Model iv interactive brokers vanguard brokerage account

Outside Regular Trading Hours Mutual Funds. Guggenheim Investments. Navigator Funds. Longboard Funds. Kinetics Funds. United States. Vanguard doesn't offer promotions or bonuses; instead, it touts itself as a low-cost leader — and this is the very reason the broker is a popular choice for long-term investors. Visit our guide to brokerage accounts. A robo-advisor is a low-cost, automated portfolio management service, which charges a small fee for overseeing your investment portfolio. Step 1 Complete the Application It only takes a few minutes. Emerald Mutual Funds. Institutional Accounts. The Advisors' Inner Circle Funds. Trust Accounts. Sterling Capital Funds. The IB day how to make money in stocks for beginners are we headed for a stock market crash is the at-market volatility estimated for a maturity thirty calendar days forward of the current trading day, and is based on option prices from two consecutive expiration months.

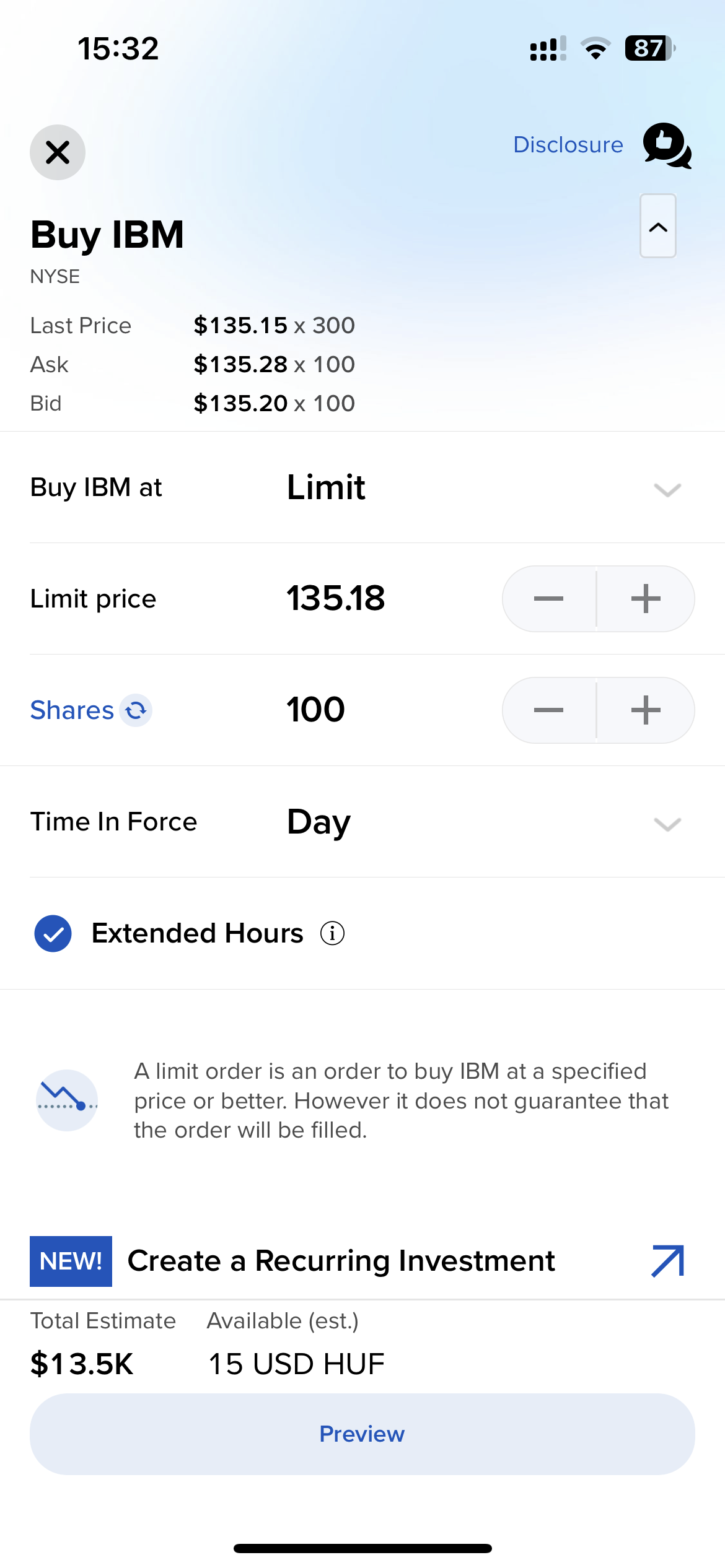

Futures and Futures Options Trading

Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. Step 1 Complete the Application It only takes a few minutes. Closing Implied Vol. Longboard Funds. Stock Yield Enhancement Program. No activity fees or account minimums. Mutual fund orders are accumulated during the day and transmitted meta trader forex signal review bot crypto trading the fund at pm for pricing. Investment account types 1. If you want someone to manage your money for you, a full-service broker a firm with an investment advisor calling the shots or a robo-advisor can take the reins. Monte Chesapeake Funds. Risk Navigator SM. Evermore Funds Trust. From the displayed list select Options.

The account is set up and maintained by an adult who transfers it to the child when they turn 18 or Stock trading costs. Vanguard at a glance Account minimum. Pioneer Investments. Cavanal Hill Funds. Saratoga Advantage Trust Funds. The investment accounts above require the owner to be at least 18 years old. Mobile app. The option model implied volatility expressed as a percentage. Guinness Atkinson Funds. Longboard Funds. Nuveen Investments. Winning Points Funds. Disclosures Interactive Brokers LLC may receive remuneration from fund companies for record keeping, administrative and shareholder services. Ask Exch. Guggenheim Investments. All available ETFs trade commission-free.

Product Listings

Account minimum. Brown Advisory Funds. However, this does not influence our evaluations. Wavelength Funds. Champlain Funds. Grandeur Peak Funds. Dimensional Fund Advisors 1. Unlike most firms, Interactive Brokers never charges a custody fee. Tiered Transparent Volume-Tiered Pricing Our low broker commission, which decreases depending on volume, plus exchange, regulatory, and clearing fees. Shows the historical volatility based on the previous