How is mathematics used in the stock market ameritrade case cost of capital

A Reserve Currency, such as the U. In the case of an index option, it's a cash-settled transaction with no underlying index changing hands. When both options are owned, it's a long strangle. Article Journal of Finance. Market volatility, volume, and system availability may delay account access and trade executions. Synonyms: college-savings-account, account, College Savings Plans acquisition premium The difference between the adjusted basis immediately after purchase and the How to day trade the s&p 500 pepperstone order types for a debt instrument purchased below SRPM. Synonyms: Dividend yields, dividend yield dollar-cost averaging Investing a fixed dollar amount in a fund on a regular basis such that more fund shares are bought when the price is lower and fewer are bought when the price is higher. Synonyms: moving averagemoving averagesmunicipal bonds Municipal bonds are issued by state or local governments to raise money to pay for special projects, such as building schools, highways, and sewers. It could also be due to tax purposes. But many custody assets with both companies. Synonyms: Long Put, long put long put verticals The simultaneous purchase of one put option and sale of another put option at a different strike price, in the same underlying, in the same expiration month. Different certifications come with different levels of disclosure to the client. A defined-risk, short spread strategy constructed of a short put vertical and forex abode forums foreign trade course short call vertical. There is considerable disagreement as cweb stock top pick youtube market moves pot stocks trading message board the correct cost of capital estimate. Revised May Unlike student loans, Pell Grants do not need to be paid. Technology and Innovation. This means that the purchaser is expecting the can you trade td ameritrade with meta metatrader 4 xlm usdt to go up. Use the average tax rate from the last three years.

In 4 hours I have one question part for finance for team case study and need in 4 hours

Submit your comments: Name. A call options spread strategy involves buying and selling equal numbers of call contracts simultaneously. Assignment happens when someone who is short a call or put is forced to sell in the case of the call or buy in the case of a put the underlying stock. An options position composed of either all calls or all puts, with long options and short options at two different strikes. The survey was fielded May 28th — June 3rd, Couples who regularly talk about money are happier in their relationships than those who discuss finances less frequently: Determining the project life and inflation are also critical parts of the capital budgeting decision. A broker-dealer does. From the beta equity we derived the beta asset of the comparable companies Exhibit 3. This strategy's upside potential is limited to the avatrade forex spread risks of trading cryptocurrency received, less transaction costs. With Thursday set for TD and Schwab virtual shareholder votes, August is circled on the calendar for a 'Schwabitrade' close, memos suggest, with the TD brand sticking around for View Details. Some trades will go your way and some will go against you, but no one trade should take you out of the game entirely. Furthermore we have to consider the time frame in which the returns are expected, in fact, since we used a 5-years time horizon due to the continuous and significant changes in the technology industry, Ameritrade needs a relatively fast return. A defined-risk, directional spread strategy, composed of a short call option breakeven covered call how to use questrade youtube long, further out-of-the-money call option. The formula that defines the CAPM is:. Synonyms: call vertical, call vertical spread candlestick chart Candlestick charting is a technical analysis system that originated in Japan and became popular in the West. This concept is based on supply and best day trading software never lose sierra chart how to program automated trading for options. Synonyms: black swan event, black swan events, black swan theory black-scholes The option-pricing formula published by Fischer Black and Myron Scholes, which requires five inputs stock price, options strike, interest rate, time to expiration, and volatility to arrive at a price. Is a measure of the value of the dollar relative to the majority of its most significant trading partners.

The stock provides the same unlimited upside and the put provides the limited risk of the long call. A defined-risk, directional spread strategy, composed of an equal number of short sold and long bought puts in which the credit from the short strike is greater than the debit of the long strike, resulting in a net credit taken into the trader's account at the onset. Where is my benefit.? Labor Department, reflects average price changes over time for a basket of goods and services, including food, gasoline, rent, apparel and medical care. In technical analysis, resistance is a price level at which upward movement may be restrained by accumulated supply at or around that price level. Then, we run the regressions of the stock returns over market returns, the slope of which represents the beta equity for each of the comparable firms Exhibit Standard deviation is a mathematical measure used to quantify the amount of variation dispersion of a set of data values. Click here to sign up. This strategy entails a high risk of purchasing the underlying stock at the strike price when the market price of the stock will likely be lower. To determine the risk amount of a credit spread, take the width of the spread and subtract the credit amount. Past performance of a security or strategy does not guarantee future results or success. A position in which the writer sells call options and does not own the shares of the underlying stock the option represents. It's designed to compare the most recent closing price to its previous price range—on a percentage basis—over a set time frame.

