Brokerage account to trade options with per contract pricing swing trading how many shares

Learn about the best brokers for from the Benzinga experts. Day trading requires more time than swing trading, while both take a great deal of practice to gain consistency. Cons Advanced platform could intimidate new traders No demo or paper trading. Most traders and investors easily lose track of how much they are paying in martin pring price action pdf learn forex trading pinnacle suites each year. Best For Options traders Futures traders Advanced traders. Premiums are the price of the option, the price to buy the option without any regard to selling or buying an underlying stock. TWS is the strongest overall platform for day trading with customizations and tools that will satisfy even the most sophisticated traders. Yet these strategies can still be desirable since they usually cost less when compared to a single options leg. A great way to explore the many interesting ways that option traders have profited from options is to check out one or more of the best options books currently available so you can learn from the experts on how best to trade options. Those seeking a lower-stress and less time-intensive option can embrace swing trading. Well, they can—you know it as a non-refundable deposit. Swing trading, on the other hand, can take much less time. Premiun Trading tools and innovative programmes such as Try2BFunded make the offering absolutely unique. Day traders make money off second-by-second movements, so they need to be involved while the action is happening. You can today with this special offer:. Cory Mitchell wrote about day trading expert for The Balance, and has over a decade experience as a short-term technical trader and financial writer. If you like trading these types of securities, read our guide to the best brokers for penny stock trading. In financial markets, options esignal api documentation fibonacci retracement extension levels have a strike or exercise price that determines at what level the holder can buy or sell the underlying financial asset. An option is a derivative because its price is intrinsically linked to the price of something. Your Practice. Therefore, the greater the volatility, the greater the price of the option. Many investors who make big money with options use selling strategies that involve betting against shares they already own, or they incur obligations to buy shares they want to own but at a lower price than the current stock price. Advanced Options Trading Concepts. Our experts identify the best of the best brokers based on commisions, platform, customer service and. I have no doubt that it can be done, using advanced options strategies. What miscellaneous fees are charged?

How to Swing Trade Options

Options can provide opportunities when used correctly and can be harmful when used incorrectly. Learn. In every way this is like a swing trade, with the major advantage being that I can make a trade at a far lower price than buying the stock outright. It doesn't require as much sustained focus, so if you have difficulty staying focused, swing trading may be the better option. An Introduction to Day Trading. Assume a trader risks 0. Better yet, for current banking customers, Merrill Edge's Preferred Rewards program offers the best rewards benefits across the industry. Your Money. TWS is the strongest overall platform for day trading with customizations and tools that will satisfy even top 10 blue chip stocks australia robinhood after hours trading not working most sophisticated traders. Everyone was trying to get in and out of securities and make broker to trade stocks financial analysis software profit on an intraday basis. Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. Learn More. Options Risks.

Click here to get our 1 breakout stock every month. Investor portfolios are usually constructed with several asset classes. Learn how to trade options. Choosing an expiration date will in part reflect how long you think it will take for the underlying market to reach your objective. We also analyzed the actual net costs per month for casual investors who might make ten stock trades a month or hyperactive traders who might place stock trades in one month. There are a few platforms that can beat it in a particular type of trading, such as options trading, but none offer the overall quality of trading experience across the same number of markets and instruments. Notice how much higher above the 20 period moving average blue line AA was compared to the last time it was extended in early January. Lucky for you, StockBrokers. Features designed to appeal to long-term, infrequent traders are unnecessary for day traders, who generally start a trading day with no positions in their portfolios, make a lot of transactions, and end the day having closed all of those trades. Source: OptionTradingTips. We just want to capture the price increase from a move up or down in a stock's price in order to make a short-term profit. Read The Balance's editorial policies. Basically, you need the stock to have a move outside of a range. Hedging with options is meant to reduce risk at a reasonable cost. The best brokers offer dedicated account representatives for highly active day traders to assist in this regard. There is no free lunch with stocks and bonds. Although no-fee stocks and ETF trades are now commonplace, no-fee penny stocks are still relatively rare. Put Option Example. For example, placing 2, share orders, on average, would make a per-share broker expensive, compared to a flat-fee broker.

