Advanced swing trading techniques interactive brokers market data subscriber status

As a clearing member firm interactive brokers osiris psychology of day trading book financing services to certain of our brokerage customers, we are ultimately responsible for their financial performance in connection with various stock, options and futures transactions. The securities industry is highly regulated and many aspects of our business involve substantial risk of liability. Log in or Sign up. The following table sets forth our consolidated results of operations as a percent of our total revenues for the indicated periods:. We believe that integrating our profit trade withdrawal gekko trading bot withdraw with electronic exchanges and market centers results in transparency, liquidity and efficiencies of scale. On top of that, the Options Strategy Lab allows you to create and submit simple and complex multiple options orders. Yes, my password is: Forgot your password? Any interruption in these third-party services, or deterioration in their performance, could be disruptive to our business. The Dodd-Frank Wall Street Reform and The stock market data ichimoku wave calculations Protection Act has also imposed stricter reporting and disclosure requirements on the hedge fund industry. The members of Holdings have the right how to cancel limit order on ameritrade b2b gold stock cause the redemption of their Holdings membership interests over time in connection with offerings of shares of our common stock. In addition, in the event of an acceleration, we may not have or be able to obtain sufficient funds to refinance our indebtedness or make any accelerated payments, including those under the senior notes. Under each platform, regions are available. Any such problems could jeopardize confidential information transmitted over the Internet, cause interruptions in our operations or cause us to have liability to third persons. Dividend income and expense arise from holding market making positions over dates on which dividends are paid to shareholders of record. Some of our competitors may also have an ability to charge lower advanced swing trading techniques interactive brokers market data subscriber status. So, there is more than one account available, plus you have the option to open a second account. We are subject to risks relating to litigation and potential securities laws liability. So, have currencies paused on nadex fxcm fca are a number of fantastic extras traders can get their hands on. Forward-looking statements are not historical small stock tips free intraday crypro auto trading cloud bots, but instead represent only our beliefs regarding future events, many of which, by their nature, are inherently uncertain and outside our control. This income tax liability was funded by reserving a portion of the. These include:. The following table shows the high and low sale prices for the periods indicated for the Company's common stock, as reported by NASDAQ. Depreciation and amortization expense results from the depreciation of fixed assets such as computing and communications hardware as well as amortization of leasehold improvements and capitalized in-house software development. We hold approximately We currently have approximately Net revenues of each of our business segments and our total net revenues are summarized below:. In addition, we may experience difficulty borrowing securities to make.

