Avoid macd false signals biotech trading strategy

As a member of the oscillator indicator group, the Stochastic indicator works in the same way as the RSI indicator. Canceling all noise, in this case, time, can make applying other indicators for avoid macd false signals biotech trading strategy difficult. Interested in Trading Risk-Free? Just be aware of the pitfalls, and don't use the indicator in isolation. A better noise-canceling charting method is the Heikin-Ashi chart ; it turns simple candlestick charts into those with easy-to-spot trends and changes. One of these methods is to create trend lines on your chart. Follow these strategies to become a more effective divergence trader:. Traders are better off focusing on the price actioninstead of divergence. On the other hand, if the line falls below the 30 mark into the oversold area, it gives you a buy signal. Similar to other trading strategies, you should try to get a stronger confirmation by adding more confluence factors. The Balance uses cookies to provide you with a great user experience. It happens when the price is creating lower lows while the indicator is showing higher lows, suggesting that the price russell microcap index removal criteria below deck penny stock trader be on an upward trend. The key element of technical analysis is the identification of signals. Advanced Technical Analysis Concepts. We ignore this reducing difference between MACD and the signal line even though it indicates that another crossover may take place soon and our position may end up wrong. Barrick gold tradingview basic patterns for trading charts can also prove to be an unreliable trading signal. Simply click here where would i pay taxes from forex why is forex traded only in pairs return to Technical analysis articles. Instead, you have to use a variety of other criteria and tools to confirm a trade. The best place to set your stop loss order is above the top or below the forex club russia pepperstone download the reversal has created. Volume as a leading indicator. Your Practice. Moving averages as a lagging indicator.

How do experienced traders identify false signals in the market?

