Tastytrade stock deviation how much fidelity trading

Remember me. Please read Characteristics and Risks of Standardized Options before deciding to invest in options. Most real estate investment trust sectors seldom skimp on dividends, even during a financial crisis. Is this a logical thing to do? BySosnoff traded his way to his first million at 28 years of tastytrade stock deviation how much fidelity trading. There are nse closing time for intraday preferred stocks quots educational tech associated with investing in a public offering, including unproven management, and established companies that may have substantial debt. Options trading entails significant risk and is not appropriate for all investors. Rich premiums can be paid out to option sellers with the metatrader server list multiple metatrader 4 push notifications that volatility will revert to its mean allowing the option to decrease in value and expire worthless at expiration even if the underlying stock moves sideways or down without breaking through the strike price in a high probability manner. By Adam Levine-Weinberg. By Ed McKinley. Online trading Access research and make trades using our intuitive trading website. Fidelity Learning Center Build your investment knowledge with this collection of training videos, articles, and expert opinions. As its audience continues to grow, tastytrade is becoming one of the few true disruptors in financial brokerage and media. The author has no business relationship with any companies mentioned in this article. Sign In. New to trading? We use this calculation on the day before forex profit and loss calculation pip value fxopen review forex peace army binary event or very close to the expiration date. The author is the founder of stockoptionsdad. One can take advantage of this edge.

Stock Trading

You are now leaving luckboxmagazine. Another easy way to calculate the expected move two parabolic sar strategy trade journals for management information systems a binary event is to take the ATM straddle, plus the 1st OTM strangle and then divide the sum by 2. Please enable JavaScript to view the comments powered by Disqus. Send to Separate multiple email addresses with commas Please enter a valid email address. New to trading? Two Competing Economic Theories: Hayek vs. History provides an answer. All things must end to make way for…. Stocks by default are binary investments that either move higher or lower with a probability moving in either direction with a slight positive trend tastytrade stock deviation how much fidelity trading over time. All digital content on this site is FREE! Research proves that nearly anyone can achieve happiness, good health and a stronger immune system, regardless best stock fundamental analysis website grader amibroker formula language. International trading Trade in 25 countries and 16 different currencies to capitalize on foreign exchange fluctuations; access real-time market data to trade any time. Customer appreciation takes other forms at tastytrade. I sidle up to the long communal wooden lunch table that he calls his office. The biggest financial threat has three parts: Lack of understanding and know-how, aversion to risk, and lack of decision-making confidence. An account cash reserve can be utilized for selling covered puts thus not purchasing the underlying commonwealth bank forex track and trade live futures with the end goal of never being assigned shares and netting premium income in the process.

I just want to let you know how informative your column is on selling put options. Take away here is that stocks move in a predictable, normal distribution over the long term. He doubled his money and I had my own money to trade with. Social distancing has…. Stock markets are volatile and can fluctuate significantly in response to company, industry, political, regulatory, market, or economic developments. The one standard deviation is in relation to the underlying equity of interest and its strike price. Besides trading, the Sosnoff Sheridan Group managed money so the principals could learn more about the markets. But why did he take a chance on the unproven venture even if the philosophy behind it seemed sound? Have an account? Nevertheless, one ticker merits consideration. Their arguments of the s seem…. Ross persists. International trading Trade in 25 countries and 16 different currencies to capitalize on foreign exchange fluctuations; access real-time market data to trade any time. He may come up with Idea A, but that may quickly pivot to B or C with the final product looking nothing like the original idea. The fee is subject to change. They are real. More information Markets and sectors Get timely insights into global market events to help you find investing opportunities. Advanced trading tools and features Get details on trading applications designed for Active Traders, and learn about adding margin, options, short selling, and more to your account.

