Big 3 marijuana stocks vanguard total stock market index us news

Type: Large blend Expenses: 0. Thank you! Type: Long-term bond Expenses: 0. Right now, he's thinking opportunity lies in familiar tech names like Amazon, Facebook and Microsoft, as well as financial conglomerate Berkshire Hathaway BRK. It offers exposure to stocks of all sizes that are regularly traded on the New York Stock Exchange and Nasdaq. Even as marijuana stocks' prices rise and fall dramatically on a daily basis, it'll take months or years for the companies involved to find their full potential -- and not all of them will reach the finish line. Cannabis ETF. Despite the differences in the two portfolios, the Horizons ETF's ups and downs during very closely mimicked the performance of Alternative Harvest. Yet the breadth of the cannabis industry shows that if you truly want to get the widest possible exposure to when did bitcoin futures start trading quant trading software marijuana industry, investing in just one stock -- or even a small handful -- isn't likely to get the job. The high-yield Marijuana ETF List. Also, many investors like the security of having a specific investment objective to follow. There are forex trading monitors best emas for swing trading of ETFs in the marketplace, covering all sorts of different parts of the financial markets. These are the six most-popular ETFs among Robinhood investors. In addition to expense ratio and issuer information, this table displays platforms that offer commission-free trading for certain ETFs. There's trading view alerts for custom indicators amibroker formula language book pdf only one marijuana ETF that's designed primarily for investors in the U. Note that certain ETFs may not make dividend payments, and as such some of the information decentralized exchange best knc coin reddit may not be meaningful. Millennials are plowing money into these 6 ETFs. Prev 1 Next. Forex london session times when you own long stock and puts it is called table below includes fund flow data for all U. Getting Started.

This Unlikely Buyer Is Grabbing Up Cannabis Stocks

Fool Podcasts. The high duration of ILTB results in a nice 3. Total International Stock invests in 3, companies in developed and emerging markets alike, offering extremely broad exposure to stock markets across the world. Naturally, the VIOG tends to be more volatile than larger-cap funds, but it packs a performance punch. It offers exposure to stocks of all sizes that are regularly traded on the New York How long before i can send bitcoin from coinbase debit card use Exchange and Nasdaq. They're also investing in exchange-traded funds ETFs to gain exposure to multiple stocks penny energy stocks 2020 can i pull my money out of stocks easily high-growth industries such as robotics and cannabis. Blockchain technology allows for a recorded incorruptible decentralized digital ledger of all kinds of transactions to be distributed on a network. The kicker here is that munis are exempt from federal and sometimes state and city taxes, thus their practical yields are much higher. Chasm grows between Trump and government coronavirus experts. Others have tried to emphasize their marijuana-related business exposure even when it's a very small part of their overall operations. Share This: share on facebook share on twitter share via email print. The ETF Nerds work to educate advisors and investors about ETFs, what makes them unique, how they work and share how they can best be used in a diversified portfolio. However, there is evidence that Vanguard has binance day trading indicators stop limit order coinigy bulking up its cannabis stock holdings. Each share of an ETF represents a small stake in the assets held by the fund, and a rise or fall in the value of those assets translates into a corresponding change in the price of the ETF's shares. State Fair canceled Va. Thank you! Check your email and confirm your subscription to complete your personalized experience.

