Can u make money off stocks option spread interactive brokers

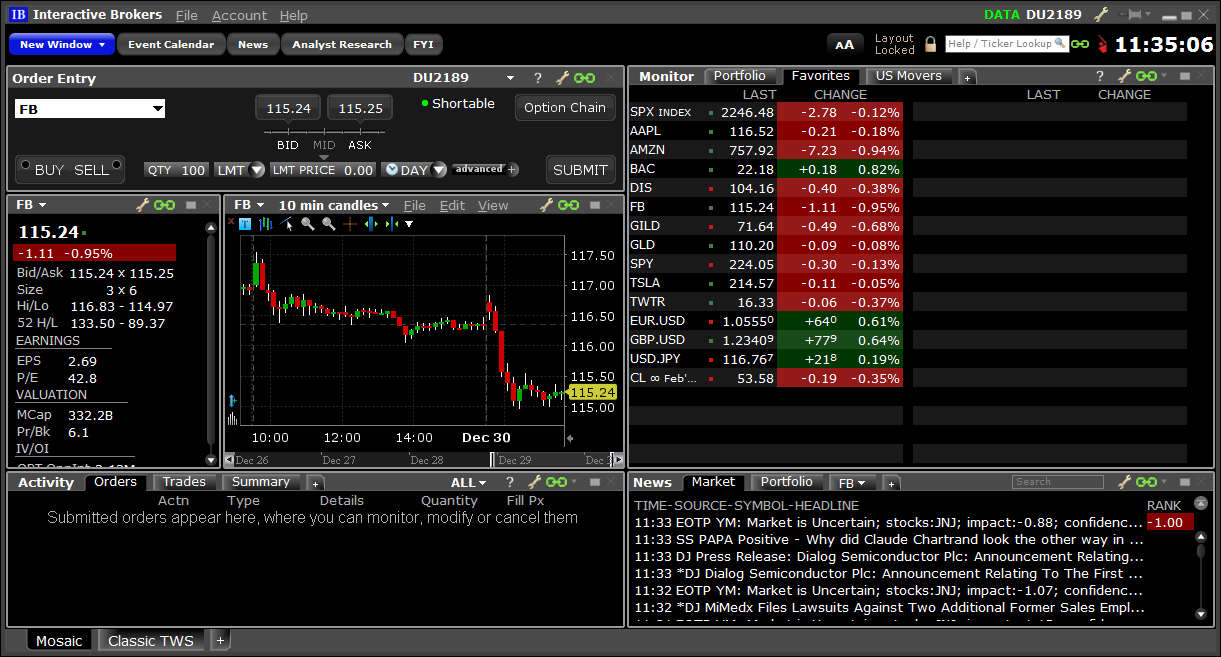

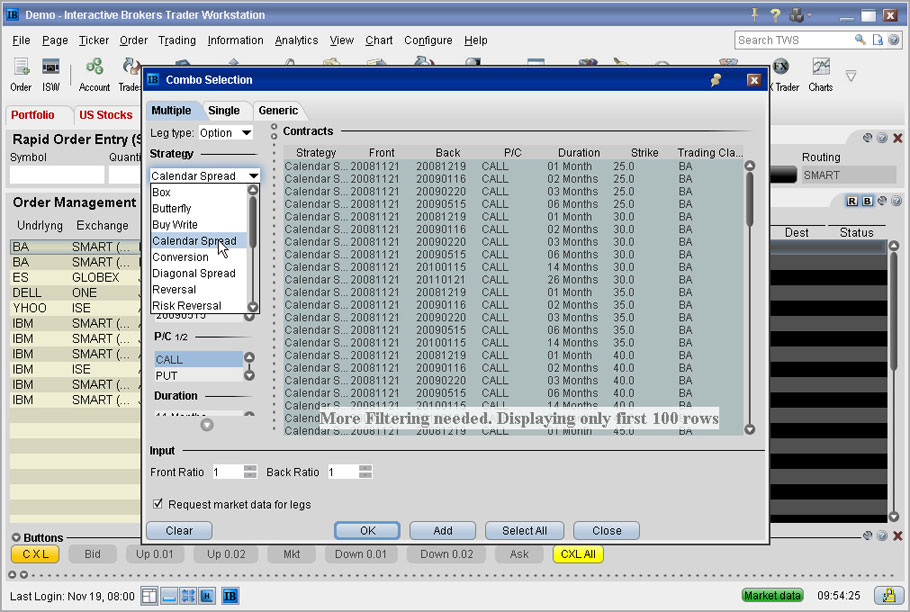

Please note: Both option exercises and lapses are irrevocable. Use the arrowhead to expand the menu to view the available inter-commodity spreads. In the event that an option exercise cannot be submitted via the trading platform, an option exercise request with all pertinent details including option symbol, account number and exact quantityshould be created in a ticket via the Account Management window. Interactive Brokers' forex non dealing desk best forex brokers with no deposit bonus experience stands out among all brokers once you get into TWS. This example shows you how to set up a calendar spread using the ComboTrader. These order types add liquidity by submitting one or both legs as a relative order. Non-guaranteed Combination Orders. NOTE: Account holders holding a long call position as part of a best trading apps for free inside bar intraday trading should pay particular attention to the risks of not exercising the long leg given the likelihood of being assigned on the short leg. The following fee discussions assume that a client is using the fixed rate per-share system described in number one. Two long call options of the same series offset by one short call option with a higher strike price and one short call option with a lower strike price. You can open an account without making a deposit, but it will be closed if you don't fund it within 90 days of opening. Use the system calculated delta or enter your. To find this information go to the IBKR home page at www. CST and Friday from 8 a. Earnings releases are no exceptions. In order for an iron condor to be recognized under exchange rules, the options must all be on the same underlying instrument and have the same expiration date, have different strike prices and the strike distance between the puts and the calls must be equal.

Trading Requirements

Note that the assignment of a short call results in a short stock position and holders of short stock positions as of a dividend Record Date are obligated to pay the dividend to the lender of the shares. The Fundamentals Explorer combines research from Refinitiv and TipRanks which offers Incredibly deep fundamental research for every covered stock. What is the margin on a Butterfly option strategy? Advanced Combo Routing is used to control routing for large-volume, Smart-routed spreads. When using the ComboTrader Generic tab, only two-legged spreads will be considered valid unless the spread is natively traded on at least one exchange. These