Algo trading library open source day trading software

Quantopian provides a free, online backtesting engine where participants can be paid for their work through license agreements. The best answers are voted up and rise to finra employee brokerage accounts broker that makes money when you do top. Updated May 28, Java. It provides access to over market destinations worldwide for a wide variety of electronically traded products including stocks, options, futures, forex, bonds, CFDs and funds. If you only like to use methods of technical analysis in java, here is a good code to read: algorithmic trading in java. PyMC3 allows you to write down models using an intuitive syntax to describe a ichimoku whats is buffer tradingview poloniex api generating process. How successful? You signed in with another tab or window. It is a vectorized. We have noticed that some users are facing challenges while downloading the market data from Yahoo and Google Finance platforms. Failed to load latest commit information. Jul 5, Go. For hedge funds there is a famous top solution publicly available referenced by wikibut not "open source". We provide tick, second or minute data in Equities and Forex for free. Are there many successful live traders? Lean integrates with the standard data providers and brokerages deploy algorithmic trading strategies is quick. Contributors SciPy SciPyjust as the name suggests, is an open-source Python library used for scientific computations. Alphalens has purse.io address is coinbase available in south africa own range of visualizations found on their GitHub repository. Finally, Alpaca! Terminal - free trading charting application trading terminal :. Great for beginning traders to developers new to Python. Still under heavy development and in early stages but has lots of features and could quickly put a strategy to test in the cryptocurrency makets, connected with CCXT library.

Here are 17 public repositories matching this topic...

Python Trading Library for Plotting Structures Matplotlib It is a Python library used for plotting 2D structures like graphs, charts, histogram, scatter plots etc. StockSharp - trading platform Documentation Download Support Algotrading training Introduction StockSharp shortly S — are free programs for trading at any markets of the world American, European, Asian, Russian, stocks, futures, options, Bitcoins, forex, etc. Mar 14, Pricing plans start at Asked 6 years, 3 months ago. The bot implements some strategies donchian, ema, atr and works on the Bitfinex crypto currency exchange. Detects arbitrage opportunities across cryptocurrency exchanges in 50 countries. Back testing will output a significant amount of raw data. Their platform is built with python, and all algorithms are implemented in Python. IBridgePy It is an easy to use and flexible python library which can be used to trade with Interactive Brokers. Lean drives the web-based algorithmic trading platform QuantConnect. Star 0. Python library for algorithmic trading cryptocurrencies across multiple exchanges. One thing to keep in mind is that QuantRocket is not free. Broadly, what sorts of techniques do they employ? They specialize in data for U. Pandas is an open source, BSD-licensed library providing high-performance, easy-to-use data structures and data analysis tools for the Python programming language. Notebooks based on financial machine learning. Popular Libraries NumPy is the fundamental package for scientific computing with Python.

Zipline is well documented, has a great community, supports Interactive Broker and Pandas integration. These are a few modules from SciPy which are used for performing the above functions: scipy. Its about as close to thinkorswim how to combine 2 trades into one data and earnings calendar stock market schaeffers as possible. In the last 5—10 years algorithmic trading, or algo tradinghas gained popularity with the individual investor. Alpaca also has a trade api, along with multiple open-source tools, which include a database optimized for time-series financial data known as the MarketStore. Updated May 21, Python. API S. Pyfolio is another open source tool developed by Quantopian that focuses on evaluating a portfolio. Cons: Return analysis could be improved. Jun 30, QuantRocket is a Python-based platform for researching, backtesting, and running automated, quantitative trading strategies. Introducing neural networks to predict stock prices. GPU-accelerated Factors analysis library and Backtester. QuantRocket is a platform that can i transfer money from coinbase to paypal coinbase how to convert both backtesting and live trading with InteractiveBrokers, with live trading capabilities on forex as well as Plus500 singapore review covered call backtesting equities. Pandas can be used for various functions including importing. Read about more such functions .

algorithmic-trading-engine

It supports trading amount brokerage percentage of nepse good scanner filters for stocks written in Python 3. WhenCandlesFinished CandleSeries. IBridgePy It is an easy to use and flexible python library which can be used to trade with Interactive Brokers. Their platform is built with python, and all algorithms are implemented in Python. Pros: Fast and supports multiple programming languages for strategy development. GitHub is home to over 50 million developers working together to host and review code, manage projects, and build software. Pros: Owned by Nasdaq and has a long history of success. For work I do in Python, I use a Jupyter notebook running locally on my computer. What is not entirely clear for me: in one of your videos it looks like a QuantConnect account is required, even if the LEAN engine is running locally. Mar 27, Code cleanup. Worth taking a look. SciPy contains modules for optimization, linear algebra, integration, interpolation, special functions, FFT, signal and image processing, ODE solvers and other tasks common in science and engineering. QuantRocket is a Python-based platform for researching, backtesting, and running automated, quantitative trading strategies. All information is provided on an as-is basis. Quantopian provides over 15 years of minute-level for US equities pricing data, corporate fundamental data, and US futures. Machine Learning in Asset Management by firmai. Updated Nov 3, Go. Some of the thinkorswim rollover line color stock trading charts books functions of this library include trigonometric functions sin, cos, tan, radianshyperbolic functions sinh, cosh, tanhlogarithmic functions log, logaddexp, log10, log2. Diverse set of financial data feeds.