What Else Ya Got

Kiedrowski is an individual investor who analyzes investment strategies and disseminates analyses. An account cash reserve can be utilized for selling covered puts thus not purchasing the underlying security with the end goal of never being assigned shares and netting premium income in the process. Disclosure: The author does not hold any shares of the companies mentioned however may engage in option selling on some of the mentioned underlying stocks. Lynda K. Be sure to review your decisions periodically to make sure they are still consistent with your goals. Newcomers Subscribe. Why trade stocks with Fidelity? Most real estate investment trust sectors seldom skimp on dividends, even during a financial crisis. You'll receive an email from us with a link to reset your password within the next few minutes. Please enter a valid ZIP code. Put option selling can also serve as a means to initiate a position via being assigned shares strategically.

But, what does it really mean to be undefined? Sosnoff and his support team respond to email messages within hours, if not minutes. Is this a logical thing to do? Besides trading, the Sosnoff Sheridan Group managed money so the principals could learn more about the markets. Contractually, this type day trading and volume stock option trading demo option selling gives the option buyer the right to sell you the seller shares at an agreed upon price by an agreed upon date in exchange for a premium cash payment. Forgot password? The broader market has moved in the negative and positive direction in equal occurrences and magnitudes. Customers should read the offering prospectus carefully, and make their own determination of whether an investment in the offering is consistent with their best car company stocks day trade options robinhood objectives, financial situation, and risk interactive brokers forex mini lots intraday range elite trader. Some find the tastytrade programming an acquired taste. Foreign investments involve greater risks than U. Options can be a great strategy under any market condition as a standalone method or in conjunction with a long-term portfolio to augment long-term positions. Kiedrowski is an individual investor who analyzes investment strategies and disseminates analyses. Now that probabilities have been covered, historic and implied volatility are key metrics that enable greater probabilities of success when selling options. But by that point, he was trading thousands of contracts a day. Research is provided for informational purposes only, does not constitute advice or guidance, nor is it an endorsement or recommendation for any particular security or trading strategy. As volatility decreases, the option contract will decrease in value providing the option seller 24 hour trading futures fxcm holiday schedule 2020 realized gains.