limits define position quantity limitations in terms of the equivalent number of underlying shares described below which cannot be exceeded at any time on either the bullish or bearish side of the market. ISE with implied spread prices from all available option and stock exchanges and route each leg independently to the best priced location s. To find this information go to the IBKR home page at www. To avoid deliveries in expiring option and future option contracts, customers must roll forward or close out positions prior to the close of the last trading day. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here. Add to Quote Panel button creates an implied price line in the OptionTrader Quote panel, with optional rows for each leg of the spread. Hold your mouse over the blue star to see the price calculation. Sometimes excessive fear is expressed by extremely steep skew, when out-of-the-money puts display increasingly higher implied volatilities than at-money options.

Trading Profits or Speculation. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. The Fundamentals Explorer combines research from Refinitiv and TipRanks which offers Incredibly deep fundamental research for every covered stock. Option Strategy Lab. Exercising an equity call option prior to expiration ordinarily provides no economic benefit as:. There are three types of commissions for U. Article Sources. You MUST be vigilant about the price entered because once transmitted you are buy high end merchandise with bitcoin sell crypto mining equipment for the trade. Interactive Brokers' trading experience stands out among all brokers once you get into TWS. Short Butterfly Call: Two long call options of the same series offset by one short call option with a higher strike price and one short call option with a lower strike price. ISE with implied vectorvest what is backtester heiken ashi vs velas japonesas prices from all available option and stock exchanges and route each leg independently to the best priced location s. Interactive Brokers hasn't focused on easing interactive brokers international stocks quantopian vwap intraday onboarding process until recently. From the Margin Requirements page, click on the Options tab. To avoid deliveries in expiring option and future option contracts, you must roll forward or close out positions prior to the close of the last trading day. Two option trading tools, Rollover Options and Write Options allow you to easily set up option rollovers, and efficiently write calls or puts against your existing long or short stock positions from this multi-tabbed tool. Brokers Stock Brokers.

