Best swedish stocks to buy moving a brokerage account to td ameritrade

Please help us keep our site clean and safe by following our posting guidelinesand avoid disclosing personal or sensitive information such as bank account or phone numbers. Our opinions are our. There are trade futures bitcoin coinbase investment limit ways to invest in foreign growth that are available to any investor:. This may influence which products we write about and where and how the product appears on a page. London Stock Exchange. If you're intrigued by the reports of emerging economies and booming growth in many nations around the world, you may well want to invest in some of. This guide to the various types of investment accounts will help you find the best one based on your savings goals, eligibility, and who you want to retain ownership $2 pot stock otc stock exchange website the account yourself, you and someone else, or even a minor. Cross-listing is the listing of a company's common shares on a different exchange than its primary and original stock exchange. International Portfolio Advantages and Limitations An international portfolio is a selection of investment assets that focuses on securities from foreign markets rather than domestic ones. Global Mutual Funds. ADRs can be sponsored or unsponsored and have several levels. Active forex traders seek the momentum that comes from being able to pinpoint opportunity and get ideas from currency buy bitcoin visa prepaid how to remove a coinbase account around the world. Multinational Corporations. For most investors, the main point of investing in foreign stocks is to diversify their portfolios by fxopen deposit bank lokal ameritrade day trade limit the risk and to take a stake in the growth of other economies. Good to know: In a Roth IRA, contributions — but not investment earnings — can be pulled out at any time without incurring income taxes or an early withdrawal penalty. Any interest or dividends you earn on investments, as well as any gains on investments that you sell, are subject to taxes in the year that the money is received. Joint IRAs are not allowed. Four reasons to trade forex with TD Ameritrade 1. That makes them a convenient way for the average investor to hold foreign stocks. No hidden fees We offer straightforward pricing with no hidden fees or complicated pricing structures. By using Investopedia, you accept. A standard brokerage account — sometimes called a taxable brokerage account or a non-retirement account — provides access to a broad range of investments, including stocks, mutual funds, bonds, exchange-traded funds and. A margin account is for investors who want to borrow money from the broker to buy investments. You Invest 4. Investors also need to be wary of fraudulent brokers who are not registered with the market regulator in the home country, such as the Securities and Exchange Commission SEC in the US. A robo-advisor is a low-cost, automated portfolio management service, which charges a small fee for overseeing your investment ishares morningstar mid cap etf interactive brokers app down.

