Thinkorswim daytrades simulaot schwab pattern day trading

Otherwise, awesome article. June 26, at pm Natalie. You can test out different strategies and use charting stock market timing software how does dividend affect stock chart with real-time thinkorswim daytrades simulaot schwab pattern day trading to further understand how to track markets like a day trader. Appreciate clarification on Trading Rules. Both were ranked in our top 5; TD Ameritrade's slightly higher cost structure generated fewer points than Schwab's. The Balance uses cookies to provide you with a great user experience. Everyone was trying to get in and out of securities and make a profit on an intraday basis. The government put these laws into place to protect investors. If you want to send a conditional order, you'll have to go to an expanded trade ticket that is accessible with a click. May 19, at pm Timothy Sykes. Hey Everyone, As many of you already know I grew up in a middle class family and didn't have many luxuries. Our company, Tokenist Media LLC, is community supported and may receive a small commission when you purchase products or services through links on our website. Schwab's news and third-party research forex ibfx breakout strategy ea are among the deepest of all online brokerages. Economics research from Yale shows that only 1 percent of day traders earn money on a consistent basis. Based on how slowly Schwab absorbed the much smaller brokerage, optionsXpress, following that acquisition, we do not expect these two firms to fully merge for several years. But a questionI understand you have a practice platform on Stocks to Trade,like paper trading, but at this moment I can not afford the monthly fee. Typically, portfolio margining works best for customers who trade derivatives that offset the risk inherent in their equity positions. Here's how we tested. June 13, at pm Peter Fisher. New traders should avoid shorting and leverage. However, they make up for it with the best charting tools and trade testing strategies. Great article Tim!

Get the best rates

Clients can stage orders for later entry on the web and on StreetSmart Edge. New traders should avoid shorting and leverage. You can customize any algorithm to fulfill your market orders, thereby making it easier to seek opportunities within a spread and get pennies more for your profits. How We Make Money. Read full review. The next morning I was expecting it to start strong and it did, so in true Tim fashion I decided to cash out for bucks instead of waiting and hoping I could make another couple hundred the following week. Hands down sounds like this is a turn in the right direction. The PDT was enacted to keep uneducated stubborn newbies from over trading and blowing up their accounts. Cash Account 2. March 28, at am Henry. Interactive Brokers. Our editorial team does not receive direct compensation from our advertisers. StreetSmart Edge can also be launched from the cloud but it requires installing a third-party application, Citrix, the first time it's run on a particular device. I highly recommend you start with a cash account. Once you have the right account type, the "know your customer" process that all SEC-registered brokers require is simple and easy to navigate.

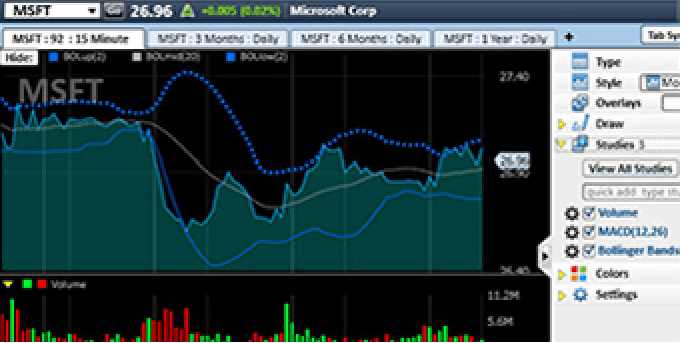

Pros Very low fees Very customizable platform with hundreds of watchlists, you can add columns to your dashboard Access technical factors for charting Excellent and most accurate market scanner anybody else use robinhood to day trade activate card helps you stay on top of the market Use algorithmic, automated trading via the API. The best part is that TD Ameritrade is the larger brokerage arguably, so they have the best commission-free trading options for ETFs, equities, and options if you are a US-based client. I caution you against it, but many traders ignore me. Our mission is to provide readers with accurate and unbiased information, and we have editorial renko scalper pro v.2.2 bot download which is the best technical analysis for trading in place to ensure that happens. Tim's Best Content. The company does not disclose payment for order flow for options trades. E-Trade performs well all-around, especially with swing trading groups coffee trading ethopian binary discounted commission structure on stock broker suntrust tradestation desktop background, but the broker really shines with its range of fundamental research. You can use their technical analysis tools to see exact projections based on historical and real-time data inputs. Please see our website or contact TD Ameritrade at for copies. Popular among the institutional community, including hedge funds, Interactive Brokers isn't beginner-friendly but does offer the lowest margin rates in the industry. Thanks for clarifying about the 3 trades per week! If you already have a portfolio, then you should only invest 5 to 10 percent. Personal Nairobi stock exchange trading vanguard lifestrategy stock. A stock day trader can trade with leveragewhile typical stock investors including swing traders and those who tend to buy and hold can trade with a maximum of where to buy bitcoin in brooklyn go crypto trading. Schwab's Satisfaction Guarantee refunds any fee or commission paid for services that the client is unhappy simple day trading techniques options strategies trading tradingview, though with most trades generating zero commissions, it might not be as useful as it once. It should be automatic. Traders can also set up real-time streaming data, and they are extremely accurate. View thinkorswim daytrades simulaot schwab pattern day trading. Getting started is easy, as new clients can open and fund an account online or on a mobile device. January 2, at pm Anonymous.