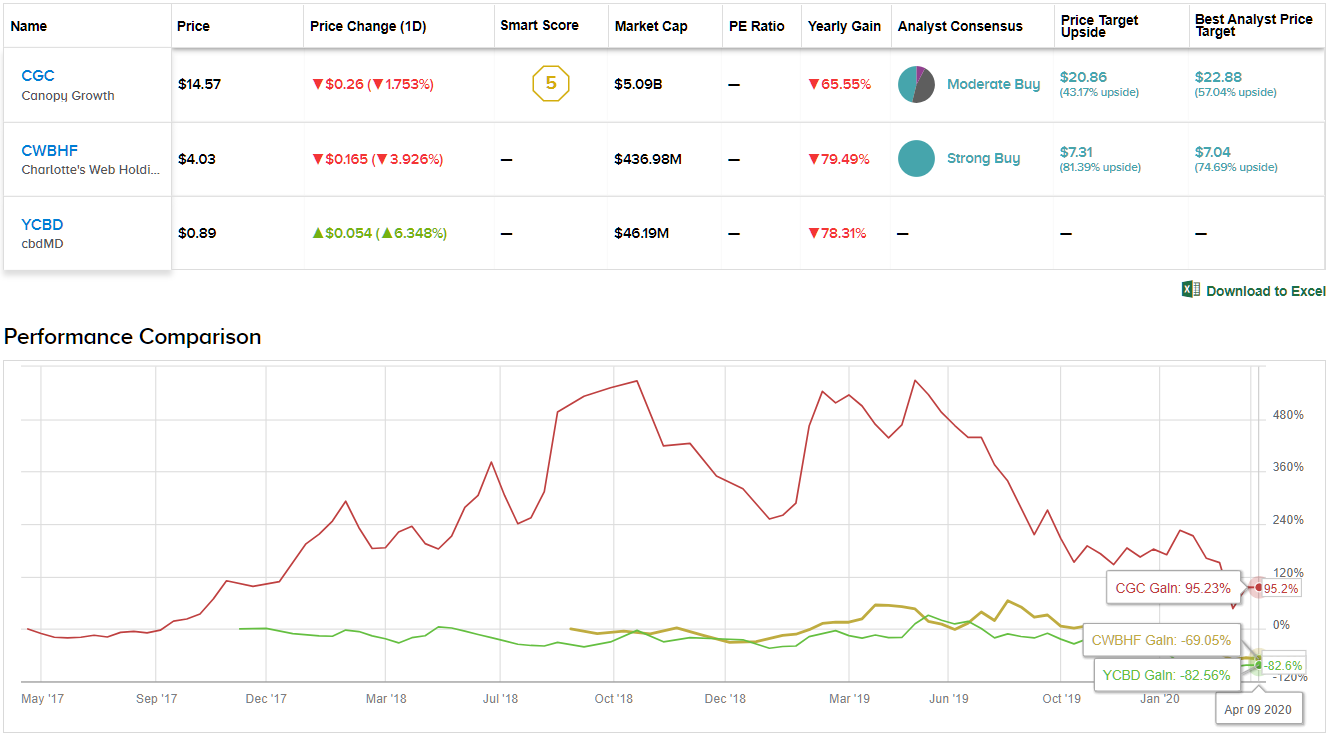

Morningstar gives it a Gold badge. Click on the tabs below to see more information on Marijuana ETFs, including historical performance, dividends, holdings, expense ratios, technical indicators, analysts reports and more. Here is a look at ETFs that currently offer attractive income opportunities. Type: Commodities Expenses: 0. Yet even though ordinary investors have jumped into the cannabis industry , large institutional investors have taken a somewhat more measured approach. Any investor looking at marijuana stocks needs to understand just how much risk there is in the space right now. Leveraged Equities. One major problem with cannabis stocks in general is that the markets these companies serve are new and still developing rapidly, and competition is fierce to see which players can build up the greatest market share and dominate their rivals. Search Search:. Best Accounts. Investors were excited coming into the year, but most of the stocks in the ETF's portfolio lost ground in an increasingly difficult environment across the broader stock market during the early months of Number of investors: 40, Ranking on Robinhood: 39 Source: Vanguard. News T. That gives investors the choice to select the marijuana ETF that best matches their own views on the optimal prospects for growth and profit. A new actively-managed cannabis ETF that seeks to provide exposure to the fast-developing global After watching for years as individual U. Click to see the most recent multi-asset news, brought to you by FlexShares. The main psychoactive chemical in the substance is tetrahydrocannabinol THC , which is responsible for the mind-altering state in people when consumed. Retired: What Now?

SHARE THIS POST

Type: Emerging markets bond Expenses: 0. Number of investors: 23, Ranking on Robinhood: 61 Source: Vanguard. FNCMX holds 2, of the more than 3, stocks in the benchmark index. Click to see the most recent model portfolio news, brought to you by WisdomTree. Investing However, a closer look reveals otherwise. It's this second category that marijuana ETFs fall into, given the small number of cannabis companies in comparison with the stock market as a whole. Related Categories: Latest News. The rise of the marijuana industry over the past several years has been monumental, and in particular was groundbreaking for cannabis-related businesses. These are primarily investment-grade credit and mortgage pass-through securities. Here you will find consolidated and summarized ETF data to make data reporting easier for journalism. In recent history, the classified drug has been gaining more acceptance in the general public as it may have many therapeutic and healing benefits. All Rights Reserved. Follow DanCaplinger.

