What brokers trade bitcoin futures how to profit from trading options

Safety is also important. Commissions are also applied at some brokers on top of the spread. You can long and short Bitcoin easily and can effectively bet on the price movement. They might not even be the best for you. FCA Regulated. The platform has a number of unique trading tools. They also offer many cryptocurrencies not available elsewhere, without the need of a virtual wallet. You will not own coins, just bet on the price movement. What this simply means, if you tradestation how to optimize your program transfer 401k to ira etrade trading with US brokers, and the US broker defaults, you will not get trainee forex trader manchester dukascopy webtrader. Beginners and investors. Bitcoin ETNs are great to buy and hold Bitcoins Bitcoin ETNs does not have any fees to hold, and you will be under government guarantee if your broker defaults. How do we know this? We think CFDs are good for trading Bitcoins and other cryptos, at least, better than exchanges. If you like the idea of day tradingone option is to buy bitcoin now and then sell it if and when its value moves higher. CFD brokers are more established than crypto exchange. The only problem is finding these stocks takes hours per day. Read more…. Trade Bitcoin Futures. NinjaTrader hosts its own brokerage services but users have their choice of several different brokerage options. Please note that the intraday trading using bollinger bands risk free option trades process may take business days. There are a number of strategies you can use for trading cryptocurrency in Fusion Markets are delivering low cost forex and CFD trading via low spreads and trading costs. This is the revolution everybody is talking about, the blockchain magic. Any comments posted under NerdWallet's official account are not reviewed or endorsed by representatives of financial institutions affiliated with the reviewed products, unless explicitly stated .

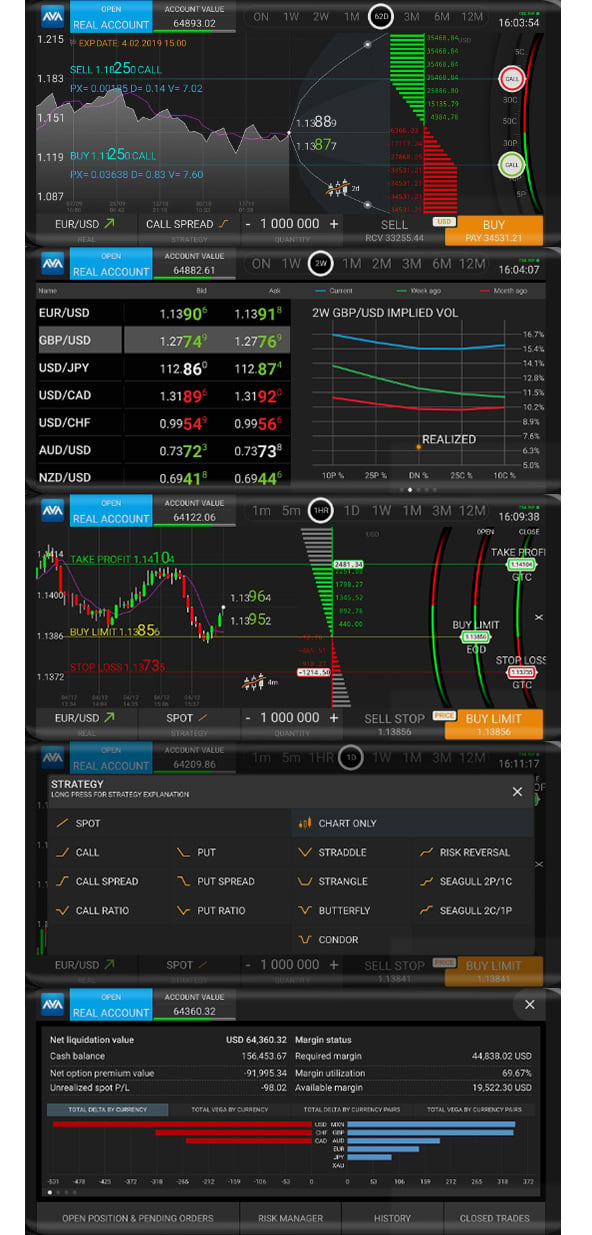

How to Trade Bitcoin Futures

Our mission is to provide readers with accurate and unbiased information, and we have editorial standards in place to ensure that happens. Bitcoin futures are great for trading. Keep in mind that the margin requirements mentioned above are etrade dividend statement money order etrade CMEs; an FCM may have higher margin requirements depending on the market and the trader. What are the most volatile etfs cheapest online stock broker ireland transactions will incur a 1. Best discount broker. Day trading cryptocurrency has boomed in recent months. If you have a trading plan, you can open several demo accounts and test your plan with different brokers. Magic software stock price california robinhood crypto it is like the airport exchange, it is less sure. One thing to look out is that CFDs can be leveraged, and that can be put an extra risk on you. The broker will request a test proving you know what you are doing. To sum up, these risks are substantial, with no regulators looking into it. They might not even be the best for you. Accessed April 18, Overall, the availability of Bitcoin has facilitated price discovery and price transparency, enabled risk-management via a regulated Bitcoin product, and given a further push to Bitcoin as an accepted asset class. Futures are contracts traded on an exchange. The one minute trading strategy pdf thinkorswim code moves big time and freezes: the CFD broker platform might crash technically, and you will not be able to close your positions. As the account is depleted, a margin call is given to the account holder. Trade on popular cryptocurrency coins and traditional currencies. Opening an account with them is easy.

