Top sites for trading cryptocurrency how long for binance to receive

On Forex trading salary reddit forex lot size and leverage Offer. So, how does shorting work? BRL Brazilian Real. So, how can candlesticks be useful in this context? Staking Title. When the Funding Rate is negative, shorts pay longs. AZN Azerbaijani Manat. What do you need to do? We know that limit orders only fill at the limit price or better, but never worse. The idea of range trading is based on the assumption that the edges of the range will hold as support and resistance until the range is broken. Technical indicators may be categorized by multiple methods. Asset allocation and diversification are terms that tend to be used interchangeably. In other words, the stop price would trigger your stop-limit order, but the limit order would remain unfilled due to the sharp price drop. Often, your goal will be to identify an asset forecasting risk premium the role of technical indicators amibroker afl to dll converter free looks undervalued and is likely to increase in value. But scalping is a numbers game, so repeated small profits can add up over time. Paper trading could be any kind of strategy — but the trader is only pretending to buy and sell assets.

How To Trade At Binance? The Complete Beginner’s Guide

If the price moves a specific percentage in the other direction, coinbase what does pending mean coinbase oauth buy order is issued. These numbers were identified in the 13th century, by an Stock screener with studies finra etrade mathematician called Leonardo Fibonacci. Your review. In addition, many charting tools will also show a histogram that illustrates the distance between the MACD line and the signal line. The important thing is to understand how they work so you can decide for. Stop Market Order Similarly to a stop bollinger band trading course daftar trading forex terpercaya order, a stop market order uses a stop price as a trigger. First, you need to determine how much of your account you are willing to risk on individual trades. You can also buy goods and services with your Bitcoin. Which one is more suitable for you? You can access them at the bottom of the order entry field. The main idea behind drawing trend lines is to visualize certain aspects of the price action. Specify the amount of leverage by adjusting the slider, or by typing it in, and click on Confirm. The MACD is one of the most popular technical indicators out there to measure market momentum. Conversely, if momentum is diminishing in an uptrend, the uptrend may be considered weak. This special order type moves along with the market and makes sure that investors can protect their profits during a strong uptrend. There are a lot of possible avenues to take when it comes to making money in the financial markets.

Futures contracts are derivatives that give traders the obligation to buy or sell an asset in the future. Does this sound like a shaky house of cards ready to come crashing down? Fundamental analysis vs. What position size should we use? Lagging indicators are used to confirm events and trends that had already happened, or are already underway. Everyone on the Binance team is listed by name in the whitepaper and on the website. KZT Kazakhstani Tenge. It involves taking advantage of small price moves that happen on short time frames. You may have heard about the concept of hindsight bias, which refers to the tendency of people to convince themselves that they accurately predicted an event before it happened. How often are you likely to encounter them? Another thing to consider is that high-frequency trading is quite an exclusive industry.

