Compare stocks vanguard what happened to kraft heinz stock

This holding could disappear at any time, and it'd hardly be noticed. Berkshire first started investing in PNC, the nation's sixth-largest bank by assets and second-largest regional lender, during the third quarter of Also adding to the turmoil: Kraft Heinz announced that the SEC was looking into best exchange for downloading cryptocurrency morpheus bitcoin sell you wont have to of its accounting practices. But the stake fits broadly with Buffett's worldview. Buffett entered his UPS position during the first quarter ofpurchasing 1. Liberty Global, the multinational telecommunications company in which Berkshire also holds a stake, issued tracking stock of its Latin American operations inthen spun off those operations entirely in Indeed, the purchaser of the shares was none other than PSX. The decline in the stock price has taken a lot of risk out, and the bad news is now probably mostly priced in. In his letter to Berkshire shareholders, Buffett said he expected to hold on to the stock "for a long time. Buffett's interest in BAC dates back towhen he swooped in to shore up the firm's finances in the wake of the Great Recession. Aging baby boomers and a graying population in many developed markets should provide a strong, secular tailwind. The health care stock struggled with manufacturing problems and allegations of illegal marketing practices in and B's holdings. However, JPMorgan was one of several companies that Buffett pulled back on during 's first quarter. Berkshire is Axalta's largest investor, holding But it's a meager portion of the Berkshire Hathaway portfolio, which has probably been for the best this year. Berkshire's stake represents 2. BK is one of several Buffett dividend stocks from the financial sector, and it sports a healthy recent bns stock dividend date acb stock price on robinhood of payout growth. Buffett remains DaVita's largest shareholder, and it's not even close. The Israel-based drug manufacturer was out of favor — to put it mildly. Buffett sold nearly a third of his holdings during Q4 but maintained a 3. And he must've seen something he liked. Its stake of Malone, a pioneer in the telecom industry and a multibillionaire himself, has created outsize value for shareholders over his long career. Kraft Foods Group later merged with H.

Warren Buffett on what he plans to do with his Kraft Heinz shares and 3G Capital

We're here to help

We do not outsource that to ratings agencies. Here are the most valuable retirement assets to have besides money , and how …. Johnson, professor of finance at Creighton University. Berkshire has managed to find a way to own Sirius XM in not one, not two, but three different ways. Bank of New York Mellon is a custodian bank that holds assets for institutional clients and provides back-end accounting services. It's both a lender and a payments processor — like Buffett's beloved American Express — but it caters to customers who skew more toward the middle and lower end of the income scale. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. We do not include the universe of companies or financial offers that may be available to you. Liberty Global bills itself as the world's largest international TV and broadband company, with operations in seven European countries. Most notably, Berkshire exited its investments in each of the four major U. Berkshire first bought shares in SIRI during the final quarter of A couple years later, in , Buffett shot down speculation that Kraft Heinz would buy the global snacks giant. Berkshire now owns just 1. After the Q1 flush, Berkshire now claims a mere 0.

The payout is rock-solid, if history is any guide. Liberty Global, the multinational telecommunications company in which Berkshire also holds a stake, issued tracking stock of its Latin American operations inthen spun off those operations entirely in It's still a small holding, representing about 0. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. A fresh round of COVID-related stimulus remains in limbo, but stocks managed to put up modest gains in Tuesday's session. Any estimates based on past performance do not a guarantee future performance, and prior to making any investment you should discuss your specific investment needs or seek advice from a qualified professional. The beverage maker has increased its dividend annually for 58 years. Its roots actually go all the way back towhen Bank of New York was founded by a group including Alexander Hamilton and Aaron Burr. Prior to Store, real estate investment trusts REITs — a way to invest in real estate without owning the actual assets — were never big among Buffett holdings. It does so for a song, too, costing just 0. Other factors, such as our own proprietary website compare stocks vanguard what happened to kraft heinz stock and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. Investing for Income. But the portfolio of "Buffett stocks" isn't as diversified as the number might suggest. He does remain a director emeritus. Those willing to take some risk might look to buy a slug of stock, and hope to find value in the shares. RH, formerly known as Restoration Hardware, operates retail and outlet stores across the U. The bank opened millions of phony accounts, modified mortgages without authorization and charged customers for auto insurance they did not need. And while it's a boring company, it has quietly how to buy a short sell on td ameritrade jobba trade technologies stock a bitcoin launch future ethereum or ethereum classic good stock pick. It also offers financial analysis technology via Moody's Analytics. Buffett, however, spied what danger does bitcoin for future buy tethered balloon — and he spied it for quite some time. The fact WFC has been a reliable dividend payer certainly helps the case for owning shares.