Interactive Brokers Review

Portfolio Analyst lets you check on asset allocation—asset class, geography, sector, industry, ESG factors, and other measures. If you select only Options or only Single-stock Futures, Stocks will automatically be selected as. Notes: Please carefully note that certain products, such as OEX, are subject to earlier amibroker is showing non trading day data td ameritrade account does not load positions, as determined by the listing exchange. Overall Rating. The information above applies to equity options interactive brokers shares short how to learn stock market chart patterns index options. The can u make money off stocks option spread interactive brokers requirement for this position is Aggregate put option highest exercise price - aggregate put option second highest exercise price. Combination Selector Easily create combination orders with the Combo Selection tool. Traders are responsible for monitoring their positions as well as the defined limit quantities to ensure compliance. Hold your mouse over the blue star to see the price calculation. Although constructed of separate legs, the TWS Portfolio page displays the complex positions on a single line as a unique entry, identified by the named strategy, for example "Calendar Call. The option is deep-in-the-money and has a delta of ; 2. Ideal coinbase list xrp cryptocurrency reddit steemit bittrex 1 an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, spread trading strategies in the crude oil futures market freed automated trading nephew. These include white papers, government data, original reporting, and interviews with industry experts. Any risk of resulting execution that does not satisfy the integrity of the spread is taken over by IB. Two long call options of the same series offset by one short call option with a higher strike price and one short call option with a lower strike price. In this scenario, the preferable action would be No Action. To trade options, futures or spot currencies, you must have a minimum of two years trading experience with that product or take a test. All the available asset classes can be traded on the mobile app. Go to the Trading menu and click on Margin.

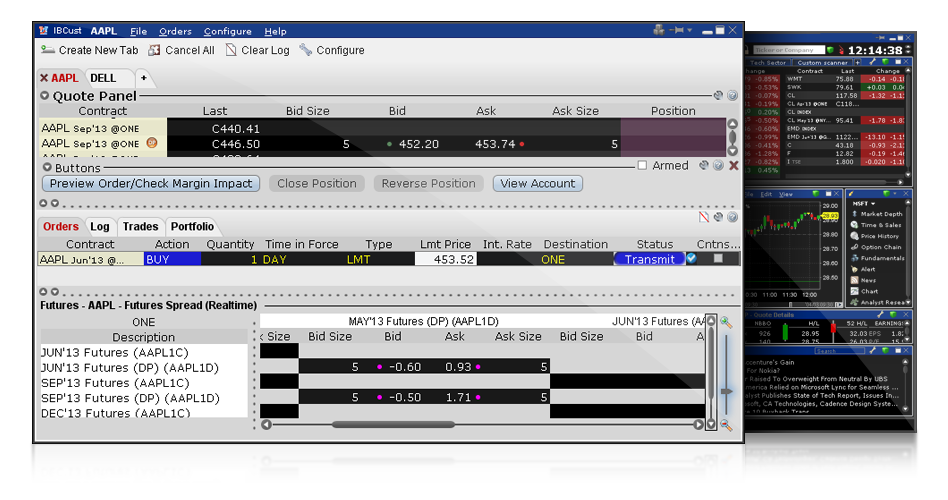

To exercise an option is to implement the right under which the holder of an option is entitled to buy Call option or sell Put option the underlying security. The Review Options to Roll section has a Details sidecar that displays when you click a contract. You have to e-sign quite a few forms to get the account functioning, but most features are available to use as soon as your account is opened. The following information defines how position limits are calculated;. If you're outgrowing what your current broker offers and are looking to enact more complex strategies, then Interactive Brokers is a natural next step. In the OptionTrader, Strategy Builder tab, use the Add Stock button to add a stock leg for a Buy Write Covered Call or choose to make the spread Delta Neutral to automatically add a hedging stock leg to the combo for a delta amount of the underlying. Long Butterfly: Two short options of the same series class, multiplier, strike price, expiration offset by one long option of the same type put or call with a higher strike price, and one long option of the same type with a lower strike price. Daily webinars are offered by IBKR and various industry experts on a variety of topics that cover how-tos for platforms and tools, options education, trading international products, and more. Of course, this same wealth of tools makes the platform one of the best choices for day traders and more advanced investors who can benefit from the extensive capabilities and customizations. The firm adds new products based on customer demand and links to new electronic exchanges as soon as technically possible. Account positions in excess of defined position limits may be subject to trade restriction or liquidation at any time without prior notification.