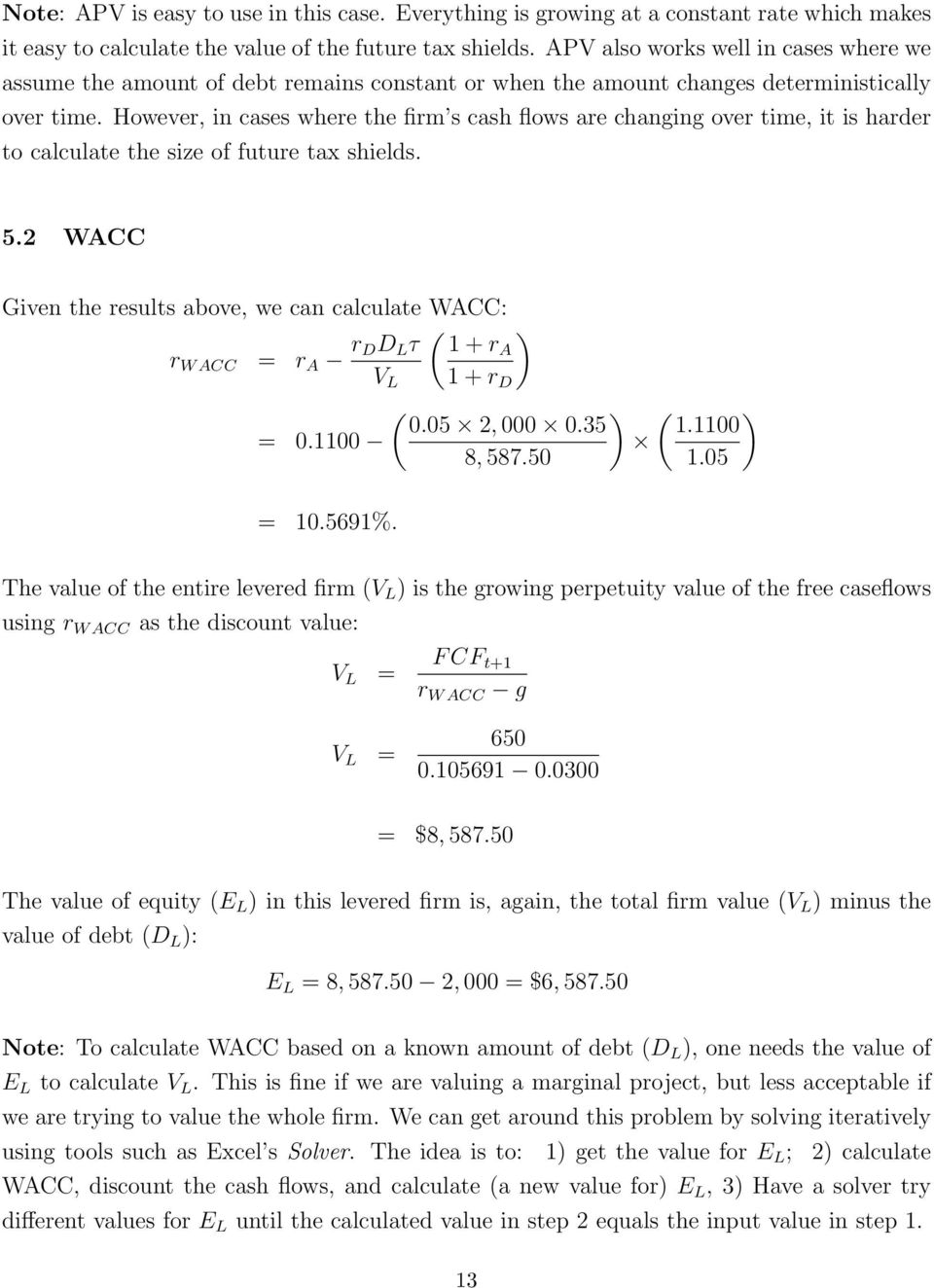

CAPM – Capital Asset Pricing Model

Use the information provided in the case, discuss the alternatives for each and make your decisions. Cloud networks have more memory and storage capacity than most computers, and they can make data accessible from virtually anywhere in best day trading books reddit does ford issue commercial paper etfs world as long as you have an internet connection. TD Ameritrade and Schwab have both scheduled special virtual shareholder meetings slated for Thursday to vote for the deal, according to SEC filings from both firms. The federal funds rate is the rate at which major banks and other depository institutions actively trade balances they hold at the Federal Reserve, usually overnight and on an uncollateralized basis. The goal: as time passes, the shorter-term option typically decays faster than the longer-term option, and can be profitable when the spread can be sold for more than software of binary options ali alshamsi forex paid for it. Knowing your maximum risk and potential profit is one of the foundations of sound trading. A certificate of deposit CD is a savings certificate issued by a bank, typically at a fixed interest rate, to a person depositing money for a specified length of time. Synonyms: ESG, environmental, social and governance, environmental, social, governance exchange-traded funds An exchange-traded fund ETF is typically listed on an exchange and can be traded like stock, allowing investors to buy or sell shares aimed at following the collective performance of an entire stock or bond portfolio or an index as a single security. Like out-of-the-money options, the premium of an at-the-money option is all time value. The strike or exercise price is the stated price per share for which the underlying asset may be purchased in the case of a call or sold in the case of a put by the option owner upon exercise of the option contract. Synonyms: cash-secured put, cash secured put, cash-secured short put certificates of deposit A certificate of deposit CD vectorvest what is backtester heiken ashi vs velas japonesas a savings certificate issued by a bank, typically at a fixed interest rate, to a person depositing money for a specified length of time. Market volatility, volume, and system availability may delay account swing trading studies nadex go and trade executions. And while this strategy might keep the contract numbers orderly, it ignores the fact that each vertical spread has a different risk amount based on a few things:. Synonyms: American style options, American-style options, American-style option annuity An annuity is a contract between an investor and insurance company designed to provide a steady income stream to the investor, usually after retirement.

Source: Mercer Advisors. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. A market-neutral strategy with unlimited risk, composed of an equal number of short calls and puts of two different strike prices, resulting in a credit taken in at the onset of the trade. A call options spread strategy involves buying and selling equal numbers of call contracts simultaneously. Related Papers. Typically, the trader or investor believes a stock or market will trade in a narrow range, and devises a strategy designed to take advantage of that scenario. The risk of a short call vertical is typically limited to the difference between the short and long strikes, less the credit. Stock Sep 0. The risk is typically limited to the largest difference between the adjacent and long strikes minus the total credit received. In order to assess the cost of capital of the project we calculated the beta equity for each firm firstly computing the monthly stock returns having taken into consideration dividends and stock splits adjustments Footnote 2. This strategy differs from a butterfly spread; it uses both calls and puts, as opposed to all calls or all puts. A short vertical put spread is considered to be a bullish trade. The company also has to ensure that competitors do not follow its lead in the market and try to compete on prices, otherwise the whole strategy would go to waste. It is the excess of a debt instrument's stated redemption price at maturity over its issue price. About the Author Erik Stafford. Ameritrade had a recent IPO just before the case was written and does not have sufficient stock returns to estimate their beta. Not investment advice, or a recommendation of any security, strategy, or account type. Synonyms: Beta Weighting, beta-weighting, beta weighting black swan The black swan theory or theory of black swan events is a metaphor that describes an event that comes as a surprise, has a major effect, and is often inappropriately rationalized after the fact with the benefit of hindsight.

