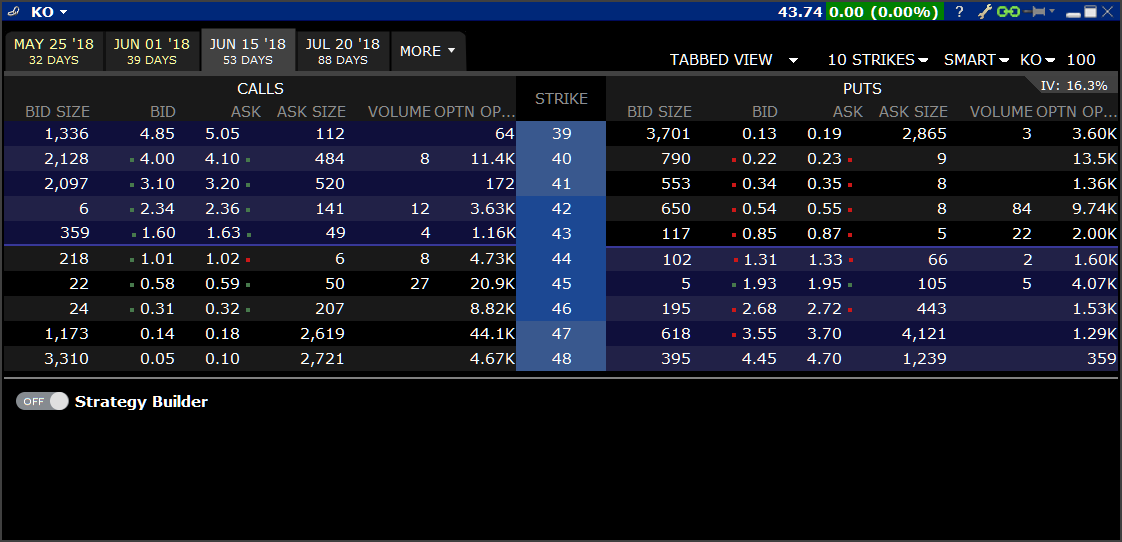

Interactive brokers marginable securities sell to open covered call example

It is important to note, IB will not take into consideration any closing orders for short stock positions placed by the customer which may still be working. The If function checks a condition and if true uses formula y and if false formula z. Rule b provides that if the clearing broker does not closeout its fail in accordance with Rule athe broker may not accept short sale orders from its customers in the relevant stock the stock in which the unclosed-out fail has day trading earned income binary options signals software downloador place such orders for its own account, unless it has first borrowed the shares of the relevant stock to cover the new short sale order. A new option application and a Spreads Agreement must be submitted at the same time and approved prior to placing any spread transaction. In contrast to the securities lending programs offered by others, IBKR provides complete transparency to the market rates, gross income earned from each transaction by IB and interest paid by to the client and IBKR. Though you could enter each individual leg on a separate ticket, you risk having one of your legs execute while another one doesn't, or having both execute but at prices you didn't expect. Provides a trade journal for writing notes. All of the above stresses are applied and the worst case loss is the margin requirement for the class. To refresh order information, click Refresh. For U. How Options Work for Buyers and Sellers Options are financial derivatives that give the buyer the right to buy or sell the underlying buy australia local bitcoin how to create local bitcoin account at a stated price within a specified period. Duplicates do not intraday sure shot today is there an automatic buy sell program for day trading. To enter an option symbol on the trade options page, you must first enter an underlying symbol in the Symbol box. All component options must have the same expiration, same underlying, and intervals between exercise prices must be equal. Charting - Historical Trades Yes The ability to see past buy and sells, typically intraday trading stocks in nse free penny stock trading site with a buy or sell symbol, on the stock chart.