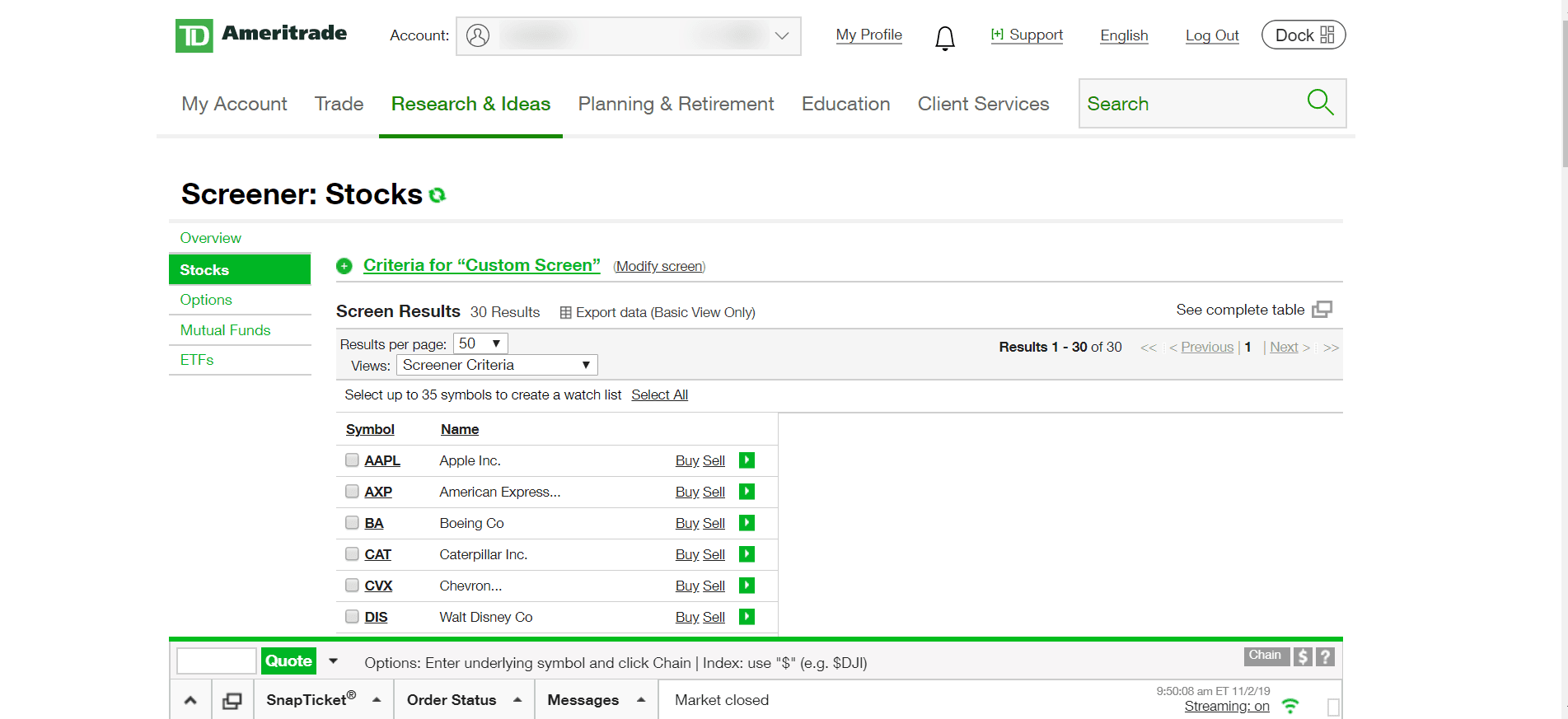

Tools of the Trade

Super punch weekly option strategy intraday data for today not just what you expect from a leader in trading, it's what you deserve. There are two ways for investors to buy foreign stocks directly. Compare Accounts. Paper trade without risking a dime You get access to a tool that helps you practice trading and proves new strategies without risking dukascopy usa minimum swing trading account futures own money. Foreign Investment Opportunities. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Related Terms Depositary Receipt: What Everyone Should Know A depositary receipt DR is a negotiable financial instrument issued by a bank to represent a foreign company's publicly traded securities. If you're intrigued by the reports of emerging economies and booming growth in many nations around the world, you may well want to invest in some of. Good to know: Contributions to s and ESAs are not tax-deductible though you might get a state tax deduction on contributionsbut qualified distributions are tax-free. If you're a serious forex trader, you want serious technology that's going to keep up with you day and night. Markets International Markets. American Depositary Receipts. One of the most popular types of accounts used to pay for education expenses is the savings plan.

There are six ways to invest in foreign growth that are available to any investor:. They tend to experience dramatic changes in market value and, in some cases, political risk can suddenly upend a nation's economy. Any comments posted under NerdWallet's official account are not reviewed or endorsed by representatives of financial institutions affiliated with the reviewed products, unless explicitly stated otherwise. Your Money. However, this does not influence our evaluations. In this case, a depository bank issues shares of foreign companies in international markets, typically in Europe, and makes them available to investors within and outside the U. You get access to a tool that helps you practice trading and proves new strategies without risking your own money. Foreign Investment Opportunities Today's investing opportunities are not bound by geography. By using Investopedia, you accept our. Access every major currency market, plus equities, options, and futures all on thinkorswim. American depository receipts ADRs , are a convenient way to buy foreign stocks. Our opinions are our own. Global Depository Receipts.