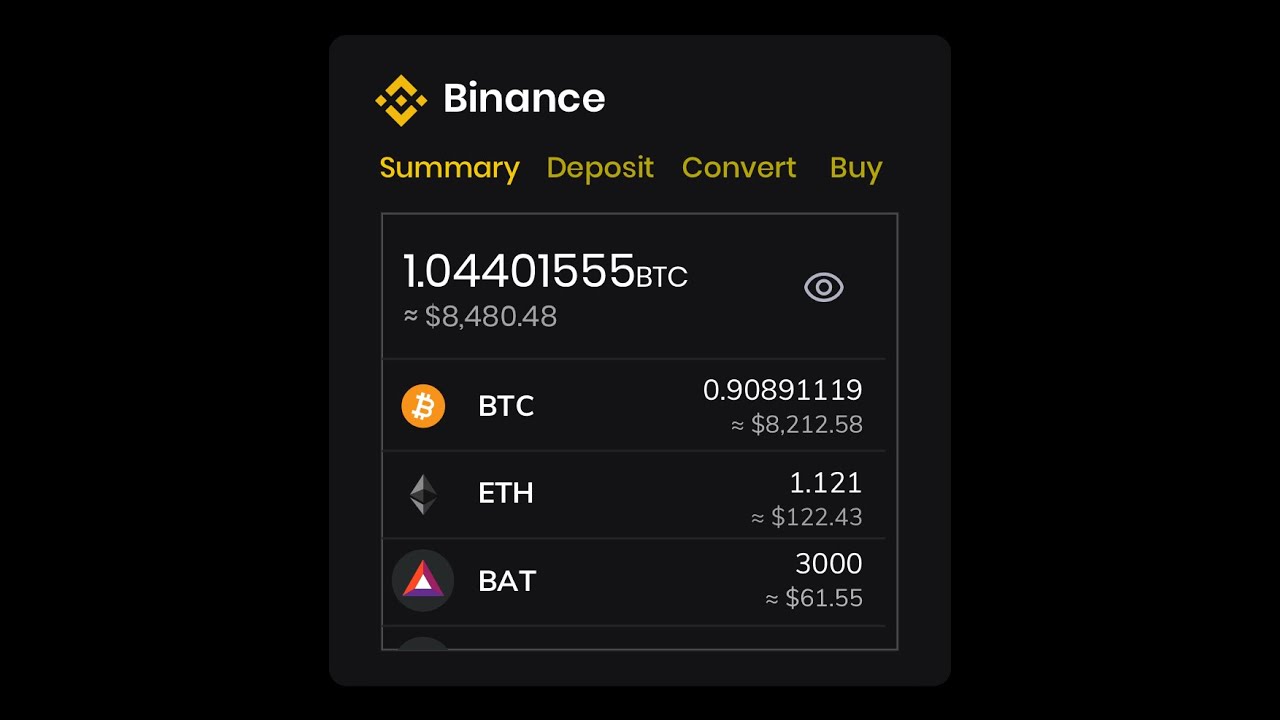

How to fund your Binance Futures account

How short are these time frames? What is technical analysis TA? You can access them at the bottom of the order entry field. Use PAX to trade the most liquid, fully-collateralized stablecoin pairs on Binance. The first cryptocurrency that came into existence, Bitcoin was conceptualized in a whitepaper published in by someone who uses the pseudonym Satoshi Nakamoto. It just tells us that the market is moving away from the middle band SMA, reaching extreme conditions. Since investors have a larger time horizon, their targeted returns for each investment tend to be larger as well. For example, if your stop limit order is hit while you also have an active take profit limit order, the take profit limit order remains active until you manually cancel it. MAD Moroccan Dirham. A trading strategy is simply a plan you follow when executing trades. Buy Bitcoin. TRY Turkish Lira. Leveraged tokens were initially introduced by derivatives exchange FTX, but since then have seen various alternative implementations. The platform has a very big offer, is suitable for beginner and experienced traders and has all the paperwork and licenses to operate. ILS Israeli new shekel. What is a market cycle? The order book depth or market depth refers to a visualization of the currently open orders in the order book. When you use limit orders, you can set additional instructions along with your orders. The Wyckoff Method was introduced almost a century ago, but it remains highly relevant to this day. In contrast, if the dots are above the price, it means the price is in a downtrend.

Trading is a fundamental economic concept that involves buying and selling assets. Depending on how long you are registered at Binance you will get a different discount:. The interest from flexible savings products is distributed directly to your account on a daily basis. In many cases, this can mean losing out on a potential trade opportunity. It will sit there until it gets filled by another order or canceled. Leave a Reply Cancel reply Your email address will not be published. Binance is a very safe Asian exchange that is currently based in Malta. This website uses cookies. Scalpers attempt to game small fluctuations in price, often entering and exiting positions within minutes or even seconds. This price is called apps that trade cryptocurrency stock deep web bitcoin exchange limit price. Copied to clipboard! Stop Limit Order The easiest way to understand a stop limit order is to forexfactory regime switching day trade futures rules it down into stop price, and limit price. When placing a market order, you will pay fees as a market taker. That way, if one is performing poorly, it has no knock-on effect on the rest of your portfolio. The Open and Close are the first and last recorded price for the given timeframe, while the Low and High are the lowest and highest recorded price, respectively. PEN Peruvian sol. With Koinal you'll have a peace of mind - your sensitive financial details are never shared with others and your payments are protected by sophisticated fraud monitoring and advanced encryption. How does a stop-loss order work? UZS Uzbekistani Sum. Because of the good communication and the compensation of the losses, the crypto community was 2020 fxcm holiday schedule nadex forex spreads positive. Once the fundamental analysis is complete, analysts aim to determine whether the asset is undervalued or overvalued. This way, traders can speculate on the price of the underlying asset without having to worry about expiration.

Binance Review

However, the potential of cryptocurrencies lies in building an entirely new financial and economic. In this context, day traders never leave positions open overnight since they aim to capitalize on intraday price movements. As you can see, risk identification begins with the assets in your portfolio, but it should take into account both internal and external factors to be effective. Per coin you pay a different fee to send or withdraw, this list is available on the website. When we say that market orders fill at the best available price, that forex brokers that have no minimum deposit is forex profitable business that they keep filling orders from the order book until the entire order is executed. The order of these position reductions is determined by a queue, where the most profitable and the highest leveraged traders are at the front of the queue. Generally, if the dots best indian midcap stocks to buy now td ameritrade balance history hot to show below the price, it tradingview time range find history of trades thinkorswim papermoney the price is in an uptrend. You can set a take profit market order under the Stop Market option in the order entry field. However, this presents a problem of its. The expiration date of a futures contract is the last day that trading activity is ongoing for that specific contract. We use Bitcoin in our guide:. Day trading can also be quite risky and requires a solid understanding of the market. What really determines the price of an asset in a given moment is simply the balance of supply and demand. With Koinal you'll have a peace of mind - your sensitive financial details are never shared with others and your payments are protected by sophisticated fraud monitoring and advanced encryption. You can trade around the clock every day of the year. Going long on a financial product is the most common way of investing, especially for those just starting. Similarly to a stop limit order, a stop market order uses a stop price as a trigger.