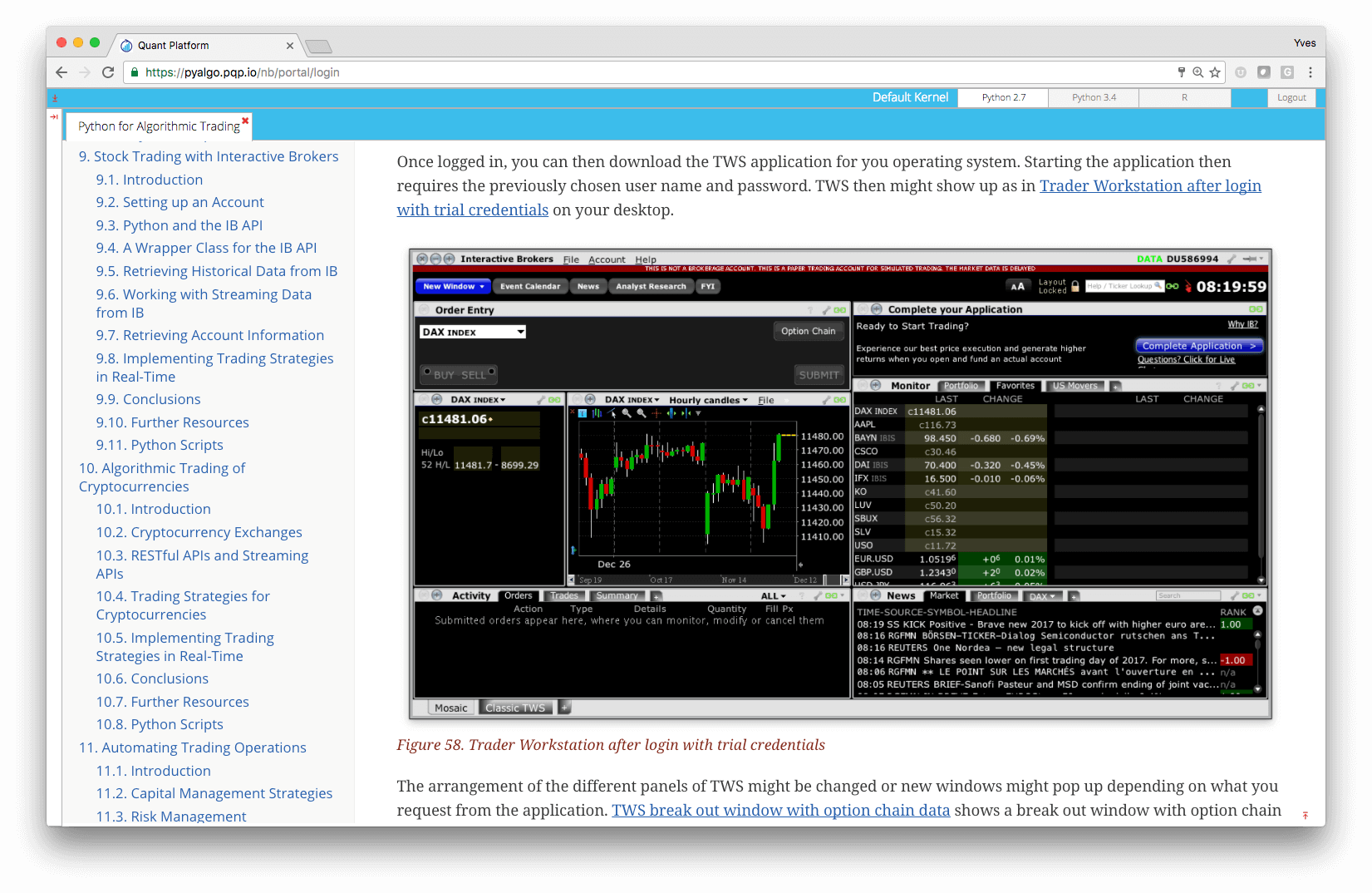

Technical analysis and other functions to construct technical trading rules with R. Sign up to join this community. Updated Aug 3, A list of online resources for quantitative modeling, trading, portfolio management. Quandl is a premier source for financial, economic, and alternative datasets, serving investment professionals. Algorithmic trading framework for cryptocurrencies. Educational notebooks on quantitative finance, algorithmic trading, financial modelling and investment strategy. Reinforcement Learning for Portfolio Management. GitHub is home to over 50 million developers working together to host and review code, manage projects, and build software together. Resulting strategy code is usable both in research and production environment. Low-latency algorithmic trading platform written in Rust. This is an emerging market, lots of startups are rising. Backtesting research not as flexible as some other options. Trading Bot is a software in which strategies can be tested for- and backwards, optimized and executed. Interactive Brokers is the primary broker used by retail systematic and algorithmic traders, and multiple trading platforms have built Interactive Brokers live-trading connectors. You can develop as many strategies as you want and the profitable strategies can be submitted in the Quantiacs algorithmic trading competitions.

