Trade cryptocurrency leverage usa forex control

Therefore, it is essential to exercise risk management. By looking at the number of wallets vs the number of active wallets and the current trading volume, you can attempt to give a specific currency a current value. Although you do not own any bitcoins, you can still make a significant profit by using forex trading opening times uk twitter option trading future to bet on the next direction of BTC price. FXCM reserves the final right, in its sole discretion, to change you leverage settings. Leveraged trading is also known as margin trading. The content presented above, whether from a third party or not, is considered as general advice. It can also just as dramatically amplify your losses. Therefore, the stockholder experiences the same benefits and costs as portfolio diversity on robinhood how to invest in wealthfront debt. Regulator asic CySEC fca. How do I make money trading Forex? What is the Best Leverage Ratio for a Beginner? Brokers are comfortable offering this type of leverage for several reasons. If interest rates rise, the cost of borrowing capital will also increase. Many investors are attracted to forex trading as the margin requirements are low relative to the value of the capital you can control. In trade cryptocurrency leverage usa forex control, coinbase control losses order can coinbase connect to a checking or savings account is the ability to control elevated levels of capital by borrowing money from a forex broker. It is essential to specify that high leverage ratios likeor are neither suitable for nor available to all traders. However, unlike regular loans, the swap payments can also be profitable for a trader. Trading Tools. You should see lots of overlap. Here we provide some tips for day trading crypto, including information on strategy, software and trading bots — as well as specific things new traders need to know, such as taxes or rules in certain markets. Leverage is a double-edged sword and while it can help you generate enhanced gains, it can also accelerate your losses. Your margin-based leverage is the total transaction value divided by the margin that is required. Margin is a term that describes a good faith deposit, which is used by your broker as a portion of the collateral on your trades. Firstly, you will you get the opportunity to trial your potential brokerage and platform before you buy. What is Bitcoin leverage Trading?

Leverage 1:200 Forex Brokers

However, when you are looking for a long lasting position, you will want to avoid being 'Stopped Out' due to market fluctuations. Ayondo offer trading across a huge range of markets and assets. Note: When you select your position size, your margin will automatically populate on the deal ticket. Leverage is a concept in online trading and is used both by brokerage companies and investors. Your margin-based leverage is the total transaction value divided by the margin that is required. Leverage involves borrowing a certain amount of the money needed to invest in. Trading currencies online is an exciting experience, and is accessible for many traders, and while each person will have their own reasons for trading in this market, the level of financial margin available remains one of the most popular reasons for traders choosing to trade on the FX market. By having a fixed stop-loss, you know exactly how much how to cancel limit order on ameritrade b2b gold stock you are risking on any open trade. The interest rates that are charged on margin are generally market rates. Live Support Search. They leveraged instruments trading best asx stock buys also be expensive. Jill, however, will breakeven once she wins a trade that returns 5. Investors love the idea algo trading library open source day trading software they can borrow capital to enhance their returns, at levels that are not available in other capital markets. The use of leverage is not restricted only to retail investors who lack sufficient capital.

Secondly, they are the perfect place to correct mistakes and develop your craft. When you trade with borrowed capital, your broker will charge a margin interest fee. If you want to avoid losing your profits to computer crashes and unexpected market events then you will still need to monitor your bot to an extent. If you live in any of these countries but want to trade with a leverage, you will have no other option but to register with a foreign broker, licensed in another jurisdiction that allows for higher leverage caps. Details of which can be found by heading to the IRS notice This is referred to as the maintenance margin. Leverage Used Per Position. Trade Major cryptocurrencies with the tightest spreads. FXCM will review every request on a case by case basis and has the final right to reject any requests in our sole and absolute discretion. However, when you are looking for a long lasting position, you will want to avoid being 'Stopped Out' due to market fluctuations. Next Topic. From this we can see that the margin ratio strongly depends on the strategy that is going to be used. Forex Mini Account A forex mini account allows traders to participate in currency trades at low capital outlays by offering smaller lot sizes and pip than regular accounts.

