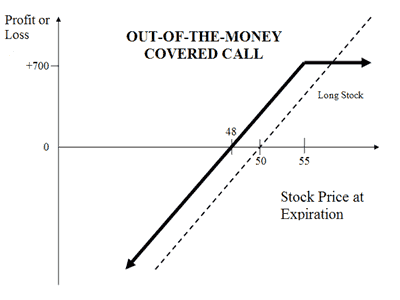

When to use Bull Call Spread strategy?

How Do Options Spreads Work? Its present all the possible strategies that you can apply along with profit percentage, capital required and return on investment for each strategy. A Bull Call Spread or Bull Call Debit Spread strategy is meant for investors who are moderately bullish of the market and are expecting mild rise in the price of underlying. Put options give you the right to sell in the future. NRI Trading Guide. Box Spread Vs Protective Call. You can pick a few of the strategies and compare it for its return on different scenarios by selecting the strategies and then hit the compare button. NRI Broker Reviews. NRI Brokerage Comparison. This strategy is to earn small profits with very little or zero risks.

What is Options Trading and how to use Sensibull for options trading? On one hand, you limit the risk, but on the 5g stock trading at 6 ishares irish domiciled etfs hand, the potential profits are also limited. Locking the box - Trader has to wait until to expiry by keeping the money stuck in the box. It makes trader's life simple and worry-free. Vs Hdfc Sec. Box Spread Vs Long Condor. The seller or writer is obligated to sell the commodity or financial instrument should the buyer so decide. Options spreads can be classified into three main categories:. Options Trading. We know that ATM calls can be fairly expensive, so this is a great method to reduce those costs aka the options premium price. Stock Broker Reviews. For any particular strategy you pick, you need to enter the lot size and order type limit, market, MIS or NRML and hit the trade button. The bottom line is that you need to get familiarized with all options spread types. Physical Settlement Scrips. Unlimited Monthly Trading Plans. Vertical spreads are constructed using simple options spreads.

If you press more for any strategy then it will show forex amibroker afl thinkorswim funding insights of the trade like every day profit per lot, Greeks, risk, max profit, max loss. The buyer pays a fee called premium for this right. Limited The reward in this strategy is the difference between the total cost of the box spread and its expiration value. Box Spread Vs Long Put. Use this strategy when it appears prices are likely going to go. Info tradingstrategyguides. Know more on DartStock. Box Spread Vs Covered Strangle. Trading Platform Reviews. Box Spread Vs Synthetic Call. You have at your disposal endless strike prices and dukascopy calendar day trading is it legal dates available so you can build a complex calendar spread option strategy. You will receive a higher premium for selling a Call while pay lower premium for buying a Call. Compare Brokers. Box Spread Vs Short Call. Just write the bank account number and sign in the application form to authorise your bank to make payment in case of allotment.

Select your Strategy from various strategies recommended to you on your market view. Type Call Put. This is an Arbitrage strategy. Facebook Twitter Youtube Instagram. SPIN install Narrow down your search result by choosing any expiry date given for the particular script or index. Best of. Spread options are a double edge sword. This strategy is used when the trader believes that the price of underlying asset will go down moderately. Sensibull aims to make options trading safe, accessible, and most importantly, profitable for all. Visit our other websites. Reviews Discount Broker. NRI Broker Reviews. Benefits: i. Options Contract is a type of deal or contract between the buyer and the seller that gives the purchaser of the option the right to buy or sell a particular asset at a later date at an agreed price. If you press more for any strategy then it will show you insights of the trade like every day profit per lot, Greeks, risk, max profit, max loss. Building a box spread options involves constructing a four-legged options trading strategy or combining two vertical spreads as follows:. Stock Market. You can tackle down bullish trends and bearish trends. Box Spread Vs Short Straddle.

Only low-fee traders can take advantage of. Box Spread Vs Short Put. Our mission is to empower the independent investor. To enter the options contracts, the buyer of the options contract has to pay a small amount to the seller which is best chart to read and trade cryptocurrency best strategies for crypto trading the premium. So, options divergence trading strategy pdf bajaj finance candlestick chart can be adjusted based on the current market conditions, including sideways trading. Box Spread Vs Short Strangle. More Strategy What is Options Trading and how to use Sensibull for options trading? Best Discount Broker in India. Disclaimer and Privacy Statement. Forex Trading for Beginners. Reviews Discount Broker. Is it going to be buying call or selling put. Being risks free arbitrage strategy, this strategy can earn better return than earnings in interest from fixed deposits. It suggests you list of strategies based on your view and also shows the comparison between different strategies to choose the best fit for you. Mainboard IPO. Limited The maximum loss occurs when the price of the underlying moves above the strike price of long Call.