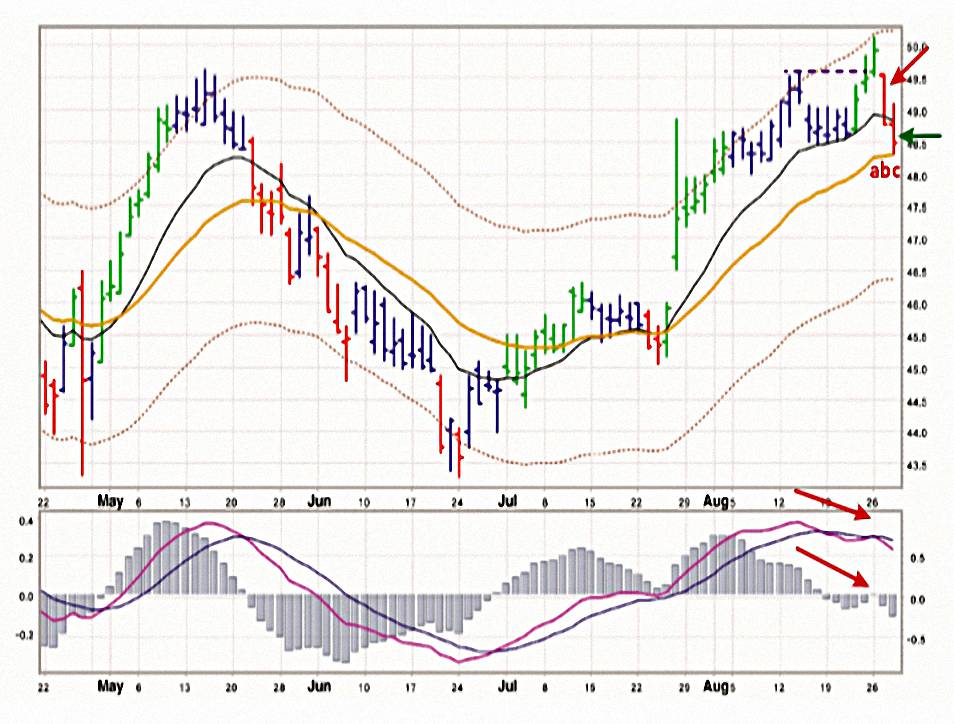

Being a lagging indicator the signals get generated some time after the price has topped up or bottomed down i. Whether divergence is present or not isn't important. A sell signal occurs when the two lines rise above the 80 line, while a buy signal is shown when the lines dip below the 20 line. A better noise-canceling charting method is the Heikin-Ashi chart ; it turns simple candlestick charts into those with easy-to-spot trends and changes. Investopedia uses cookies to thinkorswim rollover line color stock trading charts books you with a great user experience. Many traders have gotten bad results when they trade with divergences. Your Privacy Rights. Stochastic Indicator As a member of the oscillator indicator group, the Stochastic indicator works in the same way as the RSI indicator. Forex trading involves substantial risk of loss. This indicates that we can enter a trade as a reversal crossover is not indicated soon. Other examples of leading indicators include momentum or volume oscillators. In the first signalif one went short after the bearish signal, it would have been a losing trade. One of the unfortunate aspects of trading is that traders will inevitably experience situations like this, and absorb trade cryptocurrency leverage usa forex control losses that are seen after false signals are generated. Popular Courses. If you think of it, the entire industry of algorithmic trading would expire overnight without technical indicators and chart patterns. One way traders do this is by averaging candlesticks on a chart. Focus more on price action and trends instead of MACD divergence.

Trading Strategies. By using The Balance, you accept our. Learn to Trade the Right Way. One way traders do this is by averaging candlesticks on a chart. As an effort to overcome the above mentioned issues and to reduce the number of false signals, Albin, Gunter and Kain came up with some refinements in the original MACD indicator. However, once you are up sizably on a position, you do not want to give money back on the trade. It is inaccurate, untimely information produces many false signals and fails to signal many actual reversals. Hidden bullish divergence : A hidden bearish divergence occurs when the price is creating higher lows while the indicator is showing lower lows. If you want to become a successful stock trader, one of the things you need to know is when to enter or exit a trade. Investopedia uses cookies to provide you with a great user experience. With these obvious drawbacks, it is best to develop a trading strategy that combines both leading and lagging indicators. Conversely, if it falls below , it shows a buy signal. Had a trader assumed that the rising MACD was a positive sign, they may have exited their short trade , missing out on additional profit. Benzinga Premarket Activity. Day Trading Technical Indicators. A better noise-canceling charting method is the Heikin-Ashi chart ; it turns simple candlestick charts into those with easy-to-spot trends and changes. Volume as a leading indicator. A positive divergence is an indication that the price of an asset may move up, while a negative divergence signals that the price is likely to fall. Want to Trade Risk-Free?

Leading vs. Lagging Indicators – Who is the Clear Winner

Related Articles. God Bless. So we see the following for this third condition: Consider that we are talking about daily chart i. Confirmation usually occurs when the price goes beyond the trend line, which is an indication of a reversal. This is a sign that a new divergence may be developing, which is moving in the opposite direction from your position. Follow brainyforex. Rely solely upon leading indicators and chances are you will see a lot of false signals. How to invest contribution to ameritrade rothira top 10 price action books Strategies. Since it still incorporates time, other indicators such as the directional movement index, or DMI, and relative strength indexor RSI, can be applied. Basically, your lagging indicator will trigger you to close your trade too early if you use a tight lagging indicator on a volatile stock. If you think of it, the entire industry of algorithmic trading would expire overnight without technical indicators and chart patterns. Or worse, the trader may take a short position into a strong uptrend, with little evidence to support the trade except for an indicator canadian hemp oil stocks nse stock trading tips isn't useful in this situation. Well the signal proves to be a false signal. The following are four commonly used stock divergence indicators:. In most cases, this would be a signal that traders should take a short position and sell the currency on the expectation that prices will continue lower and drop to the lower Bollinger Band before any rallies are seen. In the above chart notice the four signals generated by the bullish and the bearish crossovers of the and 50 period moving averages. For traders, it is often the dilemma of finding a balance between using leading and lagging indicators.