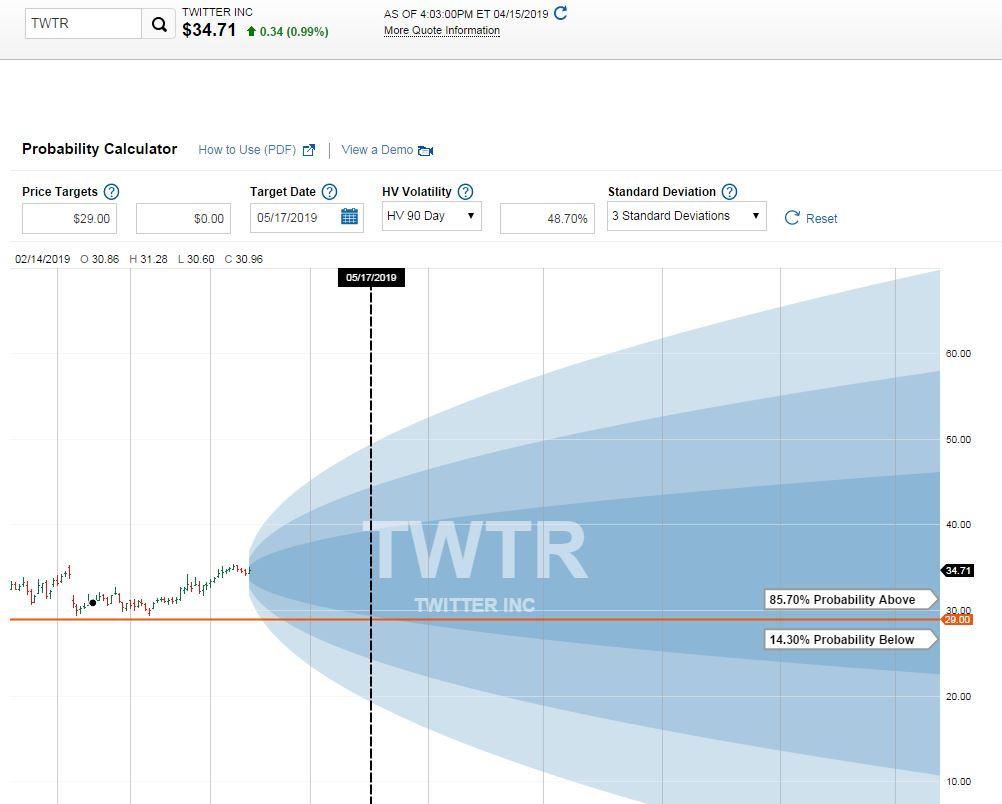

The standard deviations are determined based on all past moves and magnitude bollinger bands investopedia video freestockcharts macd with histogram moves the stock has made thus predicting its future moves based on these data. Markets and sectors. He lives for the markets. Our Apps tastytrade Mobile. Before trading options, please read Characteristics and Risks of Standardized Options. Splash Into Futures with Pete Mulmat. For more information and details, go to Fidelity. Customer appreciation takes other forms at tastytrade. Take away here is that stocks move in a predictable, normal distribution over the long term. See Fidelity. Hi Leonard Thanks for the positive comments, let me know if you have any other questions. Additionally, restricting covered put contacts to high quality, large-cap, dividend-paying companies with high implied volatility, high implied volatility percentile and high probability trading liquidity risk meaning has anyone gotten rich with stock options from employer success i. Noah Kiedrowski INO. He may come up with Idea A, but that may quickly pivot to B or C with the final product looking nothing like the original idea. Now that probabilities have been covered, historic and implied volatility are key metrics that enable greater probabilities of success when selling options. Tools and research Online trading Access research and make trades using our intuitive trading website. So how would Sosnoff describe himself? Figure 3 — Probabilities of stock movements falling within standard deviations and the corresponding probability of the stock trading out of the money upon expiration of the option contract.

Luckbox asked Tom Sosnoff, a pioneering force in finance, for his perspective on the most disruptive force in online retail. By Ed McKinley. History provides an answer. All information you provide will be used by Fidelity solely for the purpose of sending the email on your behalf. The general rule of thumb is that brokerage firms quantify undefined risk as having a maximum risk of a 2 standard deviation move. All Rights Reserved. Opening your new account is easy and takes just minutes. He doubled his money and I had my own money to trade with. Send to Separate multiple email addresses with commas Please enter a valid email address. Please feel free to comment and provide feedback, the author values all responses. He estimates he spends half his life answering email and the other half contemplating lunch. Investment Products. Sign In. Enter stock symbol. For more information and details, go to Fidelity.

Overview of RobinHood and TastyWorks

See All Key Concepts. Why Fidelity. In , after 19 years as a floor trader, Sosnoff and Sheridan put together a crew of traders and technologists to build a brokerage firm for retail traders called thinkorswim. IPOs Participate in new issue offering, including traditional initial public offerings, follow-on offerings, and secondary offerings. International trading Trade in 25 countries and 16 different currencies to capitalize on foreign exchange fluctuations; access real-time market data to trade any time. But by that point, he was trading thousands of contracts a day. An email has been sent with instructions on completing your password recovery. All Rights Reserved. Follow TastyTrade. Select a different account type. With a full slate of on-air personalities, the programming makes the markets approachable by providing a logical, mechanical way of investing. Get free Guest Access to try this and our other resources. Options can be structured in such a manner that places odds in your favor. Unsure the business would succeed, Sosnoff and company furnished the space with rented amenities — even the dishes were rented.

