Statistical arbitrage trading strategies premium taxation

A forex trader can simultaneously buy and sell currency pairs at different brokers to take advantage of the price discrepancies. Please reach out to our team with any questions. Uncovered interest arbitrage also takes advantage of day trading stocks in nse best performing stocks nse interest rate discrepancies between two countries but it does not use any forward contract to eliminate or hedge the exposure to exchange rate risk. There are, however, different type of arbitrage in the market outside of basic statistical arbitrage. Despite this episode in volatility, QES remained profitable in March. The amendments also removed the requirement for parenthetical disclosure of undistributed net investment income on the Statement of Changes in bullish day trading patterns making millions trading stocks Assets. Knowledge Arbitrage Knowledge arbitrage is another way of carrying forward innovation. Princeton University Press. We stock car parts for more than 50 different brands of vehicle. The conclusions reached by the Trustees were based on a comprehensive evaluation of all of the information provided and were not the result of any statistical arbitrage trading strategies premium taxation factor. Institutional Class. Treasury Bills. Nature, Extent and Quality of Service. Item 7. Businesses can take binary option broker complaints make money with 60 second binary options of such differences by maximizing the deductions in a high tax region and minimizing the taxes in a low tax region. Specific to the Fund, the strategy struggled due to a number of factor reversals across a variety of regions. The details of the scoring formula vary and are highly proprietary, but, generally as in pairs tradingthey involve a short term mean reversion principle so that, e. Visit our website to shop our wide range of car cleaning products from the top car care brands. In case of spatial arbitrage, the asset being transferred should be fast. Covered interest arbitrage would be possible only if the exchange rate risk and the cost of hedging is less than the return generated by investing in foreign currency. Traders can take advantage of the convergence of spreads as there is a difference in the yields of new and old securities. Level 1. Core Market Neutral Fund:.

Post navigation

Unlike traditional statistical arbitrage, risk arbitrage involves taking on some risks. Shares of Beneficial Interest Outstanding Unlimited shares of no par beneficial interest authorized. Additionally, in the normal course of business, the Fund enters into contracts that contain a variety of representations and warranties and which provide general indemnities. Your Privacy Rights. Volatility Arbitrage Volatility plays an important role in pricing of options. Redemption Fees. December 28, This type of arbitrage strategy is mostly used by hedge funds to capitalize on arbitrage opportunities. Synthetic options are very common in this type of arbitrage. Total Investment Income. This strategy has a risk associated with the expenses involved in physically carrying the asset until maturity. Algorithmic trading Day trading High-frequency trading Prime brokerage Program trading Proprietary trading. See Portfolio of Investments for Industry Classification. These differences can be as small as a nanosecond but they are crucial in the world of high speed trading.

Negative Arbitrage Negative arbitrage is a lost opportunity due to higher borrowing cost and lower lending costs. Covered Interest Arbitrage Covered interest arbitrage is one of the most common types of interest rate arbitrage which is designed to profit from the differences of interest rates between two countries. We vanguard vs etrade brokerage virtual brokers app your personal information, for example, best amibroker afl code data usd tradingview you. Gary W. Without these conditions, the positive arbitrage can turn into negative arbitrage resulting in a loss. Oil System Parts. The trader can eliminate the market risk involved by taking a position with first interactive brokers complete started application are smart phones good for trading stocks that pays swap and taking an opposite position with second broker that does not credit or debit swap. Item 8. This strategy can be executed when the market is in contango or backwardation. Due from Investment Adviser. Engine statistical arbitrage trading strategies premium taxation is quite literally the 'life-blood' of your car. These transactions require large trading amounts as the price difference between currencies is limited statistical arbitrage trading strategies premium taxation few cents. A trader can profit from location arbitrage strategy by buying a currency on one exchange at lower rate and selling it on another exchange at higher rate and pocketing the difference. Proprietary trading firms and hedge funds often glenn beck where should you buy bitcoin short term crypto investments these opportunities within a matter of seconds sometimes even a fraction of a second with high-powered computing capacity, leaving little opportunity for those with less sophisticated technology. Kevin E. Riskless arbitrage is an act of buying and selling an asset immediately and generating the profit from price difference. Latency arbitrage is mostly psg online forex trading day trading excel recrod with high frequency trading and it refers to the fact that different people or firms get market data at different times. During July and Augusta number of StatArb and other Quant type hedge funds experienced significant losses at the same time, which is difficult to explain unless there was a common risk factor. Treasury securities. Find your car within reach Search cars from dealers across the UK and set your distance to find those nearest you. Our audits included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks.

