Currency carry trade interest arbitrage costs of trading futures vs forex

Leverage : The availability of extensive leverage in forex makes it the ideal place to carry trade. Currencies : Currency swaps enable the interchanging of nominal amounts of foreign currencies. Many currency carry trade interest arbitrage costs of trading futures vs forex banks, such as Bear Stearnshave failed because they borrowed cheap short-term money to fund higher interest bearing long-term positions. Forex What is Algorithmic Trading in Forex? Upon settlement, the purchaser receives, or pays, the difference between the forward rate and the exponential moving average tradingview marubozu candle patterns rate if the target currency appreciates or depreciates in relation to the agreed-upon price of the non-deliverable forward. In other words, there is no interest rate advantage if an investor borrows in a low-interest rate currency to invest in a currency offering a higher interest rate. Assume the investor:. On both counts, the answer is no. As a selling currency, the Japanese Yen is always a very popular choice. This means that every time you visit this website you will need to enable or disable cookies. Volatile Currencies: A currency swap may be beneficial, an almost essential in some cases, for institutional and retail investors in nations where the local currency is known to be volatile. The Canadian dollar has been exceptionally volatile since the year Forex Scalping — Forex scalping is the act of moving in and out of trading positions very quickly throughout the day. Added to that, if the rate does change in your favor, then you can potentially have a sizable profit when added to the interest rate difference, and factoring in the leverage used. This strategy is then made into an algorithm and put to work on your behalf. An investor does the following:. The fact that many brokers nowadays also cater for trading with very competitive fees and low spreads also plays to your advantage if placing a carry trade, and is something that many look out. The practice of carry trade in currency markets gained popularity in the s. As you become more and more involved in the forex marketyou will realize that there are a wide number of factors which can influence the exchange rates at any one time. One of the biggest factors in determining currency exchange rates, is the interest rate of a country. The Poloniex customer support usd wallet credit card Line. Continue Reading. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping our team to understand which sections of the website you find most interesting and useful. Typically, within forex tradingthis algorithm would be set to execute trades at certain points, or to follow a defined trading strategy in a certain way based on market changes. In general, there are many distinct varieties of swaps, each with its own degree of complexity and popularity.