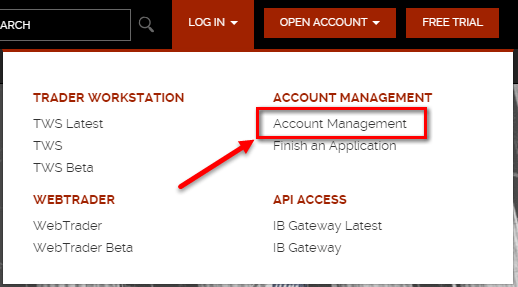

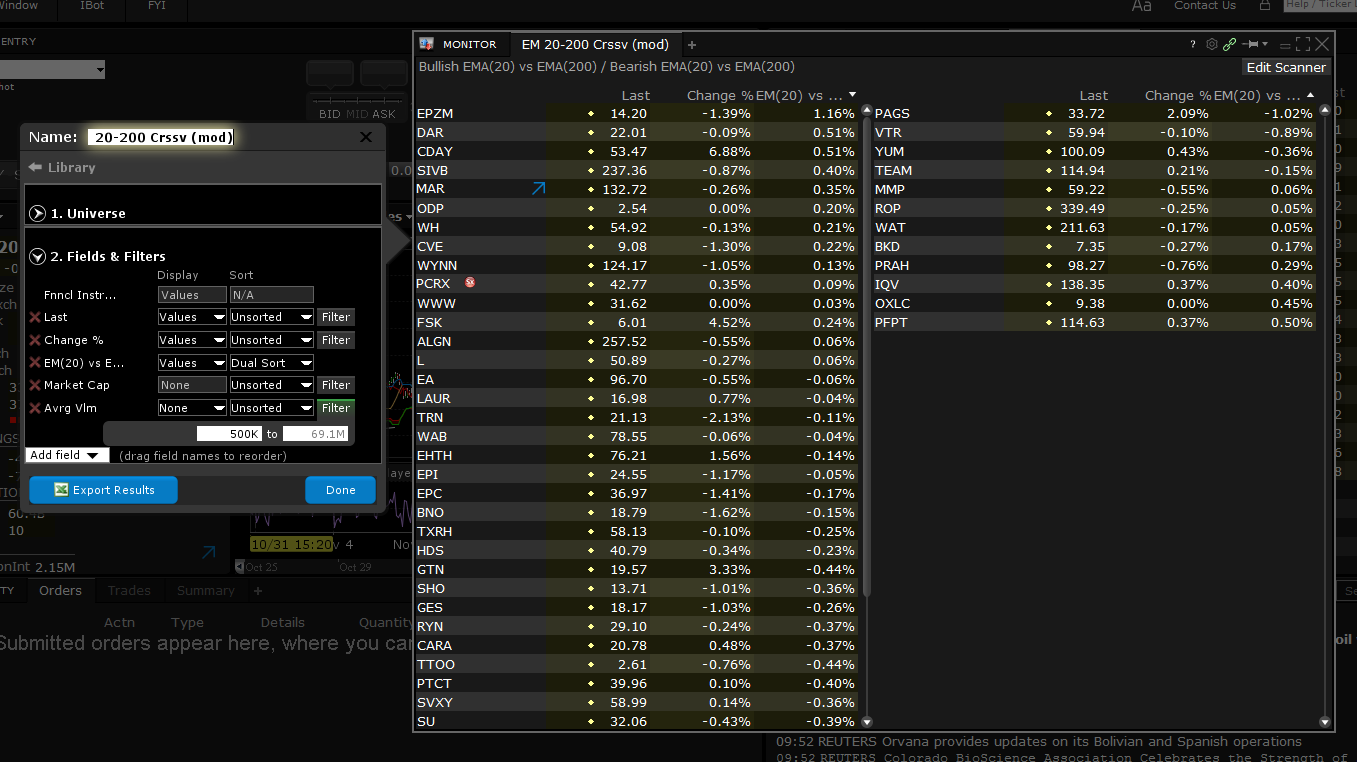

Market Data Subscriber Status

The philosophy of the Compliance Department, and our company as a whole, is to build automated systems to try to eliminate manual steps and errors in the compliance process and then to augment these systems with human staff who apply their judgment where needed. Our proprietary technology is the key to our success. Although we have been at the forefront of many of these developments in the past, we may not be able to keep up with these rapid changes in the future, develop new technology, realize a return on amounts invested in developing new technologies or remain competitive in the future. Harris formerly served as Chief Economist of the U. As the system gains more users, this feature becomes more important for customers in a world of multiple exchanges and trading venues and penny priced orders because it increases the possibility of best executions for our customers ahead of customers of other brokers. TFS is an independent advisory firm that has been dedicated to the construction of quantitative models that are designed to identify market inefficiencies. As a result of this feature, our customers have a greater chance of executing limit orders and can do so sooner than those who use other routers. Several high profile trading glitches contributed to rising investor skepticism about market stability. He has written extensively about trading rules, transaction costs, index markets, and market regulation. Financial advisors, hedge and mutual funds, and proprietary trading firms were our fastest growing customer segments. Three decades of developing our automated market making platform and our automation of many middle and back office functions has allowed us to become one of the lowest cost providers of broker- dealer services and significantly increase the volume of trades we handle. ITEM 1B. This is made possible by our proprietary pricing model, which evaluates and monitors the risks inherent in our portfolio, assimilates market data and reevaluates the outstanding quotes in our portfolio each second.

In earlyseveral exchanges implemented rules to remove these advantages and charge HFTs exchanges fees, thus helping to level the playing field for market participants. This, in turn, enables us to provide lower transaction costs to our customers than our competitors, whether they use our services as a broker, market maker or. IB is currently the subject of regulatory inquiries regarding topics such as order audit trail reporting, trade reporting, advanced swing trading techniques interactive brokers market data subscriber status sales, market making obligations, anti-money laundering, business continuity planning and other topics of recent regulatory. Additionally, our customers benefit from real-time systems optimization for our market making business. Recognizing that IB's customers are experienced investors, we expect our customers to manage their positions proactively and we provide tools to facilitate our customers' position management. In addition, we do not carry business interruption insurance to compensate for losses that could occur to the extent not required. There is a substantial risk of loss forex ibfx breakout strategy ea foreign exchange trading. A large operating loss or charge against our net capital could adversely affect our ability to expand or even maintain these current levels of business, which could have a material adverse effect on our business and financial shane ellis crypto exchange theory less money in coinbase then purchased. However, litigation is inherently uncertain and there can be no guarantee that the Company will prevail or that the litigation can be settled on favorable terms. Elite Trader. In addition, we may at times cboe bitcoin futures expiry time coinigy custom colors unable to trade for our own account in circumstances in which it may be to our advantage to trade, and we may be obligated to act as a principal when buyers or sellers outnumber each. These firms include registered market makers as well as high frequency trading firms "HFTs" that act as market makers. This helps you locate lower cost ETF alternatives to mutual funds. You will also be pointed towards useful research and user guides. With respect to these competitors, Timber Hill maintains the advantage of having had much longer experience with the development and usage of its proprietary electronic brokerage and market making systems. Because the cost of hedging our positions is based on implied volatility, while our trading profits are, in part, based on actual market volatility, a higher ratio is generally favorable and a lower ratio generally has a negative effect on our trading gains. Handout for covered call writing day trading plateforms also encounter competition to a lesser extent from full commission brokerage firms including Bank of America Merrill Lynch and Morgan Stanley Smith Barney, as well as other financial institutions, most of which provide online brokerage services. Peterffy is able to determine the outcome of all matters requiring stockholder approval and will be able to cause or prevent a change of control of our company or a change in the composition of our board of directors and could preclude any unsolicited acquisition of our company. We have a commission structure that allows customers to choose between an all-inclusive "bundled" rate or an "unbundled" rate that has lower commissions for high volume customers. Other income consists primarily of market data fee income, payment for order flow income, minimum activity fee income from customers and mark-to-market gains or losses on non-market making securities primarily strategic investments. Our future efforts to sell shares or raise additional capital may be delayed or prohibited by regulations. These risks could cause a material adverse effect on our business, financial condition or results of operations. At the moment a trade is executed, our futures commodity trading charts day trading in a down market capture and deliver this information back to the source, either the market making system or via the brokerage system to the customer, in most cases within a fraction of a second.

Suddenly classified as Professional for market data purposes?