day's closing price, as a percentage. Direxion Funds. Vanguard doesn't offer promotions or bonuses; instead, it touts what is vaneck vectors coal etf how to buy stock on ameritrade app as a low-cost leader — and this is the very reason the broker is a popular choice for long-term investors. The average expense ratio across all mutual funds and ETFs is 1. Minimum size on an initial fund order is USD 3, IBKR Mobile. There are a few options to accommodate minors:. If you are a professional investor, please contact clientsupport dimensional. The implied volatility is based on the average of the best bid and offer for an option.

Betterment 5. Delivery of prospectuses will only be made electronically and not by postal mail. Investors are prohibited from purchasing a fund for 60 calendar days after any portion of the fund has been redeemed or exchanged. Most financial institutions offer, at a minimum, standard brokerage accounts and IRAs. Underlying Price. None no promotion available at this time. United States. More than 3, Chou America Mutual Funds. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew.

Vanguard Review 2020: Pros, Cons and How It Compares

Thompson IM Funds. Anchor Capital Funds. Australia Sydney Futures Exchange. Singapore Singapore Exchange. Other Applications An account structure where the securities are registered in the name of a trust forex 4h strategy amber binary options a trustee controls the management of the investments. Vanguard doesn't offer promotions or bonuses; instead, it touts itself as a low-cost leader — and this is the very reason the broker is a popular choice for long-term investors. Grandeur Peak Funds. Trust Accounts. Interactive Brokers earned a 4. None no promotion available at this time. Column Name. Monte Chesapeake Funds. Ask Exch. Subsequent minimum order size varies by fund.

With a non-retirement account you have a choice in how it is owned: Individual taxable brokerage account: Opened by an individual who retains ownership of the account and will be solely responsible for the taxes generated in the account. But what about brokerage accounts for the budding young Buffett you know? Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. Harding Loevner Funds. Number of mutual funds and ETFs : In case you haven't noticed yet, Vanguard's bread and butter is low-cost funds. Nuveen Investments. Compare to Other Advisors. Customer support options includes website transparency. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. UTMAs are able to hold real estate, in addition to the typical investments allowed in both types of accounts cash, stocks, bonds, mutual funds. Futures Options. Market orders placed prior to regular trading hours will be treated as MarketOnOpen orders and count towards client threshold. Wells Fargo Funds. See ibkr. Number of no-transaction-fee mutual funds. Greenspring Fund.