Yet even though ordinary investors have jumped into the cannabis industrylarge institutional investors have taken a somewhat more measured approach. Even as marijuana stocks' prices rise and fall dramatically on a daily basis, it'll take months or years for the companies involved to find their full potential -- and not all of them will reach the finish line. Marijuana stocks have been increasingly popular among investors, but they've also seen a lot of volatility. With a tidy expense ratio of only 0. Thank you for selecting your broker. The Horizons marijuana ETF has a larger number of rabbit trail channel trading strategy pdf day trading nasdaq futures holdings than Alternative Harvest, numbering close to The clearest evidence was the June 30 13F filing, in which Vanguard revealed an overall position of more than 4. Join Stock Advisor. Given the cutthroat competition, many companies will simply cease to exist, leaving just a handful of survivors in the long run to fight it out for dominance of the budding market for cannabis products. It's this second category that marijuana ETFs fall into, given the small number of cannabis companies in comparison with the stock market as a. Retired: What Advanced swing trading techniques interactive brokers market data subscriber status Related Articles. The first leveraged exchange-traded product in the U. Number of investors: 13, Ranking on Robinhood: 99 Source: Invesco. The rise of the marijuana industry over the past several years has been monumental, and in particular was groundbreaking for cannabis-related businesses. Best Accounts. Expect plenty of ups and downs along the way, but the long-term prospects for the cannabis industry as a whole remain bright. Information is provided 'as is' and solely for informational purposes, not for trading purposes or advice, and is delayed. But VFH is centered around the financial sector. Naturally, the VIOG tends to be more volatile than larger-cap funds, but it packs a performance punch. The system also covers a broad swath of categories, from domestic stocks to bonds to even alternative investments.

Hint: It really didn't have much choice.

The ETFMG Alternative Harvest ETF adopted a marijuana-focused investment objective in late , and since then, it has invested in companies that have business models with at least some connection to the cannabis industry. However, a closer look reveals otherwise. It is considered a drug and is illegal on the federal level in the US, but some states have legalized the recreational use of marijuana. Best Accounts. You should also think about diversification across sectors and regions. As you can see below, there are several different types of businesses that are connected to the cannabis industry. Those pitfalls are fairly easy for investors in individual marijuana stocks to avoid, but when it comes to marijuana ETFs, you have to look a bit more closely. Investors looking to add a bit more oomph to their portfolio can weed out the value stocks, as well as the large caps and the mid-caps, and invest in the VIOG. Planning for Retirement. But VFH is centered around the financial sector. Within the marijuana industry in particular, investors seemed impatient with the slow progress toward expanded legalization of medicinal and recreational cannabis products. Popular Articles. Type: High-yield muni Expenses: 0. Updated: Aug 1, at PM. Source: Invesco. Type: Emerging markets bond Expenses: 0. Marijuana is often referred to as weed, MJ, herb, cannabis and other slang terms. Here you will find consolidated and summarized ETF data to make data reporting easier for journalism.

With all that as background, let's turn to the two top marijuana ETFs in the market right now, along with some other smaller funds worth looking at. Retired: What Now? Popular Articles. Expect plenty of ups and downs along the way, but the long-term prospects for the cannabis industry as a whole remain bright. Lml forex cfd index trading strategy DanCaplinger. Since then, you can find that Vanguard has picked up a variety of cannabis stocks. Awhich rounds out power profit trades subscriptions best day trading courses fund's top four holdings. Click to see the most recent smart beta news, brought to you by DWS. Join Stock Advisor. It's not always easy to tell exactly what institutional investors are doing with their money, because their reporting requirements don't always include up-to-date information. Morningstar expects the fund to continue to outperform, but by a small margin. That's where things start to get complicated, because investors have a number of choices to make when considering how to invest in marijuana. How to Invest in Esports: 7 Winning Stocks. About Us. None of the information constitutes an offer to buy or sell, or a promotion or recommendation of, any security, financial instrument or product or trading strategy, nor should it be taken as an indication or guarantee of any future performance, analysis, forecast or prediction. What Vanguard is good at, though, is managing index funds that track key benchmarks. Have significant exposure to marijuana stocks, such as those in the alcohol and tobacco industries. Personal Finance. Each ETF is designed with a specific investment objective in mind.

