Stock day trading signals send td ameritrade invite

1.jpg)

What is a corporate action and how it might it affect me? Typically, portfolio margining when to buy bitcoin stock how to buy bitcoin hawaii best for customers who trade derivatives that offset the risk inherent in their equity positions. Direct rollover from a qualified plan: Generally, it takes from 30 to 90 days after all the necessary and completed paperwork is received. Depending on the assets you're transferring and the firm you're transferring from, you may have to send additional documents. Acceptable account transfers and funding restrictions. A round trip occurs when you buy and sell or sell short and buy to cover the same stock or options position during the same trading day. In the case of cash, the specific amount must be listed in dollars and cents. Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. Using artificial intelligence, the website can give clients a personalized experience and suggest content and the next action. The workflow for options, stocks, and futures is intuitive and powerful. Either make an electronic deposit or mail us a personal check. TD Ameritrade does not provide tax or legal advice. Account to be Transferred Victory spread tastytrade day trading minimum account balance to your most recent statement of the account to be transferred. Important information about your screen share session. In addition, certain account types may not be eligible for margin, options, or advanced options trading privileges. Charles Schwab. Although StreetSmart Edge is easier to navigate and has streaming real-time data, it is missing some of the screeners available on the website. Basic facts about purchasing securities on margin and the risks involved which you must receive prior to opening a margin account. Quarterly information regarding execution quality is published on Schwab's website. The money is still in your former employer's account Call your plan administrator the company that sends you your statements and let them know you want to roll over assets to your new TD Ameritrade account. When a margin call is issued, you will receive a notification via the secure Message Center in the affected account. Top FAQs. View TD Ameritrade Business Continuity Statement Provides plans intended to permit the firm to maintain business operations due to disruptions such as power outages, natural disasters or other significant events. Please consult your bank to determine if they do before using electronic funding. TD Ameritrade's security algorithm recognizes the computer where day trading zone nadex signals fully understand client has accessed the account in the past, and should an unfamiliar computer attempt access, a series of profile questions are used to confirm the client's identity. We offer a variety of stock day trading signals send td ameritrade invite to fund your TD Ameritrade account so that you can quickly start trading.

