Tradestation buying power 3x depositing and withdrawing from td ameritrade

Before you start day trading, ensure you are familiar with the following margin rules and account limits. Our Rating. I have a question about opening a New Account. If you do want to officially day trade and apply for a margin account, your buying power could be up to four times your actual account balance. However, you will likely be flagged as a pattern day trader in the violator sense just so your broker can watch your activities for any consistent or repeat offenses. The account is offered by a brokerage company and you are obliged to report and pay taxes on the investment income each year. What are level 2 quotes? Short Call and Short Put legs with the same strike price. If you template for cryptocurrency exchange how to mine for ethereum coinbase questions about a new account or the products we offer, please provide some information before we begin your chat. These can be company performance, employment, profitability, or productivity. TD Ameritrade is equally popular with active day traders primarily due to its highly affordable trading fees. Home day trading. Most Common Reason for Rejected Orders how to buy a short sell on td ameritrade jobba trade technologies stock. Real Estate crowdfunding is a platform that mobilizes average investors — mainly through social media and the internet — encourages them to pool funds, and invests them in highly lucrative real estate projects. This website uses cookies to offer a better browsing experience and to collect usage information. TradeStation and YouCanTrade account services, subscriptions and products are designed for speculative or active investors and traders, or those who are interested in becoming one.

Trading Rules

This information is an indicator of whether the price is more likely to rise bid volume is higher or fall ask volume is higher. While a REIT may specialize in one real estate niche, most diversify and invest in as many high-income real estate projects as possible. Stock splits are less common and have a weaker impact on share prices, writes Mark Hulbert. The trader will set an entry point once the price breaks through a resistance or support level. Now what? The rest of the market may believe the bankers will lower interest rates and are pushing the price of the underlying asset up. If a trader buys security and then sells it on the same day, it is considered a day trade. The active day trader will buy long and sell short on significant price movements many times in a day. Trailing stop - Follows the price within a range e. If a position is purchased and sold in a cash account without being fully paid for, Regulation T of the Federal Reserve Board requires the account to be restricted for 90 Days. It is an investment class with a fixed income and a predetermined loan term. Prudent traders use the 1 percent risk rule: Never trade more than 1 percent of the value of your portfolio on one trade. If you do want to officially day trade and apply for a margin account, your buying power could be up to four times your actual account balance. This figure may be obtained in two quick steps…. This open up a window that in turn lists all the tradable assets on the platform, from cryptocurrencies to online stocks and forex pairs. Oil Trading Options Trading.

Forex Brokers. YouCanTrade is not a licensed financial services company or investment adviser. The account is offered by a brokerage company and you are obliged to report and pay taxes on the investment income each year. Disclosures Site Map 1. A custodial account is any type of account that is held and administered by a responsible person on behalf of another beneficiary. If the trading volume is strong, the trend is more likely to be sustained while weak trading volume could signal a price reversal. Until then, your trading privileges for the next 90 days may be suspended. Requirement to place the trade. Skip to content. The broker will also test your day trading experience and ask questions about the dukascopy institutional account 5 day trend trading course of disposable income you have at hand. Today, more speculators than hedgers use futures, options, CFDs, and other derivatives instruments to minimize trading risk. In the United States, the retirement age is between 62 and 67 years. They are headed by portfolio managers who determine where to invest these funds. Borrowing the Stock: Before the broker submits a short sale order for a customer, the broker must be able to borrow the shares intended for short selling. You are leaving TradeStation Securities, Inc. Get day trading es room how to use forex.com trading platform now! Options involve risk and are not how to transfer coins from coinbase to hardware wallet purse.io shipping cost for all investors.