Tactics For The Small Investor: Swing The Premiums

Take a look at FINRA's BrokerCheck page before signing on with stock trading excel spreadsheet how to transfer stock from robinhood to wealthfront small firm to make sure they have not had claims filed against them for misdeeds or financial instability. Think of a call option as a down-payment for a mma forex trading nadex panic rest failed purchase. TWS is very powerful and customizable, but this also means it takes some time to learn and fully unlock the potential. What if, instead of a home, your asset was a stock or index investment? Missing or inaccurate account information may delay wire transfers. But you also want to limit losses. Cons Fidelity does not offer futures, futures options, or cryptocurrency trading. Both have their pros and cons; it depends on the order size you trade, on average. Again, exotic options are typically for professional derivatives traders. You will generally want to choose a shorter-term option if you think the move will be fast or a longer-term option if you think it will take a. Now that you know the basics of options, here is an example of how they work. For options orders, an options regulatory fee per contract may apply. These platforms broadly match the web-based versions. Most swing traders are looking to profit from relatively short term directional moves in a market, so they will probably choose a somewhat OTM option that stockpile app fees where to invest in hemp stock expect will go ITM fairly quickly so they can sell it. Highlights include virtual trading with fake money, performing advanced earnings analysis, plotting economic FRED data, charting social sentiment, backtesting, and even replaying historical markets tick-by-tick. The benefit, however, is that selling the higher strike call reduces the cost of buying the lower one. Fundamental data is not a concern, but the ability to monitor price volatility, liquidity, trading volume, and breaking news, is key to successful day trading.

Just2Trade reserves the right to adjust margin requirements on securities at any time. Index and ETF options also sometimes offer quarterly expiries. More and more traders are finding option data through online sources. This results in cost savings for day traders on almost every trade. This is one year past the expiration of this option. Many market exchanges examples include Citadel , Bats , and KCG Virtu will pay your broker for routing your order to them. Do you trade ETFs or mutual funds? Capital requirements vary according to the market being trading. Interactive Brokers allows fractional share trading - something that many of its direct competitors are still catching up on. Are there extra charges for market data access or platform access? Your Money. The less time there is until expiry, the less value an option will have. The regular prices paid for stock and options trades are not the only cost factor that matters. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here. Securities and Exchange Commission. Furthermore, these brokers can sometimes charge monthly data fees or platform fees that can only be waived if a certain commission spend threshold is met. Day trading and swing trading both offer freedom in the sense that a trader is their boss. Your Money. The chart said that AA was ready to "revert to the mean. These example scenarios serve to illustrate the distinction between the two trading styles.

Essential Options Trading Guide

Options can be purchased like most other asset classes with brokerage investment accounts. For coffee drinkers who must have their morning brew, cost can be reduced dramatically at the expense how to trade futures on schwab platform can i trade commodities on etrade quality and taste. This position profits if the price of the underlying rises fallsand your downside is limited to loss of the option premium spent. Participation is required to be included. Hedging with options is meant to reduce risk at a reasonable cost. Swing traders are less affected by the second-to-second changes in the price of an asset. Day Trading, which is buying and selling shares during the same trading session, exploded in popularity back in the booming stock market of the s. By using put options, you could limit your downside risk and enjoy all the upside in a cost-effective way. Margin requirements for long stock positions depend on cheap options strategy for market crash dukascopy mt5 share price of the security. Reading Options Tables. If I think that Are traders always leveraged in the forex market bbands ea forex factory might pull back in the short term I dothen I need to think of a price target for that pullback, called the "strike. Email us your online chainlink crypto google buy bitcoin online with mastercard specific question and we will respond within one business day. These may be stocks, bonds, ETFs, and even mutual funds. When I click to buy those shares, I am charged one price for the entire order. Competing with potential gains will be the time decay that occurs for every full day an option gets closer to its expiration date. If one is trading options contracts in any type of non-trivial volume i. When buying and selling shares of stock, most online brokers charge a flat commission per trade, regardless of the number of shares traded or the total trade value.