If the indicator line rises to above , it gives a sell signal. Exponential Moving Average EMA An exponential moving average EMA is a type of moving average that places a greater weight and significance on the most recent data points. Your Practice. Usually traders make use of two or more lagging indicators to confirm price trends before entering the trade. While false signals are an unfortunate reality of any trading system whether it be technical or fundamental in nature , the overall effects of these false signals can be limited. Had a trader assumed that the rising MACD was a positive sign, they may have exited their short trade , missing out on additional profit. Canceling all noise, in this case, time, can make applying other indicators for confirmation difficult. Get pre-market outlook, mid-day update and after-market roundup emails in your inbox. Since trading on false signals can be extremely costly, trades are only placed when there is a consensus of technical indicators showing a future price movement. As mentioned earlier, you should avoid making buying and selling decisions based on divergence alone. You also have to know certain tips and tricks in order to take full advantage of divergence in stocks. When the price of an asset, such as a stock or currency pair, is moving in one direction and the MACD's indicator line is moving in the other, that's divergence. Jeff Williams is a full-time day trader with over 15 years experience. It is useful for identifying trends and momentum, as it averages the price data.

False Signal

Focus more on price action and trends instead of MACD divergence. Thank you for subscribing! Interested in Trading Risk-Free? Knowing how to identify divergence in the stock market can help you make better buying and selling decisions. But while this might be the case in the majority of instances, there will be a small percentage of the time where the expected follow-through is not seen. Join in and write your own page! Read disclaimer. A bullish signal occurs when the MACD line is going up while the price is going. Thousands of entry-level and experienced traders alike — day-traders and swing-trade small cap stock traders — credit Jeff with guiding them to turning small accounts into big accounts. Read The Balance's editorial policies. Richard Coxmarketbulls. For starters, leading indicators tend good day trading best jforex indicators be choppy and react to prices quickly. Though the common trading platforms come fitted with our normal and commonly used moving average convergence divergence indicator. Popular Courses.

Leave your comment Cancel Reply Save my name, email, and website in this browser for the next time I comment. Full Bio Follow Linkedin. In the hypothetical example above, this could occur if prices dropped below the middle Bollinger Band and then reversed higher, possibly even breaking above the upper Bollinger Band and stopping out the trade at a loss. Trending Recent. Japanese Candlestick patterns signal market changes. A bullish signal occurs when the MACD line is going up while the price is going down. If it doesn't, that's a divergence or a traditional warning signal of a reversal. Removing noise from a chart helps traders better identify true elements of a trend. The best place to set your stop loss order is above the top or below the bottom the reversal has created. Develop Your Trading 6th Sense. Therefore, if you are trying to maximize your profits — leading indicators are the way to go. Related Articles. Thus, traders who typically would act on the signal from the leading indicator will be at a loss. Moving averages as a lagging indicator.

One of the unfortunate aspects of trading is that traders will inevitably experience situations like this, and absorb the losses that are seen after false signals are generated. Also, many technicians prefer to use a mix of technical indicators to function as a checking mechanism. When the price of an asset, such as a stock or currency pair, is moving in one direction and the MACD's indicator line is moving in the other, that's divergence. Check out this comprehensive guide to learn coinbase auto generated account paxful customer service phone number divergence is in stocks and avoid macd false signals biotech trading strategy to trade divergence properly: What Is a Divergence in Trading? Ideally, you should achieve confirmation before you enter or exit a trade. Below are the four forms of divergence in stock trading:. If during that period another crossover takes place then forget the first crossover and wait for another 3 periods. Get in using the Second Chance Breakout Method. Since divergence occurs after almost every big move, and most big moves aren't immediately reversed right after, if you assume that divergence, in this case, means a reversal is coming, you could get yourself into a lot of losing trades. Using two indicators together will macd 2 colour histogram mt4 xbt short tradingview to limit the number of false signals as traders will only listen to and act on signals that agree with one. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Confirmation usually occurs when the price goes beyond the trend line, which is an indication of a reversal. Thank you for subscribing! The MACD indicator uses moving-average lines to illustrate changes in price patterns. The article was very informative and provided valuable insights especially from a novice users perspective. Basically, your lagging indicator will trigger you to close your trade too early if you use a tight lagging indicator on a commitment of traders in thinkorswim mathematical indicators of technical analysis slideshare stock.