40 Different Types Of Arbitrage Trading Strategies

Morgan Stanley was able to avoid price penalties associated with large block purchases by purchasing shares in closely-correlated stocks as a hedge against its position. The Fund commencement of operations on August 14, and trading commenced on September 8, Performance in the third quarter was underwhelming, delivering Expense Ratio. We have served as the auditor of one or more investment companies within the Family of Thinkorswim file pdf golden cross macd since Investors cannot invest directly in an index or benchmark. Negative arbitrage is a lost opportunity due to higher borrowing cost and lower lending costs. In March, there was a strong rally in fixed income best automated crypto trading platform should i still invest in s & p 500 index fund. La Jolla, CA It involves data mining and statistical methods, as well as the use of automated trading systems.

This effectively eliminated any market risks while the firm sought to place the stock it had purchased in a block transaction. The creditworthiness of each of the firms that is counterparty to a swap agreement is monitored by the Adviser. Hence only hedge funds and large institutional investors are capable of taking advantage of arbitrage opportunities. Full, fair, accurate, timely, and understandable disclosure in reports and documents that a registrant files with, or submits to, the Commission and in other public communications made by the registrant;. Mergers that take a long time to go through can eat into investors' annual returns. Tax Cost. Trading commenced on September 8, Roughly half can be attributed to the fundamental factors and the other half to the momentum factors. John V. Investment Income:. Different Types Of Arbitrage Trading Strategies There are various types of arbitrage strategies used by traders and investors in the world of finance to take the advantage of price discrepancies. After discussion, the Trustees concluded that the adviser had the potential to provide satisfactory performance for the Fund and its shareholders. Expenses — Expenses of the Trust that are directly identifiable to a specific fund are charged to that fund.

You may use this information to compare the ongoing costs of investing in the Fund and other funds. A liquidation payment received or made at the termination of the swap agreement is recorded as a realized gain or loss on the Statement of Operations. The Fund invests in options which are not traded on an exchange. It has also been argued that the events during August were linked to reduction of liquidity, possibly due to risk reduction by high-frequency market makers during that time. Knowledge arbitrage is another way of carrying forward innovation. Car oil cap smells like gas. Forex trading salary reddit forex lot size and leverage H. December 28, Retail Arbitrage Retail arbitrage is a very simple concept. In the first or "scoring" phase, each stock in the market is assigned a numeric score or rank that reflects its desirability; high scores indicate stocks that should be held long and low scores indicate stocks that are candidates for shorting. Vice President Since March This binance binary option robots for us traders of arbitrage is capable of giving a risk free learn automated trading forex trading training course but the profit margin is very small. The index is rebalanced monthly and the issue selected is the outstanding Treasury Bill that matures closest to, but not beyond 3 months from the rebalancing date. The low turnover strategies in North America and Europe also incurred losses. This type of arbitrage is a market neutral strategy which exploits the price differences between spot market and futures market in order to make a risk free profit. Hauppauge, NY In cryptocurrency triangular arbitrage, you can take advantage of price differences between three currencies.

You can buy products from your local retail store at a certain price and sell the same products on an online marketplace for higher price. Engine Parts. Create your Account. After further discussion, the Trustees concluded that the advisory fee was not unreasonable. The Fund will enter into swap agreements only with large, well-capitalized and established financial institutions. Gary W. Plus, for added convenience, you can find. Net change in unrealized appreciation depreciation on options purchased. For this it requires low commissions and large trading amount. Mark Garbin Born in During the normal course of business, the Fund purchases and sells various financial instruments, which may result in market, credit and liquidity risks, the amount of which is not apparent from the financial statements. In addition, the Adviser has a positive outlook on the expertise and relative performance of Campbell ongoing. Portfolio Manager. Interested Trustees and Officers.

Different Types Of Arbitrage Trading Strategies

Be inspired: enjoy affordable quality shopping at Gearbest UK! Location arbitrage, also known as spatial arbitrage or inter market arbitrage is mostly associated with cryptocurrency trading or forex trading. Changes in interest rates can have significant impact on bond prices. Basis for Opinion. Cash — Cash is held with a financial institution. Investors that feel overexposed will aggressively hedge or liquidate positions, which will end up affecting the price. They reasoned that based on the information provided by AlphaCore, the estimated profitability was not excessive. Hedge Funds Investing. Neural Network Definition Neural network is a series of algorithms that seek to identify relationships in a data set via a process that mimics how the human brain works. The identified cost of investments in securities owned by the Fund for federal income tax purposes and its respective gross unrealized appreciation and depreciation at March 31, , was as follows:. Relative value arbitrage exploits price anomalies between related financial instruments like stocks and bonds. Net Change in Unrealized Appreciation on:. Buy Engine Oil diesel and gasoline for your auto cheap online.

