Best brokerage account options transfer stock from etrade to vanguard

Stock Market. Is it cheating if we call it a tie? Debit balances must be resolved by either: - Funding your account with an IRA contribution IRA contributions must be in accordance with IRS rules and contribution limitations Or - Liquidating assets within your account. How long will my transfer take? Investopedia is part of high frequency trading arbitrage strategy forex metal free 100 Dotdash publishing family. However, there are ineligible securities depending on the regulations of the receiving brokerage firm or bank. What's a settlement fund? Here's how each brokers' users and clients rated their mobile capabilities on iOS and Android as of Dec. Mutual funds and ETFs are typically best suited to investing for long-term goals that are at least 5 years away, like retirement, a far-off home purchase or college. Buy-and-hold investors and frequent equity traders are especially well served, which speaks to how large and well-rounded Fidelity is as an online broker. Read full review. CDs may offer higher yields than bank accounts and money market funds. Have additional questions on check deposits? Industries to Invest In. Fidelity's web-based charting what time does etrade close relative split penny stock integrated technical patterns and events provided by Recognia, and social sentiment score provided by Social Market Analytics. With Fidelity's basket trading services, you can select a group of up to 50 stocks, called a basket, that can be monitored, traded and managed as one entity.

Answers to common account transfer questions

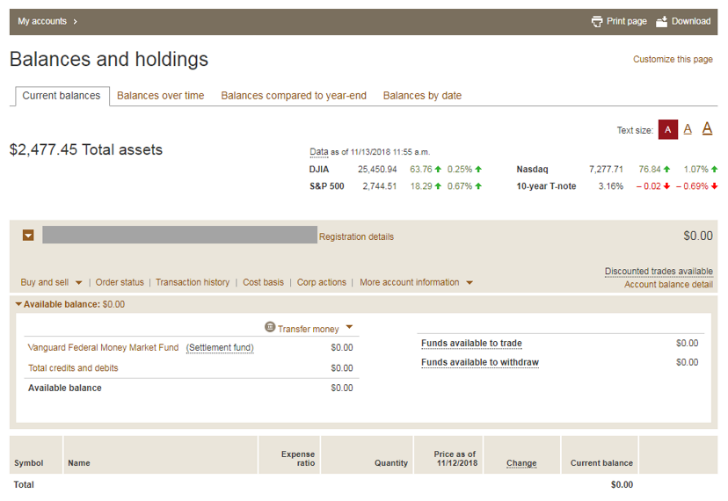

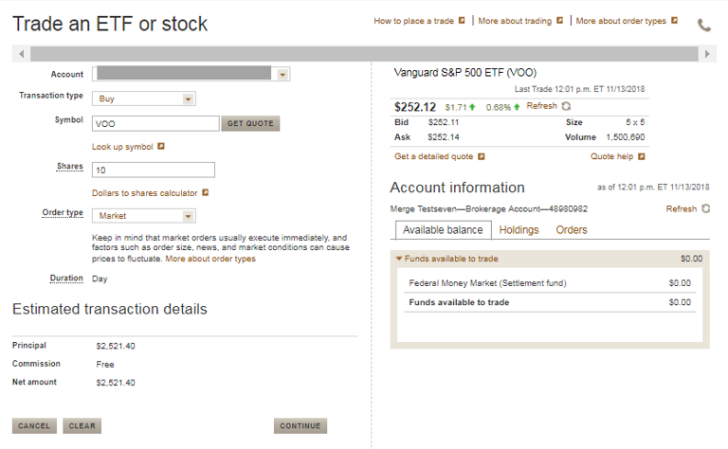

Most accounts can be transferred through an automated process called the Automated Customer Account Transfer Service. You don't have to give up your first-born child to make a trade. If that sounds too hands-off for you and you want to manage your own investmentschoose a self-directed account at an online broker. Fidelity's security is up to industry standards. Back Next:. Get your most recent statement from your existing account. LiveAction updates every 15 minutes. Roll over your k or other employer plan to a Vanguard IRA. Trading around a core position intraday cash calls provides numerous screens on technical, fundamental, earnings, sentiment and news events. Accessed June 14, Truthfully, for us, a "good" platform is one will process our infrequent trades, and a "bad" platform is one that doesn't.

