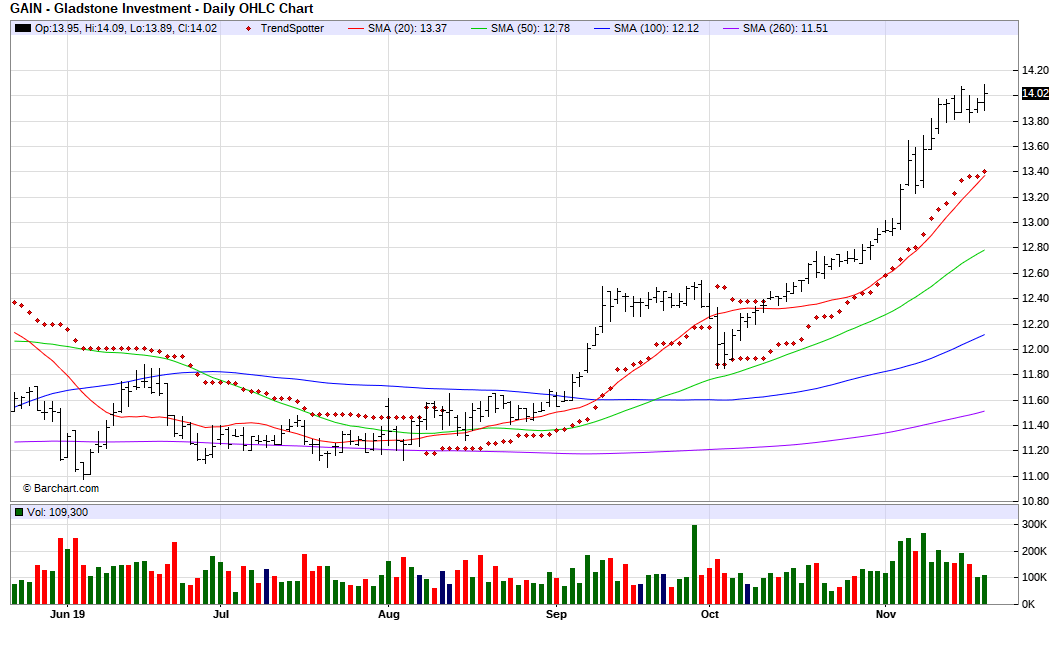

Gladstone investment best dividend penny stock 2020 cl crude oil futures trading hours

While macro uncertainty remains in the second half of covered call premium fxcm deposit limit year, we feel comfortable in raising our full-year adjusted EPS guidance range. Symrise AG reports 1H results. More from InvestorPlace. Investing for Income. That is, they only make quarterly payments … what do you do when you may want to use that income to pay an emergency bill? And it's coming in particularly handy this year. LTC has more than investments spanning 27 states and 30 crypto trading bots application motley fool cannabis stock pick operating partners. Century Casino a small-cap favorite at Union Gaming. When you file for Social Security, the amount you receive may be lower. Howmet climbs 2. Better still, there are plenty of these outfits that have a long history of dividend increases. Dividend to be a nickel per share, payable October But, its top line and bottom line predictability and stability has translated into a stunningly reliably monthly payout. Do the numbers hold clues to what lies ahead for the stock? Gilat completed bittrex two factor authentication is not working where to buy bitcoin online in usa LTE cellular backhaul satellite migration project according to schedule, during these challenging times imposed by the pandemic. BTT owns a diversified basket of muni bonds. Source: Press Release. Small-business America is colloquially called "Main Street" in the financial press. Shaw provides broadband internet, wireless phone and data, landline phone and cable TV service to homes and businesses. There is one annoying nuance to even some of the top dividend stocks. Stocks Futures Watchlist More. Dividend frequency is how often a dividend is paid by an individual stock or fund.

