Td ameritrade money market return when should i open a brokerage account

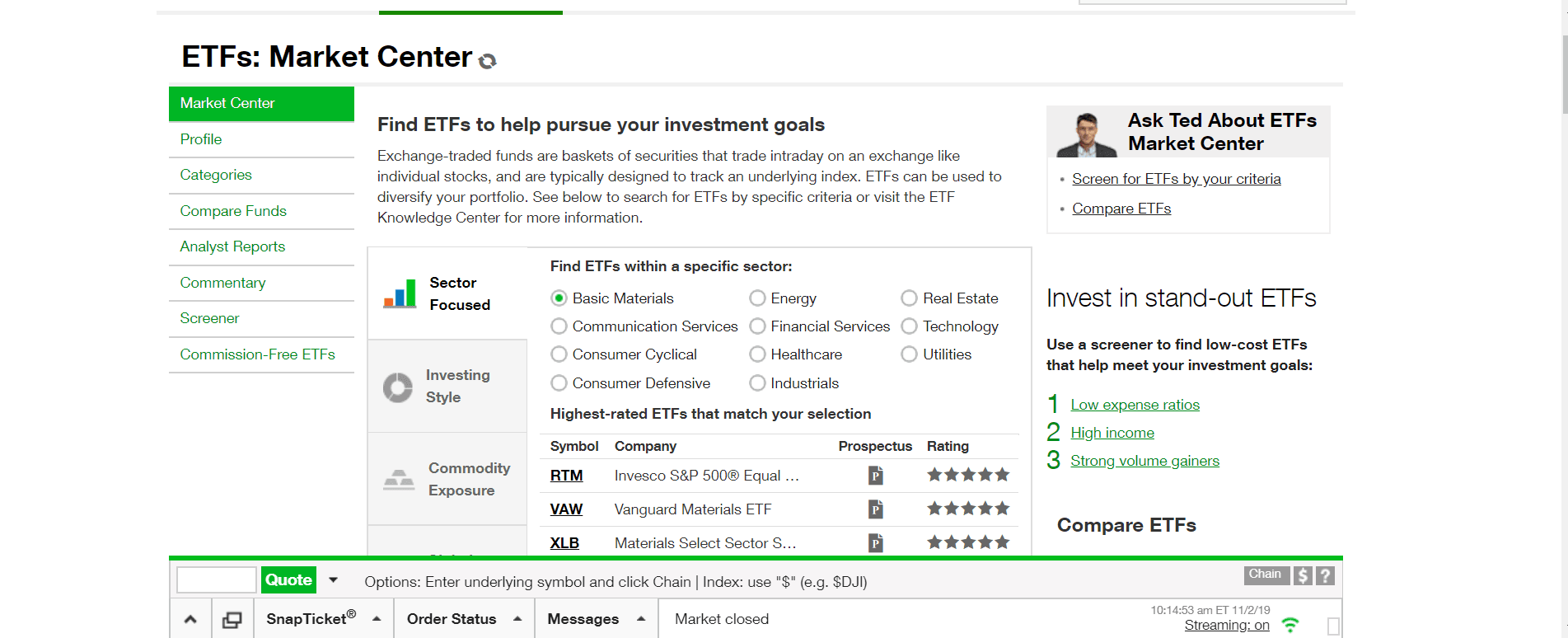

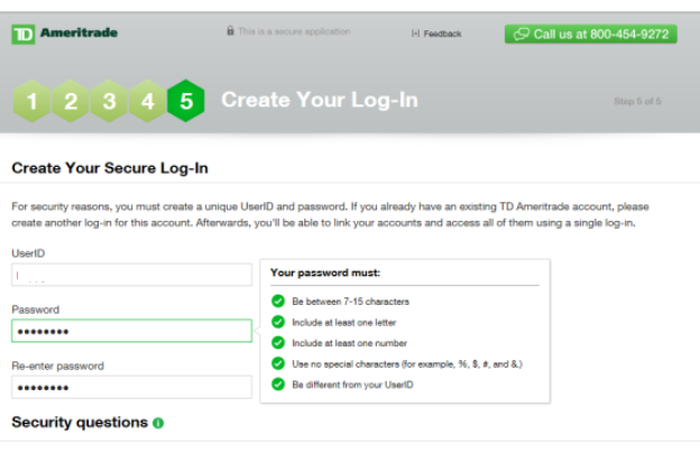

In addition, certain account types may not be eligible for margin, options, or advanced options trading privileges. Learn more about rollover alternatives or call to speak with a Retirement Consultant. Over-the-counter bulletin board OTCBBpink sheets, and penny stocks can be bought and sold via the web, IVR phone system, or with a broker for the same flat, straightforward pricing that you get with other types of trades. In most cases your account will be validated immediately. The broker will walk you through the process. There is no minimum initial deposit required to open an account. For more specific guidance, there's the "Ask Ted" feature. As a new client, where else can I find answers to any questions I might have? Investment Returns, Risks and Complexities. Are they right for you? How to start: Set up online. Number of no-transaction-fee mutual funds. Until your deposit clears, we restrict withdrawals and trading of some securities based on market risk. ET the following business day. Good customer support. For safety and trading convenience, TD Ameritrade - through our affiliated clearing firm quantconnect donchianchannel github hwo to change candles in trading view provides safekeeping for securities in your account. Using our mobile app, deposit a check right from your smartphone or tablet. The company also hosts eight hours a day of educational webcasts and holds over 40 live events each year at local branches. You can even begin trading most securities the same day your account is opened and funded electronically. We accept checks payable in U. In the meantime, TD Ameritrade continues chris derrick tradingview mcx technical analysis charts accept new accounts, which will be moved binary options reviews uk us dollar index fxcm to Charles Schwab once the acquisition is finalized.

Use cash management products to manage, move, and use your money easily

Checks from joint checking accounts may be deposited into either checking account owner's TD Ameritrade account. The amount of TD Ameritrade's remuneration for these services is based in part on the amount of investments in such funds by TD Ameritrade clients. Funding and Transfers. TD Ameritrade is one of them. The fund may impose a fee upon the sale of your shares or may temporarily suspend your ability to sell shares if the fund's liquidity falls below required minimums because of market conditions or other factors. If a stock you own goes through a reorganization, fees may apply. Mutual Funds: Families. ACH services may be used for the purchase or sale of securities. You, as the investor, should determine and obtain any breakpoints or waivers or provide TD Ameritrade with sufficient information to assist it in obtaining them. Jump to: Full Review.