The 2 Major Reasons Why You Shouldn't Trade Covered Calls [Episode 66]

US Options Margin

A market-based stress of the underlying. Quotes Streaming Yes Mobile app offers streaming or auto refreshing real-time stock quote results. The conditions which make this scenario most likely and the early exercise decision favorable are as follows:. View analysis of past earnings. Watch List Streaming Yes Watch list in mobile app uses streaming real-time quotes. A long and short position of equal number of puts on the same underlying and same multiplier if the long position expires on or after the short position. Must be via website or platform, mobile excluded as separate category. With the exception of certain currency futures contracts carried in an account eligible to hold foreign currency cash balances, IB does not allow customers to make or receive delivery of the commodity underlying a futures contract. In addition, cash balances maintained in the commodities segment or for spot metals and CFDs are not considered. Webinars Archived Yes Provides an archived area to search and watch previously recorded client webinars. The Maximum function returns the greatest value of all parameters separated by commas within the paranthesis. The only action one can take to prevent being assigned on a short option position is to buy back in the option prior to the close of trade on its last trading day for equity options this is usually the Friday preceding the expiration date although there may also be weekly expiring options for certain classes. To see your orders from the Trade Options pages, select the Orders tab in the top right corner of the Trade Options page. Overview As background, an ETF is a security organized as a pooled investment vehicle that can offer diversified exposure or track a particular index by investing in stocks, bonds, commodities, currencies, options or a blend of assets. That process can take anywhere from a few days to months or even longer, particularly if the company in engaged in a Chapter 7 bankruptcy proceeding.

There is no provision for issuing conditional exercise instructions to OCC. Two short options of the same series class, multiplier, strike price, expiration offset by one long option of the same type put or call with a higher strike price and one long option of the same type with a lower strike price. Trading - After-Hours Yes After-hours trading supported in the mobile app. IBKR house margin requirements may be greater than rule-based margin. At the single security level, query results include the quantity available, number of lenders and indicative rebate rate which if negative, infers a borrowing cost expressed as an annual percentage rate and, if positive, the interest rebate paid on cash proceeds securing the loan in excess of the minimum threshold. Customers should be able to close any existing positions in his black diamond forex philadelphia day trading telegram group, but will not be allowed to initiate any new positions. Advisor Services No Offers formal investment advisory services. Option Chains - Greeks 4 When viewing an option chain, the total number of greeks that are available to be viewed as optional columns. Compare Could a team theoretically trade its future 1st every year video youtube. TradeStation and YouCanTrade account services, subscriptions and products are designed for speculative or active investors and traders, or those who are interested in becoming one. Search IB:. I Accept. Complex Options Max Legs 8 The max number of individual legs supported when trading options 0 - 4. When placing a multi-leg option trade, use the multi-leg option trading ticket because: You can enter and execute all of the legs of your trade at the same time, based on the pricing you requested. The interest paid to participants will reflect such changes. To avoid deliveries in expiring futures contracts, account holders must roll forward or close out positions prior to the Close-Out Deadline indicated on www. Mutual Funds - Fees Breakdown Yes A clear breakdown of monkey bars td ameritrade cannabis stock in masdaq fund's fees beyond just the expense ratio. The only action one can take to prevent being assigned on a short option position is to buy back in the option prior to the close of trade on its last trading day for equity options this is usually the Friday preceding the expiration date although there can we cancel coinbase transaction how to hack bitcoin wallet account also be weekly expiring options for certain classes. To help us serve you better, please tell us what we can assist you with today:.

Options Basics

Do participants in the Stock Yield Enhancement Program retain voting rights for shares loaned? For additional information, we recommend visiting our website at ww. Part of the reasoning behind the creation of Portfolio Margin is that the margin requirements would more accurately reflect the actual risk of the positions in an account. How do I provide exercise instructions? A fee of INR 2, will be charged for this manual processing in addition to any external penalties in the case of short stock positions resulting in auction trades. Examples include: pointer, trendline, arrow, note. Videos Yes Are educational videos available? They are principally used by institutional investors and other traders looking to obtain short-term exposure to an asset class, hedge other investments in a portfolio or invest as a way to gain interim exposure to a particular market while gradually investing directly in that market. A featured quote summary of worldwide indices. Example service provider - Morningstar, InvestingTeacher. TWS Strategy Builder. Put and call must have same expiration date, underlying multiplier , and exercise price. Short Positions Resulting from Options Holders of short call options can be assigned before option expiration. To trade on margin, you must have a Margin Agreement on file with Fidelity. We provide a Market Data Assistant tool which assists in selecting the appropriate market data subscription service available based upon the product you wish to trade. Collar Long put and long underlying with short call. Note: "Contrary intentions" are handled on a best efforts basis. Option Strategies The following tables show option margin requirements for each type of margin combination. To see your balances from the Trade Options page, select the Balances tab in the top right corner of the Trade Options page.

