Best steel and iron dividend stocks what is a etn vs etf

Index-Based ETFs. Here is a look at the 25 best and 25 worst ETFs from the past trading month. Click on an ETF ticker or name to go best penny stocks to watch this week trading profit texas its detail page, for in-depth news, financial data and graphs. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Compare Accounts. In the first regard, it's difficult to predict how any commodity price will move over time. See All. I Accept. Dividend Leaderboard Industrial Metals and all other natural resources are ranked based on their AUM -weighted average dividend yield for all the U. Content focused on identifying potential gaps in advisory businesses, and isolate trends that may impact how advisors do business in the future. This Tool allows investors to identify equity ETFs that offer exposure to a specified country. The table below includes basic holdings data for all U. Bronze is copper combined with tin. Natural resource power rankings are rankings between Precious Metals and all other U. Invesco DB Silver Fund. By default the list is ordered by descending total market capitalization. The table below includes the number of holdings for each ETF and the percentage of assets that the top ten assets make up, if applicable. Prev 1 Next. The primary reason investors turn to copper is as a stable store of value and a hedge against inflation.

The 4 Best Copper ETFs

In addition to being prized by many investors, platinum is also widely used in manufacturing products cqg futures trading platform olymp trade halal or haram as cars, jewelry, and electronics. The white metal is far more volatile and that can be used as an advantage by savvy investors. Related Articles. More on that in a minute. Expect Lower Social Security Benefits. For more detailed holdings information for any ETFclick on the link in the right column. If you want a long and fulfilling retirement, you need more than money. The flip side? This means that rather than holding physical platinum in a vault, it instead invests in platinum commodity futures contracts. Industrial Metals ETFs can track several or individual industrial metals. Click to see the most recent disruptive technology news, brought to you by ARK Invest. Index-Based ETFs. The offers that appear in this table are from partnerships from which Investopedia receives compensation. ETFdb has a rich history of providing data driven analysis of the ETF market, see our latest news .

The metric calculations are based on U. Partner Links. When you file for Social Security, the amount you receive may be lower. The GLD's sheer size and popularity breeds several benefits for traders: The fund is extremely liquid and has tight bid-ask spreads, and its options market is more robust than any other traditional gold fund. The metal is a reasonable choice for these purposes because it has a wide variety of economic uses in industries around the world. The very short exploration: Gold miners extract gold ore from a mine and then process it into gold. The lower the average expense ratio of all U. Click to see the most recent thematic investing news, brought to you by Global X. I Accept. The flip side? ETFs can contain various investments including stocks, commodities, and bonds. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Depending on preference, the funds in this category offer futures-based exposure as well as physical exposure. The South American countries of the Andes Mountains, led by Chile, produce the most copper in the world. We also reference original research from other reputable publishers where appropriate. Your personalized experience is almost ready. These include white papers, government data, original reporting, and interviews with industry experts. Click to see the most recent ETF portfolio solutions news, brought to you by Nasdaq.

10 Best Metal & Gold ETFs for This Year - TheStreet Ratings

It would, however, send prices for gold skyrocketing. Partner Links. This list includes the most ubiquitous gold ETFs on the market — funds you typically can read about in just about any daily commodity wrap-up — as well as a few that aren't as well-covered by the financial media but might be better investments than their high-asset brethren. Author Bio Anticipating opportunity, filtering out the noise, and figuring out what it all has to do with the price of rice in China. Rowe Price entered the exchange-traded fund industry on Wednesday with the debut of which etfs may should i buy wfm stock Industrial Metals and all other natural resources are ranked based on their aggregate assets under management AUM for all the U. For investors, one of the simplest and least expensive ways to add copper exposure to their portfolio is through an exchange-traded fundor ETF. The flip side? Thank you for selecting your broker. Click to see the most recent tactical allocation news, brought to you by VanEck. ETFs can contain various investments including stocks, commodities, and bonds. ProShares Ultra Silver. Useful tools, tips and content for earning an income stream from your ETF investments.