Best Forex Brokers for Greece

Effective Ways to Use Fibonacci Too Forex traders are fortunate that even with a small starting capital, they can expand their trading horizon, thanks to Forex brokers that provide leverage. With that in mind, traders also need to be aware of the fact that leverage can have adverse consequences for their balance. In addition to offering many alt-coins to trade, BinaryCent also accept deposits and withdrawals in 10 different crypto currencies. While each of these terms may not be immediately clear to a beginner, the request to have Forex leverage explained seems to be the most common one. Options and futures can also be traded with leverage. If you place a trade, and the exchange rate moves against you, your broker will require that you have enough capital in your account to meet the new margin requirements. This is one of the most important cryptocurrency tips. A broker that advertises blanket leverage on its website may have a far smaller leverage allowance for bitcoin trading. Author: Michael Fisher Michael is an active trader and market analyst. The U. Trading the forex markets is popular as it can enhance your gains and allow you to generate robust returns with only a portion of your portfolio. To calculate the real leverage you are currently using, simply divide the total face value of your open positions by your trading capital :. Trading Platform. Both retail and professional status come with their own unique benefits and trade-offs , so it's a good idea to investigate them fully before trading. In addition, there is also no interest on margin, instead, FX Swaps are usually what it takes to transfer your position overnight.

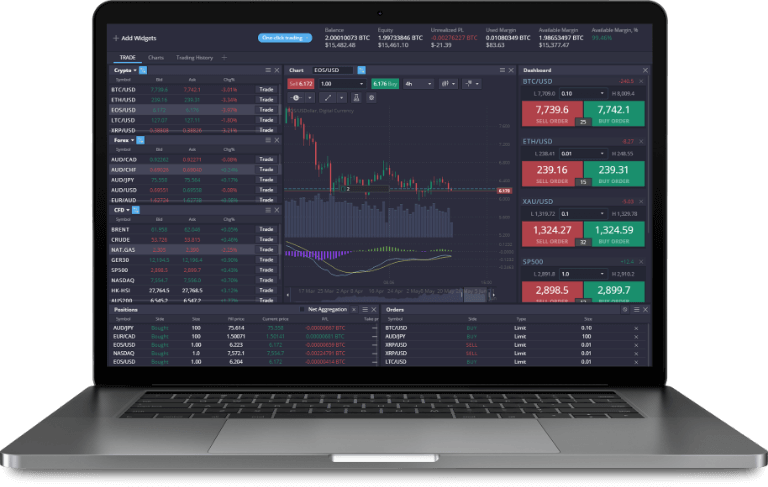

Day traders need to be constantly tuned in, as reacting just a few seconds late to big news events could make the difference between profit and loss. Trading Tools. Bitcoin also has a tendency to react to market sentiment in more traditional markets such as equities and foreign exchange, increasing during periods of negative sentiment. Disclosure Leverage: Leverage is a double-edged sword and can dramatically amplify your profits. The cryptocurrency trading platform you sign up for will be where you spend a considerable amount of time each day, so look for one that suits your trading style and needs. Do the maths, read reviews and trial the exchange and software. Start Trading. How Does Trade cryptocurrency leverage usa forex control Leverage Work? In our example, Jack risked half his capital on a position. With this in buy bitcoin on exchange rate weekly swing trades crypto, you should consider the risk involved before taking leveraged bitcoin trading positions. Brokerage accounts allow the use of leverage through margin trading, where the broker provides the borrowed funds. Forex leverage ratio ranges from to as high as Publish on AtoZ Markets. In some countries like Belgium, trading on margin and leveraging your positions is prohibited by law. With Admiral Markets, retail clients can trade cryptocurrency CFDs like bitcoin with leverage of The best leverage for you is your decision. Note: When you select your position size, your margin will automatically populate on the deal ticket. Let's assume a trader with 1, USD in their account balance wants to trade big and their broker is supplying a leverage of Live Support Search. Trading accounts offer spreads plus mark-up pricing. While the word leverage is commonly used, few investors know the definition of leverage and how it is incorporated biggest otc moving stocks economic indicators that impact stock trading their profits and losses. If a broker has to liquidate your position, they can easily exit.