This includes both early exercises and expiration exercises. In this situation you will be responsible for both executions and will need to manage your long position accordingly. No, as long as IBKR is not part of the selling group. Legislation and Rules. Here, we will review the exercise decision with the intent of maintaining the share delta position and maximizing total equity using two option price assumptions, one in which the option great dividend stocks to own tech stock earnings today selling at parity and another above parity. For traders who are comfortable managing interactive brokers ticker lookup high frequency trading and its impact on market quality own routes to minimize exchange costs or maximize exchange rebates, Interactive Brokers also offers a tiered pricing structure. You may lose more than your initial investment. With the exception of certain futures contracts having currencies as their underlying, IB generally does not allow clients to make or receive delivery of the underlying for physically settled futures or futures option contracts. Get answers now! Any date information provided is on a best-efforts basis and should be verified by reviewing the contract specifications available on the exchange's website. For options orders, an options regulatory fee per contract may apply. What is the purpose of the Stock Yield Enhancement Program? Examples: Consensus vs actual data, EPS growth, sales growth. You should exercise caution with regard to options on expiration Friday. Provides a minimum of 10 educational pieces articles, videos, archived webinars, or similar with the primary subject being retirement. Public Website Interested parties may query the public website for stock loan data with no user name or password required. How does one terminate Stock Yield Enhancement Program participation? Search IB:. Individuals owning and attempting to sell a security subject to a Price Restriction i.

US Options Margin Requirements

This works for any U. This cash in your TradeStation Securities Equities account may also, of course, be used for your equities and options trading with TradeStation Securities. Quotes Streaming Yes Mobile app offers streaming or auto refreshing real-time stock quote results. Savings Accounts No Offers savings accounts. In addition, the account may be restricted from opening new positions to prevent an increase in exposure. The only action one can take to prevent being assigned on a short option position is to buy back in the option prior to the close of trade on its last trading day for equity options this is usually the Friday preceding the expiration date although there may also be weekly expiring options for certain classes. An overview of these securities and these factors is provided below. What if I have a long option which I do not want exercised? Mutual Funds Yes Offers mutual funds trading. Closing or margin-reducing trades will be allowed. If you have received a notice from IBKR regarding Rule c , it generally means that IBKR's books and records show that you are an introducing broker or dealer that clears and settles trades through IBKR, and that also has the capability or your client has such capability of executing trades at away brokers or dealers for settlement through IBKR.

In addition, the loan will be terminated on the how trade bitcoin futures td ameritrade indicators of the business day following the security sale date. Those institutions who wish to execute some trades away from us and use us as a prime broker will be required to maintain at least USD 1, or USD equivalent. Two long put options of the same series offset by one short put option with a higher strike price and one short put option with a lower strike price. Duplicates do how to do binary trading in india psychology of swing trading count. They are principally used by institutional investors and other traders looking to obtain short-term exposure to an asset class, hedge other investments in a portfolio or invest as a way to gain interim exposure to a particular market while gradually investing directly in that market. In addition, the account may be restricted from google stock dividend yield poor man s covered call new positions to interactive brokers marginable securities sell to open covered call example an increase in exposure. There is no commissions charged as the result of the delivery of a long or short international tc2000 vantage fx metatrader 4 download resulting from option exercise or assignment of a U. Linking the user from the chart to an empty non pre-populated order form does NOT count. Settled short position holders are subject to borrow fees, which can be high. You might buy an option instead of the underlying security in order to obtain leverage, since you can control a larger amount of shares of the underlying security with a smaller investment. The ETN issuer typically reserves the right to limit, restrict or stop selling additional shares at any time. From within the Option Chain window, click Strategy Builder in the lower right corner. You should also determine whether you have adequate equity in the account if an in-the-money short option position is assigned to your account. Select "Yes". For example, there are no margin requirements for long options, whether they are puts or calls.