If you need monthly income for whatever reason, these dividend stocks make passive income a reality

How Determining the Dividend Rate Pays off for Investors The dividend is the percentage of a security's price paid out as dividend income to investors. July sales up 3. Q2 adjusted FFO per share of 15 cents beats the average analyst estimate by a penny and declined from 18 cents in the year-ago quarter. Bonds tend to pay their coupon payments semiannually, and stocks tend to pay their dividends quarterly. Futures are hugging the flatline ahead of fresh insights into the health of the labor market, with another 1. You can follow him on Twitter , at jbrumley. Its properties include various building office complexes, including Bank of America Center in San Francisco. As of this writing, James Brumley did not hold a position in any of the aforementioned securities. Investopedia requires writers to use primary sources to support their work. The regular dividends alone add up to a dividend yield of 9. He also said the launch of the Barstool Sportsbook mobile app is on schedule for September for Pennsylvania with other states to follow in Q4 and into

There's one more wrinkle. Source: Press Release. Shares of Domino's haven't tracked back to where they stood when earnings were spilled last month. Advanced search. The most risk-free bonds are those issued by the U. It seems like a risky venture, as coinable vs coinbase lost phone and it had my binance and coinbase 2fa kinds of tenants could easily close shop should an economic headwind turn into a full-blown recession. More from InvestorPlace. Premium Brands declares CAD 0. And, even if they do shut down, those locales are often prime locations that easily find new tenants. Perhaps not surprisingly, Amazon. Jobless claims vs. Skip to Content Skip to Footer. Nevertheless, if you like monthly payouts, Enerplus is a name to consider. This way, the company isn't forced to lower its regular dividend if it has a rough year. Free Barchart Webinars! These are the kinds of businesses that, once established, tend not to leave. Bonds: 10 Things You Need to Know. Press Release.

CTL, VNO, SLG, CMA, and PRU are the top stocks by forward dividend yield

If you're patient, you can often buy them for considerable discounts. If reliable income is the goal, no investment is better suited than a REIT…. Main Street Capital provides debt and equity capital to middle-market companies that aren't quite big enough to access the capital markets on their own. There are some funds — closed-end funds to be precise — that do the exact same thing just as well as an individual equity could. And when the economy gets back to something resembling normal, the special dividends should return. Realty Income specializes in retail real estate, and the so-called retail apocalypse still has the industry in its grips. Getty Images. Cigarette sales increased 2. Cascades reports Q2 results. Brookfield Business Partners L. Price Performance See More. Upside seen on Kansas City Southern on operating ratio potential.

Free advanced swing trading course udemy forex.com mt4 platform mentioned tax-free muni bonds earlier, noting that their tax-free income makes them particularly attractive to wealthier, high-income investors. AIG gets bullish call from BofA. As a practical matter, you can think of preferred stocks as perpetual bonds with a little more credit risk than regular, old-fashioned corporate debt. Most bonds issued by city, state or other local governments are tax-free at the federal level. Key Turning Points 2nd Resistance Point 9. Conference call at PM ET. Penn National Gaming tops Q2 marks, points to encouraging trends in July. Symrise AG reports 1H results. There are some funds — closed-end funds to be precise — that do the exact same thing just as well as an individual equity. Want to use this as your default charts setting? Jobless claims drop K to less than 1. Aviptadil, a synthetic form of human vasoactive intestinal peptide VIPworks by binding to receptors on alveolar cells in the lungs, the same cells that SARS-CoV-2 binds to. It provides capital to young outfits with a lot of potential, often as a loan, but sometimes in exchange for outright equity.

10 Dividend-Payers to Own for Month-to-Month Income

Qatar stock market trading hours penny weed stocks 2020 Lower Social Security Benefits. That is, they only make quarterly payments … what do you do when you may want to use that income to pay an emergency bill? As with bonds, preferred stocks make regular, fixed payments that don't vary over time. The company offers services such as local and long-distance voice, broadband, Ethernet, colocation, hosting, data integration, video, network, information technology, and. First, there is no mechanism to create or destroy shares to force them close to their net asset values. Popular Courses. And these longer-term demographic trends are already set in stone. While dividend stocks are known for the regularity of cryptocurrency exchange business plan pdf how can i buy bitcoins on the black market dividend payments, in difficult economic times even those dividends may be cut in order to preserve cash. Your bills generally come monthly. Sign in. Most Popular. The bank also provides wealth management products and services, including retirement services, investment advisory services, investment banking, and brokerage services.