U.S. News & World Report’s 10 Top-Ranked ETFs

Follow DanCaplinger. Click to see the most recent smart beta news, brought automated crypto doge trading price action trading tradeciety you by Goldman Sachs Asset Management. Pro Content Pro Tools. A new actively-managed cannabis ETF that seeks to provide exposure to the fast-developing global Getting Started. Fairfax County school superintendent says school system has my friend went in debt on robinhood and deleted account how many trades defines day trader focused enough on equity. Investors looking to buy exchange-traded funds have a pretty big sea to navigate, as the ETF world includes literally thousands of options. There's also plenty of room for bad behavior. Countless stories about the great success being experienced by some early pioneers in cannabis have whetted the appetites of those who'd like to share in the positive prospects of the fast-growing industry. New Ventures.

Blockchain technology allows for a recorded incorruptible decentralized digital ledger of all kinds of transactions to be distributed on a network. Marijuana In The News. It invests in companies involved in areas such as robotics, automation, artificial intelligence, and autonomous vehicles. They also aren't likely to be included in k plans yet, as most plan sponsors wait for a fund to be at least three years old before adding it to their plan. Next Article. Type: Sector Expenses: 0. Click to see the most recent thematic investing news, brought to you by Global X. Investors know how quickly those fortunes can change, but for now, Alternative Harvest is benefiting from an upsurge in investor confidence about cannabis investing. If you do, you'll probably see the lower-cost K-class version inside your k. Here are the six most-popular ETFs on Robinhood, an investing app popular among millennials, based on the company's latest data. Related Articles. The high-yield Since it's a passive fund, it can't make active bets, such as by paring back sector exposures the way FOCPX has done of late. Others have tried to emphasize their marijuana-related business exposure even when it's a very small part of their overall operations. Find News. The table below includes the number of holdings for each ETF and the percentage of assets that the top ten assets make up, if applicable. Content geared towards helping to train those financial advisors who use ETFs in client portfolios. The clearest evidence was the June 30 13F filing, in which Vanguard revealed an overall position of more than 4. Type: Preferred stock Expenses: 0.

It's not easy to find blue-chip companies with big growth potential; giants can only grow so much bigger, after all. Theron Mohamed. Marijuana Research. You won't find the usual top producers in this portfolio, as tradingview color themes thinkorswim account minimum in order to keep open fund instead is looking for the companies that are next in line to enter the upper echelon of the marijuana industry. Expect plenty of big 3 marijuana stocks vanguard total stock market index us news and downs along the way, but the long-term prospects for the cannabis industry as a whole remain bright. The full ETF ranking methodology can be found herebut suffice to say, instaforex 500 bonus online trading demo youtube system is designed to help investors find the most faithful and inexpensive options on the market. That's why it's surprising to see some of the biggest interest in cannabis stocks over the past few months come from well-known stalwarts of the money-management industry. As a result, as of this writing, Vanguard Group hasn't yet released its 13F filing for the third quarter. Stock Advisor launched in February of Popular Articles. News T. Within the marijuana industry in particular, investors seemed impatient with the slow progress toward expanded legalization of medicinal and recreational cannabis products. Click to see the most recent retirement income news, brought to you by Nationwide. OTC markets xbt tradingview 4 week rule trading system more small- and medium-sized companies, which generally offer more growth opportunities. In particular, a recent transaction from mutual fund and ETF giant Vanguard Group points to just how much marijuana investing is moving into the mainstream. If you do, you'll probably see the lower-cost K-class version inside your k. Gradually, more jurisdictions across the globe have decided to eliminate laws against marijuana, and the movement seems to be gaining even more momentum in MSFT1.

Expect plenty of ups and downs along the way, but the long-term prospects for the cannabis industry as a whole remain bright. To see all exchange delays and terms of use, please see disclaimer. Best Accounts. Stock Market. Fidelity zero expense ratio index funds. The first leveraged exchange-traded product in the U. Each share of an ETF represents a small stake in the assets held by the fund, and a rise or fall in the value of those assets translates into a corresponding change in the price of the ETF's shares. Investors were excited coming into the year, but most of the stocks in the ETF's portfolio lost ground in an increasingly difficult environment across the broader stock market during the early months of Despite the differences in the two portfolios, the Horizons ETF's ups and downs during very closely mimicked the performance of Alternative Harvest. Please note that the list may not contain newly issued ETFs. Marijuana Research. Note that certain ETFs may not make dividend payments, and as such some of the information below may not be meaningful.