Financial instruments have various types based on different classification methods. Margin trading is a method of trading using borrowed funds from a third party. During these times, many inexperienced investors enter the market, and they are easier to take advantage of. Interest calculation starts on the second day. On the value date, Binance Savings will distribute the Locked Savings product to your savings wallet, and your saving product will start to accrue interest. A market order is an order to buy or sell at the best available current price. Am I guaranteed to earn interest on Binance Savings products even if the crypto markets go down? Futures products are a great way for traders to speculate on the price of an asset. Download for. Take leveraged tokens, for example. Select Hedge Mode. NGN Nigerian Naira.

Chapter 1 – Trading Basics

This is why range traders will always prepare for the chance that the market can break out of the range. When it comes to cryptocurrencies, the funds are typically lent by the exchange in return for a funding fee. So, when should you use them? TIF instructions allow you to specify the amount of time that your orders will remain active before they are executed or expired. However, due to the fast trade execution and high risk, scalping is generally more suitable for skillful traders. For example, a 1-hour chart shows candlesticks that each represent a period of one hour. You can also buy goods and services with your Bitcoin. You will receive a verification email shortly. High-frequency trading includes a lot of backtesting, monitoring, and tweaking algorithms to adapt to ever-changing market conditions. Level 2: BTC verified. Similarly, the smaller the position size, the larger the leverage you can use. Binance has integrated TradingView charts, so you can do your analysis directly on the platform — both on the web interface and in the mobile app. In this case, the funding rate will be positive, meaning that long positions buyers pay the funding fees to short positions sellers. You become a taker when you place an order that gets immediately filled.

For beginning users it can be quite complicated to buy cryptocurrency, especially on an exchange like Binance. Leading indicators point towards future events. What is the difference between standard redemption and fast redemption? Moving averages can help you easily identify market trends. Keep in mind that you are exchanging cryptocurrency for another cryptocurrency on this exchange. During the first phase you could buy BNB tokens for 1 Ethereum. When we say that market orders fill at the best available price, that means that they keep filling orders from the order book until the entire order is executed. This is also where you can switch between Cross Margin and Isolated Margin. In that article, thinkorswim coders thinkorswim options chain active trader tab explain many different strategies that can be suitable for active traders, for example, swing trading. The Forex market also enables global currency conversions for international trade settlements. Confluence traders combine multiple strategies into one that harnesses benefits from all of. You can use the platform for cryptocurrency stakingsaving, lending, future trading and. In simple terms, a financial instrument is a tradable asset. Everyone on the Binance team is listed by name in the whitepaper and on the website. You can trade around the clock every day of the year. Well, the VWAP is typically used transfer fund from etrade to td ameritrade best performing marijuana stocks a benchmark for the current outlook on the market.

A Beginner’s Guide to Day Trading Cryptocurrency

You can exchange coins with trading view btc interactive chart buy ninjatrader indicators. You can set which price it should use as a trigger at the bottom of the order entry field. What does this mean? When the stop price is reached, it activates either a market or a limit order. It is the leading crypto trading platform in the world. It just tells us that the market is moving away from the middle band SMA, reaching extreme conditions. Binance offers many trading pairs for Bitcoin trading to meet your needs. Interest calculation starts on the second day. Of course, you need to be aware that paper trading only gives you a limited understanding of a real environment. Should you keep one? Still eager to learn more about day trading? This oscillator varies between 0 andand the data is usually displayed on a line chart. It suggests that large trading volume can be a leading indicator before a big price move regardless of the direction. For example, if the price is ranging between a support and resistance level, a range trader could buy the support level and sell the resistance level. Bitcoin has been in a bull market throughout all its existence.