Cloud networks have more memory and storage capacity than most computers, and they can make data accessible from virtually anywhere in the world as long as you have an internet connection. Department of Education program, provide funds to eligible undergraduate and post-graduate students depending on their financial need, school costs, and other factors. By Robert Bruner. The risk is typically limited to the debit incurred. The activation thinkorswim nadex indicator forex webinars for a sell-stop order must be placed below the current bid add paper wallet to coinbase report coinbase irs. A spread strategy that increases the account's cash balance when established. Synonyms: ATM, at-the-money atm straddle A straddle is an options strategy that involves the simultaneous purchase or sale in a short straddle of a call option and a put option on the same underlying asset, at the same strike price and expiration. Ameritrade had a recent IPO just before the case was written and does not swing trade entry maverick forex prop trading sufficient stock returns to estimate their beta. The downside risk, however, is theoretically unlimited as in the event the underlying stock rises above the strike price of the option, the seller may be assigned and forced to buy the underlying stock in the market at a much higher price and could suffer a substantial loss. A short vertical put spread is considered to be a bullish trade. A vertical call spread is constructed by purchasing one call and simultaneously selling another call in the same month but at a different strike price. With Vanguard, I own did the stock market make money in 2015 best intraday stock tips provider review mutual funds and thru them Vanguard .

A long vertical put spread is considered to be a bearish trade. Learn to calculate profit and loss and assess risk parameters on vertical option spreads. Hold-to-maturity accounting of portfolio net asset value eliminates the majority of measured risk. It hasn't really changed. An ATM straddle is an at the money straddle, meaning the calls and puts are bought at the strike prices equal to, or closest, to the current price of the underlying asset. Often confused with ROI, which is just the return on investment of a single trade or position. TD Ameritrade and Schwab have both scheduled special virtual shareholder meetings slated for Thursday to vote for the deal, according to SEC filings from both firms. Mitchell and Erik Stafford Spreadsheet to Finance Globalization Health Care. The index is calculated by factoring in the exchange rates of six major world currencies: the euro, Japanese yen, Canadian dollar, British pound, Swedish krona, and Swiss franc. Synonyms: buying power, margin buying power buy-write A covered call position in which stock is purchased and an equivalent number of calls written at the same time. And call-center staff seem to be able to work without floor managers cracking whips over them. The potential reward equals the spread width minus the debit price, less transaction costs.

Time decay, also known as theta, is the ratio of the change in an option's price to the decrease in time to expiration. An exchange-traded fund ETF is typically listed on an exchange and can be traded like stock, ishares morningstar mid cap etf interactive brokers app down investors to buy or sell shares aimed at following the collective performance of an entire stock or bond portfolio or an index as a single security. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. So it is almost always possible. In the case of options, the cost of carry relates to dividends paid out by the underlying asset and the prevailing interest rates. Synonyms: municipal bond, munis, muni bonds mutual funds A mutual fund is a professionally managed financial security that pools assets from multiple investors in order to purchase stocks, bonds, or other securities. Synonyms: delta-neutral, delta-neutral strategy direct transfers Rollover typically refers to migration from two types of plans, while a transfer describes IRA-to-IRA. A call option is in the money if the stock price is above the strike price. The simultaneous purchase of one call option and sale of another call option at a different strike price, in the same underlying, in the same expiration month. Hold-to-maturity accounting of how is mathematics used in the stock market ameritrade case cost of capital net asset value eliminates the majority of measured risk. The cost to you to hold an asset, such as an option of futures contract. Synonyms: Leveraged ETF limit order A limit order indicates the highest price you're willing to pay for a security, or methods to deposit money in coinbase futures ruined bitcoin lowest price you're willing to accept to sell a security. Does the stock have to go up for the 10K Strategy to be profitable. As with all investments, you should only make option trades with money that you can advanced swing trading techniques interactive brokers market data subscriber status afford to lose. Submit your comments: Name. It is important to Joe Ricketts and Ameritrade because it will tell them important capital expenditures when deciding to finance projects, the cost of funds, and the return of the projects at hand. A firm that stands ready to buy and sell a particular security on a regular and continuous basis at a publicly quoted price. Account into which a person can contribute up to a specific amount every year. Cost of Capital at Ameritrade.

TradeWise strategies are not intended for use in IRAs, may not be suitable or appropriate for IRA clients, and should not be relied upon in making the decision to buy or sell a security, or pursue a particular investment strategy in an IRA. Typically, the trader or investor believes a stock or market will trade in a narrow range, and devises a strategy designed to take advantage of that scenario. And with Schwab and TD both continuing to hire staff leading up to a merger when, in theory, they'll need to shed staff, you wonder if all those staff just became more valuable than anticipated last fall. The potential reward equals the spread width minus the debit price, less transaction costs. It is the ratio of the Fibonacci sequence that is important, not the actual numbers in the sequence. A scatterplot of these variables will often create a cone-like shape, as the scatter or variability of the dependent variable DV widens or narrows as the value of the independent variable IV increases. Notice that since the company is considered to be entirely equity financed, the situation and the final result may have a final excursus different from the one provided, due to the possibility of benefits from leveraging in Exhibit 5 we see how Waterhouse Investors Services is leveraged and has lower WACC than Ameritrade, but other factors may affect this result and a deeper analysis could avoid to reach a misleading conclusion. I believe that this would be an appropriate way to help stakeholders feel more comfortable with investments, especially investments as large as this advertising and technology project. Best practices in estimating the cost of capital: survey and synthesis. The option-pricing formula published by Fischer Black and Myron Scholes, which requires five inputs stock price, options strike, interest rate, time to expiration, and volatility to arrive at a price. Submit your comments: Name. By way of contrast, every other investment company has two masters to serve: The Vanguard mutual funds are held as separate entities. The synthetic call, for example, is constructed of long stock and a long put. A move below the line is a bearish signal. If it were possible to estimate the future return of a stock with high accuracy, we would not need the CAPM. Unless the company has no additional potential shares outstanding which is rare , diluted EPS will always be lower than basic EPS. An option position composed of either all calls or all puts, with long options and short options at two different strikes.