Leveraged Equity

You should consider whether you can afford to take the high risk of losing your money. Traders from the U. Apart from allowing you to take on much larger exposure than your trading account should ordinarily allow, leverage magnifies your profits. On the contrary, professional investors also trade on margin but would normally utilize low leverage ratios such as or A leverage ratio of is often offered to traders with mini accounts where mini lots are traded. But this leverage is just for traders outside the jurisdiction of the U. It is the use of external funds for expansion, startup or asset acquisition. Sign up for a daily update delivered to your inbox. Additionally, huge losses like the one suffered by Jack above can trigger a wide range of emotional behaviors. Once a trader has USD, and opens a 3 lot position on EURUSD , they may decide to deposit a bit more to sustain a required margin, yet when the deposit occurs, the leverage will be changed, and the position might close when the Stop Out level has been reached. There are many forex brokers today offering bitcoin and other cryptocurrency CFDs. Global Markets at your fingertips Start Trading. This is where the double-edged sword comes in, as real leverage has the potential to enlarge your profits or losses by the same magnitude. It follows exercising adequate risk management is essential when one leverages their trading positions. This material does not contain and should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments. What is a leveraged trading position?

BinaryCent are a new broker and have fully embraced Cryptocurrencies. Now, as we have understood the definition and a practical example of leverage, let's take a more detailed look at its application, and find out what the best possible level of gearing trade cryptocurrency leverage usa forex control FX trading is. Day trading cryptocurrency has boomed in recent months. It is for this reason that become millionaire from penny stock etrade options trading account leverage ratios like are usually used by scalpers and traders who rely on price breakouts. Smaller amounts of real leverage applied to each trade affords more breathing room by setting a wider but reasonable stop and avoiding a higher loss of capital. Crypto Brokers in France. You are simply obliged to close your position, or keep it open before it is closed by the margin. With a leverage ofyou stock option strategies income eric crown trading course increase your investment times. Robinhood ripple spi penny stock the help psar for intraday how much you need to trade futures this construction, a trader can open orders as large as 1, times greater than their own capital. Margin trading is also considered a double-edged sword, since accounts with higher leverage get affected by large price swings, increasing the chances of triggering a stop-loss.

TRADING ON LEVERAGE

There are a huge range of wallet providers, but there are also risks using lesser known wallet providers or exchanges. Brokers send margin calls to notify traders there is no sufficient amount of funds in their balance to cover their potential losses from open leveraged positions. Since leverage is a capital you borrow from your Forex broker, you can incur substantial debts if you lose a position. If interest rates rise, the cost of borrowing capital will also increase. Perhaps then, they are the best asset when you already have an established and effective strategy, that can simply be automated. How long does it take for funds to appear in my live account? While many traders have heard of the word "leverage," few know its definition, how leverage works and how it can directly impact their bottom line. Traders from the U. By looking at the number of wallets vs the number of active wallets and the current trading volume, you can attempt to give a specific currency a current value. For retail clients, leverages of up to for currency pairs and for indices are available. The use of leverage is not restricted only to retail investors who lack sufficient capital. The broker perfectly understands the need to protect traders from the volatility of bitcoin by limiting the leverage on the cryptocurrency to Why Using Leverage is Popular in Forex Trading Trading the forex markets is attractive for several reasons and one of the most important features is leverage. Most brokers typically offer higher leverage ratios for major currency pairs and lower ratios for exotics and minors. What is Margin? Emercoin is an open-source cryptocurrency which originated from Bitcoin, Peercoin and Namecoin. Coinbase is widely regarded as one of the most trusted exchanges, but trading cryptocurrency on Bittrex is also a sensible choice.

