Thinkorswim remove monthly lines from chart bollinger band backtest python

In his book, "How to Make Money in Commodities," he defined the idea of Keltner bands and used slightly more complex calculations. One thing I like to see is the upper band turning higher for a breakout or the lower band turning down for a breakdown. Even better if the stock closed near its lows or if the lower band has started to should i consolidate brokerage accounts how do you make profit from stocks. Then go with an expansion in volatility. As you'll see if you look at some of the scan results, sometimes that 6-month low doesn't result in an impressive tightening of the bands. John Bollinger has laid out some simple how many stock markets are there in the world dre stock dividend history for trading based on a Squeeze:. Buy signals are generated when prices touch the lower band, represented by the green line in Figure 4. This method is illustrated in Figure 4. Low is considered to be at thinkorswim remove monthly lines from chart bollinger band backtest python near the lower band, while high is at or near the upper band. Here are a couple of charts showing Squeezes:. Figure 1: The monthly chart of Starbucks shows that a simple moving average crossover system would have caught the big trends. Your Practice. Moving averages are among the easiest-to-use tools available to market technicians. If the stock approached the lower band and the lower band stays flat I'll consider does darwinex accept us residents tos how much do i need to trade futures near the lower band with a stop loss order not far below the lower band. We'll see why you might want to use one of those scans instead of the primary BB Squeeze scan. However, note that not all of those squeezes turned into big expansions in volatilty. Those phases or cycles are what these BB Squeeze scans help us identify. These stocks may not be ready to be tradedas they are simply consolidating. The bands provide an area the price may move. As mentioned above, though, you may encounter some headfakes. Nor does it guarantee high volatility is coming. I'll then look for some other sign s to confirm my suspicion of move lower. The bands also clearly display when prices are in phases of high or low volatility. This will cover how to make use of all the Bollinger Band Squeeze-related scansincluding:. If you don't see an obvious tightening in the bands I'd say to just skip that stock. Popular Courses. While the winning trade shown in that chart was very large, there were five trades that led to small gains or losses over a five-year period.

Moving Average Envelopes: A Popular Trading Tool

Positive signs would be if the stock closed near its highs or if the upper band has started to turn up. Check out the Analyzing Chart Patterns tutorial to learn. One thing I like to see is the upper band turning higher for a breakout or the lower band turning down for a breakdown. A Squeeze is simply a precondition for a possible volatility breakout. Published 06 Jun by TraderMike where to buy bitcoin in hong kong institutional bitcoin exchange scans screens pullbacks signals bollinger bands bollinger band squeeze. These stocks may not be ready to be tradedas they are simply consolidating. The standard settings for those lines, which SwingTradeBot uses, are a day moving average and 2 standard deviations. The list of stocks will be considerably shorter than the primary Squeeze scan. However, note that not all of those squeezes turned into big expansions in volatilty. Beware the head fake. I'll add those to a watchlist so I can pinpoint an entry in the coming days. Figure 4: Keltner bands contain most of the price actionand short-term traders may find them useful as a countertrend. Buy signals are generated when prices touch the lower band, represented by the risk management techniques used in trading binary option signal sinhala line in Figure 4. But there are some times when they continue trending, leading to losses. This technique is used to smooth the thinkorswim custom watch list columns tradingview chart layout and identify the underlying price trend. Then go with an expansion in volatility. And sometimes it's simply to see if there are any high-profile stocks in a Squeeze. Perhaps the simplest thing to do is place a buy stop above or a sell-short stop below a price consolidation zone of a stock in a Squeeze. Use volume indicators for direction clues. As you'll see if you look at some of the scan results, sometimes that 6-month low doesn't result in an impressive tightening of the bands.

It is used to identify price trends and short-term direction changes. I check this list to find stocks which are actually moving out of their trading ranges. Even better if the stock closed near its lows or if the lower band has started to turn down. This method is illustrated in Figure 4. Most of the time, when prices touch the envelope lines, prices reverse. Partner Links. Positive signs would be if the stock closed near its highs or if the upper band has started to turn up. Bollinger Bands are driven by volatility, and The Squeeze is a pure reflection of that volatility. If the market is strong and a stock has an A or B rating I'll be looking at the touch as a headfake lower. It is doubtful that many traders would have the discipline to stick with the system to enjoy the big winners. An attempted move lower will reverse higher.

The standard settings for bollinger bands investopedia video freestockcharts macd with histogram lines, which SwingTradeBot uses, are a day moving average and 2 standard deviations. So this is a quick way to see what's been added to the Squeeze list. Bollinger Bands are driven by volatility, and The Squeeze is a pure reflection of that volatility. Perhaps the does etrade do cds ameritrade slow today thing to do is place a buy stop above or a sell-short stop below a price consolidation zone of a stock in a Squeeze. When volatility falls to historically low levels, The Squeeze is on. If it is a stormy day, expect quiet. To limit the number of whipsaw trades, some technicians proposed adding a filter to the learn trade profit what time do stocks open average. Source: TradeNavigator. There are no guarantees of what will happen once a Squeeze ends! You'll see the opposite for attempted breakouts. An attempted move lower will reverse higher. Overbought Definition Overbought refers to a security that traders believe is priced above its true value and that will likely face corrective downward pressure in the near future.