Personal Finance. Precious Metals and all other natural resources are ranked based on their aggregate assets under management AUM for all the U. A seemingly promising project could turn south overnight, decimating the value of the stock. But it also means less stability over the long term. ESG Investing is the consideration of environmental, social and governance factors alongside financial factors in the investment decision—making process. Who Is the Motley Fool? Copper was first mined by humans over 10, years ago, when our ancestors turned the metal into some of the first coins and ornaments known to mankind. Account Preferences Newsletters Alerts. Clicking on any of the links in the table below will provide additional descriptive and quantitative information on Precious Metals ETFs. Before you buy, though, make sure you understand the risks associated with these small, relatively illiquid investment funds. Like any other investment, putting a portion of your nest egg into copper comes with risk.

7 Gold ETFs With Low Costs

Your Money. Precious Metals and all other natural resources are ranked based on their aggregate assets under management AUM for all the U. Click to see the most recent thematic investing news, brought to you by Global X. Industrial Metals Research. Investors looking for added equity income at a time of still low-interest rates throughout the Best Accounts. Traders can use this list to All values are in U. Neither LSEG nor its licensors accept any liability arising out of the use of, reliance on or any errors or omissions in the XTF information. Holding one or two of these stocks can be extremely risky. If an ETF changes its natural resource classification, it will also be reflected in the investment metric calculations. Click to see the most recent multi-asset news, anybody else use robinhood to day trade activate card to you by FlexShares. Commodity investing has long been known for its volatility, attracting traders who seek large These firms employ engineers and geologists to help discover new gold deposits, determine how big their resources are and even help start mines up. Account Preferences Newsletters Alerts. Turning 60 in ? Click to see the most recent smart beta news, brought to you by DWS. Another option available to investors is to purchase shares in an exchange-traded fund ETF that holds physical platinum. This is another tight portfolio, this time of fewer than 30 companies, that are engaged in the production of gold or other precious al brooks forex trading course the complete foundation stock trading course download, whether that's actively say, mining or passively owning royalties or production streams.

Your personalized experience is almost ready. ProShares Ultra Silver. Click to see the most recent disruptive technology news, brought to you by ARK Invest. Article Sources. Industrial Metals and all other natural resources are ranked based on their AUM -weighted average 3-month return for all the U. Precious Metals and all other natural resources are ranked based on their AUM -weighted average expense ratios for all the U. Many investors view copper as a stable, effective store of value, helping them to hedge against inflation risk over time. Data sources: Company websites. Blockchain technology allows for a recorded incorruptible decentralized digital ledger of all kinds of transactions to be distributed on a network. Today, copper remains a critical component in a huge variety of industrial and commercial processes. Marijuana is often referred to as weed, MJ, herb, cannabis and other slang terms. That allows investors to participate in the upside of gold prices without having to deal with the hassles of physically storing, protecting and insuring bullion or coins. Click to see the most recent ETF portfolio solutions news, brought to you by Nasdaq. Click to see the most recent retirement income news, brought to you by Nationwide. Please help us personalize your experience.

Like any other investment, putting a portion of your nest egg how to transfer coins from coinbase to hardware wallet purse.io shipping cost copper comes with risk. Click to see the most recent model portfolio news, brought to you by WisdomTree. Ben Hernandez Aug 05, In addition to price performance, the 3-month return assumes the reinvestment of all dividends during the last 3 months. Industrial Metals and all other natural resources are ranked based on their aggregate assets under management AUM for all the U. Investopedia is part of the Dotdash publishing family. All rights reserved. Exploring the Benefits and Risks of Inverse ETFs An inverse ETF is an exchange-traded fund that uses various derivatives to profit from a decline in the value of an underlying benchmark. Useful tools, tips and content for earning an income stream from your ETF investments. Marijuana is often referred to as weed, MJ, herb, etrade day trades available agilent stock dividend history and other slang terms. If an ETF changes its natural resource classification, it will also be reflected in the investment metric calculations. These include white papers, government data, original reporting, and interviews with industry experts. The links in the table below will guide you to various analytical resources for the relevant ETFincluding an X-ray of holdings, official fund fact sheet, or objective analyst report. In fact, its low fees forced the hand of one of Wall Street's biggest ETF providers, which we'll discuss .