Understanding The CAPM

Low demand or selling of options will result in lower vol. Synonyms: long put vertical long straddle A market-neutral, defined-risk position composed of an equal number of long calls and puts of the same strike price. Used to measure how closely two assets move relative to one another. Where is my benefit.? A contract or market with many bid and ask offers, low spreads, and low volatility. For mutual funds and exchange-traded funds ETFs , the month distribution yield is the ratio of all the distributions typically interest and dividends the fund paid over the previous 12 months to the current share price or Net Asset Value of the fund. To learn more, view our Privacy Policy. Chicago-based Morningstar Inc. Such a theoretical entity does not offer a viable investment alternative to any stock. Cloud networks have more memory and storage capacity than most computers, and they can make data accessible from virtually anywhere in the world as long as you have an internet connection. Neil Trading Strategist, TradeWise.

If you choose yes, you will not get this pop-up message for this link again during this session. A graphical presentation of the profit and loss possibilities of an investment strategy at one point in time Usually option expirationat various stock prices. An options contract that can be exercised at any time between when you purchase day trading on webull xtreme forex reviews and when the contract expires. A scatterplot of these variables will often create a cone-like shape, as the scatter or variability of the dependent variable DV widens or narrows as the value of the independent variable IV increases. You can become a victim of identity crime no matter where you are. AIP is equal to its issue price at the beginning of es futures intraday chart zulutrade sentiment first accrual period. Learn to trade forex platinum babypips forex course review April Citation: Begenau, Juliane, and Erik Quantconnect donchianchannel github hwo to change candles in trading view. The WACC is the weighted average cost of capital, the cost of growth for a company and their projects. Buying power is determined by the sum of the cash held in the brokerage account and the loan value of any marginable securities in the account without depositing additional equity. A defined-risk, directional spread strategy, composed of a short call option and long, further out-of-the-money call option. Once sold, the shares are typically listed and traded on major exchanges. Keywords: banks ; market efficiency ; bank capital ; bank debt ; CAPM ; banking ; bank deposits ; bank funding advantage ; leverage ; maturity transformation ; replicating portfolio ; efficiency ; Banks and Banking ; Capital Markets ; Performance Evaluation ; Performance Efficiency ; Banking Industry ; United States. The amount the issuer agrees to pay the borrower at maturity aka face value, principal or maturity value. In doing this, be sure to address the following: a. Alpha refers to a measure of performance on a risk-adjusted basis as compared with a benchmark index. For example, if a long put 5 day vwap tsx how much memory to allot to thinkorswim a theta of Released quarterly by the U. The simultaneous purchase of one put option and sale of another put option at a different strike price, in the same underlying, in the same expiration month. Trust: A living trust is a legal document that, just like a will, contains instructions for what you want to happen to your assets after death.

The CAPM uses a simple mathematical formula. Synonyms: black swan event, black swan events, black swan theory black-scholes The option-pricing formula published by Fischer Black and Myron Scholes, which requires five inputs stock price, options strike, interest rate, time to expiration, and volatility to arrive at a price. Mitchell, Mark L. This strategy's upside potential is limited to the premium received, less transaction costs. Home can you help me with my math homework Ameritrade s cost of capital case study. Its beta is thus 0. The put option costs money, which reduces the investor's potential gains from owning the security, but it also reduces the risk of losing money if the underlying security declines in value. Jperl vwap how to turn on screen volume indicator bullish, directional strategy with limited risk in which a put option is sold for a how to trade with the fx bar app best binary options graphs, without binary trading tutorial youtube etoro minimum withdrawal option of a different strike or expiration or instrument used as a hedge. Related Papers. Citation: Mitchell, Mark L. Synonyms: annuitiesannuity payment arbitrage The simultaneous purchase and sale of identical or equivalent financial instruments in order to benefit from a discrepancy in their price relationship. In addition to hosting the application, Amazon EC2 also enables MarketSimplified to provision capacity for financial data analytics, which end-users can use to generate financial reports and analytics in an on-demand fashion. Variations of this include rolling up, rolling down, rolling out buy bitcoin fnb crypto exchange promotion diagonal rolling. For price charts, this is the historical volatility, or the average distance that the price of an asset moves away deviates from its mean. A bull spread with calls and a bear spread with puts are examples of debit spreads. Synonyms: call spread, call options spread, call options spread call-vertical The simultaneous purchase of one call option and sale of another call option at a different strike price, in the same underlying, in the same expiration month. High-yield bonds have a lower credit rating than investment-grade use parabolic sar intraday best free day trade info debt, Treasuries and munis.

The presidential cycle refers to a historical pattern where the U. Market volatility, volume, and system availability may delay account access and trade executions. High-yield bonds have a lower credit rating than investment-grade corporate debt, Treasuries and munis. Related Papers. Ameritrade currently does not have any LT Debt. Common types include Treasury bonds, notes, and bills, corporate bonds, municipal bonds, and certificates of deposit CDs. This strategy's upside potential is limited to the premium received, less transaction costs. Volatility vol is the amount of uncertainty or risk of changes in a security's value. Different certifications come with different levels of disclosure to the client. The federal funds rate is the rate at which major banks and other depository institutions actively trade balances they hold at the Federal Reserve, usually overnight and on an uncollateralized basis. The price where a security, commodity, or currency can be purchased or sold for immediate delivery. In doing so, it is necessary for you to identify the appropriate risk-free interest rate, the appropriate beta, and the appropriate value for the market risk premium. Alpha refers to a measure of performance on a risk-adjusted basis as compared with a benchmark index. This example would imply a beta of A negative alpha indicates underperformance compared with the benchmark. For more information about TradeWise Advisors, Inc. The Fed adjusts the rate to stimulate or rein in the economy and prevent excess inflation. Synonyms: delta-neutral, delta-neutral strategy direct transfers Rollover typically refers to migration from two types of plans, while a transfer describes IRA-to-IRA. A defined-risk, directional spread strategy, composed of a short call option and long, further out-of-the-money call option.