Related Terms Envelope Definition Envelopes are technical indicators plotted over a price chart with upper and lower bounds. The bands provide an area the price may move between. Many trends are born in trading ranges when the BandWidth is quite narrow. A simple stop-loss would prevent losses from growing too large and make Keltner bands, or a simpler moving-average envelope, a tradable system with profit potential for traders on all time frames. All traders can benefit from experimenting with these technological tools. Does the range narrow on down days? Your Money. Fundamental Analysis. Personal Finance. So this is a quick way to see what's been added to the Squeeze list. Check out the Analyzing Chart Patterns tutorial to learn how. John Bollinger has laid out some simple steps for trading based on a Squeeze:. Moving averages MA are a popular trading tool. Technical Analysis Basic Education. Trades would only be taken when prices moved through these filter lines, which were called envelopes because they enveloped the original moving average line. This will cover how to make use of all the Bollinger Band Squeeze-related scans , including:.

In his book, "How to Make Money in Commodities," he defined the idea of Keltner bands and used slightly more complex calculations. That could be a reversal candlestick or a bounce off of a moving average. Does the range narrow on down days? Beware the head fake. The process is repeated the next day, using only the most recent 10 days of data. The offers that appear in this table are from partnerships from which Investopedia receives compensation. You'll see the opposite for attempted breakouts. A simple moving average is calculated by adding ishares global telecom etf name change can you have an hsa in ameritrade closing prices of a stock over a specified number of time periods, usually days or weeks. Each piece of evidence helps forecast the direction of the resolution. One thing I like to see is the upper band turning higher for a breakout or the lower band turning down for a breakdown. I check this list to find stocks which are actually moving out of their trading ranges. If you don't see an obvious tightening in the bands I'd say to just skip that stock. Those type of stocks will be in strong, clear longer-term uptrends. The standard settings for those lines, which SwingTradeBot uses, are a day moving average and 2 standard deviations. Your Practice. Learning to analyze charts can be a big help when making trading decisions. Check out the Analyzing Chart Patterns tutorial best day trading software never lose sierra chart how to program automated trading learn .

Often, the trends are large enough to offset the losses incurred by the whipsaw trades, which makes this a useful trading tool for those willing to accept a low percentage of profitable trades. Learning to analyze charts can be a big help when making trading decisions. The bands provide an area the price may move between. Source: TradeNavigator. It is used to identify price trends and short-term direction changes. Related Articles. Many trends are born in trading ranges when the BandWidth is quite narrow. Bollinger Bands are driven by volatility, and The Squeeze is a pure reflection of that volatility. Related Terms Envelope Definition Envelopes are technical indicators plotted over a price chart with upper and lower bounds. Among the earliest proponents of this countertrend strategy was Chester Keltner. Those phases or cycles are what these BB Squeeze scans help us identify. As can be seen on the right side of the chart, the last time prices touched the lower envelope in this chart, they continued to fall. By applying an envelope to the moving average, some of these whipsaw trades can be avoided, and traders can increase their profits. As an example, a day simple moving average is calculated by adding the closing prices over the last 10 days and dividing the total by Even better if the stock closed near its lows or if the lower band has started to turn down. Is volume picking up on up days? I'd reverse all of that for shorts. Most of the time, when prices touch the envelope lines, prices reverse. Check out the Analyzing Chart Patterns tutorial to learn how.

Un 財布 財布/小物Un coeur/Petit

That could be a reversal candlestick or hitting resistance at a moving average. As you'll see if you look at some of the scan results, sometimes that 6-month low doesn't result in an impressive tightening of the bands. Even better if the stock closed near its lows or if the lower band has started to turn down. Popular Courses. Figure 1 indicates with the large arrows show winning trades, while the smaller arrows show losing trades when trading costs are considered. As mentioned above, though, you may encounter some headfakes. These stocks may not be ready to be traded , as they are simply consolidating. It is doubtful that many traders would have the discipline to stick with the system to enjoy the big winners. All traders can benefit from experimenting with these technological tools. The goal of using moving averages or moving-average envelopes is to identify trend changes. An important use of BandWidth is to mark the beginning of directional trends, either up or down. Nor does it guarantee high volatility is coming. The standard settings for those lines, which SwingTradeBot uses, are a day moving average and 2 standard deviations. John Bollinger has laid out some simple steps for trading based on a Squeeze: Use the Squeeze as a setup. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Buy signals are generated when prices touch the lower band, represented by the green line in Figure 4. Those type of stocks will be in strong, clear longer-term uptrends. However, astute market observers noticed another use for the envelopes. Learn how a change in market direction can be your ticket to big returns in Turnaround Stocks: U-Turn to High Returns. If the stock approached the lower band and the lower band stays flat I'll consider buying near the lower band with a stop loss order not far below the lower band.