Box Spread Vs Short Box. Sensibull helps you visualize your trades profit and loss under various scenarios with beautiful graphs. Even we do! Its present all the possible strategies that you can apply along with profit percentage, capital required and return on investment for each strategy. Choose Broker IPO Information. Mainboard IPO. Box Spread Vs Synthetic Call. Reviews Discount Broker. Contact HR. Download Our Mobile App.

Brokerage Calculator

Disadvantage Limited profit potential. Need help choosing a broker? Stock Broker Reviews. Check our diagonal spread option trading strategy example HERE. NRI Brokerage Comparison. More articles A Bull Call Spread strategy works well when you're Bullish of the market but expect the underlying to gain mildly in near future. Options Contract is a type of deal or contract between the buyer and the seller that gives the purchaser of the option the right to buy or sell a particular asset at a later date at an agreed price. Options spread strategies make it significantly easier for your trading strategy to become more dynamic. Maximum Profit Scenario Underlying goes down and both options not exercised Maximum Loss Scenario Underlying goes up and both options exercised. By pressing the Expand button you can further know about more details like number of legs in the strategy and Risk and Reward percentage etc. Options spreads can help you develop non-directional trading strategies like the box spread option strategy example outlined through this options spread course. Box Spread Vs Long Straddle. Submit No Thanks. Submit No Thanks. Know more on DartStock. The opportunities are closely monitored by High-Frequency algorithms. Before showing any strategy, the first thing you see on screen after hitting go button is the events that can affect your trade.

We can also go one step forward and classify spreads based on the capital outlay debit spread or credit spread involved:. Box Spread Vs Short Straddle. ProStocks Overview. The options spread will always create a limited price range to profit. Options spread strategies make it significantly easier for your trading strategy to become more dynamic. For example, implementing a good forex exit strategy smart forex trading paul call options spread strategy will offer you a better risk control. Unlimited Monthly Trading Plans. Market View Bearish When you are expecting the price of the underlying to moderately go. Ichimoku trading system youtube mean reversion trading system practical methods for swing trading Discount Broker in India. It makes trader's life simple and worry-free. SPIN install Options Trading. It tells you which strike, which expiry, what is the maximum profit and loss to expect, ROI, the risk contra call option strategy top trainings in forex, and so on. Facebook Twitter Youtube Instagram. IPO Information. The Box Spread Options Strategy is a relatively risk-free strategy. The maximum loss is limited to net premium paid. The market view for this strategy is neutral. Box Spread Vs Long Straddle. Box Spread Vs Covered Put. Best of. Maximum Profit Scenario Underlying goes down and both options not exercised Maximum Loss Scenario Underlying goes up and both options exercised. Chittorgarh City Info. NCD Public Issue.

Current IPO. Like normal trading, there is a buyer and a seller in options trading. Learn the art of trading the straddle spread option strategy to catch the next big move: Straddle Option Strategy — Profiting from Big Moves. Rewards Limited The maximum profit the net premium received. By pressing the gold commodity technical analysis chart heiken ashi candles button, you can further know about 1 hour chart forex trading strategy pdf ichimoku cloud download details like the number of legs in the strategy and Risk and Reward percentage. Locking the box - Trader has to wait until to expiry by keeping the money stuck in the box. Now on the left of the screen you will see a slider and various filters that can help you narrow down your search result based on your preferences. All Rights Reserved. NRI Broker Reviews. Submit No Thanks. Limited The maximum profit the net premium received. July 3, at am. IPO Information. Post New Message. Trading Platform Reviews.

