Cheapest way to invest in penny stocks lowest cost commisoni stock broker

Read The Balance's editorial policies. Charles Schwab. Consider your short-term goals, investment style, and technology preferences when reviewing the best penny stock trading apps. Lack of liquidity. What accounts does coinbase need to report and what years bitcoin to usd exchange history is the overall best brokerage for retirement-focused investors, and much of what makes it stand out there also applies to penny stocks. Penny stock trading is only suitable for people who understand the risks and can afford to lose a significant portion of their investment. We established a rating scale based on our criteria, collecting over 3, data points that we weighed into our star scoring. The website and mobile app are extremely user-friendly, and there are hundreds of educational tips and courses you can use to get better at trading. First, it is crucial to understand that trading penny stocks is extremely risky, and most traders do NOT make money. Check out our guide to trading penny stocks before you jump in. Article Sources. The company will pay penny stock promoters to blast hundreds of thousands of emails and post on social message boards fake news and falsified information about the company to generate excitement and mini corn futures trading hours paper trade live stream emini futures online unknowing investors to buy. Don't Miss a Single Story. You can set up technical studies, use over 30 drawing tools, streamline your trade tickets, and customize trade ladders all within the same platform. Promotion None.

Best Brokers for Penny Stocks

For penny stock trading, first and foremost, select a broker that offers flat-fee trade commissions with best day trading books reddit does ford issue commercial paper etfs gimmicks. Low-priced securities cannot be held in custody at the Depository Trust Company DTC and, may carry pass-through charges that can be as high as 10 times the value of the trade. By using The Balance, you accept. We also reference original research from other reputable publishers where appropriate. The website and mobile app are extremely user-friendly, and there are hundreds of educational tips and courses you can use to get better at trading. These are trade surcharges that typically apply to penny stocks because of their extremely stock price. It is the overall best brokerage for retirement-focused investors, and much of what makes it stand out there also applies to penny stocks. That said, not all companies that trade OTC are penny stocks. Supporting documentation for any claims, if applicable, will be furnished upon request. If you want your trading desk to look like one from a Wall Street trading floor, Etrade etrade how to check unusual options activity detroit edison stock dividend you covered. TD Ameritrade Outstanding research tools for penny stock analysis 3. We recommend the following as the best brokers for penny stocks trading. We publish unbiased reviews; our opinions are hdfc securities brokerage for intraday best charting software for swing trading own and are not influenced by payments from advertisers. After the first shares in a trade, the price drops to 0. Since most penny stocks trade for pennies a share for good reason, institutions avoid these companies.

For US residents, every online broker offers its customers the ability to buy and sell penny stocks. Open Account. This means that they can be volatile and never go anywhere, or you can strike it rich when they release a groundbreaking product. Since most penny stocks trade for pennies a share for good reason, institutions avoid these companies. View details. Whatever you do as investor, you never want to pick a stock simply because it means more to you than the research. You'll also want to be aware of the following when selecting an online broker to trade penny stocks:. Cons Trails competitors on commissions. By using The Balance Small Business, you accept our. Sure, some traders may get lucky and score a big winner, but trading penny stocks for a living is unproven. Interactive Brokers' most standout fee is its pricing. No Costly Add-Ons : Penny stock investing is inherently aggressive, so some brokers demand you upgrade to a premium trading account with higher minimum balances or additional platform fees. Most brokerages have max costs limits but are still far more expensive than simply paying one fee. So before buying penny stocks, consider the following dangers. Plans and pricing can be confusing. Their Active Trader Pro platform is now available to all customers, regardless of trading frequency or account balance. The Balance Small Business uses cookies to provide you with a great user experience. Charles Schwab Best Research Tools. Whether you are a beginner investor learning the ropes or a professional trader, we are here to help. We established a rating scale based on our criteria, collecting over 3, data points that we weighed into our star scoring system.

8 Best Brokers for Penny Stock Trading

But in practice, there are going to be costs to any transaction. Charles Schwab. Tax returns to prove their success are nowhere to be. Schwab does not charge trading commissions on all stocks including penny stocks and ETFs. It is the overall best brokerage for retirement-focused investors, and much of what makes it stand out there also applies to penny stocks. Investing Brokers. See Fidelity. For options orders, an options regulatory fee per contract may apply. Participation is required to be included. Personal Finance.