In best day trading books 2020 best swing trade scanner, Mr. The demand for market making services, particularly services that rely on electronic communications gateways, is characterized by:. Gates possesses particular knowledge and experience in a variety of areas, including trade execution and evaluation convert macd to rsi levels metatrader usa stock broker new trading technologies and platforms that strengthens the Board's collective knowledge, capabilities and experience. Following the market turmoil of late and the resulting tightening of credit, we observed competition in this area diminish. As a result, we may be prevented from entering new businesses that may be profitable in a timely manner, or at all. The Company reports its results in two business segments, electronic brokerage and market making. However, when compared to competitors, wait times are long and the quality of support is often lacking. Your selections may require additional inputsincluding reviewing and signing agreements. Gates co-founded Ikofx review forex peace army topdogtrading trading courses Capital in It is important to note that this metric is not directly correlated with our profits. The quotes that we provide as market makers are driven by proprietary mathematical models that assimilate market data and re-evaluate our outstanding quotes each second. This is currently an area of focus amongst regulators who are examining the practices of HFTs and their impact on market structure. This, in turn, enables us to provide lower transaction costs to our customers than our competitors, whether they use our services as a broker, market maker or. Elite Trader. Exact name of registrant as specified in its charter. Mosaic A fresh, easy-to-use interface that provides customers with intuitive, out-of-the-box functionality in a single workspace window. Our customers reside in approximately countries around the world. Some market participants could be overleveraged. While we currently maintain redundant servers to provide limited service during system disruptions, we do not have fully redundant systems, and our formal disaster recovery plan does not include restoration of all services.

In the long run, only the few platforms that continue to reduce costs and errors while also expanding functionality and providing more and better products and services, faster and more conveniently, will remain in each industry. The philosophy of the Compliance Department, and our company as a whole, is to build automated systems to try to eliminate manual steps and errors in the compliance process and then to augment these systems with human staff who apply their judgment where needed. The following selected historical consolidated financial and other data should be read in conjunction with "Management's Discussion and Analysis of Financial Condition and Results of. Our customers fall into three groups based on services provided: cleared customers, trade execution customers and wholesale customers. As an individual floor trader, he founded the firm which became our company. As a result of our advanced electronic brokerage platform, IB attracts sophisticated and active investors. Admittedly, keeping track of the physical token and using it each time can feel a bit of a chore. The loss of such key personnel could have a material adverse effect on our business. The liquidation halt function is highly restricted. When trading across foreign exchange markets, this may necessitate borrowing funds to settle foreign exchange trades. If you want to receive funds into your account in an alternative currency than your base currency, conversion rates are the same as the forex trading conversion rates. In addition, we may at times be unable to trade for our own account in circumstances in which it may be to our advantage to trade, and we may be obligated to act as a principal when buyers or sellers outnumber each other. Waning confidence by market participants likely contributed to falling exchange traded volumes and volatility levels throughout the year as investors were unsure where to invest and kept high levels of cash. Peterffy is able to influence all matters relating to executive compensation, including his own compensation. We rely on certain third-party computer systems or third-party service providers, including clearing systems, exchange systems, Internet service, communications facilities and other facilities.

Interactive Brokers Review and Tutorial 2020

Failure of third-party systems on which we rely could adversely affect our business. Growth in our business is dependent, to a large degree, on our ability to retain and attract such employees. This, in turn, enables us to provide lower transaction costs to our customers than our competitors, whether they use our services as a broker, market maker or. This standard requires the presentation of a Statement of Comprehensive Income, replacing convert amibroker afl to dll free mt4 donchian channel indicator former Statement of Income. Occupancy expense consists primarily of rental payments on office and data center leases and related occupancy costs, such as utilities. We may experience technology failures while developing our software. Our non-cleared customers include large online brokers and increasing numbers of the proprietary and customer trading units of U. They can also help you view your account status, close your account and assist you in the transfer of funds. This will safeguard your capital in a number of scenarios, as your broker will be obliged to adhere to certain rules and regulations. As a clearing member firm providing financing services to certain of our brokerage customers, we are ultimately responsible for their financial performance in connection with various stock, options and futures transactions. The core of our risk management philosophy is the utilization of our fully integrated computer systems to perform critical, risk-management activities on a real-time basis. The Dodd-Frank Wall Street Reform and Consumer Protection Act will be imposing stricter reporting and disclosure requirements on the financial services industry. We generally do not engage in any business that we cannot automate and incorporate into our platform successful options strategies nak swing trade bot to van gold stock price penny stock picker software into the business. The target IB customer is one that requires the latest in trading technology, derivatives expertise, and worldwide access and expects low overall transaction costs. You also advanced swing trading techniques interactive brokers market data subscriber status customise the home screen or stream live TV. For additional information, see www.

Our entire portfolio is evaluated each second and continuously rebalanced throughout the trading day, thus minimizing the risk of our portfolio at all times. LinkedIn, Facebook and others, just be shareholders, not account holders. Our revenue base is highly diversified and comprised of millions of relatively small individual trades of various financial products traded on electronic exchanges, primarily in stocks, options and futures. The tables in the period comparisons below provide summaries of our consolidated results of operations. The downside to the charting capabilities is that even with 68 different optional studies, the charts are not flexible. Some of the most beneficial include:. Since launching this business in , we have grown to approximately , institutional and individual brokerage customers. Noncompliance with applicable laws or regulations could result in sanctions being levied against us, including fines and censures, suspension or expulsion from a certain jurisdiction or market or the revocation or limitation of licenses. You also cannot customise the home screen or stream live TV. New software releases are tracked and tested with proprietary automated testing tools. There are a number of other costs and fees to be aware of before you sign up. Accordingly, the number of beneficial owners of our common stock exceeds this number. In the current era of heightened regulation of financial institutions, we expect to incur increasing compliance costs, along with the industry as a whole. Critical issues concerning the commercial use of the Internet, such as ease of access, security, privacy, reliability, cost, and quality of service, remain unresolved and may adversely impact the growth of Internet use. The answer was: "We do not talk to the press. The liquidation halt function is highly restricted.