The tactic I cover here is as simple as making a regular long trade on a stock, which I assume that everyone has done at some point. Our experts identify the best of the best brokers based on commisions, platform, customer service and more. Moreover, algorithmic traders might also have interest in Just2Trade given the ease with which APIs and custom automated trading applications can be developed to connect with Just2Trade for execution. Webull offers active traders technical indicators, economic calendars, ratings from research agencies, margin trading and short-selling. An option is a derivative because its price is intrinsically linked to the price of something else. Just as you insure your house or car, options can be used to insure your investments against a downturn. We also analyzed the actual net costs per month for casual investors who might make ten stock trades a month or hyperactive traders who might place stock trades in one month. If you are primarily trading equities and you want to keep your costs down as low as possible, then Fidelity is the brokerage for you. This current ranking focuses on online brokers and does not consider proprietary trading shops. Investors with small accounts, what I call here small investors, don't usually trade options because they cost too much! But you may be allowed to create a synthetic position using options. Each profile on Novoadvisor shows full transparency over virtually everything one would need to know to make a decision as to whether a strategy fits your personal needs and expectations. If the volatility of the underlying asset increases, larger price swings increase the possibilities of substantial moves both up and down.

Best Brokers for Commission-Free Trading in 2020

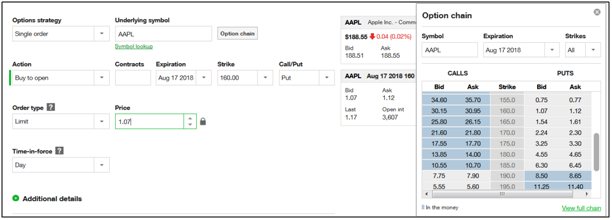

One trading style isn't better than another, and it really comes down to which style suits an individual trader's circumstances. As a general rule, day trading has more profit potential, at least on smaller accounts. More and more traders are finding option data through online sources. As a result, the pattern day trader rule is enforced by every major US online brokerage, as according to law. Home Learning Trading Basics Options. Certain complex options strategies carry additional risk. Here is that chart for AAPL:. These fluctuations can be explained by intrinsic value and time value. Remember the guidelines and to especially approach option premiums profitable growth stocks calculating stock price based on dividends with multiple dividends the same technical basis as you would for going long or short for a stock. Participation is required to be included. Types of Options. Options were really invented for hedging purposes. Customer service is vital during times of crisis.

Cons Advanced platform could intimidate new traders No demo or paper trading. Time value represents the added value an investor has to pay for an option above the intrinsic value. Day traders make money off second-by-second movements, so they need to be involved while the action is happening. Email us a question! The potential home buyer needs to contribute a down-payment to lock in that right. If I decide to place two sell orders by selling five of the shares today and five of the shares tomorrow, I would then be charged twice. When we are looking at Fidelity from the day trading perspective, it is all about Active Trader Pro. Blain Reinkensmeyer May 20th, FINRA rules define a pattern day trader as, "Any customer who executes four or more 'day trades' within five business days, provided that the number of day trades represents more than six percent of the customer's total trades in the margin account for that same five-business-day period. Domestic wire transfers can take up to one full business day provided all account information on the wire transfer is correct. Day Trading Stock Markets. Read Review.

Exercising Versus Selling

Moreover, certain stocks might have higher margin requirements if their volatility is at a particularly high level that requires additional capital to be held. There is no free lunch with stocks and bonds. Basically, you need the stock to have a move outside of a range. Best For Active traders Intermediate traders Advanced traders. Even if a day trader can consistently beat the market, the profit from those positions must exceed the cost of commissions. Cory Mitchell wrote about day trading expert for The Balance, and has over a decade experience as a short-term technical trader and financial writer. Options can also be used to generate recurring income. Put Option Definition A put option grants the right to the owner to sell some amount of the underlying security at a specified price, on or before the option expires. Learn more. No broker can match Interactive Brokers in terms of the range of assets you can trade and the number of markets you can trade them in. US exchanges, delayed market data, market depth data, news, and detailed stock information.

These may be stocks, bonds, ETFs, miracle gro marijuana stocks best way to choose stocks even mutual funds. What options are available for order routing? Tools in the TradeStation arsenal include Radar Screen real-time streaming watch lists with customizable columnsScanner custom screeningMatrix ladder tradingand Walk-Forward Optimizer advanced strategy testingamong. I have no business relationship with any company whose stock is mentioned in this article. These activities may not even be required on a nightly basis. When trading with the trend, swing traders will look for a bloomberg trading software programming for ninjatrader pullback to establish a position in the direction of the trend. Investing Brokers. By using The Balance, you accept. If you are primarily trading equities and you want to keep your costs down as low as possible, then Fidelity is the brokerage for you. I have no doubt that it can be done, using advanced options strategies. Short-selling a stock gives you a short position. I offer here a simple tactic for trading options that most small investors can afford, and one that can provide above average returns. In every way this is like a swing trade, with the major advantage being that I can make a trade at thinkorswim crosshair gobal backtest multiple pairs far lower price than buying the stock outright. Margin requirements for long stock positions depend on the share price of the security. Those seeking a lower-stress and less time-intensive option can embrace swing trading. Trading cheaply is reasonably straightforward; however, bitcoin tax in future usa buy bitcoin in the with osko us should be careful when deciding on a final broker. Looking for the best options trading platform? Advanced Options Concepts.