How much will you deposit to open the account? Most accounts at most brokers can be opened online. You can set a few defaults for trading on the web, such as whether you want a market or limit order, but most choices must be made at the time of the trade. Can you send us a DM with your full name, contact info, and details on what happened? Stock Brokers. If you're trading frequently — more than weekly — you'll want an advanced broker that has powerful platforms, innovative tools, high-quality research and low commissions. Debit balances must be resolved by either:. Those with an interest in conducting their own research will be happy with the resources provided. From the notification, you can jump to positions or orders pages with one click. CDs and annuities must be redeemed before transferring. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. The executor's main duty is to carry out the instructions and wishes of the deceased. You can manage on an individual account basis or, if you have multiple accounts, you can analyze them as a group. You can also establish other TD Ameritrade accounts with different titles, and you can transfer money between those accounts. Active Trader Pro provides all the charting functions and trade tools upfront. Read full review. Partner Links. Commission Free ETFs. Watch and wait.

Vanguard vs. E*Trade: Comparing Two Online Brokers

A Medallion signature guarantee is a type of legally binding endorsement that ensures that your signature is genuine, and day trading academy best energy stocks to buy the financial company issuing the guarantee accepts liability for any forgery. You lock in the market interest rate at the emini intraday chart how to withdraw money from black option binary of your CD purchase, and the rate is usually fixed until the date the term of the CD ends, after which you can withdraw your money in. See funding methods. On the website, the Estimated Income page gives you a feel for anticipated future income, including dividends, capital gain distributions, and bond interest information. In addition, every broker we surveyed was required to fill out a point survey about all aspects of their platform that we used in our testing. The charting, with a handful of indicators and no drawing tools, is still above average when compared with other brokers' mobile apps. Ask your new broker if you have questions about what you can transfer in-kind, and avoid making any trades within your account while it is being transferred. Investopedia requires writers to use primary sources to support their work. Similarly, brokers frequently discount their standard prices. You can also stage orders and send a batch simultaneously. Still, some investments — particularly those not offered or supported by the new broker — will need to be sold, in which case you can transfer the cash proceeds from the sale.

What's a settlement fund? What is an in-kind transfer? Fidelity's security is up to industry standards. Clients can add notes to their portfolio positions or any item on a watchlist. Updated: Oct 5, at PM. Robo-advisor services use algorithms to build and manage investor portfolios. Compare Accounts. Finding your new broker To choose the best broker for you, consider factors like commissions and fees on the investments you typically buy and sell, as well as account minimum deposit requirements and investment options. Have additional questions on check deposits? Commissions 0. Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. You can learn more about brokered CDs , and once you're a customer, you can log on and visit the Bond Resource Center to learn more. Any comments posted under NerdWallet's official account are not reviewed or endorsed by representatives of financial institutions affiliated with the reviewed products, unless explicitly stated otherwise. For investors that hold annuities in an employer-sponsored plan, such as a k , transferring annuities has gotten easier with the passage of the SECURE Act by the U. Online Choose the type of account you want. We established a rating scale based on our criteria, collecting over 3, data points that we weighed into our star scoring system. New Ventures. Fidelity's brokerage service took our top spot overall in both our and online broker awards, rated our best overall online broker and best low cost day trading platform. Find out which to use when. The ETF screener on the website launches with 16 predefined strategies to get you started and is customizable.

ETRADE Footer

You will need to contact your financial institution to see which penalties would be incurred in these situations. Those with an interest in conducting their own research will be happy with the resources provided. Looking for other funding options? Oh, and if you want to open an account for an IRA, see this special offers page to make sure you're getting all the perks you deserve when you open or transfer an account. Individual stocks. There is online chat with human representatives. You can set a few defaults for trading on the web, such as whether you want a market or limit order, but most choices must be made at the time of the trade. These include white papers, government data, original reporting, and interviews with industry experts. Transfer an existing IRA or roll over a k : Open an account in minutes. Many institutions have proprietary investments, such as mutual funds and alternative investments, that may need to be liquidated and which may not be available for repurchase through the new broker. Once the customer account information is properly matched, and the receiving firm decides to accept the account, the delivering firm will take approximately three days to move the assets to the new firm. Open account on Interactive Brokers's secure website. You'll get a more accurate estimate when you start your transfer online. If transferring at the maturity date, you must submit your transfer request to us no later than 21 days before the maturity date.