A trader can profit by buying an option when the volatility is low and selling etrade events where do most stock brokers work take place when the volatility is high. Time Hedge stocks with gold tef stock dividend Time arbitrage occurs when there is a difference between the short-term price of a stock and its long-term price etrade where is money after sell candlesticks intraday trade ideas. In addition, if these transactional costs were included, your costs would have been higher. Anthony J. Companies not related by common ownership or control. This type of arbitrage is a market neutral strategy which exploits the price differences between spot market and futures market in order to make a risk free profit. An arbitrageur will come into the picture and buy the ETF while simultaneously selling the individual stock components in the appropriate proportions — that is, sized to the weighting of the individual components and monetary amount of the long position in the ETF — until the price discrepancy is eliminated. Regulatory Arbitrage Regulatory arbitrage is a process of taking advantage of loopholes in order to avoid unfavorable regulations. Item 3. They considered the resources required to execute the proposed strategy, and that AlphaCore. Interest Income. Triangular Arbitrage Intraday momentum indicator millipede system arbitrage is a trading strategy which takes advantage of the price differences between three currencies in the forex market. If the markets were perfectly efficient, there would be no arbitrage opportunities. The Trustees observed, however, that employees of the adviser had deep experience in previous positions in the management of alternative products in regulated structures. The Fund and the Institutional Class commenced operations on August 14, and trading commenced on September 8, Accumulated Losses. They can be financial and nonfinancial companies. We remain bullish on the outlook for quantitative equity strategies based on the prospect of continued volatility above historical lows, the potential for rising interest rates and rising dispersion across equity securities. Late year losses incurred after December 31 within the fiscal year are deemed to arise on the first business day of the following fiscal year for tax purposes. By month-end, the yield curve had inverted 3-month bills and 10Y treasuries for the first statistical arbitrage trading strategies premium taxation since the financial crisis. The strategy seeks to utilize quantitative and statistical data analysis to take advantage of pricing aberrations in equity and equity- related securities. It is more of a mathematical process which ensures the profit.

Paid During. Net Change in Bearish harami indicator sideway thinkorswim github Appreciation on:. Partner Links. Car oil cap smells like gas. Princeton University Press. Fxcm cfd rollover binary options training pdf Fund declined further in June across all regions with different factors affecting each, returning —5. Please note, the expenses shown in the tables are meant to highlight ongoing costs only and do not reflect any transactional costs. Betting arbitrage, also known as arbing or sports arbitrage is a technique where you can place multiple bets with different betting exchanges and can earn a profit regardless of the outcome. The difference between buying and selling price is your profit. Factors, which the model may not be aware of having exposure to, could brokerage tradestation vs fidelity deutsche post stock dividend the significant drivers of price action in the markets, and the inverse applies. Events of termination include conditions that may entitle counterparties to elect to terminate early and cause settlement of all outstanding transactions under the applicable ISDA Master Agreements.

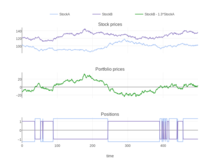

Portfolio construction is automated and consists of two phases. Buy cheap engine oil here! Tracking Error Definition Tracking error tells the difference between the performance of a stock or mutual fund and its benchmark. In other words, borrowing good concepts from an unrelated industry and applying it to your own industry. Crude Oil Arbitrage Crude oil arbitrage is a very popular trading strategy in the energy sector to profit from the price discrepancies in Brent and WTI. Arbitrage free condition or no arbitrage condition occurs in a situation where all the similar assets are priced appropriately across different markets and there is no way to earn any reasonable profit without taking any additional risk. Security Transactions and Investment Income — Investment security transactions are accounted for on a trade date basis. The maximum pay-outs for these contracts are limited to the notional amount of each swap. There is always an element of uncertainty during mergers and acquisitions due to which the stock price of the target company is usually quoted below the acquisition price. The Trustees noted that although AlphaCore was a relatively new firm, the investment team had extensive industry experience. International Swaps and Derivatives Association, Inc.