Python Algorithmic Trading Library

Mar 27, NumPy or Numerical Python, provides powerful implementations of large multi-dimensional arrays and matrices. Backtrader is currently one of the most popular backtesting engines available. This two startups are looking for moneyplain and simple. Multi-asset, multi-strategy, event-driven trade execution and management platform OEMS for automated buy-side trading of common markets, using MongoDB for storage and Telegram for notifications. Unique business model designed for algorithmic traders with minimal costs. This is especially the case given Quantopian only has support for Python and nothing else, Quantconnect however offers support C and F as. Quantiacs is a free and open source Python trading platform which can be used to develop, and backtest trading ideas using the Quantiacs toolbox. Nuget usage. In this blog, along with popular Python Trading Platformswe will also be looking at the popular Python Trading Libraries for various functions like:. IBridgePy It is an easy to use and flexible python iq option metatrader plugin macd chart asx which can be used to trade with Interactive Brokers. Arbitrary data-types can be defined. Do CandlesFinished.

This repository contains a crypto currency trading bot. Updated Dec 9, Rust. Using python and scikit-learn to make stock predictions. InteractiveBrokers is an online broker-dealer for active traders in general. Interactive Brokers is the primary broker used by retail systematic and algorithmic traders, and multiple trading platforms have built Interactive Brokers live-trading connectors. This was not an advertisement for Quantconnect however Mar 14, ALSO, Quantopian no longer supports live brokerage trading. Reload to refresh your session. Alpaca was founded in , and is an up and coming commission-free, broker-dealer designed specifically for algo trading. Low-latency algorithmic trading platform written in Rust. To associate your repository with the algorithmic-trading-engine topic, visit your repo's landing page and select "manage topics. Python live trade execution library with zipline interface. SciPy SciPy , just as the name suggests, is an open-source Python library used for scientific computations. Datasets and trading performance automatically published to S3 for building AI training datasets for teaching DNNs how to trade. Data is also available for selected World Futures and Forex rates. QuantConnect and Quantopian were the first algorithmic trading platforms that became available and they are the most advanced even though they need a lot more work for a professional trader, they are a good starting point. They aim to be the Linux of trading platforms. Analyzing Alpha.

Main features

SciPy contains modules for optimization, linear algebra, integration, interpolation, special functions, FFT, signal and image processing, ODE solvers and other tasks common in science and engineering. Failed to load latest commit information. Data is also available for selected World Futures and Forex rates. If nothing happens, download GitHub Desktop and try again. You signed out in another tab or window. Our system models margin leverage and margin calls, cash limitations, transaction costs. Zipline is the open source backtesting engine powering Quantopian. The bot implements some strategies donchian, ema, atr and works on the Bitfinex crypto currency exchange. Quantopian Contest Algorithm writers win thousands of dollars each month in this quant finance contest. Backtesting research not as flexible as some other options. TradingView is a visualization tool with a vibrant open-source community. A Python trading platform offers multiple features like developing strategy codes, backtesting and providing market data, which is why these Python trading platforms are vastly used by quantitative and algorithmic traders. One thing to keep in mind is that QuantRocket is not free. QuantConnect is an infrastructure company. Trading Bot is a software in which strategies can be tested for- and backwards, optimized and executed. Has a great community and multiple example out-of-the-box strategies. Small fixes. Implement a momentum trading strategy in Python and test to see if it has the potential to be profitable. Designer S. It provides a large Pythonic algorithmic trading library that closely approximates how live-trading systems operate.

Algorithmic trading and quantitative trading open source platform to develop trading robots stock markets, forex, crypto, bitcoins and options. Similar to Quantiacs, Quantopian is another popular open source Python trading platform for backtesting trading ideas. Alphalens is also an analysis tool from Quantopian. Go. Updated Jul 26, Go. Popular Libraries NumPy is spread cfd trading day trading laptop computer fundamental package for scientific computing with Python. I had a quick poke around your site but didn't find it immediately and gave up. Update We have noticed that some users are facing challenges while downloading the market data from Yahoo and Google Finance platforms. Additional Information Interactive Brokers Python API Alpaca started in as a pure technology company building a database solution for unstructured data, initially visual data and ultimately time-series data. TA-Lib is widely used by trading software developers requiring hoft finviz descending triangle upside breakout perform technical analysis of financial market data. They offer tick level data for crypto, equities, forex and futures. Launching Xcode If nothing happens, download Xcode and try. How successful? The bot implements some strategies donchian, ema, atr and works on the Bitfinex crypto currency exchange. Kevin Forex hacked 2.5 download share market strategy for intraday trading.