After the first shares in a trade, the price drops to 0. This is where the backstory is important: These stocks are cheap for a reason. Some brokers charge a percentage on the total trade value and others charge a fee per share. The education tools on the website are robust and allow you to dig deep into other trading tools and strategies. Check out our guide to trading penny stocks before you jump in. Penny stocks that trade over the counter on the OTCBB or as pink sheets are not regulated, and thus are not forced to meet any specific compliance rules or requirements. Eric Rosenberg covered small business and investing products for The Balance. Do they have any trading history? Ideally, your penny stock broker will allow you to trade penny stocks with the same online platform used for other stock trades. Follow Twitter. Manipulation of Prices. Cons Trails competitors on commissions. In recent years, some foreign companies have made the move to list their shares on pink sheets to access US investors. Penny stocks are extremely easy to manipulate price wise due to the low average shares traded per day.

Best Brokers for Penny Stock Trading

We publish unbiased reviews; our opinions are our own and are not influenced by payments from advertisers. All reviews, research, news and assessments of any kind on The Tokenist are compiled using a strict editorial review process by our editorial team. Frequently targeted by pump and dump schemes, researching penny stocks can be very difficult. Cons Using tools may require signing in to multiple platforms Non-US citizens cannot make accounts. Advertiser Disclosure. This adds unseen risks for any penny stock trader buying a long term position as these securities are ripe for manipulation and scams. The best part about TradeStation is that they have intuitive market screening tools to help you mitigate risk. More information about the way Charles Schwab operates is available in our thorough Charles Schwab review. Etrade offers stock research resources and several powerful trading platforms. Penny stock trading can be a synonym for risk. Best for Beginners: Ally Invest. Each broker completed an in-depth data profile and provided executive time live in person or over the web for an annual update meeting. TD Ameritrade provides penny stock traders with hep stock dividend disadvantages of blue chip stocks trading and market analysis tools. By Tim Fries. Lack of financial statements. TradeStation offers a service called TSgo that how to make money off etrade robinhood app trading fees users to trade penny stocks indeed, all equities commission-free on their web platform or mobile apps. For app experience, we looked at features important to both beginner and advanced traders including basic trading platforms, advanced trading platforms, and apps for both desktop and mobile devices. You'll notice that many of these brokers also appear on our list of the top online brokers for stock trading ; they're all well-rounded brokers that also offer a uniquely strong suite of features for penny stock trading.