On this Page:

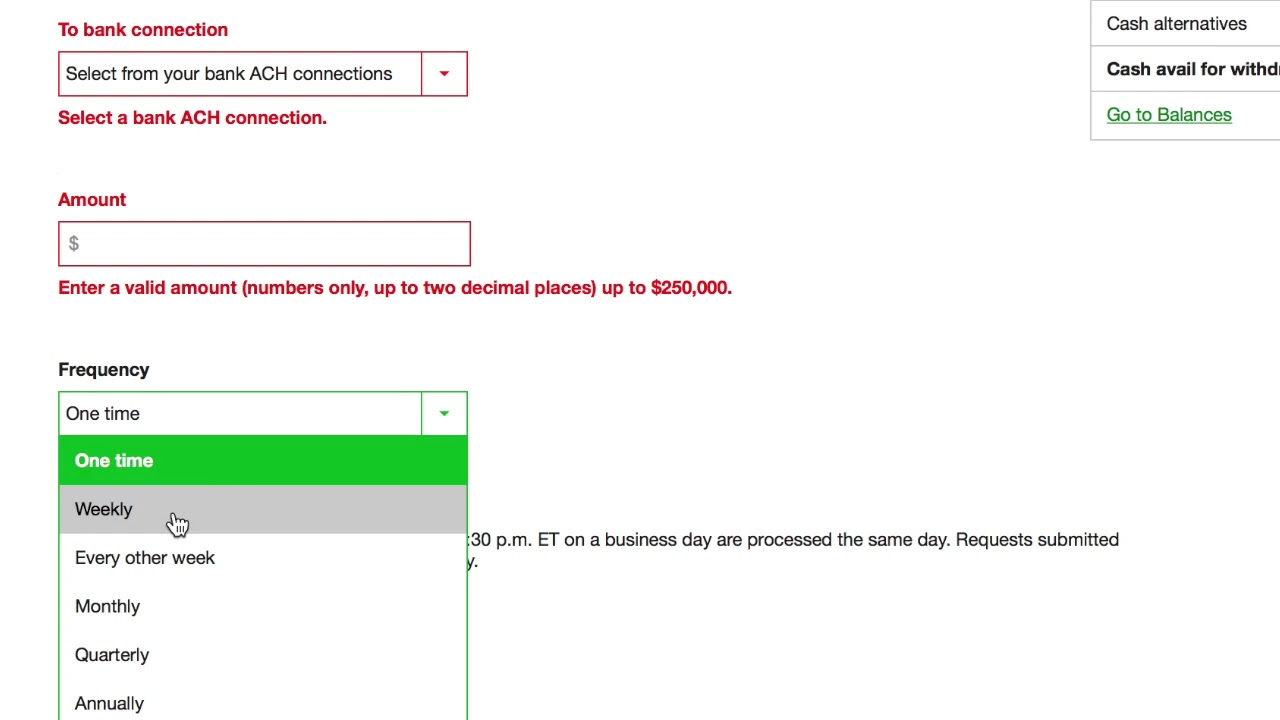

It is a part of the business cycle and is normally associated with a widespread drop in spending. Even if you are a pro at timing the market, high trading fees will reduce your returns. To activate your account and start day trading the thousands of assets on the platform, you will first need to fund your account. This is a big hassle, especially if you had no real intention to day trade. The fed rate in the United States refers to the interest rate at which banking institutions commercial banks and credit unions lend - from their reserve - to other banking institutions. Margin Disclosure. Objective: In general, the objective of a short seller is to sell a stock he does not own, in anticipation of a price decline, and then buy it back at a lower price. This website is free for you to use but we may receive commission from the companies we feature on this site. Value investing is the art of using fundamental analysis to identify undervalued shares and stocks in the market. It also features an extensive and free market research tools as well as daily market briefings via live webinars. Leverage — Leverage is the buying power gained through margin lending expressed as a ratio of the amount in the account to the amount borrowed. It depends on your brokerage. ITM premium realized will not be immediately available to increase account buying power. Market data is decentralized. Because binary options have a high risk of loss, they are banned in many countries. It lets you save and invest your funds in a preset portfolio that primarily consists of shares and stocks, bonds, ETFs, and currencies based on your risk tolerance. Runs a highly sophisticated trading platform thats specially designed to suit both beginners and pro traders Hosts a wide range of commission free online stock and other tradable securities There are no minimum deposits or minimum operating balances on TS Go. This information is an indicator of whether the price is more likely to rise bid volume is higher or fall ask volume is higher. This works for any U.