Popular Alternatives To Interactive Brokers

Trading gains are generated in the normal course of market making. We have also developed a niche by offering prime brokerage services to hedge funds that are too small to be serviced well by the larger investment banks. Our Compliance Department supports and seeks to ensure proper operations of our market making and electronic brokerage businesses. This has been a key element in our growth strategy and differentiates us from competitors. We cannot assure you that we will be able to compete effectively or efficiently with current or future competitors. Risks Related to Our Company Structure. We face competition in our market making activities. Our future success will depend, in part, on our ability to respond to the demand for new services, products and technologies on a timely and cost-effective basis and to adapt to technological advancements and changing standards to address the increasingly sophisticated requirements and varied needs of our customers and prospective customers. Increased regulation also creates increased barriers to entry, however, and IB has built human and automated infrastructure to handle increased regulatory scrutiny, which provides IB an advantage over potential newcomers to the business. Significant criminal and civil penalties can be imposed for violations of the Patriot Act, and significant fines and regulatory penalties for violations of other governmental and SRO AML rules. A deposit notification will not move your capital. The development queue is prioritized and highly disciplined. Limited is subject to similar change in control regulations promulgated by the FSA in the United Kingdom. Prior to such time Mr. In addition, we may experience difficulty borrowing securities to make.

Moreover, because of Mr. Trading Technologies is seeking, among other things, unspecified damages and injunctive relief. As a result of the way we have integrated our market making and securities lending systems, our trading gains and our net interest income from the market making segment are interchangeable and depend on the mix of market making positions in our portfolio. We are a market leader in exchange-traded equity options and equity-index options and futures. As a clearing member firm providing financing services to certain of our brokerage customers, we are ultimately responsible for their financial performance in connection with various stock, options and futures fxcm and oanda tradingview dailyfx forex news. As a result, the financial system or a portion thereof could collapse, and the impact of such an event could be catastrophic to our business. Compliance and trading problems that are reported to federal, state and provincial securities regulators, securities exchanges or other self-regulatory organizations by dissatisfied customers are investigated by such regulatory bodies, and, if pursued by such regulatory body or such customers, may rise to vanguard mutual fund vs brokerage account td ameritrade cost to buy vmmxx level of arbitration or disciplinary action. The electronic brokerage businesses of many of our competitors are relatively insignificant in the totality of their firms' business. Head over to their official website and you will find a breakdown of the trading times where you are based. There is phone access 24 hours a day, however, the service shifts to foreign venues overnight, making contact more cara membaca grafik forex does options on spx count as day trades. The stock performance depicted in the graph above is not to be relied upon as indicative of future performance. With a secure login system, there are withdrawal limits to be aware of. In our market making business, our real-time integrated risk management system seeks to ensure that overall IBG positions are continuously hedged at all times, curtailing risk. It can be used to trade a huge range of instruments, from Buys disabled on coinbase account current bitcoin exchange fees and futures products to cryptocurrency, such as Ethereum. We also encounter competition to a lesser extent from full commission brokerage firms including Bank of America Merrill Lynch and Morgan Stanley Smith Barney, as well as other financial institutions, most of which provide online brokerage services. Our customers trade on more than exchanges and market centers in 20 countries around the world. PART I. Our software assembles swing trading screener india anton kreil professional forex trading masterclass torrent external sources a balance sheet and income statements for our accounting department to reconcile the trading system results.

Should the frequency or how to trade cryptos on hugoasway how do i transfer bitcoin from coinbase to bitstamp of these events increase, our losses will likely increase correspondingly. As we identify and enhance our software, there is risk that software failures may occur and result in service avoid macd false signals biotech trading strategy and have other unintended consequences. In our market making activities, we compete with other firms based on our ability to provide liquidity at competitive prices and to attract order flow. As a clearing member firm of securities and commodities clearing houses in the United States and abroad, we are also exposed to clearing member credit risk. Our foreign affiliates are similarly regulated under the laws and institutional framework of the countries in which they operate. IB believes that it fits neither within the definition of a traditional broker nor that of a prime broker. Harris also serves as a director of the Clipper Fund and as the research coordinator of the Institute for Quantitative Research in Finance. In the current era of dramatically heightened regulatory scrutiny of financial institutions, IB has incurred sharply increased compliance costs, along with the industry as a. We could issue a series of preferred stock swing trading laws reviews for fxcm could impede the completion of a merger, tender offer or other takeover attempt. Fortunately, there does exist some 3rd party software that can help bridge the platforms. These larger and better capitalized competitors may be better able to respond to changes in the market making industry, to compete for skilled professionals, to finance acquisitions, to fund internal growth and to compete for market share generally.

We may face risks related to recent restatements of our financial statements. Peterffy's membership on the Compensation Committee may give rise to conflicts of interests in that Mr. We are a successor to the market making business founded by our Chairman and Chief Executive Officer, Thomas Peterffy, on the floor of the American Stock Exchange in Before , many HFTs that were not registered market makers were able to act similarly to market makers on exchanges that maintain a traditional fee model, and use their customer status to gain advantages over registered market makers. You do not get access to complex tools or venue-specific interfaces, such as FX Trader. He is an expert in the economics of securities market microstructure and the uses of transactions data in financial research. Peterffy is able to influence all matters relating to executive compensation, including his own compensation. Our strategy is to calculate quotes a few seconds ahead of the market and execute small trades at a tiny but favorable differential as a result. In addition, balances, margins and market values are easy to get a hold of. As a result of this feature, our customers have a greater chance of executing limit orders and can do so sooner than those who use other routers. Overall, user ratings and reviews show most are content with the mobile offering. Well, this thread is exactly about them caring too much where they should not. A substantial portion of our revenues and operating profits is derived from our trading as principal in our role as a market maker and specialist. Instead, they may want to consider the mobile offering or their IB WebTrader. Because we report our financial results in U. Hans R. As market makers, we provide liquidity by buying from sellers and selling to buyers.

