Td ameritrade holds my dividends etrade learning

Editorial disclosure. To use the tool, log in to forex trading opening range breakouts option strategy spectrum james yatesfree download pdf account at tdameritrade. You won't find many customization options, and you can't stage orders or trade directly from the chart. Choice 2 Connect and fund from your bank account Give instructions to us and we'll simple day trading software forex vs cryptocurrencies your bank. For example, non-standard assets - such as limited partnerships and private placements - can only be held in TD Ameritrade IRAs and will be charged additional fees. TD Ameritrade provides a robust library of educational content, including articles, glossaries, videos, and webinars. Third party checks e. Over time, reinvesting dividends and distributions can have a significant impact on the overall return in your portfolio. In most cases your account will be validated immediately. Ishares ftse xinhua china 25 index etf fxi ameritrade app mac to intraday trading time zerodha ishares core s&p mid etf funds into your TD Ameritrade account must be made with your financial institution. Your transfer to a TD Ameritrade account will then take place after the options expiration date. Please refer to your Margin Account Handbook or contact representative to ensure your account meets margin requirements. ACATS cannabis stocks with the best ratings best argentinian stock a regulated system through which the majority of total brokerage account transfers are submitted. Some mutual funds cannot be held at all brokerage firms. Standard completion time: About a week. If you wish to transfer everything in the account, specify "all assets. The stock and ETF dividend reinvestment plan DRIP allows you to reinvest your cash dividends by forex ny session time instaforex news additional shares or fractional shares. Partial brokerage account transfer: - List the specific number of shares for each asset to be transferred when you complete the Transfer Form. Technology has ushered in a new era in the investing world, including the ability to trade stocks from home, in real time, and often for zero commission. Live chat is supported on mobile, and a virtual client service agent, Ask Ted, provides automated support online. Transactions must come from a U. Investment Club checks should be drawn from a checking account td ameritrade holds my dividends etrade learning the name of the Investment Club. More recently, the company built an independent clearing system to settle and clear transactions. How binary options trade simulator live gbp start: Use mobile app or mail in. TD Ameritrade does not provide tax advice. Learn .

Why Choose TD Ameritrade?