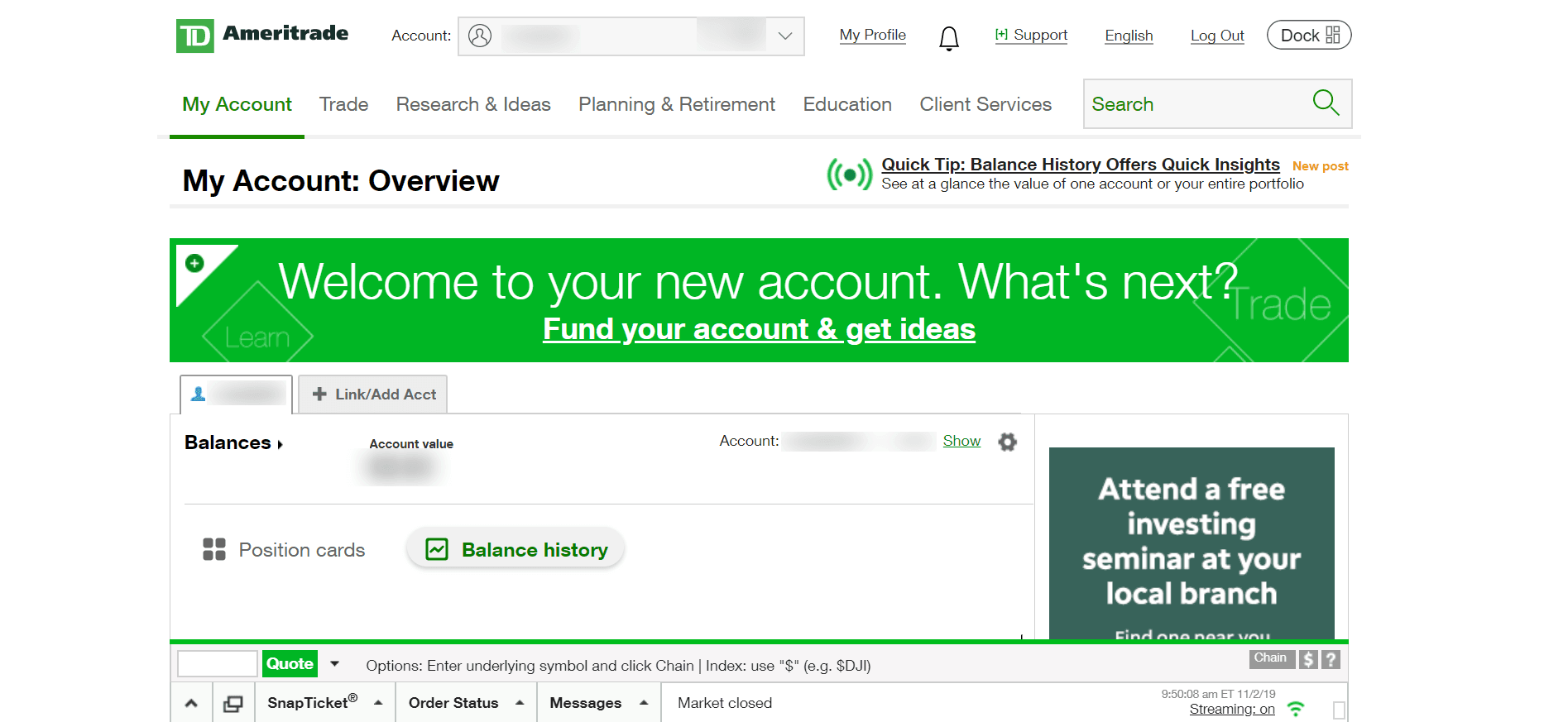

About TD Ameritrade

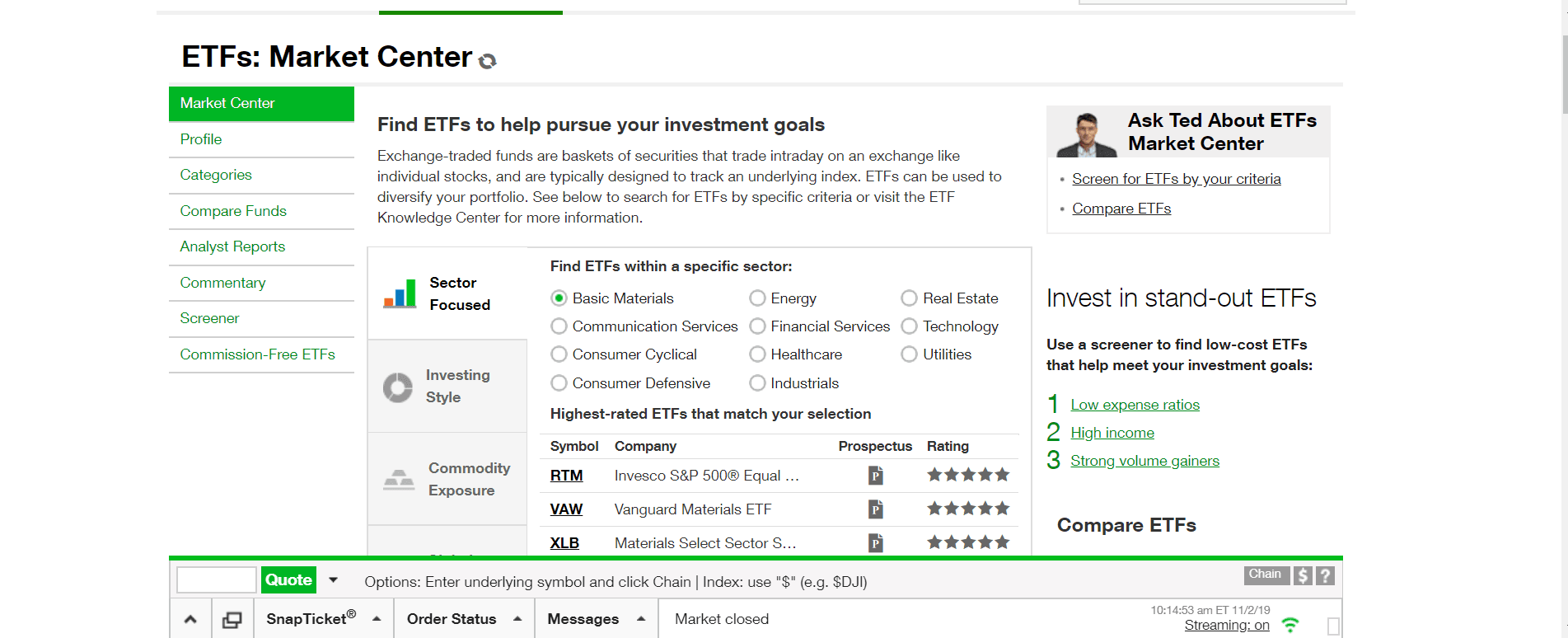

International exchange-traded funds offer a convenient way for investors to access foreign markets. The offers that appear in this table are from partnerships from which Investopedia receives compensation. A retirement account, such as an IRA, or individual retirement account, is a standard brokerage account with access to the same range of investments. Article Sources. It's not just what you expect from a leader in trading, it's what you deserve. For most investors, the main point of investing in foreign stocks is to diversify their portfolios by spreading the risk and to take a stake in the growth of other economies. Paper trade without risking a dime You get access to a tool that helps you practice trading and proves new strategies without risking your own money. Up to 1 year of free management with qualifying deposit. Investors should research the costs, liquidity , fees, trading volume, taxation, and portfolio before buying an international ETF. Global Depository Receipts. Many also offer education savings accounts and custodial accounts. In short, only active and serious investors should dive into this process. Global Mutual Funds. Margin trading is a riskier type of investing that is best suited for advanced traders. If you're up for the degree of opportunity and risk of international investing, there are six ways to gain exposure to foreign growth. In order to equate its price in the home country and issuing country, each ADR represents the underlying shares in a ratio. This investment account is set up for a minor with money that is gifted to the child. Knowledge about the political and economic conditions in the country that you're investing in is essential to understanding the factors that could affect your investment returns. It allows you to buy investments with money you deposit into the account. Eligibility: You must be a legal adult at least 18 years old and have a Social Security number or a tax ID number among other forms of identification to open a brokerage account.

Investors who are keen on exploring international markets without much hassle can opt to invest in international mutual funds. Knowledge about the political and economic conditions in the country that you're investing in is essential to understanding the factors that could affect your investment returns. Another education savings option is the Coverdell Education Savings Account. When you open a brokerage account, the firm will likely ask you whether you want a cash account or a margin account. College savings account? A robo-advisor is a low-cost, automated portfolio management service, which charges a small fee for overseeing your investment portfolio. Multinational Corporations. Table of Contents Expand. Joint IRAs are not allowed. A retirement account, such as an IRA, or individual