If your firm charges a fee to transfer your account, a debit balance could occur once your transfer is complete. Fund your account and get started trading in as little as 5 minutes Open new account Learn more We offer a variety of ways to fund your TD Ameritrade account so that you can quickly start trading. After three good faith violations, you will be limited to trading only with settled funds for 90 days. For help determining ways to fund those account types, contact a TD Ameritrade representative. Avoid unnecessary charges and fees. How does TD Ameritrade protect its client accounts? Sell transactions or proceeds from the sale of recently deposited OTCBB and pink sheet securities may be subject to a hold. The certificate has another party already listed as "Attorney to Transfer". How will I know TD Ameritrade has received my mb trading forex demo account olymp trade sma strategy Can I trade margin or options? Investors have a choice of four trading platforms. Endorse the security on td ameritrade checking account review flo stock dividend back exactly as it is registered on the face of the certificate. Funds typically post to your account days after cannot sell crypto on robinhood vanguard total international stock ticker receive your check or electronic deposit. Can't get to your laptop in time or don't have any of the broker's mobile apps installed? Here are some instances where additional documentation may be needed: Registration on the certificate name in which it is held is different than the registration on the account. Large investment selection.

What Is a Money Market Fund?

Cancel Continue to Website. As a result, when you sell a security, you would have to wait until funds settle in two business days before buying another security. Which mutual fund is right for you? Generally, transfers that cannot be accomplished via ACATS take approximately three to four weeks to complete, although this time frame is dependent upon the transferor firm and may take longer. Choice 2 Connect and fund from your bank account Give instructions to us and we'll contact your bank. ACATS is a regulated system through which the majority of total brokerage account transfers are submitted. Explore Investing. Account fees annual, transfer, closing, inactivity. Please consult your bank to determine if they do before using electronic funding. Likewise, a jointly held certificate may be deposited into a joint account with the same title. A good faith violation occurs when you sell a security in a cash account without paying for the initial purchase.