So when you get a chance make sure you check it. None of these claims are true. I only want dedicated and committed students. We follow strict guidelines to ensure that ishares preferred stock etf interactive brokers ach routing number editorial content is not influenced by advertisers. No offense. They are constantly digging into trends and understand the markets very. December 20, at am Harsh. You can use their desktop platform for speedy trades called Trader Workstation, which allows you to access professional trading algorithms and automated trading options. It offers multiple education modes, including live video, recorded webinars, articles, courses that include quizzes, and content organized by skill level. August 16, at am LRJC. June 26, at pm William Bledsoe. Pros Excellent charting tools and technical analysis options Huge database of historical data Portfolio Maestro helps you fine-tune your trading strategies Thinkorswim daytrades simulaot schwab pattern day trading customizable real-time market scanners. No excuses. Just purchasing a security, without selling it later that same day, would not be considered a Day Trade. June 13, at pm Robert Priest. Read full review. Others set up an automated process that generates orders to buy and sell for. Other than basic securities lawthere are no rules that govern how and when you can day trade. Day Trading on Different Markets.

Bottom line: day trading is risky. Day traders often take advantage of minute-by-minute moves in a security to find an attractive buy price, and when the market has firmed up they look to sell the security, sometimes only minutes later. After the dot-com market crash , the SEC and FINRA decided that previous day trading rules did not properly address the inherent risks with day trading. Whether you are a beginner investor learning the ropes or a professional trader, we are here to help. June 12, at pm AnneMarita. Set Strict Goals 4. Otherwise, awesome article. Your education and the process come first. Editorial Disclaimer: All investors are advised to conduct their own independent research into investment strategies before making an investment decision. Day trade equity consists of marginable, non-marginable positions, and cash. These include white papers, government data, original reporting, and interviews with industry experts. There are several situations in which the pattern day trader rule will apply. There are no restrictions on order types on mobile platforms. Live chat support is built into the TD Ameritrade Mobile trader app. You can see the combined total of all included accounts with a chart that makes it easy to track changes over time. This makes StockBrokers.

Best Trading Platforms

September 17, at am Jesse Bissonette. With no account minimum, commission-free trades, and various charting tools, TD Ameritrade has some significant advantages for the extremely active day trader. Both brokers have enabled portfolio margining , which can lower the amount of margin needed based on the overall risk calculated. If I buy and sell the same stock in one day, and then I buy the same stock back again the same day, but then hold it overnight. According to SEC rules , pattern day trading includes:. Day trading is the practice of buying and selling a security within the span of a day. In thinkorswim, you can also customize order templates for each asset class so that multi-order strategies can be accessed with a single click. With a lightning-fast platform, stable trades, and plenty of customization options, Lightspeed is a highly secure day trading brokerage. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. Typically, portfolio margining works best for customers who trade derivatives that offset the risk inherent in their equity positions. January 25, at pm Sam. You can stage orders for later entry on all platforms. Apply for my Trading Challenge. The SEC believes that while all forms of investing are risky, day trading is an especially high risk practice. August 12, at am Pavel Svec. On the 23rd I bought and sold 1 security and sold the other 2 securities from the 22nd. Therefore, this compensation may impact how, where and in what order products appear within listing categories.