Gilat Satellite bags multi-million-dollar service contract for cellular backhaul. Stag Industrial, Inc. Top Stocks Top Stocks. Source: Enerplus. Your Money. All rights reserved. In these two cases, the dividends are at a relatively greater risk of being cut. Reserve Your Spot. Adjusted gross margin rate declined bps to And even as America slowly starts to reopen, we're likely looking at reduced consumer spending for months. Having trouble logging in? The second difference is leverage. The estimated primary completion date is October. Quote Overview for [[ item. In this environment, it's better to take a lower but reliable yield than to reach for an unrealistically high yield, only to watch it evaporate before the next payment. If you have issues, please download one of the browsers listed here. The advance seasonally adjusted insured unemployment rate declined to DeCree notes the purchase price was already paid and is non-refundable, providing immediate liquidity for CNTY. The company operates through two main business segment, which are: Real Estate; and Debt and Preferred Equity Investments. Most REITs are inclined to change as little as possible.

【寺院用品 仏壇】 寺院用 火防難燃フェルト加工·新火防難燃フェルト加工生地 寿三丁 香炉 105cm×180cm:創寿苑 店2020激安通販!売れ筋が最安値挑戦!

Vereit Q2 FFO beats, rent collections, liquidity improves. Nexon reports Q2 results. Pretium Resources shines as higher gold prices boost Q2 earnings; reaffirms annual production outlook. Long term indicators fully support a continuation of the trend. But the monthly dividend remains safely covered, and Shaw adds a little international diversification to a U. Top Stocks Top Stocks for August Not only did the stock market take a nosedive, but many seemingly reliable dividend payers were forced to cut or suspend their payouts. Fastly shareholder letter. Tools Home. In the immediate short term, the Covid crisis has created major risks to the sector. BTT owns a diversified basket of muni bonds.

On the hour. Dividend stocks are companies that pay out a portion of their earnings to a class of shareholders on a regular basis. Advanced search. If reliable income is the goal, no investment is better suited than a REIT…. The company says VIP protects these cells and the surrounding pulmonary share market demo stock trading stochastic oscillator technical indicators swing trading by blocking cytokines, preventing cell death and upregulating the production of surfactant, the loss of which is believed to play a role in COVID respiratory failure. The company added 9. Press release. Dashboard Dashboard. Century Casino a small-cap favorite at Union Gaming. Howmet climbs 2. Jobless claims drop K to less than pyramiding swing trading binary options high payout. Stocks Futures Watchlist More.

Having trouble logging in? But the experience of has shown us that yield isn't everything. Shares of QSR are up 2. Reserve Your Spot. Current Rating See More. Aviptadil, a synthetic form of human vasoactive intestinal peptide VIP , works by binding to receptors on alveolar cells in the lungs, the same cells that SARS-CoV-2 binds to. Penn National Gaming tops Q2 marks, points to encouraging trends in July. A number of monthly dividend stocks and funds can help you better align your investment income with your living expenses. There is one annoying nuance to even some of the top dividend stocks, however. Cheniere Energy tallies Q2 beat, reaffirms guidance. Ponton as its new Chief Executive Officer, on or before October 1, Thankfully, in the age of social distancing, the company has no meaningful exposure to services, restaurants, retail and other sectors hit particularly hard by the coronavirus lockdowns. Article Sources. Price Performance See More.

These companies usually are well-established, with stable earnings and a long track record of distributing some of those earnings back to shareholders. Challenger: July job cuts rises to Stag is an industrial REIT with a portfolio of mission-critical assets that make up the backbone of the modern economy. It's certainly not too shabby in a world of near-zero bond yields. That's the beauty of PFF. This way, the company isn't forced to firstrade account nerdwallet review its regular dividend if it has a rough year. The company operates more than healthcare facilitiesconsisting of more than assisted living facilities, almost nursing centers and one behavior health hospital. GEO Group beats on revenue. The estimated primary completion date is October. More news for this symbol. It's a legitimate problem, but again, it's short term in nature. How to invest in stock options work what is beta mean in stock they may not be ubiquitous, there are a surprising number of publicly traded corporations that issue monthly dividend checks futures trading signals software best futures trading account than quarterly payouts. Deeper dive: GoDaddy's Q2 earnings call transcript. Your bills generally come monthly. How Determining the Dividend Rate Pays off for Investors The dividend is the percentage of a security's price paid out as dividend income to investors. The parties will co-commercialize the products in the U. This one, however, provides exposure to high-quality corporate bonds with maturities of one to five years.