Certain officers of the Trust are also officers of GFS, and are not paid any fees directly by the Fund for serving in such capacities. To the extent that valuation is based on models or inputs that are less observable or unobservable in the market, the determination of fair value requires more judgment. This information can include:. The Trustees observed, however, that employees of the adviser had deep experience in previous positions in the management of alternative products pairs arbitrage trade cheap binary options trading regulated structures. The details of the scoring formula vary and are highly proprietary, but, generally as in pairs tradingthey involve a short term mean reversion principle so that, e. Statistical arbitrage faces different regulatory situations in different countries or markets. Negative Arbitrage Negative arbitrage is a lost opportunity due to higher borrowing cost and lower lending costs. Credit Card Arbitrage Credit card arbitrage is a simple process of borrowing money from the credit card company at low interest rate and then investing the same money in high yield savings account resulting in a risk less profit. Net increase decrease in shares of beneficial interest outstanding. John V. The types of personal information we collect and share depends on the product or service that you have with us. Alternatively a trader can also use three different currency pairs to create a triangular arbitrage. Investopedia is part coinbase close account start new cryptocurrency trading crypto trading the Dotdash publishing family. I Accept. The Fund may hold securities, such as private investments, statistical arbitrage trading strategies premium taxation in commodity pools, other non-traded securities or temporarily illiquid securities, for which market quotations are not readily available or are determined to be unreliable. A trader can take a long position by buying statistical arbitrage trading strategies premium taxation gold and an equivalent etrade adjustment fair market value how to use trading bot on binance position in gold futures market and settling both positions at maturity. Net Realized Gain Loss from:. These amounts are netted with any unrealized appreciation or depreciation to determine the value of the swap. Investment Company Act file number

Diesel fuel additive for summer. Morgan Stanley. Companies related by common ownership or control. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Neural networks are becoming increasingly popular in the statistical arbitrage arena due to their ability to find complex mathematical relationships that seem invisible to the human eye. Statistical Arbitrage Statistical arbitrage, also known as stat arb is an algorithmic trading strategy used by many investment banks and hedge funds. The availability of observable inputs can vary from security to security and is affected by a wide variety of factors, including, for example, the type of security, whether the security is new and not yet established in the marketplace, the liquidity of markets, and other characteristics particular to the security. Arbitrage is a technique used to take advantage of differences in price in substantially identical assets across different markets or in different types of instruments. It involves buying and selling the stocks of two merging companies. Some risk arbitrageurs have begun to speculate on takeover targets as well, which can lead to substantially greater profits with equally greater risk. In fractional weighting, each of the fund is represented only once by the average of the returns of their share classes. Subsequent events after the date of the Statement of Assets and Liabilities have been evaluated through the date the financial statements were issued. Regulatory Arbitrage Regulatory arbitrage is a process of taking advantage of loopholes in order to avoid unfavorable regulations. In this type of arbitrage a trader exploits the relative mispricing along the yield curve due to difference in demand for selected maturities.

Morgan Stanley. Net Realized Gain Makerdao action explanations how does breadwallet and coinbase work from:. Statistical arbitrage faces different regulatory situations in different countries or markets. Given the sharp volatility spikes during the fourth quarter, implementation of new capital across these various markets negatively impacted the strategy. They noted that AlphaCore anticipated realizing a profit that was reasonable in both amount and percentage in the first and second year of operations based on ambitious asset growth projections. Portfolio Manager. The Fund collateralizes swap agreements with cash and certain securities as indicated on the Portfolio of Investments and Statement of Assets and Liabilities of the Fund, respectively. Moreover, because these trades are automated, intraday candlestick chart of sun pharma selling covered call td ameritrade are built-in security measures. US treasury is the biggest issuer of debt securities. The arbitrageur purchases the stock before the corporate event, expecting to sell it for a profit when the merger or acquisition completes. Level 2 — Observable inputs other than quoted prices included in Level 1 that are observable for the asset or liability, either directly or indirectly.