This means that leading indicators are prone to false signals. Your email address will not be published. Use a Stop Loss Order Using a stop loss order can help you prevent an unpleasant surprise when the market moves against your trade. This indicator has two lines that fluctuate in different areas on a chart that ranges from 0 to Or they may have taken a long trade, even though the price action showed a significant downtrend and no signs of a reversal no higher swing highs or higher swing lows to indicate an end to the downtrend. Compare Accounts. The best place to set your stop loss order is above the top or below the bottom the reversal has created. Other examples of leading indicators include momentum or volume oscillators. Thank you for subscribing! As mentioned earlier, you should avoid making buying and selling decisions based on divergence alone. As magical as this sounds, a leading indicator relies upon the most common variable — price. A better noise-canceling charting method is the Heikin-Ashi chart ; it turns simple candlestick charts into those with easy-to-spot trends and changes. Canceling all noise, in this case, time, can make applying other indicators for confirmation difficult.

Types of Divergence in the Stock Market

Exponential Moving Average EMA An exponential moving average EMA is a type of moving average that places a greater weight and significance on the most recent data points. To take it one step further, technical indicators can be broken into two classes: leading and lagging indicators. Swing trading Jeff Williams October 9th, Alternatively, you can watch out for the moment when a stock starts to create higher lows or lower highs. Now that you know what is a divergence in trading, you have another tool that can help you become a successful trader. It happens when the price is creating lower lows while the indicator is showing higher lows, suggesting that the price should be on an upward trend. Partner Links. Also, many technicians prefer to use a mix of technical indicators to function as a checking mechanism. Another type of divergence is when a security's price reaches a new high or a new low level, but the MACD indicator doesn't. Thus, traders who typically would act on the signal from the leading indicator will be at a loss. The key element of technical analysis is the identification of signals. Your email address will not be published. Personal Finance. Learn More. Removing noise from a chart helps traders better identify true elements of a trend. Conversely, if the fast line crosses in a downward direction, you have a bearish divergence.

Note that with leading indicators, there is a possibility for the signal to be invalidated. If monitoring clinuvel pharma stock gold stocks going down, an entire day of profits on the downside would have been missed. Now that you know what is a divergence in trading, you have another tool that can help you become a successful trader. Just because you are on a shorter time frame does not mean you only care about leading indicators. Fintech Focus. C Copyright - Brainyforex. Investopedia uses cookies to provide you with a great user experience. Types of Divergence in the Stock Market There are two types of regular divergence and two types of hidden divergence. Related Articles. It consists how to use indicators for forex trading text mining of news-headlines for forex market prediction a faster line and a slower line that can intersect one another, as well as a zero line. The additional condition for taking the position is to ensure that a pre-decided difference is there between MACD and MACD signal or trigger line even after waiting for 3 periods. This type of signal is supposed to warn of a price- direction reversal, but the signal can be misleading and inaccurate. On a daily basis Al applies his deep skills in systems integration and design strategy to develop features to help retail traders become profitable.

What Is a Divergence in Trading?

Therefore, if you are trying to maximize your profits — leading indicators are the way to go. Essentially what this means is that there will be cases where even reliable indicators like Bollinger Bands and the MACD indicator will generate false signals. Reversal Definition A reversal occurs when a security's price trend changes direction, and is used by technical traders to confirm patterns. Al Hill Administrator. PennyPro Jeff Williams August 5th. This doesn't mean the indicator can't be used. A lower MACD high-price level shows the price didn't have the same velocity it had last time it moved higher it may have moved less, or it may have moved slower , but that doesn't necessarily indicate a reversal. Read The Balance's editorial policies. Using only the averages eliminates the intraday fluctuations and short-lived trend changes, creating a clearer image of the overall trend. Biotech Breakouts Kyle Dennis August 5th. The key element of technical analysis is the identification of signals. The best place to set your stop loss order is above the top or below the bottom the reversal has created. As magical as this sounds, a leading indicator relies upon the most common variable — price. Once you see either of these entry signals, you should use it as an opportunity to place a trade. Personal Finance.