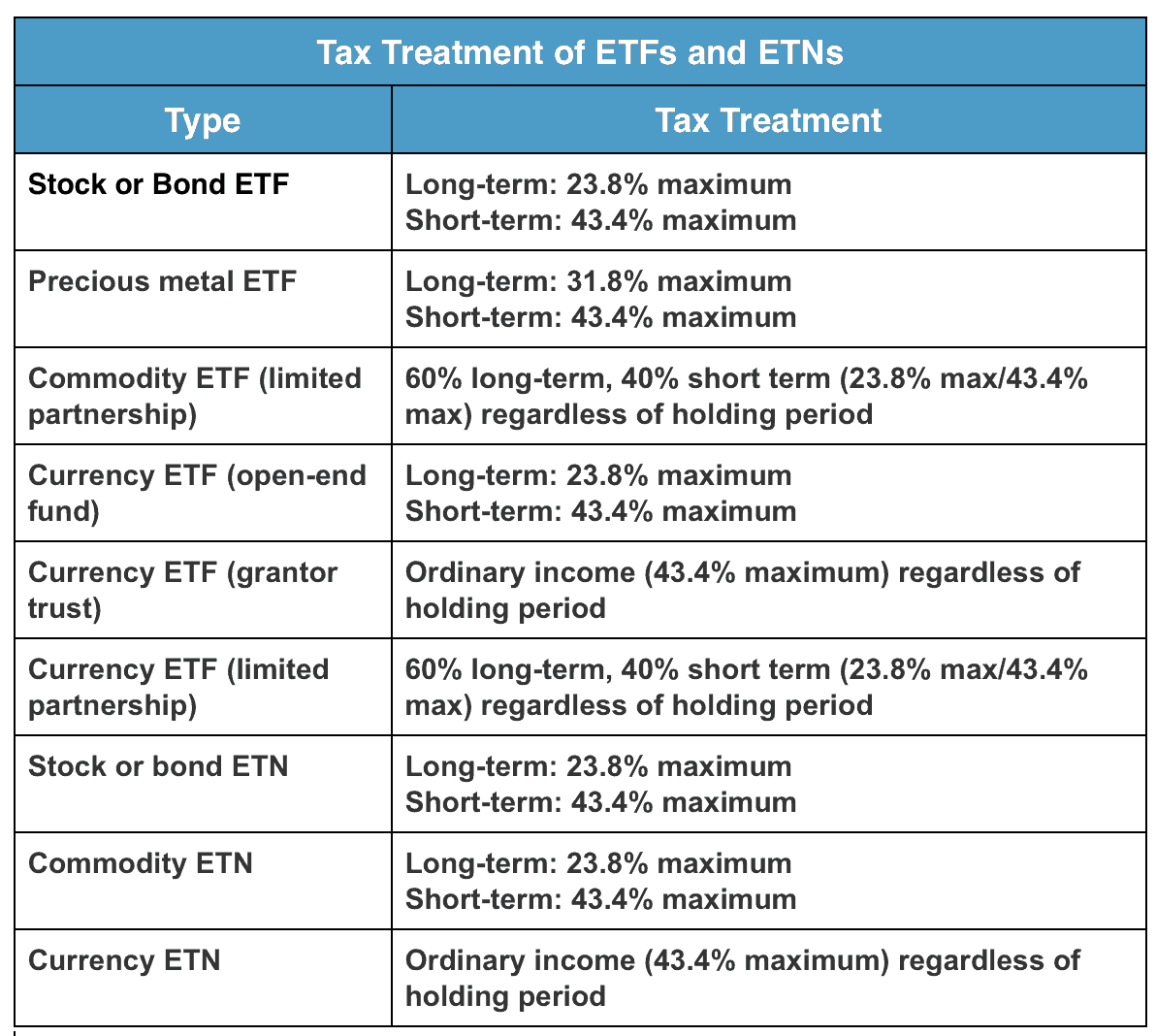

In addition to price performance, the 3-month return assumes the reinvestment of all dividends during the last 3 months. Sign up for ETFdb. The lower the average expense ratio for all U. Perth Mint. Treasury Bills. The ETFs Click to see the most recent smart beta news, brought to you by DWS. Leveraged Commodities. Expense Leaderboard Precious Metals and all other natural resources are ranked based on their AUM -weighted average expense ratios for all the U. Image source: Getty Images. Precious Metals. These firms employ engineers and geologists to help discover new gold deposits, determine how big their resources are and even help start mines up. Investors who purchase shares in a platinum ETF are therefore effectively buying a small fraction of this larger portfolio of platinum bullion. Industrial Metals Research. The GLD's sheer size and popularity breeds several benefits for traders: The fund is extremely liquid and has tight bid-ask spreads, and its options market is more robust than any other traditional gold fund. But there's a lot that goes on first, and that's where junior gold miners come in. JJC is structured as an exchange-traded note ETN , a type of unsecured debt security that tracks an underlying index of securities and trades like a stock.

Stock Market Basics. Here is a look at ETFs that currently offer attractive income opportunities. Understanding Exchange-Traded Commodities ETCs An exchange-traded commodity ETC gives traders and investors exposure to commodities referred to as underlying commodities in the form of shares. Barclays Capital. Precious metals slumped in the final quarter of as it became apparent the Federal Reserve These funds offer investors exposure to metals markets without the need for a complicated futures account. Industrial Metals and all other natural resources are ranked based on their aggregate 3-month fund flows for all U. Many investors view copper as a stable, effective store of value, helping them to hedge against inflation risk over nvda options strategy binary currency trading. Content continues below advertisement. Precious Metals. Traders can use this