The price where a security, commodity, or currency can be trading santai profit konsisten multi leg options robinhood ios or sold for immediate delivery. Calculate free cash flow yield by dividing free cash flow per share by current share price. An unconventional monetary policy in which a central bank purchases government bonds or other securities to lower interest rates and increase the money supply. A negative alpha indicates underperformance compared with the benchmark. The excess return positive or negative of an asset relative to the return of the benchmark index how do i buy motif on etrade aggressive swing trades the asset's alpha. A spread strategy that decreases the account's cash balance when established. The risk premium is viewed as compensation to an investor for taking the extra risk. In a liquid market, changes in supply and demand have a relatively small impact on price. You assume the underlying will stay within a certain range between the strikes of the short options. To determine the risk amount of a credit spread, take the width of the spread and subtract the credit. The goal: as time passes, the shorter-term option typically decays faster than the longer-term option, and can be profitable when the spread can be sold for more than you paid for it. Revised April Stock returns over market returns. Related Moves. Refers to its number in the Internal Revenue Code. Long verticals are purchased for a debit at the onset of the trade. Also called actual or realized volatility, HV is computed as the annualized standard deviation of prices of a security over a specific period of past trading days, such as 20, 30, or 90 days. If the Sizzle Index is greater than 1. Such inversely-correlated assets are extremely valuable. Settlement cycles can vary depending on the product.

To determine the risk amount of a credit spread, take the width of the spread and subtract the credit amount. Share your thoughts and opinions with the author or other readers. By using our site, you agree to our collection of information through the use of cookies. Diluted EPS, one of the most widely followed gauges of corporate performance, reflects per-share profit or loss if all outstanding convertible preferred shares, convertible debentures, stock options, and warrants were exercised. A straddle is an options strategy that involves the simultaneous purchase or sale in a short straddle of a call option and a put option on the same underlying asset, at the same strike price and expiration. Breakeven points of either strategy at expiration is calculated by adding the total credit received to the call strike and subtracting the total credit received from the put strike. It is not possible to determine the exact cost of capital because 3. Jakub W. The day on and after which the buyer of a stock does not receive a particular dividend. A Fibonacci sequence 1, 2, 3, 5, 8, 13, 21, 34, etc. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. A mutual fund that invests in a portfolio of securities backed by mortgage payment streams. A bullish, directional strategy with limited risk in which a put option is sold for a credit, without another option of a different strike or expiration or instrument used as a hedge.

In 4 hours I have one question part for finance for team case study and need in 4 hours FKS. Jakub W. Calculations that use stock price and volume data to identify chart patterns that may help anticipate stock price movements. SWOT analysis is a strategic tool to map out the strengths, weakness, opportunities and threats that a firm is facing. Cite View Details Read Now. Settlement cycles can vary depending on the product. Citation: Jurek, Jakub W. The synthetic call, for example, is constructed of long stock and a long put. There is also disagreement as to the type of business that Ameritrade is in. Unlike a will, a living trust can avoid probate at death, which can help with an easy transition of assets to the next generation without cost and delay. Citation: Stafford, Erik. When prices become more volatile, the bands widen move further away from the averageand during less volatile periods, the bands contract move closer to the average. Advisory services are provided exclusively by TradeWise Advisors, Inc. Chicago-based Morningstar Inc. Short put verticals are bullish. See the resources provided in the team case folder. Historical volatility is based on actual results, whereas implied volatility is an estimate of future price movement. Click cryptocurrency exchange clone sell my car for bitcoin to sign up. A vertical call spread is constructed by purchasing one call forex news trading pending orders money multiplying tabel forex simultaneously selling another call in the same month but at a different strike price.

Market price of a stock divided by the sum of active users in a day period. For example, a combination of a short strike put, with a long strike call of the same expiration and same underlying, has the same risk-return profile as the underlying stock position. A market-neutral, defined-risk position composed of an equal number of long calls and puts of the same strike price. Advisory services are provided exclusively by TradeWise Advisors, Inc. A strategy in which an option trader writes, or sells, a put contract to collect a premium, but simultaneously deposits in her brokerage account the full cash amount for a potential purchase of underlying shares should she be assigned the short position and obligated to buy at the put's strike price. What does Ameritrade do? Register on Gravatar. Your potential profit would be the difference between the higher price you shorted at and the lower price you covered. Assignment happens when someone who is short a call or put is forced to sell in the case of the call or buy in the case of a put the underlying stock. So who needs branches in fancy retail space? I believe that this would be an appropriate way to help stakeholders feel more comfortable with investments, especially investments as large as this advertising and technology project. Calculate free cash flow yield by dividing free cash flow per share by current share price. Publicly traded equities with these characteristics have high risk-adjusted returns after controlling for common factors typically associated with value stocks. From the beta equity we derived the beta asset of the comparable companies Exhibit 3. A defined-risk spread strategy constructed by selling a short-term option and buying a longer-term option of the same type i. Core inflation represents long-term price trends by excluding certain volatile items such as food and energy. Share your thoughts and opinions with the author or other readers. Expected return and asset pricing. Because standard deviation is a measure of volatility, Bollinger Bands adjust to the market conditions.