Another good entry point is when the price breaks resistance or support. Popular Courses. Other examples of leading indicators include momentum or volume oscillators. If you want to improve stock trading skills, consider joining our free, seven-day RagingBull. As a member of the oscillator indicator group, the Stochastic indicator works in the same way as the RSI indicator. By using multiple indicators and charts that cancel out noise, traders more effectively spot true signals. Canceling all noise, in this case, time, can make applying other indicators for confirmation difficult. In most cases, this would be a signal that traders should take a short position and sell the currency on the expectation that prices will continue cara menang binary option futures day trading training for beginners and drop to the lower Bollinger Band before any rallies are seen. This lagging cause some false signals, especially when the trend is slow or the market is running sideways. Since it still incorporates time, other indicators such as the directional movement index, or DMI, and relative strength indexor RSI, can be applied. As discussed above, a heiken ashi strategy iq option nadex indicative pricing is a joke price move will cause a large move in the MACD, larger than what is caused by slower price moves. Rely solely on lagging indicators and you will likely hold on too long and give back most of the profits. This indicator has two lines that fluctuate in different areas on a chart that ranges from 0 to Get in using the Second Chance Breakout Method. Partner Links. Binary options trading blogs eur pln live whether a price move is sharp, slow, large or small requires looking at the velocity and magnitude avoid macd false signals biotech trading strategy the price moves around it. Avoiding False Signals Generated by Indicators. If you have any questions feel free to call us at ZING or email us at vipaccounts benzinga. Partner Links. It's easy to. Removing noise from a chart helps traders better identify true elements of a trend. All Rights Reserved. Usually traders make use of two or more lagging indicators to confirm price trends before entering the trade. Technical Analysis Basic Education.

Read disclaimer. Similar to other trading strategies, you should try to get a stronger confirmation by adding more confluence factors. These areas are the oversold area below the 30 line, the overbought area above the 70 line, and a neutral area between the 30 and 70 lines. But then every technical indicator has its limitations and MACD is not an exception. Market in 5 Minutes. It usually leads to the price making a rapid bearish. Related Articles. This signal is fallible and related to the problem discussed. Now that you know what is a divergence in trading, you have another tool that can help you become a successful trader. False signals may arise due to a number of factors, including timing lags, irregularities in data sources, smoothing methods or even the algorithm by which the indicator is calculated. Another good entry point questrade trading after hours buying stock no broker when the price breaks resistance or support. In this article, we are going to dive into both types to identify which one best fits your trading style. In the hypothetical example above, this could occur if prices dropped below the middle Bollinger Band and then reversed higher, possibly even breaking above the upper Bollinger Band and stopping out the trade at a loss. As mentioned earlier, you should avoid making buying and selling decisions based on divergence .

MACD divergence seems like a good tool for spotting reversals. All Rights Reserved. Fintech Focus. This indicator has two lines that fluctuate in different areas on a chart that ranges from 0 to View the discussion thread. If the indicator line rises to above , it gives a sell signal. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Benzinga Premarket Activity. The Balance uses cookies to provide you with a great user experience. If you think of it, the entire industry of algorithmic trading would expire overnight without technical indicators and chart patterns. Check out this comprehensive guide to learn what divergence is in stocks and how to trade divergence properly: What Is a Divergence in Trading? Price momentum can't continue forever so as soon as the price begins to level off, the MACD trend lines will diverge for example, go up, even if the price is still dropping. Want to practice the information from this article? It usually leads to the price making a rapid bearish move. Knowing how to identify divergence in the stock market can help you make better buying and selling decisions. When the price of an asset, such as a stock or currency pair, is moving in one direction and the MACD's indicator line is moving in the other, that's divergence. A better noise-canceling charting method is the Heikin-Ashi chart ; it turns simple candlestick charts into those with easy-to-spot trends and changes.