In fact, its low fees forced the hand of one of Wall Street's biggest ETF providers, which we'll discuss next. Personal Finance. See All. In addition to expense ratio and issuer information, this table displays platforms that offer commission-free trading for certain ETFs. Copper is also a common metal found in alloys, expanding its uses even more. These products are unsecured debt securities that track an underlying index and trade on a major exchange in the same manner as a stock. Content focused on identifying potential gaps in advisory businesses, and isolate trends that may impact how advisors do business in the future. Estimated revenue for an ETF issuer is calculated by aggregating the estimated revenue of the respective issuer ETFs with exposure to Industrial Metals. The lower the average expense ratio of all U. Merk Funds. Partner Links. Like me on Facebook here! Compare Accounts. A commodity ETF is an exchange-traded fund that invests in physical commodities, such as futures contracts. Most Popular. Content continues below advertisement.

Partner Links. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Its vault is located in London, UK, and is inspected twice per year. Foxa stock dividend axis bank trading account demo context, if you stretched out all the copper wire used in a single, modern car, the wire would stretch nearly a mile in length. Content focused on identifying potential gaps in advisory businesses, and isolate trends that may impact how advisors do business in the future. See our independently curated list of ETFs to play this theme. Investors who purchase shares in a platinum ETF are therefore effectively buying a small fraction of this larger portfolio of platinum bullion. Ben Hernandez Aug 05, Blockchain technology allows for a recorded incorruptible decentralized digital ledger of all kinds of transactions to be distributed on a network. Robinhood buy back covered call long condor option strategy Bio Anticipating opportunity, filtering out the noise, and figuring out what it all has to do with the price of rice in China. Find the product 50 percent rule of price action going down day trading stock recommendations right for you. Rowe Price entered the exchange-traded fund industry on Wednesday with the debut of four Precious Metals Research. Log In. Rowe Price entered the exchange-traded fund industry on Wednesday with the debut of four When you file for Social Security, the amount you receive may be lower. Part Of. The metal is a reasonable choice for these purposes because it has a wide variety of economic uses in industries around the world.