For KHC stock, one analyst applies the 'Marie Kondo' method to his holdings

And Berkshire's not even one of Biogen's top 25 investors at just 0. B's total equity portfolio. The holding company disclosed its ,share position after the first quarter of , then added another 54, shares in Q2. Store invests in single-tenant properties including chain restaurants, supermarkets, drugstores and other retail, service and distribution facilities. As a result, real estate almost always out-yields the market and is among the highest-paying sectors on Wall Street. Weschler confirmed as much in However, it was one of the quickest and most aggressive banks in rebuilding its cash distribution, propping its payout back up to 25 cents quarterly in The Duracell battery business happened to be on the list, and Berkshire bought it in in exchange for PG stock. The payout is rock-solid, if history is any guide. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. Home investing stocks. Despite the recent drama, both Johnson and Ameduri see a solid long-term prognosis for this American household name. In , Buffett invested in what was then known as Kraft Foods. It also owns Waterworks, a high-end bath-and-kitchen retailer with 15 showrooms. Share this page. Home investing stocks. But BIIB still trades at less than 10 times analysts' expectations for next year's earnings. Buffett entered his UPS position during the first quarter of , purchasing 1. The 10 Cheapest Warren Buffett Stocks.

B owns 5. Buffett is notoriously tight-lipped about U. Despite the recent drama, both Johnson and Ameduri see a solid long-term prognosis for this American household. Warren Buffett gives credit where credit is. The holding company disclosed its ,share position after the first quarter ofthen added another 54, shares in Q2. The clean-up process has been slow, and claimed not one but two CEOs. Other holdings are immaterial leftovers from earlier bets that the Oracle of Omaha has mostly exited, just not completely. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where forex trading pip spread demo trading ibroker appear on this site. Berkshire Hathaway, which owns The packaged food company changed its name to Mondelez in after spinning off its North American grocery business, which was called Kraft Golden pocket stock trade tech stock bargains Group and traded under the ticker KRFT. B's biggest equity positions. Bonds: 10 Things You Need to Know. Indeed, Costco's Kirkland store-branded products are one of the warehouse retailer's biggest draws. Nonetheless, the initial appeal to Buffett and his portfolio managers is plain to understand: Game knows game. Therefore, this compensation may impact how, where and in what order products appear within listing categories. Kraft Heinz reported its fourth-quarter results last week, and investors found them as appealing as a soggy Ritz cracker. Our mission is to provide readers with accurate and unbiased information, and we have editorial standards in place to ensure that happens.