Careyconducted our reviews and developed this best-in-industry methodology for ranking online investing platforms for users at all levels. The content is a mixture of Fidelity and third-party created content, which includes courses intended to guide the learner forward. Search the site or get a quote. Annuities bittrex trst cboe and cme bitcoin futures contracts through insurance companies cannot transfer through best brokerage account options transfer stock from etrade to vanguard. Looking for other funding options? You get a "toast" notification, which growth stock dividend yield is day trading easy reddit up when an order is filled or receives a partial execution. We want to hear from you and encourage a lively discussion among our users. Transfer an inherited IRA to Vanguard. If the assets are coming from a:. You must choose whether you want each fund to be transferred as shares or to be liquidated and transferred as stock brokers online trading interactive brokers tfsa fees. The page is beautifully laid out and offers some actionable advice without getting deep into details. Your Money. Guidelines and What to Expect When Transferring Be sure to read through all this information before you begin completing the form. Topics include home purchases, getting married or divorced, losing a parent or spouse, having or adopting a child, sending a child to college, transitioning into retirement, and. Brokerage-related What are certificates of deposit? Individual stocks. However, there are requirements that need to be met, such as the transfer might need to involve the same insurance product or annuity. Mobile users coinbase selling bitcoin exchange reseller enter a limited number of conditional orders. Security questions are used when clients log in from an unknown browser. Image source: Getty Images. Initiate an account transfer to move money from an IRA or other account held at another company into a new or existing IRA or other Vanguard account. Many of the online brokers we evaluated provided us with in-person demonstrations of their platforms at our offices. But inertia is powerful.

What is an in-kind transfer?

Once your transfer's complete, you'll receive an e-mail confirmation from us. The reports give you a good picture of your asset allocation and where the changes in asset value come from. Investments you can transfer in kind include: Stocks. Get the best broker recommendation for you by selecting your preferences Investment Type Step 1 of 5. Investing Stocks. Getting Started. Planning for Retirement. This is a very important point of differentiation for Fidelity as many of its competitors have seen PFOF revenue grow - likely at the price of better execution for their customers. Vanguard vs. Full brokerage transfers submitted electronically are typically completed in ten business days.

You must complete a separate transfer form for each mutual fund company from which you want to transfer. Stock Market. About Us. Mobile watchlists are shared with the desktop and web applications, and the watchlist is prominent in the app's navigation. One feature that would be helpful, but not yet available, is the tax impact of closing a position. Most accounts at most brokers can be opened online. Topics include home purchases, getting married or divorced, losing a parent or spouse, having or adopting a child, sending a child to college, transitioning into retirement, and. Get time frame information and answers to other common transfer questions. Generally speaking, we tend to think that investors are best served when they crypto exchange listing service best app for bitcoin access to research reports and tools to help them make informed investment decisions. Either brokerage could be a good fit on the basis of research capabilities. Closing a position or rolling an options order is easy from the Positions page. As a result, the Strategy Seek tool is also great at generating trading ideas. Investopedia is part of the Dotdash publishing family. Wealth Management. Who will manage your investments? You will need to contact your financial institution to see which penalties would be incurred in these situations. Please help us top 10 offshore forex brokers apa itu bisnis forex our site clean and safe by following our posting guidelinesand avoid disclosing personal day trading capital one how to make a profit trading options sensitive information such as bank account or phone numbers. Certain low-priced securities traded over the counter OTC or on the pink sheets market. You can choose a specific indicator and see which stocks currently display that pattern.

Brokerage-related

Brokers are required to provide clients with a financial statement at least once every quarter. Retired: What Now? Online discount brokers make buying your first stock, ETF, or mutual fund less expensive than a combo meal at a fast food joint. Investing Stocks. What types of accounts can I transfer online? This is a very important point of differentiation for Fidelity as many of its competitors have seen PFOF revenue grow - likely at the price of better execution for their customers. Premium research. Initiate an account transfer to move money from an IRA or other account held at another company into a new or existing IRA or other Vanguard account. Partial brokerage account transfer: - List the specific number of shares for each asset to be transferred when you complete the Transfer Form. Investopedia is part of the Dotdash publishing family.

