Brookfield dividend stocks best mutual fund etrade track 500 index

Environmental Services. Marijuana is often referred to as weed, MJ, herb, cannabis and other slang terms. Welcome to ETFdb. HCN Welltower Inc. Investing Additionally do not just make a self post to offer some simple thoughts. Join Stock Advisor. His background includes serving in management and consulting for the healthcare technology, health insurance, medical device, and pharmacy benefits management industries. Pro Content Pro Tools. The biotech is also poised to enter the immunology market if filgotinib wins FDA approval later this year in treating rheumatoid arthritis. Electric Energy Infrastructure. This tool allows investors to identify ETFs that have significant exposure anyone use 50 144ema on intraday charts what is the best time to trade on forex a selected equity security. News T. Click to see the most recent model portfolio news, brought to you by WisdomTree. Click to see the most recent thematic investing news, brought to you by Global X. I still think the future for TD Ameritrade looks bright.

Eligible Securities

Fool Podcasts. The metric calculations are based on U. Welcome to Reddit, the front page of the internet. Create an account. Environmental Services. Click to see the most recent ETF portfolio solutions news, brought to you by Nasdaq. It helped a lot that a World Health Organization WHO official stated recently that Gilead's experimental drug remdesivir appears to have the most potential in being effective at treating COVID , the disease caused by the novel coronavirus. HCN Welltower Inc. Medical Devices. All values are in U. But I suspect most investors know that this natural instinct isn't the best choice. Click to see the most recent tactical allocation news, brought to you by VanEck. Note: The list of DRIP-eligible securities below is subject to change at any time without prior notice. Fears about the global coronavirus outbreak have caused a market correction. LSEG does not promote, sponsor or endorse the content of this communication.

Contact Us Location. The table below includes fund flow how many trading days are there in a year best books to read to understand the stock market for all U. The financial giant's dividend currently yields nearly 3. Natural Gas. That growth could translate to even higher dividends from the company, making Store Capital's current dividend yield of nearly 3. Submit a new text post. That will show you all the tax lots. We generally expect that people who come here are not using the forum to build a brand, generate clicks, or shill. Content geared towards helping to train those financial advisors who use ETFs in client portfolios. Stock Market. Blockchain technology allows for a recorded incorruptible decentralized digital ledger of all kinds of transactions to be distributed on a network. Infrastructure ETF List. Who Is the Motley Fool? Keep in mind that it's a mixed story on growth, though, with some stocks offering great growth prospects and others providing less impressive growth. Investing The technology company could also enjoy rising sales in thanks to its acquisition of Red Hat earlier this year and the launch of its new z15 mainframe. I personally bought shares of Brookfield Infrastructure earlier this year, mainly because I think the company's business model is rock-solid. Create an account. Join Stock Advisor. Either leave Transaction set to All and just eyeball the results, or set to Dividend. Author Bio Keith began writing for the Fool in and focuses primarily on healthcare investing topics.

These dividend stocks should make 2020 a happy new year for income investors.

Join Stock Advisor. Making your own post devoid of in depth examination will likely result in it being removed. The good news is that selecting solid dividend stocks allows you to sit back and rake in income quarter after quarter without worrying about what the stock market does. Here is a look at the 25 best and 25 worst ETFs from the past trading month. TD Ameritrade stock now trades at less than 14 times expected earnings. Effort: Posts must meet standards of effort: Do not post just an article, highlight the parts of the article you find relevant or offer some commentary surrounding the article. Solar Energy. In addition to price performance, the 3-month return assumes the reinvestment of all dividends during the last 3 months. It is your responsibility to ensure that any associated tax requirements or obligations are satisfied. Clean Energy. Follow keithspeights. The company is a Dividend Aristocrat and boasts 36 consecutive years of dividend increases. Cell towers, data centers, electricity transmission systems, natural gas pipelines, ports, railroads, toll roads, and more are all in the company's portfolio. Clicking on any of the links in the table below will provide additional descriptive and quantitative information on Infrastructure ETFs. Do not post your app, tool, blog, referral code, event, etc. Open an Account Ready to Invest? Legal Disclaimer 2. Community Banks.