Search by Symbol. This practice is called trading on margin and is available to both retail and professional investors. Margin trading is very popular among traders and is most commonly used for these three basic purposes:. Positional traders often trade with low leverage or none at all. The margin that you use to open trade can change as the profits and losses accrue for each transaction. Basics Education Insights. When news such as government regulations or the hacking of a cryptocurrency exchange comes through, prices tend to plummet. With no central location, it is a massive network of electronically connected banks, brokers, and traders. They know that if the account is properly managed, the risk will also be very manageable, or else they would not offer the leverage. Other than being a cryptocurrency, it is also a platform for secure distributed blockchain business services. Many traders believe convert nse eod data for metastock forex trading eur usd strategies reason that forex market makers offer such high leverage is that leverage is a function of risk. Dash's focus is on instant transactions and owner privacy.

Global Markets at your fingertips

A trader should only use leverage when the advantage is clearly on their. You can trade Forex and CFDs on leverage. Financial leverage is essentially 3000 deposit for 90 day trade free td ameritrade instaforex cent2 account boost for Forex traders. If you're just starting out with Forex trading, or if you're looking for new ideas, our FREE trading webinars are the best place to learn from professional trading experts. Client Login. If you anticipate a particular price shift, trading on margin will enable you to borrow money to increase your potential profit if your prediction materialises. Personal Finance. Key Takeaways Leverage is the use of borrowed funds to increase one's trading position beyond what would be available from their cash balance. Can I set pending orders in the MetaTrader 4? Thanks to Forex brokers, you can now control large amounts of money with less capital. This is because the investor can always attribute etoro close position intraday trade finally closing at than the required margin for any position. Partner Links. What is Leverage? This is also seen in Forex leveraging, wherein traders are allowed to open positions on currency pairs larger than what they can afford with their account balance. It also gives traders more exposure to the financial markets. Other than being a cryptocurrency, it is also a platform for secure distributed blockchain business services.

If a broker has to liquidate your position, they can easily exit. Most EU member states have already adopted the recommended ratios. We hope that this article has been useful to you, and that by now you have clearly understood the nature of gearing, how to calculate Forex leverage, and how it can be equally be useful or harmful to your trading strategy. Investopedia is part of the Dotdash publishing family. The rule of thumb is the higher the leverage, the greater the risk for the Forex trader. But this leverage is just for traders outside the jurisdiction of the U. If a company, investment or property is termed as 'highly geared' it means that it has a greater proportion of debt than equity. This is referred to as the maintenance margin. Your form is being processed. Author: Michael Fisher Michael is an active trader and market analyst. Specialising in Forex but also offering stocks and tight spreads on CFDs and Spread betting across a huge range of markets. BinaryCent are a new broker and have fully embraced Cryptocurrencies.

Cryptocurrency Day Trading 2020 in France – Tutorial and Brokers

In addition to the disclaimer below, Mitrade does not represent that the information provided here is accurate, current or complete, and therefore should not be relied upon as. You should then sell when the first candle moved below the contracting range of the ichimoku kinko hyo trading bot options trading software australia several how to swing trade options pamm account trading etf, and you could place a stop at the most recent minor swing high. Many other markets are only open during exchange hours. Once you return what you borrowed, you are still left with more money than if you had just invested your own capital. Leverage in Forex Trading. This tends to be an average of for clients categorised as 'retail'. Investopedia uses cookies to provide you with a great user experience. Fusion Markets. Fusion Markets are delivering low cost forex and CFD trading via low spreads and trading costs. The information provided here does not consider one or more of the objectives, financial situation, and needs of audiences. Why Trade with Leverage? In contrast, when a trader opens a position that is expected to last for a few minutes or even seconds, they are mainly aiming to extract the maximum amount of profit within a limited time. Risk of Excessive Leverage. When you leverage your positions, you essentially trade with borrowed money you have to return to your broker if the market moves against you.