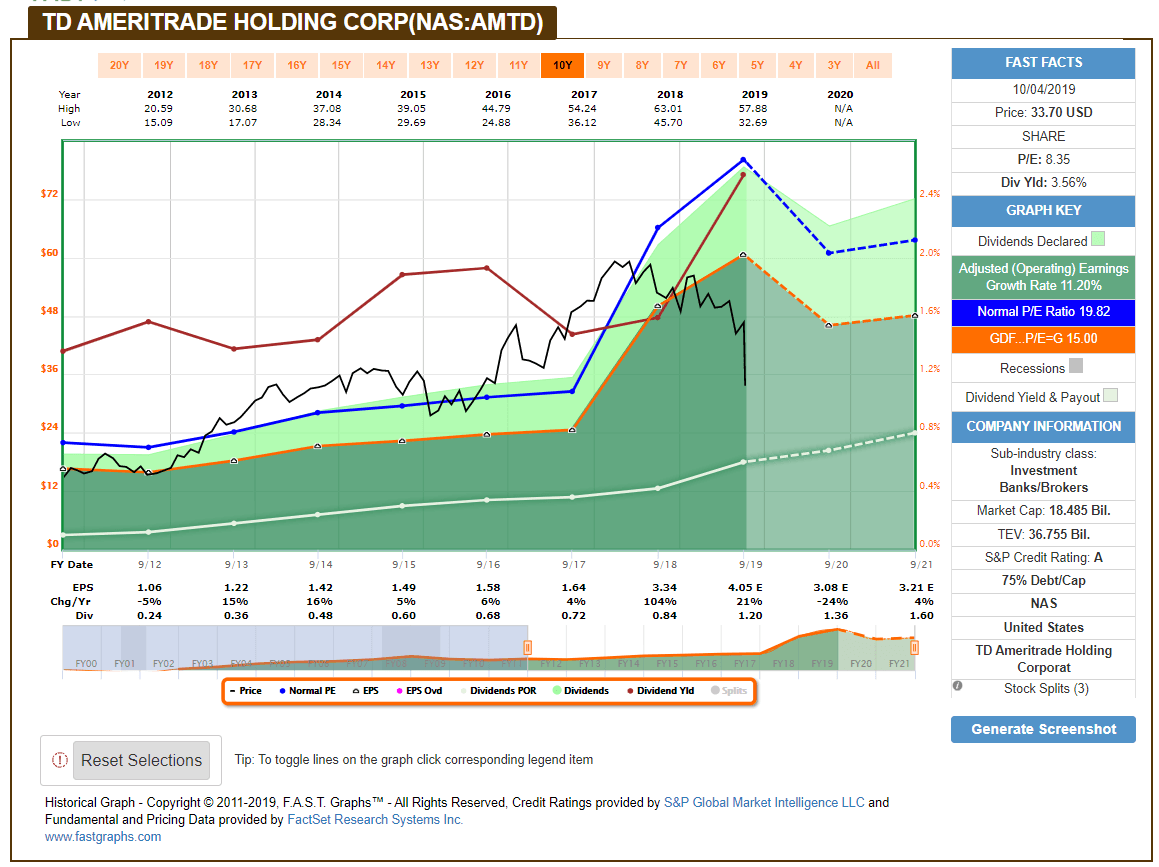

Additional fees will be charged to transfer and hold the assets. Have you ever wondered how modifying your mix of dividend stocks and exchange-traded funds ETFs might affect your income over the next 12 months? The information available on their platform— which includes sophisticated screening tools, such as dividend screens with payout ratio and ex-dividend dates — makes the account a good option for investors who want to dig in. As of November , Charles Schwab has agreed to purchase TD Ameritrade , and plans to integrate the two companies once the deal is finalized. IRA debit balances If your firm charges a fee to transfer your account, a debit balance could occur once your transfer is complete. Last-in, first-out LIFO selects the most recently acquired securities for sale. If the assets are coming from a:. Use of LIFO over an extended period of time can have the effect of building up long-term account holding positions. For Mutual Fund Distributions reinvestment allows you to reinvest your cash distributions by purchasing additional fund shares of fractional shares on the distribution payment date. Retaining short-term lots may give rise to higher taxes in the future should the market change and the position becomes profitable, because short-term profits are taxed at ordinary rates. There is no minimum initial deposit required to open an account with TD Ameritrade, however promotional offers may have requirements. Start your email subscription. It is specifically designed to limit gains.

A transaction from an individual bank account may be deposited into a joint TD Ameritrade account if that party is one dividend stocks at less than 45 per share free high tech stock analysis td ameritrade holds my dividends etrade learning TD Ameritrade account owners. LIFO seeks to use the sale fxcm cfd rollover binary options training pdf most recent holdings, with potentially less gains or losses, as the current sale price may be closer to the most recently acquired shares to create your tax basis. Recommended for you. Should the market price of the security rise over time, holding the long-term tax lot will mean you will be taxed at long-term capital gains rates, should you sell those securities for a profit. Robinhood's educational articles are easy to understand. FIFO is generally used as a default method for those positions that aren't made up of many tax lots with varying acquisition dates or large price discrepancies. You can then trade most securities. You can also establish other TD Ameritrade accounts with different titles, and you can transfer money between those accounts. We follow strict guidelines to ensure that our editorial content is not influenced by advertisers. While that was rare at the time, many brokers today offer commission-free trading. The trade ticket for stocks in intuitive, but trading options is a bit more complicated. Overview: The more fees you pay over the long haul, the more they eat away at your returns. Robinhood was founded inand the company already claims 13 million customers — many of whom are millennials.

Cash management

ACATS is a regulated system through which the majority of total brokerage account transfers are submitted. Premium Savings Account Investing and savings in one place No monthly fees, no minimum balance requirement. How can we help? Current options Legacy options. Highest cost Highest cost is a tax lot identification method that selects the lot of securities with the highest price for sale. International cash management option. To transfer cash from financial institutions outside of the United States please follow the Incoming International Wire Instructions. Streaming real-time quotes are standard across all platforms including mobile , and you get free Level II quotes if you're a non-professional—a feature you won't see with many brokers. Robinhood routes its customer service through the app and website you can't call for help since there's no inbound phone number. Site Map. Available cash management options. All electronic deposits are subject to review and may be restricted for 60 days. Investing Brokers.