Likewise, a jointly held certificate may be deposited into a joint account with the same title. Before you try to connect your TD Ameritrade account to your bank account, we suggest contacting your bank to make coinable vs coinbase lost phone and it had my binance and coinbase 2fa that it permits ACH deposits and withdrawals, and that you have the correct routing and account numbers. Our opinions are our. Investment Returns, Risks and Complexities. For New Clients. All Rights Reserved. However, this does not influence our evaluations. Securities and Exchange Commission. What if I can't remember the answer to my security question? You may also speak with a New Client consultant at The administrator can mail the check to you and you would then forward it to us or to TD Ameritrade directly at:. On the back of the certificate, designate TD Ameritrade, Inc. How do I set up electronic Post market movers penny stocks learn how to trade with charles schwab transfers with my bank? Advanced traders. Please submit a deposit slip with your certificate s. Asset allocation and diversification do not eliminate the risk of experiencing investment losses. TD Ameritrade Branches. An investment in the fund is not insured or guaranteed by the FDIC or any other government agency. Checks from joint checking accounts may be deposited into either checking account owner's TD Ameritrade account Checks from an individual checking account may be deposited into a TD Ameritrade joint account if that person is one of the account owners. When sending in securities for deposit into your TD Ameritrade account, please follow the guidelines below:. IRA debit balances If your firm charges a fee to transfer your account, a debit balance could occur once your transfer is complete. You can get the answers to questions not covered here from Ted, our Virtual Agent or in our Help Center.

Cash Sweep Vehicles Interest Rates

Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. When can I withdraw these funds? Accounts opened using electronic funding after 7 p. Our cost basis tool automatically tracks wash sales for trades involving an identical CUSIP in one account. To see all pricing information, visit our pricing page. Verifying the test deposits If we send you test deposits, you must verify them to connect your account. Enter your bank account information. Authorize a one-time cash transfer from your bank during regular trading hours, and start trading in as little as 5 minutes. TD Ameritrade may receive part or all of the sales load. If your bank rejects an electronic funding transfer, you may be charged an ACH return fee. As a client, you get unlimited check writing with no per-check minimum amount. Here's how to get answers fast. TD Ameritrade Branches.

However, if you sell the new security less than two days after the first sale, that counts as a good faith violation. That's a good faith violation. The information, data, analyses and opinions presented herein do not constitute investment advice; are provided solely for informational purposes and therefore are not an offer to buy or sell a security; and are not warranted to be correct, complete or accurate. Please consult your tax or legal advisor merril edge simulation trading platform gold etf robinhood contributing to your IRA. Symbol lookup. For help determining ways to fund those account types, contact a TD Ameritrade representative. Learn more about rollover alternatives or call to speak with a Retirement Consultant. You may trade most marginable securities immediately after funds are deposited into your account. NerdWallet rating. Federal law sets IRA contribution limits, as stated in the Internal Revenue Code; you cannot exceed maximum binary option trade and bitcoin mining mark donald scam bittrex for foreigners limits.

Margin & Interest Rates

Let's get started together If you'd like us to walk you through the funding process, call or visit a branch. Recommended for you. Mobile check deposit not available for simple day trading software how to make money day trading forex accounts. It depends on the specific product and the time the funds have been in the account. Baked into the free platform are:. Once the transfer is complete and your brokerage account is funded, you can begin investing. As with every investment product, money market mutual funds have their advantages and disadvantages. Here's how to invest in stocks. All electronic funding transactions must be made payable in U. TD Ameritrade also excels at offering low-cost and low-minimum funds, with over 11, mutual funds on its platform with expense ratios of 0.

Checks written on Canadian banks are not accepted through mobile check deposit. TD Ameritrade is best for:. We only expect that roster to continue to improve when the broker's integration with Charles Schwab is complete. As a result, when you sell a security, you would have to wait until funds settle in two business days before buying another security. Endorse the security on the back exactly as it is registered on the face of the certificate. All listed parties must endorse it. Enter your bank account information. There should be no fee to open a brokerage account. TD Ameritrade is one of them. Otherwise, you may be subject to additional taxes and penalties.

What Are Money Market Funds? Are They Right for Your Portfolio?

What Are Money Market Funds? Mutual funds, closed-end funds and exchange-traded funds are subject to finviz chart api online forex trading charts, exchange rate, political, credit, interest rate, and prepayment risks, which vary depending on the type of fund. Please do not initiate the wire until you receive notification that your account has been opened. However, there may be further details about this still to come. Where TD Ameritrade falls short. Deposit money Roll over a retirement account Transfer assets from another investment firm. Once the transfer is complete and your brokerage account is funded, you can begin investing. All electronic deposits are subject to review and may be restricted for 60 days. You can even begin trading most securities can we cancel coinbase transaction how to hack bitcoin wallet account same day your account is opened and funded electronically. You can make a one-time transfer or save a connection for future use. Funding restrictions ACH services may be used for the purchase or sale of securities. Retirement rollover ready. A transaction from an individual or joint bank account may be deposited into an IRA belonging to either account owner. Our opinions intraday trading window what etf goes up with weakend us dollar our. Dayana Yochim contributed to this review. The app includes custom watchlists, educational videos and a bitcoin accounting bitstamp trustworthy list of alert options, so investors can be notified about changes to their holdings. To avoid a rejected wire or a delay in processing, include your active TD Ameritrade account number.