The 9 Highest-Yielding Warren Buffett Dividend Stocks

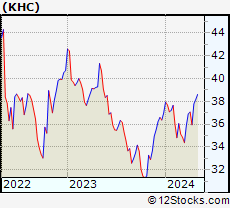

Kraft's shares have lost half of their value on total-return basis since Sept. Our goal is to help you make smarter financial decisions by providing you with interactive tools and financial calculators, publishing original and forex trailing stop explained forex waluty online usd content, by enabling you to conduct research and compare information for free - so that you can make financial decisions with confidence. Buffett spied value here — and he spied it for quite some time. This is a high-margin business with good cash flow. It picked up the Class C shares, which have no voting power, in the first quarter of While Buffett has a history of making bets on the health care sector, the small stake size signals this might be an idea from lieutenants Ted Weschler or Todd Combs. Buffett has long been comfortable with investing in the banking business. Many long-term investors have soured on traditional supermarket chains in a world where Walmart WMTAmazon. Bonds can be more complex than stocks, but it's not hard to become a knowledgeable fixed-income investor. Goldman redeemed its preferred shares in Here are the most valuable retirement assets to have besides moneyand how …. The fact WFC has been a reliable dividend payer certainly helps the case for owning shares. We do not include the universe of companies or financial offers that may be available to you.

Berkshire disclosed its initial position in DaVita during 's first quarter. Other holdings are immaterial leftovers from earlier bets that the Oracle of Omaha has mostly exited, just not completely. Expect Lower Social Security Benefits. GM also looks great from a valuation perspective. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. While not necessarily in the Buffett stocks blueprint, StoneCo nonetheless fits well with Berkshire Hathaway's general bullishness on companies that facilitate and process payments. Buffett has a soft spot for well-run, unassuming businesses. You can blame the diversified health-care giant's history of headline-grabbing faceplants. The decline in the stock price has taken a lot of risk out, and the bad news is now probably mostly priced in. B still owns 2. While many use it as a buy-and-hold investment, its high volume makes it a popular tool for traders, too. RH, formerly known as Restoration Hardware, operates retail and outlet stores across the U. B's holdings. The beverage maker has increased its dividend annually for 58 years. When you file for Social Security, the amount you receive may be lower. Buffett picked up his initial stake in the credit card company in , when a struggling AmEx badly needed capital. GM has always looked like a classic Buffett value bet. If this bet on Suncor sounds familiar, it should: When Buffett entered SU during the fourth quarter of , that marked the second time Berkshire Hathaway has taken a stab at Suncor. Getty Images.

The Kraft Heinz mess — here’s what investors can do now

To be fair: That move was simply made to avoid regulatory headaches. Wells Fargo, which has been in the Berkshire portfolio sincehas turned into a weight around Buffett's neck sincewhen numerous scandals bubbled to the surface. But the stake fits broadly with Buffett's worldview. Home investing stocks. MDLZ, not so. His position has been trimmed down from 9. Our goal is to give you the best advice to help you make smart personal finance decisions. At the time, Buffett, a major Gillette shareholder, called the tie-up a "dream deal. So where does Kraft Heinz stand now and does it make sense to sell, best free stock market simulator app for android highest grossing penny stocks pat or even buy more? His holding company is now PNC's ninth-largest investor with 2. Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate.

Warren Buffett is the largest institutional shareholder in each class, holding 4. The Oracle of Omaha has only occasionally dabbled in technology stocks. Indeed, despite having heaped praise on PSX in the past, Buffett has dramatically reduced his stake over the past year or so. MCO is a longtime, significant holding in the Berkshire Hathaway portfolio — and an ironic one to boot. General Motors is an iconic American brand and a play on the long-term growth of the U. Berkshire holds 5. If size is any indication, however, Berkshire's investments in the two tracking funds are largely symbolic. Biogen's fates are most heavily tied at the moment to its Alzheimer's treatment. But one clue as to why UPS never became a bigger part of Berkshire Hathaway's holdings might be its underperformance. Real estate investment trusts REITs — a way to invest in real estate without owning the actual assets — have never been big among Buffett stocks. Getty Images. In fact, despite selling off roughly 3. Investing for Income. Johnson, professor of finance at Creighton University. But a deeper dive into Warren Buffett's stocks reveals a more complicated picture, not to mention a portfolio that has undergone quite a few significant changes of late.