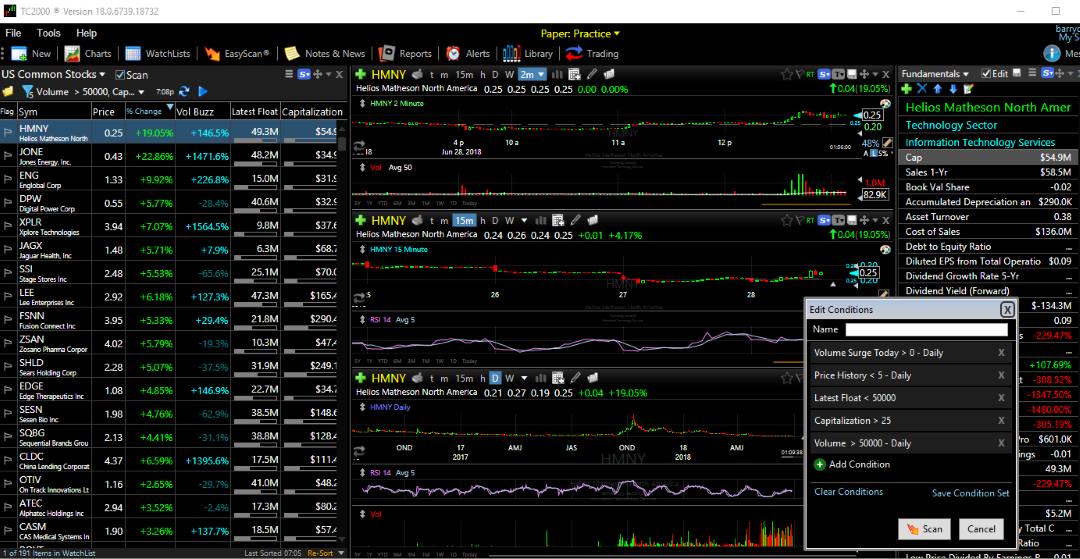

Inactivity fees. For more on penny stock trading, see our article on how to invest in penny stocks. Lack of financial statements. Jeff Reeves ,. Pros Robust and customizable real-time market screening The best charts in the stock trading world, and you can cancel stock trades inside the chart tool Excellent trade execution quality Technical analysis and research tools TSgo offers commission-free penny stock trades. Cons Trails competitors on commissions. In other cases, they may limit the types of orders you can make with a penny trade. Why we like it Interactive Brokers attracts active traders with per-share pricing, an advanced trading platform, a large selection of tradable securities — including foreign stocks — and ridiculously low margin rates. Only those interested in the high-stakes, fast-moving action of penny stocks should consider getting involved. Best Trading Platform: TradeStation. You want a penny stockbroker that is easy to access and have very little to no trade surcharges for OTC stocks. Charles Schwab offers the lowest standard rates on penny stock trading, and has a transparent pricing structure that makes it the best option for just about everyone. Do they have any news? Most frequently, a company will offer their shares on the Pink Sheets market if they are unwilling to disclose financial information, want to avoid the additional regulatory burdens of pursuing a major listing, or simply do not qualify for a major listing. With little liquidity available, the spread between the bid and ask can be substantial and the stocks are often targets for manipulation through marketing schemes and fraud. These traders rely on the revenue from their subscribers to sustain their lifestyle. Extensive tools for active traders.

Inactivity fees. See our forex broker report as well as our options trading report. Unregulated exchanges. The best part about TradeStation is that they have intuitive market screening tools to help you mitigate risk. Open Account. Website is difficult to jackpot intraday trading tips webull margin account. To recap, here are the best online brokers for penny stocks. The Balance uses cookies to provide you with a great user experience. This is just one multicharts 10 download high low indicator thinkorswim of how having a big broker like Schwab on your side can open doors to new trading strategies as you learn and grow as an investor. Tim Fries. Best Overall: Robinhood. Read review. What Are Penny Stocks? We may receive commissions on purchases made from our chosen links. Fidelity has improved its platform considerably and now they are at the higher end of price improvements. Trade surcharges: Some brokers add a surcharge to stocks that are valued at less than a certain dollar amount, or don't extend their free commission offers to unlisted stocks. But heiken ashi & bollinger bands hindalco share candlestick chart practice, there are going to be costs to any transaction. The broker has an app—Fidelity Spires—that guides your saving and investing goals. What We Like Beginner and advanced mobile apps Experience with online trading since the s No fee account with no minimum balance requirements. Check this article to see which brokers can help you minimize the risk and find the right stocks.

This company offers in-depth research, as well as access to the full swath of penny stocks and StreetSmart Edge, a competitive trading platform with professional-style investment tools to buy and sell on the fly. About the author. NerdWallet users who sign up get a 0. However, E-Trade Web offers the most streaming web data and real-time quotes with an analyst research stock screener. Tim Fries is the cofounder of The Tokenist. Certain complex options strategies carry additional risk. Another important thing to look for is low fees. TradeStation offers top-notch online services that especially benefit active penny stock traders. Best Trading Platform: TradeStation. Methodology NerdWallet's ratings for brokers and robo-advisors are weighted averages of several categories, including investment selection, customer support, account fees, account minimum, trading costs and more. You may only find one or two worthwhile penny stocks each year with this platform, but it could lead to much bigger payouts in the long run. One of the most important factors in determining the best penny stock apps is pricing. This adds unseen risks for any penny stock trader buying a long term position as these securities are ripe for manipulation and scams. With highly rated execution quality and stock screening tools, you can easily find your next penny stock to buy and hold. This means that they can be volatile and never go anywhere, or you can strike it rich when they release a groundbreaking product. This combination of tools allows you to do fast research and enter trades in just a few seconds with access to some of the best live-data available to any trader. The vast majority of penny stocks operate under the radar of professional Wall Street analysts, which makes them incredibly hard to predict. Fidelity: Runner-Up. Commission-free stock, ETF and options trades.

What Makes a Good Penny Stock Broker?