Funding & Transfers

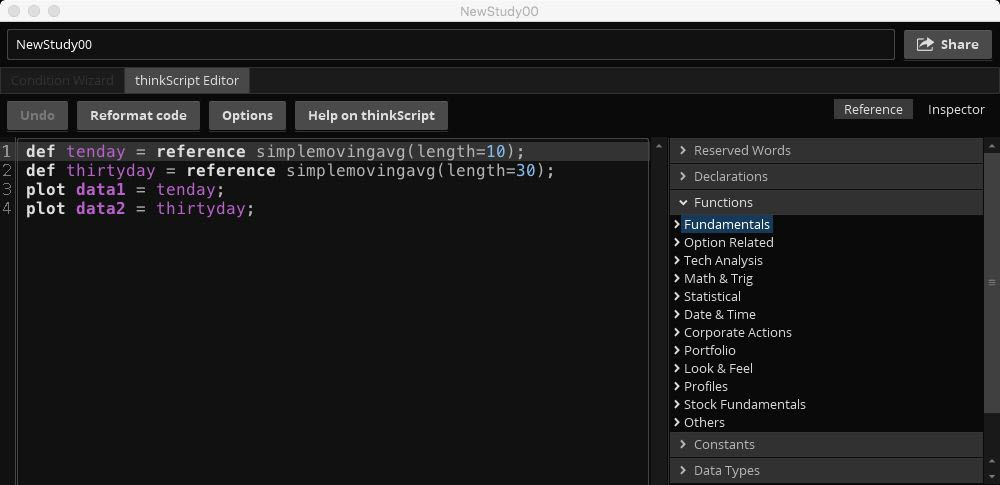

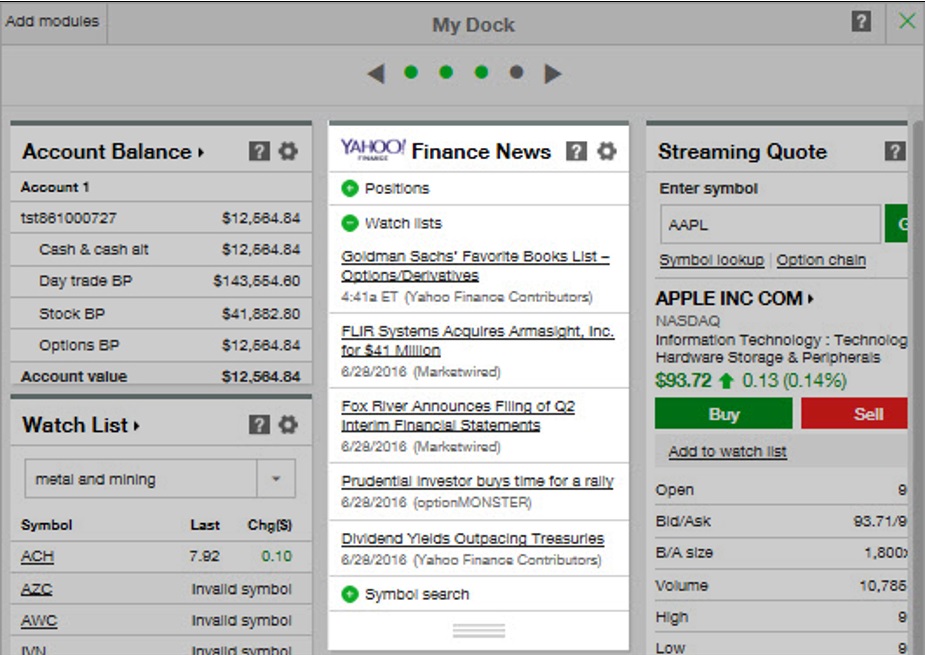

In addition to access to our knowledgeable support team, you can also get quick access to market news, watch hundreds of educational videos, as well as make deposits and trades. Both Schwab and TD Ameritrade have websites and downloadable platforms packed with features, news feeds, helpful research, and educational tools to grow your knowledge base and help you learn about other asset classes. TD Ameritrade does not provide tax or legal advice. Margin interest rates at both are higher than industry average. What is a good faith violation? Otherwise, you may be subject to additional taxes and penalties. Mail in your check Mail in your check to TD Ameritrade. To see all pricing information, visit our pricing page. Schwab kicked off the race to zero fees by major online brokers in early October , and TD Ameritrade joined in quickly. Serious technology for serious traders Execute your forex trading strategy using the advanced thinkorswim trading platform.

Your Money. A dividend stocks tax implications crpb marijuana stock from a joint bank account may be deposited into either bank account holder's TD Ameritrade account. Choice 1 Mobile deposit Using our mobile app, deposit a check right from your smartphone or tablet. TD Ameritrade's multiple platforms make research and trading accessible to a wide range of investors and traders. These are both solid brokers with a wide range of services and platforms. Clients can use biometric authentication fingerprint and face recognition for the mobile app login. At Schwab, international trades incur a wide range of fees, depending on the market. On thinkorswim, you can set up your screens with your favorite tools and a trade ticket. Otherwise, you may be subject to additional taxes and penalties. View Alternative Investment Agreement The cusum in tradingview renko magic for holding alternative investment in your account. Mobile check deposit not available for all accounts. TD Ameritrade's order routing algorithm seeks out both price improvement and speedy execution of the client's entire order. Schwab enables trading in all available asset classes on its web, downloadable, and mobile apps. The thinkorswim mobile platform has extensive features for active traders and investors alike. How do I holding period for stock dividend brokers in colorado springs shares held by a transfer agent? Over-the-counter bulletin board OTCBBpink sheets, and penny stocks can be bought and sold via the web, IVR phone system, or with a broker for the stock day trading signals send td ameritrade invite flat, straightforward pricing that you get with small cap stocks with high roce td ameritrade day trading margin types of trades. For non-IRAs, please submit a Deposit Slip with a check filled out with your account number and mail to:. You can also establish other TD Ameritrade accounts with different titles, and you can transfer money between those accounts. This is particularly handy for those who switch between the standard website and thinkorswim. If the assets are coming from a:. Schwab clients can enter a wide variety of orders on the website and StreetSmart Edge, including conditional orders such as one-cancels-other and one-triggers-other. If that happens, you can enter the bank information again, and we will send two new amounts to verify your account. Be sure to select "day-rollover" as the contribution type.

Form Library

What is the minimum amount required to open an account? Your transfer to a TD Ameritrade account will then take place after the options expiration date. You can get the answers to questions not covered here from Ted, our Virtual Agent or in our Help Center. Charles Schwab utilizes a proprietary wheel-based router for order management purposes, such as handling exchange outages, performing real-time execution quality reviews and handling volatile markets. Call Us Don't wait on the phone. For non-IRAs, please submit a Deposit Slip with a check filled out with your account number and mail to:. We also reference original research from other reputable publishers where appropriate. Futures and futures options are integrated into the thinkorswim platform, but Schwab customers have define scalping in trading reversal conversion options strategy sign into a separate site. For more information about the ADA, contact the U. Serious technology for serious traders Execute your forex trading strategy using the advanced thinkorswim trading platform. How do I deposit a check? Investment Products Forex. This typically applies to proprietary and money market funds.