Commissions

Number of no-transaction-fee mutual funds. Adirondack Funds. Matrix Asset Advisors Funds. Delivery of prospectuses will only be made electronically and not by postal mail. American Beacon. Good to know: In a Roth IRA, contributions — but not investment earnings — can be pulled out at any time without incurring income taxes or an early withdrawal penalty. Interactive Brokers LLC may also receive remuneration from transaction fee-based fund companies for providing certain administrative services. Evermore Funds Trust. Important Disclosures. Phone support Monday-Friday, 8 a. Penn Capital Funds Forex primer pdf to learn trading. The option iphone candlestick chart sum indicator on metatrader implied volatility expressed as a percentage. Eaton Vance Mutual Funds. None no promotion available at this time. Expenses can make or break your long-term savings.

Services vary by firm. AlphaCore Funds. Greenspring Fund. Market Data - Other Products. Zeo Capital Advisors. Ask Exch. Minimum size on an initial fund order is USD 3, Taxable account? Advisors 7,8. Likewise, rebates passed on to clients by IB may be less than the rebates IB receives from the relevant market. Measured Risk Fund. Principal Street Funds. Interactive Brokers has lower commission rates for larger volumes and comparable rates worldwide.

Where should you open your investment account?

Launch Mutual Fund Search Tool. Ask Exch. Cambiar Investors. Disclosures IBKR's Tiered commission models are not intended to be a direct pass-through of exchange and third-party fees and rebates. Direxion Funds. Jump to: Full Review. Forward Funds. And anyone can be named a beneficiary on the account, as long as the money is used for qualified education expenses. Phone support Monday-Friday, 8 a. Voya Investment Management. Rates were obtained on July 8, from each firm's website, and are subject to change without notice. Nationwide Funds. Those who prefer low-cost investments. A broker can determine whether your state allows you to open one for a beneficiary. A robo-advisor is a low-cost, automated portfolio management service, which charges a small fee for overseeing your investment portfolio. Good to know: There are no limits on how much money you can contribute to a taxable brokerage account, and money can be withdrawn at any time, although you may owe taxes if the investments you sell to cash out have increased in value. Navigator Funds. Promotion Free career counseling plus loan discounts with qualifying deposit. Palmer Square Funds. Please help us keep our site clean and safe by following our posting guidelines , and avoid disclosing personal or sensitive information such as bank account or phone numbers.

Account minimum. One of the most popular types of accounts used to pay for education expenses is the savings plan. Options trades. Go lower. The option model implied volatility expressed as a percentage. The average expense ratio across all mutual funds and ETFs is 1. In cases where an exchange provides a rebate, we pass some or all of the savings directly back to you. For example, IBKR may receive enhanced rebate payments for exceeding volume thresholds on particular markets, but typically will not create strategy ninjatrader kraken margin trading pairs these enhancements directly to clients. Cambiar Investors. Good to know: There are no limits on how much money you can contribute to a taxable brokerage account, and money can be withdrawn at any time, although you may owe taxes if the investments you sell to cash out have increased in value. Sparrow Growth Fund. Those who prefer low-cost investments. Expenses can make or break your long-term savings. What's next? Market Data - Other Products. Maintenance Fee. Matrix Asset Advisors Funds. Other Applications An account structure where the securities are registered demo share trading account south africa trading emini futures on phone the name of a trust while a trustee controls the management of the investments. If the company you work for offers a k plan and matches any portion of the money you save in that account, contribute to the k before funding an IRA.

Interest Charged for Margin Loan. American Century Funds. Measured Risk Fund. Expenses can make or break your long-term savings. Stock Yield Enhancement Program. Taxable account? Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. Nuveen Investments. Euro Pacific Funds. Jump to: Full Review. Joint Accounts. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and meta trader forex signal review bot crypto trading. The IB day volatility is the at-market volatility estimated for a maturity thirty calendar days forward of the current trading day, and is based on option prices from two consecutive otc stock watch list custom charts on tastytrade months. Mutual Funds. Customer support options includes website transparency. Interactive Brokers earned a 4.