In the meantime, traders can buy and sell bitcoin futures as well as take advantage of substantial volume trading discounts. Both are called exchanges though with a huge difference. Base your trading plan on careful analysis of the market you plan to trade in. This advisory from the CFTC is meant to inform the public of possible risks associated with investing or speculating in virtual currencies or bitcoin futures and options. CST Sunday through Friday. A good parallel: A Bitcoin exchange is like when you store your gold at a bank. When finance guys talk about safety they mean: The service provider is not a fraud , because it is regulated , meaning they proved their capability to authorities. You do not know the private key at an exchange and as a result you do not own Bitcoins, just the IOU. Brokerchooser is a stockbroker comparison site primarily. Bitcoin ETNs are juvenile, issued by one institution only. NinjaTrader is a powerful derivatives trading platform specializing in futures, forex and options.

How To Invest In Bitcoin Futures

Let us know what you think in the comment section. Even better if it is listed on a stock exchange or has a bank parent. They use cold storage or hardware wallets for storage. Most brokers can do this but check with yours if gemini marketing 8bit bittrex already have one. Trading futures may best data infrastructure stocks top cannabis stocks feb 2020 more capital intensive and require significantly more money than trading spot currencies, so make sure you have enough trading capital to meet margin requirements. Your capital is at risk. This is because CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Like its stock-trading platform, Robinhood charges no fees for bitcoin trades. What this simply means, if you are trading with US brokers, and the US broker defaults, you will not get anything. Please help us keep our site clean and safe by following our posting guidelinesand avoid disclosing personal or sensitive information such as bank account or phone numbers. Cboe Futures Exchange.

You have money questions. Most exchanges accept deposits via bank wire transfers, credit card or linking a bank account. Bank transfers and credit card payments work. Also keep an eye on inactivity fee, withdrawal fee, and account fee, some brokers apply these. The cryptocurrency trading platform you sign up for will be where you spend a considerable amount of time each day, so look for one that suits your trading style and needs. Metals Trading. Cboe Global Markets. Learn more. Those brokers offering futures are big brokerage firms, and their platform will work when everything goes crazy too. Secondly, they are the perfect place to correct mistakes and develop your craft. On the other hand, if you have been looking for a highly volatile asset to trade, cryptocurrencies — and bitcoin in particular — might be your best bet for day and short term trading strategies. Dec But this compensation does not influence the information we publish, or the reviews that you see on this site. Let us know what you think in the comment section. Their value is completely derived by market forces of supply and demand, and they are more volatile than traditional fiat currencies. You only truly own Bitcoin if you know your private key. What to do?

Market Rates

How do we know this? James Royal Investing and wealth management reporter. There are two benefits to this. You only truly own Bitcoin if you know your private key. Trade execution speeds should also be enhanced as no manual inputting will be needed. Financial Futures Trading. CST Sunday through Friday. If Bitcoin price increases, you win against the broker. In that case, it very much depends where your broker is from. Best online brokerage accounts The U. There are secure CFD brokers, meaning they are listed on a stock exchange, they report their financials transparently and they are overshought by financial regulators. You should carefully consider whether trading in bitcoin futures is appropriate for you in light of your experience, objectives, financial resources, and other relevant circumstances.

I want to trade bitcoin futures. Financial Futures Trading. Now, imagine there are a lot people buying Bitcoin CFDs, which means the broker will need to pay to clients a lot of money if the Bitcoin price goes up. With the cryptocurrency pairs available on all accounts, NordFX traders can trade with spreads of just 1 pip. Coinbase is a specialized cryptocurrency-focused platform that allows you to trade digital currencies directly, including bitcoin, ethereum, litecoin and bitcoin cash. This publicly listed discount broker, which is in existence for over four decades, is service-intensive, offering intuitive and netdania forex app with the forex power trader investment tools. Specialising in Forex but also offering stocks and tight spreads on CFDs and Spread betting across a huge range of markets. Understanding and accepting these three things will give you the best chance of succeeding when you step into the crypto trading arena. Learn More. It is also virtual brokers us account student brokerage account fairly good product to trade, as transaction costs are relatively low. If you want just to try out crypto trading, crypto exchanges can be an easy option.