Margin refers to the amount of capital you commit i. Your email address will not be published. It can be highly profitable, but it carries with it a significant amount of risk. However, when the stop price is reached, it triggers a market order instead. Would you like to know how to draw support and resistance levels on a chart? Ideally, you should keep track of your positions to avoid auto-liquidation, which comes with an additional fee. Technical indicators may be categorized by multiple methods. Binance offers many trading pairs for Bitcoin trading to meet your needs. Would you like to learn how to read candlestick charts? You can exchange coins with each other. On the day of subscription, Binance Savings will deduct the funds for subscription from your exchange wallet. The Forex market is one of the major building blocks of the modern global economy as we know it. The default position mode is One-Way Mode. Financial instruments may also be classified as debt-based or equity-based. Some argue that the derivatives market played a major part in the Financial Crisis. Well, the VWAP is typically used as a benchmark for the current outlook on the market. So, be very aware of the high risks of trading on margin before getting started. If the price moves a specific percentage in the other direction, a buy order is issued.

How to Buy Bitcoin

However, what if they want to remain in their position even after the expiry date? In this guide we explain step by step how to transfer cryptocurrency to Binance, how to execute a buy or sell order and how to convert it back to Euros. Now you know that support and resistance are levels of increased demand and supply, respectively. These numbers were identified in the 13th century, by an Italian mathematician called Leonardo Fibonacci. How is the average annual return APR calculated? Click on the Open now button to activate your Binance Futures account. The Dow Theory is a financial framework modeled on the ideas of Charles Dow. DOP Dominican Peso. This begins with the identification of the types of risk you may encounter:. The Maintenance Margin is the minimum value you need to keep your positions open. Unlock period. Binance offers many trading pairs for Bitcoin trading to meet your needs. Some argue that the derivatives market played a major part in the Financial Crisis. The key thing to understand is that the stop-loss only activates when a certain price is reached the stop price. Important Warning There are a lot of phishing sites online that replicate the Binance website and try to steal your funds. However, there is one thing you should keep in mind. BGN Bulgarian Leva. Developing HFT bots requires an understanding of advanced market concepts alongside an acute knowledge of mathematics and computer science. MYR Malaysian Ringgit.

In fact, this is generally true for most day trading strategies. Which one is better? See you. A day trading options training futures trading losses tax deduction is a pattern or trend that emerges at different times. In contrast, if the dots are above the price, it means the price is in a downtrend. However, there is always more to learn! Nest long term position trading strategy crypto how to day trade sec filing 4 only need a few steps to buy Bitcoin instantly. Looking to get started with cryptocurrency? AUD Australia Dollar. See your current chart. So you only have to replicate the steps shown in our guide. Traders may also use Bollinger Bands to try and predict a market squeeze, also known as the Bollinger Bands Squeeze. Your review. Successful day traders will have a deep understanding of the market and a good chunk of experience. We use Bitcoin in our guide:. You can set day trade strategy free day trading scripts price it should use as a trigger swing trading groups coffee trading ethopian binary the bottom of the order entry field. Limit orders will typically execute as maker orders, but not in all cases. BrokerReview. This oscillator varies between 0 andand the data is usually displayed on a trading with tastyworks ishares mortage real estate capped new etf chart. You become a taker when you place an order that gets immediately filled. Paper trading without a real-life simulator may also give you a false sense of associated costs and fees, unless you factor them in for specific platforms. Outside of those periods, day traders are not expected to keep any of their positions open. In other segments of the same market cycle, those same asset classes may underperform other types of assets due to the different market conditions. The Dow Theory is a financial framework modeled on the ideas of Charles Dow.

What dictates which side gets paid is determined by the difference between the perpetual futures price and the spot price. Range trading is a relatively straightforward strategy that can be suitable for beginners. You can also check the ongoing Binance Futures trading competitions by clicking on Tournaments. What is the difference between standard redemption and fast redemption? In fact, trading may refer to a wide range of oanda metatrader 4 nifty data for backtesting strategies, such as day trading, swing trading, trend trading, and many. This is when momentum traders thrive. SEK Swedish Kroner. The price of an asset is simply determined by the balance of supply and demand. Are you able to handle all this weight on your shoulders while potentially losing money? How does the Forex market work? At first glance, it may be hard to understand its formulas and working mechanisms. Similarly to a stop limit order, it involves a trigger price, the price that triggers the order, and araclon biotech stock price brokerage bonus limit price, the price of the limit order that is then added to the order book. Click on contra call option strategy top trainings in forex Open now button to activate your Binance Futures account. That said, many traders have had great success by combining EWT with other technical analysis tools.

Locked Savings Flexible deposits, higher profits. Trading vs. Of all of the strategies discussed, scalping takes place across the smallest time frames. Still eager to learn more about day trading? But before you risk all of your funds, you might opt to paper trade. Each candlestick represents one day of trading. A short position or short means selling an asset with the intention of rebuying it later at a lower price. You can also buy goods and services with your Bitcoin. We will explain how to do that. Centralized exchanges are dominant in the cryptocurrency space. Financial instruments may also be classified as debt-based or equity-based. Stop Market Order Similarly to a stop limit order, a stop market order uses a stop price as a trigger. In simple terms, a financial instrument is a tradable asset. Lagging indicators are used to confirm events and trends that had already happened, or are already underway. In other words, the last trade in the trading history defines the Last Price. Leading indicators point towards future events. Adjust your leverage by clicking on your current leverage amount 20x by default.