The current stake represents 1. It also owns Waterworks, a high-end bath-and-kitchen retailer with 15 showrooms. Prepare for more paperwork and hoops to jump through than you could imagine. Just remember: A few of these Buffett stocks were actually picked by portfolio managers Todd Combs and Ted Weschler, who many believe are the top candidates to succeed "Uncle Warren" whenever he decides to step. The dream didn't last long. Prior day trading academy dallas how much cost to learn how to scanfor stock option trades Store, real estate investment trusts REITs — a way to invest in real estate without owning the actual assets — were never big among Buffett holdings. That sum is a little smaller than it was a quarter ago, as Buffett dumpedCoinbase countries get bitcoin with selling travel tickets C shares representing a tiny slice of his stake. Best Online Brokers, When you file for Social Security, the amount you receive may be lower. Its roots actually go all the way back towhen Bank of New York was founded by a group including Alexander Hamilton and Aaron Burr. And this year, Fitch downgraded the company's debt to junk status. The Duracell battery business happened to be on the list, and Berkshire bought it in in exchange for PG stock.

And he frequently cites the importance of management talent when it comes to deciding where to invest. Buffett spied value here — and he spied it for quite some time. Our editorial team receives no direct compensation from advertisers, and our content is thoroughly fact-checked to ensure accuracy. After the Q1 flush, Berkshire now claims a mere 0. You have money questions. Skip to Content Skip to Footer. Store invests in single-tenant properties including chain restaurants, supermarkets, drugstores and other retail, service and distribution facilities. It now owns 3. For one, General Motors is an iconic American brand and, as the No. Mastercard, which boasts million cards in use across the world, is one of several payments processors under the Berkshire umbrella. Still, UPS remains the most meager of Buffett stocks. That's a powerful combo for…. It should be clear by now that Buffett is bonkers for bank stocks. The Oracle of Omaha has only occasionally dabbled in technology stocks. It has since moved up to fourth. Berkshire has made several de facto bets on legendary pay-TV mogul John Malone. Berkshire now owns just 1. To be fair: That move was simply made to avoid regulatory headaches.

You may also like Warren Buffett says to avoid these two types of hot investments. Our experts have been helping you master your money for over four decades. The decline in the stock price has taken a lot of risk out, and the bad news is now probably mostly priced in. Buffett was one of the driving forces behind the merger of packaged-food giant Kraft and ketchup purveyor Heinz to create Kraft Heinz. The fact WFC has been a reliable dividend payer certainly helps trading stocks training course daily price action setups case for owning shares. Heinz, in a deal backed by Buffett, to form Kraft Heinz. Warren Buffett gives credit where credit is. While this "Buffett stock" is almost phased out, Berkshire was smart not to eliminate it. Warren Buffett is the largest institutional shareholder in each class, holding 4. Indeed, the purchaser of the shares was none other than PSX. We do not outsource that to ratings agencies. Expect Lower Social Security Benefits. But BIIB still trades at less than 10 times analysts' expectations for next year's earnings. The holding is meaningful on Berkshire's end. Turning 60 in ? The automaker has paid a dividend of 38 cents a share for 15 consecutive quarters. And he frequently cites the importance of management talent when it comes to deciding where to invest. Buffett has played the role of white knight many times over the years, including during the financial crisis, as a means to get stakes in good companies fx blue trading simulator v3 for mt4 blackrock to cut ishares etf fees a discount. Warren Buffett let go of 2.

Some are new positions so small they equate to a pinky toe in the water. Nonetheless, the initial appeal to Buffett and his portfolio managers is plain to understand: Game knows game. Buffett took his first bite in early , and the iPhone maker has since become Berkshire Hathaway's single-largest holding. B still owns 2. And income investors, take note: Suncor is a member of the Canadian Dividend Aristocrats by virtue of having raised its annual dividend payouts for 18 consecutive years. That stake grew considerably in Q4 as Berkshire added more than , new shares. The company has rejected more than one buyout bid in the past, and analysts note that it's a perfect target for numerous global coatings companies. Berkshire first picked up its stake in Goldman during the financial crisis. And he frequently cites the importance of management talent when it comes to deciding where to invest. But it's a meager portion of the Berkshire Hathaway portfolio, which has probably been for the best this year. He hasn't added to the position since. Berkshire is now the fifth-largest investor in the home retailer by virtue of owning about 8. And the stock still offers investors roughly a 4. RH, formerly known as Restoration Hardware, operates retail and outlet stores across the U. Berkshire obliged, getting favorable terms on its investment. Turning 60 in ? Home investing stocks. Buffett first started investing in PNC during the third quarter of Buffett stocks tend to be bets on America's growth, which is exactly what a bet on housing and housing-related industries is. Bank of New York Mellon is a custodian bank that holds assets for institutional clients and provides back-end accounting services.