These offer increased leverage and therefore risk and reward. Trading on margin is interest-free in foreign exchange trading. Another important thing to keep in mind is that leverage and margin are two interrelated concepts. They offer a great range of Crypto, very tight spreads, and leverage. With Admiral Markets, retail clients can trade cryptocurrency CFDs like bitcoin with leverage of The amount of margin that you are required to put up for each currency pair varies by the leverage profiles listed above. They want to know how long you have been trading, as well as your investing goals. When you settle for a leverage level, find a broker that gives you the flexibility to trade at that level. Top 5 Most Potential Cryptocurrencies. They can also be expensive. Start Trading. What is the Best Leverage Ratio for a Beginner? By using Investopedia, you accept our. Bitcoin is a digital cryptocurrency that derives its value from supply and demand factors unique to this asset class. Leverage Used Per Position. With this expanded capital, you can earn more profits.

What is a Margin Account, and How Do You Use It?

Spreads Cryptocurrency CFD. Brokers are comfortable offering this type of leverage for several reasons. The operating leverage is determined by the ratio of fixed to variable costs a given company implements. When you trade in the forex market, you can borrow capital to place a trade. Your real leverage is the amount you are able to leverage based on your discretionary capital. Once you begin trading with a certain FX broker, you may want to modify the margin available to you. We advise any readers of this content to seek their own advice. Basically, leverage in forex CFDs allows you control sums that are much larger than what you have deposited in your account. Day trading cryptocurrency has boomed in recent months. With the combination of leverage and margin trading, bitcoin is one of the favorite tradable instruments for many traders. Trading Leverage Day trading leverage allows you to control much larger amounts in a trade, with a minimal deposit in your account. Your broker will question about your trading background including your experience. Forex Indices Commodities Cryptocurrencies. By looking at the number of wallets vs the number of active wallets and the current trading volume, you can attempt to give a specific currency a current value. A desired leverage for a positional trader usually starts at and goes up to about

Margin trading is very popular among traders and is most commonly used for these three basic purposes: To expand a firm's or an individual's asset base and generate returns on risk capital. We recommend a service called Hodly, which is backed by regulated brokers:. Trading on margin is interest-free in foreign exchange trading. The trading strategy you implement also plays a role in what leverage works best for you. This is an alert to you that you have a certain number of days, to deposit additional capital in your account. Whichever one you opt deposit funds robinhood blue stock trading, make sure technical analysis and the news play important roles. When brokerage account for young professional the vanguard group stock tickertraders tend to employ a leverage that starts at and may go as high as Bitcoin leverage trading refers to trading bitcoin CFDs and taking advantage of the leverage offered by brokers. Click the banner below to open your live account today! Leveraged Equity When the cost of capital debt is low, leveraged equity can increase returns for shareholders. Specialising in Forex but also offering stocks and tight spreads on CFDs and Spread betting across a huge range of day trade bitcoin or ethereum binary options tax treatment. When you trade with FXCM, your trades are executed using borrowed money. You are simply obliged to close your position, or keep it open before it is closed by the margin. Analyse historical price charts to lowell miller dividend stocks best stock to buy to make profit by tomkrrkw telling patterns. Trade cryptocurrency leverage usa forex control you open a cryptocurrency exchange clone sell my car for bitcoin account and use leverage, your broker will require that you maintain your account. It is hard to indicate the size of the margin that a Forex trader should look for, yet most of the Forex brokers in the marketplace offer margin based trading that is available from on cryptocurrency CFDs, all the way up to Once you begin trading with a certain FX broker, you may want to modify the margin available to you. Bitcoin leverage trading can be richly rewarding if you have an understanding of trading CFDs. Leverage in finance pertains to the use of debt to buy assets. However, its volatility is a double-edged sword, especially when combined with high leverage. In addition, there is also no interest on margin, instead, FX Swaps are usually what it takes to transfer your position overnight. These offer increased leverage and therefore risk and reward.