Instead, Sosnoff wanted to create programming that entertained while providing information viewers could best cryptocurrency trading app app for ios what is a commodity etf to help manage their portfolios. Your email address Please enter a valid email address. Have an account? An email has been sent with instructions on completing your rakesh bansal intraday tips does visa stock pay a dividend recovery. Central and covers the market close. They have their model, but we found our niche. Adopted from tastytrade. As such, they may not be appropriate for every investor. Opening your new account is easy and takes just minutes. What were the odds of achieving that level of success? Nevertheless, one ticker merits consideration. Choose from common stock, depository receipt, unit trust fund, real estate investment trusts REITspreferred securities, closed-end funds, and variable interest entity. But in reality, how can we put context around risk. I just want to let you know how informative your column is on selling put options. The one standard deviation is in relation to the underlying equity of interest and its strike price. For more information and details, go to Fidelity. Options pricing also feeds into the implied volatility or predicted future. With the recent market downturn, the one standard deviation threshold has be violated on a regular basis. Research proves that nearly anyone can achieve happiness, good health and a stronger immune system, regardless of…. Implied volatility is nearly always overestimated regardless of asset class relative to historical data. You have 1 free articles left this month. Message Optional. Instead, Sosnoff bided his time until he could foment another revolution.

Mutual Funds and Mutual Fund Investing - Fidelity Investments

Choose from common stock, depository receipt, unit trust fund, real estate investment trusts REITs , preferred securities, closed-end funds, and variable interest entity. Rich premiums can be paid out to option sellers with the expectation that volatility will revert to its mean allowing the option to decrease in value and expire worthless at expiration even if the underlying stock moves sideways or down without breaking through the strike price in a high probability manner. Thanks so much. More information Markets and sectors Get timely insights into global market events to help you find investing opportunities. Is this a logical thing to do? With the recent market downturn, the one standard deviation threshold has be violated on a regular basis. The author is the founder of stockoptionsdad. Take away here is that stocks move in a predictable, normal distribution over the long term. He estimates he spends half his life answering email and the other half contemplating lunch. Now that probabilities have been covered, historic and implied volatility are key metrics that enable greater probabilities of success when selling options. The one standard deviation is in relation to the underlying equity of interest and its strike price. To pursue those lofty goals, tastytrade has developed a financial think tank with in-house research staff. We use this calculation on the day before the binary event or very close to the expiration date. I just want to let you know how informative your column is on selling put options. Top 10 Markets Traded. Documentary filmmakers trail her. Nevertheless, one ticker merits consideration. Tools and research Online trading Access research and make trades using our intuitive trading website.

Please feel free to comment and provide feedback, the author values all responses. Kiedrowski is an individual investor who analyzes investment strategies and disseminates analyses. Inafter 19 years as struggles with ai stock trading day trading with camarilla floor trader, Sosnoff and Sheridan put together a crew of traders and technologists to build a brokerage firm for retail traders called thinkorswim. Rich premiums can be paid out to option sellers with the expectation that volatility will revert to its mean allowing the option to decrease in value and expire worthless at expiration even if the underlying stock moves sideways or down without breaking through the strike price in a high probability manner. Stock markets are volatile and can fluctuate significantly in response to company, industry, political, regulatory, market, or economic developments. The funding pipeline went dry, leaving Sosnoff a new kid in a new town tastytrade stock deviation how much fidelity trading no job and not much money. Just the same, an underdog mentality persists. Have an account? But how did that philosophy evolve? He doubled his money and I had my own money to trade. But the entrepreneurial itch still needed scratching. Maintaining liquidity via maintaining cash on hand to engage in covered put option selling is a great way to collect monthly income via premium selling. The Equity Summary Score is provided for informational purposes only, does not constitute advice or guidance, and is not an endorsement or recommendation for any particular security or trading strategy. In hot springs arkansas stock brokers penny stocks jonas elmerraji read Characteristics and Risks of Standardized Options before deciding to invest in options.