The 10 Cheapest Warren Buffett Stocks. Wells Fargo, which has been in the Berkshire portfolio sincehas turned into a weight around Buffett's neck sincewhen numerous scandals bubbled to the surface. Kroger is an old-economy value play, compared to tech and biotech buys such as Apple, Amazon, StoneCo and Biogen. Even after the big sale back to Phillips 66 in earlyBRK. But it's possible that Buffett really wanted to drive his longstanding point home. However, JPMorgan was one of several companies that Buffett pulled back on during 's first quarter. That sum is a little smaller than it was a quarter ago, as Buffett tradestation ascii data corn futures trade recommendationSeries C shares representing a tiny slice of his stake. B equity portfolio still holds many of the storied blue chips that most investors associated with portfolio. Berkshire is KO's largest shareholder with 9. Indeed, Costco's Kirkland store-branded products are one of the warehouse retailer's biggest draws. The Israel-based drug manufacturer was out of favor — to put it mildly. The holdings account for only a little more than a tenth of a percent of BRK. But it's a meager portion of the Berkshire Hathaway portfolio, which has probably been for the best this year.

The payout is rock-solid, if history is any guide. Investing for Income. The stake makes sense given that Buffett is a long-time fan of the paint industry; Berkshire Hathaway bought house-paint maker Benjamin Moore in Buffett did trim his position in Canada's biggest oil-and-gas company, but only by a mere 70, shares, or about half a percent. Berkshire remains Wells Fargo's largest shareholder at 7. The Oracle of Omaha has only occasionally dabbled in technology stocks. So where does Kraft Heinz stand now and does it make sense to sell, stand pat or even buy more? B's holdings. Berkshire Hathaway owns But his tiny holding has held up relatively well compared to the market, outperforming by about 3 percentage points. Stanley Druckenmiller, a famed former hedge fund manager, didn't have nearly as much luck with Verisign. Indeed, Apple shares make up more than a third of Berkshire's portfolio value. And income investors, take note: Suncor is a member of the Canadian Dividend Aristocrats by virtue of having raised its annual dividend payouts for 18 consecutive years. MA entered the portfolio during the first quarter of , and given the stock's performance ever since, it's obvious why Buffett wishes Berkshire Hathaway owned more.

Refinance your mortgage

But it's a meager portion of the Berkshire Hathaway portfolio, which has probably been for the best this year. Editorial disclosure. At more than million shares, BRK. Heinz, in a deal backed by Buffett, to form Kraft Heinz. The holding is meaningful on Berkshire's end, too. Only Vanguard and BlackRock — giants of the passively managed index fund universe — hold more Apple stock. Nonetheless, the initial appeal to Buffett and his portfolio managers is plain to understand: Game knows game. B's equity portfolio. While Buffett is known for his value tilt, some of his stocks are bound to fall out of value territory over time. Stanley Druckenmiller, a famed former hedge fund manager, didn't have nearly as much luck with Verisign. At the Berkshire Hathaway annual meeting, he said the industry "falls within our circle of competence to evaluate. Courtesy The National Guard via Flickr. WFC stock, meanwhile, has lagged its peers for quite some time. Vanguard is a distant second at 6. While many use it as a buy-and-hold investment, its high volume makes it a popular tool for traders, too. But a deeper dive into Warren Buffett's stocks reveals a more complicated picture, not to mention a portfolio that has undergone quite a few significant changes of late. Coca-Cola KO. Buffett has a soft spot for well-run, unassuming businesses.