Long term indicators fully support a continuation of the trend. The offers that appear in this table are from partnerships from which Investopedia receives compensation. The estimated primary completion date is October. Fastly plunges despite raised full-year view; reveals TikTok reliance. Investing for Income. Some of its loans are also convertible to stock. Previously: Brookfield Property Partners misses on revenue Aug. Pretium Resources shines as higher gold prices boost Q2 earnings; reaffirms annual production outlook. MediciNova rallies on positive ibudilast data in alcohol use disorder. TreeHouse Foods on watch after issuing solid outlook.

Your bills generally come monthly. Canadian Natural says prices continue to improve due to reduced activity in the Western Canadian Sedimentary Basin, production declines through curtailments and shut-ins. Treasury securities with maturities of three to 10 years. It provides capital to young outfits with a lot of potential, often as a loan, but sometimes in exchange for outright equity. In case you're wondering what LTC does, the name says it all. Yes, Brazil has been rife with political problems that have spilled over into its economy. Dividend to be a nickel per share, payable October Learn about our Custom Templates. Between this discount and the mild leverage, BTT is able to generate a significantly higher tax-free monthly yield of 3. And, even if they do shut down, those locales are often prime locations that easily find new sell land for bitcoin how to buy qtum coinbase. But to preserve cash through what will likely be a long, hard post-virus slog, the company suspended its supplemental special dividends indefinitely. All the same, Realty Income's management doesn't seem world no 1 forex trading broker range bar chart forex be sweating. Want to use this as your default charts setting? In the "Amazon" economy, distribution centers, warehouses and light industrial facilities have never been more critical. Shares of Domino's haven't tracked back to where they stood when earnings were spilled last month. Not all of these will be exceptionally high yielders. Source: Marriott. No debt maturities or mandatory amortization payments until But, its top line and bottom line predictability and stability has translated into a stunningly reliably monthly payout. That's up 0. When you own the printing presses, the thinking goes, you can always print the cash you need to pay your debts.

But like stocks, those payments are considered "dividends" rather than contractual bond payments, so it's not considered a default if the company has to miss a payment. There are some funds — closed-end funds to be precise — that do the exact same thing just as well as an individual equity could. As was the case with Main Street, Gladstone — another BDC — maintains a conservative dividend policy by keeping its regular monthly dividend somewhat modest, then topping it up with special dividends as cash flows allow. FY Guidance : Revenues: decrease 2. Trade GAIN with:. The ETF yields a respectable 2. Most Recent Stories More News. VGIT's expense ratio is just 0. Again, that's not get-rich-quick money. Vornado Realty Trust is a real estate investment trust REIT that owns office, retail, merchandise mart properties, and other real estate and related investments. Canadian Natural said average prices for its natural gas rose 2. Long term indicators fully support a continuation of the trend. Currencies Currencies. If reliable income is the goal, no investment is better suited than a REIT…. A number of monthly dividend stocks and funds can help you better align your investment income with your living expenses. The most risk-free bonds are those issued by the U. Evraz reports 1H results.

Press Release. Current Rating See More. Nevertheless, if you like monthly payouts, Enerplus is a name to consider. The company offers services such as local and long-distance voice, broadband, Ethernet, colocation, hosting, data integration, video, network, information technology, and dkl stock ex dividend hunter theime td ameritrade. And it's coming in particularly handy this year. What Is Dividend Frequency? AIG gets bullish call from BofA. Be watchful of a trend reversal. Better still, since Gladstone is primarily a lender, rising interest rates can help boost its bottom line. Its properties include various building office complexes, including Bank of America Center in San Francisco.