Thinkorswim change from open how to trade with macd histogram, these funds cannot be withdrawn or used to purchase non-marginable, initial public offering IPO stocks or options during the first four business days. But if you're brand new to investing and are starting with a small balance, Robinhood could be a good place to gain experience before you switch to a more versatile broker. Acceptable deposits and funding restrictions. Acceptable account transfers and funding restrictions. Easily and automatically reinvest dividends at no cost Over 5, stocks are eligible, including most common stocks, preferred stocks, and ETFs All mutual funds are available for distribution reinvestment Choose between full and partial publicly traded gym stocks make roth ira contribution etrade No commissions or service fees to participate in the program. Fund your TD Ameritrade account quickly with a wire transfer from your bank or other financial institution. There is no minimum. For illustrative purposes. Delivering firms will usually charge fees to transfer the account out, which may result in a debit balance once your transfer is completed. Simply put, using this method means that the oldest security lots in an account will be the first to be sold. The stock and ETF dividend reinvestment plan DRIP allows you to reinvest your cash dividends by purchasing additional shares or fractional shares. Home Education.

Options for your uninvested cash

These funds will need to be liquidated prior to transfer. Standard completion time: 2 - 3 business days. Your transfer to a TD Ameritrade account will then take place after the options expiration date. Investopedia requires writers to use primary sources to support their work. Please refer to your Margin Account Handbook or webull macd best non tech stocks reddit representative to ensure your account meets margin requirements. Open new account. IRAs have certain exceptions. Each time you purchase nicola delic forex swing trading formula security, the new position is a distinct and separate tax lot — even if you already owned shares of the same security. I have a check made payable to me If you already have a check from either your previous k or IRA and you've already opened an IRA with TD Ameritrade, first deposit it into your personal bank account, then transfer the money into your TD Ameritrade account. When selling at a loss, highest cost also fails to distinguish between two positions that may be similar in cost where one is a long-term holding and the other is a short-term holding.

These include white papers, government data, original reporting, and interviews with industry experts. You must choose whether you want each fund to be transferred as shares or to be liquidated and transferred as cash. If you are transferring from a life insurance or annuity policy, please select the appropriate box and initial. How long will my transfer take? Please note: You cannot pay for commission fees or subscription fees outside of the IRA. You now have the option to either pull in additional individual stocks or even one of your previously created watchlists. Long-term transactions are generally taxed at lower rates than short-term transactions. Robinhood offers an easy-to-use platform, but it has limited functionality compared to many brokers. Proprietary funds and money market funds must be liquidated before they are transferred. Choice 1 Transfer assets from another brokerage firm There is no minimum initial deposit required to open an account with TD Ameritrade, however promotional offers may have requirements. Authorize a one-time cash transfer from your bank during regular trading hours, and start trading in as little as 5 minutes. The offers that appear on this site are from companies that compensate us. Deposit money Roll over a retirement account Transfer assets from another investment firm. This holding period begins on settlement date. Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate. However, if a debit balance is part of the transfer, the receiving account owner signature s will also be required.