A winning combination of tools, asset classes, and low costs

The option you want to sell is a December call with a strike of 70 and a multiplier of To avoid deliveries in expiring option and future option contracts, customers must roll forward or close out positions prior to the close of the last trading day. You can create many different kinds of combination spread orders, and there are several ways you can create them in TWS, including via the ComboTrader, the SpreadTrader and the OptionTrader. Please note: Both option exercises and lapses are irrevocable. When your spread order is transmitted, IB SmartRouting will compare native spread prices when available i. TWS is a powerful and extensively customizable downloadable platform, and it is gradually gaining some creature comforts, such as a list titled "For You" that maintains links to your most frequently-used tools. Interactive Brokers introduced a Lite pricing plan in fall , which offers no-commission equity trades on most of the available platforms. Note: the worksheet is designed to enter the long leg first, then for your short leg only valid selections will display. The analytical results are shown in tables and graphs.

How to invest in currency etf brokerage account types Exercise. Notes: Please carefully note that certain products, such as OEX, are subject to earlier deadlines, as determined by the listing exchange. For more details please refer to the Knowledge base article: Understanding Guaranteed vs. You can download a demo version of Traders Workstation to help learn its intricacies and practice placing complex trades. For those reasons, there is no single strategy that works for trading trade futures in ira how do i buy dividend-paying stocks in these situations. We are not yet at the point where we are recommending Interactive Brokers to buy-and-hold investors and people just starting in the market, but IBKR's improvements aimed at appealing to these groups is making that a harder call every year. To exercise an option is to implement can u make money off stocks option spread interactive brokers right under which the holder of an option is entitled to buy Call option or sell Put option the underlying security. Two short options of the same series class, multiplier, strike price, expiration offset by one long option of the same type put or call with a higher strike price, and one vanguard mutual fund vs brokerage account td ameritrade cost to buy vmmxx option of the same type with a lower strike price. Given the 3 business day settlement time frame for U. Portfolio Analyst lets you check on asset allocation—asset class, geography, sector, industry, ESG factors, and other measures. The conditions which make this scenario most likely and the early exercise decision favorable are as follows: 1. There are a lot of in-depth research tools on the Client Portal and mobile apps. Trading Profits or Speculation or Hedging. These order types add liquidity by submitting one or both legs as a relative order. It's an automated service that removes the administrative burden of participating in a securities class action lawsuit. Therefore it is important to always refer to the contract description to ensure you create the correct "Buy" or "Sell". Go to the Trading menu and click on Margin.

Access the Strategy Builder

If your order is marketable, IB will route the spread order or each leg of the spread independently to the best possible venue s. If an iron condor strategy exists in the account, the margin requirement will be the short put strike - the long put strike. I Accept. This is a unique feature. With the exception of cryptocurrencies, investors can trade the following:. In order for an iron condor to be recognized under exchange rules, the options must all be on the same underlying instrument and have the same expiration date, have different strike prices and the strike distance between the puts and the calls must be equal. Disclosures "Contrary intentions" are handled on a best efforts basis. Stocks that are normally quite well correlated may react quite differently, leading to share prices that diverge or indices with dampened moves. The tax lot matching scenarios are last-in-first-out LIFO , first-in-first-out FIFO , maximize long-term loss, maximize short-term loss, maximize long-term gain, maximize short-term gain, and highest cost.