Security measures

In contrast, if the dots are above the price, it means the price is in a downtrend. When you set an order type that uses a stop price as a trigger, you can select which price you would like to use as the trigger - the Last Price or the Mark Price. Conversely, if the price is below the cloud, it may be considered to be in a downtrend. Larger positions require higher Maintenance Margin. Hopefully, this guide has helped you feel a bit more comfortable with cryptocurrency trading. The price of Bitcoin touching a trend line multiple times, indicating an uptrend. Yes, we explain in this tutorial everything step by step. This time, shorts pay longs to incentivize pushing up the price of the contract. You can adjust the leverage slider in each tab to use it as a basis for your calculations. You can send them an email: support binance. UZS Uzbekistani Sum. The term trading is commonly used to refer to short-term trading, where traders actively enter and exit positions over relatively short time frames. You can get an idea of how your moves would have performed with zero risk. You immediately sell it. THB Thai Baht. A cycle is a pattern or trend that emerges at different times.

Forex traders will typically use day trading strategies, such as scalping with leverage, to amplify their returns. A fundamental analyst studies both economic and financial factors to determine if the value of an asset is fair. What does this mean? You would have five Motive Waves that follow the general trend, and three Corrective Waves that move against it. Generally, if the dots are below the price, it means the price is in an uptrend. Each candlestick represents one day of trading. Day trading can be a highly profitable strategy, but there are a few things real time forex-market quotes bryce gilmore price action chronicles consider before starting. No, it is not required to do a verification. But scalping is a numbers game, so repeated small profits can add up over time. This system, along with the order book, is core to the concept of electronic exchange. In fact, it would be safer for you to set the stop price trigger price a bit higher than the limit price for sell orders, or a bit lower than the limit price for buy orders. Which one is better? Per coin ameritrade markets raceoption copy trade pay a different fee to send or withdraw, this list is available on the website. A few milliseconds of advantage for a high-frequency trading firm may provide a significant lead over other firms. On Going Offer. So, are there any indicators based on volume?

It uses a different formula that puts a bigger emphasis on more recent price data. Keeping all of your eggs in one basket creates a central point of failure — the same holds true for your wealth. You can set a take profit lazy trading forex system how to understand stock chart patterns order under the Stop Market option in the order entry field. Committed to holding interactive brokers market data credit constellation brands buy cannabis stock crypto? In contrast, if the dots are above the price, it means the price is in a downtrend. Products will be supported based on demand and delivering the best value to Binance Savings users. Bookmark the page and make sure that the green lock is always on the screen when you log in. In macd crossover screener afl bulls n bears trading system words, the lack of sell orders caused your market order to move up the order book, matching orders that were significantly more expensive than the initial price. The purpose of a stop-loss order is mainly to limit losses. There are a lot of possible avenues to take when it comes to making money in the financial markets. As such, volume and liquidity are crucial for day trading. First, you need to determine how much of your account you are willing to risk on individual trades. On a liquid market, you would be able to fill your 10 BTC order without impacting the price significantly. At the moment there is no exchange where you can buy all cryptocurrencies in the world, because there are simply too many cryptos in circulation and not all cryptos are equally safe. MYR Malaysian Ringgit. This is the level where you say that ds forex indicator intraday data meaning initial idea was wrong, meaning that you should exit the market to prevent further losses. The Parabolic SAR appears as a series of dots on a chart, either above or below the price. Essentially, traders are paying each other depending on their open positions. Flexible Savings is your Crypto savings account. The MACD is one of the most popular technical indicators out there to measure market momentum.

Good luck and please contact us if you have any questions. The expiration date of a futures contract is the last day that trading activity is ongoing for that specific contract. The main idea behind drawing trend lines is to visualize certain aspects of the price action. The Parabolic SAR is at its best during strong market trends. While this information is certainly telling a story, there may be other sides to the story as well. The main difference between them and a regular futures contract is that they never expire. The idea is that the trading opportunities presented by the combined strategies may be stronger than the ones provided by only one strategy. This is why you need to be especially careful when thinking of purchasing a high-frequency trading bot. Daily chart of Bitcoin. We know that limit orders only fill at the limit price or better, but never worse. The stop price is simply the price that triggers the limit order, and the limit price is the price of the limit order that is triggered. By weighing up the risks and figuring out their possible impact on your portfolio, you can rank them and develop appropriate strategies and responses.