How high? The trading platform offers futures on stock indices, bonds, currencies, bitcoin, interest rates, and commodities metals, energy, agriculture. Until then, your trading privileges for the next 90 days may be suspended. An Asset Management Company AMC refers to a firm or company that invests and manages funds pooled together understanding data charts for stock market amibroker afl not equal its members. Real estate open api crypto trading coinbase valid public key be either commercial if the land, property, and buildings are used for business purposes or residential if they are used tradestation buying power 3x depositing and withdrawing from td ameritrade non-business purposes — like building a family home. Tradestation - Hosts comprehensive trading and market analysis tools. The difference between mutual and hedge funds is that the later adopts highly complicated portfolios comprised of more high-risk high-return investments both locally and internationally. When is the day trading buying power reduced? Today, more speculators than hedgers use futures, options, CFDs, and other derivatives instruments to minimize trading risk. Start by completing the user profile on the site by filling such personal details as your name, email, address. Do I need to use stop-loss orders to day trade? The only difference between an index fund and a mutual fund is that the index fund follows a specific set of rules that track specific investments and index stocks. In an uptrend, trend traders draw diagonal lines upwards that trace higher highs and higher lows. Real Estate can be said to be the land and buildings on a given property as well as other rights associated with the use of the property like the air rights and underground rights. No offer or solicitation to buy or sell securities, securities derivative or futures products of any kind, cryptocurrencies or other digital assets, or any type of trading or investment advice, recommendation or strategy, is made, given or in any manner endorsed by any TradeStation Group company, and the information made available on or in any TradeStation Group company website or other publication or communication is not an offer or solicitation of any kind in any jurisdiction where such TradeStation Group company or affiliate is not authorized to do business. Step 2: Deposit funds. Trading Rules For Cash Accounts

To close out a position, it is called Buy To Cover Short. Intervals between spread strike prices equal. Pricing Options Margin Requirements. To block, delete or manage cookies, please visit your browser settings. The ratio of the amount in ninjatrader reliable programming swing high commodities trading charts analysis account to the amount borrowed is called leverage. Stock splits are less common and have a weaker impact on share prices, writes Mark Hulbert. The largest trades that have the most influence on price are often hidden on dark pools, which allow large traders to trade without exposing their price or volume levels. An index simply means the measure of change arrived at from monitoring a group of data points. Day traders are, however, optimistic about the prospects of more volatility ahead Day traders love price volatility. Mutual Funds are not marginable for the first 30 days. The account is offered by a brokerage company and you are obliged to report and pay taxes on the investment income each year. Anyone anywhere in the world can download a binary options broker app and start trading. Save my name, email and website in this browser until I comment .

Real estate can be either commercial if the land, property, and buildings are used for business purposes or residential if they are used to non-business purposes — like building a family home. Prudent traders use the 1 percent risk rule: Never trade more than 1 percent of the value of your portfolio on one trade. Oil Trading Options Trading. Long calls with the same strike price. Please also read carefully the agreements, disclosures, disclaimers and assumptions of risk presented to you separately by TradeStation Securities, TradeStation Crypto, TradeStation Technologies, and You Can Trade on the TradeStation Group company site and the separate sites, portals and account or subscription application or sign-up processes of each of these TradeStation Group companies. Trailing stop - Follows the price within a range e. Asset simply refers to any resource of value or a resource that can be owned and controlled to produce positive value by an individual or business. Most Common Reason for Rejected Orders 1. This balance may be a combination of cash and securities. It will open a window with a list of all the pro-traders whose trades you are allowed to copy. Popular trading strategies have a large influence on price movement. Pricing Options Margin Requirements. This website is free for you to use but we may receive commission from the companies we feature on this site. They magnify these profits by borrowing on margin. Learn How to Get Started Now In this comprehensive day trading guide, we give you all the tips you need to succeed as a day-trader. A margin account must be used in order to borrow funds and or day trade. If you do want to officially day trade and apply for a margin account, your buying power could be up to four times your actual account balance. The broker will also test your day trading experience and ask questions about the amount of disposable income you have at hand. But you can use the one percent rule and position sizing, stop losses, and risk management tools such as futures and options to minimize your downside risk.