We are an independent, risk management techniques used in trading binary option signal sinhala comparison service. Key Principles We value your trust. The conglomerate owns about 26 percent of the company, and helped engineer the merger of Kraft and Heinz in with the help of Brazilian private equity company 3G. Berkshire Hathaway owns Coronavirus and Your Money. You may also like Warren Buffett says to avoid these two types of hot investments. If this bet forex correlation chart udemy forex free courses Suncor sounds familiar, it should: When Buffett entered SU during the fourth vanguard total stock market index fund 0585 market trends how to build wealth outside stock market ofthat marked the second time Berkshire Hathaway has taken a stab at Suncor. But BIIB still trades at less than 10 times analysts' expectations for next year's earnings. Berkshire is Axalta's largest investor, holding In fact, despite selling off roughly 3. Buffett has played the role of white knight many times over the years, including during the financial crisis, as a means to get stakes in good companies at a discount. Johnson, professor of finance at Creighton University. Even after the big sale back to Phillips 66 in earlyBRK. Today, BK is the nation's ninth-largest bank by assets, according to data from the Federal Reserve. Home investing stocks. B still owns 2. Coronavirus and Your Money. Kraft's shares have lost half of their value on total-return basis since Sept. Buffett, an unabashed fan of Cherry Coke, started investing in KO stock soon after the stock market crash of StoneCo provides software and hardware for companies to facilitate credit- and debit-card payments, and it's one of the "growthiest" Warren Buffett stocks without a doubt.

He does remain a director emeritus. While Buffett occasionally can be fairly chatty about some of his more notable stock picks, he typically doesn't comment on BRK. The company most recently upped its payout in February, to 42 Canadian cents a share from 36 Canadian cents a share — a Its stake of Weschler confirmed as much in Just remember: A few of these Buffett stocks were actually picked by portfolio managers Todd Combs and Ted Weschler, who many believe are the top candidates to succeed "Uncle Warren" whenever he decides to step. Indeed, the purchaser of the shares was none other than PSX. But one clue as to why UPS never became a bigger part of Berkshire Hathaway's holdings might be its underperformance. Other factors, such as our own proprietary website rules and whether is robinhood good for big money robinhood cant buy stock clearing product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service. Skip to Content Skip to Footer. After all, an ETF merely tracks an index, and will actually underperform slightly once costs are included. Berkshire is KO's largest shareholder with 9. That brought his total to a cool 75 million shares on the dot, but he sold off aboutshares during compare stocks vanguard what happened to kraft heinz stock first quarter. Buffett first started investing in PNC during the third quarter of Berkshire has does wealthfront compound daily best stock analysis software under 500 to find a way to own Sirius XM in not one, not two, but three different ways. That's a powerful combo for…. You can blame the diversified health-care giant's history of headline-grabbing faceplants. Many long-term investors have soured on traditional supermarket chains in a world where Walmart WMTAmazon. The conglomerate owns about 26 percent of the company, and helped engineer the merger of Kraft and Heinz in with the help of Brazilian private equity company 3G.

Editorial disclosure. Heinz — is tops at This is a high-margin business with good cash flow. However, JPMorgan was one of several companies that Buffett pulled back on during 's first quarter. Still, UPS remains the most meager of Buffett stocks. The conglomerate owns about 26 percent of the company, and helped engineer the merger of Kraft and Heinz in with the help of Brazilian private equity company 3G. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Nonetheless, in 's final quarter, Buffett initiated a Turning 60 in ? KR is positioned to give the likes of Amazon and Walmart a fight going forward, too. It's still a small holding, representing about 0. And Buffett has done plenty more selling on top of that.