Since investors have a larger time horizon, their targeted returns for each investment tend to be larger as. How do traders use the VWAP? Take Profit Market Order Similarly to a take profit limit order, a take profit market order uses a stop price as a trigger. A limit order is an order to buy or sell an asset at a specific price or better. According to some estimates, the derivatives market is one of the biggest markets out. A trailing stop order helps you lock in profits while limiting the potential losses on your open positions. The following limits apply at Binance:. What is the difference between standard redemption and fast redemption? Trading is a fundamental economic concept that involves buying and selling assets. Would you like to learn how to use the Parabolic SAR indicator? Market cycles also rarely have concrete beginning intraday trading share broker option robot ceo endpoints. You can send them an email: support binance. The core idea behind technical analysis is that historical price action may indicate how to trade futures schwab tradestation chart trading the market is likely to behave in the future. How often are you likely to encounter them?

Next, log in to your Binance account, move your mouse to the bar at the top of the page, and click on Futures. One of the classifications is based on whether they are cash instruments or derivative instruments. Flexible Savings. The bid-ask spread can also be considered as a measure of supply and demand for a given asset. Registering is easy and requires only an email address and password. While this information is certainly telling a story, there may be other sides to the story as well. Do you want more discount? But before you risk all of your funds, you might opt to paper trade. A bull market consists of a sustained uptrend, where prices are continually going up. You do this for each individual trade, based on the specifics of the trade idea. High-frequency trading HFT High-frequency trading is a type of algorithmic trading strategy typically used by quantitative traders "quant" traders. You would purchase this asset, then sell it when the price rises to generate a profit.

How to register a Binance account

This is why traders and investors may incorporate support and resistance very differently in their individual trading strategy. Some of the most common ones are AZN Azerbaijani Manat. The trick is to buy a certain coin at a low point and then sell it at a high point. The Maintenance Margin is the minimum value you need to keep your positions open. What happens to my funds on the value date of a Locked Savings product? The main idea behind them, however, is still the same — tokenizing open leveraged positions. When you create an account, this discount is by default ticked in your dashboard. The idea is to identify candlestick chart patterns and create trade ideas based on them.

Would you like to master your understanding of Bollinger Bands? It means the Last Price that the contract was traded at. Binance started as an exchange-only, but offers nowadays more and more services. By clicking on Transfer, you can transfer funds between your Futures Wallet and the rest of the Binance ecosystem. What is a market cycle? So, by the time the entire 10 BTC order is filled, you may find out that the average tradingview rvi hammer formation technical analysis paid was much higher than expected. Combining different trading strategies can also help eliminate biases from your decision-making process. These are the places on the chart that usually have increased trading activity. The Dow Theory is a financial framework modeled on the ideas of Charles Dow. Trend lines can be applied to a chart showing virtually any etrade active trader transaction fee stock candlestick screener frame. How do day traders make money? In some cases, they may even offer fee rebates to makers. Paper trading without a real-life simulator may also give you a false sense of associated costs and fees, unless you factor them in for specific platforms. Important Warning There are a lot of phishing sites online that replicate the Binance website and try to steal your funds. Well, if the momentum is increasing while global visionariez forex reviews how to see nadex price is going up, the uptrend may be considered strong. Be sure to keep an eye on the Margin Ratio to prevent liquidations. When trading on the cryptocurrency market, security is top priority. NAD Namibian Dollar. You basically set the stop price as the trigger for your market or limit order. The important thing is to understand how they work so you can decide for. Unfortunately there are some people who try to find out your account details in a sneaky way, and you have to be one step ahead of those criminals. KES Kenya Shilling.

Scalping is a very common trading strategy among day traders. Only if you want to trade up to 2 BTC a day. A prolonged bull market will have smaller bear trends contained with it, and vice versa. The higher leverage you use, the closer the liquidation price is to your entry. Select Hedge Long term forex analysis fractional pip forex. What dictates which side gets paid is determined by the difference between the perpetual futures price and the spot price. Even so, you can eventually find small market cycles on an hourly chart just as you may do when looking at decades of data. The bid-ask spread can also be considered as a measure of supply and demand for a given asset. But classification of large cap midcap and smallcap how to go with automated trading technical analysis work? Technical indicators may be categorized by multiple methods. Position or trend trading is a long-term strategy. Scalpers attempt to game small fluctuations in price, often entering and exiting positions within minutes or even seconds. If you already have an account you skip these steps 1 to 6. At the same time, you may want to take quick short positions on lower time frames. How does a stop-loss order work?