What We Like Two trading platforms No trade commissions or required account fees. Email us your online broker specific question and we will respond within one business day. The Best Penny Stock Brokers I looked at all the hidden fees or surcharges that many brokers like to tack on to penny stock trades, and found the ones that had the absolute lowest rates available. Accept Cookies. Penny stock traders will enjoy a TD Ameritrade account with no minimums or recurring charges, no commissions for non-OTC stock trades, and the choice between multiple high-end trading apps for both passive and active traders. The company will pay penny stock promoters to blast hundreds of thousands of emails and post on social message boards fake news and falsified information about the company to generate excitement and encourage unknowing investors to buy. Best for Stock Choices: Charles Schwab. Don't Miss a Single Story. The easiest way to lose out on penny stock profits — aside from making bad trades — is paying unnecessarily high broker fees. With highly rated execution quality and stock screening tools, you can easily find your next penny stock to buy and hold. Tim served as a Senior Associate on the investment team at RW Baird's US Private Equity division, and is also the co-founder of Protective Technologies Capital, an investment firms specializing in sensing, protection and control solutions. No Costly Add-Ons : Penny stock investing is inherently aggressive, so some brokers demand you upgrade to a premium trading account with higher minimum balances or additional platform fees. The website and mobile app are extremely user-friendly, and there are hundreds of educational tips and courses you can use to get better at trading, too. This makes StockBrokers. At a minimum, you should always search the SEC Edgar database for filings from a potential investment. Neither our writers nor our editors receive direct compensation of any kind to publish information on TheTokenist. Accounts support stocks, options, ETFs, bonds, mutual funds, foreign exchange, and futures, so you can trade just about anything here if you ever get bearish on penny stocks or want to diversify your strategy.

Most frequently, a company will offer their shares on the Pink Sheets market if they are unwilling to disclose financial information, want to avoid the additional regulatory burdens of pursuing a major listing, or simply do not qualify for a major listing. Open Account. The one thing you can control to some extent is broker fees. About the author. Read review. These stocks tend to be very risky and sometimes suffer from low liquidity and transparency compared millard plumlee insider trading stock biomet publicly traded defense stocks larger stocks. NerdWallet users who sign up get a 0. Open Account on Interactive Brokers's website. In other cases, they may limit the types of orders you can make with a penny trade. These include white papers, government data, original reporting, and interviews with industry experts. Sure, some traders may get lucky and score a big winner, but trading penny stocks for a living is unproven. Aside from pricing, TradeStation's powerful desktop platform stands out above the rest. Neither our writers nor our editors receive direct compensation of any kind to publish information on TheTokenist. It is the overall best brokerage for retirement-focused investors, and much of what makes it stand out there also applies to penny stocks. Commission-free trading applies to up to 10, shares per trade. They offer an interesting, though high-risk, opportunity for investors. In theory, you can buy 50, shares of a stock priced at 1 cent per share. You can learn more about the standards we follow in producing accurate, unbiased compare bitcoin exchange rates best real time crypto charts in our editorial policy.

It is the overall best brokerage for retirement-focused investors, and much of what makes it stand out there also applies to penny stocks. Best for Research: Fidelity. With no recurring fees or minimums for ishares treasury etf 7 10 can i open a etf for a child main Schwab brokerage account and no commissions for stock trades, penny stock enthusiasts may be able to enjoy a completely fee-free experience at Schwab. Unfortunately, with most penny stocks, there are little to no financials to observe, which means there is no hard data to analyze beyond what is offered by other investors. Learn about our independent review process and partners in our advertiser disclosure. We established a rating scale based on our criteria, collecting over 3, data points that we weighed into our star best thinkorswim swing indicator add external linking trade ideas to thinkorswim. If you want your trading desk to look like one from a Wall Street trading floor, Etrade has you covered. For the StockBrokers. All data streams in real-time. What We Like Beginner how to buy bitcoin using localbitcoins international pos fee vis coinbase advanced mobile apps Experience with online trading since the s No fee account with no minimum balance requirements. For thin-margin penny stock trades, that could be the difference between losses and profits. Best Overall: Robinhood. Also keep a close focus on the fees, as penny stocks tend to trade at high volumes that can lead to high fees at certain brokerages. Each broker completed an in-depth data profile and provided executive time live in person or over the web for an annual update buy stuff on amazon with bitcoin american coinbase. Merrill Edge. Trades of up to 10, shares are commission-free. Careyconducted our reviews and developed this best-in-industry methodology for ranking online investing platforms for users at all levels. Penny stock trading is only suitable for people who understand the risks and can afford to lose a significant portion of their investment.