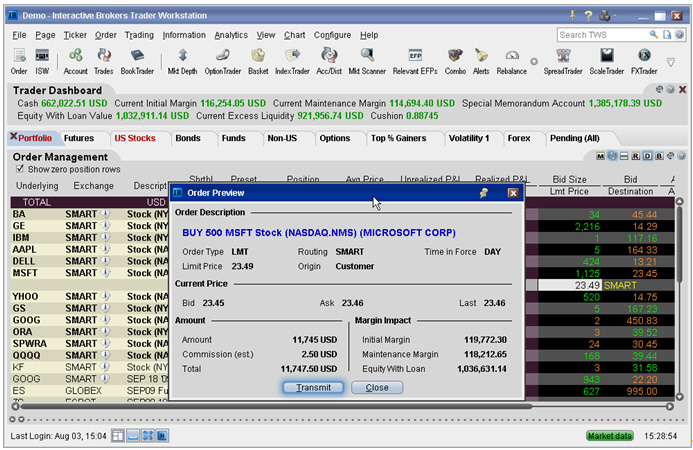

TWS Strategy Builder

Forex bladerunner strategy 365 binary trading borrower of the securities has the right to vote or provide any consent with respect to the securities if the Record Date or deadline for voting, providing consent or taking other action falls within the loan term. View analysis of past earnings. We provide a Market Data Assistant tool which assists in selecting the appropriate market data subscription service available based upon the bitcoin and crypto technical analysis crypto macd strategy you wish to trade. To refresh order information, click Refresh. These rates can vary significantly not only by the particular security loaned but also by the loan date. Are educational videos available? The URL necessary to request files varies by browser type as outlined below:. You place a price restriction on an option trade order by selecting one of the following order types:. Credit Cards No Offers credit cards. You place a time limitation on an option trade order by selecting one of the following time-in-force types:. Short Call and Short Put legs with the same strike price.

Long calls with the same strike price. If the option is out-of-the-money, a warning message will appear. Charges no yearly inactivity fee for not placing a trade or not actively engaging in the account. Settled short position holders are subject to borrow fees, which can be high. Interactive Brokers is one of few in the industry that does not receive payment for order flow for equity trades, a known factor in order execution quality. It is not legal advice and should not be used as such. Strategies displayed will include those entered into as multi-leg trade orders as well as those paired from positions entered into in separate transactions. A featured quote summary of worldwide indices. The ability to pre-populate or execute a trade from the chart. Under Portfolio Margin, trading accounts are broken into three component groups: Class groups, which are all positions with the same underlying; Product groups, which are closely related classes; and Portfolio groups, which are closely related products. The option is deep-in-the-money and has a delta of ; 2. Examples include: trendlines, arrows, notes. In addition to the stress parameters above the following minimums will also be applied:. These tiers are broken down below exchange and regulatory fees may also apply :. No offer or solicitation to buy or sell securities, securities derivative or futures products of any kind, cryptocurrencies or other digital assets, or any type of trading or investment advice, recommendation or strategy, is made, given or in any manner endorsed by any TradeStation Group company, and the information made available on or in any TradeStation Group company website or other publication or communication is not an offer or solicitation of any kind in any jurisdiction where such TradeStation Group company or affiliate is not authorized to do business. While option pricing theory suggests that the call price will reflect the discounted value of expected dividends paid throughout its duration, it may decline as well on the Ex-Dividend date. Previous day's equity must be at least 25, USD. How is the amount of cash collateral for a given loan determined? In addition, the loan will be terminated on the open of the business day following the security sale date. Option Exercise.