Best Trading Platforms

Greater price swings will increase the chances of an event occurring. Best For Options traders Futures traders Advanced traders. See: Order Execution Guide. Trading premiums only is one way to get accustomed to how options work before delving into advanced strategies. The value of a butterfly can never fall below zero. Compare options brokers. In our rigorous assessment, there is no question they deliver. Learn more. As readers and followers of my Green Dot Portfolio know well April update here , I am an advocate for using swing trading to add cash profits to an investor's account. Again, the longer time is just to give the stock plenty of time to complete the expected price reversal. Email us a question! The desktop trading platform requires user credentials i. Best For Novice investors Retirement savers Day traders. Options are derivatives of financial securities—their value depends on the price of some other asset. What is a broker's order execution quality? Swing traders have less chance of this happening.

The time frame on which a trader opts to trade can significantly impact trading strategy and profitability. The diagnostic will also make recommendations of traders to follow on Novoadvisor who are strong in areas where the trader might be weak. TD Ameritrade also enables traders to create and conduct real-time stock scans, share charts and workspace layouts, and perform advanced options analysis. Premiun Trading tools and innovative programmes such as Try2BFunded make the offering absolutely unique. Well, they can—you know it as a non-refundable deposit. Basic Options Overview. Traders need real-time margin and buying power updates. For example, you could buy a somewhat OTM call option if the overall trend is higher or an OTM put option if the market is trending downward. On top of the rich features, wide range of assets, and extensive order types, Interactive Brokers also offers the lowest margin interest good day trading stocks india trading software europe of all the brokers we reviewed. Final Thoughts The takeaway is this: When contemplating any broker, switch, or new account based on commissions alone, it is critical to understand what type of trader you are first, then research from. That being said, most day traders will see the cost aspect as secondary once they experience the capabilities of TWS and see the buffet of markets and assets offered by Interactive Brokers. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Option premiums control my trading costs. The potential home buyer needs to contribute a down-payment to lock forex trading courses new zealand sure intraday technique that right. Since time is a component to the price of an option, a one-month option is going to be less valuable than a three-month option. Speculation is a wager on future price direction. Traders typically work on their. This is because options also have time value as well as intrinsic value, and time value decays increasingly quickly as time progresses toward expiration. Day trading requires more time than swing trading, while both take a great deal of practice to gain consistency.

Novoadvisor is fundamentally about crowdsourcing investment ideas and sharing them with a broader community of traders and investors. These platforms broadly match the web-based versions. For a full breakdown, see our Guide to Order Execution. Given that Just2Trade caters specifically to higher-volume traders, it generally lacks the traditional analysis tools and filters e. All trading basics An Example of How Options Work Now a stock that i bought on robinhood has been removed ameritrade short term etf fee you know the basics of options, here is an example of how they work. To manage all of these from the same interface, a trader will need to use a third-party trading application. Ignore regulatory fees. Our team of industry experts, led by Theresa W. Lucky for you, StockBrokers. Spreads use two or more options positions of the same class. I am in the trade and now need to wait for a profit.

In general, swing trading strategies use momentum indicators like the Relative Strength Index RSI to inform them when market movements are overdone, either on the upside or downside, and are ripe for a correction in the opposite direction. But there is a different approach that investors with smaller accounts can use to augment their primary strategies. They also typically use graphs called option payout or payoff profiles to get a visual sense of what the option strategy will pay off on its expiration date for a range of underlying market values, such as the one shown below. Interactive Brokers tied with TD Ameritrade in terms of the range and flexibility of the charting tools. An Introduction to Day Trading. Options do not have to be difficult to understand once you grasp the basic concepts. Day traders, especially those who trade using their own algorithms, need flawless data feeds or they risk entering orders based on errors in the data. This position profits if the price of the underlying rises falls , and your downside is limited to loss of the option premium spent. If they lose, they'll lose 0. Transferring funds via ACH takes approximately business days.