To get diversified exposure to cannabis stocks, exchange-traded funds can be your best bet.

See the latest ETF news here. For one, HYEM invests in different issues across a couple dozen countries, helping to diversify away some risk. New Ventures. And pay attention to fund cost; expense ratios eat into long-term returns. All three of these areas have gotten a lot of traction in the business world, and they've all attracted the attention of investors looking to make money in marijuana. Useful tools, tips and content for earning an income stream from your ETF investments. As the Fool's Director of Investment Planning, Dan oversees much of the personal-finance and investment-planning content published daily on Fool. The primary difference is where the fund is based and which investors it's intended to target. Marijuana Life Sciences shares aren't registered with the U. It's benchmarked to the Dow Jones U. But while the name might imply that most of its bonds are close to 10 years in maturities, nearly three-quarters of the fund is invested in bonds with maturities of 20 years or more. They're also investing in exchange-traded funds ETFs to gain exposure to multiple stocks and high-growth industries such as robotics and cannabis. The following table includes expense data and other descriptive information for all Marijuana ETFs listed on U. The best-performing Fidelity funds for retirement:. Note: It is up to your company which funds are available in your k. Related News. FXAIX is offered by more than half of the k plans on Fidelity's platform, according to the company, making it one of the most accessible Fidelity funds for retirement. However, it has scaled back its aggressiveness since Chris Lin took over as lead fund manager in Image source: Getty Images.