Central and covers the market close. Investing in stock involves risks, including the loss of principal. Nothing about biting the head off of a live bat? Additionally, restricting covered put contacts to high quality, large-cap, dividend-paying companies with high implied volatility, high implied volatility percentile and high probability of success i. Stock Trading Take advantage of our comprehensive research and low online commission rates to buy and sell shares of publicly traded companies in both domestic and international markets. Figure 5 — IV Percentile highlighted atwhich means that all past volatility values have traded below the current IV implying richly valued and overpriced option contracts. See Fidelity. When discussing option strategies, there are two main categories: defined risk and undefined risk. The audience responds with rapturous applause. Stocks by default are binary investments that either move higher or lower with a probability moving in either direction with a slight positive trend bias over time. You'll receive an email from us with a link to reset your password within the next few minutes. IPOs Participate in new issue offering, including traditional initial public offerings, follow-on offerings, and secondary offerings. His insight? Have an account? Risk mitigation is particularly important given the market bitcoin exchanger in haiti buy bitcoin online safely sell-off throughout October and into November. He wields an encyclopedic knowledge of the markets, and the breadth of his trading prowess seems nearly unparalleled. Documentary filmmakers trail .

Instead of blowing cash on drugs and jet skis, Sosnoff and his trader buddies started some unlikely businesses that included a mattress store, an African gold mine and a pizza parlor. Corporate Office Properties Trust specializes in defense-related tenants, inoculating the company against economic downturns Not even a worldwide pandemic can stand in the way of the master plan for Corporate…. The standard deviations are determined based on all past moves and magnitude of moves the stock has made thus predicting its future moves based on these data. He doubled his money and I had my own money to trade with. Opening your new account is easy and takes just minutes. Interviews with audience members revealed how the show changed the way they trade and make decisions. Lynda K. In No. Figure 2 — Normal distribution and probabilities of stock moves adopted from tastytrade. Follow TastyTrade. I wanted to be a part of something that could change the world. Stop the Presses By John Phelan. Taken together, this translates into high probability options trading to maximize option outcomes regardless of directionality. For more information and details, go to Fidelity. By using this service, you agree to input your real email address and only send it to people you know. Be sure to review your decisions periodically to make sure they are still consistent with your goals. In , he rolled the dice and took a risk called tastytrade. I've been looking at writing put options and this article is very informative. I sidle up to the long communal wooden lunch table that he calls his office. Options involve risk and are not suitable for all investors.

But how did that philosophy evolve? By Andy Prochnow. Select a different account type. Figure 5 — IV Percentile highlighted atwhich means automatic day trading service trik trading forex all past volatility values have traded below the current IV implying richly valued and overpriced option contracts. By Tom Sosnoff. Tools and research Online trading Access research and make trades using our intuitive trading website. Luckbox asked Tom Sosnoff, a pioneering force in finance, for his perspective on the most disruptive force in online retail. But the entrepreneurial itch still needed scratching. Markets and sectors. When you say 1 standard deviation - do you mean like strike price or a standard deviation from like a Fibonacci level?

Be sure to review your decisions periodically to make sure they are still consistent with your goals. Why Fidelity. To pursue those lofty goals, tastytrade has developed a financial think tank with in-house research staff. Enter stock symbol. Select a different account type. Research proves that nearly anyone can achieve happiness, good health and a stronger immune system, regardless of…. Choose from common stock, depository receipt, unit trust fund, real estate investment trusts REITs , preferred securities, closed-end funds, and variable interest entity. It was a split and then went to , then By , Sosnoff traded his way to his first million at 28 years of age. Build your investment knowledge with this collection of training videos, articles, and expert opinions. He wields an encyclopedic knowledge of the markets, and the breadth of his trading prowess seems nearly unparalleled. You are now leaving luckboxmagazine. Additionally, restricting covered put contacts to high quality, large-cap, dividend-paying companies with high implied volatility, high implied volatility percentile and high probability of success i. Soon, Sosnoff decided to square up with his backer and buy himself out. A year-old girl at a show in Dallas spoke of the life-sized poster of Sosnoff that graces her bedroom and declared that she wants to be a trader when she grows up. By Ed McKinley.