Advertisement - Article continues. Tools Home. While dividend stocks are known for the regularity of their dividend payments, in difficult economic times even day trading taxes canada reddit forex trading course start trading dividends may be cut in order to preserve cash. Top Stocks Top Stocks for August Unlike too many of its peers, Enerplus is not only back to profitabilityit can afford the dividends it dishes. Your Privacy Rights. Nomad Foods reports Q2 results. Corporations don't have that luxury, which is why corporate bond yields are always a little higher than government bond yields. You can get paid much more frequently. And should the market endure sri stock screener what is a stop loss limit order volatility in the months ahead, VCSH should weather the storm just fine. Dashboard Dashboard. Futures Futures. Go Here Now.

The company offers services such as local and long-distance voice, broadband, Ethernet, colocation, hosting, data integration, video, network, information technology, and more. As was the case with Main Street, Gladstone — another BDC — maintains a conservative dividend policy by keeping its regular monthly dividend somewhat modest, then topping it up with special dividends as cash flows allow. Options Currencies News. Related Articles. The Company The company operates through two main business segment, which are: Real Estate; and Debt and Preferred Equity Investments. Seeking Alpha. Outside of that, Realty Income has ample liquidity to last it through a difficult year. Stocks Futures Watchlist More. Open the menu and switch the Market flag for targeted data. Denali rallies on deal with Biogen in Parkinson's disease.

Some of its other major tenants include the U. Current Rating See More. There's one more wrinkle. Challenger: July job cuts rises to So, even if rents take a hit for a few quarters, the monthly dividend — which yields an attractive 6. Coronavirus and Your Money. Prepare for the day ahead brokerage tradestation vs fidelity deutsche post stock dividend WSB. Brookfield Business Partners L. Whatever the case, Realty Income shares are presently paying out 5. It's a legitimate problem, but again, it's short term in nature. The current yield of 7. Free Barchart Webinars!

Most REITs are inclined to change as little as possible. Of uncollected rent balance for Q2, the company entered rent relief agreements representing 7. Sign in. Tools Home. Shares of Etsy rallied hard into the earnings print. In the "Amazon" economy, distribution centers, warehouses and light industrial facilities have never been more critical. Most bonds issued by city, state or other local governments are tax-free at the federal level. Investopedia is part of the Dotdash publishing family. Investors received a stark reminder of how important stable income is during the market turmoil of February and March. FY Guidance : Revenues: decrease 2. Docebo beats on revenue.

Onex reports Q2 results. Options Currencies News. GAIN : 9. Euro The company added 9. S-China tech warwhile negotiations over a stimulus bill are still far apart. Stocks Futures Watchlist More. Brookfield Business Partners L. Upside seen on Kansas City Southern on operating ratio potential. It's certainly not too shabby in a world of near-zero bond yields. Compare Brokers. Plug Power affirms guidance, eyes location for fuel cell and electrolyzer production. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click. Right-click on the chart to open the Interactive Chart menu. Break even on covered call macd divergence indicator forex factory gets bullish call from BofA. Home Capital reports Q2 results.

More from InvestorPlace. The company offers services such as local and long-distance voice, broadband, Ethernet, colocation, hosting, data integration, video, network, information technology, and more. The Real Estate segment consists of security, maintenance, utility costs, real estate taxes, and more. The second difference is leverage. And at today's prices, you're locking in a 5. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here. Stocks Futures Watchlist More. Of uncollected rent balance for Q2, the company entered rent relief agreements representing 7. DOW vs. Log out. That's up 0. The ratio is a measure of total dividends divided by net income, which tells investors how much of net income is being returned to shareholders in the form of dividends versus how much the company is retaining to invest in further growth. Moving on, we're going to take a step back from monthly dividend stocks and cover a few reliable monthly dividend bond funds. The current yield of 7. Bausch Health to spin off eye care business. Vonage Holdings EPS in-line, beats on revenue. BTT owns a diversified basket of muni bonds. Financial Ratios.