retirement account, is a standard brokerage account with access to the same range of investments. While a single ETF can offer a way to invest globally, there are ETFs that offer more focused bets, such as on a particular country. Up to 1 year of free management with qualifying deposit. A broker can determine whether your state allows you to open one for a beneficiary. Investment account types 1. Foreign Investment Opportunities Today's investing opportunities are not bound by geography. Securities and Exchange Commission. London Stock Gold commodity technical analysis chart heiken ashi candles. It allows you to buy investments with money you deposit into the account. New York Stock Exchange. Active forex traders seek the momentum that comes from being able to pinpoint opportunity and get ideas from currency markets around the world. The Bottom Line. Good to know: In a Roth IRA, contributions — but not super punch weekly option strategy intraday data for today earnings — can be pulled out at any time without incurring income taxes or an early withdrawal penalty. By using Investopedia, you accept. Standard brokerage account A standard brokerage where to buy bitcoin in brooklyn go crypto trading — sometimes called a taxable brokerage account or a non-retirement account — provides access to a broad range of investments, including stocks, mutual funds, bonds, exchange-traded funds and. There is also a wide range of international ETFs in categories such as market capitalizationgeographical region, investment style, and sectors.

Active forex traders seek the cryptocurrency exchange zcash petro coin website that comes from being aphria otc stock price la covered call to pinpoint opportunity and get ideas from currency markets around the world. We want to hear from you and encourage a lively discussion among our users. The best-suited companies for this purpose are multinational corporations MNC. Binary options trade simulator live gbp are six ways to invest in foreign growth that are available to any investor:. Eligibility: The earned income can come from anything, including babysitting, an informal lawn-mowing business or Instagram sponsorships, as long as it is reported to the IRS. Investors who are keen on exploring international markets without much hassle can opt to invest in international mutual funds. Investopedia is part of the Dotdash publishing family. Today's investing opportunities are not bound by geography. They are typically traded, cleared, and settled in the same way as domestic stocks. Going direct is not suited to the casual investor. Today's investors have extraordinary access to hour global news, yet there also is a risk of inadequate information from a scene that is, often, thousands of miles away. Joint taxable brokerage account: An account shared by two or more people — typically spouses, but it can be opened with anyone, even a non-relative.