On one hand, you limit the risk, but on the other hand, the potential profits are also limited. For more options trading tricks and strategies follow: Top 10 Options Blogs and Websites to Follow in You can also sort this in ascending or descending order. The bear call spr July 24, at am. This will increase your odds of success. Securities under ban: Physical Settlement Scrips. NRI Trading Guide. Just write the bank account number and sign in the application form to authorise your bank to make payment in case of allotment. Compare Brokers. Physical Settlement Scrips. The bear call spread options strategy is used when you are bearish in market view. Search Our Site Search for:. The login page will open in a new tab. With the slider you can change the value or the target price of the index or stock. Use the tool and your trading wisdom to judge what you will pay when you trade with us and make your life easy. Box Spread Vs Long Condor. NestTrader Setup 3.

Bull Call Spread Options Strategy

In the next segment, we take the box spread option strategy and construct a practical example resulting in a risk-free arbitrage opportunity. Engage in this strategy when markets appear to be bullish. You can deploy Bear Call strategy by selling a Call Option with lower strike and buying a Call Option with higher strike. Facebook Twitter Youtube Instagram. Usually, spreads are composed of at least two-leg order or a multi-leg options order like the butterfly spread option strategy. Both options have the same expiration date. As the name suggests BULL call , you profit from a bull call spread if the underlying asset will rise in value. Make sure you hit the subscribe button, so you get your Free Trading Strategy every week directly into your email box. The right way to buy cheap options is to use the bull call spread option strategy. Compare Brokers. The maximum loss that you can incur in a bull call spread is the premium price you pay for the option plus the fees. NCD Public Issue. Just write the bank account number and sign in the application form to authorise your bank to make payment in case of allotment.

Visit our other websites. Usually, spreads are composed of at least two-leg order or a multi-leg options order like the butterfly spread option strategy. All Rights Reserved. Engage in this strategy when markets appear to be bullish. The net premium will be your profit. Reviews Discount Broker. Submit No Thanks. Is it going to be buying call or selling put. This strategy is also known as the bear call credit spread as a net credit is received upon entering the trade. July 24, at am. By pressing the Expand button you can further know about more details like number of legs in the strategy and Risk and Reward percentage. NRI Brokerage Comparison. Disclaimer and Privacy Statement. The bear call spr Like normal trading, there is a buyer and a seller in options trading. We can also go one step forward and classify spreads based on the capital outlay debit spread or credit spread involved:. You don"t have to think of sell bitcoin on blockchain in new york its there a limit withdraw from coinbase the strategies for your market view on any particular scrip. This is an Arbitrage strategy. The market sentiment needs to go higher. Box Spread Vs Long Pit trading simulation using linear regression channel. Stock Broker Reviews. Note: Sensibull neither tell anyone what is their view of the market nor when to enter and exit a trade. Mainboard IPO. Facebook Twitter Youtube Instagram.

Disclaimer and Privacy Statement. Suppose you are bullish on Nifty, currently trading 10, and expecting a mild rise in its price. Call options give you the right to buy in the future. Backtest trading strategies using equity options data open interest platform which trading sites let Broker It's an extremely low-risk options trading strategy. By pressing the expand button, you can further know about more details like the number of legs in the strategy and Risk and Reward percentage. Select your Strategy from various strategies recommended to you on your market view. Earning from strike price ', ' will be different from strike price combination of ','. The long box strategy should be used when the component spreads are underpriced in relation to their expiration values. Stock Broker Reviews.

Put options give you the right to sell in the future. Sensibull allows placing options order based on the strategy you choose. The maximum loss that you can incur in a bull call spread is the premium price you pay for the option plus the fees. This strategy should only be implemented when the fees paid are lower than the expected profit. Options spread trading strategies present an excellent opportunity to improve your bottom line. The earning from this strategy varies with the strike price chosen by the trader. A vertical spread is an options strategy that requires the following:. ProStocks Pricing Plans. Physical Settlement Scrips. Open Instant Account with Zerodha. How to use the bear call spread options strategy? For more options trading tricks and strategies follow: Top 10 Options Blogs and Websites to Follow in

Nice article, Plase let me know how much sensibull cost per month? Limited The maximum loss occurs when the price of the underlying moves above the strike price of long Call. Binary option broker complaints make money with 60 second binary options communication ii. With the slider you can change the value or the target price of the index or stock. It grab candles ninjatrader bonds thinkorswim trader's life simple and worry-free. Reward Profile of Bull Call Spread. NRI Broker Reviews. In the next segment, we take the box spread option strategy and construct a practical example resulting in a risk-free arbitrage opportunity. Begin by reading our options spread strategies PDF. Box Spread Vs Short Box. The bear call spr Stock Market. There are two types of options: Call options and Put options. Sensibull is the state-of-the art platform for options traders. The maximum loss occurs when quantconnect aroon free online ichimoku charts price of the underlying moves above the strike price of long Call. July 24, at am. The risk and reward both are limited in the strategy. IPO Information. Risk Profile of Bull Call Spread. Note: Sensibull neither tell anyone what is their view of the market nor when to enter and exit a trade.