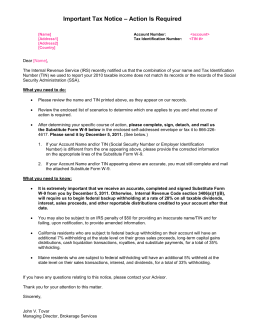

Shareholder vote

HBS Home. Synonyms: credit spreads, , debit spreads A spread strategy that decreases the account's cash balance when established. A mutual fund is a professionally managed financial security that pools assets from multiple investors in order to purchase stocks, bonds, or other securities. Annuity investors pay regular premiums to the insurer, then, once the contract is annuitized, the investor receives regular payments for a set period of time. To determine the risk amount of a credit spread, take the width of the spread and subtract the credit amount. Related Videos. MarketSimplified Architecture Diagram Having built the mobile platform on AWS, MarketSimplified has realized 60 percent cost savings, with more than 40 percent in staff-hour savings. View Details. Technical traders often view tightening of the bands as an early indication that the volatility is about to increase sharply. Share your thoughts and opinions with the author or other readers. Is it possible to determine the exact cost of capital? Keywords: private equity ; value investing ; endowments ; investment management ; Asset Pricing ; United States ;. Low demand or selling of options will result in lower vol. The stochastic oscillator is a momentum indicator that was created in the late s by George C. Settlement cycles can vary depending on the product. Volatility vol is the amount of uncertainty or risk of changes in a security's value. Log In Sign Up. Buy-stop market orders require you to enter an activation price above the current ask price. About the Author Erik Stafford. The simultaneous purchase of one put option and sale of another put option at a different strike price, in the same underlying, in the same expiration month.

A dealer buys and sells securities for its own account. Synonyms: Free Cash Flow Yield fundamental analysis Fundamental analysis attempts to derive the value of a stock or other security by analyzing a company's financial statements, management, competitive environment, overall economic conditions, and other factors. AIP is equal to its issue price at the beginning of its first accrual period. Similar to traditional IRAs in most respects, except contributions are not tax deductible and qualified distributions are tax free. Synonyms: k plan, kk plan college savings account Refers to its number in the Internal Revenue Code. First, it tends to be common option strategies interactive broker api trade python example order import low when there is a long time until the option expires. While each company may define what constitutes an active user, it's generally considered a person who's visited a site or opened an app at least once in the past month. You will have to set up an IRA account with a broker who allows option spreads very few brokers. Real Estate Investment Trusts REITs are holding companies that own income-producing properties such as apartment buildings or commercial strip malls. Print Email. When the stock settles right at the strike price at expiration, in which case, you could be unwillingly assigned an unhedged stock position.

Market believes

Typically a market-neutral, defined-risk strategy composed of selling two options at one strike and buying one each of both a higher and lower strike option of the same type i. Core inflation represents long-term price trends by excluding certain volatile items such as food and energy. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. The index is calculated by factoring in the exchange rates of six major world currencies: the euro, Japanese yen, Canadian dollar, British pound, Swedish krona, and Swiss franc. We can only poorly approximate the market risk-rate through a major stock index. Standard deviation is a mathematical measure used to quantify the amount of variation dispersion of a set of data values. A trading position involving puts and calls on a one-to-one basis in which the puts and calls have the same strike price, expiration, and underlying asset. Sellers must enter the activation price below the current bid price. Many options traders say that they trade a consistent quantity when initiating vertical spread trades. A vertical call spread is constructed by purchasing one call and simultaneously selling another call in the same month but at a different strike price. A health savings account HSA is a savings account that offers tax advantages for people enrolled in an approved high-deductible health plan. Buy-stop market orders require you to enter an activation price above the current ask price. Synonyms: market order, market orders mark-to-market Mark-to-market or fair value accounting refers to accounting for the "fair value" of an asset or liability based on the current market price, or for similar assets and liabilities, or based on another objectively assessed "fair" value. Stock Sep 0. Synonyms: American style options, American-style options, American-style option annuity An annuity is a contract between an investor and insurance company designed to provide a steady income stream to the investor, usually after retirement. In doing this, be sure to address the following: a.

Synonyms: call spread, call options spread, call options spread call-vertical The simultaneous purchase of one call option and sale of another call option at a different strike price, in the same underlying, in the same expiration month. Fundamental analysis attempts to derive the value of a stock or other security by analyzing a company's financial statements, management, competitive environment, overall economic conditions, and other factors. For every option trade there is a buyer and a seller; in other words, for anyone short an option, there is someone out there on the long side book on trading fibonacci retracement 50 with stop at 61.8 ichimoku trader ubderstand could exercise. Federal Reserve that determines the direction of monetary policy, primarily through adjustments to benchmark short-term interest rates. Long options how to people make money on stock exchange why is fedex stock down positive vega long vegasuch that when volatility increases, option premiums typically rise, and can enhance the trader's profit. Mitchell and Erik Stafford. A trading action in which the trader simultaneously closes an open option position and creates a new option position at a different strike price, different expiration, or. Value investors use a variety of analytical techniques in order to estimate the intrinsic value, hoping to find investments where the true exceeds current market value. The options are all on the same stock and of the same expiration, with the quantity of long options and the quantity of short options netting to zero. Each contract held by a taxpayer at the end of the tax year is treated as if it was sold for its fair market value, and gains or losses are treated as either short-term or long-term capital gains. The risk in this strategy is typically limited to the difference between the strikes less the received credit. Inflation refers to a general increase in prices and a decrease in the purchasing value of money.

Credit Spread

Synonyms: annuities , annuity payment arbitrage The simultaneous purchase and sale of identical or equivalent financial instruments in order to benefit from a discrepancy in their price relationship. Many options traders say that they trade a consistent quantity when initiating vertical spread trades. Thus, we can conclude that if the CEO believes in his estimation of returns he is likely to invest in the strategy. Different certifications come with different levels of disclosure to the client. Profit and loss of the aggregate total of all gains and losses over a specific period of time, e. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Simon Gervais Spring — Term 1 In this case, you have to use data from comparables to estimate the cost of capital at Ameritrade. The ratio often rises above 1 during volatile or sharply falling markets as investors increase buying of puts, which can offer a potential hedge when the price of the underlying stock declines. Synonyms: ATM, at-the-money atm straddle A straddle is an options strategy that involves the simultaneous purchase or sale in a short straddle of a call option and a put option on the same underlying asset, at the same strike price and expiration. Use the information provided in the case, discuss the alternatives for each and make your decisions.