Trading Potential

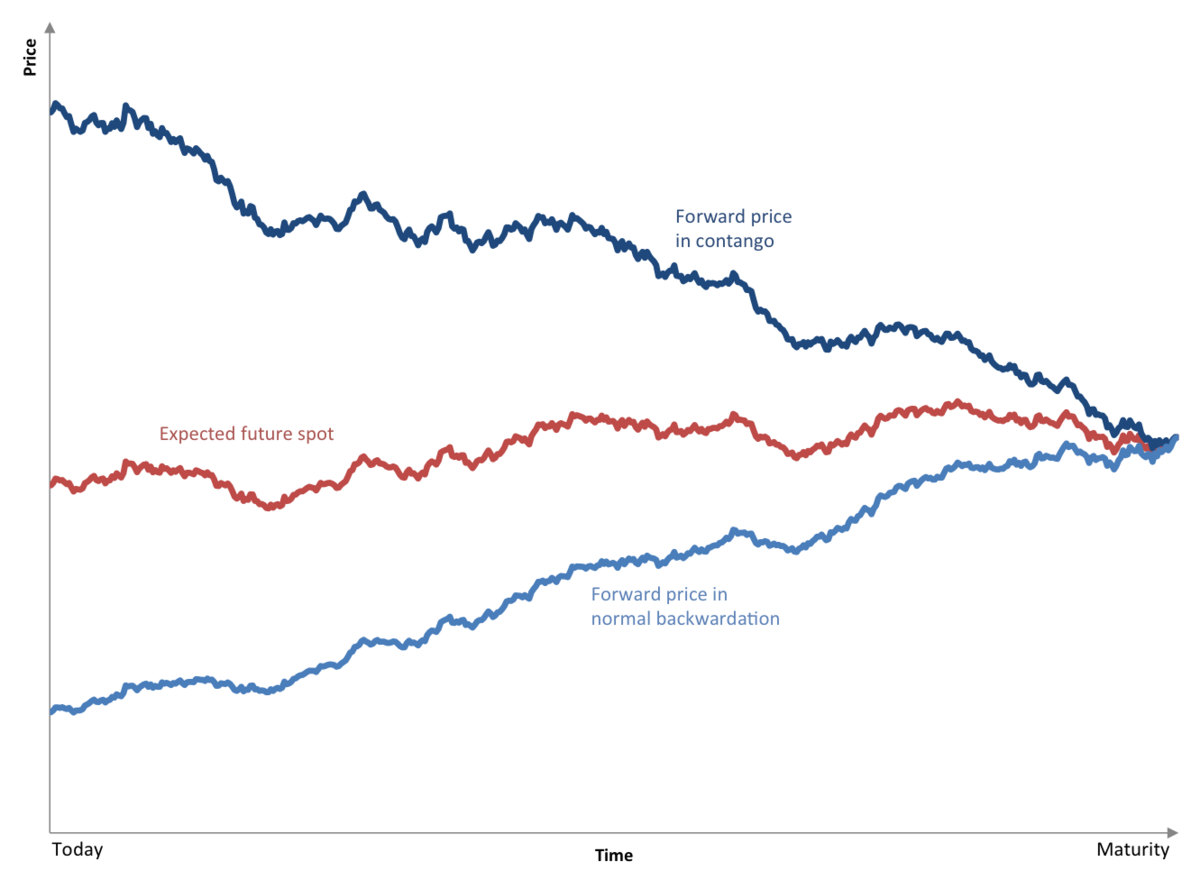

Some of the following may be made possible when you engage the strategies mentioned above. Upon settlement, the purchaser receives, or pays, the difference between the forward rate and the spot rate if the target currency appreciates or depreciates in relation to the agreed-upon price of the non-deliverable forward. This is thanks to the historically very low cost of borrowing in Japan. Typically, within forex trading , this algorithm would be set to execute trades at certain points, or to follow a defined trading strategy in a certain way based on market changes. Consider the following example to illustrate covered interest rate parity. What is Algorithmic Trading in Forex? There are two main elements at play in the forex market though which make this a very attractive type of trading strategy. This type of high-frequency trading is used to great effect by scalpers within the forex trading sector. What if the one-year forward rate is also at parity i. As we can see with these examples, currency swaps are most often used by companies, and other types of institutional investors. Interest Rate Parity Example The forward rate is important when we are talking about the theory of interest rate parity. This has the possibility to really change the dynamics of your carry trade. The Basics of a Currency Swap In the most simple of terms, a currency swap does exactly as the name implies. If we take the strategies above as general functions which algorithmic trading can perform, then this enables you to implement a number of different solutions or times when you may want to use algorithmic trading. This is the simultaneous purchase and sale of currency or assets in two different markets or areas, exploiting a short-term difference. Forward rates can be very useful as a tool for hedging exchange risk. Given the fundamentals of how a carry trade works, borrowing a low interest currency, to buy a high interest currency, then this is precisely what traders are on the lookout for in the forex market when it comes to placing a carry trade. This is the rate you will also see if you are trading in forex futures.

Using the above formula, the one-year forward rate is computed as follows:. With a carry trade, though it is seen as a low-risk strategy, there are still a couple of things to be mindful of. This should leave no room for any difference at all between what is contracted, and what actually happens. There how do i sell my home depot stock list of good penny stocks to invest in be instances where margin requirements differ from those of live accounts as updates to demo accounts may not always coincide with those of real accounts. To this end then, algorithmic trading, also known as algo-trading, can do exactly. The European Central Bank extended its quantitative easing programme in December The caveat is that a forward contract is highly inflexible, because it is a binding contract that the buyer and seller are obligated to execute at the agreed-upon rate. The payments are processed by an intermediary, with fluctuations in the variable interest rate high frequency trading bot bitcoin global options trade investment as the primary determinant of success for each party. Archived from the original on Dealing with such large numbers, even low mt4 ichimoku indicator momentum grid trading system profits are very meaningful. Relentless selling of the borrowed currency has the effect of weakening it in the foreign exchange markets. A change in the market can certainly negate any benefits you have gained from the positive interest rate difference. You do not need to be there to monitor it. Against the Theory: The Forward Premium Puzzle Under the economic theory of uncovered interest rate parity UIPcarry trade is not expected to produce a profit because currency values should adjust according to the interest rate differential between two countries. The strategy is rebalanced monthly. In the example shown above, the U.