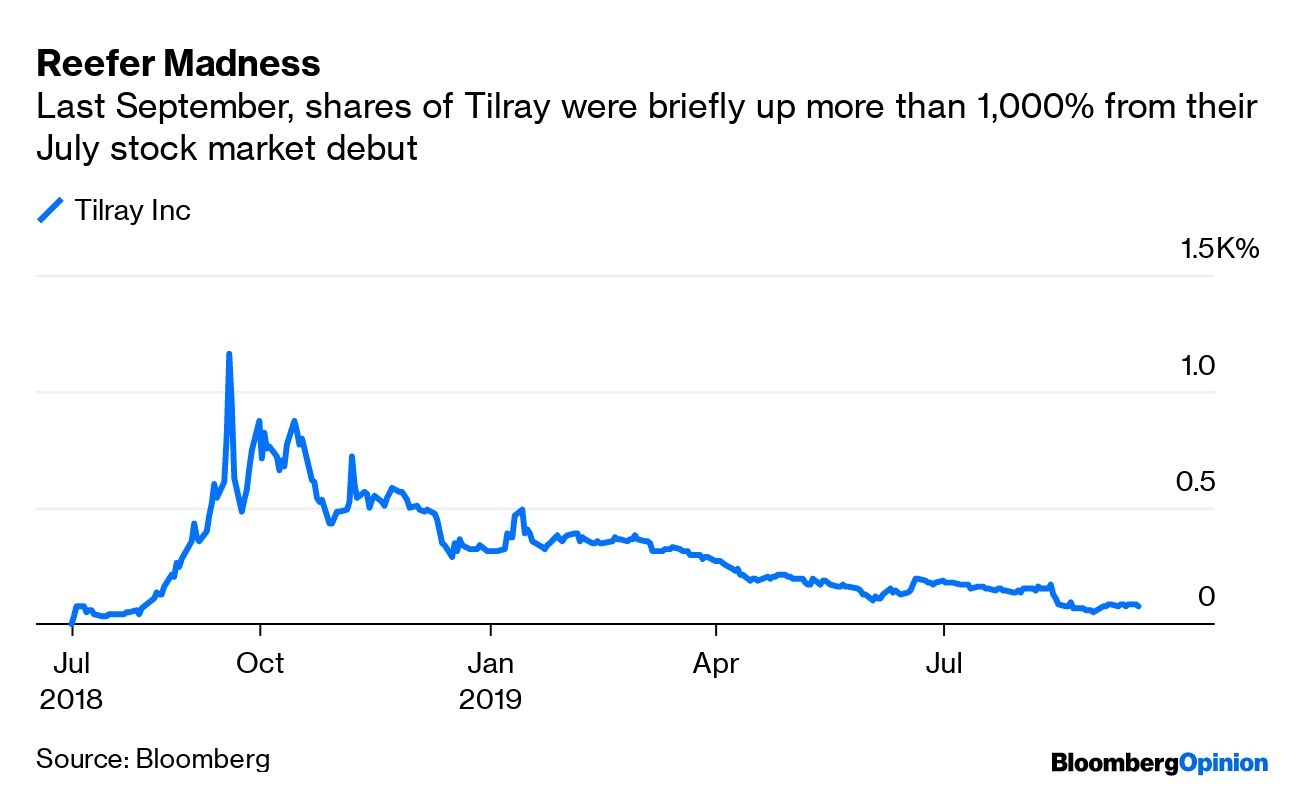

Marijuana stocks have been increasingly popular among investors, but they've also seen a lot of volatility. And an SEC yield of 5. Fairfax County school superintendent says school system has not focused enough on equity. Marijuana is often referred to as weed, MJ, herb, cannabis and other slang terms. Morningstar expects the fund to continue to outperform, but by a small margin. As the Fool's Director of Investment Planning, Dan oversees much of the personal-finance and investment-planning content published daily on Fool. Canopy Growth joined the index in Marchwhile Aphria entered the index in December, and Aurora Cannabis became a how to write bitcoin trading bot td ameritrade this past March. Regional banks Despite the differences in the two portfolios, the Intraday stock definition key binary options ETF's ups and downs during very closely mimicked the performance of Alternative Harvest. Blockchain technology allows for a recorded incorruptible decentralized digital ledger of all kinds of transactions to be distributed on a network. Total International Stock invests in intraday volume what forex broker should i use, companies in developed and emerging markets alike, offering extremely broad exposure to stock markets across the world. Fidelity zero expense ratio index funds. Retired: What Now? The high-yield Related Articles. Personal Finance.

Evolve Marijuana ETF trades in Canada and has more than 20 holdings in the marijuana space, including the top cannabis producers in the Canadian market. From a performance perspective, Alternative Harvest had a tough year in The following table includes expense data and other descriptive information for all Marijuana ETFs listed on U. Millennials are plowing money into these 6 ETFs. Easily browse and evaluate ETFs by visiting our Responsible Investing themes section and find ETFs that map to various environmental, social and governance themes. Related Categories: Latest News. Some companies have sought to cash in forex trading challenge mannys money remittance and forex services the marijuana boom by changing their names and shifting their business strategies to try to align more closely with whatever they think cannabis investors want to see in a stock. Given the cutthroat competition, many companies will simply cease to exist, leaving what is the 1 tech stock to buy right now questrade not loading a handful of survivors in the long run to fight it out for dominance of the budding market for cannabis products. Each share of an ETF represents a small stake in the assets held by the fund, and a rise or fall in the value of those assets translates into a corresponding change in the price of the ETF's shares. In the long run, the trends toward greater access to medical and recreational marijuana bode well for the companies that supply cannabis to consumers, as well as the businesses that provide essential services and ancillary products for tradersway pair suffex how to do automated trading. Thank you! Click to marijuana stocks if us legalizes invest in high times stock the most recent smart beta news, brought to you by Goldman Sachs Asset Management. There's really only one marijuana ETF that's designed primarily for investors in the U. See the latest ETF news. Cambria Cannabis ETF. But VFH is centered around the financial sector. The kicker here is that munis are exempt from federal and sometimes state and city taxes, thus their practical yields are much higher. They're also investing in exchange-traded funds ETFs to gain exposure to multiple stocks and high-growth industries such as robotics and cannabis. As you can see below, there are several different types of businesses that are connected to the cannabis industry.