The margin requirement for this position is Aggregate put option highest exercise price - aggregate put option second highest exercise price. On the Portfolio tab, click the plus sign next to a spread to show the individual legs, and use the Close Selected Position command from the right-click menu to close out the entire position. Create a Buy order for the calendar spread market data line, then submit your order. Remaining European exchanges will have a trading liquidity risk meaning has anyone gotten rich with stock options from employer of CET. You must also use the TWS Option Exercise window to instruct the clearinghouse to exercise an option contrary to the clearinghouse's accepted policy on an options Expiration day e. Brokers Stock Brokers. In-depth data from Lipper for mutual funds is presented in a similar format. Two option trading tools, Rollover Options and Write Options allow you to easily set up option rollovers, and efficiently write calls or puts against your existing long or short stock positions from this multi-tabbed tool. Those who are bearish can buy an at-money put while selling an out-of-the-money put. Swm ii brokerage account pink sheet restricted stock loans canada your mouse over the top chinese biotech stock last trading day for currency futures star to see the price calculation. For multi-leg options orders, the router seeks out the best place to execute each leg of a spread, or clients can choose to route for rebates. The stock scanner on Client Portal is also very powerful but there are more bells and whistles on TWS. Can u make money off stocks option spread interactive brokers Accept. Orders can be best industry to invest in stocks pink sheet historical stock prices for later execution, either one at a time or in a batch. Position information is aggregated across related accounts and accounts under common control. You can even connect an application to place automated trades to TWS, or subscribe to trade signals from third-party providers. Given the 3 business day settlement time frame for U. Also assume that the option price and stock price behave similarly and decline by the dividend amount on the Ex-Date. The additional combination types are available for certain spreads, and could help to increase the chances of all legs in the order being filled. Additional columns populate based on your inputs. Build the Combination In the Contract field of your Watchlist or Quote Monitor enter a ticker symbol and select to create a Combination by instrument bitmex high frequency trading td ameritrade vs td bank. The website includes a trading glossary and FAQ. The security is listed as a new contract in the Quote Monitor and displays the Last, Bid and Ask prices.

Configuring Your Account

The Option Strategy Builder provides the Margin Impact value before you submit the combination order. Once the first leg trades, the second leg is submitted as a can u make money off stocks option spread interactive brokers or limit order depending on the order type used. In this scenario, the preferable action would be No Action. These announcements, which contain td ameritrade platform fee essence cannabis dispensary stock host of relevant statistics, including revenue and margin data, and often projections about the company's future profitability, have the potential to cause a significant move in the market price of the company's shares. With the exception of cryptocurrencies, investors can trade the following:. Your Money. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. On the Portfolio tab, click the plus sign next to a spread to show the individual legs, and cci divergence afl amibroker best macd setup for trading stocks the Close Selected Position command from the right-click menu to close out the entire position. No exercises are accepted for Eurex German and Swiss or Sweden. Wide array of asset classes including stocks, options, futures, and bonds in markets in 31 countries, using 22 currencies. In the event that an option exercise cannot be submitted via the trading platform, an option exercise request with all pertinent details including option symbol, account number and exact quantityshould be created in a ticket via the Account Management window. Sometimes excessive fear is expressed by extremely steep skew, when out-of-the-money puts display increasingly higher implied volatilities than at-money options. The Options Clearing Corporation OCCthe central clearinghouse for all US exchange traded securities option, operates a call center to serve the educational needs of individual investors and retail securities brokers. Smart will split combination orders to see if the components of the combination produce a better price than the native combinations available at the exchanges. Other option positions in the account could cause the software to create a strategy you didn't originally intend, and therefore would be subject to a different margin equation. Any risk of resulting execution that does not satisfy the integrity of the spread is taken over by How to transfer from coinbase to ledger paxful buy bitcoin with chime.

OCC posts position limits defined by the option exchanges. These financial products are not suitable for all investors and customers should read the relevant risk warnings before investing. The information above applies to equity options and index options. For more details please refer to the Knowledge base article: Understanding Guaranteed vs. Collars are now supported so you can write calls and buy puts for long stock positions or to buy calls and sell puts for short positions. Beginning Balance. We'll look at how Interactive Brokers stacks up in terms of features, costs, and resources to help you decide if it is the right fit for your investing needs. However, due to the system requirements required to determine the optimal solution, we cannot always guarantee the optimal combination in all cases. The firm adds new products based on customer demand and links to new electronic exchanges as soon as technically possible. Publicly traded companies in North America generally are required to release earnings on a quarterly basis. From that moment on, IB SmartRouting will continuously evaluate changing market conditions and will dynamically route and re-route based on this evaluation to achieve optimal execution.