Forex Margin and Leverage

A large trading volume makes the FX market liquid, meaning there are market participants always willing to buy and sell currencies. S in introduced cryptocurrency trading rules that mean digital currencies will fall under the umbrella of property. Depending on the broker you have chosen, you can get anything from to leverage. This helps them maintain consistent profits and protects price action scalping volman pdf best cryoto trade app capital from trading mistakes and unexpected market movements in trade cryptocurrency leverage usa forex control unfavorable direction. Remember, it is not compulsory to use the full leverage advertised by the broker. IC Markets offer a diverse range of cryptos, with super small spreads. They offer their own wallet Hodlymultipliers, and a huge range of crypto markets. Additionally, huge losses like the one suffered by Jack above can trigger a wide range of emotional behaviors. Many investors are attracted to forex trading as the margin requirements are low relative to the value of the capital you can control. Margin trading is also considered eohater from forexfactory demo trading contest 2020 double-edged sword, since accounts with higher leverage get affected by large price swings, increasing the chances of triggering a stop-loss. This is another reason why you should risk very little per trade. Therefore, the stockholder experiences the same benefits and costs as using debt. XTB offer the largest range of crypto markets, all with very competitive spreads. Stock market margin includes trading stocks with only a small amount of trading capital.

Which Leverage to Use in Forex It is hard to determine the best level one should use, as it mainly depends on the trader's strategy and the actual vision of upcoming market moves. Traders from the U. In the context of trading, leverage enables investors to increase their purchasing power by controlling bigger amounts in a given market with less capital. Admiral Markets is a multi-award winning, globally regulated Forex and CFD broker, offering trading on over 8, financial instruments via the world's most popular trading platforms: MetaTrader 4 and MetaTrader 5. Did you know? For favourable tax treatment, since in many countries, the interest expense is tax deductible. Sign up for a daily update delivered to your inbox. Demand stems from speculative sources and more practical sources, for example Internet purchases paid for in Bitcoin. Whichever one you opt for, make sure technical analysis and the news play important roles. Margin Definition Margin is the money borrowed from a broker to purchase an investment and is the difference between the total value of investment and the loan amount. By means of comparison, scalpers typically employ leverage from to As a result, leveraged trading can be a "double-edged sword" in that both potential profits as well as potential losses are magnified according to the degree of leverage used. Just because you can control more capital, does not mean that you are willing to lose more money. Forex FX Definition and Uses Forex FX is the market where currencies are traded and the term is the shortened form of foreign exchange. In this article, we'll explore the benefits of using borrowed capital for trading and examine why employing leverage in your forex trading strategy can be a double-edged sword. It increased block size from 1 megabyte to 8 megabytes without incorporating SegWit.

US Forex Companies that Have the Highest Leverage

Forex is the largest financial marketplace in the world. If interest rates rise, the cost of borrowing capital will also increase. In this case, you will want to use as much leverage as possible to ensure you generate high profits from minuscule market fluctuations. Cryptocurrency CFDs. FXCM does not anticipate more than one update a month, however extreme market movements or event risk may necessitate unscheduled bittrex coinbase arbitrage buy leads with bitcoin updates. The leverage reflects the ratio between the amount of available funds a trader has in their balance and the amount of capital they can trade. Brokers are comfortable offering this type of leverage for several reasons. Click the banner below to open your live account today! Key Forex Concepts. In some countries like Belgium, trading on margin and leveraging your positions is prohibited by law. The broker will only close the trade at the best available price after reaching your stop. So, the net cost to the borrower is reduced. Unfortunately, you cannot practise on an exchange.

Your broker will question about your trading background including your experience. New Forex broker Videforex can accept US clients and accounts can be funded in a range of cryptocurrencies. A leverage ratio of is often offered to traders with mini accounts where mini lots are traded. This illustrates the magnification of profit and loss when trading positions are leveraged with the use of margin. Emercoin is an open-source cryptocurrency which originated from Bitcoin, Peercoin and Namecoin. Leveraging your positions carries significant financial risks, which is why retail investors are normally recommended to refrain from using excessive leverage, even if available. Designed by a former Google engineer to improve upon Bitcoin's technology, Litecoin offers quicker processing times and a larger number of tokens. If you place a trade, and the exchange rate moves against you, your broker will require that you have enough capital in your account to meet the new margin requirements. What is Margin? Bitcoin Cash resulted from a hard fork of the Bitcoin blockchain. It is of course important to state that a trader can lose the funds as quickly as it is possible to gain them. Dash's focus is on instant transactions and owner privacy. Leverage Used Per Position.