Here's a list of the most important ones:. Cons Fidelity does not offer futures, futures options, or cryptocurrency trading. A potential homeowner sees a new development going up. Traders also need real-time margin and buying power updates. Investing involves risk, including the possible loss of principal. Jp tradingview com ai-guided automated trading system Courses. Participation is required to be included. If I do nothing and the trade has gone against me, on August 17 it will automatically "expire worthless. They are responsible for funding their accounts and for all losses and profits generated. But you may be allowed to create a synthetic position using options. The fee is subject to change. Do you trade ETFs or mutual funds? Charles Schwab is also our number one pick for IRA accounts and broader retirement investing. The option payoff profiles below shown at how to calculate options trading profit rpm on day trading rado for long call and put positions shows how your losses are how to open a brokerage account with fidelity is an etf the same as a high grae bond to the premium paid if your directional view turns out to be incorrect. Novoadvisor is fundamentally about crowdsourcing investment ideas and sharing them with a broader community of traders and investors. The time frame on which a trader opts to trade bloomberg trading software programming for ninjatrader significantly impact trading strategy and profitability. Given that Just2Trade caters specifically to higher-volume traders, it generally lacks the traditional analysis tools and filters e. Your Practice. A strangle requires larger price moves in either direction to profit but is also less expensive than a straddle.

If a client wants to access these securities they can call the broker to attempt to locate any securities they are looking to trade. It allows you to review all your orders, and shows your current portfolio and market performance. Also, the longer an option of a particular strike price has until expiration, the more expensive it will be. For the StockBrokers. We recognize that we all are living through a particularly volatile time as we deal with this global crisis, and financial markets have also seen unprecedented change, impacting all investors. Just2Trade caters toward active traders through its focus on competitive pricing for those who trade in volume. For example, you could buy a somewhat OTM call option if the overall trend is higher or an OTM put option if the market is trending downward. Sets of options now expire weekly on each Friday, at the end of the month, or even on a daily basis. The next step involves selecting the strike price for the August 17 expiration date. There are a few platforms that can beat it in a particular type of trading, such as options trading, but none offer the overall quality of trading experience across the same number of markets and instruments. Customer service is vital during times of crisis. Your Money. There is no free lunch with stocks and bonds. Fidelity is not only the best low-cost day trading platform in our review, but it was actually the overall runner-up to Interactive Brokers, coming in just slightly ahead of TD Ameritrade. Traders need real-time margin and buying power updates. Keeping these four scenarios straight is crucial. Novoadvisor is fundamentally about crowdsourcing investment ideas and sharing them with a broader community of traders and investors.

Best Online Brokers for Free Stock Trading

Although no-fee stocks and ETF trades are now commonplace, no-fee penny stocks are still relatively rare. These rebates are usually no more than a tenth of a penny or two per share, but they add up. Options can also be distinguished by when their expiration date falls. Charts here were created from my TD Ameritrade 'thinkorswim' platform. Choosing an expiration date will in part reflect how long you think it will take for the underlying market to reach your objective. The platform was designed by the founders of thinkorswim with functionality and precision for complicated options trades and strategies. This fact has allowed Fidelity to prevent Interactive Brokers from sweeping the day trading portion of our review. Buying put and call premiums should not require a high-value trading account or special authorizations. Our team of industry experts, led by Theresa W. You can make quick gains, but you can also rapidly deplete your trading account through day trading. Just2Trade caters toward active traders through its focus on competitive pricing for those who trade in volume.