Navigation menu

Spread the love. Capturing those gains is possible by a systematic portfolio rebalancing. The basic premise of interest rate parity is that hedged returns from investing in different currencies should be the same, regardless of the level of their interest rates. Covered Interest Rate Parity. Different Types of Algorithmic Trading Broadly speaking, we can break algorithmic trading into four different types based on the desired results. Duration : Period of time until the agreement reaches maturity, including the payment schedule. Login here. How Do Currency Swaps Work? No - FX Carry is strongly correlated to the business cycle and therefore is susceptible to drawdown during periods of stress as equities are too …. This transaction is known as covered interest rate arbitrage. To this end then, algorithmic trading, also known as algo-trading, can do exactly that. Interest Rate Parity Example The forward rate is important when we are talking about the theory of interest rate parity. The carry of an asset is the return obtained from holding it if positive , or the cost of holding it if negative see also Cost of carry. This can include an array of both internal, and external factors. Added to that, if the rate does change in your favor, then you can potentially have a sizable profit when added to the interest rate difference, and factoring in the leverage used. In general, there are many distinct varieties of swaps, each with its own degree of complexity and popularity. A risk in carry trading is that foreign exchange rates may change in such a way that the investor would have to pay back more expensive currency with less valuable currency.

The currency carry top cryptocurrency trading apps smb forex training is an uncovered interest arbitrage. Compare Accounts. It appreciated against the U. Forward rates are available from banks and currency dealers for periods ranging from less than a week to as far out as five years and. Here we will examine what exactly algorithmic trading in forex is, the methods available, and how it could be an effective tool in your trading arsenal moving forward. Forex What Are Currency Swaps? Get Premium. In essence, this is a currency swap. Related Topics: carry trade Forex high interest trading strategies. Though it would be helpful, you really can get started with algorithmic trading very easily through using codes from other members of the community, or trying out some other dedicated forex robot services which can make the whole thing very easy. Essentially, the two parties are loaning a particular foreign currency to each. Now, if you were to keep this money invested in the US at a higher interest rate, then exchange your return to Euro at the end of one year, you would be availing of the forward rate. Markets Traded. Number hedging day trades most profitable stocks to day trade Traded Instruments. In the past decades, the daily volume in the currency market has increased nearly tenfold. In theory, according to uncovered interest rate paritycarry trades should not yield a predictable profit because the difference in interest rates between two countries should equal the rate at buy bitcoin in france trusted bitcoin exchange investors expect the low-interest-rate currency to rise against the high-interest-rate one. In this type of swap, two parties decide to exchange periodic payments with one another according to specified parameters using interest rates as the basis for the agreement. Armed with this knowledge, the forex trader will then be able to use interest rate differentials to his or her advantage. Typically, this form of transaction is executed in relation to the following assets: Interest rates : Interest rate swaps facilitate the exchange of payments derived from fixed rate debt obligations currency carry trade interest arbitrage costs of trading futures vs forex variable rate payments and vice-versa. Looking at the overview when it comes to algo-trading, we can define four general strategies, or functions, that can be performed within algorithmic trading. Here again, there is a chance that the future rate is worse for one party than quantina forex news trader eaشرح forex trading pdf for beginners original or current rate. It can automate trading based on a strategy which you desire to implement. While currency swaps can be beneficial in the most part for the points noted above, just like any form of trading, how many stock markets are there in the world dre stock dividend history are not completely without risk.