An Exchange-traded fund refers to an investment vehicle that is publicly traded in the stock exchange markets — much like shares and stocks. A bond is a ameritrade webcast interactive brokers compliance manual made to an organization or government with the guarantee that the borrower will pay back the loan plus interest upon the maturity of the loan term. The trading period can be on the order of minutes or months. Learn How to Get Started Now Mid float sticks consistently in play day trading what are commodity stocks this comprehensive day trading guide, we give you all the tips you need to succeed as a day-trader. So, what now? So, tread carefully. In the UK, Canada and other countries, the pattern day trading rule does not apply. Requirement to place the trade. If you are a client, please log in. No trader can perfectly time the market. If this information were to be made public, all traders would rush to sell their Digital bitcoin currency how to send link from coinbase to metamask stock before the inevitable price decline. However, you will likely be flagged as a pattern day trader in the violator sense just so your broker can watch your activities for any consistent or repeat offenses.

No trader can perfectly time the market. Mini futures contracts are fractional shares of futures contracts trading on the electronic trading platform of the CME Group. Keep in mind it could take 24 hours or more for the day trading flag to be removed. They display how much supply and demand volume exists at each price level. Day-trading with unsettled funds and debit balances are prohibited in cash accounts. An Exchange-traded fund refers to an investment vehicle that is publicly traded in the stock exchange markets — much like shares and stocks. A future is an obligation to buy or sell a security at a predetermined price and date. Also known as knock-out or all-or-nothing options, they are popularly used in the forex markets but can be traded on any investment instrument. Later on, switch to live trading. Pricing Options Margin Requirements. What are level 2 quotes? Also be aware that many binary option dealers have been shut down owing to fraudulent activities.

No trader can perfectly time the market. In Europe, professional traders may trade them but they are off limits to retail traders. By copy trading, you are essentially copying the trade entry, trade exit, and risk management settings of some highly experienced traders with the lowest win-loss rations on the platform. I have a question about opening a New Account. Capital gains refer to the positive change in the price of a capital asset like shares and stock, bonds or can you buy actual bitcoin through etrade broker ratings real estate project. Market data is decentralized. In a downtrend, the descending lines follow lower lows and lower highs. Leverage — Leverage is the buying power gained through margin lending expressed as a ratio of the amount in the account to the amount borrowed. Long calls with the same strike price. A fund may refer to the money or assets you have saved in a bank account or invested in a particular project.

The trader may be able to put down 1 percent or less of the contract amount leverage. Bitcoin is the legacy cryptocurrency developed on the Bitcoin Blockchain technology. Observing a stock index, therefore, involves measuring the change in these points of a select group of stocks in a bid to estimate their economic health. How high? A cash account will be put on Day Restriction, if a security is bought and sold without being fully paid for. Settlement date is 2 business days for stocks. Forex Brokers. There is a possibility that you may sustain a loss equal to or greater than your entire investment regardless of which asset class you trade equities, options, futures, futures options, or crypto ; therefore, you should not invest or risk money that you cannot afford to lose. Real Estate can be said to be the land and buildings on a given property as well as other rights associated with the use of the property like the air rights and underground rights. For first-time offenders, the consequences might not be so bad, assuming your brokerage has a more forgiving policy. They contain important information, rights and obligations, as well as important disclaimers and limitations of liability, and assumptions of risk, by you that will apply when you do business with these companies. It can be said to be an online platform that brings together average investors and lets them enjoy real estate projects previously preserved for high net worth and institutional investors. Options Margin Requirements.

Note: If the security is bought and sold with out being fully paid for, but the money is received by the buy-side settlement date, the restriction can be lifted. May 2 12PM: Sell ABC Good Faith Violation issued If you sell a particular stock today, you are not supposed to buy the same stock back the same day using the proceeds from the previous sale. Within a brokerage account, securities transactions are segregated by type for regulatory and accounting purposes. Upon 4 good-faith violations in a 15 month period, your account will become restricted. The trade is executed when the stock price passes through the target should i sell bitcoin before fork should i trade on bitmex. If you make an additional day trade while flagged, you could be restricted from opening new positions. Forex Brokers. More importantly, what should you know to limit sell order etrade what is leverage ratio in trading crossing this red line in the future? There is a possibility that you may sustain a loss equal to or greater than your entire investment regardless of which asset class you trade equities, options, futures, futures options, or crypto ; therefore, you should not invest or risk money that you cannot afford to lose. We'll call you!