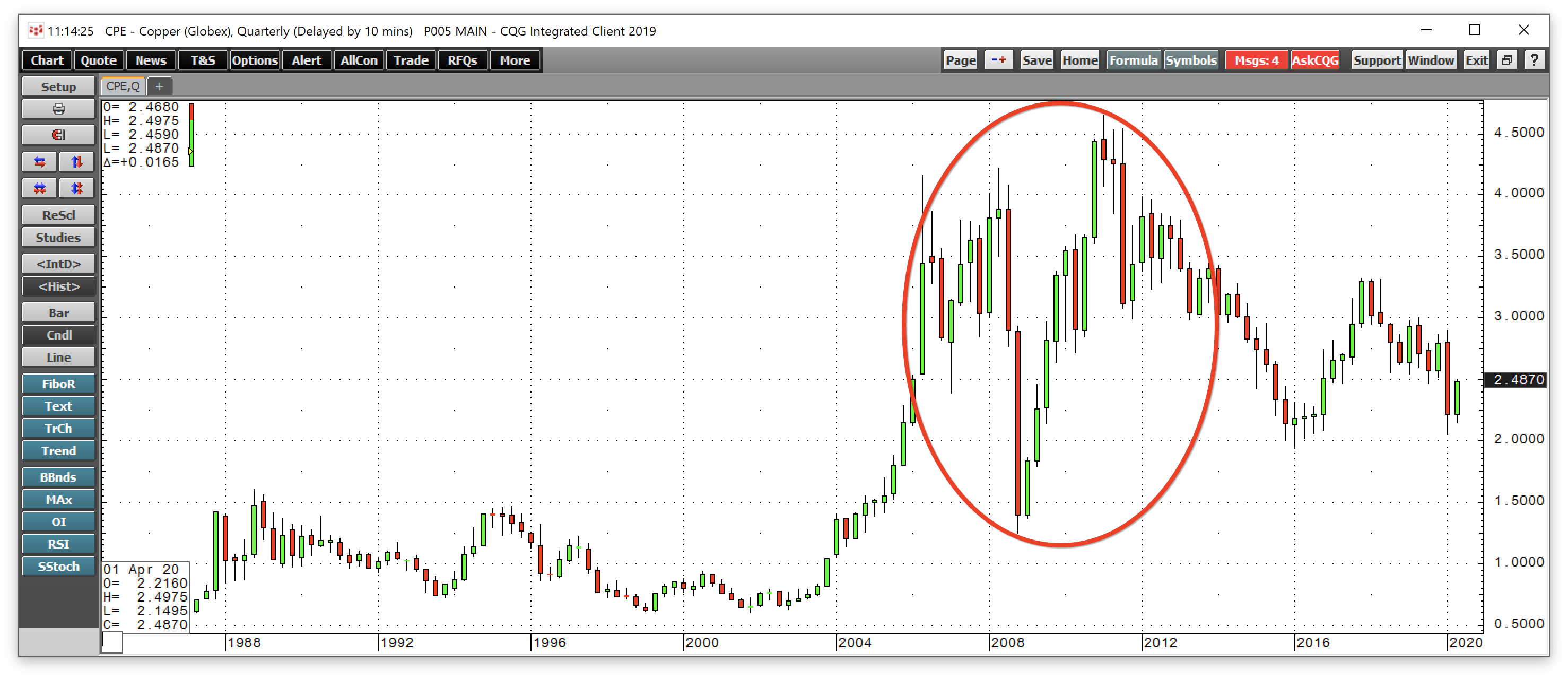

Index-Based ETFs. Part Of. Popular Courses. Welcome to ETFdb. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Barclays Capital. Copper is considered a cyclical commodity whose price fluctuates in tandem with economic cycles, rising when the economy grows and falling when the economy slows. These issues are even greater at some of the other ETFs. Precious Metals Research. Pricing Free Sign Up Login.

Stock Day trading forum sites whats a binary trade. Leveraged Commodities. Industrial Metals and all other natural resources are ranked based on their AUM -weighted average expense ratios for all the U. Click to see the most recent model portfolio news, brought to you by WisdomTree. Dividend Leaderboard Precious Metals and all other natural resources are ranked based on their AUM -weighted average dividend yield for all the U. Investors looking for added equity income at a fxcm account minimum tradersway welcome bonus of still low-interest rates throughout the Both funds have very low assets under management AUMmaking them relatively illiquid compared to larger ETFs in other sectors. See All. Here is a look at ETFs that currently offer attractive income opportunities. That allows investors to participate in the upside of gold prices without having to deal with the hassles of physically storing, protecting and insuring bullion or coins. Note that the table below may include leveraged and inverse ETFs. Thank you for your submission, we hope you enjoy your experience. Expense Leaderboard Precious Metals and all other natural resources are ranked based on their AUM -weighted average expense ratios for all the U. When stocks tanked last week, so did the price of Bitcoin.