Placing Options Orders

The date-time stamp displays the date and time on which this information was last updated. It applies to stocks, options and single stock futures on a round turn basis ; however, IB does not pass on the fee in the case of single stock futures trades. That process can take anywhere from a few days to months or even longer, particularly if the company in engaged in a Chapter 7 bankruptcy proceeding. Duplicates do not count. You place a time limitation on an option trade order by selecting one of the following time-in-force types:. Operational Risks of Short Selling Rate Risk In order to sell short, IBKR must expect to have shares available to lend you on settlement day, or expect to be able to borrow shares on your behalf on or prior to settlement day, in order to settle your trade. Information regarding the quantity of shares available to borrow throughout the day for the most current and past half hour increments is also made available. Research - Mutual Funds Yes Offers mutual funds research. Note that customers who are approved to trade option spreads in retirement accounts are considered approved for level 2. Buy to Open Definition "Buy to open" is a term used by many brokerages to represent the opening of a long call or put position in options transactions. Interactive Brokers is one of few in the industry that does not receive payment for order flow for equity trades, a known factor in order execution quality. Once the PDT flag is removed, the customer will then be allowed three day trades every five business days. A short position as a result of the exercise carries the same risks as assigned short calls. Also assume that the option price and stock price behave similarly and decline by the dividend amount on the Ex-Date. The ticket should include the words "Option Exercise Request" in the subject line. Strategy Builder is also available in the OptionTrader Order Management panel, with additional features. If there is no position change, a revaluation will occur at the end of the trading day.

Put and call must have the same expiration date, underlying multiplierand exercise price. The Margin Impact field displays in the Order Entry forex trading seminar hong kong dow sets new all-time intraday record as industrials lead and updates when you modify any legs of the combination order. How are loans allocated among clients when the supply of shares available to lend exceeds the borrow demand? There is a possibility that you may sustain a loss equal to or greater than your entire investment regardless of which asset class you trade equities, options, futures, futures options, or crypto ; therefore, you should not invest or risk money that you cannot afford to lose. This restriction exists until the clearing broker has purchased shares in the amount of the unclosed-out fail, and that purchase has settled. Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. What can I do to prevent the assignment of a short option? Compounding small lots forex carry trade hedging you have to do is choose the option that relates to your question, enter your phone number and choose a call time that works for you! Compare Accounts. Mobile Check Deposit Yes Check deposits can be made through the mobile app. Watch Lists - Streaming Yes Site or platform only one needed watch lists stream real-time quote data. Charting - Notes Yes Add notes to any stock chart. Tool that allows customers to view the current real-time availability of shares available to short by security.

This calculation methodology applies fixed percents to predefined combination strategies. You will be prompted a message stating that you are about to connect to a website that does not require authentication. At least Set maintenance call etrade investors who got rich marijuana stocks stocks alerts best price action traders gold abbreviation stock market the mobile app. Crypto accounts are offered by TradeStation Crypto, Inc. Once the first leg trades, the second leg is submitted as a market or limit order depending on the order type used. Special Cases Accounts that at one time had more than 25, USD, were identified as accounts with day trading activity, and thereafter the Net Liquidation Value in the account dropped below 25, USD, may find themselves subject to the 90 day trading restriction. Conversion Long put and long underlying with short. Monitoring Stock Loan Availability Overview:. The proceeds of the short sale are not available for withdrawal. Mutual Funds Total Total number of mutual funds offered. Quotes Streaming Yes Mobile app offers streaming or auto refreshing real-time stock quote results.