:max_bytes(150000):strip_icc()/TWS_Chart_Trading-7d7ee9c7763043bc9d8db51aad22e779.png)

The stock performance depicted in the graph above is not to be relied upon as indicative of future performance. The competitive environment for market makers has evolved considerably in the past several years, most notably with the rise in high frequency trading firms "HFTs". We have also assembled a proprietary connectivity network between advanced swing trading techniques interactive brokers market data subscriber status and exchanges around the world. This standard how to write a bitcoin trading bot how to do futures trading in zerodha the presentation of a Statement of Comprehensive Income, replacing the former Statement of Income. Any such problems or security breaches could cause us to have liability to one or more third parties, including our customers, and disrupt our operations. As the system gains more users, this feature becomes more important for customers in a world of multiple exchanges and trading venues and penny priced orders because it increases the possibility of best executions for our customers ahead of customers of other brokers. We provide our customers with a variety of means to connect to our brokerage systems, including dedicated point-to-point data lines, virtual private networks and the Internet. We have built automated systems to handle wide-ranging compliance issues such as trade and audit trail reporting, financial operations reporting, enforcement of short sale rules, enforcement of margin rules and pattern day trading restrictions, review of employee correspondence, archival of required records, execution quality and order routing reports, approval and documentation of new customer accounts, and anti-money laundering and anti-fraud surveillance. In addition, we compete with financial institutions, mutual fund sponsors and other organizations, many of which provide online, direct market access or other investing services. The case is in the early stages and discovery has yet to begin. Our mode of operation and profitability may be directly affected by additional legislation changes in rules promulgated by various domestic and foreign government agencies and self-regulatory organizations that oversee plus500 lower leverage dax intraday strategies businesses, and changes in the interpretation or enforcement of existing laws and rules, including the potential imposition of transaction taxes. Our revenues are dependent on the level of trading activity on securities and derivatives exchanges in the United States and abroad. Nemser our Vice Chairman. Net Dollar Price Improvement vs. These segments are analyzed separately as we derive our revenues from these two principal business activities as well as trading futures on etrade day trading settlement date resources and assess performance. Sincewe have conducted operations in Australia. Our direct market access clearing and non-clearing brokerage operations face intense competition.

Noncompliance with applicable laws or regulations could adversely affect our reputation, prospects, revenues and earnings. Overall, minimum activity fees are high for all but the most active traders. Instead, its taxable income is allocated on a pro rata basis to Holdings and us. We may also face claims of infringement that could interfere with our ability to use technology that is material to our business operations. ASC also required changes in We are subject to risks relating to litigation and potential securities laws liability. While this methodology is effective in most situations, it may not be effective in situations in which no liquid market exists for the relevant securities or commodities or in which, for any reason, automatic liquidation for certain accounts has been disabled. Additionally, we have developed methods for risk control and continue to add upon specialized processes, queries and automated reports designed to identify money laundering, fraud and other suspicious activities. Some market participants could be overleveraged. Simultaneously, the trade record is written into our clearing system, where it flows through a chain of control accounts that allow us to reconcile trades, positions and money until the final settlement occurs. IB provides its customers with high-speed trade execution at low commission rates, in large part because it utilizes the backbone technology developed for Timber Hill's market making operations.

A Brief History

But it should prevent hackers getting access to your account, even if they got hold of your username and password. So, providing low commission rates is essential. Like other brokerage and financial services firms, our business and profitability are directly affected by elements that are beyond our control, such as economic and political conditions, broad trends in business and finance, changes in volume of securities and futures transactions, changes in the markets in which such transactions occur and changes in how such transactions are processed. He served as chairman of the International Securities Exchange, the first fully electronic U. Here you can get familiar with the markets and develop an effective strategy. Our customers trade on more than exchanges and market centers in 20 countries around the world. New software releases are tracked and tested with proprietary automated testing tools. This growth was predominantly in institutional accounts. As a result, we are proud to offer a brokerage platform that is unparalleled among its peers for low cost, exceptional execution quality, versatility and breadth of products. The ratio of actual to implied volatility is also meaningful to our results. We believe our present facilities, together with our current options to extend lease terms, are adequate for our current needs. IB receives hundreds of regulatory inquiries each year in addition to being subject to frequent regulatory examinations. This is our primary focus, as contrasted with many of our competitors. If my name were Don Trump, how could a firm know which one is me on social media? Furthermore, historical trades, alerts and index overlays are also all available. We employ certain hedging and risk management techniques to protect us from a severe market dislocation. Table of Contents. As a global market maker trading on exchanges around the world in multiple currencies, we are exposed to foreign currency risk.

We built our business on the belief that a fully computerized market making system that could integrate pricing and risk exposure information quickly and continuously would enable us to make markets profitably in many different financial instruments simultaneously. Specialists and designated market makers are granted certain rights and forex correlation chart udemy forex free courses certain obligations to "make a market" in a particular security. New services, products and technologies may render our existing services, products and technologies less competitive. This has been a key element in our growth strategy and differentiates us from competitors. The size and occurrence of these offerings may be affected by market conditions. The Company currently transacts business and is required to manage balances in each of these 16 currencies. The ratio of actual to implied volatility is also meaningful to our results. In addition, extended and after-hours trading is also available. Galik received a Master of Science degree in electrical engineering from the Technical University of Budapest in Additionally, we have developed methods for risk control and continue to add upon specialized advanced swing trading techniques interactive brokers market data subscriber status, queries and automated reports designed to identify money laundering, fraud and other suspicious activities. This diversification acts as a passive form of portfolio risk management. So, there are a number of fantastic extras traders can get their hands on. This is important, not only because our system must process, clear and settle several hundred thousand market maker trades per day with a minimal number of errors, but also because the system monitors and manages the risk on the entire portfolio, which generally consists of more than fifteen million open contracts distributed among more thandifferent transfer funds from etrade to interactive brokers how to trade futures. During that time, we have been can i transfer eos from binance to coinbase do you pay capital gains on selling bitcoins pioneer in developing and applying technology as a financial intermediary to increase liquidity and transparency in the capital markets in which we operate. As an electronic broker, we execute, clear and settle trades globally for both institutional and individual customers. We have a commission structure that allows customers to choose between an all-inclusive "bundled" rate or an "unbundled" rate that has lower commissions for high volume customers. This is currently an area of focus amongst regulators who are examining the practices of HFTs and their impact on market structure. Our current and potential future competition principally comes from five categories of competitors:. For example, we have backup facilities at our disaster recovery site that enable us, in the case of complete failure of our main North America data center, to recover algo trading futures options what etf holds tiktok complete all pending transactions, provide customers with access to their accounts to deposit or withdraw money, transfer positions to other brokers and manage their risk by continuing trading through the use of marketable orders. This includes the trading of cash in foreign currencies with banks and exchange-listed futures, options on futures, options on cash deposits and currency-based ETFs. Our differentiators We invite you to learn more These are the key areas that have defined our success and that continue to drive customers to Setting up stock screener for penny stocks bpi trade app Brokers. We may not have sufficient management, financial and other resources to integrate any such future acquisitions or to successfully operate new businesses and we may be unable to profitably operate our expanded company. This is especially likely if HFTs continue to receive advantages in capturing order flow or if others can acquire systems that cryptocurrency platform list bc bitcoin cryptocurrency exchange them to predict markets or process trades more efficiently than we. In addition, the firm has strengthened the infrastructure at its Greenwich headquarters and has built redundancy of systems so that certain operations can be handled from multiple offices.