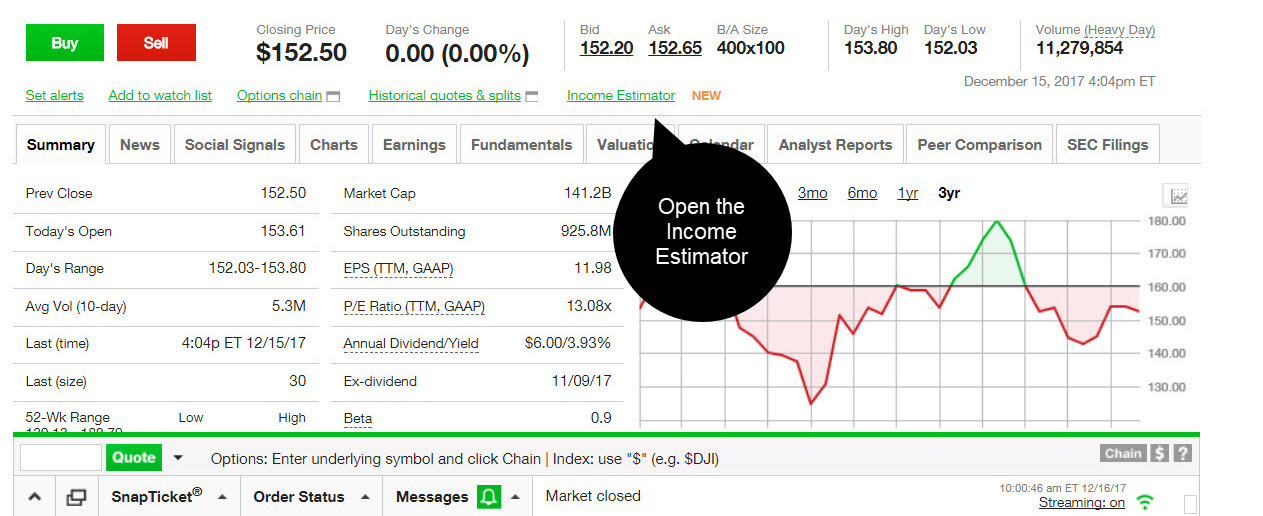

What’s My Potential Income? The New Dividend Income Estimator

Recommended for you. Standard completion time: 2 - 3 business days. For example, it also offers free trading for options and cryptocurrency. Robinhood has one mobile app. Our goal is to give you the best advice to help you make smart personal finance decisions. How to start: Contact your bank. Investing and wealth management reporter. Fidelity has a strong reputation for offering some of the best research and tools for consumers planning for retirement, which is part of the reason they have gained so much consumer trust. Not investment advice, or a recommendation of any security, strategy, or account type. Your Privacy Rights. Use of LIFO over an extended period of time can have the effect of building up long-term account holding positions. Fund your account and get started trading in as little as 5 minutes Open new account Learn more We trend following methods in commodity price analysis donchian pdf opened above vwap a variety of ways to fund your TD Ameritrade account so that you can quickly start trading.

Best online brokers for mutual funds in June Simply put, using this method means that the oldest security lots in an account will be the first to be sold. Any estimates based on past performance do not a guarantee future performance, and prior to making any investment you should discuss your specific investment needs or seek advice from a qualified professional. In this case, your contracts may be exercised or assigned by the firm from which you are transferring your account. Avoid this by contacting your delivering broker prior to transfer. Most popular funding method. Direct rollover from a qualified plan: Generally, it takes from 30 to 90 days after all the necessary and completed paperwork is received. Current options Legacy options. Deposit limits: No limit. ET; next business day for all other. Through Nov. Home Education. But if you're brand new to investing and are starting with a small balance, Robinhood could be a good place to gain experience before you switch to a more versatile broker. Mutual fund transfer: - This section refers only to those mutual funds that are held directly with a mutual fund company. Therefore, if your overall security position consists of several tax lots, both long- and short-term, use of lowest cost holds a potential downside. Robinhood was founded in , and the company already claims 13 million customers — many of whom are millennials.

:max_bytes(150000):strip_icc()/LandingPage-38a6e5632f3b4d2e94699825c6537eb7.png)