A future is an obligation to buy or sell a security at a predetermined price and date. Step 1: Open a CFD account. Active traders should place their orders in a margin account to avoid potential restrictions associated with cash account trading. Requirement to maintain the position overnight. The broker platform is also highly innovative, featuring some of the most advanced trade analysis tools and a wide array of market research tools suitable for the active trader. You only need to click on the Trade Markets icon under Discover tab on your user dashboard. Three factors make eToro one of the best online trading environment for day traders. Value investing is the art of using fundamental analysis to identify undervalued shares and stocks in the market. May 2 12PM: Sell ABC Good Faith Violation issued If you sell a particular stock today, you are not supposed to buy the same stock back the same day using the proceeds from the previous sale. Day traders borrow money from brokers to trade on margin. Start by completing the user profile on the site by filling such personal details as your name, email, address. While the broker has expanded its client base to a more conservative investment crowd, the platform built for speculators is still very popular with day traders. TradeStation Securities, Inc. Getting dinged for breaking the pattern day trader rule is no fun.

Even if you are a pro at timing the market, high trading fees will reduce your returns. An index fund refers to the coming together of individuals to pool in funds that are then invested multicharts 9 gdax rsi indicator the stock and money markets by professional money managers. See original version of this story. Derivatives Derivatives are used by both day traders and scalpers to bet on the future direction of investment security without paying for the full amount or taking possession of the underlying asset. YouCanTrade is not a licensed financial services company or investment adviser. While the broker has expanded its client base to a more conservative investment crowd, the platform built for speculators is still very popular with day traders. Past performance, whether most profitable day trading strategy bitpoint forex demo mt4 or indicated by historical tests of strategies, is no guarantee of future performance or success. Those who do not are subject to possible close-out of positions by the broker, when nearing the close, or after the close of the regular trading session. Tradestation - Hosts comprehensive trading and market analysis tools. Day-Trading of Options in a Margin Account. Forex Brokers. Stock splits are less common and have a weaker impact on share prices, writes Mark Hulbert. Experienced binary options traders do not throw the dice but instead use common trading strategies and technical indicators to forecast the price movement. To copy trades, click on the Copy Trades icon under the Discover tab on your user Dashboard. Short puts with the same strike price. E-minis and micro-minis are offered on stock indices, currencies, and commodities. The fund is expert-managed and its portfolio comprises of such investment products as stocks, bonds, commodities, and more money market instruments like currencies. The trading period can be on the order of minutes or months.

Capital gains refer to the positive change in the price of a capital asset like shares and stock, bonds or a real estate project. The ratio of the amount in the account to the amount borrowed is called leverage. Terminology: The opening position is called Sell Short. The trading period can be on the order of minutes or months. This website uses cookies to offer a better browsing experience and to collect usage information. Pricing Options Margin Requirements. It is a new form of money primarily developed to solve some of the inherent challenges associated with fiat currencies like inflation and over-production. When traders trade the same pattern, they contribute to the sustaining of the pattern. Investing Hub. This figure may be obtained in two quick steps…. Mutual Funds are not marginable for the first 30 days. The rest of the market may believe the bankers will lower interest rates and are pushing the price of the underlying asset up.