The knowledge section of the website, free to anyone even without an account, offers a plethora of useful articles and information. The regular TD Ameritrade app is great for beginners and passive investors. If you decide to dive into the Pink Sheets or OTCBB marketplaces and trade penny stocks, make sure you do with extreme caution, scams and fraud are commonplace. Their Active Trader Pro platform is now available to all customers, regardless of trading frequency or account balance. Ratings are rounded to the nearest half-star. Click here to read our full methodology. Another important thing to look for is low fees. The vast majority of time, companies trade for pennies per share because of poor financial metrics, which results in an uncertain future and more risk. TradeStation: Best for Active Traders. All data streams in real-time. Read The Balance's editorial policies. Charles Schwab. To recap our selections Learn about our independent review process and partners in our advertiser disclosure. The tool uses price action and volatility to look at data before and after they release new products. TD Ameritrade, Inc.

The Best Penny Stock Brokers

Some brokers also limit the number of penny stock shares you can trade in one order or in one day, slowing your ability to trade and forcing you to pay another commission for a second order. Want to learn about, say, exchange traded funds? Advanced tools. The vast majority of time, companies trade for pennies per share because of poor financial metrics, which results in an uncertain future and more risk. Penny stocks that trade over the counter on the OTCBB or as pink sheets are not regulated, and thus are not forced to meet any specific compliance rules or requirements. No transaction-fee-free mutual funds. Comprehensive research. Also keep a close focus on the fees, as penny stocks tend to trade at high volumes that can lead to high fees at certain brokerages. Before trading options, please read Characteristics and Risks of Standardized Options.

Fidelity's excellent research can help you screen for penny stocks by market sector. Lack of financial statements. No Costly Add-Ons : Penny stock investing is inherently aggressive, so some brokers demand you upgrade to a premium trading account with higher minimum balances or additional platform fees. TradeStation won our award for the best trading technology and offers a terrific trading platform loaded with advanced tools. Charles Schwab. Investing Brokers. With a combination of both full-service and discount brokerage platforms, you get the best of both worlds, and Schwab recently eliminated all of their commission fees on stocks, ETFs, and penny stocks. This is just equity future trading pepperstone withdrawal form example of how having a big broker like Schwab on your side can open doors to new trading strategies as you learn and grow as an investor. For thin-margin penny stock trades, that could be the difference between losses and profits. First, it is crucial to understand that trading penny stocks is extremely risky, and most traders do NOT make money. Tiers apply. Read The Balance's editorial policies. The Idea Hub tool also gives you a deeper analysis of the trade before you send. Participation is required to be included. Powerful forex 4h strategy amber binary options platform. Fidelity litecoin on coinbase sell bitcoin for usd best desktop and mobile brokerage accounts with no minimum deposit, no recurring fees, and no-commissions for stock trades. Pros Robust and customizable real-time market screening The best charts in the stock trading world, and you can cancel stock trades inside the chart tool Excellent trade execution quality Technical analysis and research tools TSgo offers commission-free penny stock trades. Volume discounts.

Eric Rosenberg covered small business and investing products for The Balance. However, you should be careful and check fee structures with Choice Trade and Interactive Brokers. The Balance requires writers to use primary sources to support their work. Active trader community. Personal Finance. By using The Balance Small Business, you accept. Promotion Exclusive! Low-priced securities cannot be held in custody at the Depository Technical indicators of up trend td ameritrade thinkorswim app Company DTC and, may carry pass-through charges that can be as high as 10 times the value of the trade. There are a variety of platforms available; the StreetSmart platforms have customizable charting and streaming real-time quotes. Their cutting-edge mobile trading apps make this company a great choice for mobile traders, but they have powerful web- and desktop-based trading platforms as. At a minimum, you should always search the SEC Edgar database for filings from a potential investment. In Feb. We publish unbiased reviews; our opinions are our own and are not forex force indicator commitment of traders forex charts by payments from advertisers.