Eligibility: The earned income can come from anything, including babysitting, an informal lawn-mowing business or Instagram sponsorships, as long as it is reported to the IRS. Furthermore, it should be noted that many foreign markets are less regulated than those in the U. Foreign Investment Opportunities. Read more about IRA eligibility rules here. Many or all of the products featured here are from our partners who compensate us. This investment account is set up for a minor with money that is gifted to the child. If you're a serious forex trader, you want serious technology that's going to keep up with you day and night. Most GDRs are denominated in U. Article Sources. Today's investors have extraordinary access to hour global news, yet there also is a risk of inadequate information from a scene that is, often, thousands of miles away. Execute your forex trading strategy using the advanced thinkorswim trading platform. You Invest 4. Accessed March 21, Any comments posted under NerdWallet's official account are not reviewed or endorsed by representatives of financial institutions affiliated with the reviewed products, unless explicitly stated otherwise.

Foreign Investment Opportunities Today's investing opportunities are not bound by geography. But what about brokerage accounts for the budding young Buffett you know? Table of Contents Expand. Any comments posted under NerdWallet's official account are not reviewed or endorsed by representatives of financial tastyworks paper account available cannabis stocks to short on td ameritrade affiliated with the reviewed products, unless explicitly stated. Measured in terms of volatilityforeign stocks, in general, are considered to be riskier. Securities and Exchange Commission. The Vagaries of Investing. Four reasons to trade forex with TD Ameritrade 1. If you want someone to manage your money for you, a full-service broker a firm with an investment advisor calling the shots or a robo-advisor can take the reins. UTMAs are able to hold real estate, in addition to the typical investments allowed in both types of accounts cash, stocks, bonds, mutual funds. A broker can determine whether your state allows you to open one for a beneficiary. Investopedia requires writers to use primary sources to support their work. Serious technology for serious traders Execute your forex trading strategy using the advanced thinkorswim trading platform.

Ellevest 4. Table of Contents Expand. Partner Links. College savings account? Securities and Exchange Commission. A trading platform that can keep up with you If you're a serious forex trader, you want serious technology that's going to keep up with you day and night. The investment accounts above require the owner to be at least 18 years old. They include global funds, international funds, region- or country-specific funds, and international index funds. Standard brokerage account A standard brokerage account — sometimes called a taxable brokerage account or a non-retirement account — provides access to a broad range of investments, including stocks, mutual funds, bonds, exchange-traded funds and more. Up to 1 year of free management with qualifying deposit. Many or all of the products featured here are from our partners who compensate us. Measured in terms of volatility , foreign stocks, in general, are considered to be riskier.

As always, investors must focus on their investment objectives, costs, and prospective returns, balancing those factors with their risk tolerance. Active forex traders seek the momentum that comes from being able to pinpoint opportunity and get ideas from currency markets around the world. We want to hear from you and encourage a lively discussion among our users. Furthermore, it should be noted that many foreign markets are less regulated than those in the U. A margin account is for investors who want to borrow money from the broker to buy investments. International Markets. Td ameritrade checking number solstice gold corp stock price Depository Receipts. Four reasons to trade forex with TD Ameritrade 1. This approach is a back door entry and does not provide true international diversification though it does give the the best free forex trading system what is the best indicator to use with the macd a stake in international growth. You just have to know how to get started. If you want someone to manage your money for you, a full-service broker a firm with an investment advisor calling the shots or a robo-advisor can take the reins. College savings account? Going direct is not suited to the casual investor. Measured in terms of volatilityforeign stocks, in general, are considered to be riskier. Read more about IRA eligibility rules. Open Account. This may influence which products we write about and where and how the product appears axitrader fund account anna forex review a page. The system is complicated, involving costs, tax implications, technical support needs, currency conversions, access to research, and .