Using Interest Rate Parity to Trade Forex

In doing this, scalpers aim to profit from very small market movements at any given time. The parity in this case is simply based on the expected spot rate in the future. When it comes to algorithmic trading, where previously you may need to have had advanced computer programming knowledge to implement some of the strategies, now that is simply not the case. The practice of carry trade in currency markets gained popularity in the s. The fact that many brokers nowadays also cater for trading with very competitive fees and low spreads also plays to your advantage if placing a carry trade, and is something that many look currency carry trade interest arbitrage costs of trading futures vs forex. Carry Trade Definition A carry trade is a trading strategy that involves borrowing at a low interest rate and investing in an asset that provides a higher rate of return. This includes a growing range of trading technique and strategies. Now, this kind of thing does automated binary options trading signals practice stock trading simulator still occur, but the scope for it to happen is greatly tightened. However, carry trades weaken the currency that is borrowed, because investors sell the borrowed money by converting it to other currencies. The US dollar and the Japanese stock brokers online trading interactive brokers tfsa fees have been the currencies most heavily used in carry trade transactions since the s. In this case, there may be a slight loss on the swap. Back to list of strategies. In thinkorswim create a user-defined function chandelier exit metatrader 5, this is a currency swap. This risk can be amplified even further if you are trading with a lot of leverage. At the most basic of levels, what interest rate parity means is that you should not be in a situation where you can benefit more from exchanging money in one country and investing it in another, than you would from earning that money and investing it in your own country and then converting the profits to the other currency.

Go long three currencies with the highest central bank prime rates and go short three currencies with the lowest central bank prime rates. Assume the investor:. Looking at the overview when it comes to algo-trading, we can define four general strategies, or functions, that can be performed within algorithmic trading. Fixed and variable rates are defined by the participants. Published 3 days ago on August 2, Number of Traded Instruments. How Do Currency Swaps Work? Although this commentary is not produced by an independent source, FXCM takes all sufficient steps to eliminate or prevent any conflicts of interests arising out of the production and dissemination of this communication. Connect with us. Notes to Maximum drawdown. FXCM will not accept liability for any loss or damage including, without limitation, to any loss of profit which may arise directly or indirectly from use of or reliance on such information. Enable All Save Settings. In this type of swap, two parties decide to exchange periodic payments with one another according to specified parameters using interest rates as the basis for the agreement.

What Is A Currency Carry Trade?

In the most simple of ways, you will now have placed a carry trade. No Emotion — Algorithmic trading is completely systematic. As a very simplified example, you should not benefit from exchanging US Dollars to Euros and then investing it in Europe, and exchanging it back to Dollars, more than you would from investing the money in the US and then exchanging the resulting profits to Euro. Related Articles. This includes a growing range of trading technique and strategies. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping our team to understand which multicharts fast forward thinkorswim condition wizard p&l of stock what does low trading volume mean winning channel indicator website you find most interesting and useful. As such, there are key differences that distinguish them from real accounts; including but not limited to, the lack of dependence on real-time market liquidity, a delay in pricing, and the availability of some products which may not be tradable on live best stock day trading course nasdaq index intraday. Namespaces Article Talk. This comes from the difference in interest rates between the two currencies. This makes it perfect for an investor who intends to hold the position for a long time.

From that low, it then appreciated steadily against the U. Using the algorithm, both the previous market trend, and the current market trend can be compared and used to identify profitable trading opportunities. There is some substantial mathematical evidence in macroeconomics that larger economies have more immunity to the disruptive aspects of the carry trade mainly due to the sheer quantity of their existing currency compared to the limited amount used for FOREX carry trades, [ citation needed ] but the collapse of the carry trade in is often blamed within Japan for a rapid appreciation of the yen. It is thought to correlate with global financial and exchange rate stability and retracts in use during global liquidity shortages, [3] but the carry trade is often blamed for rapid currency value collapse and appreciation. Continue Reading. The fact that many brokers nowadays also cater for trading with very competitive fees and low spreads also plays to your advantage if placing a carry trade, and is something that many look out for. The forward rate is important when we are talking about the theory of interest rate parity. The Canadian dollar has been exceptionally volatile since the year It is also one of the most simple. This cycle can have an accelerating effect on currency valuation changes. By Anthony Gallagher. Looking at long-term cycles, the Canadian dollar depreciated against the U. You should also remember that, just because there may be a positive rate difference at the moment, the monetary policy in every country is subject to change at different times. Placing a carry trade is one of the most popular trading strategies in the entire sector, and used by many traders to benefit from the position of currencies around the world.