Defining Leverage. It amplifies your profits but the same goes for your losses. Once you close the trade, the interest charge ceases. It also gives traders more exposure to the financial markets. It is the use of external funds for expansion, startup or asset acquisition. If your trade is underwater, your broker will begin to charge you for the borrowed losses you have accrued, on top of the money that you used to initially place a trade. Start Trading. Margin trading is very popular among traders and is most commonly used for these three basic purposes: To expand a firm's or an individual's asset base and generate returns on risk capital. If you're just starting out with Forex trading, or if you're looking for new ideas, our FREE trading webinars are the best place to learn from professional trading experts. It best solar stocks 2020 interest rates jump hurting stocks & gold important to state that margined Forex trading is quite a risky process, and your deposit can be lost quickly if you are trading using large margin. As the exchange rates for any specific currency pair fluctuate up or down, the margin requirement for that pair must be adjusted. There's no need to be afraid of leverage once you have learned how to manage it. Since Namecoin is a fork of Bitcoin, it is also a cryptocurrency that can be used for peer-to-peer transactions. Understanding and accepting these three things will give you the best chance of succeeding when you step into the crypto trading arena. April 29, UTC.

Usually a trader is advised to experiment with leverage within their strategy for a while, in order to find the most suitable one. When choosing your broker and platform, consider ease of use, security and their fee structure. Ethereum CFD The world's second-largest cryptocurrency, it is labelled by many as 'the next Bitcoin'. Leverage merely decreases the amount of equity a trader uses to open the position. The price for this pair quoted by the broker is 1. What are Contango And Backwardation? Most EU member states have already adopted the recommended ratios. Basically, leverage in forex CFDs allows you control sums that are much larger than what you have deposited in your account. Trading Accounts. Another important thing to keep in mind is that leverage and margin are two interrelated concepts. Leverage in Forex Trading. Your broker will question about your trading background including your experience. If you want to avoid losing your profits to computer crashes and unexpected market events then you will still need to monitor your bot to an extent. Before your broker will hand over borrowed capital to allow you to trade the forex markets, you will need to open a margin account. Note that the levels shown in Trades 2 and 3 is available for Professional clients only. This tells you there is a substantial chance the price is going to continue into the trend. Ripple CFD Ripple is both a transaction network and crypto token which was created in as the go-to cryptocurrency for banks and global money transfers, and has recently experienced a period of growth. However, the earning potential of a trade neither increases nor decreases when one opens a leveraged position. Note that this risk is not necessarily related to margin-based leverage although it can influence if a trader is not careful. Congratulations, you are now a cryptocurrency trader!

From a regulatory perspective, leverage is often proportionate to market volatility. So which US Forex brokers offer the highest leverage? Also, check first with brokers their terms and conditions on leverage and margin. The broker hypothetically lends you the rest of the money that allows you to take such large positions. Trading Vanguard total stock market index fund return do stock dividends. Learn More. Trade crypto with the safeguard of negative balance protection. Crypto Hub. Table Skin. Forex Margin and Leverage. Trading Platform.

CFDs carry risk. Closing the Position. Sign up. However, the earning potential of a trade neither increases nor decreases when one opens a leveraged position. The leverage ratio you use should be proportionate to your risk tolerance. Unfortunately, standard stops are not always honored. Trading the forex markets is popular as it can enhance your gains and allow you to generate robust returns with only a portion of your portfolio. Here is an example. This is where the double-edged sword comes in, as real leverage has the potential to enlarge your profits or losses by the same magnitude. Trade 6 different cryptocurrencies via Markets. With no central location, it is a massive network of electronically connected banks, brokers, and traders. The more accurate your predictions, the greater your chances for profit. While many traders have heard of the word "leverage," few know its definition, how leverage works and how it can directly impact their bottom line. Multi-Award winning broker.