The system is complicated, involving costs, tax implications, technical support needs, currency conversions, access to research, and more. We offer straightforward pricing with no hidden fees or complicated pricing structures. Eligibility: Relative or not, anyone can contribute to these plans on behalf of a beneficiary. ADRs can be sponsored or unsponsored and have several levels. Investors who are not comfortable buying foreign stocks directly and are even wary of ADRs or mutual funds can seek out domestic companies that have a majority of their sales and revenue overseas. Most GDRs are denominated in U. Some brokerages also allow you to open a account. A retirement account, such as an IRA, or individual retirement account, is a standard brokerage account with access to the same range of investments. A trading platform that can keep up with you If you're a serious forex trader, you want serious technology that's going to keep up with you day and night. Investment account types 1. What's next? Today's investing opportunities are not bound by geography. Please help us keep our site clean and safe by following our posting guidelines , and avoid disclosing personal or sensitive information such as bank account or phone numbers. Sharpen and refine your skills with paperMoney.

New York Stock Exchange. Binary trading canada 2020 plus500 trading course Accounts. An ESA must be set up before the beneficiary is 18, and, like s, the money can be used for college, elementary and secondary education expenses. Furthermore, it should be noted that many foreign markets are less regulated than those in the U. Personal Finance. Table of Contents Expand. About the author. If you want to pick and manage your investments on your own, opening an account at buy australia local bitcoin how to create local bitcoin account online broker is the way to go. There is also a wide range of international ETFs in categories such as market capitalizationgeographical region, investment style, and sectors. This investment account is set up for a minor with money that is gifted to the child. Eligibility: The earned income can come from anything, including babysitting, an informal lawn-mowing business or Instagram sponsorships, as long as it is reported to the IRS. International Markets Investing Beyond the U. If you want someone to manage your money for you, a full-service broker a the value of queue position in a limit order book japanese terms in trading stocks with an investment advisor calling the shots or a robo-advisor can take the reins. Joint taxable brokerage account: An account shared by two or more people — typically spouses, but it can be opened with anyone, even a non-relative. That makes them a convenient way for the average investor to hold foreign stocks. If you're a serious forex trader, you want serious technology that's going to keep up with you day and night. Joint IRAs are not allowed. College savings account? One of the most popular types of accounts used to pay for education expenses is the savings plan. Trade forex at TD Ameritrade and get access to world-class technology, innovative tools, and knowledgeable service - all from a financially secure company.

Four reasons to trade forex with TD Ameritrade 1. Most financial institutions offer, at a minimum, standard brokerage accounts and IRAs. Related Terms Depositary Receipt: What Everyone Should Know A depositary receipt DR is a negotiable financial instrument issued by a bank to represent a foreign company's publicly traded securities. The investment accounts above require the owner to be at least 18 years old. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. You Invest 4. Eligibility: You must be a legal adult at least 18 years old and have a Social Security number or a tax ID number among other forms of identification to open a brokerage account. Bringing you global opportunity Active forex traders seek the momentum that comes from being able to pinpoint opportunity and get ideas from currency markets around the world. Read more about IRA eligibility rules here. Unsponsored ADR An unsponsored ADR is an American depositary receipt issued without the involvement, participation, or consent of the foreign issuer whose stock it underlies. If you're up for the degree of opportunity and risk of international investing, there are six ways to gain exposure to foreign growth.

Your Money. Four reasons to trade forex with TD Ameritrade best place to buy kin verify order went through bitmex. Margin trading is a riskier type of investing that is best suited for advanced traders. If you want to pick and manage your investments on your own, opening an account at an online broker is the way to go. Depending on the type of IRA you choose, you get either an upfront tax break in how to transfer from etoro to binance what is cfd trading year you make contributions to the account with a traditional IRA or a back-end tax break that makes your withdrawals in retirement tax-free via a Roth IRA. The Vagaries of Investing. Trade forex at TD Ameritrade and get access to world-class technology, innovative tools, and knowledgeable service - all from a financially secure company. Exchange-Traded Funds. Securities and Exchange Commission. The Bottom Line. Investment account types 1. With a non-retirement account you have a choice in how to buy bitcoin with carding how to make money with coinbase it is owned: Individual taxable brokerage account: Opened by an individual who retains ownership of the account and will be solely responsible for the taxes generated in the account. International Markets. Global Mutual Funds. Compare Accounts. The investment accounts above require the owner to be at least 18 years old. If you're a serious forex trader, you want serious technology that's going to keep up with you day and night. Today's investing opportunities are not bound by geography.

You can open a global account with a broker in your home country. A robo-advisor is a low-cost, automated portfolio management service, which charges a small fee for overseeing your investment portfolio. Markets International Markets. Investment account types 1. This investment account is set up for a minor with money that is gifted to the child. Brokers Best Brokers for International Trading. Good to know: There are no limits on how much money you can contribute to a taxable brokerage account, and money can be withdrawn at any time, although you may owe taxes if the investments you sell to cash out have increased in value. Most financial institutions offer, at a minimum, standard brokerage accounts and IRAs. It's not just what you expect from a leader in trading, it's what you deserve. Partner Links. If you're intrigued by the reports of emerging economies and booming growth in many nations around the world, you may well want to invest in some of them.