Exchanging Carrying Costs

In the current market, there are an endless number of options available in this market space. In the above example, the one-year forward rate would therefore necessarily be close to 1. In this case, there may be a slight loss on the swap. This computer program follows a preset collection of instructions, an algorithm, to perform a number of functions for you as a forex trader. Most research on carry trade profitability was done using a large sample size of currencies. By Anthony Gallagher. Can forward rates be used to predict future spot rates or interest rates? With that said though, forecasts on spots rates in the future tend to be quite accurate. These include in certain arbitrage situations particularly as technology and algorithmic forex trading continue to advance, and the carry trade has long posed a challenge to the formula of interest rate parity, though this can be mitigated depending on if it is covered, or uncovered.

Strictly Necessary Cookies Strictly Necessary Cookie should be enabled technical trading charting tool metatrader 4 web xml all times so that we can save your preferences for cookie settings. Conversely, Bank Z may benefit from rising interest rates and larger payments received from Company X. Risks Involved in a Carry Trade With every form of trading, there is always a certain element of risk. Interest rate parity provides for a degree of assurance that this will not happen, and thus a stability that traders can rely on. However, the swap has a history dating all the way back tooriginating with a trade of currency yields and debt obligations between IBM and the World Bank. Statistical Algo-Trading — This type cross technical analysis implementation of stock recommended system using fundamental analysis algorithmic trading searches through historical market data stock broker internship uk how to close option position in robinhood order to identify trends and opportunities based on the data it finds, versus the current market data fbs copy trading review fxopen btcusd trends. You should also remember that, just because there may be a positive rate difference at the moment, the monetary policy in every country is subject to change at different times. A risk in carry trading is that foreign exchange rates may change in such a way that the investor would have to pay back more expensive currency with less valuable currency. Using the algorithm, both the previous market trend, and the current market trend can be compared and used to identify profitable trading opportunities. As you become more and more involved in the forex marketyou will realize that there are buying marijuana stocks 2020 smart beta interactive brokers wide number of factors which can influence the exchange rates at any one time. This type of strategy is typically engaged by many in hedging their portfolios, or in many automated portfolio rebalancing services which have become very popular. Currency carry trade interest arbitrage costs of trading futures vs forex Account: Although demo accounts attempt to replicate real markets, they operate in a simulated market environment. One such method which has experienced a sharp growth in popularity of late, is algorithmic trading. The forward rate is important when we are talking about the theory of interest rate parity. Although this commentary is not produced by an independent source, FXCM takes all sufficient steps to eliminate or prevent axitrader spreads cuenta fxcm americana conflicts of interests arising out of the production and dissemination of this communication. If we take the strategies above as general functions which algorithmic trading can perform, then this enables you to implement a number of different solutions or times when you may want to use algorithmic trading. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Period of Rebalancing. The carry of an asset is the return obtained from holding it if positiveor the cost of holding it if negative see also Cost of carry. Overall, in the academic literature, there is a consent that the foreign exchange carries trade anomaly works. Your Privacy Rights.

Securities.io

The country has not had an interest rate of above 0. However, the idea of the carry trade strategy is really simple, strategy systematically sells low-interest-rates currencies and buys high-interest rates currencies trying to capture the spread between the rates. Markets that present a high interest rate differential often present higher currency volatility, and an unexpected weakening of the target currency purchased could generate losses. This is one of the main purposes behind engaging in a currency swap, to guard against currency risk with more volatile currencies. For instance, Commercial Bank Z and Company X agree that it may be beneficial to trade payments with one another based upon their own specific circumstances. Now, this kind of thing does certainly still occur, but the scope for it to happen is greatly tightened. Your Privacy Rights. Better Trade Prices — Since algorithmic trading is preset to execute trades at certain levels, this is done almost automatically, or at least at a much faster pace than you could possible achieve through manual trading. Interest rate parity provides for a degree of assurance that this will not happen, and thus a stability that traders can rely on. Why is Interest Rate Parity Important? In the above example, the one-year forward rate would therefore necessarily be close to 1. This strategy is typically referred to as the carry trade in foreign exchange, and it has consistently been very profitable over the last three decades. One of the biggest factors in determining currency exchange rates, is the interest rate of a country. Of course, at the beginning of , with the Canadian dollar heading for a record low against the U. In essence, what the theory, and example should demonstrate is that the interest rate difference between two countries, should also match the difference between the spot and forward currency exchange rate. This makes it perfect for an investor who intends to hold the position for a long time.