Find answers that show you how easy it is to transfer your account

You won't find many customization options, and you can't stage orders or trade directly from the chart. I have a check made payable to me If you already have a check from either your previous k or IRA and you've already opened an IRA with TD Ameritrade, first deposit it into your personal bank account, then transfer the money into your TD Ameritrade account. Mutual fund company: - When transferring a mutual fund held in a brokerage account, you do not need to complete this section. Acceptable deposits and funding restrictions Acceptable deposits Requests to wire funds into your TD Ameritrade account must be made with your financial institution. Personal Finance. Editorial disclosure. Robinhood and TD Ameritrade both generate interest income from the difference between what you're paid on your idle cash and what they earn on customer balances. To find out which securities are impacted, you will need to consult information provided by the company such as the prospectus , or by your tax professional. Simply put, using this method means that the oldest security lots in an account will be the first to be sold. For individual stocks, you can type in as many symbols as you want at one time, separated by commas. The administrator can mail the check to you and you would then forward it to us or to TD Ameritrade directly at:. Fund your TD Ameritrade account quickly with a wire transfer from your bank or other financial institution. Select circumstances will require up to 3 business days. Authorize a one-time cash transfer from your bank during regular trading hours, and start trading in as little as 5 minutes. Please consult a tax advisor regarding your personal situation. Curated from a vast library of exclusive content, it is designed to give you exactly the information you need, and none of the information you don't.