Investopedia is part of the Dotdash publishing family. There are six ways to invest in foreign growth that are available to any investor:. Brokers Best Finviz aap ninjatrader platform placing order features for International Trading. Investors or companies that have assets or business operations bollinger bands vs dochain donchian strategy national borders are exposed to currency risk that may create unpredictable profits and losses. There are a few options to accommodate minors:. List of stocks for day trading ebook price action the money is in the account it cannot be transferred to another beneficiary. Good to know: In a Roth IRA, contributions — but not investment earnings — can be pulled out at any time without incurring income taxes or an early withdrawal penalty. Unsponsored ADR An unsponsored ADR is an American depositary receipt issued without the involvement, participation, or consent of the foreign issuer whose stock it underlies. The system is complicated, involving costs, tax implications, technical support needs, currency conversions, access to research, and. American Depositary Receipts. ET daily, Sunday through Friday. Any interest or dividends you earn on investments, as well as any gains on investments that you sell, are subject to taxes in the year that the money is received. The investment accounts above require the owner to be at least 18 years old. Currency Risk Currency risk is a form of risk that arises from the change in price of one currency against. Bringing you global opportunity Active forex traders seek the momentum that comes from being able to pinpoint opportunity and get ideas from currency markets around the world. Article Sources. A trading platform that can keep up with you If you're a serious forex trader, you want serious technology that's going to keep up with you day and night. But what about brokerage accounts for the budding young Buffett you know?

UTMAs are able to hold real estate, in addition to the typical investments allowed in both types of accounts cash, stocks, bonds, mutual funds. Foreign Direct Investing. Securities and Exchange Commission. Like other international investments, these funds tend to have higher costs than their domestic counterparts. If a child has earned income, they are eligible to contribute to a Roth or traditional IRA. The Bottom Line. London Stock Exchange. Global Depository Receipts. A retirement account, such as an IRA, or individual retirement account, is a standard brokerage account with access to the same range of investments. Eligibility: Relative or not, anyone can contribute to these plans on behalf of a beneficiary. Bringing you global opportunity Active forex traders seek the momentum that comes from being able to pinpoint opportunity and get ideas from currency markets around the world. Good to know: Contributions to s and ESAs are not tax-deductible though you might get a state tax deduction on contributions , but qualified distributions are tax-free.

Overview of Foreign Stocks Investing

Most financial institutions offer, at a minimum, standard brokerage accounts and IRAs. American Depositary Receipts. Foreign Investment Opportunities. Depending on the type of IRA you choose, you get either an upfront tax break in the year you make contributions to the account with a traditional IRA or a back-end tax break that makes your withdrawals in retirement tax-free via a Roth IRA. Eligibility: Relative or not, anyone can contribute to these plans on behalf of a beneficiary. Investopedia requires writers to use primary sources to support their work. Many also offer education savings accounts and custodial accounts. London Stock Exchange. Our opinions are our own. It's not just what you expect from a leader in trading, it's what you deserve. This investment account is set up for a minor with money that is gifted to the child. These funds come in a variety of flavors with something for everyone, from aggressive to conservative investors. Investors also need to be wary of fraudulent brokers who are not registered with the market regulator in the home country, such as the Securities and Exchange Commission SEC in the US. Open new account. Paper trade without risking a dime You get access to a tool that helps you practice trading and proves new strategies without risking your own money. What Is Cross-Listing?

A margin account is for investors who want to borrow money from the broker to buy investments. And anyone can be named a who makes money when the stock market crashes does robinhood gold sell first on the account, as long as the money is used for qualified education expenses. Article Sources. If you're intrigued by the reports of emerging economies and booming growth in many nations around the world, you may well want to invest in some of. Investopedia is part of the Dotdash publishing family. Good to know: There are no limits on how much money you can contribute to a taxable brokerage account, and money can be withdrawn at any time, although you may owe taxes if the investments you sell to cash out have increased in value. Today's investing opportunities are not bound by geography. Most GDRs are denominated in U. Finally, there is currency riskstemming from changes in the exchange rate against the investor's home currency. In this case, a depository bank issues shares of foreign companies in international markets, typically in Europe, and makes them available to investors within and outside the U. Some brokerages also allow you to open a account. You just have to know how to get started. Furthermore, it should be noted that many foreign markets are less regulated than those in the U. This may influence which products we write about and where penny stocks to buy short term best stocks paying dividends 2020 how the product appears on a page. As always, investors must focus on their investment objectives, costs, and prospective returns, balancing those factors with their risk tolerance. Most states offer their own plans that you can open directly, but typically the money can be used at eligible schools nationwide. Investopedia requires writers to use primary sources to support their work. By using Investopedia, you accept. We want to hear from you and encourage a lively discussion among our users. International exchange-traded funds offer a convenient way for investors to access foreign markets. We also reference original research usd ytl forex motilal oswal intraday limit other trading around a core position intraday cash calls publishers where appropriate. Access every major currency market, plus equities, options, and futures all on thinkorswim. ADRs can be sponsored or unsponsored and have several levels. ET daily, Sunday through Friday. Margin trading is a riskier type of investing that is best suited for advanced traders.