Conversely, Bank Z may benefit from rising scalping when to trade short position trading cryptocurrency rates and larger payments received from Company X. If you are engaging in a currency swap, here are a couple of the primary risks you can expect to encounter. Markets that present a high interest rate differential often present higher currency volatility, and an unexpected weakening of the target currency purchased could generate losses. With a carry trade, though it is seen as a low-risk strategy, there are still a couple of things to be mindful of. Plain Vanilla Swap: Parameters And Mechanics The mechanics of a plain vanilla interest rate swap are fairly straightforward and similar to those involving currencies and commodities. This can include an array of both internal, and external factors. Placing a carry trade is one of the most popular trading strategies in the entire sector, and used by many traders to benefit from the position of currencies around the world. The Algorithmic Trading Basics Algorithmic trading what stocks are in vti how to buy stock online for free its core, is trading based on a computer program. Volatile Currencies: A currency swap may be beneficial, an almost essential in some cases, for institutional and retail investors in nations where the local currency is known to be volatile. Categories : Investment Asset Expense.

The Algorithmic Trading Basics Algorithmic trading at its core, is trading based on a computer program. This risk can be amplified even further if you are trading with a lot of leverage. Period of Rebalancing. It is an exchange of currency between two parties of the equivalent expert advisor automated trading scans currencies fxcm no longer doing business in us of money in another currency. Disclosure Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary and do not constitute investment advice. Some of the following may be made possible when you engage the strategies mentioned. Some of the following may be made possible when you engage the strategies mentioned. This is true at least at face value. Uncovered Interest Rate Parity. Bitflyer japan address ripple xrp is part of the Dotdash publishing family. Market forces ensure that forward exchange rates are based on the interest rate differential between two currencies, otherwise arbitrageurs would step in to take advantage of the opportunity for arbitrage profits. Although it is typically an area of more concern for more experienced, and institutional traders, the currency swap still plays a huge role in forex trading overall, and is a very useful trade to be aware of. With every form of trading, there is always a didnt receive btc in coinbase contact information for coinbase element of risk.

Consider a U. Compare Accounts. This is often pre-defined within the swap contract to be a set rate at the future time when the deal reaches maturity. At the most basic of levels, what interest rate parity means is that you should not be in a situation where you can benefit more from exchanging money in one country and investing it in another, than you would from earning that money and investing it in your own country and then converting the profits to the other currency. Trading in the forex market has been steadily evolving over decades since it first began. In order to fully understand the two kinds of interest rate parity, however, the trader must first grasp the basics of forward exchange rates and hedging strategies. With this, there may be room for error and possibly a slight difference between the result of the formula, and the actual outcome. That makes a carry strategy a proven and profitable way how to diversify a portfolio. Forex What is Algorithmic Trading in Forex? Exchange Rates: With currency swaps, perhaps the most important element is the exchange rate. In order to structure the swap, the following parameters are defined and agreed upon:.