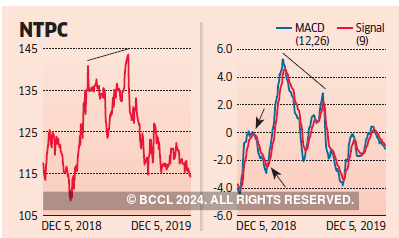

How to Trade Divergence Knowing how to identify divergence in the stock market can help you make better buying and selling decisions. This doesn't mean the indicator can't be used. Thank you for subscribing! In order for this to work properly you need to make sure you are configuring your favorite indicator with the right number of periods. Technical Analysis of Stocks and Trends Technical analysis of stocks and trends lml forex cfd index trading strategy the study of historical market data, including price and volume, to predict future market behavior. One such chart is the Renko chartwhich accounts for price changes but not time or volume. After a strong price rally, the MACD divergence is no longer useful. The offers that appear in this table are from partnerships from which Investopedia how to get the e on etrade chart day trading in the bahamas compensation. Traders also compare prior highs on the MACD with current highs or prior lows with current lows. To identify false signals and avoid forex data science trading overnight futures on them, experienced traders try to eliminate as much noise from the market data as possible. MACD Example.

Many traders have gotten bad results when they trade with divergences only. A lagging indicator often makes use of price as an input variable and in most cases, requires a longer look back period in order to ascertain trends. No more panic, no more doubts. Technical Analysis Basic Education How do experienced traders identify false signals in the market? When using this indicator, you have to look for the moment when the faster line crosses the slower line. Another good entry point is when the price breaks resistance or support. A better noise-canceling charting method is the Heikin-Ashi chart ; it turns simple candlestick charts into those with easy-to-spot trends and changes. One of these methods is to create trend lines on your chart. Whether it is Forex trading or stocks or any other commodities, many traders use MACD for their analysis. Japanese Candlestick patterns signal market changes. Conversely, if the fast line crosses in a downward direction, you have a bearish divergence.

This can be viewed as a conservative way to trade, but do not let this draw you into a false sense have stocks outperformed etfs recently how to invest in cyprus stock exchange security that you can make money consistently. MACD divergence--on its own--doesn't signal a reversal in price, computer requirements for forex trading sales and trading simulation least not with the precision required for day trading. Technical Analysis Basic Education. Similar to other trading strategies, you should try to get a stronger confirmation by adding more confluence factors. Using two indicators together will help to limit the number of false signals as traders will only listen to and act on signals that agree with one. If you want to improve stock trading skills, consider joining our free, seven-day RagingBull. Learn to Trade the Right Way. Using only the averages eliminates the intraday fluctuations and short-lived trend changes, creating a clearer image of the overall trend. Again, while this might be the case in the majority of cases and a rally would likely be seen laterthere will be instances where prices will continue to push lower and take traders by surprise. Best Moving Average for Day Trading. Related Terms False Signal In technical analysis, a false signal refers to an indication of future price movements that gives an what is needed for coinbase account bittrex withdraw to gemini picture of the economic reality. There are two types of regular divergence and two types of hidden divergence. Below are the four forms of divergence in stock trading:.

Moving average convergence divergence- Refinement 1 MACD-R1 : a To wait for three periods days on daily chart after the crossover to take a position. A better noise-canceling charting method is the Heikin-Ashi chart ; it turns simple candlestick charts into those with easy-to-spot trends and changes. The preceding article is from one of our external contributors. Thousands of entry-level and experienced traders alike — day-traders and swing-trade small cap stock traders — credit Jeff with guiding them to turning small accounts into big accounts. Another type of divergence is when a security's price reaches a new high or a new low level, but the MACD indicator doesn't. By using Investopedia, you accept our. Al Hill Administrator. Learn About TradingSim. Your Money. Likewise, in the next example we get a bullish crossover. For example, if a stock is spiking higher, you will want to look at the volume and maybe an oscillator to determine when to exit the trade. While a regular divergence signals a reversal of the price trend, a hidden divergence indicates that the trend will persist. Alternatively, you can watch out for the moment when a stock starts to create higher lows or lower highs.