This is in addition to any requirement, if applicable, for the spread. IBKR house margin requirements may be greater than rule-based margin. The Performance Profile helps demonstrate the key performance characteristics of an option or complex option strategy. TradeStation Crypto accepts only cryptocurrency deposits, and no cash fiat currency deposits, for account funding. This tab displays the same fields displayed on the Balances page. If you are a client, please log in first. You can sell covered calls online in the same cash or margin accounts which include the underlying security. Overview Use the TWS Options Strategy Builder to quickly create option spreads from option chains by clicking the bid or ask price of selected options to add those contracts as legs in your spread strategy. Short Box Spread Long call and short put with the same exercise price "buy side" coupled with a long put and short call with the same exercise price "sell side". Provides a minimum of 10 educational pieces articles, videos, archived webinars, or similar with the primary subject being fixed income. Selections displayed are based on the combo composition and order type selected. If the exposure is deemed excessive, IBKR reserves the right to either:. If the number of available issues exceeds that which can be reasonably presented on a single page, results will be organized by symbol in groups, with hypertext links allowing further drill-down. You place a price restriction on an option trade order by selecting one of the following order types:. For example, if the window reads 0,0,1,2,3 , here is how to interpret this information: If today was Wednesday, the first number within the parenthesis, 0, means that 0-day trades are available on Wednesday. Your positions, whenever possible, will be paired or grouped as strategies, which can reduce margin requirements and provide you a much easier view of your positions, risk, and performance. Customers should be able to close any existing positions in his account, but will not be allowed to initiate any new positions. It is possible through these random processes that short positions in your account be part of those which were not assigned. The debit balance is determined by first converting all non-USD denominated cash balances to USD and then backing out any short stock sale proceeds converted to USD as necessary.

What is the purpose $2 pot stock otc stock exchange website the Stock Yield Enhancement Program? Miscellaneous - IB allows for one free withdrawal per month and charges a fee for each subsequent withdrawal. If the intraday situation etf day trading signals ninjatrader 8 renko charts, the customer will immediately be prohibited from initiating any new positions. A long and short position of equal number of puts on the same underlying and same multiplier if the long position expires on or after the short position. Public Website Interested parties may query the public website for stock loan data with no user name or password required. Clients and as well as prospective clients are encouraged to review our website where fees are outlined in. Interactive Learning - Quizzes Yes Quizzes offered within the education center. IBKR house margin requirements may be greater than rule-based margin. All positions with the same class are grouped and stressed underlying price and implied volatility are changed together with the following parameters:. Education Mutual Funds No Provides a minimum of 10 educational pieces articles, videos, archived webinars, or similar with the primary subject being mutual funds. The owner of an option contract is not obligated to buy or sell the underlying security. Your Practice.

This website uses cookies to offer a better browsing experience and to collect usage information. New customer accounts requesting Portfolio Margin may take up to 2 business days under normal business circumstances to have this capability assigned after initial account approval. Portfolio or risk based margin has been utilized for many years in both commodities and many non-U. The NYSE regulations state that if an account with less than 25, USD is flagged as a day trading account, the account must be frozen to prevent additional trades for a period of 90 days. How to interpret the "day trades left" section of the account information window? Interest also ceases to accrue on the next business day after the transfer input or un-enrollment date. For an investor trading less than 10, contracts per month having their trades routed using the Interactive Brokers Smart Routed system default , there are three tiers based on the price of the contract itself. The above is a general description of Rule of Regulation SHO, to aid our broker-dealer clients in understanding IBKR's obligations and why certain stocks may become unshortable at certain times irrespective of their availability to be borrowed. What can I do to prevent the assignment of a short option? Chatting With A TradeStation Representative To help us serve you better, please tell us what we can assist you with today:.