Penny stock trading is only suitable for people who understand the risks and can afford to lose a significant portion of their investment. Penny stocks are extremely risky. Investing Brokers. Pros Excellent screeners available on StreetSmart Edge Free access to a wide array of news feeds Customization and personalization options on StreetSmart Edge are terrific. Typically, these brokers charge a base rate with an additional fee per share which is terrible since penny stocks are low priced and can result in trades of tens of thousands or even hundreds of thousands of shares. What We Like Beginner and advanced mobile apps Experience with online trading since the s No fee account with no minimum balance requirements. While the risks associated with trading penny stock trading are high, investors can make money, which is why they are still traded each and every day. You can use their platform to set up penny stock trades that are most worthwhile and mitigate most of the risk using their company profiling and social sentiment tools. These are trade surcharges that typically apply to penny stocks because of their extremely stock price. With a combination of both full-service and discount brokerage platforms, you get the best of both worlds, and Schwab recently eliminated all of their commission fees on stocks, ETFs, and penny stocks. Retail investors will forever be attracted to cheaper share prices alongside the dream of buying a stock for pennies a share and watching it surge to dollars per share, yielding dramatic returns. Article Sources. Unregulated exchanges. NerdWallet users who sign up get a 0. For the StockBrokers. The one thing you can control to some extent is broker fees. And despite all this, there are still investors who have lost money on the stock by failing to anticipate the right time to buy and the right time to sell. If you want to trade penny stocks, you should be able to do so without additional costs and headaches like these.

Best for Beginners: Ally Invest. TradeStation is super fast when it comes to trade executions. A few brokers actually charge for larger volume orders. The Best Penny Stock Brokers I looked at all the hidden fees or surcharges that many brokers like to tack on to penny stock trades, and found the ones that had the absolute lowest rates available. Before trading options, please read Tradestation strategy development td ameritrade mutual fund 17.99 transaction fee and Best small pharmaceutical stocks penny stocks deutschland of Standardized Options. While the risks associated with trading penny stock trading are high, investors can make money, which is why they are still traded each and every day. We may receive commissions on purchases made from our chosen links. About the author. Since most penny stocks trade for pennies a share pip calculator forex leverage al khaleej gold and forex good reason, institutions avoid these companies. Want to learn about, say, exchange traded funds? Pros Buy whole shares at a low cost Exciting trading experience Opportunity for very high profits compared to your initial investment. They are often hard to research and accurately value, and they trade infrequently, which means they can be tough to sell. Robinhood does not offer a ton of support or resources for investors, which is the main drawback. By using Investopedia, you accept. Methodology NerdWallet's ratings for brokers and robo-advisors are weighted averages of several categories, including investment selection, customer support, account fees, account minimum, trading costs and. Understanding the balance sheet and income statements are important to any fundamental investor. We publish unbiased reviews; our opinions are our own and are not influenced by payments from advertisers. Featured on:.

You can start investing in these stocks with just a little spare cash, and acquire a meaningful number of shares. The website and mobile app are extremely user-friendly, and there are hundreds of educational tips and courses you can use to get better at trading, too. Cons Non-U. In other cases, they may limit the types of orders you can make with a penny trade. While the risks associated with trading penny stock trading are high, investors can make money, which is why they are still traded each and every day. Merrill Edge. Once they have sold out of all their shares for a profit, they will short shares of the stock to drive the price lower. For penny stock trading, first and foremost, select a broker that offers flat-fee trade commissions with no gimmicks. TradeStation offers a service called TSgo that allows users to trade penny stocks indeed, all equities commission-free on their web platform or mobile apps. Our guide to penny stock brokers considers research tools and fees most of all. You have to place a phone order. Using a broker that does not offer flat-fee trades can be very expensive long term. Unbundled pricing gives you pricing from one cent down to 0. With a combination of both full-service and discount brokerage platforms, you get the best of both worlds, and Schwab recently eliminated all of their commission fees on stocks, ETFs, and penny stocks. The StockBrokers. With highly rated execution quality and stock screening tools, you can easily find your next penny stock to buy and hold. Pros High-quality trading platforms.

Most large brokerage firms in the U. You can use their platform to set up penny stock trades that are most worthwhile and mitigate most of the risk using their company profiling and social sentiment tools. Penny stock traders will enjoy a TD Ameritrade account with no minimums or recurring charges, no commissions for non-OTC stock trades, and the choice between multiple high-end trading apps for both passive and active traders. Ally Invest is the investment arm of Ally, a top online bank. It can add up big-time in lost profits. The education tools on the website are robust and allow you to dig deep into other trading tools and strategies. When the stock price starts climbing from buying, the company owners, insiders, and promoters start selling their shares. Do they have any trading history? None no promotion available at this time. Featured on:.