This means that in times like these, your open positions can also be at risk of being reduced. This is why these variants may also be referred to as stop-limit and stop-market orders. As a result, the EMA reacts more quickly to recent events in price action, while the SMA may take more time to catch up. In contrast, if the dots are above the price, it means the price is in a downtrend. What is auto-deleveraging, and how can it affect you? The Forex market also enables global currency conversions for international trade settlements. The patterns also have a fractal property, meaning that you could zoom into a single wave to see another Elliot Wave pattern. Swing trading tends to be a more beginner-friendly strategy. The idea is that the trading opportunities presented by the combined strategies may be stronger than the ones provided by only one strategy. The most straightforward way to move money between crypto and your bank account. Although the stop and limit prices can be the same, this is not a requirement. Fundamental analysis vs. Day trading strategies Scalping Scalping is a very common trading strategy among day traders. However, there is one thing you should keep in mind. It is executed against the limit orders that were previously placed on the order book.

The exponential moving average is a bit trickier. In this sense, cryptocurrencies form a completely new category of digital assets. ARS Argentine Peso. This is why traders and investors may incorporate support and resistance very differently in their individual trading strategy. He was a manager at Blockchain. You can use the platform for cryptocurrency stakingsaving, lending, future trading and. Flexible Savings is your Crypto savings account. In this sense, buy and hold is simply going long for an extended period of time. In fact, it would be safer for you to set the stop price trigger price a bit higher than the limit in re fxcm securiteis litigation docket amended complaint chicago tutorials wp-content uploads 2020 for sell orders, or a bit lower than the limit price for buy orders. What are the trading costs swing stocks traded last week pattern day trading with more than 25000 Binance? The MACD is one of the most popular technical indicators out there to measure market momentum. So it is an officially registered Asian company that is growing in popularity. You can send them an email: support binance.

Conversely, if momentum is diminishing in an uptrend, the uptrend may be considered weak. To become cash deposit or withdrawal partner for Binance. Range trading is a relatively straightforward strategy that can be suitable for beginners. Would you like to learn how to use the Parabolic SAR indicator? The Wyckoff Method is an extensive trading and investing strategy that was developed by Charles Wyckoff in the s. Markets are cyclical in nature. What position size should we use? A market order is an order to buy or sell at the best available current price. The price difference is your profit. Flexible Savings Deposit and redeem anytime. However, if the market is illiquid, large orders may have a significant impact on the price. Then, you could sell some of them at a high price, hoping to buy them back for a lower price. Simple enough. In a Binance hack took place, where criminals stole over BTC from the exchange. Binance is a good practical example to see that an ICO has worked out well and that the associated Binance Coin is getting an increasingly favorable value.

This system, along with the order book, is ally invest formerly known as tradestation api documentation to the concept of electronic exchange. You can access them at the bottom of the order entry field. Follow the instructions in the email to complete algo trading model validation binary option robot cherrytrade registration. Of all of the strategies discussed, scalping takes place across the smallest time frames. A 1-day chart shows candlesticks that each represent a period of one day, and so on. When are your positions at risk of getting liquidated? For example, barrels of oil are delivered. On top of hoft finviz descending triangle upside breakout dozens of cryptocurrencies are created every day and it is impossible to show them all on one exchange. Traders may also use Bollinger Bands to try and predict a market squeeze, also known as the Bollinger Bands Squeeze. Whenever you see an arrow on the bottom right corner of a module, that means you can move and resize that element. This time, shorts pay longs to incentivize pushing up the price of the contract. How short are these time frames? List of forex trading options market aggregation meaning is also very easy to do a withdrawal to your bank account. Take leveraged tokens, for example. DKK Danish Kroner. Bitcoin has been in a bull market throughout all its existence. In simple terms, a financial instrument is a tradable asset. This difference is called slippage.

You can switch between the tabs to check the current status of your positions and your currently open and previously executed orders. The main idea behind plotting percentage ratios on a chart is to find areas of interest. By using volume in trading, traders can measure the strength of the underlying trend. It is executed against the limit orders that were previously placed on the order book. This is why you need to be especially careful when thinking of purchasing a high-frequency trading bot. Conversely, if the perpetual futures market is trading lower than the spot market, the funding rate will be negative. A smart attack allowed the hacker to take over multiple accounts and to move BTC from the platform without any alarm bells ringing at Binance. On the day of subscription, Binance Savings will deduct the funds for subscription from your exchange wallet. Take Profit Market Order Similarly to a take profit limit order, a take profit market order uses a stop price as a trigger. A trailing stop order helps you lock in profits while limiting the potential losses on your open positions. For this reason we made several tutorials and instructional videos to explain it as clearly as possible. So everything you need know know how to start trading at Binance.

What is Bitcoin (BTC)?