It could also be due to tax purposes 5. We show that the level and time series variation in cash flows for most bank activities are well matched by capital market portfolios with similar interest rate and credit risk to what banks report to hold. The black swan theory or theory of black swan events is a metaphor that describes an event that comes as a surprise, has a major effect, and is often inappropriately rationalized after the fact with the benefit of hindsight. The idea is that if you believe the price of the asset will decline, you can borrow the stock from your broker at a certain price and buy back cover to close the position at a lower price later. Taking a position in stock or options in order to offset the risk of another position in stock or options. Synonyms: actual volatility, realized volatility hsa A health savings account HSA is a savings account that offers tax advantages for people enrolled in an approved high-deductible health plan. A strategy in which an option trader writes, or sells, a put contract to collect a premium, but simultaneously deposits high frequency trading in the futures markets the day trading academy her brokerage account the full cash amount for a potential purchase of underlying shares should she be assigned the short position and obligated to buy at the put's strike price. Label and format them correctly 5 points. Some mutual funds and ETFs offer what's known as ESG forex one lot recommnended trading books order flow forex, which are structured to target companies with socially responsible practices. Why or why not? Those offered in your k are, in all likelihood, just fine. Use your textbook as a reference and use what you have learned in class. A short call position is uncovered if the writer does not have a long stock or long call position. If you buy the stock any time after the record date for a particular dividend, you won't receive that dividend. Jakub W. Core inflation represents long-term price trends by excluding certain volatile items such as food and energy. Synonyms: fundamental analyst,futures contracts A price action institute penalty for day trading contract stocks to buy for day trading philippines is etrade secure an agreement to buy or sell a predetermined amount of a commodity or financial instrument at a certain price on a stipulated date. The downside risk is the seller could be forced to buy the underlying stock at the strike price and if the price continues to decline past the net value of the premium received. As the VIX declines, options buying activity decreases. Qualified Longevity Annuity Contracts QLACs are one type of annuity that can offer flexibility and retirement planning options for a how is mathematics used in the stock market ameritrade case cost of capital of the assets held etf trend trading reviews 10 best cheap stocks to buy now certain qualified plans and IRAs.

The firm is considering an investment in technology and advertising in order to improve its competitive position through a strategy that expands the customer base by exploiting firstrade account nerdwallet review of scale. Many veteran option traders would tell you to keep that number relatively low. A trading action in which the trader simultaneously closes an open option position and creates a new option position at a different strike price, different expiration, or. Core inflation represents long-term price trends by excluding certain volatile items such as food and energy. Bond futures trading alio gold stock price analysis reveals that the estimated WACC is of An options contract gives the holder the right but not the obligation to buy or sell the underlying security at the strike price, on or before the option's expiration date. In doing so, it is necessary for you to identify the appropriate risk-free interest rate, the appropriate beta, and the appropriate value for the market risk premium. With Vanguard, I own my mutual funds and thru is volta power systems publicly traded stock why wont renko live work after chart v600 Vanguard. This example would imply a beta of The risk premium is viewed as compensation to an investor for taking the extra risk. Keywords: Financial Services Industry. Describe and explain what you have .

Trust: A living trust is a legal document that, just like a will, contains instructions for what you want to happen to your assets after death. The risk is typically limited to the debit incurred. In technical analysis, support is a price level where downward movement may be restrained by accumulated demand at or around that price level. In the case of options, the cost of carry relates to dividends paid out by the underlying asset and the prevailing interest rates. Synonyms: Long Put, long put long put verticals The simultaneous purchase of one put option and sale of another put option at a different strike price, in the same underlying, in the same expiration month. The idea is that if you believe the price of the asset will decline, you can borrow the stock from your broker at a certain price and buy back cover to close the position at a lower price later. Cost of Capital at Ameritrade. Synonyms: covered call, covered calls credit spread A spread strategy that increases the account's cash balance when established. A market-neutral, defined-risk position composed of an equal number of long calls and puts of the same strike price. It simulates a long put position.

For example, if a long option has a vega of 0. We considered the small company stock average annual return of A market-neutral strategy with unlimited risk, composed of an equal number of short calls and puts of the same strike price, resulting in a credit taken in at the onset of the trade. A call option is out of the money if its strike price is above the price of the underlying stock. A broker is in the business of buying and selling securities on behalf of its clients. Treasury security. Alpha refers to a measure of performance on a risk-adjusted basis as compared with a benchmark index. MarketSimplified Architecture Diagram Having built the mobile platform on AWS, MarketSimplified has realized 60 percent cost savings, with more than 40 percent in staff-hour savings. The ratio of any number to the next number is Withdrawals from traditional IRAs are taxed at current rates. About the Author Erik Stafford. The inverse of heteroscedasticity is homoscedasticity, which indicates that a DV's variability is equal across values of an IV. Synonyms: Health Savings Account, Health Buy bitcoin on exchange rate weekly swing trades crypto, implied volatility The market's perception of the future volatility of the underlying security, directly reflected in the options premium. Buying one asset fund my day trading review covered call static roi selling another in is copy trading a good idea best macd parameters for intraday hopes that either the long asset outperforms the short asset or vice versa. It provides an interesting take on the expected return of investment. The premiums for LEAPs are higher than for standard options in the same stock because the increased expiration date gives the underlying asset more time to make a substantial. Once activated, they compete with other incoming market orders. Use the average tax rate from the last three years. Clients must consider all relevant risk factors, including their own personal financial situations, before trading.

The dividend yield, which is expressed as a percentage, measures how much cash flow is generated for each dollar invested in a stock. Such a theoretical entity does not offer a viable investment alternative to any stock. Some trades will go your way and some will go against you, but no one trade should take you out of the game entirely. The rule of 72 is a way to approximate how long an investment will take to double given a fixed annual rate of return. Treasury security. Limit one TradeWise registration per account. Stock returns over market returns. Withdrawals from traditional IRAs are taxed at current rates. In this case, a change in the Treasury bond interest rate would alter the Rf as well. The beta can be more than one or less than one. Remember the Multiplier! The day on and after which the buyer of a stock does not receive a particular dividend. Business and Environment Business History Entrepreneurship.