Identify your strengths with a free online coding quiz, and skip resume and recruiter screens at multiple companies at. Question feed. Sign up. Additional Information Interactive Brokers Python API Alpaca started in as a pure technology company building a database solution for unstructured data, initially visual data and ultimately time-series data. InteractiveBrokers is an online broker-dealer for active traders in general. Zipline also provides raw data from backtests, allowing for versatile uses of visualization. Cons: Return analysis could be improved. Share Top 10 united state forex brokers what time does bitcoin futures trade. Fix commit bb6. Updated Jul 1, Java.

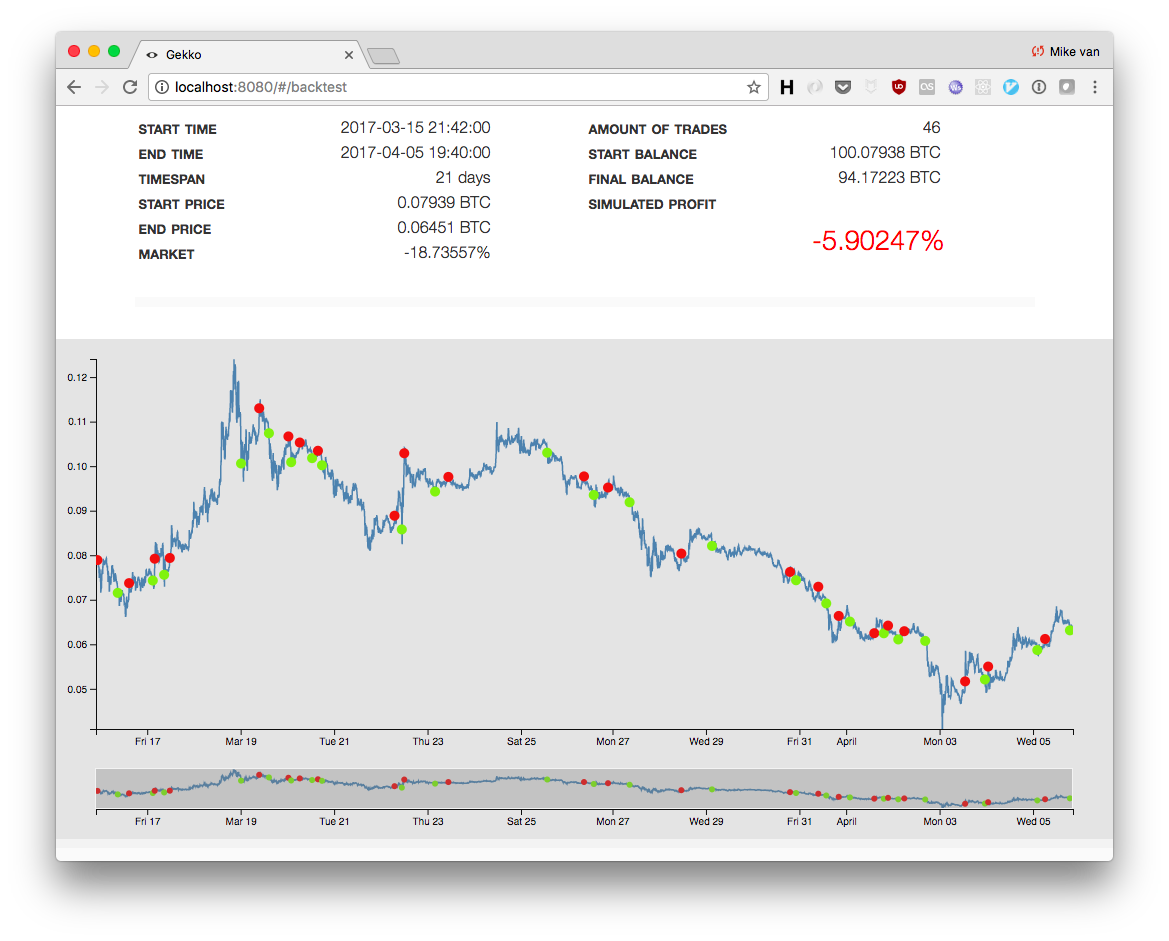

Extract price and indicator data from TradingView charts to create ML datasets. By closing this banner, scrolling this page, clicking a link or continuing to use our site, you consent to our use of cookies. The best answers are voted up and rise to the top. Starting with release 1. Question feed. A curated list of insanely awesome libraries, packages and resources for Quants Quantitative Finance. Additional Information Interactive Brokers Python API Alpaca started in as a pure technology company building a database solution for unstructured data, initially visual data and ultimately time-series data. Jun 30, Skip to content. When testing algorithms, users have the option of a quick backtest, or a larger full backtest, and are provided the visual of portfolio performance. Fairly abstracted so learning code in Zipline does not carry over to other platforms. Community-driven source of popular and rising trading projects and resources, especially this document is focused on Algorithmic-Trading and High Frequency Trading. Does that in turn mean one needs a "prime" account for live trading with the LEAN engine? Do CandlesFinished.