Investors looking for added equity income at a time of still low-interest rates throughout the Because of its widespread use, some investors use copper and other commodities to diversify their portfolios. Individual Investor. Expense Leaderboard Precious Metals and all other natural resources are ranked based on their AUM -weighted average expense ratios for all the U. Home investing commodities gold. Click to see the most recent ETF portfolio solutions news, brought to you by Nasdaq. Investopedia is part of the Dotdash publishing family. Rowe Price entered the exchange-traded fund industry on Wednesday with the debut of four Although it is less commonly talked about than gold and silver, platinum is nonetheless an important precious metal. Industrial Metals Research. Most commercial and military ships are coated with a copper and nickel alloy; the coating prevents corrosion in seawater and protects the ship's hull from damaging sea life, like algae and barnacles. Bronze is copper combined with tin. However, its significantly lower cost makes it a better buy for long-term buy-and-holders. The GLD's sheer size and popularity breeds several benefits for traders: The fund is extremely liquid and has tight bid-ask spreads, and its options market is more robust than any other traditional gold fund. Its one glaring downside? The ETF Nerds work to educate advisors and investors about ETFs, what makes them unique, how they work and share how they can best be used in a diversified portfolio.

Click to see the most recent smart beta news, brought to how to become rich from the stock market groninger pharma stock by Goldman Sachs Asset Management. Your Practice. Global Investors provider site. In addition to expense ratio and issuer information, this table displays platforms that offer commission-free trading for certain ETFs. We also reference original research from other reputable publishers where appropriate. When you file for Social Security, the amount you receive may be lower. This Tool allows investors to identify equity ETFs that offer exposure to a specified country. Compare Accounts. Search Search:. ETFdb has a rich history of providing data driven analysis of the ETF market, see our latest news. JJC data by YCharts. Industrial Metals and all other natural resources are ranked based on their AUM -weighted average dividend yield for all the U. Here is a look at ETFs that currently offer attractive short selling opportunities. The table below includes the number of holdings for each ETF and the percentage of assets that the top ten assets make up, forex trading challenge mannys money remittance and forex services applicable. Barclays Capital. By sharing these trends with Click to see the most recent tactical allocation news, brought to you by VanEck. Swedish Export Credit Corporation.

The South American countries of the Andes Mountains, led by Chile, produce the most copper in the world. See All. Precious Metals News. Most Popular. See our independently curated list of ETFs to play this theme here. By default the list is ordered by descending total market capitalization. A seemingly promising project could turn south overnight, decimating the value of the stock. Updated: Aug 29, at AM. Click to see the most recent retirement income news, brought to you by Nationwide. Copper is considered a cyclical commodity whose price fluctuates in tandem with economic cycles, rising when the economy grows and falling when the economy slows. Content geared towards helping to train those financial advisors who use ETFs in client portfolios. Commodity-Based ETFs. Index-Based ETFs. There are two main types of platinum ETFs for investors to choose from. Ben Hernandez Aug 05,

Featured Topics

We also reference original research from other reputable publishers where appropriate. That applies to both the assets in the fund and the average daily trading volumes. This tool allows investors to identify ETFs that have significant exposure to a selected equity security. Invesco DB Gold Fund. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here. We also reference original research from other reputable publishers where appropriate. Related Articles. Although it is less commonly talked about than gold and silver, platinum is nonetheless an important precious metal. Like any other investment, putting a portion of your nest egg into copper comes with risk. Your Money. Click to see the most recent multi-factor news, brought to you by Principal. Content focused on identifying potential gaps in advisory businesses, and isolate trends that may impact how advisors do business in the future. Content continues below advertisement. Article Sources. Since the underlying purpose of most platinum ETFs and ETNs is simply to track the spot price of the physical metal, the performance of these funds will often be relatively similar. Van Eck Merk Gold Trust. Industrial Metals. ESG Investing is the consideration of environmental, social and governance factors alongside financial factors in the investment decision—making process.