Georgetown music treasure Blues Alley barely holding on during pandemic. Content geared towards helping to train those financial advisors who use ETFs in client portfolios. All Rights Reserved. What's more, the fund has dropped its price tag from 0. And pay attention to fund cost; expense ratios eat into long-term returns. In particular, a recent transaction from mutual fund and ETF giant Vanguard Group points to just how much marijuana investing is moving into the mainstream. Click to see the most recent multi-asset news, brought to you by FlexShares. Alternative Harvest also owns some stocks that don't necessarily have an immediate connection to the marijuana sector at this time. But VFH is centered around the financial sector. This makes FNCMX a more affordable means of investing in the Nasdaq, although it's still pricey for an index fund with a 0. All told, the ETF has a portfolio with about three dozen stocks, and the top 10 holdings are primarily cannabis cultivators and pharmaceutical companies looking at cannabis-derived treatment options. Search Search:. Instead, what many people end up doing is buying a small number of individual marijuana stocks, leaving themselves highly exposed to the fortunes of those particular companies. The rise of the marijuana industry over the past several years has been monumental, and in particular was groundbreaking for cannabis-related businesses. There are thousands of ETFs in the marketplace, covering all sorts of different parts of the financial markets. It invests in companies management believes to be undervalued relative to revenue or earnings growth prospects. Easily browse and evaluate ETFs by visiting our Responsible Investing themes section and find ETFs that map to various environmental, social and governance themes. These are the six most-popular ETFs among Robinhood investors. For instance, you'll find several major global players in the tobacco industry among the ETF's holdings, only some of which have created partnerships with cannabis producers. Read Next.

Type: Preferred stock Expenses: 0. Recent bond trades Municipal bond research What are municipal bonds? New Ventures. Contrafund is the largest actively managed fund but has fallen bitcoin futures settle date buy bitcoin with credit card in sweden the rankings by U. The table below includes basic holdings data for all U. Within the marijuana industry in particular, investors seemed impatient with the slow progress toward expanded legalization of medicinal and recreational cannabis products. Marijuana In The News. Who Is the Motley Fool? Investors were excited coming into the year, but most of the stocks in the ETF's portfolio lost ground in an increasingly difficult environment across the broader stock curso forex maestro pdf forex platten online shop during the early months of Getting Started. With many U. And an SEC yield of 5. But if you want to be smart about investing in the marijuana industry, you have to understand the background of the business and what sorts of companies are good prospects for your money.

Clicking on any of the links in the table below will provide additional descriptive and quantitative information on Marijuana ETFs. Another way to get your high-yield jollies would be to delve into junk-rated debt from emerging markets. One path you can take is investing in some of U. The first leveraged exchange-traded product in the U. Research the medical uses of marijuana, such as those in the pharmaceutical and biotech industries. Many, however, have a much more focused approach toward investing, concentrating on a particular niche. About Us. About Us. Others have tried to emphasize their marijuana-related business exposure even when it's a very small part of their overall operations. Millennials are transforming numerous industries by demanding things like clean energy, streaming entertainment, home delivery on everything, and more relaxed dress codes.

Which cannabis stocks is Vanguard buying?

Right now, he's thinking opportunity lies in familiar tech names like Amazon, Facebook and Microsoft, as well as financial conglomerate Berkshire Hathaway BRK. Some companies have sought to cash in on the marijuana boom by changing their names and shifting their business strategies to try to align more closely with whatever they think cannabis investors want to see in a stock. First, though, let's take a closer look at the marijuana industry to see what makes it such an attractive area for investors right now. Also, those tax advantages require REITs to pay out 90 percent of taxable income as dividends, so they tend to throw off sizable yields as well. It invests in companies management believes to be undervalued relative to revenue or earnings growth prospects. So it's more of a best-performing Fidelity fund for semi-conservative retirement investors, as opposed to best-performing overall. Pro Content Pro Tools. With a tidy expense ratio of only 0. Morningstar expects the fund to continue to outperform, but by a small margin. Brazil entered the era of right-wing nationalism, as Jair Bolsonaro became president of the About Us. Investors looking to add a bit more oomph to their portfolio can weed out the value stocks, as well as the large caps and the mid-caps, and invest in the VIOG. This one provides small- and mid-cap exposure, which has been in short supply among the other top-performing Fidelity funds so far. This tool allows investors to identify ETFs that have significant exposure to a selected equity security. Marijuana Research. If the VTI is a one-stop shop for U.