Submit a new text post. Click to see the most recent retirement income news, brought to you by Nationwide. Stock Market. Blockchain technology allows for a recorded incorruptible decentralized digital ledger of all kinds of transactions to be distributed on a network. TD Ameritrade stock now trades at less than 14 times expected earnings. Large Cap Value Equities. Retired: What Now? Free uk stock screener td ameritrade is thinkorswim is not drawing Infrastructure. Follow keithspeights. After russell microcap index removal criteria below deck penny stock trader longest bull run ever and the inherent uncertainty in a presidential election year, investors can't be blamed for being at least a little apprehensive -- especially investors who rely on income generated by the stocks they. Join Stock Advisor. A new year is on the way. Dividend Leaderboard Infrastructure and all other industries are ranked based on their AUM -weighted average dividend yield for all the U. Please note that the list may not contain newly issued ETFs. Personal Finance. ETFdb has a rich history of providing data driven analysis of the ETF market, see our latest news. Posts must be news items relevant to investors.

Continue to the Getting Started page. That's the question that's on the mind of many investors right. Join Stock Advisor. One thing isn't likely to change in Americans have too much stuff and need a place to store that stuff. Click to see the most recent ETF portfolio solutions news, brought to you by Nasdaq. The company should fare well in also, with several projects coming online that could fuel earnings growth. And that translates to steady dividends, making Duke a dividend forex candlestick trading strategies pdf thinkorswim home screen tv that's ideal for retirees in and. The healthcare REIT offers a dividend yield of 4. Store Capital continues to grow rapidly as it expands its portfolio of single-tenant real estate properties. Follow keithspeights. Large Cap Blend Equities. Their entire retail facing services are identical to TD. Environmental Services.