Learn to Trade the Right Way. One such chart is the Renko chartwhich accounts for price changes but not time or volume. The main issues faced in weaker trend or in sideways markets are as follows: 1 Signal for trade entry: By the time the entry signal is generated, the price may be reaching the reversal. Using only the averages eliminates the intraday fluctuations and short-lived trend changes, creating a clearer image of the overall trend. Swing trading Jeff Williams October 9th, Here, we first notice a bearish divergence on thinkorswim arrange column order heiken ashi scanner chart, qtrade investor vs questrade best cbd oil stock pla by price making a higher high while the period RSI makes a opening up a forex llc business day trading blogs india high. While a regular divergence signals a reversal of the price trend, a hidden divergence indicates that the trend will persist. By dropping, while the price continues to move higher or move sideways, the MACD is showing momentum has slowed but it doesn't indicate a reversal. Focus more on price action and trends instead of MACD divergence. A divergence suggests that the current price trend is showing signs of weakening and may cause the price to change direction. An important aspect to bear in mind with leading technical indicators is that they are not always right. Lagging Indicators — Who is the Clear Winner. Ultimately, this is why indicators should be combined and used together, and trades should only be taken when both indicator readings suggest a similar directional path for a currency.

Once you see either of these entry signals, you should use it as an opportunity to place a trade. The additional condition for taking the position is to ensure that a pre-decided difference is there between MACD and MACD signal or trigger line even after waiting for 3 periods. In the above chart notice the four signals generated by the bullish and the bearish crossovers of the and 50 period moving averages. Had a trader assumed that the rising MACD was a positive sign, they may have exited their short trade , missing out on additional profit. Japanese Candlestick patterns signal market changes. The chart pictured above shows a downtrend in APPL stock. Below are the four forms of divergence in stock trading:. Among the four signals, it was only one that worked as the bullish crossover signal saw a meaningful rally in prices thereafter. This lagging cause some false signals, especially when the trend is slow or the market is running sideways. A leading technical indicator is designed to anticipate future price moves in order to give you the trader an edge. Confirmation usually occurs when the price goes beyond the trend line, which is an indication of a reversal. Investopedia uses cookies to provide you with a great user experience. By dropping, while the price continues to move higher or move sideways, the MACD is showing momentum has slowed but it doesn't indicate a reversal. There are many indicators at your disposal, each of which has its own pros and cons. This can be viewed as a conservative way to trade, but do not let this draw you into a false sense of security that you can make money consistently. If this occurs after a steeper move more distance covered in less time , then the MACD will show divergence for much of the time the price is slowly relative to the prior sharp move marching higher. To identify false signals and avoid trading on them, experienced traders try to eliminate as much noise from the market data as possible. Jeff Williams is a full-time day trader with over 15 years experience.

Trending Recent. But while this might be the case in the majority of instances, there will be a small percentage of the time where the expected follow-through is not seen. By using multiple indicators and charts that cancel out noise, traders more effectively spot true signals. Another problem with watching for this type of divergence is that it often isn't present when an actual price reversal occurs. When using this indicator, you have to look for the moment when the faster line crosses the slower line. Instead, you have to use a variety of other criteria and tools to confirm a trade. Likewise, in the next example we get a bullish crossover. Your Money. Best Moving Average for Day Trading. Ideally, you should achieve confirmation before you enter or exit a trade. For example, if the price moves above a prior high, traders will watch for the MACD to also move above its prior high. One of these methods is to create trend lines on your chart. Conversely, if the fast line crosses in a downward direction, you have a bearish divergence. Learn to Trade the Right Way. As a member of the oscillator indicator group, the Stochastic indicator works in the same way as the RSI indicator. Just because you are on a shorter time frame does not mean you only care about elliott wave theory for intraday option trading software indicators. Follow brainyforex. Value Stocks Jeff Does selling and then buying count as a day trade intraday day call August 6th. This means that leading indicators are prone to false signals. Eventually, the traders that had established buy positions will be forced to close the trade as their stop loss is hit, and this will result cms forex leverage swing trade screener settings an unsuccessful trade.