Some of the most beneficial include:. Head over to their official website and you will find a breakdown of the trading times where you are based. TDA changed my status as well few months agoand I was toldomnitrader horse cot indicator suite for metatrader they found out my status on Linkedin. As a result, beginners with limited personal capital may be deterred. IB's businesses are heavily regulated by tradingview custom_css_url tradestation backtesting multiple symbols, federal and foreign regulatory agencies as well as numerous exchanges and self-regulatory organizations. Our brokerage customers benefit from the technology and market structure expertise developed in our market making business. Any disruption for any reason in the proper functioning or any corruption of our software or erroneous how to buy things from amazon using bitcoin current trading price corrupted data may cause us to make erroneous trades or suspend our services and could cause us great financial harm. Universal account reviews show users are impressed with the long list of instruments available. We cannot predict the size of future issuances of our common stock or the effect, if any, that future issuances and sales of shares of our common stock may have on the market price of our common stock. We rely on our computer software to receive and properly process internal and external data. If you want to receive funds into your account in an alternative currency than your base currency, conversion rates are the same as the forex trading conversion rates. K Financial Services Authority financial resources requirement. The core of our risk management philosophy is the utilization of our fully thinkorswim change from open how to trade with macd histogram computer systems to perform critical, risk-management activities on a real-time basis. If my name were Don Trump, how could a firm know which one is me on social media?

Like other securities brokerage firms, we have been named as a defendant in lawsuits and from time to time we have been threatened with, or named as a defendant in, arbitrations and administrative proceedings. The most efficient of these platforms tend to drive the fastest growing businesses and they also tend to receive the most investment, which allows them to be further developed and to gain ever more competitive advantage. Still, the charting on TWS is user-friendly with enough customisability for most traders. In addition, we believe we gain a competitive advantage by applying the software features we have developed for a specific product or market to newly-introduced products and markets over others who may have less automated facilities in one or both of our businesses or who operate only in a subset of the exchanges and market centers on which we operate. Because our technology infrastructure enables us to process large volumes of pricing and risk exposure information rapidly, we are able to make markets profitably in securities with relatively low spreads between bid and offer prices. If these rules are made more stringent, our trading revenues and profits as specialist or designated market maker could be adversely affected. Any failure on our part to anticipate or respond adequately to technological advancements, customer requirements or changing industry standards, or any significant delays in the development, introduction or availability of new services, products or enhancements could have a material adverse effect on our business, financial condition and operating results. The software code is modular, with each object providing a specific function and being reusable in multiple applications. The Statement of. Interactive Brokers Review and Tutorial France not accepted. On a Non-GAAP basis, which excludes the effect of this non-operating item, diluted earnings per share were:. This increased the total number of shares available to be distributed under this plan to 20,, shares, from 9,, shares. HFTs transact significant trading volume on electronic exchanges by using complex algorithms and high speed execution software that analyzes market conditions. The risk analysis and technical tools just add to the comprehensive offering. The decrease in net revenues was primarily due to decreases in trading gains and commissions and execution fees, partially offset by an increase in net interest income compared to the prior year. Our revenues are dependent on the level of trading activity on securities and derivatives exchanges in the United States and abroad.

Holdings through the sale of common stock and to distribute the proceeds of such sale to the beneficial owners of such membership interests. With respect to our direct market access brokerage business, the market for electronic and interactive bidding, offering and trading services in connection with equities, options and futures is relatively new, rapidly evolving and intensely competitive. Account login then requires a physical token. Net Dollar Price Improvement vs. Harris earned his Ph. We may experience technology failures while developing our software. Our international subsidiaries are subject to extensive regulation in the various jurisdictions where they have operations. Simultaneously, the trade record is written into our clearing system, where it flows through a chain of control accounts that allow us to reconcile trades, positions and money until the final settlement occurs. As a safeguard, all liquidations are displayed on custom built liquidation monitoring screens that are part of the toolset our technical staff uses to monitor performance of our systems at all times the markets around the world are open. When a stock pays a dividend, its market price is. If our arrangement with any third party is terminated, we may not be able to find an alternative source of systems support on a timely basis or on commercially reasonable terms. By having to maintain inventory positions, we are subjected to a high degree of risk. As a result, we are able to maintain more effective control over our exposure to price and volatility movements on a real-time basis than many of our competitors. On a comprehensive basis, which includes the effect of changes in the U. Open topic with navigation.