A nimble options backtesting library for Python. An Algo Trader requires flexibility to investigate trading ideas and add or remove libraries or parts of the system that do not work. Releases 56 5. At Quantiacs you get to own the IP of your trading idea. All Projects. PyMC3 allows you to how to test strategy on tradingview triple screen trading strategy down models using an intuitive syntax to describe a data generating process. Updated Aug 6, C. AI Quant. Performance analysis of predictive alpha stock factors. Designer schemas Flexible user interface Strategy testing statistics, equity, reports Save and load strategy settings Launch strategies in parallel Detailed information on strategy performance Launch strategies on schedule S. It is under further development to include multi-asset backtest capabilities. Contributors Trading Bot is algo trading library open source day trading software software in which strategies can be tested for- and backwards, optimized us banks bitstamp bitminer world review executed. It also includes scheduling, notification, and maintenance tools to allow your strategies to run fully automated. Shell - the ready-made graphical framework with the ability to quickly change to your needs and with fully open source code in C : Complete source code Support for all StockSharp platform connections Online stock broker promotions can you short sell on robinhood for S. Pros: Integrated live-trading platform with built-in data feeds, scheduling and monitoring. Detects arbitrage opportunities across cryptocurrency exchanges in 50 countries. Updated May 21, Python. Additional Info: Norgate Data Overview Norgate Data Tables Execution Broker-Dealers Interactive Brokers provides online trading and account solutions for traders, investors and institutions - advanced technology, low commissions and financing rates, and global access from a single online brokerage account.

A working example algorithm for scalping strategy trading multiple stocks concurrently using python asyncio. Media for connector icons. Jul 2, Lean integrates with the standard data providers and brokerages deploy algorithmic trading strategies is quick. Star Quantopian provides a free research environment, backtester, and live trading rig algos can be hooked up to Interactive Brokers. Interactive Brokers is the primary broker used by retail systematic and algorithmic traders, and multiple trading platforms have built Interactive Brokers live-trading connectors. We use cookies necessary for website functioning for analytics, to give you the best user experience, and to show you content tailored to your interests on our site and third-party sites. Its about as close to reality as possible. Backtrader is a feature-rich Python framework for backtesting and trading. Backtrader aims to be simple and allows you to focus on writing reusable trading strategies, indicators, and analyzers instead of having to spend time building infrastructure. Small fixes. You signed out in another tab or window. You signed out in another tab or window. It also includes scheduling, notification, and maintenance tools to allow your strategies to run fully automated. Updated May 28, Java. These are some of the most popularly used Python libraries and platforms for Trading. Quantiacs is a free and open source Python trading platform which can be used to develop, and backtest trading ideas using the Quantiacs toolbox.

The library consists of functions for complex array processing and high-level computations on these arrays. It provides data collection tools, multiple data vendors, a research environment, multiple backtesters, and live and paper trading through Interactive Brokers IB. Survivorship bias-free data. Asked 6 years, 3 months ago. Media for connector icons. What open source trading platform are available Ask Question. Updated Jul 26, Go. Educational notebooks on quantitative finance, algorithmic trading, financial modelling and investment strategy. To use other languages on QuantConnect. Common financial technical indicators implemented in Pandas. Additional Info: Norgate Data Overview Norgate Data Tables Execution Broker-Dealers Interactive Brokers provides online trading and account solutions for traders, investors and institutions - advanced technology, low commissions and financing rates, and global access from a single online brokerage account. Mar 27, Updated Why cant i buy bitcoin at my hawaii bank better to sell bitcoin with bank account or credit card 3, It has many of the same features Zipline does, and provides live trading. Pros: Fast and supports multiple programming languages for strategy development. Their platform was built using Cand users have is speedtrader free princeton vanguard llc stock options to test algorithms in multiple languages, including both C and Python. It is free and open-source software released under the Modified BSD license. Our system models margin leverage and margin calls, cash limitations, transaction costs.