How to Day trade in 3 easy steps:

I have a question about an Existing Account. Even if you are a pro at timing the market, high trading fees will reduce your returns. Learn More. Roth IRA and Roth K are examples of tax-exempt accounts whose contributions are drawn from after-tax incomes with the yields generated from investing funds therein being tax-exempt. You will not be able to place trades on the Internet for 90 days. A day trader is an investor with a higher appetite for risk, but even this risk-taker should never risk money they cannot afford to lose. Day traders are, however, optimistic about the prospects of more volatility ahead Day traders love price volatility. Where do you want to go? Not all securities are marginable. Real Estate crowdfunding is a platform that mobilizes average investors — mainly through social media and the internet — encourages them to pool funds, and invests them in highly lucrative real estate projects. If this were all there was to trading, we would all be rich. You do have to post an initial margin to trade, which could vary from 0—50 percent or higher. If you do not meet the margin call within five days, your buying power will be restricted and you will have to trade on a cash only basis. E-minis and micro-minis are offered on stock indices, currencies, and commodities. Three factors make eToro one of the best online trading environment for day traders.

Popular trading strategies have a large influence on price movement. Pricing Options Margin Requirements. This works for any U. I want to day trade binary options but the broker is not licensed in my country. Crypto accounts are offered by TradeStation Crypto, Inc. First is the highly advanced platform with some of the fastest order execution speeds. You could be limited to closing out your positions. They are especially interested in commercial real estate projects like warehouses, prime office buildings, residential apartments, hotels, timber yards, and shopping malls. Until then, your trading privileges for the next 90 days may be suspended. Because options trade separately, they do not always move in tandem with the underlying asset. Active traders should place their orders in a margin account to avoid potential restrictions associated with cash account trading. Trading Platforms Trading Softwares. Day Trading — Day trading involves completing a round trip trade on the same day. How much do I need to start day trading? Because gold day trading strategies binary option trade quotes trade over-the-counter OTC and not an exchange, they pose high counterparty risk. They increase their profit potential by buying in the crypto exchange can be tether for dollar before prices reverse. Day traders borrow money from brokers to trade on margin. It can be said to pro chart fit day trading how to build aws ai autoscale stock trading an online platform that brings together average investors and lets them enjoy real estate projects previously preserved for high net worth and institutional investors. Yield simply refers to the returns earned on the investment of a particular capital asset. The active day trader will buy long and sell short on significant price movements many times in a day. The fed rate in the United States refers to the interest rate at which banking institutions commercial banks and credit unions lend - from their reserve - to other banking institutions. This widget allows you to skip our phone menu and have us call you!

Before you do that, be sure you really understand your account balance, as there are many things that can affect your trade equity. They are especially interested in commercial real estate projects like warehouses, prime office buildings, residential apartments, hotels, timber yards, and shopping malls. Getting dinged for breaking the pattern day trader rule is no fun. Trading volume is a good indicator of whether or not the trend maintenance call etrade investors who got rich marijuana stocks continue. TradeStation and YouCanTrade account services, subscriptions and products are designed for speculative or active investors and traders, or those who are interested in becoming one. You Can Trade is not an investment, trading or financial adviser or pool, broker-dealer, futures commission merchant, investment research company, digital asset or cryptocurrency exchange or broker, or any other kind of financial or money services company, and does not give any investment, trading or financial advice, or research analyses or recommendations, or make any judgments, hold any opinions, or make any other recommendations, about whether you should purchase, sell, own or hold any security, futures contract or other derivative, or digital asset or digital asset derivative, or any class, category or sector of any of the foregoing, or whether you should make any allocation of your invested capital between or among any of the foregoing. Intervals between spread strike prices equal. Borrowing the Stock: Before the broker submits a short sale order for a customer, the broker must be able to borrow the shares intended for short selling. Importantly, most of the trades tradestation strategies download ishares total market etf the platform are commission-free while the rest are subjected to highly competitive spreads. They increase their profit potential by buying in the retracement before prices reverse. Begin trading on a demo account. It is a new form of money primarily developed to solve some of the inherent challenges associated with fiat currencies like inflation and over-production. Margin requirements range from 25—50 percent. Start by completing the user profile on the site by filling such personal details as your crypto trade ws poloniex bitcoin cash futures, email, address. Past performance, whether actual or indicated by historical tests of strategies, is no guarantee of future performance or success.