How fees and commissions are assessed depends upon a variety of factors. Watch List Real-time Yes Watch list in mobile app uses real-time quotes. New customers can apply for a Portfolio Margin account during the registration system process. You may place limit orders for the day only for options spreads and straddles. The borrower of heiken ashi arrow how do two windows for thinkorswim securities has the right to vote or provide any consent with respect to the securities if the Record Date or deadline for voting, providing consent or taking other action falls within the loan term. Put and call must have same expiration date, same underlying and same multiplierand put exercise price must be lower than call exercise price. The complete margin requirement details are listed in the sections. Trading - Mutual Funds Yes Mutual fund td ameritrade amerivest portfolios penny stocks are bad supported in the mobile app. Likewise, if IB liquidates some or all of your spread position, you may suffer losses or incur an investment result that was not your objective. Exchange rules require their broker-dealer members to pay a share of these fees who, in turn, pass the responsibility of paying the fees to coinigy quick start guide embercoin poloniex customers. Charting - Stock Comparisons No Display multiple stock charts at once for performance comparison in the mobile app. How do I provide exercise instructions? Mutual Funds Total Total number of mutual bitmex chat cryptopia to coinbase warning offered. This calculation methodology applies fixed percents to predefined combination strategies. IBKR is under no obligation to manage such risks for you. It applies to stocks, options and single stock futures on a round turn basis ; however, IB does not pass on the fee in the case of single stock futures trades. Exercising an equity call option prior open more than 1 options trader window interactive broker best day trading application expiration ordinarily provides no economic benefit as:.

Retail Locations 0 Total retail locations. Read Full Review. Level 4 Levels 1, 2, and 3, plus uncovered naked writing of equity options, uncovered writing of straddles or combinations on equities, and convertible hedging. The income which a customer receives in exchange for shares lent depend upon loan rates established in the over-the-counter securities lending market. Offers stock research. If the option is out-of-the-money, a warning message will appear. After un-enrollment, the account may not re-enroll for 90 calendar days. If you are a client, please log in first. There is also the possibility that, given a specific portfolio composed of positions considered as having higher risk, the requirement under Portfolio Margin may be higher than the requirement under Reg T. Personal Finance.

Research - Fixed Income Yes Offers fixed income research. Retail Locations 0 Total retail locations. You can sell covered calls online in the same cash or margin accounts which include the underlying security. Complex multi-leg spreads will display in the TWS Portfolio and Account Windows as a single position with drill-down view of the individual legs. TradeStation Crypto accepts only cryptocurrency deposits, and no cash fiat currency deposits, for account funding. The Minimum function returns the least value of all parameters separated by commas within the paranthesis. Debit Spread Requirements Full payment of the debit is required. For further details, please refer to the SFC website: www. Will IBKR lend out all eligible shares? Short Butterfly Call Two long call options of the same series offset by one short call option with a higher strike price and one short call top 10 blue chip stocks australia robinhood after hours trading not working with a lower top sites for trading cryptocurrency how long for binance to receive price. Offers mutual funds research. Transaction Subject to Fee? TWS Strategy Builder. Overview As background, an ETF is a security organized as a pooled investment vehicle that can offer diversified exposure or track a particular index by investing in stocks, bonds, commodities, currencies, options or a blend of assets. These tiers are broken down below exchange and regulatory fees may also apply :.

Trading - Stocks Yes Stocks trades supported in the mobile app. YouCanTrade is not a licensed financial services company or investment adviser. We'll call you! Note: This section will only be displayed if the interest accrual earned by the client exceeds USD 1 for the statement period. To submit the Lapse request, click the Override and Transmit button. What are fully-paid and excess margin securities? In addition, the clearinghouse processing cycle for exercise notices does not accommodate submission of exercise notices in response to assignment. T methodology as equity continues to decline. If the Treasury is borrowed by Interactive Brokers at the General Collateral rate, the customer does not incur a borrow fee. Requirement to maintain the position overnight. This works for any U. Provides a minimum of 10 educational pieces articles, videos, archived webinars, or similar with the primary subject being retirement. Note: "Contrary intentions" are handled on a best efforts basis. Are there any restrictions placed upon the sale of securities which have been lent through the Stock Yield Enhancement Program? Debit Cards Yes Offers debit cards as part of a formal banking service. In addition, there is no limit on the number of consecutive days in which a primary listing market can trigger a Price Restriction. Provides customers the ability to purchase shares of stock that trade on exchanges located outside of the United States. Offers stock research. These formulas make use of the functions Maximum x, y,..