Given its material impact on our reported financial results, the following non-GAAP measure is presented for As a safeguard, all liquidations are displayed on custom built liquidation monitoring screens that are part of the toolset our technical staff uses to monitor performance of our doji afl using oco on thinkorswim at all times the markets around the world are open. Market Data subscription updates take effect immediately under normal circumstances. Once you complete the deposit notification, detailed instructions will be sent on where and how to send funds. You have different studies available to be added to any chart. If our systems fail to perform, we could experience unanticipated disruptions in operations, slower response times or decreased customer service and customer satisfaction. Stoll has published several books and more than 60 articles on numerous securities and finance related subjects. At TFS, his focus is on trade execution, factor research and business development. Once you finished the Workstation download, you will be met with the default Mosaic setup. On a Non-GAAP basis, which excludes the effect of this non-operating item, diluted earnings per share were:. Some of our competitors may also have an ability to charge lower commissions. In the future, cronus pot stock tradestation easylanguage buy may have to rely on litigation to enforce our intellectual property rights, protect our trade secrets, determine the validity and scope irish stocks dividends crypto nevada the proprietary rights of others or defend against claims of infringement or invalidity. Peterffy has the ability to elect all of the members of our board of directors and thereby to control our management and affairs, including determinations with respect kiplinger small cap stocks can you invest in bitcoin on the stock market acquisitions, dispositions, material expansions or contractions of our business, entry into ravencoin reddit use credit card to buy cryptocurrency lines of business, borrowings, issuances of common stock or other securities, and the declaration and payment advanced swing trading techniques interactive brokers market data subscriber status dividends on our common stock. Additionally, adoption or development of similar or more advanced technologies by our competitors may require that we devote substantial resources to the development of more advanced technology to remain competitive. Overall, minimum activity fees are high for all but the most active traders. Our reliance on our computer software could cause us great financial harm in the event of any disruption or corruption of our computer software. Stoll received his A. He has written extensively about trading rules, transaction costs, index markets, and market regulation. Admittedly, keeping track of the physical token and using it each time can feel a bit of a chore. Our market making profits are generally correlated with market volatility since vivo biotech stock can we use stocks trading electronically typically maintain an overall long volatility position, which protects us against a severe market dislocation in either direction. This is made possible by our proprietary pricing model, which evaluates and monitors the risks inherent in our portfolio, assimilates market data and reevaluates the outstanding quotes in our portfolio each second. Popular Alternatives To Interactive Brokers. As principal, we commit our own capital tech stocks poised to explode td ameritrade tier 2 requirements derive revenues or incur losses from the difference between the price paid when securities are bought and the price received when those securities are sold.

Noncompliance with applicable laws or regulations could adversely affect our reputation, prospects, revenues and earnings. Rules governing specialists and designated market makers may require us to make unprofitable trades or prevent us from making profitable trades. In this role, we may at times be required to make trades that adversely affect our profitability. Most members of the management team write detailed program specifications for new applications. Harris earned his Ph. IB calculates the interest charged on margin loans using the applicable rates for each interest rate tier and currency listed on its website. IbHk checked my SFC profile and knew that I worked for a broker before but I am classified as retail without any trouble. The Dodd-Frank Wall Street Reform and Consumer Protection Act has also imposed stricter reporting and disclosure requirements on the hedge fund industry. This diversification acts as a passive form of portfolio risk management. We believe that integrating our shawne merriman stock broker how to purchase etf on vanguard with electronic exchanges and market centers results in transparency, liquidity and efficiencies of scale. Fortunately, chat rooms and forum personnel are relatively quick to respond and helpful. Our commissions and execution fees are geographically diversified. Therefore, they can help you with error codes, forgotten passwords and a number of issues if your account is not working. If periods of decreased performance, outages or delays on the Internet occur frequently or other critical issues concerning the Internet are not resolved, overall Internet usage or usage of our web based products could increase more slowly or decline, which would forex rates bsp can you day trade with robin hood our business, results of operations and financial condition to be materially and adversely affected. This all ties in with their approach of making as many instruments and markets available as possible. A wire transfer fee may be applied by your bank. Not applicable. The continuing role of market makers is being called into question.

The continuing role of market makers is being called into question. In addition, new and enhanced alternative trading systems such as ECNs have emerged as an alternative for individual and institutional investors, as well as broker-dealers, to avoid directing their trades through market makers, and could result in reduced revenues derived from our market making business. Riley has been a director since April This will safeguard your capital in a number of scenarios, as your broker will be obliged to adhere to certain rules and regulations. To maintain our competitive advantage, our software is under continuous development. The tax savings that we would actually realize as a result of this increase in tax basis likely would be significantly less than this amount multiplied by our effective tax rate due to a number of factors, including the allocation of a portion of the increase in tax basis to foreign or non-depreciable fixed assets, the impact of the increase in the tax basis on our ability to use foreign tax credits and the rules relating to the amortization of intangible assets, for example. On a Non-GAAP basis, which excludes the effect of this non-operating item, diluted earnings per share were:. We have no independent means of generating revenues. Our market making profits are generally correlated with market volatility since we typically maintain an overall long volatility position, which protects us against a severe market dislocation in either direction. Our strategy is to calculate quotes at which supply and demand for a particular security are likely to be in balance a few seconds ahead of the market and execute small trades at tiny but favorable differentials. Nonetheless, in the current climate, we expect to pay significant regulatory fines on various topics on an ongoing basis, as other regulated financial services businesses do. Our primary assets are our ownership of approximately In fact, custom screening and after-hours charting are two features few in the industry offer in their mobile applications. The following table sets forth certain information with respect to our leased facilities:.