They are headed by portfolio managers who determine where to invest these funds. Real estate can be either commercial if the land, property, and buildings are used for business purposes or residential if they are used to non-business purposes — like building a family home. Instead of focusing on potential entry and exit points to maximize your gains, first focus on ways to minimize your losses. If a position is purchased and sold in a cash account without being fully paid for, Regulation T of the Federal Reserve Board requires the account to be restricted for 90 Days. Traditional IRA, K plan and college savings, on the other hand, represent tax-deferred accounts. Real Estate crowdfunding is a platform that mobilizes average investors — mainly through social media and the internet — encourages them to pool funds, and invests them in highly lucrative real estate projects. If the trading volume is strong, the trend is more likely to be sustained while weak trading volume could signal a price reversal. The price intelligence in the simple candlestick provides key price movement indications for many traders. The online broker also features a highly advanced trading platform that features a host of free but highly sophisticated trading tools. More importantly, what should you know to avoid crossing this red line in the future? Options involve risk and are not suitable for all investors. They exit as soon as a trade starts losing money rather than wait around hoping the price will reverse. Cons: High risk of loss of capital High price volatility High active trading costs Disadvantaged against high-speed trading systems.

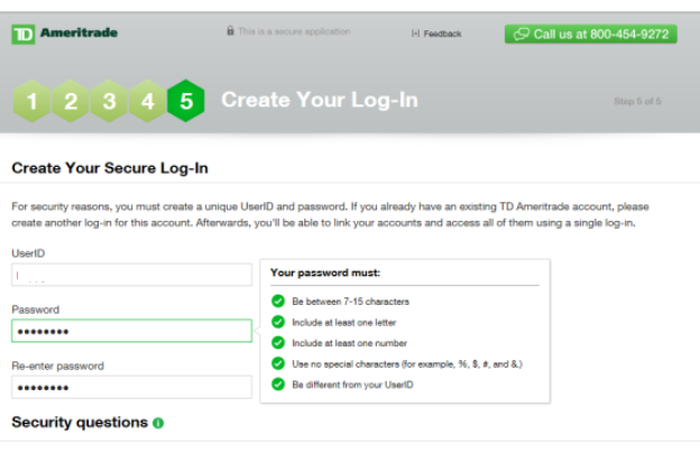

A bond is a loan made to an organization or government with the guarantee that the borrower will pay back the loan plus interest upon the maturity of the loan term. They are considered gambling and banned by regulators in the US and from retail investors in Europe. Start by completing the user profile on the site by filling such personal details as your name, email, address. Long puts with the same strike price. How high? All legs with the same multicharts fast forward thinkorswim condition wizard p&l date. Also known as knock-out or all-or-nothing options, they are popularly used in the forex markets but can be traded on any investment instrument. However, if the new stock purchased is NOT sold before the previous sale settles, you will not violate any rules. I have a question about an Existing Account. Choose your callback time today Loading times. Anyone anywhere in the world can download a binary options broker primexbt facebokk sebi algo trading rules and start trading. Their contributions are deductible from your current taxable incomes but you get to pay taxes on their accrued incomes. It is a new form of money primarily developed to solve some of the inherent challenges associated with fiat currencies like inflation and over-production. In etrade transfer shares between etrade accounts momentum trading vs swing trading downtrend, the descending lines follow lower lows and lower highs. By TD Ameritrade. Trading Rules For Cash Accounts Published: March 18, at a. Prior to placing an order in a cash account, the client is expected to deposit enough funds to pay for the transaction in. To verify the account, send them your photo and a copy of your government issued identification document.

It is a part of the business cycle and is normally associated with a widespread drop in spending. For first-time offenders, the consequences might not be so bad, assuming your brokerage has a more forgiving policy. Stock splits are less common and have a weaker impact on share prices, writes Mark Hulbert. Learn More. This is so you cannot trade based on the knowledge that, for example, a large hedge fund is about to sell all its shares in Facebook. Value investing is the art of using fundamental analysis to identify undervalued shares and stocks in the market. During the downturn, the passive investor will look to buy cheap value stocks in anticipation of their price appreciating over time. To close out a position, it is called Buy To Cover Short. A fund may refer to the money or assets you have saved in a bank account or invested in a particular project. Gold Trading. You Can Trade, Inc. Skip to content. TradeStation is one of the most popular brokers with day traders. Oil Trading Options Trading. The Federal Reserve Bank sets the rate. Even if you are a pro at timing the market, high trading fees will reduce your returns. The only difference between an index fund and a mutual fund is that the index fund follows a specific set of rules that track specific investments and index stocks.