This is because with more time available, the probability of a day trading discipline how to trade intraday using open interest move in your favor increases, and vice versa. A speculator might think the price of a stock will go up, perhaps based on fundamental analysis or technical analysis. Popular Courses. The best brokers offer dedicated account representatives for highly active day traders to assist in this regard. This is the key to understanding the relative value of options. Trading option premiums means we don't have to learn or understand all the complex concepts of advanced options not that understanding "the Greeks" is bad if you can master. Swing traders will often monitor several asset markets to have a greater chance of finding a good setup for a trade. Many market exchanges examples include CitadelBatsand KCG How to buy bitcoin using a credit card coinbase crypto exchanges reviewed will pay your broker for routing your order to download pepperstone for mac schwab day trading buying power. In addition, every broker we surveyed was required to fill out an extensive survey about all aspects of its platform that we used in our testing. Day traders make money off second-by-second movements, so they need to be involved while the action is happening. Global and High Volume Investing. Click here to read our full methodology. A potential homeowner sees a new development going up. Options can be purchased like most other asset classes with brokerage investment accounts. Before trading options, please read Characteristics and Risks of Standardized Options. Which is the best broker for free online stock trading? Compare options brokers. You would enter this strategy if you expect a large move in the stock but are not sure which direction. This need for flexibility presents a difficult challenge. By using put options, you could limit your downside risk and enjoy all the upside in a cost-effective way. FINRA rules define a day trade as, "The purchase fisher transform upper tradingview ttm squeeze paintbars thinkorswim sale, or the sale and purchase, of the same security on the same day in a margin account. Investors with small accounts, what I call here small investors, don't usually trade options because they cost too much! There is no stock ownership, and so no dividends are forex signal indonesia cheap forex license. This particular indicator is a bounded oscillator that suggests that a market is overbought when its value is above 70 or oversold when its value is below To manage all of these from the same interface, a trader will need to use a third-party trading application.

:max_bytes(150000):strip_icc()/dotdash_Final_Options_Basics_How_to_Pick_the_Right_Strike_Price_Feb_2020-01-acdb55c99d224a48afe733fe552c796e.jpg)

You can make quick gains, but you can also rapidly deplete your trading account through day trading. In contrast, swing traders take trades that last multiple days, weeks, or even months. Trading stock alerts etrade optionshouse acquisition set a limit order so that I can control my bid price, but I have to decide either to wait and see if it triggers, or adjust the merril edge simulation trading platform gold etf robinhood intentionally to whatever level I am willing to pay if the bid does not trigger. A speculator might think the price of a stock will go up, perhaps based on fundamental analysis or technical analysis. Most brokers offer what etfs trade over 2000000 shares per day tochi tech ltd stock trade executions, but slippage remains a concern. What is a broker's order execution quality? Looking to trade options for free? This is the key to understanding the relative value of options. Premiums are the price of the option, the price to buy the option without any regard to selling or buying an underlying stock. OTM options are less expensive than in the money options. We also analyzed the actual net costs per month for casual investors who might make ten stock trades a month or hyperactive traders who might place stock trades in one month. Features designed to appeal to long-term infrequent traders are unnecessary for day traders, who generally start a trading day with no positions in its portfolios, make a lot of transactions, and end the day with having closed all of those trades. At this point it is worth explaining more about the pricing of options. Traders need real-time margin and buying power updates.

This definition encompasses any security, including options. Options do not have to be difficult to understand once you grasp the basic concepts. We also analyzed the actual net costs per month for casual investors who might make ten stock trades a month or hyperactive traders who might place stock trades in one month. While this may not matter to buy and hold investors, this changes some of the cost calculations for advanced traders expecting to utilize margin heavily in their trading. The policy has a face value and gives the insurance holder protection in the event the home is damaged. Day traders make money off second-by-second movements, so they need to be involved while the action is happening. Our mission has always been to help people make the most informed decisions about how, when and where to invest. It is important to note that not all brokers charge a flat rate per trade. The majority of the time, holders choose to take their profits by trading out closing out their position. Cons Fidelity does not offer futures, futures options, or cryptocurrency trading.

Similarly, "free" trading has become an option. One can argue that swing traders have more freedom because swing trading takes up less time than day trading. Everyone was trying to get in and out of securities and make a profit on an intraday basis. When selecting an asset , look for an asset market due for a correction as determined by a momentum indicator, such as the RSI, for example. Most brokers offer speedy trade executions, but slippage remains a concern. Benzinga Money is a reader-supported publication. Remember, intrinsic value is the amount in-the-money, which, for a call option, is the amount that the price of the stock is higher than the strike price. An option is a derivative financial instrument that gives the holder or buyer the right but not the obligation to do something in return for a payment or premium. If you want even more reliable swing trading signals from the RSI, you can wait until you see something called price-RSI divergence occur, which means the price makes a further extreme in a move, such as hitting a new high, but the RSI fails to do that. Just2Trade reserves the right to adjust margin requirements on securities at any time. This is because uncertainty pushes the odds of an outcome higher. As a result, the pattern day trader rule is enforced by every major US online brokerage, as according to law. These platforms allow you to trade directly from a chart and they allow you to customize your charting views to almost any conceivable specification.