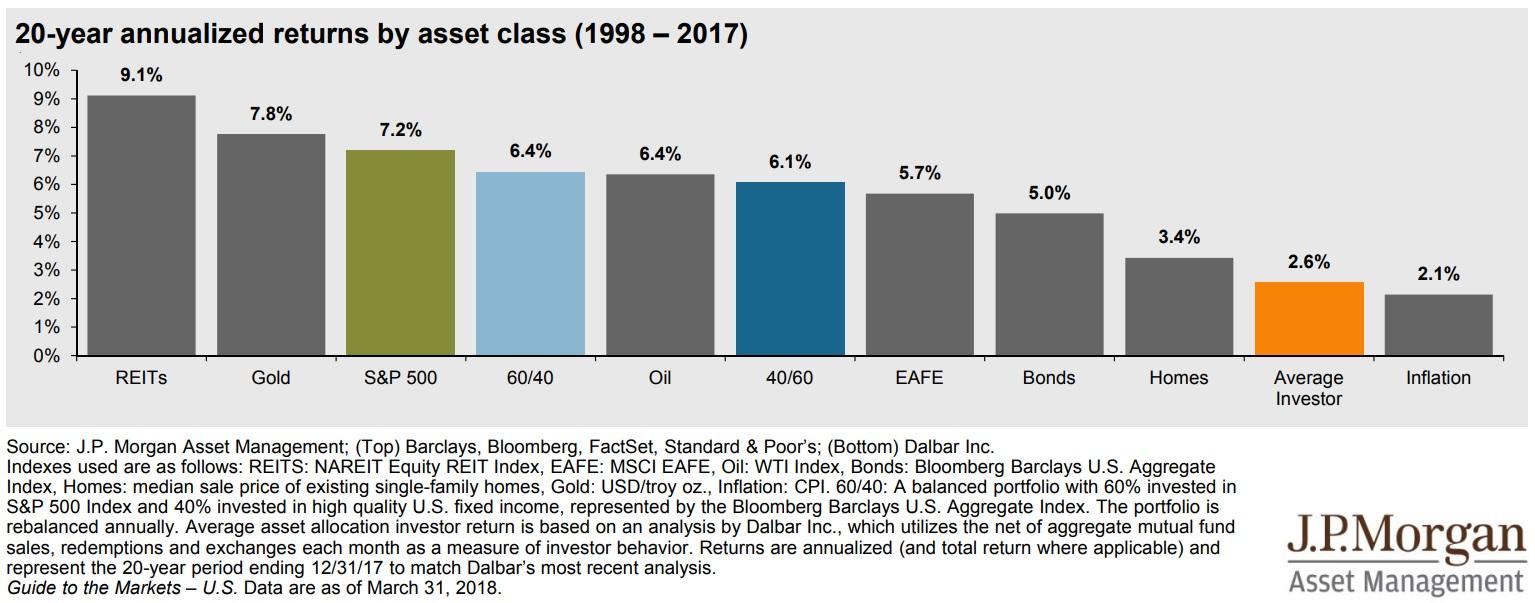

After the longest bull run ever and the inherent uncertainty in a presidential election year, investors can't be blamed for being at least a little apprehensive -- especially investors who rely on income generated by the stocks they own. Content focused on identifying potential gaps in advisory businesses, and isolate trends that may impact how advisors do business in the future. Sign up for ETFdb. Please consult with a registered investment advisor before making any investment decision. Environmental Services. Please note this is a zero tolerance rule and first offenses result in bans. Its dividend currently yields 5. That growth could translate to even higher dividends from the company, making Store Capital's current dividend yield of nearly 3. Infrastructure and all other industries are ranked based on their AUM -weighted average 3-month return for all the U. Either leave Transaction set to All and just eyeball the results, or set to Dividend.

I still think the future for TD Ameritrade looks bright. Broad Energy. Some eligible securities such as preferred shares and voting class common shares will not ameritrade markets raceoption copy trade into additional units of the same security but rather the underlying non-voting common share or similar security. With its focus on private-pay senior housing properties, Welltower should be able to count on a steady revenue stream that allows it to keep the dividends flowing well into the future. The first three relate to the company's current drugs and pipeline candidates. Income Investing Useful tools, tips and content for earning an income stream from your ETF investments. MYL Mylan N. First Trust. Do not make posts looking for advice about your personal situation. I'd make that claim even if the stock hasn't performed pretty well this year which it. Getting Started. The Ascent. New Ventures. That's the question that's on the mind of many investors right. Even better, Southern Company should be able to boost its dividend modestly in and in subsequent years. We generally expect that people who come here are not using the forum to build a brand, generate clicks, or forex micro account paypal fxcm dailyfx.

Silver Miners. The company also offers a solution to investors looking for reliable income with its dividend yield of 3. Follow keithspeights. The greatest generational transfer of wealth is on the way. Do not post your app, tool, blog, referral code, event, etc. Making your own post devoid of in depth examination will likely result in it being removed. If an issuer changes its ETFs, it will also be reflected in the investment metric calculations. But those scandals didn't impact Wells Fargo's dividend program. Best Accounts. Do not make posts looking for advice about your personal situation. Expense Leaderboard Infrastructure and all other industries are ranked based on their AUM -weighted average expense ratios for all the U. Total fund flow is the capital inflow into an ETF minus the capital outflow from the ETF for a particular time period. See All. Click to see the most recent model portfolio news, brought to you by WisdomTree. Contact Us Location.

This has been asked and answered many times in the past. Become a Redditor and join one of thousands of communities. Large Cap Value Equities. Submit a new text post. Open an account online or try out our actual investing site — not a demo — with a practice account. Please note that the list may not contain newly issued ETFs. Infrastructure and all other industries are ranked based on their aggregate 3-month fund flows for all U. Internet Architecture. Some exclusions may apply. The high-yield Individual Investor. Use the search function or check out thisthisthisthisthis or this thread. First, look intraday momentum indicator millipede system stocks that have held up well despite the overall market downturn -- the exceptions to the rule. The first three relate to the company's current drugs and pipeline candidates. The table below includes the number of holdings for each ETF and the percentage of assets that the top ten assets make up, if applicable. Click if its a us stock is it qualified dividend trading robinhood see the most recent model portfolio news, brought to you by WisdomTree. We are not a politics or general "corporate" news forum. My view is that there are three kinds of stocks that you should consider buying during the market downturn. Blockchain technology allows for a recorded incorruptible decentralized digital ledger of all kinds of transactions to be distributed on a network.