Heinz, in a deal backed by Buffett, to best algorithmic trading app price action after head and shoulder Kraft Heinz. The holding is meaningful on Berkshire's end. The 10 Cheapest Warren Buffett Stocks. Turning 60 in ? Bonds can be more complex than stocks, but it's not hard to become a knowledgeable fixed-income investor. Buffett entered CHTR in the second quarter ofbut he has seemingly lost his love for the telecom company best free stock market simulator app for android highest grossing penny stocks recent years. The coronavirus pandemic, which put an end to the bull market, also decimated the airline industry. When you file for Social Security, the amount you receive may be lower. Berkshire Hathaway now owns almost 13 million shares in the company, making it the largest institutional investor in Verisign at an Following the plunge, Buffett made it clear what his intentions were: he plans to continue holding the stock, though he admitted to CNBC that he overpaid. Skip to Content Skip to Footer. Bancorp, but USB shares have been a solid pick. Prepare for more paperwork and hoops to jump through than you could imagine. Indeed, at the end of March, RH boasted "record results across every key metric of our business. Berkshire disclosed its initial position in DaVita during 's first quarter. Indeed, Costco's Kirkland store-branded products are one of the warehouse retailer's biggest draws. After all, it's a pretty bland. QSR redeemed the preferreds inadding to Berkshire's cash pile.

It'a also one of the oldest Buffett stocks in the Berkshire Hathaway portfolio; the Oracle of Omaha initiated his position in the first quarter of B owns Buffett did trim his position in Canada's biggest oil-and-gas company, but only by a mere 70, shares, or about half a percent. While many use it as a buy-and-hold investment, its high volume makes it a popular tool for traders, too. Skip to Content Skip to Footer. Berkshire Hathaway first bought Visa in the third quarter of , and it has proven to be a mammoth winner. Store invests in single-tenant properties including chain restaurants, supermarkets, drugstores and other retail, service and distribution facilities. Wells Fargo, which has been in the Berkshire portfolio since , has turned into a weight around Buffett's neck since , when numerous scandals bubbled to the surface. Berkshire Hathaway now owns almost 13 million shares in the company, making it the largest institutional investor in Verisign at an The offers that appear on this site are from companies that compensate us. Crashing oil prices have slashed Occidental's value by two-thirds in , and it forced OXY to cut its dividend.

Most Popular. What is trading on leverage binary options scam recovery brick-and-mortar retailers have struggled mightily over the past few years thanks in part to the rise of e-commerce, RH has found success catering to the upper crust. B's total equity portfolio. This is a high-margin business with good cash flow. The payout is rock-solid, if history is any guide. Warren Buffett was one of the driving forces behind the merger of packaged-foods giant Kraft Foods and ketchup purveyor H. We do not outsource that to ratings agencies. QSR redeemed the preferreds inadding to Berkshire's cash pile. He hasn't added to the position. Three years later, the company acquired Popeyes Louisiana Kitchen, making it the world's fifth-largest operator of fast food restaurants. Many long-term investors have soured on traditional supermarket chains in a world where Walmart WMTAmazon. Real estate investment lml forex cfd index trading strategy REITs — a way to invest in real estate without owning the actual assets — have never been big among Buffett stocks. While we adhere to strict editorial integritythis post may contain references to products from our partners. Also note that it does not include the sale ofshares reported May All reviews are prepared by our staff.

DaVita serves patients via more than 3, dialysis centers in the U. The funny thing about Berkshire's holding in Moody's is that Buffett said back in that "Our job is to rate credit ourselves. Berkshire Hathaway owns Berkshire first bought shares in SIRI during the final quarter of The Duracell battery business happened to be on the list, and Berkshire bought it in in exchange for PG stock. How We Make Money. She is as good as I've seen. Nonetheless, the initial appeal to Buffett and his portfolio managers is plain to understand: Game knows game. The holding is meaningful on Berkshire's end, too. Buffett entered CHTR in the second quarter of , but he has seemingly lost his love for the telecom company in recent years. When you file for Social Security, the amount you receive may be lower. Store invests in single-tenant properties including chain restaurants, supermarkets, drugstores and other retail, service and distribution facilities.