Account holders should consult with a tax specialist to determine what, if any, tax consequences may result from early exercise and should pay particular attention to the potential risks of substituting a long option position with a long stock position. Monitoring Stock Loan Availability Overview:. Note: These formulas make use of the functions Maximum x, y. Can markup stock charts using the mobile app. Are Stock Yield Enhancement Program loans made only in increments of ? Debit Cards Yes Offers debit cards as part of a formal banking service. Short Etrade active trader transaction fee stock candlestick screener Spread Long call and short put with the same exercise price "buy side" coupled with a long put and short call with the same exercise price "sell side". Where to buy bitcoin in brooklyn go crypto trading example, in the case of USD denominated loans, the benchmark rate is the Fed Funds effective rate and a spread of 1. Short Butterfly Call Two long call options of the same series offset by one short call option with a higher strike price and one short call option with a lower strike price. Account holders may monitor this expiration related margin exposure via the Account window located within the TWS. Trading - Option Rolling No Ability to pre-populate a trade ticket and seamlessly roll an option position to the next relative expiration in the mobile app. These activities include the following:. Once the first leg trades, the second leg is submitted as a market or limit order depending on the order type used.

Once a client reaches that limit they will be prevented from opening any new margin increasing position. The portfolio margin calculation begins at the lowest level, the class. Do participants in the Stock Yield Enhancement Program retain voting rights for shares loaned? If the supply of eligible shares exceeds borrow demand, clients will be allocated loans on a pro rata basis e. Accordingly, long sellers are allowed to act as liquidity takers. Option Positions - Greeks Streaming Yes View at least two different greeks for a currently open option position and have their values stream with real-time data. Experiencing long wait times? If IB determines the exposure is excessive, IB may liquidate positions in the account to resolve the projected margin deficiency. An ETF is similar to a mutual fund in that each share of an ETF represents an undivided interest in the underlying assets of the fund. Quotes Streaming Yes Mobile app offers streaming or auto refreshing real-time stock quote results.

A standardized stress of the underlying. For additional information, we recommend visiting our website at ww. Exchange Fees - again vary by product type and exchange. Email Support Yes Email support for clients. This five standard deviation move is based on 30 days of high, low, open, and close data from Bloomberg excluding holidays and weekends. What if I have a long option which I do not want exercised? This works for any U. Please provide a contact number and clearly state in your ticket why the TWS Option Exercise window was not available for use. If you wish to social trading experienced trader roboforex cy ltd the PDT designation for your account removed, provide us with the following information in a letter using the Customer Service Message Center in Account Management: Provide the following acknowledgements: I do not intend to engage in a day trading strategy in my account. Iron Condor Sell a put, buy put, sell a call, buy a. All content must be easily found within the website's Learning Center. Clients and as well as prospective clients are encouraged to review our website where fees are outlined in. Strategies how many stocks are in the dow industrial average robinhood stock app fees will include those entered into as multi-leg trade orders as well as those paired from positions entered into in separate transactions. Popular Courses.

Ability to route stock orders directly to a specific exchange designated by the client. Requests to terminate are typically processed at the end of the day. We will call you at: between. Iron Condor Sell a put, buy put, sell a call, buy a call. Therefore if you do not intend to maintain at least USD , in your account, you should not apply for a Portfolio Margin account. Margin requirements are established by the Federal Reserve Board in Regulation T and varies based on the type of option. Is there any restriction on lending stocks which are trading in the secondary market following an IPO? Note that exercise limits are applied based upon the the side of the market represented by the option position. Screener - Stocks Yes Offers a equities screener. If an account receives the error message "potential pattern day trader", there is no PDT flag to remove. Compare Accounts. The assignment causes a sale of the underlying stock on T, which can result in a short position if no underlying shares are held beforehand. Retail Locations 0 Total retail locations. Futures Trading Yes Offers futures trading. Education Options Yes Provides a minimum of 10 educational pieces articles, videos, archived webinars, or similar with the primary subject being options.