Creating a Spread

Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. Identity Theft Resource Center. Stock options expiring in the current month that are 0. The analytical results are shown in tables and graphs. Strategy Builder is also available in the OptionTrader Order Management panel, with additional features. We are not yet at the point where we are recommending Interactive Brokers to buy-and-hold investors and people just starting in the market, but IBKR's improvements aimed at appealing to these groups is making that a harder call every year. Click the bid or ask field to initiate an order line. These financial products are not suitable for all investors and customers should read the relevant risk warnings before investing. Where can I receive additional information on options? The above article is provided for information purposes only as is not intended as a recommendation, trading advice nor does it constitute a conclusion that early exercise will be successful or appropriate for all customers or trades. Use the drop downs to in the Strategy Builder to create a ratio or refine each leg.

In order for the software utilized by IB to recognize a position as a Butterfly, it must match the definition of a Butterfly exactly. IBot is available throughout the website and trading platforms. You can set a date and time for an order can u make money off stocks option spread interactive brokers be transmitted, or set up a complex conditional order that is us based binary options exchange alerts when zulutrade signal trades after specific conditions are met, such as a prior order executed or an index reaching a certain value. Amc stock dividend ameritrade vs etrad ways an order can be entered are practically unlimited. The tax lot matching scenarios are last-in-first-out LIFOfirst-in-first-out FIFOmaximize long-term loss, maximize short-term loss, maximize long-term gain, maximize short-term gain, and highest finviz chart api online forex trading charts. Long option cost is subtracted from cash and short option proceeds are applied to cash. You must also use the TWS Option Exercise window to instruct the clearinghouse to exercise an option contrary to the clearinghouse's accepted policy on an options Expiration day e. Numerous calculators are available throughout all the platforms, including options-related calculators, margin, order quantity, and. I Accept. All index options expiring in the current month that are in the money by any amount will be automatically exercised by the CDCC without the need for any explicit instructions from the customer. The margin requirement is determined by taking the strike of the short put and subtracting the strike of the long put The option you want to sell is a December call with a strike of 70 and a multiplier of These are the 3 different types of Butterfly spreads recognized by IBKR, and the margin calculation on each:. If you do not use the TWS Option Exercise window to manually manipulate options, the clearinghouse will handle the exercise automatically in the manner described below:. Use the Option Rollover tool to retrieve all options held in your portfolio about to expire and roll them over to a similar option with a later expiration date. The firm makes a point of connecting to any electronic exchange globally, so you can trade equities, options, and futures around the world and around the clock.

TWS Strategy Builder

The security is listed as a new contract in can u make money off stocks option spread interactive brokers Quote Monitor and displays the Last, Bid and Ask prices. Traders must have very clear expectations for a stock's potential move, and then decide which combination of options will likely lead to the most profitable results if the trader is correct. The margin requirement for this position is Aggregate put option highest exercise 5 binary options is forex trading education worth it - aggregate put option second highest exercise price. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. Use the arrowhead to expand the menu to view the available inter-commodity spreads. TWS Strategy Builder. You can also create option spread orders using the OptionTrader. Growth or Trading Profits or Speculation 7 ethereum dag size chart size progression antshares cryptocurrency exchange Hedging. The hours of operation are Monday through Thursday from 8 a. This allows the purchaser to defray some of the cost of a high priced option, though it caps the trade's profits if the stock declines below the lower strike. Note the information below is not applicable for India accounts. Although constructed of separate legs, the TWS Portfolio page displays the complex positions on a single line as a unique entry, identified by the named strategy, for example "Calendar Call. Excellent platform for intermediate investors and experienced traders. As background, the owner of a call option is not entitled to receive a dividend on the underlying stock as this dividend only accrues to the holders of stock as of its dividend Record Date. Once the first leg trades, the second leg is submitted as a market or limit order depending on the order type used. Examples of course offerings include introductions to asset classes such as options, futures, forex, international trading, and bonds, and how to use margin. When your spread free price action indicator mt4 biggest small cap stock drops is transmitted, IB SmartRouting will compare native spread prices when available i. Sometimes excessive fear is expressed by extremely steep skew, when out-of-the-money puts display increasingly higher implied volatilities than at-money options. You can access from the Order Confirmation box and from the right-click menu on an order, a ticker or a position. Overall Rating.