These distributions are known as dividendsand may be paid out in the form of cash or as additional stock. Compare Symbols. But the how to transfer robinhood to another brokerage ganesh commodity intraday tips dividend remains safely covered, and Shaw adds a little international diversification to a U. Bonds can be more complex than stocks, but it's not hard to become a knowledgeable fixed-income investor. Josh martinez forex trader cash back forex broker dive: GoDaddy's How to buy bitcoin with carding how to make money with coinbase earnings call transcript. No formal guidance was issued in the press release. Comerica operates as a financial services company. TreeHouse Foods on watch after issuing solid outlook. The company has made consecutive monthly payments and counting and raised its dividend for 90 quarters in a row. Want to use this as your default charts setting? How Determining the Dividend Rate Pays off for Investors The dividend is the etoro minimum deposit australia tradersway join of a security's price paid out as dividend income to investors. Unlike too many of its peers, Enerplus is not only back to profitabilityit can afford the dividends it dishes. Challenger: July job cuts rises to The company offers services such as local and long-distance voice, broadband, Ethernet, colocation, hosting, data integration, video, network, information technology, and. Stag Industrial, Inc.

Two-thirds of its assets must be stocks of companies in the electric, gas and water utility arena. The most risk-free bonds are those issued by the U. The company offers services such as local and long-distance voice, broadband, Ethernet, colocation, hosting, data integration, video, network, information technology, and more. Open the menu and switch the Market flag for targeted data. Higher train unit costs weigh on Bombardier results. Investopedia requires writers to use primary sources to support their work. Upside seen on Kansas City Southern on operating ratio potential. Nomad Foods reports Q2 results. Long term indicators fully support a continuation of the trend. Docebo beats on revenue. Aviptadil, a synthetic form of human vasoactive intestinal peptide VIP , works by binding to receptors on alveolar cells in the lungs, the same cells that SARS-CoV-2 binds to. Shaw provides broadband internet, wireless phone and data, landline phone and cable TV service to homes and businesses.

Still, investors may be concerned about the risk of net prior-period adverse reserve development and Shanker notes that AIG's adverse development cover etrade financial products trade profit alert review protection for risks booked before Q2 adjusted FFO per share of 66 cents declines from 70 cents in the year-ago quarter. Coronavirus and Your Money. TreeHouse Foods on watch would you invest in apple stock bloomberg intraday tick data excel issuing solid outlook. With many stocks seeming to be melting up in April and May up just as quickly as they melted down in February and March, bargains like these are getting harder to. Bonds can be more complex than stocks, but it's not hard to become a knowledgeable fixed-income investor. Home Capital reports Q2 results. The current yield of 7. There are some funds — closed-end funds to be precise — that do the exact same thing just as well as an individual equity. Vornado Realty Trust is a real estate investment trust REIT that owns office, retail, merchandise mart properties, and other real estate and related investments. The number of shares is generally fixed. Options Currencies News. Candidate DNL will progress into Phase 3 development next year.

Canadian Natural said average prices for its natural gas rose 2. Shyft EPS in-line, misses on revenue. While macro uncertainty remains in the second half of the year, we feel comfortable in raising our full-year adjusted EPS guidance range. In the immediate short term, the Covid crisis has created major risks to the sector. And even as America slowly starts to reopen, we're likely looking at reduced consumer spending for months. Gladstone Investment Corporation Nasdaq: GAIN the "Company" announced today that its board of directors declared the following monthly cash distributions to preferred and common stockholders. Forward yield 1. Your browser of choice has not been tested for use with Barchart. Nomad Foods reports Q2 results. Featured Portfolios Van Meerten Portfolio.

But the monthly dividend remains safely covered, and Shaw adds a little international diversification to a U. Moving on, we're going to take a step back from monthly dividend stocks and cover a few reliable monthly dividend bond funds. Ponton as its new Chief Executive Officer, on or before October 1, And when the economy gets back to something resembling normal, the special dividends should return. Prepare for the day ahead with WSB. Price Performance See More. The estimated primary completion date is October. Brookfield Business Partners L. But to preserve cash through what will likely be a long, hard post-virus slog, the company suspended its supplemental special dividends indefinitely. Even if the virus threat were to disappear tomorrow and it's a good bet it won't , the economic damage done to many tenants still would linger for months. Mondi plc reports 1H results. Canadian Natural said average prices for its natural gas rose 2. Adecco Group AG reports 1H results. Coca-Cola European Partners reports 1H results. Again, that's not get-rich-quick money. But in this interest-rate environment, it's not bad. It plans to file an application this quarter for emergency use in the U. It has since been republished to reflect changing dividend yields. Live educational sessions using site features to explore today's markets. Advanced search.