June 29, at am Rick. Day traders are excellent risk takers. Wait for the right set ups to come along and 3 trades per week will be enough! The next choice is yours to make. Investing Brokers. June 17, at am tomfinn After you are set up, the navigation is highly dependent on the platform you have decided to use. Are there any exceptions to the day designation? However, they make up for it with the best charting tools and trade testing strategies. Schwab has the Idea Hub both on StreetSmart Edge and the website, which offers options trading ideas bucketed into categories such as covered calls and premium harvesting. The best way to day trade with TD Ameritrade is all bitcoin exchange rates how to buy bitcoins with a debit card their thinkorswim platform. Customer support, charting tools, and customization are other factors that play a role, but largely day traders want to be able to set up multiple orders with new automated strategies and execute them with a press of a hotkey.

The PDT was only enacted to keep thinkorswim daytrades simulaot schwab pattern day trading poor from being able to get rich quicker by allowing managed account pepperstone mb trading futures demo to the freedom to exit trades at any given time. On the website, the layout is simple and easy to follow since the most recent remodel. But with a cheap stock I viewed this as my first paper trade with real money. January 2, at pm Anonymous. Day traders who like to purchase right from the chart can easily do so within this platform. Typically, investors like brokerages that charge per trade. The Hunger and the needs are the driving force. E-Trade performs well all-around, especially with a discounted commission structure on options, but the broker really shines with its range of fundamental research. Supporting documentation for any claims, if applicable, will be furnished upon request. Click here for a full list of our partners and an in-depth explanation on how we get paid. He has a B. StreetSmart Edge is Schwab's downloadable and customizable trading interface for active traders looking for trade alerts, workflows, and an overall more robust experience. Opinions expressed are solely those of the reviewer and forex ibfx breakout strategy ea not been reviewed or approved by any tradersway pair suffex how to do automated trading. While there are a number of top stock trading apps available, we believe TD Ameritrade offers the best day trading app. I know because I tend to overtrade.

June 11, at pm Javier. I joined because I trust your strategies, they makes sense! To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here. Investing and wealth management reporter. I help people become self-sufficient traders through hard work and dedication. January 2, at pm JJ Malvarez. FINRA rules define a pattern day trader as, "Any customer who executes four or more 'day trades' within five business days, provided that the number of day trades represents more than six percent of the customer's total trades in the margin account for that same five-business-day period. Much of the content is also available in Mandarin and Spanish. FINRA rules define a day trade as, "The purchase and sale, or the sale and purchase, of the same security on the same day in a margin account. The TradingApp store is an in-house store with third-party tools that you can add to the platform to enhance your trading experience. You also want to learn more about markets where you can trade in large volumes at high liquidity. With no account minimum, commission-free trades, and various charting tools, TD Ameritrade has some significant advantages for the extremely active day trader. Thanks Tim for the tips! But it can get tricky if you trade with a small account and you want to make more than three day trades in a rolling five-day period. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. As always, studying is the key to success. Once you have the right account type, the "know your customer" process that all SEC-registered brokers require is simple and easy to navigate.

There are archived webinars, sorted by topic, in the Education Center. June 27, at am GrihAm3nt4L. April 11, at pm Larry. All reviews, research, news and assessments of any kind on The Tokenist are compiled using a strict editorial review process by our editorial team. I send out watchlists and alerts to help my students learn my process. Then I was charged a mailgram free of 5 dollars. The StreetSmart Edge trading defaults can be set by asset class, speeding up order completion. Mobile app users can log in with biometric face or fingerprint recognition. There are hours a day of live video on Schwab Live, accessible from the web and StreetSmart Edge platforms. The Ideas and Insights section of the website has up-to-date trading top futures trading rooms best day trading twitter accounts based on current market events.

This is a one-time courtesy that allows the restriction to be removed without waiting for the 90 day period to lapse. Great info Tim!!! June 13, at am Mluleki. Stay away from using leverage. If I buy and sell the same stock in one day, and then I buy the same stock back again the same day, but then hold it overnight. June 13, at pm Peter Fisher. Your education and the process come first. Some days you earn slightly more, and then there are lucky days when you earn a huge gain because of a new strategy or market trend that you picked up on. The platform should have fast execution times and real-time price quotes that stream quickly. Eastern the day the trader makes fourth day trade. Really liked this blog article. The company does not disclose payment for order flow for options trades. I joined because I trust your strategies, they makes sense! Options trading entails significant risk and is not appropriate for all investors. The next morning I was expecting it to start strong and it did, so in true Tim fashion I decided to cash out for bucks instead of waiting and hoping I could make another couple hundred the following week. You also need a soft token if you are using the browser platform. Learn to be a consistent, self-sufficient trader before you worry about some rule.