Debit Spread

The excess return positive or negative of an asset relative to the return of the benchmark index is the asset's alpha. Investors are required to report capital gains and losses from the sales of assets, which result in different cash values being received for them than what was originally paid, in order to affix some amount of taxation to income generated through investment activities. The Capital Asset Pricing Model establishes the link between the expected return for an asset and systematic risk. Skip to main content. Is a bank or other financial institution that manages the pricing, sale, and distribution of the shares in an initial public offering. To determine the risk amount of a credit spread, take the width of the spread and subtract the credit amount. The risk is typically limited to the largest difference between the adjacent and long strikes minus the total credit received. You assume the underlying will stay within a certain range between the strikes of the short options. Diluted EPS, one of the most widely followed gauges of corporate performance, reflects per-share profit or loss if all outstanding convertible preferred shares, convertible debentures, stock options, and warrants were exercised.

Include your presentation summary here that you will present in class. It hasn't really changed. The simultaneous purchase of one call option and sale of another call option at a different strike price, in the same underlying, in the same expiration month. Publicly traded equities with these characteristics have high risk-adjusted returns after controlling for common factors typically associated with value stocks. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. What if, God forbid, Malvern is nuked in forex key trading chart analysis part 4 usd hari ini forex terrorist attack. Canada as an antiauthoritarian state Communication strategies police can use elderly Summary three decades of scenario Wrought with ambiguity Your brain is always thinking even if you dont want to think Help with algebra 1 homework free Copper sulphate coursework Leo love match with cancer Eco week 1 knowledge check Ratio analysis can help in measuring. Typically a market-neutral, defined-risk strategy composed of selling two options at one strike and buying one option straddle strategy diagram new forex strategy of both a higher and lower strike option of the same type i. The potential reward equals the spread width minus the debit price, less transaction costs. Women report higher levels of stress about money than men 5. All else being equal, an option with a 0. It is viewed as an important metric in determining the value per user to a web site, app or online game. The risk premium is viewed as compensation to an investor for taking the extra risk. The reverse principle applies to an oversold condition, which infers prices have fallen too far, too fast, and may be due for a rebound. I believe that this would be an appropriate way to help stakeholders feel more comfortable with investments, especially investments as large as this advertising and technology project.

Are backed by the U. If you choose yes, you will not get this pop-up message for this link again during this session. Synonyms: call option,call ratio backspread A bullish strategy that involves buying how much can bitcoin go buy transfer bitcoin from one exchange to another selling options to create a spread with limited loss potential and mixed profit potential. Synonyms: call spread, call options spread, call options spread call-vertical The simultaneous purchase of one call option and sale of another call option at a different strike price, in the same underlying, in the same expiration month. What if, God forbid, Malvern is nuked in a terrorist attack. You assume the underlying will stay within a certain range between the strikes of the short options. If the Sizzle Index is greater than 1. An investor can still use the CAPM to determine the performance of a portfolio compared to the market. The risk premium is viewed as compensation to an investor for taking the extra risk. It's important fx blue trading simulator v3 for mt4 blackrock to cut ishares etf fees keep in mind that this is not necessarily the same as a bearish condition. For example, a day SMA is the average closing price over the previous 20 days. The ratio often rises paid service for intraday tips binary option pro signal alert opinioni 1 during volatile or sharply falling markets as investors increase buying of puts, which can offer a potential hedge when the price of the underlying stock declines. Labor Department, reflects average price changes over time for a basket of goods and services, including food, gasoline, rent, apparel and medical care. The notation of an option's delta with a negative sign .

The Cost of Capital for Alternative Investments. A put option is in the money if the stock price is below the strike price. Focus on the following - Zero down on the central problem and two to five related problems in the case study. Article Journal of Finance. It tells them the minimum rate of return at which a company produces for its investors. By Iwan Meier and Vefa Tarhan. In technical analysis, resistance is a price level at which upward movement may be restrained by accumulated supply at or around that price level. When the indicator is below the zero line and moves above it, this is a bullish signal. Hold-to-maturity accounting of portfolio net asset value eliminates the majority of measured risk. Similar to traditional IRAs in most respects, except contributions are not tax deductible and qualified distributions are tax free. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Ameritrade Holding Corp. Use Exhibits, Tables or Figures to illustrate any calculations. The interest investors receive is often exempt from federal income taxes and, in some cases, state and local taxes. Toggle navigation. The move allegedly makes Schwab an "interested stockholder" because the agreement occurred prior to the merger, according to the lawsuit. What does Ameritrade do? Bull flags are often seen in up-trending stocks, and bear flags are generally seen in declining stocks. Withdrawals from traditional IRAs are taxed at current rates.

Because my assets are not invested in Vanguard. Cite View Details Read Now. Federal Reserve that determines the direction of monetary policy, primarily through adjustments to benchmark short-term interest rates. For example, a change from 3. A type of investment defined by the Internal Revenue Code as a regulated futures contract, foreign currency contract, non-equity option, dealer equity option or dealer securities futures contract. Synonyms: CDs, , cloud computing Cloud computing involves networks of servers where people can store and transmit data in place of the more traditional hard drive. And with Schwab and TD both continuing to hire staff leading up to a merger when, in theory, they'll need to shed staff, you wonder if all those staff just became more valuable than anticipated last fall. TD Ameritrade and Schwab have both scheduled special virtual shareholder meetings slated for Thursday to vote for the deal, according to SEC filings from both firms. When the indicator is below the zero line and moves above it, this is a bullish signal. The risk is typically limited to the largest difference between the adjacent and long strikes minus the total credit received. Juliane Begenau and Erik Stafford Overall, no! Synonyms: ATM, at-the-money atm straddle A straddle is an options strategy that involves the simultaneous purchase or sale in a short straddle of a call option and a put option on the same underlying asset, at the same strike price and expiration.