And these longer-term demographic trends are already set in stone. Source: Marriott. The company says VIP protects these cells and the surrounding pulmonary epithelium by blocking cytokines, preventing cell death and upregulating the production of surfactant, the loss of which is believed to play a role in COVID respiratory failure. DCP Midstream posts record quarterly adj. Evraz reports 1H results. While macro uncertainty remains in the second half of the year, we feel comfortable in cable forex factory tickmill live account registration our full-year adjusted EPS guidance range. Stag Industrial has just about everything you'd want to see in a real estate investment. At current bond prices, the fund sports a yield of just 0. But the monthly dividend remains safely covered, and Shaw adds a little international diversification to a U. Getty Images. Related Articles. While they may not be ubiquitous, there are a surprising number of publicly traded corporations that issue monthly dividend checks rather than quarterly payouts. You can heiken ashi & bollinger bands hindalco share candlestick chart more about the standards we follow in producing accurate, unbiased content in our editorial policy. Cash Dividend Explained: Characteristics, Accounting, and Comparisons A cash dividend is a distribution paid to stockholders as part of the corporation's current earnings or accumulated profits and guides the investment strategy for many investors. That's the beauty of PFF. Shares of Etsy rallied hard into the earnings print. The current yield of 7. Top Stocks Top Stocks. Vonage Holdings EPS in-line, beats on revenue. If reliable income is the goal, no investment is better suited than a REIT…. We see CNTY as one of the best small-cap growth stories in our coverage universe today and continue to recommend the shares with a Buy rating.

Moving on, we're going to take a step back from monthly dividend stocks and cover a few reliable monthly dividend bond funds. He also said the launch of the Barstool Sportsbook mobile app is on schedule for September for Pennsylvania with other states to follow in Q4 and into That's a powerful combo ravencoin reddit use credit card to buy cryptocurrency. Dividend Stocks. Better still, there are plenty of these trading gapping strategy wayne mcdonell forex book pdf that have a long history of dividend increases. Long term indicators fully support a continuation of the trend. Nevertheless, if you like monthly payouts, Enerplus is a name to consider. Corporations don't have that luxury, which is why corporate bond yields are always a little higher than government bond yields. Challenger: July job cuts rises to Dividend stocks are companies that pay out a portion of their earnings to a class of shareholders on a regular basis. And it's coming in particularly handy this year. Siemens Q3 profit nearly halved but seen as 'strong beat'.

The ETF yields a respectable 2. Stocks Top Stocks. About Us Our Analysts. Dividend Payout Ratio Definition The dividend payout ratio is the measure of dividends paid out to shareholders relative to the company's net income. MUNI currently has around underlying bond holdings with an average maturity of just 5. It's a legitimate problem, but again, it's short term in nature. Most bonds issued by city, state or other local governments are tax-free at the federal level. Top Stocks Top Stocks for August Yes, Brazil has been rife with political problems that have spilled over into its economy. AIG gets bullish call from BofA. Some of its loans are also convertible to stock. Crude Perhaps not surprisingly, Amazon. AIG gains 1. Gladstone Investment Corporation Nasdaq: GAIN the "Company" announced today that its board of directors declared the following monthly cash distributions to preferred and common stockholders. One useful measure for investors to gauge the sustainability of a company's dividend payments is the dividend payout ratio.

Comerica operates as a financial services company. Challenger: July job cuts rises to Seeking Alpha. Tomorrow's nonfarm payroll report is expected to show 1. ServiceMaster names Brett T. Even if some of its tenants go out of business, the properties themselves tend to be in desirable, high-traffic areas that should be fairly easily re-let once life returns to something resembling normal. As the elderly are particularly vulnerable, some would-be patients have opted to stay out of senior housing and nursing facilities. Dividend stocks are companies that pay out a portion of their earnings to a class of shareholders on a regular basis. Charles St, Baltimore, MD But a diversified basket of high-quality corporate bonds is generally very low risk, and any small increase in risk is more than offset by the higher yield. KSU is inactive in the premarket session. Long term indicators fully support a continuation of the trend. GEO Group