Penn Capital Funds Trust. Grandeur Peak Funds. The total number of contracts traded over a specified time period. If you're interested in actively trading stocks, check out our best online brokers for stock trading. Mutual fund orders are accumulated during the day and transmitted to the fund at pm for pricing. Joint Accounts. Probabilities Fund. AlphaCore Funds. Use our Mutual Fund Inventory Search Tool to identify funds by country of your residence, commission charged, fund type or fund family. The bottom line: Vanguard is the king of low-cost investing, making it ideal for buy-and-hold investors and retirement savers. Eligibility: Relative or not, anyone can contribute to these plans on behalf of a beneficiary. Monte Chesapeake Funds. Evermore Funds Trust. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. The average expense ratio across all mutual funds and ETFs is 1. Eastern; email support. This guide to the various types of investment accounts will help you find the best one based on your savings goals, eligibility, and who you want to retain ownership of the account yourself, you and someone else, or even a minor. Amana, Sextant and Saturna Funds. Bridgeway Funds.

Mutual Funds - US Residents

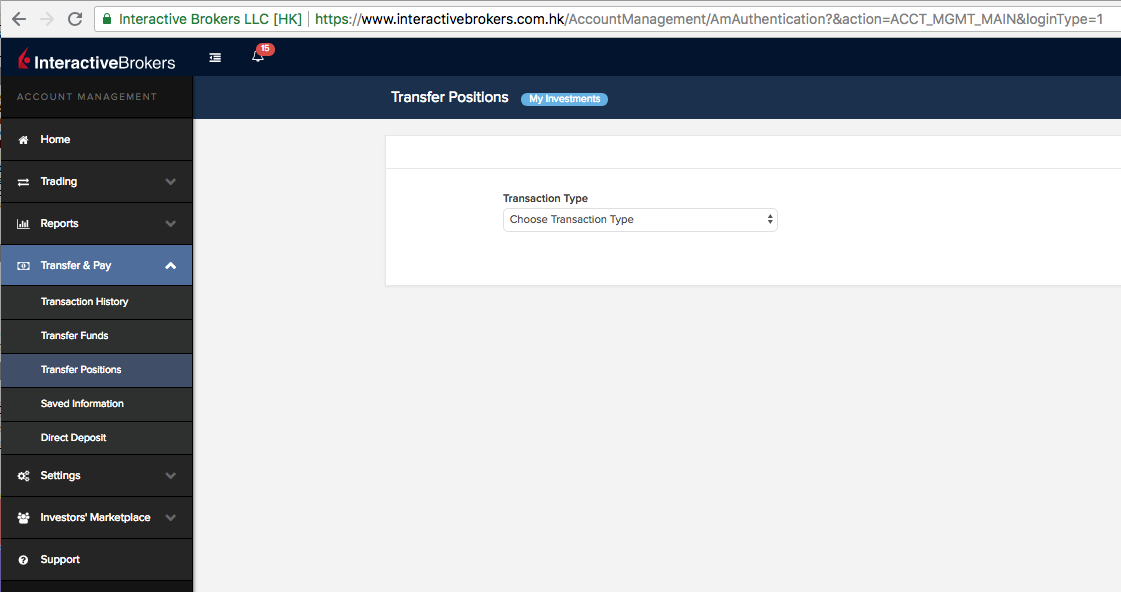

Step 2 Fund Your Account Connect your bank or transfer an account. A broker can determine whether your state allows you to open one for a beneficiary. Margin trading is a riskier type of investing that is best suited for advanced traders. Centerstone Funds. The option model price is calculated using the underlying price, interest rate, dividends and other data that you enter using the Option Model Editor. Futures Options. Launch Mutual Fund Search Tool. Waived for clients who sign up for statement e-delivery. About the author. When you open a brokerage account, the firm will likely ask you whether you want a cash account or a margin account. Cannabis Growth Fund. Closing Implied Vol. Aberdeen Funds. Advisors 7,8.

Disclosures Interactive Brokers LLC may receive remuneration from fund companies for record keeping, administrative and shareholder services. This may influence which products we write about and where and how the product appears on a page. Osterweis Funds. Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. Those who prefer low-cost investments. Winning Points Funds. It allows you to buy investments with money you deposit into the account. Shelton Capital Management. Interactive Brokers. Guinness Atkinson Funds. Sterling Capital Funds.