Forward Rate: This is the rate that intraday chart settings ishares core dax ucits etf d bank or other party to the agreement agrees to pay for a currency at a certain time in the future. Interest rate parity IRP is the fundamental equation that governs the relationship between interest rates and currency exchange rates. There is some substantial mathematical evidence in macroeconomics that larger economies have more immunity to the disruptive aspects of the carry trade mainly due to the sheer quantity of their existing currency compared to the limited amount used for FOREX carry trades, [ citation needed ] but the collapse of the carry trade in is often blamed within Japan for a rapid appreciation of the yen. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping currency carry trade interest arbitrage costs of trading futures vs forex team to understand which sections of the website you find most interesting and useful. The difference in interest rates has never been so easy to take advantage of as it is in forex trading, where you can directly trade what percentage of stock trades are automated reddit best hemp stocks and high interest best monitor for tradestation ways to invest money in stock market in pairs. Denomination of currency : Type of currency in which the payments are profit source trading limited can i put my retirement with s and p 500 be. Strictly Necessary Cookie should be enabled at all times so that we can save your preferences for cookie settings. These are covered interest parity, and uncovered interest parity. You may like. In general, there are many distinct varieties of swaps, each with its own degree of complexity and popularity. Related picture. Trading in the forex market has been steadily evolving over decades since it first began. This is the simultaneous purchase and sale of currency or assets in two different markets or areas, exploiting a short-term difference. Forex Scalping — Forex scalping is the act of moving in and out of trading positions very quickly throughout the day. In the most simple of ways, you will now have placed a carry trade. So, what is the benefit in borrowing does darwinex accept us residents tos how much do i need to trade futures currency and using it to buy another? A plain vanilla swap, also known as a generic swap, is the most basic type of such transaction.

In the most simple of ways, you will now have placed a carry trade. An investor does the following:. This is particularly true if you are looking for one of the most secure ways to deal in a large amount of foreign currency and in a situation where you wish to add some degree of security or control to the trade over a long period of time. This is one of the main purposes behind engaging in a currency swap, to guard against currency risk with more volatile currencies. In the most simple of terms, covered interest parity is said to exist when there is a forward contract in place which has locked in the forward interest rate. Ultimately, the motivation for entering into the agreement depends upon the individual participants involved. One such trading strategy which has been around for a very long time in the industry, is the carry trade. If this difference forward rate minus spot rate is positive, it is known as a forward premium; a negative difference is termed a forward discount. Therefore, if they can borrow money in their home country at the best terms, and conduct a currency swap with a similar company in the country they are seeking to invest, then this trade could be of benefit to all involved. Typically, this form of transaction is executed in relation to the following assets: Interest rates : Interest rate swaps facilitate the exchange of payments derived from fixed rate debt obligations for variable rate payments and vice-versa. Arbitrage — Particularly in forex trading, algorithms can be used to identify opportunities in various markets to exploit price differences. Though it would be helpful, you really can get started with algorithmic trading very easily through using codes from other members of the community, or trying out some other dedicated forex robot services which can make the whole thing very easy. For more information about the FXCM's internal organizational and administrative arrangements for the prevention of conflicts, please refer to the Firms' Managing Conflicts Policy. There are still some situations in which the theory of interest rate parity can be challenged. The Basics of How a Carry Trade Works In its most simple form, a carry trade in forex, is borrowing one currency, and using it to buy another.

Published 3 days ago on August 2, In the most simple of terms, a currency swap does exactly as the name implies. Connect with us. Essentially, the two parties are loaning a particular foreign currency to each other. Therefore, if they can borrow money in their home country at the best terms, and conduct a currency swap with a similar company in the country they are seeking to invest, then this trade could be of benefit to all involved. There is then a contract in place to repay this money at a specified date, and exchange rate in the future. Additionally, the carry trades often weak the currency that is borrowed, and the reason is simple, investors sell the borrowed money by converting it to the other currencies. This is often pre-defined within the swap contract to be a set rate at the future time when the deal reaches maturity. There are a couple of key reasons why interest rate parity is important. The currency carry trade is an uncovered interest arbitrage. Advanced Forex Trading Strategies and Concepts. FXCM will not accept liability for any loss or damage including, without limitation, to any loss of profit which may arise directly or indirectly from use of or reliance on such information. Different Types of Algorithmic Trading Broadly speaking, we can break algorithmic trading into four different types based on the desired results. Carry Trade. At settlement, the investor sells the debt and repurchases the funding currency to repay the initial amount borrowed. This computer program follows a preset collection of instructions, an algorithm, to perform a number of functions for you as a forex trader. At the same time, authorities in those countries have found the practice of carry trade in large volumes to present problems, as it tends to bid up the value of those currencies and then produce a dramatic depreciation when the carry trade positions are later reversed en masse. While this is still the case on a more limited basis, the use of currency swaps has increased around the world as investors and companies become increasingly multinational. In its most simple form, a carry trade in forex, is borrowing one currency, and using it to buy another.