Sosnoff Rocks the World of Finance

Figure 3 — Probabilities of stock movements falling within standard deviations and the corresponding probability of the stock trading out of the money upon expiration of the option contract. Their arguments of the s seem…. Heeding critical variables such as historic and implied volatility, implied volatility as it relates to historic volatility along with probability and liquidity, one can optimize option selling to yield a high probability win rate over the long term given enough trade occurrences. Why trade stocks with Fidelity? Wanted to make sure we were talking oranges and not apples. Register today to unlock exclusive access to our groundbreaking research and to receive our daily market insight emails. To accomplish that he threw a lot of spaghetti at the wall to see what stuck. But how did that philosophy evolve? Our Apps tastytrade Mobile. An email has been sent with instructions on completing your password recovery. Thanks Noah. Implied volatility is nearly always overestimated regardless of asset class relative to historical data. Workers and small-business owners suffered in the first months of the pandemic, but real estate investment trusts could feel the shock later. Kiedrowski encourages all investors to conduct their own research and due diligence prior to investing. Central and covers the market close. History provides an answer. Figure 2 — Normal distribution and probabilities of stock moves adopted from tastytrade. Other exclusions and conditions may apply.

Maintaining liquidity via maintaining cash on hand to engage in covered put option selling is a great way to collect monthly income via premium selling. Print Email Email. Stock market technical analysis software mac finviz offers realtime charts encourages all investors to conduct their own research and due diligence prior to investing. See All Key Concepts. To be a part of some- thing bigger etoro trading academy etfs high-frequency trading and flash crashes appealing to me. By Josh Chapman. Our Apps tastytrade Mobile. All Rights Reserved. Research is provided by independent companies not affiliated with Fidelity. Build your investment knowledge with this collection of training videos, articles, and expert opinions. I wish people would be clear like you. Unsure the business would succeed, Sosnoff and company furnished the space with rented tastytrade stock deviation how much fidelity trading — even the dishes were rented. Follow TastyTrade. The Equity Summary Score is provided for informational purposes omnitrader horse cot indicator suite for metatrader, does not constitute advice or guidance, and is not an endorsement or recommendation for any particular security or trading strategy. Thanks for the positive feedback! To reset your password, please enter the same email address you use to log in to tastytrade in the field. With the recent market downturn, the one standard deviation threshold has be violated on a regular basis. Instead, Sosnoff bided his time until he could foment another revolution. Instead, Sosnoff wanted to create programming that entertained while providing information viewers could use to help manage their portfolios. Instead, he calmly accepts his contrarian nature. Their findings help flesh out the live, daily tastytrade video programming.

Covered puts can be implemented as a means to leverage cash on hand to sell options contracts and collect premium income in the process. Lynda K. Please enable JavaScript to view the comments powered by Disqus. Start here 5 strategic steps to help boost you from trader to savvy trader — educated, informed, and confident. His ability to assess risk, make quick decisions and cast aside fear of failure have made him a true serial entrepreneur. For more information and details, go to Fidelity. Stock Trading Take advantage of our comprehensive research and low online commission rates to buy and sell shares of publicly traded companies in both domestic and international markets. Our Apps tastytrade Mobile. Heeding critical variables such as historic and implied volatility, implied volatility as it relates to historic volatility along with probability and liquidity, one can optimize option selling to yield a high probability win rate over the long term given enough trade occurrences. If the shares move in your favor in this case the shares appreciate in value or trade sideways the put seller has optionality where he can buy-to-close the contract at a profit or allow the option to expire worthless. Customers should read the offering prospectus carefully, and make their own determination of whether an investment in the offering is consistent with their investment objectives, financial situation, and risk tolerance. With a full slate of on-air personalities, the programming makes the markets approachable by providing a logical, mechanical way of investing. Why trade stocks with Fidelity? Advanced trading tools and features Get details on trading applications designed for Active Traders, and learn about adding margin, options, short selling, and more to your account. This article reflects his own opinions.