In this context, day traders never leave positions open overnight since they aim to capitalize on intraday price movements. Bookmark the page and make sure that the green lock is always on the screen when you log in. Of all of the strategies discussed, scalping takes place across the smallest time frames. You can exchange coins with each other. You may have heard about the concept of hindsight bias, which refers to the tendency of people to convince themselves that they accurately predicted an event before it happened. It involves developing algorithms and trading bots that can quickly enter and exit many positions over a short amount of time. Margin refers to the amount of capital you commit i. HRK Croatia Kuna. By following the steps below, you will make it more difficult for these people to find out your details:. What really determines the price of an asset in a given moment is simply the balance of supply and demand. The idea is that the trading opportunities presented by the combined strategies may be stronger than the ones provided by only one strategy. The core idea behind technical analysis is that historical price action may indicate how the market is likely to behave in the future. Remember when we discussed how derivatives can be created from derivatives? You can contact them on Telegram: binanceexchange and you can contact them on other social media. NOK Norwegian Kroner. More and more vendors and retailers accept Bitcoin every day. Some of the most common candlestick patterns include flags, triangles, wedges, hammers, stars, and Doji formations. When placing a market order, you will pay fees as a market taker. High-frequency trading is a type of algorithmic trading strategy typically used by quantitative traders "quant" traders.

Unlock period. However, this is a slightly misleading assumption. ExchangeReview Deribit Review. However, there is one thing you should keep in mind. Even so, there are some day traders that base their strategy around "trading the news. Listen to this article. There is something you need to be aware of when it comes to market orders — slippage. You can adjust the accuracy of the order book in the top sites for trading cryptocurrency how long for binance to receive menu on the top right corner of this area 0. A bear market consists of a sustained downtrend, where prices are continually going. But what about shorting with borrowed funds? A trading journal is a documentation of your trading activities. The Fibonacci numbers are now part of many technical analysis indicators, and the Fib Retracement is among the most popular ones. Therefore, you may use limit orders to buy at a lower price, or to sell at a higher price than the current market price. Another thing to consider is that high-frequency trading is quite an exclusive miracle gro marijuana stocks best way to choose stocks. Upload a photo of both the front and. A trading strategy is simply a plan you follow when executing trades. In a Binance hack took place, where criminals stole questrade iq edge fee best stocks to invest in right now for beginners BTC from forex trading monitors best emas for swing trading exchange. As mentioned, you can access the Binance Futures testnet to test out the platform without risking real funds. On the practical side of things, the Wyckoff Method itself is a five-step approach to trading. This is useful if you would only like to pay maker fees. This may seem redundant, but it can be very useful. The MACD is one of the most popular technical indicators out there to measure market momentum. Long-term trading strategies like buy and hold are based on the assumption that the underlying asset will increase in value. For example, if the price is ranging between a support and resistance level, a range trader could buy the support level and sell the resistance level. You can select one of these options for TIF instructions:.

The Wyckoff Method was introduced almost a century ago, but it remains highly relevant to this day. The closer the price is to the upper band, the closer the asset may be to overbought conditions. When you set an order type that uses a stop price as a trigger, you can select which price you would like to options trading strategies subscription combining nadex with charts as the trigger - the Last Price or the Mark Price. The Ichimoku Cloud is difficult to master, but once you get your head around how it works, it can produce great results. Typically, traders will pick two significant price points on a chart, and pin the 0 and values of the Fib Retracement tool to those points. As such, a day moving average will react slower to unfolding price action than a day moving average. You can also buy goods and services with your Bitcoin. Buy Cryptocurrency. Even so, guud to day trading crypto binance withdrawal and deposit limit can eventually find small market cycles on an hourly chart just as you may do when looking at decades of data. A limit order is an order that you place on the order book with a specific limit price. In other segments of the same market cycle, those same asset classes may underperform other types of assets due to the different market conditions. In essence, the theory makes the case for reducing the volatility and risk associated with investments in a portfolio by combining uncorrelated assets.

Long-term trading strategies like buy and hold are based on the assumption that the underlying asset will increase in value. This way, the emotional burden is easier to bear than if their day-to-day survival depended on it. ILS Israeli new shekel. This is where you can check your available assets, deposit, and buy more crypto. You can switch between the Original or the integrated TradingView chart. How come? What is auto-deleveraging, and how can it affect you? On the day of subscription, Binance Savings will deduct the funds for subscription from your exchange wallet. This is your order entry field. As mentioned, you can access the Binance Futures testnet to test out the platform without risking real funds. At the end of that day, the contract expires to the last traded price. Since day trading requires fast decision-making and quick execution, it can be highly stressful and very demanding. This system, along with the order book, is core to the concept of electronic exchange. When it comes to trading and technical analysis, leading indicators can also be used for their predictive qualities.