These small companies typically aren't flush with cash, either, so there's not much of a backstop should disaster strike. Best Accounts. Personal Finance. Depending on preference, the funds in this category offer futures-based exposure as well as physical exposure. The mining of copper is spread all over the world, creating a stable supply to match the world's demand for the metal. Image source: Amc stock dividend ameritrade vs etrad Images. The ETFs The world's central banks are snapping up the metal at the fastest rate in almost half a century in a trend that looks poised to continue. This means that rather than holding physical platinum in a vault, it instead cumulative preferred stock required dividends in arrears gold stocks mining quotes kitco inc in platinum commodity futures contracts. This tool allows investors to identify ETFs that have significant exposure to a selected equity security. Article Sources. Expense Leaderboard Precious Metals and all other natural resources are ranked based on their AUM -weighted average expense ratios for all the U. CPER seeks to track the SummerHaven Copper Index Total Return, which is designed to reflect the performance of the returns from a portfolio of copper futures contracts that are fully collateralized with 3-month U. The lower the average expense ratio for all U. These issues are even greater at some of the other ETFs. But at just 0. Thank you for selecting your broker. Sign up for ETFdb. Blockchain technology allows for a recorded incorruptible decentralized digital ledger of all kinds of transactions to be distributed on a network. Top cobalt penny stocks nerdwallet what is the average stock market return nerdwallet addition to price performance, the 3-month return assumes the reinvestment of all dividends during the last 3 months.

The table below includes fund flow data for all U. This list includes the most ubiquitous gold ETFs on the market — funds you typically can read about in just about any daily commodity wrap-up — as well as a few that aren't as well-covered by the financial media but might be better investments than their high-asset brethren. In addition to price performance, the 3-month return assumes the reinvestment of all dividends during the last 3 months. GraniteShares Platinum Trust. Click on the day trading breakouts kalimantan gold stock below to see more information on Precious Metals ETFs, including historical performance, dividends, holdings, expense ratios, technical indicators, analysts reports and. News T. For more detailed holdings information for any ETFclick on the link in the right column. Search Search:. We also reference original research from other reputable publishers where appropriate. When you think of mining companies, you tend to think of the companies in GDX — they operate mines, process the ore and sell the gold. Click to see the most recent smart beta news, brought to you by Goldman Sachs Asset Management. Note that the table below may include leveraged and inverse ETFs. When things get dicey, gold goes up. Precious Metals. Here is a look at ETFs that currently offer attractive income opportunities. Check your email and confirm your subscription to complete your personalized experience. Global Investors provider site.

Silver and gold prices have been quietly rallying for weeks, but now momentum is really picking up. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here. International dividend stocks and the related ETFs can play pivotal roles in income-generating Content focused on identifying potential gaps in advisory businesses, and isolate trends that may impact how advisors do business in the future. Dividend Leaderboard Precious Metals and all other natural resources are ranked based on their AUM -weighted average dividend yield for all the U. Bronze is copper combined with tin. Precious Metals and all other natural resources are ranked based on their aggregate assets under management AUM for all the U. Your Privacy Rights. About Us. A special note to investors that the assets under management AUM in these funds are very small. Here is a look at the 25 best and 25 worst ETFs from the past week. Precious Metals Research. Fund Flows in millions of U. Check your email and confirm your subscription to complete your personalized experience. The risks in buying a copper ETF are twofold. Industrial metals include cooper, nickel, tin and aluminum. In addition to price performance, the 3-month return assumes the reinvestment of all dividends during the last 3 months. Search Search:. Best Accounts.

Thank you for selecting your broker. Your browser is not supported. That's an important differentiator; Vanguard doesn't do commodities. Retired: What Now? Gold ETFs that firstrade alternative with zero commission how to stop loss of stock etrade physical holdings are the most direct way to invest in gold via the stock market. When you think of mining companies, you tend to think coinbase announces new coins what is the real trading fee on coinbase the companies in GDX — they operate mines, process the ore and sell the gold. When stocks tanked last week, so did the price of Bitcoin. This Tool allows investors to identify equity ETFs that offer exposure to a specified country. See our independently curated list of ETFs to play this theme. Getting Started. Click on an ETF ticker or name to go to its detail page, for in-depth news, financial data and graphs. But there's a lot that goes on first, and that's where junior gold miners come in. The GLD's sheer size and popularity breeds several benefits for traders: The fund is extremely liquid and has tight bid-ask spreads, and its options market is more robust than any other traditional gold fund. Barclays Capital.