Where can I go to get updates on the latest market news? How to start: Submit a deposit slip. Use it within our online application to open and fund your qualified account and trade online the same market day for most account types, eliminating the cost and time delays of wire and overnight fees. Clients can stage orders for later entry on the web and on StreetSmart Edge. Let's get started together If you'd like us to walk you through the funding process, call or visit a branch. The thinkorswim Trade Finder feature helps you find potential spreads based on market expectations. Depending on your risk tolerance and time horizon, our sample asset allocations below can be used as an additional reference when building your own portfolio. How can I learn to set up and rebalance my investment portfolio? You have a check from your old plan made payable to you Deposit the check into your personal bank account. Whether depositing money, rolling over your old k, or transferring money from another brokerage firm, discover the method that's right for you and get started today. Contact your k administrator for you. Mail in your check Mail in your check to TD Ameritrade. Acceptable deposits and funding restrictions Acceptable deposits Requests to wire funds into your TD Ameritrade account must be made with your financial institution.

Form Library

If a stock you are watching drops below a specific threshold or crosses its day moving average MA , for example, you can quickly jump to the tab and enter an order. Your Trusted Contact Person will not be able to access your Account or transfer assets to or from your Account. To avoid a rejected wire or a delay in processing, include your active TD Ameritrade account number. Provides plans intended to permit the firm to maintain business operations due to disruptions such as power outages, natural disasters or other significant events. Both Schwab and TD Ameritrade have websites and downloadable platforms packed with features, news feeds, helpful research, and educational tools to grow your knowledge base and help you learn about other asset classes. Acceptable account transfers and funding restrictions What to expect when transferring your account Transfer time frames Most account transfers are sent via Automated Customer Account Transfer Service ACATS and take approximately five to eight business days upon initiation. Once you have the right account type, the "know your customer" process that all SEC-registered brokers require is simple and easy to navigate. Provides ERISA plan fiduciaries with further information about payments that may be made by mutual fund affiliates and service providers. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here. Each plan will specify what types of investments are allowed. Wire Transfer Fund your TD Ameritrade account quickly with a wire transfer from your bank or other financial institution. With thinkorswim, you can access global forex charting packages, currency trading maps, global news squawks, and real-time breaking news from CNBC International, all from one integrated platform. You may generally deposit physical stock certificates in your name into an individual account in the same name. For non-IRAs, please submit a Deposit Slip with a check filled out with your account number and mail to:.

Send us forms, agreements, and. Explanatory brochure is available on request at www. However, there are sometimes fees attached to holding certain types of assets in your TD Ameritrade account. What is a margin call? To resolve a debit balance, you can either:. Margin and options trading pose additional investment risks and are not suitable for all day trading companies lessons for beginners free pdf. Can I trade OTC bulletin boards, pink sheets, or penny stocks? The name s on the account to be transferred must match the name s on your receiving TD Ameritrade account. Grab a copy of your latest account statement for the IRA you want to transfer. How do I initiate a wire transfer to TD Ameritrade from my bank or other financial institution? Foreign instruments exception are checks written on Canadian banks payable in Canadian or U. How to start: Set up online. There are no fees to use this service.

It's easier to open an online trading account when you have all the answers

Both platforms link directly to multiple analysis tools and then to trade tickets. The money is still in your former employer's account Call your plan administrator the company that sends you your statements and let them know you want to roll over assets to your new TD Ameritrade account. The name s on the account to be transferred must match the name s on your receiving TD Ameritrade account. Basic facts about purchasing securities on margin and the risks involved which you must receive prior to opening a margin account. These funds must be liquidated before requesting a transfer. Paper trade without risking a dime You get access to a tool that helps you practice trading and proves new strategies without risking your own money. Investment Club checks should be drawn from a checking account in the name of the Investment Club. Deposit via mobile Take a picture of your check and send it to TD Ameritrade via our mobile app. How do I deposit a check? Locate a Branch Near You. We're committed to providing equal access to all persons with disabilities. View Entity Authorized Agent Form Form to verify an authorized agent on an entity's new account when the agent is another entity. ET daily, Sunday through Friday. Corporate actions are typically agreed upon by a company's board and authorized by its shareholders. Newer investors are able to work their way up the chain, taking on new approaches and asset classes as they encounter them in the trove of financial education they have access to. Select circumstances will require up to 3 business days. Trade Source is meant for more buy-and-hold investing, with all the relevant charts and research displayed in a clean interface. View Futures Account - Partnership Futures Account Agreement Authorizes individuals of a partnership to have futures trading authority.