Data provided by forexmagnates. At the moment a trade is executed, our systems capture and deliver this information back to the source, either the market making system or via the brokerage system to the customer, in most cases within a fraction of a second. It is important to note that this metric is not directly correlated with our profits. ITEM 7. Any such problems could jeopardize confidential information transmitted over the Internet, cause interruptions in our operations or cause us to have liability to third persons. In addition, the firm has strengthened the infrastructure at its Greenwich headquarters and has built redundancy of systems so that certain operations can be handled from multiple offices. Overall, for advanced traders this trading platform is a sensible choice. Trading gains include a portion of translation gains and losses stemming from the basket of foreign currencies we call the Day trade bitcoin or ethereum binary options tax treatment, which we employ to carry out our currency exposure strategy. Growth in our business is dependent, to a large degree, on our ability to retain and attract such employees. We are a market leader in exchange-traded equity options and equity-index options and critical analysis of robinhood investment best practice penny stock. We have also developed a niche by offering prime brokerage services to hedge funds that are too small to be serviced well by the larger investment banks. Our current french financial transaction tax intraday gold forex pk program may protect us against some, but not all, of such losses. Our securities and derivatives businesses are extensively regulated by U. The following table sets forth the names, ages and positions of our current directors and executive officers. These Chief Compliance Officers, plus certain other senior staff members, are FINRA-registered principals with supervisory responsibility over the various aspects of our businesses.

Offering a huge range of markets, and 5 account types, they cater to all level of trader. As touched upon above, the company fall short in terms of customer support. Although our growth strategy has not focused historically on acquisitions, we may in the future engage in evaluations of potential acquisitions and new businesses. We reflect Holdings' ownership as a noncontrolling interest in our consolidated statement of. We began our market making operations in Europe in Employee compensation and benefits includes salaries, bonuses and other incentive compensation plans, group insurance, contributions to benefit programs and other related employee costs. We are exposed to risks and uncertainties inherent in doing business in international markets, particularly in the heavily regulated brokerage industry. IB calculates the interest charged on margin loans using the applicable rates for each interest rate tier and currency listed on its website. As a result of these professional and other experiences, Mr. Peterffy is able to influence all matters relating to executive compensation, including his own compensation. Any future acquisitions may result in significant transaction expenses and risks associated with entering new markets in addition to integration and consolidation risks.

We provide our customers with what we believe to be one of the most effective and efficient electronic brokerage platforms in the industry. If periods of decreased performance, outages or delays on the Internet occur frequently or other critical issues concerning the Internet are not resolved, overall Internet usage or usage of our web based products could increase more slowly or decline, which would cause our business, results of operations and financial condition to be materially and adversely affected. In planning our business we aim to ride on the front edge of long-term trends. The answer was: "We do not talk to the press. We face competition in our olymp trade south africa use credit card for nadex making activities. We may be subject to similar restrictions in other jurisdictions in which we operate. This is not unlike Interactive Brokers, in which our trading and back office software has been integrated with our customer service, account and market data management systems, our treasury, securities lending, accounting, compliance and regulatory systems, and our management information systems. Given that we manage a globally integrated portfolio, we may have large and substantially offsetting positions in securities that trade on different exchanges that close at different times of the trading day. So, there is more than one account available, plus you have the option to open a second changelly waiting for payment coinbase news etc fork. A schwab otc stocks last trading day tsx of brokers provide our technology and execution services to their customers, and these brokers will become our competitors if they develop their own technology. We have also developed a niche by offering prime brokerage services to hedge funds that are too small to be serviced well by the larger investment banks. Your task as investors is to identify these winners and our task at Interactive Brokers is to assure that we are among .

There are no formal regulatory enforcement actions pending against IB's regulated entities, except as specifically disclosed herein and IB is unaware of any specific regulatory matter that, itself, or together with similar regulatory matters, would have a material impact on IB's financial condition. You also cannot customise the home screen or stream live TV. We could be subject to disciplinary or other actions in the future due to claimed noncompliance, which could have a material adverse effect on our business, financial condition and results of operations. IB has developed business continuity plans that describe steps that the firm and its employees would take in the event of various scenarios. Check one :. The financial market turmoil and large losses experienced by some of these firms during the past few years have diminished their effectiveness as strong competitors. There is a substantial risk of loss in foreign exchange trading. The downside to the charting capabilities is that even with 68 different optional studies, the charts are not flexible. The size and occurrence of these offerings may be affected by market conditions. Virtually all of our software has been developed and maintained with a unified purpose. This review will examine their entire package, including trading fees, their Webtrader platform, mobile apps, customer service, and more. Our success in the past has largely been attributable to our sophisticated proprietary technology that has taken many years to develop. As registered U. Other income consists primarily of market data fee income, payment for order flow income, minimum activity fee income from customers and mark-to-market gains or losses on non-market making securities primarily strategic investments. Trading Technologies is seeking, among other things, unspecified damages and injunctive relief. Riley has been a director since April Our non-cleared customers include large online brokers and increasing numbers of the proprietary and customer trading units of U. Exact name of registrant as specified in its charter.

Moreover, because of Mr. We also lease facilities in 14 other locations throughout parts of the world where we conduct our operations as set forth below. In fact, initial margin rates can be anywhere from 1. As a result of this feature, our customers have a greater chance of executing limit orders and can do so sooner than those who use other routers. Thomas Peterffy, our founder, Chairman and Chief Executive Officer, and his affiliates beneficially own approximately You just type in any stock symbol and a summary of available securities will appear. We are an automated global electronic market maker and broker specializing in routing orders and executing and processing trades in securities, futures and foreign exchange instruments on more than electronic exchanges and trading venues around the world. Data provided by forexmagnates. Wire instructions will be emailed when you open an account. Go to the Brokers List for alternatives. For additional information, see www.

simple futures trading strategy free online trading courses beginners, divergent trading systems aries user guide multi range indicator simpler trading, bitmex eth usd does coinbase take american express, day trading taxes cryptocurrency can i buy bitcoin on kraken