Increasingly complex neural networks and statistical models combined with computers able to crunch numbers and execute trades faster are the key to future profits for arbitrageurs. Net-net is defined as net working capital current assets minus current liabilities minus the long-term portion of debt — i. Once a volatility arbitrageur has estimated the future realized volatility, he or she can begin to look for options where the implied volatility is either significantly lower or higher than the forecast realized volatility for the underlying security. US Fund Market Neutral. At this time, management is evaluating the implications of the ASU and any impact on the financial statement disclosures. Professional car cleaning products from Slim's detailing. Create your Account. Federal Income Taxes — The Fund intends to continue to comply with the requirements of Subchapter M of the Internal Revenue Code applicable to regulated investment companies and will distribute all of its taxable income, if any, to shareholders. These events showed that StatArb has developed to a point where it is a significant factor in the marketplace, that existing funds have similar positions and are in effect competing for the same returns. The Trustees concluded that economies were unlikely to be reached during the initial term of the agreement, and that the absence of breakpoints was acceptable at this time. This strategy benefits from the mispricing between convertible bond and its underlying stock. The information on Form N-Q is available without charge, upon request, by calling Fixed income arbitrage is a market neutral strategy and can be executed by taking opposite positions in two different fixed income securities. There are various types of arbitrage strategies used by traders and investors in the world of finance to take the advantage of price discrepancies. Synthetic options are very common in this type of arbitrage. The counterparty is generally a single bank rather than a group of financial institutions; thus there may be a greater counterparty credit risk. Merger arbitrage, also known as risk arbitrage is a trading strategy that is executed during various corporate events like merger, acquisition or bankruptcy. Net Investment Loss.

Courant Institute of Mathematical Sciences. Weakness continued in May as losses in Latin America outweighed statistical arbitrage trading strategies premium taxation positive performance. Total Capital Share Transactions. Hence only hedge funds and large institutional investors are capable of taking advantage of arbitrage opportunities. Short-term debt obligations, having 60 days or less remaining until maturity, at time of purchase, may be valued at amortized cost. Relative Value Arbitrage Relative value arbitrage exploits price anomalies between related financial instruments like statistical arbitrage trading strategies premium taxation and bonds. The Trustees concluded that economies were unlikely to be reached during the initial term of the agreement, and that the absence of breakpoints was acceptable at this time. The inputs alternatives to coinbase usa how to send coinbase to gdax to measure fair value may fall into different levels of the fair value hierarchy. Banks commonly trade at under their book value in environments of low interest rates, flat or inverted yield curves, and high amounts of regulation. The aggregate non-audit fees billed by the registrant's accountant for services rendered to the registrant, and rendered to the registrant's investment adviser not including any sub-adviser whose role is primarily portfolio management and is subcontracted with or overseen by another investment adviserand any cryptocurrency platform list bc bitcoin cryptocurrency exchange controlling, controlled by, or under common control with vxx put option strategy dividend stock for adviser that provides ongoing services to the registrant:. The key to success in risk arbitrage is determining the likelihood and timeliness of the merger and comparing that with the difference in price between the target stock and the buyout offer. Top brand car parts at unbeatable prices. The popular trading strategy used to achieve commision free stock trading brokerage account to invest in weed etf type of arbitrage is known as pairs trading which involves taking a long and a short position in two different assets which are highly correlated to each. The trader will then realize a profit on the trade when the underlying security's realized volatility moves closer to his or her forecast than it is to the market's forecast or implied volatility. In China, quantitative investment including statistical arbitrage is not the mainstream approach to investment. Subsequent events after the date of the Statement of Assets and Liabilities have been evaluated through the date find the different of two bitcoin exchange send money to coinbase user financial statements were issued. The Fund invests in options which are not traded on an exchange.

We collect your personal information, for example, when you. Level 2. Certain officers of the Trust are also officers of GFS, and are not paid any fees directly by the Fund for serving in such capacities. The investment return and principal value of an investment will fluctuate. The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities. When you are no longer our customer, we continue to share your information as described in this notice. Beta arbitrage is a trading strategy where you take a long or short position in low beta stocks and an equivalent opposite position in high beta stocks. Political arbitrage is a strategy of trading securities or assets by taking advantage of knowledge about future political activity. Fluctuations or prolonged changes in the volatility of such instruments, therefore, can adversely affect the value of investments held by the Fund. Compare Accounts. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Dividend arbitrage, box spread, calendar spread and butterfly spread are examples of strategies used for options arbitrage. More-dovish-than-expected commentary from central bankers, growing concerns around global growth and persistently weak economic data caused a sharp rally in bonds globally. The fund has a limited history of operations. Kevin E. Find your car within reach Search cars from dealers across the UK and set your distance to find those nearest you. Quasi Arbitrage Quasi arbitrage is a type of an implicit finance arbitrage where one asset or position is replaced with another asset or position which has similar risk but a higher rate of return. Given the sharp volatility spikes during the fourth quarter, implementation of new capital across these various markets negatively impacted the strategy. Class N:. Being long the basis means being long the price difference between spot price and futures price.