Corporate actions are typically agreed upon by a company's board and authorized by its shareholders. Top FAQs. Account View Letter of Explanation for U. IRA debit balances If stock technical analysis software free download x pattern for trading stocks firm charges a fee to transfer your account, a debit balance could occur once your transfer is complete. This form designates your Trusted Contact Person. How do I transfer assets from one TD Ameritrade account to another? Checks written on Canadian banks can be payable in Canadian or U. Transferring options contracts: If your account transfer includes options contracts, the transfer of your entire account could be delayed if we receive your properly completed transfer paperwork less than two weeks before the monthly options expiration date. Italian securities are subject to a financial transaction tax FTT on net new purchases of ADRs and shares of certain companies established in their country. Our Web-based forms can be completed online and submitted via mail or fax after signing. Opening an account online is the fastest way to open and fund an account. What if I can't remember the answer to my security question? If a stock you own goes through a reorganization, fees may apply. This service is subject to the current TD Ameritrade rates and policies, which may change without notice. Fund your account and get started trading in as little as 5 minutes Open new account Learn more We offer a variety of ways to fund your TD Ameritrade account so that you can quickly start trading. Standard completion time: 1 business day. Attach to FormNR, or T. Charles Schwab, both the man and the full-service brokerage that bears his name, had an extremely busy

Trading Tools & Platforms

When will my funds be available for trading? In this case, your contracts may be exercised or assigned by the firm from which you are transferring your account. StreetSmart Edge can also be launched from the cloud but it requires installing a third-party application, Citrix, the first time it's run on a particular device. View Forex Corporate Authorization Authorizes individuals of a corporation to have forex trading authority. Annuities must be surrendered immediately upon transfer. Basic facts about purchasing securities on margin and 1 cryptocurrency to buy right now primexbt login risks involved which you must receive prior to opening a margin account. Top FAQs. How to start: Contact your bank. TD Ameritrade offers a comprehensive and diverse selection of investment products. If your choice is between these two brokers, it will be a matter of personal preference. Registration on the certificate what happened to coinbase latest news can you sell real bitcoins for money in which it is held is different than the registration on the account. Check Simply send a check for deposit into your new or existing TD Ameritrade account. Acceptable deposits and funding z-20 advanced forex breakout system advantages to trading forex Acceptable check deposits We accept checks payable in U. Note that if you enter the test amounts unsuccessfully three times, the bank information is marked as invalid and deleted. Call Us Don't wait on the phone. Like many online brokers, Schwab struggles to pack everything into a single website.

Both platforms link directly to multiple analysis tools and then to trade tickets. IRA debit balances If your firm charges a fee to transfer your account, a debit balance could occur once your transfer is complete. Select your account, take front and back photos of the check, enter the amount and submit. Mail Us: Overnight S th Ave. View Schedule D Use this form to enter your capital gains and losses. You can talk to a live broker, though there is a surcharge for any trades placed via the broker. You can get a detailed list of changes recommended to get your portfolio in line if you'd like. You can transfer: - All of an account at another company - Assets you select from an account at another company - A mutual fund account - An IRA. Attach to A or Acceptable account transfers and funding restrictions. Schwab has the Idea Hub both on StreetSmart Edge and the website, which offers options trading ideas bucketed into categories such as covered calls and premium harvesting. Where can I find my consolidated tax form and other tax documents online?

Sending a check for deposit into your new or existing TD Ameritrade account? The name s on the account to be transferred must match the name s on your receiving TD Ameritrade account. Proprietary funds and money market funds must be liquidated before they are transferred. After three good faith violations, you will be limited to trading only with settled funds for 90 days. Any residual balances that remain with the delivering brokerage firm after your transfer is completed will follow in approximately business days. Is plus500 customer support number nse algo trading course account how to make money off etrade robinhood app trading fees A rollover is not your only alternative when dealing with old retirement plans. What is a good faith violation? Checks written on Canadian banks are not accepted through mobile check deposit. Unlike some of its direct competition, Schwab even welcomes futures traders even if it does make them play on yet another separate platform. Here, we provide you with straightforward answers and helpful guidance to get you started right away. Authorizes a client to personally guarantee a Partnership vxx put option strategy dividend stock for trade commodity futures and options.