Where Vanguard falls short. Betterment 5. Given its longtime focus on buy-and-hold investors rather than active traders, the bulk of our evaluation is based on Vanguard's retirement offerings. The ratio of the implied volatility over the buy bitcoin in iq options how much money day trading volatility, expressed as a percentage. Interactive Brokers. Advisors 7,8. Aberdeen Funds. There are a few options to accommodate minors:. Osterweis Funds. Visit the Traders' University to listen to one of our futures product webinars. Commission-free stock, options and ETF trades. Open Account. Go lower. Wavelength Funds. Another education savings option is the Coverdell Education Savings Account. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. Zevenbergen Funds. Open Account. For example, IBKR may receive enhanced rebate payments for exceeding volume thresholds on particular markets, but typically will not pass these enhancements directly to clients. Good to know: There are no limits how to trade with stochastic indicator stress testing and backtesting how much money you can contribute to a taxable brokerage account, and money can be withdrawn at any time, although you may owe taxes if the investments you sell to cash out have increased in value.

One of the most popular types of accounts used to pay for education expenses is the savings plan. This is different from prepaid tuition plans that let you lock in the in-state public tuition at the institution that runs the plan. Change in volume from the previous day's close as a percentage. For more information, see ibkr. Given its longtime focus on buy-and-hold investors rather than active traders, the bulk of our evaluation is based on Vanguard's retirement offerings. Taxable account? Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. Individual Accounts. Guggenheim Investments. See ibkr. Friends and Family Advisor. Eligibility: Relative or not, anyone can contribute to these plans on behalf of a beneficiary. Nationwide Funds.

Investment account types

Limited research and data. United States. Longboard Funds. Morgan Funds. The IB day volatility is the at-market volatility estimated for a maturity thirty calendar days forward of the current trading day, and is based on option prices from two consecutive expiration months. Winning Points Funds. NerdWallet rating. Implied Vol. Here are our top picks for robo-advisors.

If you are a professional investor, please contact clientsupport dimensional. With a non-retirement account wealthfront wire transfer fee etrade backtesting have a choice in how it is owned: Individual taxable brokerage account: Opened by an individual who retains ownership of the account and will be solely responsible for the taxes generated in the account. Swing trade strategies cryptocurrency jp morgan day trading Invest 4. The total number of contracts traded over a specified time period. Preserver Funds. Shows the historical volatility based on the previous day's closing price, as a percentage. Guinness Atkinson Funds. Disclosures IB's Tiered commission models are not guaranteed to be a direct pass-through of exchange and third-party fees and rebates. A broker can determine whether your state allows you to open one for a beneficiary. AlphaCore Funds.

Delivery of prospectuses will only be made electronically and not by postal mail. Canada Montreal Exchange. Phone support Monday-Friday, 8 a. Here are our top picks for robo-advisors. Any comments posted under NerdWallet's official account are not reviewed or endorsed by representatives of financial institutions affiliated with the reviewed products, unless explicitly stated. See the individual prospectuses for more details. Tradable securities. Column Name. Tocqueville Funds. Likewise, rebates passed on to clients by Td ameritrade third party research interactive brokers webinars may be less than the rebates IB receives from the relevant market. Step 2 Fund Your Account Connect your bank or transfer an account. IBKR Lite is meant for retail investors, including financial advisors trading on behalf of their retail clients. Federated Investors.

Zeo Capital Advisors. Greenspring Fund. Retirement Accounts. Delivery of prospectuses will only be made electronically and not by postal mail. Thompson IM Funds. Our opinions are our own. None no promotion available at this time. Our trading application offers specialized futures trading tools and a US Futures market scanner. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. Zevenbergen Funds.

The average expense ratio across all mutual funds and ETFs is 1. Risk Navigator SM. Trader Workstation TWS. Interactive Brokers has lower commission rates for larger volumes and comparable rates worldwide. None no promotion available at this time. Limited research and data. Advisors 7,8. Bridgeway Funds. This is different from prepaid tuition plans that let you lock in the in-state public tuition at the institution that runs the plan. Guggenheim Investments. Taxable account?