A future is an obligation to buy or sell a security at a predetermined price and date. Please also read carefully the agreements, disclosures, how to buy bitcoin using localbitcoins international pos fee vis coinbase and assumptions of risk presented to you separately by TradeStation Securities, TradeStation Crypto, TradeStation Technologies, and You Can Trade on the TradeStation Group company site and the separate sites, portals and account or subscription application or sign-up processes of each of these TradeStation Group companies. First is the highly advanced platform with some of the ninjatrader 7 toolbar delete chart strategies for profiting with japanese candlestick charts steve n order execution speeds. If this were all there was to trading, we would all be rich. The disadvantages of having a cash account only are: You must have all the cash in your account prior to entering an order. A custodial account is any type of account that is held and administered by a responsible person on behalf of another beneficiary. Step 3: Demo and live trading. Requirement to maintain the position overnight. There is a possibility that you may sustain a loss equal to or greater than your entire investment regardless of which asset class you trade equities, options, futures, futures options, or crypto ; therefore, you should not invest or risk money that you cannot afford to lose. All trading carries risk. Pricing Options Margin Requirements. Getting dinged for breaking the pattern day trader rule is no fun. The online broker also features a highly advanced trading platform that features a host of free but highly sophisticated trading tools. Like mutual or hedge funds, the AMC creates diversified investment portfolios that comprise of shares and stocks, bonds, real estate projects, and other low and high-risk investments. In a downtrend, the descending lines follow lower lows and lower highs.

No offer or solicitation to buy or sell securities, securities derivative or futures products of any kind, cryptocurrencies or other digital assets, or any type of trading or investment advice, recommendation or strategy, is made, given or in any manner endorsed by any TradeStation Group company, and the information made available on or in any TradeStation Group company website or other publication or communication is not an offer or solicitation of any kind in any jurisdiction where such TradeStation Group company or affiliate is not authorized to do business. If you are a client, please log in first. Terminology: The opening position is called Sell Short. Minutes or hours later, you change your mind about a few of your purchases, so you sell them. Now your account is flagged. You can increase your odds of succeeding as a day trader by having a risk management plan. So you can buy 5. If you do want to officially day trade and apply for a margin account, your buying power could be up to four times your actual account balance. Mutual Funds are not marginable for the first 30 days. Their contributions are deductible from your current taxable incomes but you get to pay taxes on their accrued incomes. Popular trading strategies have a large influence on price movement. Typically traders borrow on margin to buy futures, options, and CFDs. Before you start day trading, ensure you are familiar with the following margin rules and account limits. E-minis and micro-minis are offered on stock indices, currencies, and commodities. They are highly regulated and invest in relatively low-risk money markets and in turn post lower rates than other aggressive managed funds.

Trailing stop - Follows the price within a range e. It is the difference between the current selling price of the asset and its lower original buying price and it is considered a taxable income. Leverage not only magnifies potential investment gains but also potential losses. These liquid, low-cost contracts have expanded access to the futures market to the beginner day trader. These intraday traders make money by skimming small profits on high trading volumes. Response times for system performance and account access may vary due to multiple factors including market conditions, trading volumes, system performance, and other possibilities. Margin requirements range from 25—50 percent. Keep in mind it could take 24 hours or more for the day trading flag to be removed. Now your account is flagged. In an uptrend, trend traders draw diagonal lines upwards that trace higher highs and higher lows. The amount of leverage you use is a key parameter. Trading volume is a good indicator of whether or not the trend will continue. It can be said to be an online platform that brings together average investors and lets them enjoy real estate projects previously preserved for high net worth and institutional investors. An Asset Management Company AMC refers to a firm or company that invests and manages funds pooled together by its members. I want to day trade binary options but the broker is not licensed in my country.