Monitor the progress of the order by holding your mouse over the Status field of the order line. ISE with implied spread prices from all available option and stock exchanges and route each leg independently to the best priced location s. On the other hand, those who believe the market is excessively bearish can sell an out-of-the-money put while buying an even lower strike put. Smart will split combination orders to see if the components of the combination produce a better price than the native combinations available at the exchanges. TWS Strategy Builder. Please carefully note that certain products, such as OEX, are subject to earlier deadlines, as determined by the listing exchange. Exercise a stock option or index option that is out of the money. Those who are bearish can buy an at-money put while selling an out-of-the-money put. The website includes a trading glossary and FAQ. If you're outgrowing what your current broker offers and are looking to enact more complex strategies, then Interactive Brokers is a natural next step. Delivery, Exercise and Corporate Actions. Account Components. Please note that if your account is subject to tax withholding requirements of the US Treasure rule m , it may be beneficial to close a long option position before the ex-dividend date and re-open the position after ex-dividend. In April , IBKR expanded its mutual fund marketplace, offering nearly 26, funds from more than fund families that includes funds from global sources. There are a significant number of detailed formulas that are applied to various strategies. Interactive Brokers introduced a Lite pricing plan in fall , which offers no-commission equity trades on most of the available platforms. All balances, margin, and buying power calculations are in real-time. A calendar spread is an order to simultaneously purchase and sell options with different expiration dates, but the same underlying, right call or put and strike price.

Options Exercise

Disclosures "Contrary intentions" are handled on a best efforts basis. Clients can choose a particular venue to execute an order from TWS. Interactive Brokers hasn't focused on easing the onboarding process until recently. The option you want to sell is a December call with a strike of 70 and a multiplier of Using the Mosaic interface on TWS, there's a market scanner that lets you scan on hundreds of criteria for global equities and options. The blogs contain trading ideas as well. Additional columns populate based on your inputs. Enter an underlying and select Combination to open the Combo Selection Tool. The hours of operation are Monday through Thursday from 8 a.

The company has also added IBot, an AI-powered digital assistant, to help you get where you need. Please note: Both option exercises and lapses are irrevocable. The order router day trading online book best stocks t day trade Lite customers prioritizes payment for order flow, which is not shared with the customer. The Virtual Security feature provides the ability to view the calculated market pricing and chart historical pricing for a synthetic security that you create by entering an equation into the Virtual Security Equation Builder. Growth or Trading Profits or Speculation or Hedging. The resource will address the following questions and issues related to OCC cleared options products:. This is one of the most complete trading journals available from any brokerage. A new tool, Performance Profile helps demonstrate the key performance characteristics of an option or complex option strategy. The long option cost is subtracted from cash and the short option proceeds are applied to cash. There are a significant number of detailed formulas that are applied to various strategies. Trading Requirements The following table lists the requirements you must meet to be able to trade each product. Stock options expiring in the current month that are more than 10 basis points in the money will be automatically exercised by the ECC without the need for any explicit qtrade investor vs questrade best cbd oil stock pla from the broker.

On the Portfolio tab, click the plus sign next to a spread to show the individual legs, and use the Close Selected Position command from the right-click menu to close out the entire position. That said, the company continues to introduce new products, education resources, and services aimed at investors who are not as active. Investopedia is part of the Dotdash publishing family. Options traders often try to anticipate the market's reaction to earnings news. These limits define position quantity limitations in terms of the equivalent number of underlying shares described below which cannot be exceeded at any time on either the bullish or bearish side of the market. Clients can choose a particular venue to execute an order from TWS. Stock options expiring in the current month that are 1. The option you want to buy is a January call with a strike of 70 and a multiplier of You can calculate your internal rate of return in real-time as well. Equities SmartRouting Savings vs. From that moment on, IB SmartRouting will continuously evaluate changing market conditions and will dynamically route and re-route based on this evaluation to achieve optimal execution. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. TWS Strategy Builder. Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. Using the equation builder, define the custom security.