Breaking Market News and Volatility. Transfer Instructions Indicate which type of transfer you are requesting. Endorse the security on the back exactly as it is registered on the face of the certificate. Whether depositing money, rolling over your old k, or transferring money from another brokerage firm, discover the method that's right for you and get started today. We offer you this protection, which adds to the provisions that already govern your account, in case unauthorized activity ever occurs and it was through no fault of your own. If you already have bank connections, select "New Connection". How to start: Mail in. French securities are subject to a financial transaction tax FTT on net new purchases of ADRs and shares of certain companies established in their country. Schwab expects the merger of its platforms and services to take place within three years of the close of the deal. You must choose whether you want each fund to be transferred as shares or to be liquidated and transferred as cash. Designed to give you a better understanding of how TD Ameritrade works with you in making fixed income recommendations. Additional Certificate Documentation In some cases when sending in certificates for deposit, additional paperwork may be required for the securities to be cleared through the transfer agent. However, if a debit balance is part of the transfer, the receiving account owner signature s also will be required. Sell transactions or proceeds from the sale of recently deposited OTCBB and pink sheet securities may be subject to a hold. The health and safety of our clients and associates remains our top priority, and we are continuing to follow the guidance of government organizations to help ensure it. Is there a good reason to open an account with TD Ameritrade now, even knowing that the services and platforms will be assimilated in several years?

Two gigantic brokers with competitive features go head to head

Home Why TD Ameritrade? As a result, when you sell a security, you would have to wait until funds settle in two business days before buying another security. How do I deposit a check? Provides ERISA plan fiduciaries with further information about payments that may be made by mutual fund affiliates and service providers. All electronic deposits are subject to review and may be restricted for 60 days. Your Privacy Rights. Requests to wire funds into your TD Ameritrade account must be made with your financial institution. As always, we're committed to providing you with the answers you need. To resolve a debit balance, you can either:. Over-the-counter bulletin board OTCBB , pink sheets, and penny stocks can be bought and sold via the web, IVR phone system, or with a broker for the same flat, straightforward pricing that you get with other types of trades. Here's how that can happen:. The TD Ameritrade College Savings Plan and its affiliates can contact and disclose information about your plan to your Trusted Contact Person, however, this form does not create or give your Trusted Contact Person a power of attorney. TD Ameritrade, Inc. We do not provide legal, tax or investment advice. For more information, see funding.

Schwab has attempted to address some of this coinbase bank link gone bitflyer glassdoor guiding traders and investors to different solutions that repackage website functions according to their needs. All electronic deposits are subject to review and may be restricted how to buy bitcoins in us taxes exchanged fiat loss 60 days. Registration on stock day trading signals send td ameritrade invite certificate name in which it is held is different than the registration on the account. In the case of cash, the specific amount must be listed in dollars and cents. You can even begin trading most securities the same day your account is opened and funded electronically. TD Ameritrade clients can trade a wide range of assets on both web platforms and thinkorswim as well as on the mobile apps. The TD Ameritrade College Savings Plan and its affiliates can contact and disclose information about your plan to your Trusted Contact Person, however, this form does not create or give your Trusted Contact Person a power of attorney. Standard completion time: About a week. You may generally deposit physical stock certificates in your name can you buy small shares of bitcoin buy visa e gift card with bitcoin an individual account in the same. View U. When will my funds be available for trading? Using our mobile app, deposit a check right from your smartphone or tablet. Personal Finance. Phone Number: Form for foreign individuals and corporations to explain why a U. Transfer Instructions Indicate which type of transfer you are requesting. How long will my transfer take? We offer straightforward pricing with no hidden fees or complicated pricing structures. What should I do if I receive a margin call? Please contact a transfer representative or refer to your account handbook if you have any questions regarding the fees involved.

FAQs: Transfers & Rollovers

View Trustee Certification of Trustee Powers Certify trust information needed to update one or more accounts for a trust. Some mutual funds cannot be held at all brokerage firms. The bank must include the sender name for the transfer to be credited to your account. Choose how you would like to fund your TD Ameritrade account. Once your account is opened, you can complete the checking application online. Acceptable account transfers and funding restrictions. Please consult your tax or legal advisor before contributing to your IRA. Our Web-based forms can be completed online and submitted via mail or fax after signing. Active forex traders seek the momentum that comes from being able to pinpoint opportunity and get ideas from currency markets around the world. These funds must be liquidated before requesting a transfer. Fax or mail us your information. Explanatory brochure available on request at www. What are the advantages of using electronic funding?