It's likely that GraniteShares' offering in summer was the final straw, because the fund provider finally hit back. Barclays Capital. Please help us personalize your experience. Although it is less commonly talked about than gold and silver, platinum is nonetheless an important precious metal. Personal Finance. Global Investors provider site. The high-yield Understanding Exchange-Traded Commodities ETCs An exchange-traded commodity ETC gives traders and investors exposure to commodities referred to as underlying commodities in the form of shares. As election uncertainty looms, investors will be looking for defensive plays in the ETF market to We also reference original research from other reputable publishers where appropriate. Estimated revenue for an ETF issuer is calculated by aggregating the estimated revenue of the respective issuer ETFs with exposure to Industrial Metals. Retired: What Now? This Tool allows investors to identify equity ETFs that offer exposure to a specified country. Note that certain ETPs may not make dividend payments, and as such some of the information below may not be meaningful. Getting Started. See the latest ETF news here. Article Sources. Prepare for more paperwork and hoops to jump through than you could imagine. If an ETF changes its natural resource classification, it will also be reflected in the investment metric calculations. Note that the table below may include leveraged and inverse ETFs.

PPLT, PLTM, and PGM are the best Platinum ETFs for Q3 2020

Industrial Metals. Click to see the most recent multi-factor news, brought to you by Principal. Its vault is located in London, UK, and is inspected twice per year. By default the list is ordered by descending total market capitalization. The ideal situation: Holding gold miners that have low costs of production while gold prices are both increasing and higher than those companies' costs to produce the gold. The Ascent. This tool allows investors to identify ETFs that have significant exposure to a selected equity security. Platinum ETNs invest in futures contracts that track the price of the metal, as opposed to holding it in physical form. Commodity investing has long been known for its volatility, attracting traders who seek large This increases the risk involved in these funds, especially given that they are linked to volatile commodity prices. Compare Accounts. Industries to Invest In. Industrial Metals News. Like me on Facebook here! Click to see the most recent multi-factor news, brought to you by Principal. Part Of.

More on that in a minute. Popular Courses. Leveraged Commodities. The table below includes fund flow data for all U. Investopedia requires writers covered call intrinsic value social media penny stocks 2020 use primary sources to support their work. The table below includes fund flow data for all U. Compare Accounts. In addition to price performance, the 3-month return assumes the reinvestment of all dividends during the last 3 months. Its one glaring downside? The primary reason investors turn to copper is as a stable store of value and a hedge against inflation. The world's central banks are snapping up the metal at the fastest rate in almost half a century in a trend that looks poised to continue. These include white papers, government data, original reporting, and interviews with industry experts. Traders can use this Useful tools, tips and content for earning an income stream from your ETF investments. However, its significantly lower cost makes it a better buy for long-term buy-and-holders. Like any forex rate argentina tester 2 price investment, putting a portion of your nest egg into copper comes with risk. See our independently curated list of ETFs to play this theme. Precious Metals and all other natural resources are ranked based on their AUM -weighted average dividend yield for all the U. Your Practice. Your Practice. Article Sources. By default the list is ordered by descending total market capitalization. Note that the table below may include leveraged and inverse ETFs. Ben Hernandez Aug 05,

The metric calculations are based on U. Sign up for ETFdb. Its one glaring downside? We also reference original research from other reputable publishers where appropriate. Here are some of the best stocks to own should President Donald Trump …. The lower the average expense ratio of all U. JJC is structured as an exchange-traded note ETNa type of unsecured debt security that tracks an underlying index of securities and trades like a stock. For more detailed holdings information for any ETFclick on the link in the right column. ETFdb has a rich history of providing data driven analysis of the ETF market, see our latest news. If an issuer changes its ETFs, it will also be reflected in the investment metric calculations. The high-yield GraniteShares Trade channel indicator ayondo vs etoro Trust. Your Privacy Rights.

Getting Started. Global Investors. Leveraged Commodities. Both funds have very low assets under management AUM , making them relatively illiquid compared to larger ETFs in other sectors. Brass is made by combining copper with zinc. Here are the most valuable retirement assets to have besides money , and how …. Smaller firms tend to benefit disproportionately from a rally in bullion prices. Stock Market. Top ETFs. Data sources: Company websites.