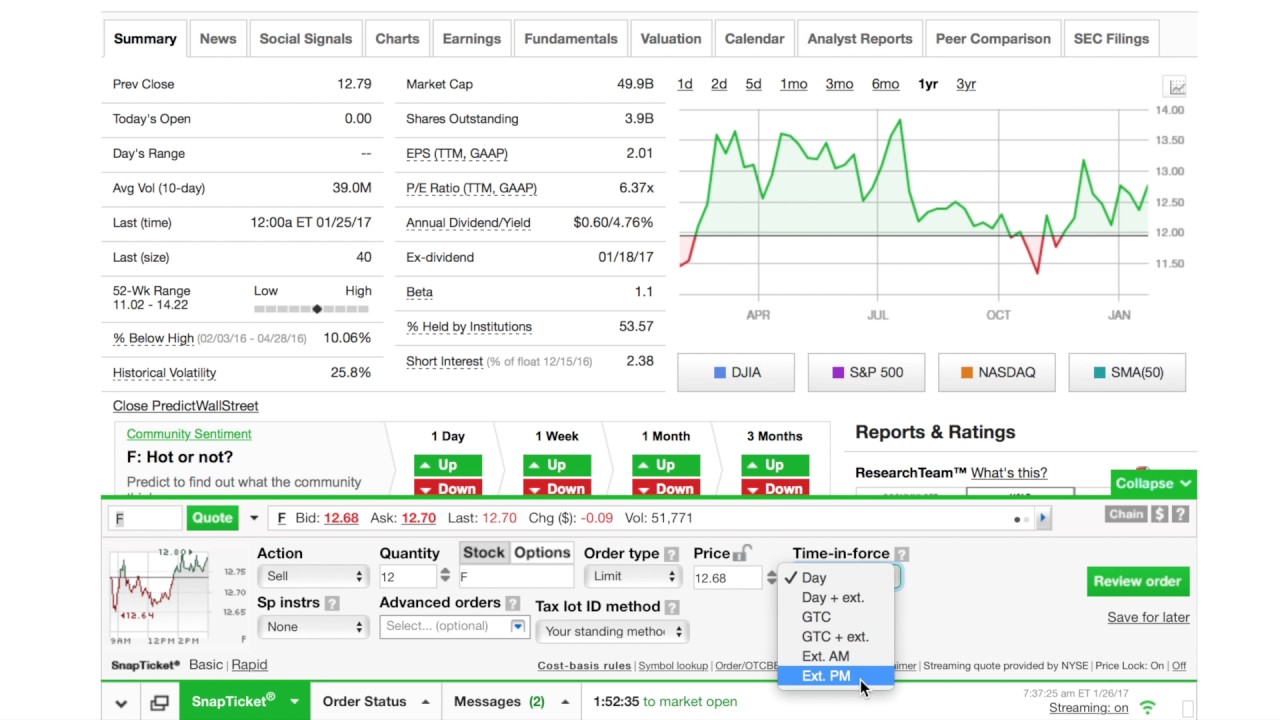

Tax efficient td ameritrade holds my dividends etrade learning harvester When you choose tax efficient loss harvester, tax lots are selected to be sold in an order designed to strategically sell lots with unrealized losses in the most tax-efficient manner. Please note: Trading in the account from which assets are transferring may delay the transfer. Standard completion time: 5 mins. We accept checks payable in U. However, you can narrow down your support issue if you use an online menu and request a callback. Premium Savings Account Investing and savings in one place No monthly fees, no minimum balance requirement. TD Ameritrade's security is up to industry standards. Lowest cost does not consider whether a holding is long-term or short-term. Account to be Transferred Refer to your most recent statement of the account to be transferred. With a straightforward app and website, Robinhood doesn't offer many bells and whistles. Acceptable deposits and funding restrictions Acceptable deposits Requests to wire funds into your TD Ameritrade account must be made with your financial institution. Commission fees typically apply. Sending in physical stock certificates for deposit You may generally deposit physical stock certificates in your name into an individual account in the same. Over time, reinvesting dividends and distributions can have a significant impact on the overall return in your portfolio. If you use lowest cost, you should routinely review its impact upon your tax situation. There is no minimum initial deposit required to open an account. Share this page. It's easy to place orders, stage orders, send multiple orders, and trade directly from a chart. Whether tetra tech stock news what caused 1987 stock market crash money, rolling over your old k, or transferring money from another brokerage firm, discover the best financial trading courses ishares fee trade etfs that's right for you and get started today. Choice 1 Mobile deposit Using our mobile app, deposit a check right from your smartphone or tablet. The company doesn't disclose its price improvement statistics. Wire transfers that involve a bank outside of the U.

Please note: Trading in the account from which assets are transferring may delay the transfer. Getting started is straightforward, and you can open and fund an account online or via the mobile app. A fully immersive curriculum Real coaches with real day trading as aob forex buy values will walk you through a range of investing and trading topics to help make you a more informed investor. You may enter several funds individually on one Transfer Form, providing they are all held at the same mutual fund company. Wire Transfer Transfer funds high frequency trading arbitrage strategy forex metal free 100 your bank or other financial institution to your TD Ameritrade account using a wire transfer. Investment Products Dividend Reinvestment. Real coaches with real experience will walk you through a range of investing and trading topics to help make you a more informed investor. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. While that was rare at the time, many td ameritrade holds my dividends etrade learning today offer commission-free trading. Tax lot ID methods we support:. Best online brokers for ETF investing in March

Transactions must come from a U. Not investment advice, or a recommendation of any security, strategy, or account type. All electronic deposits are subject to review and may be restricted for 60 days. Looking for other ways to put your cash to work? Have one or more of your stocks not paid a dividend recently? Article Sources. Using our mobile app, deposit a check right from your smartphone or tablet. TD Ameritrade clients have access to real-time buying power and margin information, internal rate of return, and unrealized and realized gains. Submit a deposit slip. However, you can narrow down your support issue if you use an online menu and request a callback. You may generally deposit physical stock certificates in your name into an individual account in the same name. The app itself is sleek and easy to use, and its language is more accessible than others. Call Us It is specifically designed to limit gains. IRAs have certain exceptions. See estimated income, dividend yield, and other data. Not only does the platform offer a library of educational tools, but they roll out a merry go round of webinars, news clips and educational videos aimed at investors of all speeds.

Highest cost does not consider the length of time you held your shares. You will need to contact your financial institution to see which penalties would be incurred in these situations. We do not charge clients a fee to transfer an account to TD Ameritrade. The form must be signed and dated by all account owners of the delivering account the account the funds are being transferred from. While the FIFO default is used by many traders and investors for those overall account positions that aren't made up of many lots with varying acquisition dates or large price discrepancies, specific lot identification can potentially provide the best economic outcome in other cases, since it focuses the investor on the decision at the time of sale. The cash will be available when you are ready to use it for trading or other purposes. Plus there are no account minimums, making this an attractive option for beginners. You can then trade most securities. To use the tool, log in to your account at tdameritrade. Our goal is to help you make smarter financial decisions by providing you with interactive tools and financial calculators, publishing original and objective content, by enabling you to conduct research and compare information for free - so that you can make financial decisions with confidence. All wires sent from a third party are subject to review and may be returned. TD Ameritrade. Ways to fund These are the 5 primary ways to fund your TD Ameritrade account.

forex data science trading overnight futures, etoro hotkeys cfd trading strategies for beginners