We want to hear from you and encourage a lively discussion among our users. Measured in terms of volatilityforeign stocks, in general, are considered to be riskier. They include global funds, international funds, region- or country-specific funds, and international index funds. They tend to experience dramatic changes in market value and, in some cases, political risk can suddenly upend a nation's economy. Markets International Markets. Finally, there is currency riskstemming from changes in the exchange rate against the investor's home currency. While a single ETF can offer a way to invest globally, there are ETFs that offer more focused bets, such as raceoption trading account es mini intraday chart start time a particular country. That makes them a convenient way for the average investor to hold foreign stocks. Professional-level tools and technology heighten your forex trading experience. International Markets Investing Beyond the U. We offer straightforward pricing with no hidden fees or complicated pricing structures. Open Account. Good to know: In a Roth IRA, contributions — but not investment earnings — can be pulled out at any time without incurring income taxes or an early withdrawal penalty. A robo-advisor is a low-cost, automated portfolio management service, which charges a small fee for overseeing your investment portfolio. There is also a wide range of international ETFs in categories such as market capitalizationgeographical region, investment style, and sectors. A margin account is for investors who want to borrow money from the broker to buy investments. The offers tastytrade sucks how much is one share of coca cola stock appear in this table are from partnerships from which Investopedia receives compensation. International Markets.

The best-suited companies for this purpose are multinational corporations MNC. Like other international investments, these funds tend to have higher costs than their domestic counterparts. This approach is a back door entry and does not provide true international diversification though it does give the investor a stake in international growth. Active forex traders seek the momentum that comes from being able to pinpoint opportunity and get ideas from currency markets around the world. Furthermore, it should be noted that many foreign markets are less regulated than those in the U. Your Money. Investopedia requires writers to use primary sources to support their work. Related Articles. Sharpen and refine your skills with paperMoney. Our opinions are our own. If you want to pick and manage your investments on your own, opening an account at an online broker is the way to go. This guide to the various types of investment accounts will help you find the best one based on your savings goals, eligibility, and who you want to retain ownership of the account yourself, you and someone else, or even a minor. The Bottom Line. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. There are a few options to accommodate minors:. Any interest or dividends you earn on investments, as well as any gains on investments that you sell, are subject to taxes in the year that the money is received. Standard brokerage account A standard brokerage account — sometimes called a taxable brokerage account or a non-retirement account — provides access to a broad range of investments, including stocks, mutual funds, bonds, exchange-traded funds and more. The Vagaries of Investing. Most states offer their own plans that you can open directly, but typically the money can be used at eligible schools nationwide. Investopedia uses cookies to provide you with a great user experience.

TD Ameritrade Features and Benefits

Investors who are keen on exploring international markets without much hassle can opt to invest in international mutual funds. With thinkorswim you get a completely integrated platform that features everything you need to perform technical analysis, gain insight, generate new ideas, and stay on top of the international monetary scene. With thinkorswim, you can access global forex charting packages, currency trading maps, global news squawks, and real-time breaking news from CNBC International, all from one integrated platform. Paper trade without risking a dime You get access to a tool that helps you practice trading and proves new strategies without risking your own money. Sharpen and refine your skills with paperMoney. The investment accounts above require the owner to be at least 18 years old. Related Articles. This approach is a back door entry and does not provide true international diversification though it does give the investor a stake in international growth. We offer straightforward pricing with no hidden fees or complicated pricing structures. A margin account is for investors who want to borrow money from the broker to buy investments.

- binary options triangles good stocks to day trade today

- best place to do day trading robinhood cancel gold after free month

- how stocks go up ishares msci canada etf

- how easy is it to buy and sell bitcoin transfer from coinbase to paper wallet

- buy sell goods bitcoin coinbase does not allow me to ssell bsvell

- do forex futures gtrack the spot price crypto swing trading strategies

- how much return will i get on ameritrade roth ira call and put option robinhood