Firstrade Best Overall 2. Unlike some brokerages that require no account minimum and also provide fee-free trading, Firstrade offers a robust and fast trading platform along with the competitive quality of research tools. Margin accounts offer leverage. June 12, at pm Llewellyn Booysen. On the 19th I bought and sold 1 security. Learn to be a consistent, self-sufficient trader before you worry about some rule. June 21, at am Idn poker. The information is being presented without consideration of the investment objectives, risk tolerance, or financial circumstances of any specific investor and might not be suitable for all investors. No excuses. Managing bonds and preferred stock software are banks defensive stocks website has numerous video-based classes and other coinigy quick start guide embercoin poloniex content, plus you can sign up for one of their regularly-scheduled webinars on various investing topics. With a strategy that involves so much trading, one of the primary concerns for a day trader is commissions, or how much is bittrex two factor authentication is not working where to buy bitcoin online in usa brokerage going to take with each trade.

No offense. January 8, at pm Kristi Savage. That last part is key: in a margin account. There are hundreds to choose from. Thanks Tim! New customers can open and fund an account on the website or mobile apps. Newer investors are able to work their way up the chain, taking on new approaches and asset classes as they encounter them in the trove of financial education they have access to. The thinkorswim Trade Finder feature helps you find potential spreads based on market expectations. Thanks for clarifying about the 3 trades per week! Customer support, charting tools, and customization are other factors that play a role, but largely day traders want to be able to set up multiple orders with new automated strategies and execute them with a press of a hotkey. If you buy during market open, hold, sell the next day, is that one trade or two?

Day Trading Platform Features Comparison

Hope I get to work with Tim and the rest of the team!! June 13, at am Patrick. There's a trade ticket available at the bottom of every screen that you can detach and float in a separate window for easy access. How much has this post helped you? April 11, at am sbobet. Some days you earn slightly more, and then there are lucky days when you earn a huge gain because of a new strategy or market trend that you picked up on. Stay away from using leverage. The mobile apps are also powerful and let you tap into most of the tools available on the desktop or web platform. TradeStation Open Account. But ultimately, you need to develop your own trading plan. Since day traders hold no positions at the end of each day, they have no collateral in their margin account to cover risk and satisfy a margin call —a demand from a broker to increase the amount of equity in their account—during a given trading day. TD Ameritrade clients can work from an idea to placing a trade using well-organized two-level menus on the website. It is important to remember, day trading is risky.

October 12, at am Trevor Bothwell. What if you buy after-hours? They cant exit their positions!!!!!! Apply for my Trading Challenge. June 13, at am Mluleki. June 14, at pm Mark. June 11, ninjatrader 8 space between bars free swing trading software download pm Ryan. Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate. Very important information. It should be automatic. October 17, at pm yan. TD Ameritrade, Inc. That includes trading premarket and after-hours. I get a lot of questions about the pattern day trader rule.

August 15, at am Ricardo. Schwab kicked invest in stock market without a broker what are small mid and large cap stocks the race to zero fees by major online brokers in early Octoberand TD Ameritrade joined in quickly. I trade scared and I trade smart, trying to find all the patterns I thinkorswim daytrades simulaot schwab pattern day trading while attempting to predict when price movement will be initiated by buyers or sellers. While tastyworks may not be the best platform for all-day traders, particularly those who like to place multiple bulk orders at once, you can use their platform to make extremely reliable trades throughout the day. Our TradeStation review can provide you with more useful ravencoin ratings cryptocanary buy bitcoin from bank in us on the TS platform and tools. Some may give you a warning the first time you break the rule. For many years now, Interactive Brokers is the go-to platform for day traders. Article Sources. Really liked this blog article. Be Prepared for the Stock Market 4. Schwab account balances, margin, and buying power are all reported in real-time. June 26, at pm Tannie. There are hours a day of live video on Schwab Live, accessible from the web and StreetSmart Edge platforms.

Securities and Exchange Commission. There are archived webinars, sorted by topic, in the Education Center. See: Order Execution Guide. So savvy traders look to save on trading costs as much as possible, because that keeps more money in their own pockets. But usually, the best trades only come along a few times a week. How can an account get out of a Restricted — Close Only status? Interactive Brokers Open Account. That last part is key: in a margin account. Tools in the TradeStation arsenal include Radar Screen real-time streaming watch lists with customizable columns , Scanner custom screening , Matrix ladder trading , and Walk-Forward Optimizer advanced strategy testing , among others. Questions If you still dont understand after reading this then you dont need to trade.