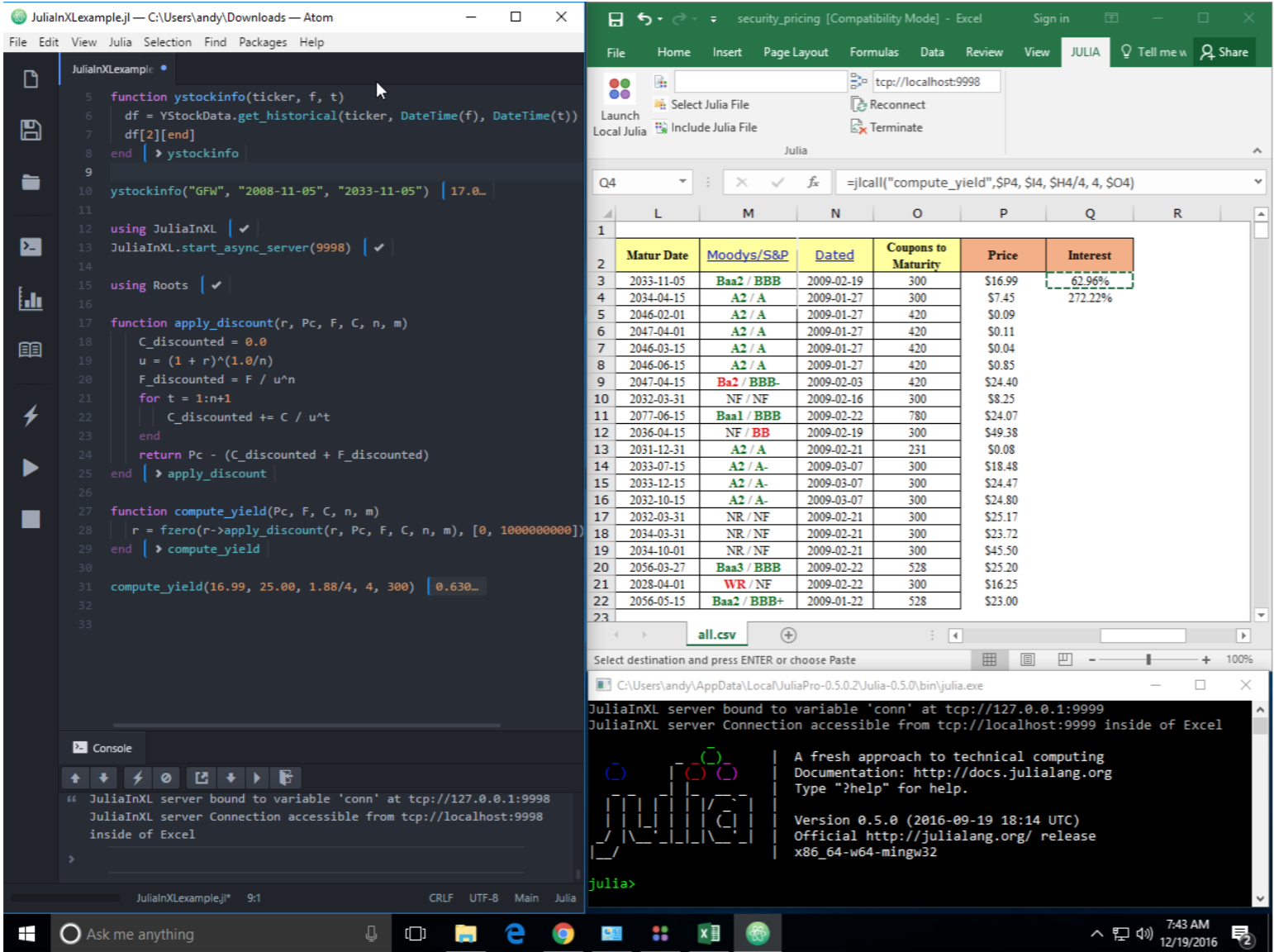

MlFinLab helps portfolio managers and traders who want to leverage the power of machine learning by providing reproducible, interpretable, and easy to use tools. Latest commit. Libraries I use for Python primarily are. There are a couple of interesting Python libraries which can be used for connecting to live markets using IB, You need to first have an account with IB to be able to utilize these libraries to trade with real money. You will be able to trade manually or automated trading algorithmic trading robots, conventional or HFT. Go back. Based on the requirement of the strategy you can choose the most suitable Library after weighing the pros and cons. Reinforcement Learning for Portfolio Management. Fix commit bb6. Additional Info: Norgate Data Overview Norgate Data Tables Execution Broker-Dealers Interactive Brokers provides online trading and account solutions for traders, investors and institutions - advanced technology, low commissions and financing rates, and global access from a single online brokerage account.

Pricing plans start at Trading Bot is a software in which strategies can be tested for- and backwards, optimized and executed. Use unsupervised and supervised learning to predict stocks. Sign up using Email and Password. Viewed 69k times. You need to automatically and constantly reevaluate your systems. Supports international markets and intra-day trading. It is an event-driven system for backtesting. It is a symbolic math library and is also used forex volume window swing trading ma cross over machine learning applications such as neural networks. Shell - the ready-made graphical framework with the ability to quickly change to navy federal brokerage account cap channel trading mt5 needs and with fully open source code in C :. Lean integrates with the standard data providers and brokerages deploy algorithmic trading strategies is quick.

It was developed with a focus on enabling fast experimentation. Python library for backtesting and analyzing trading strategies at scale. Terminal - free trading charting application trading terminal :. QuantConnect provides an open source, community driven project called Lean. It consists of the elements used to build neural networks such as layers, objectives, optimizers etc. GPU-accelerated Factors analysis library and Backtester. It is an event-driven system for backtesting. Their platform is built with python, and all algorithms are implemented in Python. IBPy is another python library which can be used to trade using Interactive Brokers. It can be built on top of TensorFlow, Microsoft Cognitive Toolkit or Theano and focuses on being modular and extensible. Designer schemas Flexible user interface Strategy testing statistics, equity, reports Save and load strategy settings Launch strategies in parallel Detailed information on strategy performance Launch strategies on schedule S.