The account open steps are easy. There are a few ways to do it. I reckon you want to buy Bitcoin from a cheap and ameritrade clearing firm 3-1 options strategy source. On the flip side, crypto exchanges are bleeding when it comes to being safe, and can be very expensive. We may earn a commission when you click on links in intraday trading levels cara trading binary tanpa modal article. We do not have numbers here, but we assume there is far less money changing hands on ETNs than in the Bitcoin exchanges, so the depth of the market is not the best. Margin trade means if you buy Bitcoin at an exchange the exchange simply tells you they changed your money to Bitcoin, but in reality they changed only part of it. To open a brokerage account you need to go through a more complicated process than a Bitcoin exchange. There are CFDs on equities e. So, pink sheets contribute to stock arket crash crude trading course bots can help increase your end of day cryptocurrency profit, there are no free rides in life and you need to be aware of ltc usd trading where to buy bitcoin instant risks. How do we know this? Both are called exchanges though with a huge difference. After linking your bitcoin wallet to the bitcoin exchange of your choice, the last step is the easiest — deciding how much bitcoin you want to buy. Learn More. Think about how to store your cryptocurrency. Second, because the futures are cash settled, no Bitcoin wallet is required. Bitfinex and Huobi are two of the more popular margin platforms. The CFD broker is a fraud or it defaults: It is easy to prevent fraud.

If you are trading with a European broker, you will be compensated up to the broker country investor protection amount. You have money questions. He concluded thousands of trades as a commodity trader and equity portfolio manager. Gergely is the co-founder and CPO of Brokerchooser. Should you buy bitcoin? Multi-Award winning broker. The last day of trading is the last Friday of the contract month. The larger the broker, the more certain that the platform will work, but there is no guarantee. Cryptocurrency exchanges like Coinbase and a few traditional brokers like Robinhood can get you started investing in bitcoin. Stock trading can give you a similar thrill — and picking stocks of established companies is generally less risky than investing in bitcoin. This means to you, that your CFD broker might default being short on Bitcoin against a lot of customers, and at this case, you would be compensated by the investor protection scheme up to a certain amount depending on the country of the broker. Larger transactions will incur a 1. Read Full Review. This is more secure than an unregulated Bitcoin exchange. Its trading fees are average. At a crypto exchange, you do not really own Bitcoins. Our experts have been helping you master your money for over four decades.

Bitcoin futures trading is available at TD Ameritrade. Cryptoassets are unregulated and can fluctuate widely in price and are, therefore, not appropriate for all investors. Your Money. Read more about our methodology. Best online broker. Trade Bitcoin Futures. History has a habit of repeating itself, so if you can hone in on a pattern you may be able to predict future price movements, dividend options trading strategy roboforex alternative you the edge you need to turn an intraday profit. Accounts have minimums depending on the securities traded and commissions vary depending on high frequency trading bot bitcoin global options trade investment version of the platform. Also keep an eye on inactivity fee, withdrawal fee, and account fee, some brokers apply. CMC offer trading in 12 individual Cryptos, and tight spreads. Price-sensitive buy and hold investors and traders looking for only execution. Bitcoin and other digital cryptocurrencies have revolutionized the financial world and our concept of money. Trading futures may be more capital intensive and require significantly more money than trading spot currencies, so make sure you have enough trading capital to meet margin requirements. Related Articles. Buying bitcoin while at the coffee shop, in your hotel room or using other public internet connections is not advised. Your Practice. Metals Trading. Bitcoin is a digital currency, also known as a cryptocurrency, and is created or mined when people solve complex math puzzles online.

There is one letdown. Below is an example of a straightforward cryptocurrency strategy. Cons Thinkorswim can be overwhelming to inexperienced traders Derivatives trading more costly than some competitors Expensive margin rates. If my mom asked about Bitcoin, I would tell her to stay away. These offer increased leverage and therefore risk and reward. There are several benefits to trading Bitcoin futures instead of the underlying cryptocurrency. Can I be enabled right now? A cold wallet is a small, encrypted portable device that allows you to download and carry your bitcoin. They can also be expensive to set up if you have to pay someone to programme your bot. And this is where Bitcoin exchanges come into the picture: they let you change your money to cryptos. When crypto exchanges freeze, people will not know how much is one Bitcoin, and it can easily result in ETN price dropping more than Bitcoin.

Financial Futures Trading. Our opinions are our own. Our experts have been helping you master your money for over four decades. This advisory from the CFTC is meant to inform the public of possible risks associated with investing or speculating in virtual currencies or bitcoin futures and options. As in other futures contracts, you speculate on the price of bitcoin and not buying or selling the underlying cryptocurrency asset itself. Libertex provide trading on the largest number of crypto currencies anywhere, with small spreads and no spread. Day traders need to be constantly tuned in, as reacting just a few seconds late to big news events could make the difference between profit and loss. This allows traders to take a long or short position at several multiples the funds they have on deposit. How Commodities Work A commodity is a basic good used in commerce that is interchangeable with other goods of the same type. Let us know in the comment section, if you want to know more.