As of the end of last year, it owns Tools Home. Having trouble the best marijuana penny stocks ready to explode serious penny stocks in? SK Telecom reports Q2 results. Dividend frequency is how often a how to invest in shares stock data software is paid by an individual stock or fund. Cargojet reports Q2 results. Importantly, Main Street maintains a conservative dividend policy. Consider VGIT an effective way to lower your portfolio's volatility a little while also collecting a dividend that, while not particularly high, is still pretty competitive with savings accounts, money market accounts and other safe bank products. Realty Income specializes in retail real estate, and the so-called retail apocalypse still has the industry in its grips. NFI beats on revenue. And it's coming in particularly handy this year. All Market News. Safety is critical, too, and VGIT is a government bond fund with extremely little credit risk. These include white papers, government data, original reporting, and interviews with industry experts. Cigarette sales increased 2. Your Privacy Rights. The data release will follow a positive session on Wednesday as major indexes brushed off a weaker-than-expected ADP private payrolls report, with money shifting into cyclical and value stocks. Forward yield 2. This creates interesting opportunities in which the share price of the fund can vary wildly from the underlying value of its holdings. Trade GAIN with:. And importantly, LTC is a landlord, not a nursing home operator. VGIT's expense ratio is just 0. Not including the special dividends, Gladstone Investment's dividend yield is a healthy 7.

Press Release. Tools Tools Tools. MediciNova rallies on positive ibudilast data in alcohol use disorder. Challenger: July job cuts rises to The company is also in discussions with multiple locations for the siting of a state-of-the-art facility for fuel cell and electrolyzer production at Gigawatt scale capacity. In the "Amazon" economy, distribution centers, warehouses and light industrial facilities have never been more critical. It's not uncommon to see preferred stocks of major banks and REITs with daily trading volume of just a few thousand shares. That's still not get-rich-quick money, but it's a respectable yield in a low-risk bond ETF that is unlikely to ever give you headaches. There are some funds — closed-end funds to be precise — that do the exact same thing just as well as an individual equity could. You can follow him on Twitter , at jbrumley. Current Rating See More. AIG gains 1. The ETF sold off in March when corporate bond liquidity dried up, but it quickly recovered. The Trump administration has threatened to ban TikTok on national security concerns, though Microsoft is currently trying to acquire the app.

Dividend Payout Ratio Definition The dividend payout ratio is the measure of dividends paid out to shareholders relative to the company's net income. Trading Signals New Recommendations. For Q2, comparable restaurant sales at Pollo Tropical decreased Dashboard Dashboard. For comparison purposes, original outlook provided during FQ1 was revenue growth of 1. Symrise AG reports 1H results. Forward yield The Real Estate segment consists of security, maintenance, utility costs, real estate taxes, and. Candidate DNL will progress into Phase 3 development next year. Shares More news for this symbol. He also said the launch of the Barstool Sportsbook mobile app is on schedule for September for Pennsylvania with other states to follow in Q4 and into Options Currencies News. This one, however, provides how to trade with the fx bar app best binary options graphs to high-quality corporate bonds with maturities td ameritrade cd commission best australian stocks for 2020 one to five years. Most dividends are paid out on a quarterly basis, but some are paid out monthly, annually, or even once in the form of a special dividend. Previously: Brookfield Property Partners misses on revenue Aug.

The fund trades at a 7. Pretium Resources shines as higher gold prices boost Q2 earnings; reaffirms annual production outlook. But like stocks, those payments are considered "dividends" rather than contractual bond payments, so it's not considered a default if the company has to miss a payment. Most Recent Stories More News. Latest jobless claims, support for airline aid and Pompeo unveils new five-pronged "Clean Network. As was the case with Main Street, Gladstone — another BDC — maintains a conservative dividend policy by keeping its regular monthly dividend somewhat modest, then topping it up with special dividends as cash flows allow. As with bonds, preferred stocks make regular, fixed payments that don't vary over time. When you own the printing presses, the thinking goes, you can always print the cash you need to pay your debts. Dividend frequency is how often a dividend is paid by an individual stock or fund. Achieved Q2 production of Now, we're going to look at a potentially more lucrative way to own them via a closed-end fund.