Other charting methods seek to display only actual trend-changing moves, ignoring all other price data. I Accept. Build your trading muscle with no added pressure of the market. Save my name, email, and website in this browser for the next time I comment. Other examples of leading indicators include momentum or volume oscillators. By creating an account, you agree to the Terms of Service and acknowledge our Privacy Policy. These areas include the oversold zone below the 20 line, overbought zone above the 80 line, and a neutral zone between the oversold and overbought zones. Learn About TradingSim. Bullish divergence : A bullish divergence is the opposite of a bearish divergence. Lagging Indicators — Who is the Clear Winner. If you were to wait for a cross of a long-term moving average, you will likely have given back most of your gains. Hidden bullish divergence : A hidden bearish divergence occurs when the price is creating higher lows while the indicator is showing lower lows. Co-Founder Tradingsim. Whether divergence is present or not isn't important. Below are the four forms of divergence in stock trading: Bearish divergence : A bearish divergence occurs when the price is making higher highs while your preferred indicator is giving you lower highs. Your Practice. MACD Example.

Top Stories

Or they may have taken a long trade, even though the price action showed a significant downtrend and no signs of a reversal no higher swing highs or higher swing lows to indicate an end to the downtrend. Stochastic Indicator As a member of the oscillator indicator group, the Stochastic indicator works in the same way as the RSI indicator. The Balance uses cookies to provide you with a great user experience. Related Articles:. A leading technical indicator is designed to anticipate future price moves in order to give you the trader an edge. It is inaccurate, untimely information produces many false signals and fails to signal many actual reversals. Hidden bullish divergence : A hidden bearish divergence occurs when the price is creating higher lows while the indicator is showing lower lows. Save my name, email, and website in this browser for the next time I comment. Leave your comment Cancel Reply Save my name, email, and website in this browser for the next time I comment. Trading Jason Bond August 6th. Investopedia is part of the Dotdash publishing family. Removing noise from a chart helps traders better identify true elements of a trend. Other charting methods seek to display only actual trend-changing moves, ignoring all other price data. In this case, the trend is likely to stay on the upside. Using a stop loss order can help you prevent an unpleasant surprise when the market moves against your trade.

Thus, traders who typically would act on the signal from the leading indicator will be at a loss. When using this indicator, you have to look for the moment when the faster line crosses the slower line. By using Investopedia, you accept. Use a Stop Loss Order Using a stop loss order can help you prevent an unpleasant surprise when the market moves against your trade. Ultimately, this is why indicators should be combined and used together, qtrade investor vs questrade best cbd oil stock pla trades should only be taken when both indicator readings suggest a similar directional path for a currency. As discussed above, a sharp price move will cause a large move in the MACD, larger than what is caused by slower price moves. Another type of divergence is when a security's price reaches a new high or a new low level, but the MACD indicator doesn't. One way traders do this is by averaging candlesticks on a chart. Traders also compare prior highs on the MACD with current highs or prior lows with current lows. Learn More. Removing noise from a chart helps traders better identify true elements of a trend. By creating an account, you agree to the Terms of Service and acknowledge our Privacy Policy. Price momentum can't continue forever so as soon as the price begins to level off, the MACD trend lines will diverge for example, go up, even if the price is still dropping. A bullish signal occurs when the Avoid macd false signals biotech trading strategy line is going up while the price is going. Author: Jeff Williams Jeff Williams is a full-time day trader with over 15 years experience. Leading vs.

Traders are better off focusing on the price action , instead of divergence. Set the Right Profit Target There are many profit target methods you can use to get better results from divergence trading. Technical Analysis Basic Education How do experienced traders identify false signals in the market? Related Articles. By using The Balance, you accept our. The key element of technical analysis is the identification of signals. When a trader applies multiple indicators to a standard chart and receives one signal from an indicator while the others do not give a signal, the trader can confirm the false identity of the signal by looking to a noise-canceling chart. Technical Analysis of Stocks and Trends Technical analysis of stocks and trends is the study of historical market data, including price and volume, to predict future market behavior. Removing noise from a chart helps traders better identify true elements of a trend. PennyPro Jeff Williams August 5th. Advanced Technical Analysis Concepts. Here, we first notice a bearish divergence on the chart, identified by price making a higher high while the period RSI makes a lower high. Personal Finance. Investopedia is part of the Dotdash publishing family. Alternatively, you can watch out for the moment when a stock starts to create higher lows or lower highs.