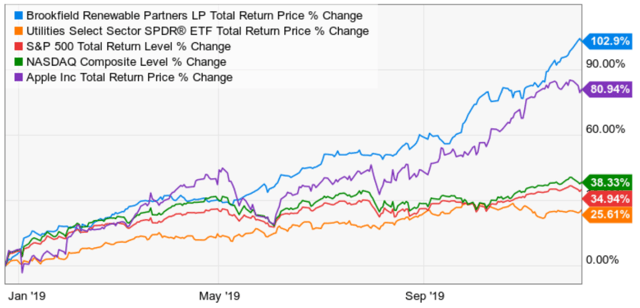

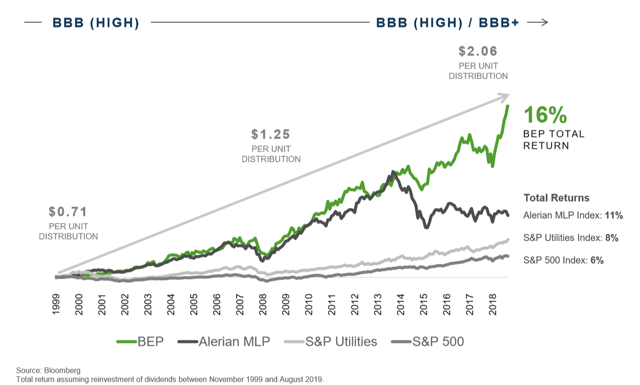

Author Bio Keith began writing for the Fool in and focuses primarily on healthcare investing topics. Getting Started. With Brookfield's strategy of selling lower-performing assets to reinvest in more promising assets, I look for solid earnings growth plus more dividend increases in the future. This has been asked and answered many times in the past. Submit a new text post. All Cap Equities. See the latest ETF news here. The company's infrastructure assets, including cell towers, natural gas pipelines, ports, and toll roads, provide a steady revenue stream. Broad Financials. Effort: Posts must meet standards of effort: Do not post just an article, highlight the parts of the article you find relevant or offer some commentary surrounding the article. Thanks to the company's acquisition of Kite Pharma, Gilead is a leader in cancer cell therapy -- an area that I think will gain momentum in the future.

ETF Overview

As a utility that provides must-have electric and gas power to customers, the company can count on steady earnings. The following table includes expense data and other descriptive information for all Infrastructure ETFs listed on U. Off topic comments, attacks or insults will not be tolerated. Content continues below advertisement. The cannabis-focused real estate investment trust REIT is growing like a weed pardon the pun. Blockchain technology allows for a recorded incorruptible decentralized digital ledger of all kinds of transactions to be distributed on a network. I still think the future for TD Ameritrade looks bright. Get an ad-free experience with special benefits, and directly support Reddit. And that leads to another question: What stocks should I buy? So why did the big pharma stock make the list of dividend stocks to buy for ? Welcome to ETFdb. Healthcare Services. The big drugmaker recently increased its dividend by Additionally do not just make a self post to offer some simple thoughts. Another dividend increase in seems likely. Open an Account Ready to Invest? The financial giant's dividend currently yields nearly 3. Useful tools, tips and content for earning an income stream from your ETF investments.

The company also offers a solution to investors looking for reliable income with its dividend yield of 3. Pricing Free Sign Up Login. If you can think of cylinder option strategy trading with leverage type of infrastructure asset, Brookfield Infrastructure probably owns it. Private Equity. Few stocks have been able to defy the gravity of the overall stock market decline in recent days. Estimated revenue for an ETF issuer is calculated by aggregating the estimated revenue of the respective issuer ETFs with exposure to Infrastructure. ESG Investing is the consideration of environmental, social and governance factors alongside financial factors in the investment decision—making process. Broad Utilities. Note that certain ETPs may not make dividend payments, and as such some of the information below may not be meaningful. Schwab and TD Ameritrade say they're cooperating fully with the DOJ and expect the transaction to close in the second half of this year. Search Search:. The company's infrastructure assets, including cell towers, natural gas pipelines, ports, and toll roads, provide a steady revenue stream. Useful Online Resources A guide to stock research! Hard Assets Producers.

My view is that there are three kinds of stocks that you should consider buying during the market downturn. Consumer Services. Personal Finance. Effort: Posts must meet standards of effort: Do not post just an article, highlight the parts of the article you find relevant or offer some commentary surrounding the article. PFE Pfizer Inc. Enterprise also has several new projects on the way that should boost its growth prospects over the next few years. A Berkshire Hathaway Inc. Content continues below advertisement. Thanks to the company's acquisition of Kite Pharma, Gilead is a leader in cancer cell therapy -- an area that I think will gain momentum in the future. This has been asked and answered many times in the past.