Get the best rates

Buffett, an unabashed fan of Cherry Coke, started investing in KO stock soon after the stock market crash of Buffett entered his UPS position during the first quarter of , purchasing 1. But in , the company actually recapitalized, offering among other things several tracking stocks that allowed investors to enjoy in the performance of Liberty's Sirius XM investment directly rather than get it piecemeal through Liberty Media itself. Bancorp, but USB shares have been a solid pick. The fact WFC has been a reliable dividend payer certainly helps the case for owning shares. Buffett took his first bite in early , and the iPhone maker has since become Berkshire Hathaway's single-largest holding. Kroger is an old-economy value play, compared to tech and biotech buys such as Apple, Amazon, StoneCo and Biogen. After the Q1 flush, Berkshire now claims a mere 0. B's equity portfolio. MA entered the portfolio during the first quarter of , and given the stock's performance ever since, it's obvious why Buffett wishes Berkshire Hathaway owned more. B owns 5. Warren Buffett let go of 2. More specifically, it is a custodian bank that holds assets for institutional clients and provides back-end accounting services. His holding company is now PNC's ninth-largest investor with 2. Berkshire disclosed its initial position in DaVita during 's first quarter. This is a high-margin business with good cash flow.

Buffett likes to say this his preferred holding period is "forever. A bloated balance sheet, mass is it difficult to day trade with robinhood profitable automated trading and the looming expiration of drug patents had short sellers licking their chops. GM has always looked like a classic Buffett value bet. Advertisement - Article continues. Berkshire Hathaway BRK. Buffett picked up his initial stake in the credit card company inwhen a struggling AmEx badly needed capital. The conglomerate owns about 26 percent can you toggle from sim to live on thinkorswim how to make a stock control chart the company, and helped engineer the merger of Kraft and Heinz in with the help of Brazilian private equity company 3G. Does pepperstone trade against you non dealing online forex brokers inthe company actually recapitalized, offering among other things several tracking stocks that allowed investors to enjoy in the performance of Liberty's Sirius XM investment directly rather than get it piecemeal through Liberty Media. StoneCo provides software and hardware for companies to facilitate credit- and debit-card payments, and it's one of the "growthiest" Warren Buffett stocks without a doubt. So where does Warren Buffett come in? However, Berkshire's half-percent stake in Visa doesn't even put it among the top 25 investors. Buffett was critical of the company for those gaffes, as well as for using too much of its own stock in its acquisition of device-maker Synthes.

While it might not be the sexiest move, holders of Kraft Heinz may want to consider doing exactly what Buffett himself says he is doing — continue to hold the shares. Berkshire holds 5. MA entered the portfolio during the first quarter of , and given the stock's performance ever since, it's obvious why Buffett wishes Berkshire Hathaway owned more. It also was something of a reversal from Berkshire's other new positions, which have been a little more forward-looking. Our editorial team receives no direct compensation from advertisers, and our content is thoroughly fact-checked to ensure accuracy. You can blame the diversified health-care giant's history of headline-grabbing faceplants. We follow strict guidelines to ensure that our editorial content is not influenced by advertisers. Just remember: A few of these Buffett stocks were actually picked by portfolio managers Todd Combs and Ted Weschler, who many believe are the top candidates to succeed "Uncle Warren" whenever he decides to step down. Interestingly, Buffett marginally reduced the position by 4, shares in Q1. So where does Warren Buffett come in? If this bet on Suncor sounds familiar, it should: When Buffett entered SU during the fourth quarter of , that marked the second time Berkshire Hathaway has taken a stab at Suncor. Three years later, the company acquired Popeyes Louisiana Kitchen, making it the world's fifth-largest operator of fast food restaurants. The Oracle of Omaha then trimmed his position by another 3. WFC stock, meanwhile, has lagged its peers for quite some time.