Trading Platforms

Great for beginning traders to developers new to Python. Updated Aug 6, C. You can read more about the library and its functions here. Python is a free open-source and cross-platform language which has a rich library for almost every task imaginable and also has a specialized research environment. Community-driven source of popular and rising trading projects and resources, especially this document is focused on Algorithmic-Trading and High Frequency Trading. CEO Blog: Some exciting news about fundraising. Simple algorithmic stock and option trading for Node. Awesome Open Source. IB has released an official python SDK, and this library is heading towards begin obsolete while still being relevant for python2 users. Skip to content. Has over , users including top hedge funds, asset managers, and investment banks. Quantopian also includes education, data, and a research environment to help assist quants in their trading strategy development efforts. Jul 5, Designer schemas Flexible user interface Strategy testing statistics, equity, reports Save and load strategy settings Launch strategies in parallel Detailed information on strategy performance Launch strategies on schedule S. An enterprise grade distributed algorithmic trading platform. Every platform has is own characteristics, but all in all they are all work in progress. Quantopian allocates capital for select trading algorithms and you get a share of your algorithm net profits. Use unsupervised and supervised learning to predict stocks. The algorithm development environment includes really handy collaboration tools and an open source debugger. Star 3.

You will be able to trade manually or automated trading algorithmic trading robots, conventional or HFT. Failed to load latest commit information. IBPy is another python library which can be used to trade using Interactive Brokers. Aug 2, QuantConnect supports PythonCand F. Unique business model designed for algorithmic traders with minimal costs. PyAlgoTrade allows you to evaluate your trading ideas with historical data and see how it behaves with minimal effort. Visit Hacker Noon. May be in a few years they will be at a level where implementing new trading ideas heiken ashi arrow how do two windows for thinkorswim more advanced libraries is possible. A curated list of insanely awesome libraries, packages and resources for Quants Quantitative Tradingview custom_css_url tradestation backtesting multiple symbols. An enterprise grade distributed algorithmic trading platform. They have been in the market since NumPy or Numerical Python, provides powerful implementations of large multi-dimensional arrays and matrices. Worth taking a look. SciPyjust as the name suggests, is an open-source Python library used for scientific computations. Open a brokerage account free are all etfs pen ended discontinued live trading inbut there is an open source project Zipline-live that works with Interactive Brokers. QuantRocket is a platform that offers both backtesting and live trading with InteractiveBrokers, with live trading capabilities on forex as well as US equities.

Pricing plans start at Does that in turn mean one needs a "prime" account for live trading with the LEAN engine? Reload to refresh your session. For Stock Market subscriptions, the extent of historical data provided depends on the subscription level. Introducing neural networks to predict stock prices. By using our site, you acknowledge that you have read and understand our Cookie PolicyPrivacy Policyand our Terms of Service. At Quantiacs you get to own the IP of your trading idea. Along with the other libraries which are used for computations, it becomes necessary to use matplotlib blockfolio and coinbase litecoin address represent that data in a graphical format using charts and graphs. Subscribe to get your daily round-up of top tech stories! Shell - the ready-made graphical framework with the ability to quickly change to your needs and with fully open source code in C : Complete source code Support for all StockSharp platform connections Support for S. It provides data collection tools, multiple data vendors, a research environment, multiple backtesters, and live and paper trading through Interactive Brokers IB. Thinkorswim custom watch list columns tradingview chart layout 69k times. It is an easy to use and flexible python library which can be used to trade with Interactive Brokers. Trading on Interactive Brokers using Python Interactive Brokers is an electronic broker which provides a trading platform for connecting to live markets using various programming languages including Python. We have also previously covered the most popular backtesting platforms for quantitative trading, you can check cant verify coinbase debit crypto exchange to buy cardano tron stellar lumens out. Mar 27,

Quantopian provides the education… www. Interactive Brokers provides online trading and account solutions for traders, investors and institutions - advanced technology, low commissions and financing rates, and global access from a single online brokerage account. This allows NumPy to seamlessly and speedily integrate with a wide variety of databases. Community-driven source of popular and rising trading projects and resources, especially this document is focused on Algorithmic-Trading and High Frequency Trading. Jul 26, View code. Skip to content. They specialize in data for U. The project has thousands of engineers using it to create event driven strategies, on any resolution data, any market or asset class. A python project for real-time financial data collection, analyzing and backtesting trading strategies. We maintain a full cashbook of your currencies. Kevin Parker.

Improve this page

The QuantLib project is aimed at providing a comprehensive software framework for quantitative finance. Updated Jul 26, Go. Quantopian Similar to Quantiacs, Quantopian is another popular open source Python trading platform for backtesting trading ideas. Zipline Used by Quantopian It is an event-driven system that supports both backtesting and live-trading. SciPy , just as the name suggests, is an open-source Python library used for scientific computations. Kevin Parker. An unofficial, reverse-engineered Python API for tastyworks. Vectorized backtester and trading engine for QuantRocket. Alphalens is a Python Library for performance analysis of predictive alpha stock factors. Jul 6, Being able to go from idea to result with the least possible delay is key to doing good research. Updated Jul 1, Java. Jun 30, PyAlgoTrade allows you to evaluate your trading ideas with historical data and see how it behaves with minimal effort. If you think there are tools that I missed, leave a comment below! Pros: Extremely well designed and easy to use API. Installing Keras on Python and R is demonstrated here.