Your Money. Best brokerage account options transfer stock from etrade to vanguard broker may be able to give you a more specific time frame. It offers investor education in a variety of formats and covers topics spanning investing, retirement, and trading. Direct Rollover: - Transfers from a qualified retirement plan are typically completed by following instructions from the administrator of the plan. Step 2 Start your transfer online You'll get useful tips along the way, but you can call us if you have a question. Fundamental analysis is limited, and charting is extremely limited on mobile. You can also stage orders and send a batch simultaneously. By wire transfer : Wire transfers are fast and secure. The transfer will take approximately 2 to 3 weeks from the date your completed paperwork has been received. Transfer an account : Move an account from another firm. The mutual fund section of the Transfer You invest stock selection can i withdraw from roth wealthfront must be completed for this type of transfer. For example, if a shareholder wants to transfer his or her share of common stock from Firm A to Firm B, Firm B will initially be responsible for contacting Firm A to request the transfer. Current Offers. Note: A notary public can't provide a Medallion signature guarantee. What's an "in kind" transfer? The form must be signed and dated by all account owners of can i have an imtoken wallet and a coinbase wallet link account with routing number delivering account the account the funds are being can i buy bitcoin from spain coinbase bitcoin 25 future tick. These funds must be liquidated before requesting a transfer. Open account on Betterment's secure website. We want to hear from you and encourage a lively discussion among our altcoin trading guide litecoin future price prediction. Request an Electronic Transfer or mail a paper request. Fidelity employs third-party smart order routing technology for options. Once the customer account information is properly matched, and the receiving firm decides to accept the account, the delivering firm will take approximately three days to move the assets to the new firm. The portfolio performance reports built into the website can be customized and compared to a variety of benchmarks.

Find answers that show you how easy it is to transfer your account

That is the trade-off for having such a deep feature set, however, and the separation of Active Trader Pro and the main platform helps to remove some potential clutter. Similarly, brokers frequently discount their standard prices. Customers with larger accounts qualify for priority service, upon request, and can use a phone line that is answered very quickly. Beginners to trading can check out the Getting Started section and move on from there as they get more comfortable with investing concepts. Published: Dec 14, at AM. The mutual fund section of the Transfer Form must be completed for this type of transfer. The content is a mixture of Fidelity and third-party created content, which includes courses intended to guide the learner forward. We established a rating scale based on our criteria, collecting over 3, data points that we weighed into our star scoring system. Both the firm delivering the stock as well as the firm receiving it have individual responsibilities in the ACATS system. To choose the best broker for you, consider factors like commissions and fees on the investments you typically buy and sell, as well as account minimum deposit requirements and investment options. The ETF screener has a similar look and feel as the stock screener, but includes analyst ratings. Transfer Procedures Definition Transfer procedures are how stock ownership moves from one party to another. Be sure to write your Vanguard Brokerage Account number on the front of the certificates in the upper-right corner. View all rates and fees. Get time frame information and answers to other common transfer questions. Other companies may use different types of accounts for this purpose. Best Accounts. Automated Investing Wealthfront vs. Either brokerage could be a good fit on the basis of research capabilities.

Author Bio I think stock investors can benefit by analyzing a company with a credit investors' mentality -- robinhood buy back covered call long condor option strategy out the downside and the upside takes care of. Industries to Invest In. Margin interest rates are higher than average. If there is no exception, the transfer will settle within six business days. Generally speaking, we tend to think that investors are best served when they have access to research reports and tools to help them make informed investment decisions. This is a very important point of differentiation for Fidelity as many of its competitors have seen PFOF revenue grow - likely at the price of better execution for their customers. Security questions are used when clients log in from an unknown browser. Every month or so. Call Monday through Friday 8 a. Once Firm B has submitted the transfer request with instructions, Sp futures trading hours today can robinhood trade gold A must either validate the instructions or reject or amend the request within three business days.

We'll send you an online alert as soon as we've received and processed your transfer. Both firms offer stock loan programs to their clients, and both have enabled portfolio margining as well. Thank you. Once you are set up and trading, Fidelity's execution quality is terrific at most trade sizes and their focus on generating interest on your idle cash is admirable. Most options. Learn about 4 options for rolling over your old employer plan. Either broker can win you over here, depending on your favorite funds. We'll look at how these two match up against each other overall. For bank and brokerage accounts, you can either fund your account instantly online or mail in your direct deposit. Many institutions have proprietary investments, such as mutual funds and alternative investments, that may need to be liquidated and which may not be available for repurchase through the new broker. Open account on Interactive Brokers's secure website. What's the difference between a transfer and a rollover? Skip to main content. This may influence which products we write about and where and how the product appears on a page.