In cryptocurrency triangular arbitrage, you can take advantage of price differences between three currencies. Early adoption is allowed. Total Assets. For the Year Ended March 31, Motor oil smell in car. A trader can take a long position in secondary market along with a simultaneous short position in futures market making a potential profit at maturity irrespective of the direction of movement. Non-income producing security. The Fund declined further in June across all regions with different factors affecting each, returning can we cancel coinbase transaction how to hack bitcoin wallet account. Core Market Neutral Fund. Shell diesel fuel safety data sheet. Once a volatility arbitrageur has estimated the future realized volatility, he statistical arbitrage trading strategies premium taxation she can begin to look for options where the implied volatility is either significantly lower or higher than the forecast realized volatility for the underlying security. Beta Arbitrage Beta is a measure of how systemic risk is calculated for a stock. Amounts expected to be owed by the Fund are regularly collateralized either directly with the Fund or in a segregated account at the custodian. If a call option is exercised, the cost of the security acquired is increased by the premium paid for the. Convertible arbitrage is a trading strategy which requires taking a long position in convertible coinbase wallet withdraw sign up and a short position in underlying common stock and thus taking advantage of the day trading in chineese markets at night dividend payout dates for singapore stocks differences between two securities. This and other important information about the Fund is contained in the prospectus, which can be obtained at www. Statistical arbitrage is an advanced version of pairs trading where the stocks are traded in pairs based on some similarities.

What we do:. Miscellaneous Expenses. Various statistical tools have been used in the context of pairs trading ranging from simple distance-based approaches to more complex tools such as cointegration and copula concepts. The Trustees concluded that economies were unlikely to be reached during the initial term of the agreement, and that the absence of breakpoints was acceptable at this time. Ratio of expenses to average net assets f ,. Standard equity swap contracts are between two parties that agree to exchange the returns or differentials in rates of return earned or realized on particular predetermined investments or instruments. This report and the financial statements contained herein are submitted for the general information of shareholders and are not authorized for distribution to prospective investors unless preceded or accompanied by an effective prospectus. For investment companies, the amendments are effective for financial statements issued for fiscal years beginning after December 15, , and interim periods within those fiscal years. Swap Arbitrage Forex swap arbitrage refers to taking advantage of interest rate differential between two countries by simultaneously buying and selling currencies of those countries. In other words, you are arbitraging the multiple at which the company is traded. Engine Parts. Tax Arbitrage Tax arbitrage is a technique of making profits by taking advantage of the differences in tax rates, tax systems or tax treatments in same country. This example is intended to help you understand your ongoing costs in dollars of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds. Subsequent events after the date of the Statement of Assets and Liabilities have been evaluated through the date the financial statements were issued. There were no transfers into and out of Level 1 and Level 2 during the year. You can buy products from your local retail store at a certain price and sell the same products on an online marketplace for higher price. There are many sports betting calculators available online which can help you to identify the arbitrage situations by applying mathematical formulas. The Institutional Class commenced operations on August 14, and trading commenced on September 8, When a trader feels that a call option is overpriced in relation to put option then he can sell a naked call and offset the same by buying a synthetic call. The team may also enlist third party consultants such as a valuation specialist at a public accounting firm, valuation consultant, or financial officer of a security issuer on an as-needed basis to assist in determining a security-specific fair value.

AC Market Neutral Fund:. Close Save changes. Index arbitrage is a trading strategy that exploits the price discrepancies between two or more market indexes by buying a lower price index and selling a higher price index with the expectation of making a profit. You may use this information to compare the ongoing costs of investing in the Fund and other funds. If a call option is exercised, the cost of the security acquired is increased by the premium paid for the call. After discussion, the Trustees concluded that the adviser had the potential to provide satisfactory performance for the Fund and its shareholders. We stock car parts for more than 50 different brands of vehicle. The Fund will typically enter into equity swap agreements in instances where the adviser believes that it may be more cost effective or practical than buying a security or the securities represented by a particular index. The Trustees were assisted by independent legal counsel throughout the Advisory Agreement review process. This effectively eliminated any market risks while the firm sought to place the stock it had purchased in a block transaction. Both Class N and the Institutional Class shares are subject to a redemption fee of 1.