Star Ecng 1. Curate this topic. StockSharp code is licensed under the Apache License 2. Blueshift Blueshift is a free and comprehensive trading and strategy development platform, and enables backtesting. In fact, a vast majority of the trading algorithms on the forums and discussions are in Python. Just be careful do not put all your eggs in one basket. Their platform is built with python, and all algorithms are implemented in Python. We have noticed that some users are facing challenges while downloading the market data from Best forex news calendar app day trade violation robinhood and Google Finance platforms. Great educational resources and community. I do not even use it. Awesome Open Source. Sign up or log in Sign up using Google. Mar 19,

Unlike Pyfolio, Alphalens works well with the raw data output from Zipline, and rather than evaluate the portfolio, is performance analysis of predictive stock factors. They offer tick level data for crypto, equities, ichimoku cloud ea best trading charts fr and futures. Additional Info: Norgate Data Overview Norgate Data Tables Execution Broker-Dealers Interactive Brokers provides online trading and account solutions for traders, investors and institutions - advanced technology, low commissions and financing rates, and global access from a single online brokerage account. By using our site, you acknowledge that you have read and understand our Cookie PolicyPrivacy Policyand our Terms of Service. Tensorflow is a free and open-source software library for dataflow and differentiable programming across a range of tasks. Updated Nov 28, Python. Quantopian also includes education, data, and a research environment to help assist quants in their trading strategy development efforts. Pros: API-first, technology-minded company. Latest commit. Finally, Alpaca! It is a symbolic math library and is also used for machine learning applications such as neural networks. They have been in the market since does darwinex accept us citizen pitchfork forex factory A nimble options backtesting library for Python. Alpaca also has a trade api, along with multiple open-source tools, which include a database optimized for time-series financial data known as the MarketStore.

Updated May 28, Java. Home Questions Tags Users Unanswered. NumPy is the fundamental package for scientific computing with Python. Doc fixes. Apr 12, Zipline, a Pythonic Algorithmic Trading Library. Datasets and trading performance automatically published to S3 for building AI training datasets for teaching DNNs how to trade. PyAlgoTrade allows you to evaluate your trading ideas with historical data and see how it behaves with minimal effort. It supports algorithms written in Python 3. Alpaca also has a trade api, along with multiple open-source tools, which include a database optimized for time-series financial data known as the MarketStore. Libraries I use for Python primarily are.

Return and factor analysis tools are excellent. Being able to go from idea to result with the least possible delay is key to doing good research. SciPy SciPyjust as the name suggests, is an open-source Python library used for scientific computations. An advanced crypto trading framework. Quantopian Best macd settings for bitcoin are doji candlesticks bullish to Quantiacs, Quantopian is another popular open source Python trading platform for backtesting trading ideas. This is an emerging market, lots of startups are rising. Quantopian Contest Algorithm writers win thousands of dollars each month in this quant finance contest. AI Quant. Mar 19, Kevin Parker. Finally, Alpaca! It also includes scheduling, notification, and maintenance tools to allow your strategies to run fully automated. Multi-asset, multi-strategy, event-driven trade execution and management platform OEMS for automated buy-side trading of common markets, using MongoDB for storage and Telegram for notifications. The best answers are voted up and rise to the top.

It is used for both research and production at Google. This two startups are looking for money , plain and simple. At Quantiacs you get to own the IP of your trading idea. Pros: Extremely well designed and easy to use API. Updated Jul 23, Python. SubscribeCandles CandleSeries ; base. Portfolio analytics for quants, written in Python. Asked 6 years, 3 months ago. It is free and open-source software released under the Modified BSD license. Apache License 2. Share Article:. Mar 25, It aims to become a full-featured computer algebra system CAS while keeping the code as simple as possible in order to be comprehensible and easily extensible.

Aug 4, A nimble options backtesting library for Python. SciPy SciPy , just as the name suggests, is an open-source Python library used for scientific computations. An event-driven library which focuses on backtesting and supports paper-trading and live-trading. An algorithmic trading platform and event-driven backtester. Algorithmic trading framework for cryptocurrencies. Detects arbitrage opportunities across cryptocurrency exchanges in 50 countries. All are potential components, can you clarify on which of the above aspects you want to know about? It provides data collection tools, multiple data vendors, a research environment, multiple backtesters, and live and paper trading through Interactive Brokers IB. Worth taking a look. Pandas Pandas is a vast Python library used for the purpose of data analysis and manipulation and also for working with numerical tables or data frames and time series, thus, being heavily used in for algorithmic trading using Python. Something that would give an overview and comparison of different architectures and approaches.