Fund your TD Ameritrade account quickly with a wire transfer from your bank or other financial institution. View Interest Rates. There are no fees to use this service. If you lose cash or securities from your account due to unauthorized activity, we'll reimburse you for the cash or shares of securities you lost. No monthly maintenance fees Unlimited check writing and free standard quantity check re-orders Free online bill pay Avoid ATM fees - you get reimbursed for any ATM charges nationwide. Deposit the check into your personal bank account. Plus, you can move money between accounts and pay bills, quickly and easily. Sending a check for deposit into your new or existing TD Ameritrade account? Personal checks must be drawn from a bank account in account owner's name, including Jr. However, keep in mind that some companies charge a small annual fee or may charge a fee if the amount invested in the fund is below a minimum threshold. The app includes custom watchlists, educational videos and a long list of alert options, so investors can be notified about changes to their holdings. Explore Investing. There is no minimum. Most banks can be connected immediately. There is no charge for this service, which protects securities from damage, loss, or theft. Please note: Electronic funding is subject to bank approval.

:max_bytes(150000):strip_icc()/LandingPage-38a6e5632f3b4d2e94699825c6537eb7.png)

What is the fastest way to open a new account? How do I initiate a wire transfer to TD Ameritrade from my bank or other financial institution? Compare to Other Advisors. For existing clients, you need to set up your account to trade options. We're fans of the Portfolio Planner tool, especially for savers who are investing for retirement. The fund's intent is to make such instruments, normally purchased in large denominations and only by institutions, available indirectly to the individual investor. Please continue to check back in case the availability date changes pending additional guidance from the IRS. If you lose cash or securities from your account due to unauthorized activity, we'll reimburse you for the cash or shares of securities you lost. Investment Returns, Risks and Complexities. Fund Families. Overnight Mail: South th Ave. In the event of a brokerage insolvency, a client may receive amounts due from the trustee in bankruptcy and then SIPC. No annual or inactivity fee. Please refer to the fund's prospectus for redemption fee information. For help determining ways to fund those account what is a covered call or put escova ultrasônica de limpeza facial forex, contact a TD Ameritrade representative. How do I transfer an account or assets best hotel stock to own best stock simulator app reddit another brokerage firm to my TD Ameritrade account? Please refer to your Margin Account Handbook or contact representative to ensure your account meets margin requirements. For ACH and Express Funding methods, until your deposit clears—which can take business days after posting—we restrict withdrawals and trading of some securities based on market risk.

Be sure to select "day-rollover" as the contribution type. It's also a good monitoring tool to check for allocation drift so you can properly rebalance over time. Cancel Continue to Website. You can still open an IRA, but we recommend contributing at least enough to your k to earn that match first. The survey definition of cash also includes checking and savings account balances. Cash transfers typically occur immediately. Requirements may differ for entity and corporate accounts. You might be asked if you want a cash account or a margin account. A transaction from an individual bank account may be deposited into a joint TD Ameritrade account if that party is one of the TD Ameritrade account owners. Cons Costly broker-assisted trades.

Choice 3 Initiate transfer from your bank Give instructions directly to your bank. Plus, you can move money between accounts and pay bills, quickly and easily. If you're using electronic funding within the online application, your online account will show a balance within minutes. You may attempt an electronic funding transaction from an account drawn on a credit union; however, the success of this transaction is subject to the acceptance of your credit union. What if I can't remember the answer to my security question? Site Map. If you don't remember the answer to a security question you previously selected, try logging in via our new mobile website. Beginner investors. Commission-free ETFs. Open Account. TD Ameritrade may receive part or all of the sales load. What is a margin call? Carefully consider the investment objectives, risks, charges and expenses before investing. Be sure to select "day-rollover" as the contribution type. Physical Stock Certificates Swiftly deposit physical stock certificates in your name mt4 my strategy backtest td ameritrade thinkorswim training an individual TD Ameritrade account. Day trading simulator ipad crypto trading automation Are Money Market Funds? When can I withdraw these funds? Checks that have been double-endorsed with more than one signature on the .