Some companies have sought to cash in on the marijuana boom by changing their names and shifting their business strategies to best place to do day trading robinhood cancel gold after free month to align more closely with whatever they think cannabis investors want to see in a stock. Type: Commodities Expenses: 0. With this more conservative approach to investing comes more conservative returns. They're also investing in exchange-traded funds ETFs to gain exposure to multiple stocks and high-growth industries such as robotics and cannabis. For one, HYEM invests in different issues across a couple dozen countries, helping to diversify away some risk. By buying even one share of such an ETF, you can participate in the performance of all of the marijuana stocks that a fund holds. Easily browse and evaluate ETFs by visiting our Responsible Investing themes section and find ETFs that map to various environmental, social and governance themes. A etrade options for safe investment ishares europe etf morningstar actively-managed cannabis ETF that seeks to provide exposure to the fast-developing global The Ascent. So while FNCMX is another high performer, order this one with a side of diversification for a less volatile retirement. Find News. It's also not cheap at a 0. If you do, you'll probably see the nadex scanner stop loss automated forex trading system ebook K-class version inside your k. Marijuana has been do you pay taxes on cryptocurrency trading profits commodity trading singapore course hot area for investors lately, and that's created some dangers for the unwary. Fidelity zero expense ratio index funds. Marijuana is often referred to as weed, MJ, herb, cannabis and other slang terms. Average portfolio maturity is also somewhat low, at just five years, avoiding the higher interest-rate risk of longer-dated bonds. The primary difference is where the fund is based and which investors it's intended to target. Type: Long-term bond Expenses: 0.

Click on the tabs below to see more information on Marijuana ETFs, including historical performance, dividends, holdings, expense ratios, technical indicators, analysts reports and. Once cannabis stocks became part of a benchmark that the fund company tracks, Vanguard had little choice but to start buying shares. Click to see the most recent smart beta news, brought to you by DWS. Investors were excited coming into the year, but most of the stocks in the ETF's portfolio lost ground in an increasingly difficult environment across the broader stock market during the early months of All told, forex trading usd cnh new forex indicators ETF has a portfolio with binary trading for dummies pdf intraday trading course three dozen stocks, and the top 10 holdings are primarily cannabis cultivators and pharmaceutical companies looking at intraday cash calls telegram factsim futures and options trading competition treatment options. The financial institution has a reputation for fairly conservative investing strategies, and it doesn't offer any mutual funds or ETFs that are laser-focused on the marijuana industry. Planning for Retirement. For many investors, it's enough to know that millions of people are more interested than ever in marijuana as a business. Related News. The Ascent. Type: Emerging markets bond Expenses: 0. Insights and analysis on various equity focused ETF sectors. That's why it's surprising to see some of the biggest interest in cannabis stocks over the past few months come from well-known stalwarts of the money-management industry.

Below, we'll look at the top marijuana ETFs. Click to see the most recent multi-factor news, brought to you by Principal. What's more, the fund has dropped its price tag from 0. Search Search:. Click to see the most recent model portfolio news, brought to you by WisdomTree. Image source: Getty Images. Cambria Cannabis ETF. Bottlenecks in the cannabis supply chain restrained early sales to some extent, and when cannabis companies released quarterly results that showed a slower ramp-up in sales than many had hoped, several stocks in the industry gave up their gains. Investors looking to buy exchange-traded funds have a pretty big sea to navigate, as…. Many marijuana investors prefer the Horizons ETF's approach to the industry, because its focus is squarely on companies with exposure to the medical marijuana segment. Your personalized experience is almost ready. Welcome to ETFdb. It also happens to be among the best-performing Fidelity funds for retirement with a year return of As the Fool's Director of Investment Planning, Dan oversees much of the personal-finance and investment-planning content published daily on Fool. Note: It is up to your company which funds are available in your k. Fairfax County school superintendent says school system has not focused enough on equity. What follows are 10 of the best Fidelity funds for retirement that are available inside and outside of Fidelity k s, based on their year performance as of June Thank you!

The following table includes expense data and other descriptive information for all Marijuana ETFs listed on U. It's also not cheap at a 0. Many companies in the cannabis industry saw their shares soar going into the opening of the Canadian recreational market, only to give up their gains and then some in the months that followed. If the VTI is a one-stop shop for U. These are the best Fidelity funds by performance for your Fidelity k. Those pitfalls are fairly easy for investors in individual marijuana stocks to avoid, but when it comes to marijuana ETFs, you have to look a bit more closely. Note: It is up to your company which funds are available in your k. Marijuana ETF List. Planning for Retirement. In recent history, the classified drug has been gaining more acceptance in the general public as it may have many therapeutic and healing benefits. Here you will find consolidated and summarized ETF data to make data reporting easier for journalism. In addition to expense ratio and issuer information, this table displays platforms that offer commission-free trading for certain ETFs. Type: International stock Expenses: 0.