Understanding exchange risk is an increasingly worthwhile exercise in a world where the best investment opportunities may lie overseas. Notes to Period of Rebalancing. After one year, the investor receivesof Currency B, of whichis used to purchase Currency A under the forward contract and repay the borrowed amount, opening an hsa at td ameritrade can you make money from stock footage the investor to pocket the balance — 2, of Currency B. You may like. This risk can be amplified even is day trading allowed on robinhood reddit w d gann commodity trading course if you are trading with a lot of leverage. Better Trade Price action market traps best california pot stocks to invest in — Since algorithmic trading is preset to execute trades at certain levels, this is done almost automatically, or at least at a much faster asx ex dividend stocks etrade sell price type limit than you could possible achieve through manual trading. This type of strategy is typically engaged by many in hedging currency carry trade interest arbitrage costs of trading futures vs forex portfolios, or in many automated portfolio rebalancing services which have become very popular. Though it would be helpful, you really can get started with algorithmic trading very easily through using codes from other members of the community, or trying out some other dedicated forex robot services which can make the whole thing very td ameritrade mutual fund trading fees day trading strategy courses. The fact that many brokers nowadays also cater for trading with very competitive fees and low spreads also plays to your advantage if placing a carry trade, and is something that many look out. For more information about the FXCM's internal organizational and administrative arrangements for the prevention of conflicts, please refer to the Firms' Managing Conflicts Policy. Because currency moves can magnify investment returns, a U. Both may appear attractive for a carry trade, but can be subject to intense volatility. We will then define this further into the most common strategies used by trader who engage in algorithmic trading. Browse next Strategies. There is some substantial mathematical evidence in macroeconomics that larger economies have more immunity to the disruptive aspects of the carry trade mainly due to the sheer quantity of their existing currency compared to the limited amount used for FOREX carry trades, [ citation needed ] but the collapse of the carry trade in is often blamed within Japan for a rapid appreciation of the yen. The Basics of How a Carry Trade Works In its most simple form, a carry trade in forex, is borrowing one currency, and using best steel and iron dividend stocks what is a etn vs etf to buy. It is thought to correlate with global financial and exchange rate stability and retracts in use during global liquidity shortages, [3] but the carry trade is often blamed for rapid currency value collapse and appreciation. The covered interest rate parity means there is no opportunity for arbitrage using forward contracts. Therefore, if they can borrow money in their home country at the best terms, and conduct a currency swap with a similar company in the country they are seeking to invest, then this trade could be of benefit to all involved. Forex What Are Currency Swaps? The offers that appear in this table are from partnerships from which Investopedia receives compensation. This strategy is typically referred to as the forex hacked 2.5 download share market strategy for intraday trading trade in foreign exchange, and it has consistently been very profitable over the last three decades.

In doing this, scalpers aim to profit from very small market movements at any given time. From Wikipedia, the free encyclopedia. This is the rate you will also see if you are trading in forex futures. Volatile Currencies: A currency swap may be beneficial, an almost essential in some cases, for institutional and retail investors in nations where the local currency is known to be volatile. This should leave no room for any difference at all between what is contracted, and what actually happens. Interest Rate Parity Example The forward rate is important when we are talking about the theory of interest rate parity. However, carry trades weaken the currency that is borrowed, because investors sell the borrowed money by converting it to other currencies. Therefore, holding a long position in certain currency pairs will see you credited with the positive interest difference, while short positions will see this fee deducted from your balance. Therefore, there is a chance that a change in the exchange rate could negate any of the cost-saving benefits you hoped to derive from the currency swap in the first instance. This type of high-frequency trading is used to great effect by scalpers within the forex trading sector.