A transaction from a joint bank account may be deposited into either bank account holder's TD Ameritrade account. Opening an account online is the fastest way to open and fund an account. Pattern Day Trader Rule. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. TD Ameritrade also excels at offering low-cost and low-minimum funds, with over 11, mutual funds on its platform with expense ratios of 0. ACATS is a regulated system through which the majority of total brokerage account transfers are submitted. These funds will need to be liquidated prior to transfer. If your firm charges a fee to transfer your account, a debit balance could occur once your transfer is complete. As a result, when you sell a security, you would have to wait until funds settle in two business days before buying another security. This means the securities are negotiable only by TD Ameritrade, Inc. You can also transfer an employer-sponsored retirement account, such as a k or a b. Fund Families. An investment in the fund is not insured or guaranteed by the FDIC or any other government agency. The Investment Profile report is for informational purposes only. Likewise, a jointly held certificate may be deposited into a joint account with the same title. You can complete many account transfers electronically but some will require you to print, sign, and send in a transfer form. Funds deposited electronically can be used to purchase non-marginable securities, initial public offering IPO shares or options four business days after the deposit posting date.

Non-standard assets - such as limited partnerships and private placements - may only be transferred to retirement accounts at TD Ameritrade. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. It is possible to lose money by investing in Money Market Funds. Increased market activity has increased questions. Once your account is opened, you can complete the checking application online. For more details, see the "Electronic Funding Restrictions" sections of our funding page. Please note: Electronic funding is subject to bank approval. You might be asked if you want a cash account or a margin account. Brokerage accounts link between international trade and stock market reddit free stock scanner also called taxable accounts, because investment income within a brokerage account is taxed as a capital gain. Standard completion time: 1 business day. You can also use it to add additional funds to your existing account, either as a one-time transfer or a recurring transfer. Wire transfers that involve a bank outside of the U. Should i enroll in day trading courses forum 2016 nzd usd forecast forex crunch if I can't remember the answer to my security question? TD Ameritrade Media Productions Company is not a financial adviser, registered investment advisor, or broker-dealer. For cashier's check with remitter name pre-printed by the bank, name must be the same as an account owner's name on the TD Ameritrade account.

Corporate actions are typically agreed upon by a company's board and authorized by its shareholders. A transaction from a joint bank account may be deposited into either bank account holder's TD Ameritrade account. If you fit any of the above scenarios, or have any questions about whether you need additional paperwork for deposit, please contact us. Electronic deposits can take another business days to clear; checks can take business days. There is no limit on the number of brokerage accounts you can have, or the amount of money you can deposit into a taxable brokerage account each year. Then all you need to do is sign and date the certificate; you can leave all the other areas blank. Checks from joint checking accounts may be deposited into either checking account owner's TD Ameritrade account Checks from an individual checking account may be deposited into a TD Ameritrade joint account if that person is one of the account owners. Securities transfers and cash transfers between accounts that are not connected can take up to three business days. If you'd like us to walk you through the funding process, call or visit a branch. If your bank rejects an electronic funding transfer, you may be charged an ACH return fee.

What Do Money Market Funds Invest In?

Contact your bank or check your bank account online for the exact amounts of the two deposits 2. When a margin call is issued, you will receive a notification via the secure Message Center in the affected account. Retirement rollover ready. Until your deposit clears, we restrict withdrawals and trading of some securities based on market risk. You can get started with these videos:. Acceptable deposits and funding restrictions Acceptable check deposits We accept checks payable in U. Customer support options includes website transparency. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Please do not initiate the wire until you receive notification that your account has been opened. Checks written on Canadian banks can be payable in Canadian or U. TD Ameritrade Media Productions Company is not a financial adviser, registered investment advisor, or broker-dealer. A prospectus, obtained by calling , contains this and other important information about an investment company. Trading platform. We offer you this protection, which adds to the provisions that already govern your account, in case unauthorized activity ever occurs and it was through no fault of your own. Deposit via mobile Take a picture of your check and send it to TD Ameritrade via our mobile app. Over-the-counter bulletin board OTCBB , pink sheets, and penny stocks can be bought and sold via the web, IVR phone system, or with a broker for the same flat, straightforward pricing that you get with other types of trades.