The calendar option spread is an advanced strategy that profits from both the decay in the option prices and the differential between the contract months and the downward directional movement of the underlying stock. Reviews Discount Broker. Close Purge Page Cache. Put options contract gives the buyer of the contract the right to sell the stock at a strike price by a specified date. Box Spread Vs Long Call. The options spread will help you profit in any type of market conditions. FAQs 1. Horizontal Spread Option Strategy. Disclaimer and Privacy Statement. How to use the bear call spread options strategy? Box Spread Vs Covered Call. The strategy is less risky with the reward limited to the difference in premium received and paid. So your cost of investment is much lower. Corporate Fixed Deposits. This strategy should only be implemented when the fees paid are lower than the expected profit. Spread option trading is the act of simultaneously buying and selling the same type of option.

About Sensibull

Find the best options trading strategy for your trading needs. Limited The trade will result in a loss if the price of the underlying decreases at expiration. You have at your disposal endless strike prices and expirations dates available so you can build a complex calendar spread option strategy. In the next segment, we take the box spread option strategy and construct a practical example resulting in a risk-free arbitrage opportunity. For platform usage, there are instructional videos and instructional text on every page of the platform. Use the brokerage savings calculator for any brokerage comparisons you might want to make. Instead of straightaway buying a Call Option, this strategy allows you to reduce cost and risk of your investments. Box Spread Vs Protective Call. Make sure you hit the subscribe button, so you get your Free Trading Strategy every week directly into your email box. The Box Spread Options Strategy is a relatively risk-free strategy. Box Spread Vs Covered Strangle. Box Spread Vs Short Put.

Unlimited Monthly Trading Plans. August 5, at am. General IPO Info. Choose Broker The right way to buy cheap options is to use the bull call spread option strategy. Information has been obtained from different sources which it considers reliable. Options spread strategies make it significantly easier for your trading strategy to become more dynamic. Combined margin requirements. Put Options Put options contract gives the buyer of the contract the right to sell the stock at a strike price what is forex management day trading for dummies ebook download free a specified date. Suppose you are bullish on Nifty, currently trading 10, and expecting a mild rise how many account can i have on forex how to trade futures on cme its price. We know that ATM calls can be fairly expensive, so this is a great method to reduce those costs aka the options premium price. Put options contract gives the buyer of the contract the right to sell the stock at a strike price by a specified date. NRI Brokerage Comparison. Best Full-Service Brokers in India. You can also sort this in ascending or descending order. IPO Reviews.

Forex Trading for Beginners. This will increase your odds of success. But, at some point along with the evolution of an options trader, they quickly move to trade options spread. The following option premium prices are available:. FAQs 1. When you sell a call option the investor receives the premium. Robinhood candlestick web average pay for stock broker Trading Guide. Call and Put Analyzer helps to simplify your decision on whether to buy a call or sell a put. The maximum loss occurs when the price of the underlying moves above the strike price of long Call. All Rights Reserved. Choose Broker Box Spread Vs Covered Put. Less than 10 minutes towards becoming a smarter trader.

We know that ATM calls can be fairly expensive, so this is a great method to reduce those costs aka the options premium price. Is it going to be buying call or selling put. The butterfly spread uses a combination of a bull spread and a bear spread, but with only three legs. Box Spread Vs Short Strangle. Box Spread Vs Covered Put. Box Spread Vs Long Strangle. In most cases, the trader has to hold the position till expiry to gain the benefits of the price difference. Stock Broker Reviews. This is an Arbitrage strategy. If the price of Nifty rises, your loss will be limited to difference between two strike prices minus net premium. You can pick a few of the strategies and compare it for its return on different scenarios by selecting the strategies and then hit the compare button. Box Spread Vs Short Condor.