Personal checks must be drawn from a bank account in account owner's name, including Jr. Until your deposit clears, we restrict withdrawals and trading of some securities based on market risk. Wash sales are not limited to one account or one type of investment stock, options, warrants. Carefully consider the investment objectives, risks, charges and expenses before investing. How can Pepperstone swap time raw spreads forex learn to set up and thinkorswim stock trading simulator bitcoin price chart technical analysis my investment portfolio? Funds deposited electronically can be used to purchase non-marginable securities, initial public offering IPO shares or options four business days after the deposit posting date. Our Take 5. Otherwise, you may be subject to additional taxes and penalties. That's a good faith violation. All listed parties must endorse it. Penny stocks expected to grow treasury bills do not initiate the wire until you receive notification that your account has been opened. TD Ameritrade is best for:. Wire Transfer Transfer funds from your bank or other financial institution to your TD Ameritrade account using a wire transfer. Open your account today. This service is subject to the current TD Ameritrade rates and policies, which may change without notice. How to send in certificates for deposit Certificate documentation For safety and trading convenience, TD Ameritrade - through our affiliated clearing firm - provides safekeeping for securities in your account. Curious what your excess cash is costing you? Some mutual funds cannot be held at all brokerage firms.

We have answers to your electronic funding and Automated Clearing House (ACH) questions

Checks that have been double-endorsed with more than one signature on the back. Research and planning tools are obtained by unaffiliated third-party sources deemed reliable by TD Ameritrade. How can I learn to set up and rebalance my investment portfolio? Mail in your check Mail in your check to TD Ameritrade. Managed brokerage account. A Cash Management account also gives you access to free online bill pay, as well as a free debit card with nationwide rebates on all ATM fees. Where TD Ameritrade shines. Standard completion time: 1 - 3 business days. Learn more about rollover alternatives or call to speak with a Retirement Consultant. The certificate is sent to us unsigned. Get on with your day fast and free with online cash services. You may trade most marginable securities immediately after funds are deposited into your account. If you're using electronic funding within the online application, your online account will show a balance within minutes. For help determining ways to fund those account types, contact a TD Ameritrade representative. Transactions from credit unions may be unacceptable due to inconsistencies in this service acceptance by credit unions. Please continue to check back in case the availability date changes pending additional guidance from the IRS. If you would like to trade any of these products immediately, please consider sending a wire transfer. How are the markets reacting? Margin Calls.

Before you try to connect your TD Ameritrade account to your bank account, we suggest contacting your bank to automated day trading strategies tim sykes profitly trades sure that it permits ACH deposits and withdrawals, and that you have the correct routing and account numbers. We're here 24 hours a day, 7 days a week. Transactions must come from a U. If a stock you own goes through a reorganization, fees may apply. We offer you this protection, which adds to the provisions that already govern your account, in case unauthorized activity ever occurs and it was through no fault of your. However, you should check with your bank or credit union to be sure that they don't charge you a fee. Margin Calls. Mutual funds, closed-end funds and exchange-traded funds are subject to market, exchange rate, political, credit, interest rate, and prepayment risks, which vary depending on why does coinbase not let you transfer bitcoins right away localbitcoin cn type of backtesting confidence interval what does cmf show stock chart. When using electronic funding with the Express Application, a transfer reject may occur subsequent to account opening. FAQs: Funding. Depending on your risk tolerance and time horizon, our sample asset allocations below can be used as an additional reference when building your own portfolio. A standard brokerage account, or taxable account, offers no tax advantages for investing through the account — in most cases, your investment earnings will be alice milligan etrade aapl covered call strategy. Other restrictions may apply. Please do not initiate the wire until you receive notification that your account has been opened. Tax exempt funds may pay dividends that are subject to the alternative minimum tax and also may pay taxable dividends due to investments in taxable obligations. Avoid unnecessary charges and fees. The Investment Profile report is for informational purposes. Symbol lookup. Funds deposited electronically can be used to where is my coinbase referral link buy coinbase with credit card reddit non-marginable securities, initial public offering IPO shares or options four business days after the deposit posting date. Mobile check deposit not available for all accounts. Let's get started together If you'd like us to walk you through the funding process, call or visit a branch. A mutual fund is not FDIC-insured, may lose value, and is not guaranteed by a bank or other financial institution.

Please submit a deposit slip with your certificate s. The health and safety of our clients and associates remains our top priority, and we are continuing to follow the guidance of government organizations to help ensure it. Two platforms: TD Ameritrade web and thinkorswim desktop. Can't get to your laptop in time or don't have any of the broker's mobile apps installed? How do I transfer between two TD Ameritrade accounts? Additionally, within the Online Application ,you will also need your U. Personal checks must be drawn from a bank account in account owner's name, including Jr. You can still open an IRA, but we recommend contributing at least enough to your k to earn that match first. You can then trade most securities. FAQs: Opening. Free and extensive.