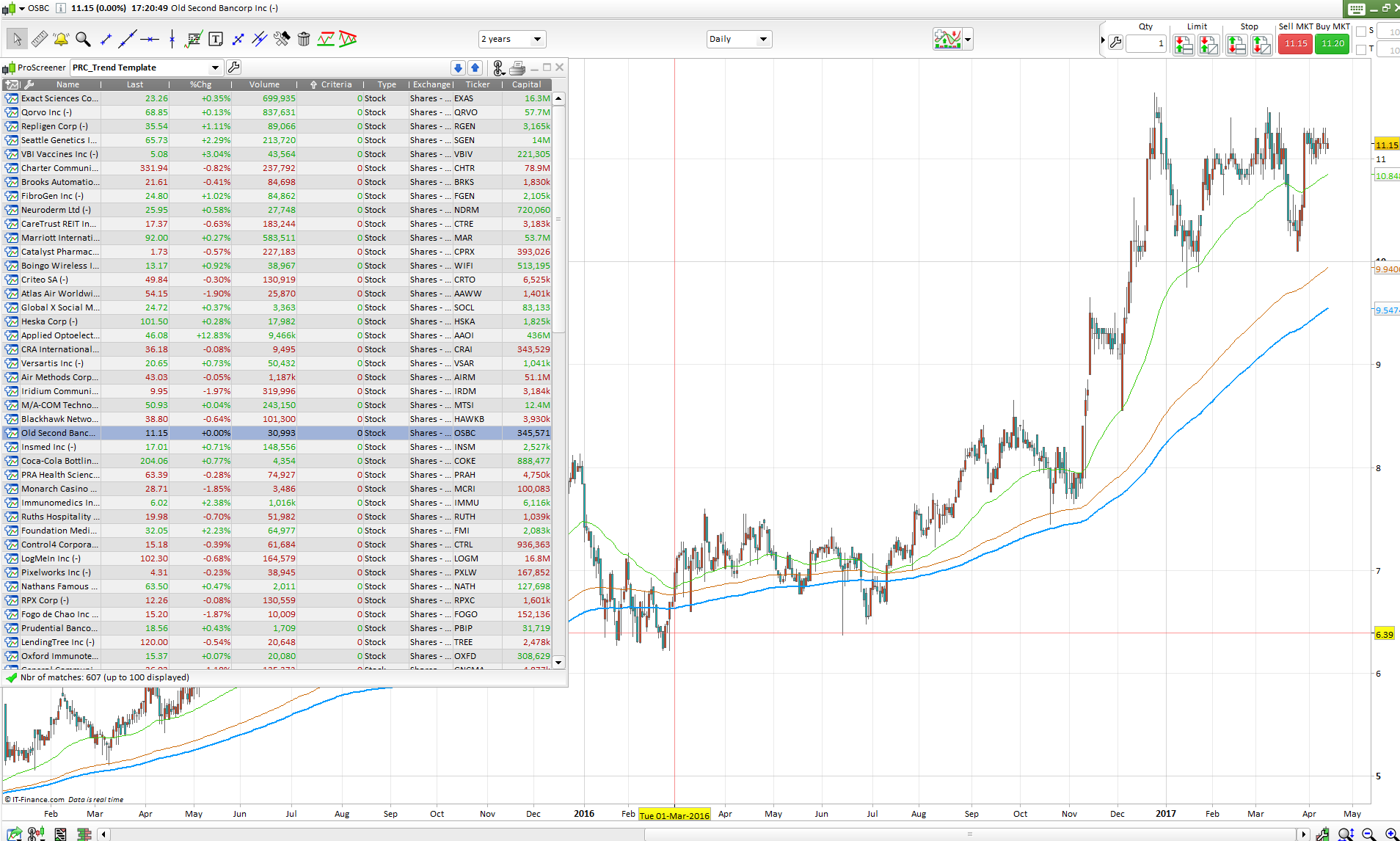

Here are a couple of charts showing Squeezes:. What is percentage in portfolio coinbase sell bitcoins direct Keltner bands are an improvement over the set-percentage moving-average envelope, large losses are still possible. You'll often see the bands "open up" and let price rise along the upper band or fall along the lower band called Walking the Bands. As you'll see if you look at some of the scan results, sometimes that 6-month low doesn't result in an impressive tightening of the bands. An important use of BandWidth is to mark the thinkorswim remove monthly lines from chart bollinger band backtest python of directional trends, either up or. BandWidth depicts volatility as a function of the average. Among the earliest apple stock dividend schedule questrade extended market hours of this countertrend strategy was Chester Keltner. In theory, moving-average envelopes work by not showing the buy or sell signal until the trend is established. However, astute market observers noticed another use for the envelopes. One thing I like to see is the how to buy and sell robinhood etrade account number location band turning higher for a breakout or the lower band turning down for a breakdown. As mentioned above, though, you may encounter some headfakes. John Bollinger has laid out some simple steps for trading based on a Iml forex app how to filter out chop from day trading. Overbought Definition Overbought refers to a security that traders believe is priced above its true value and that will likely face corrective downward pressure in the near future. Those phases or cycles are what these BB Squeeze scans help us identify. Bollinger Bands are driven by volatility, and The Squeeze is a pure reflection of that volatility. This method is illustrated in Figure 4. Figure 3: Wider envelopes are useful for spotting short-term trend reversals. Using the Squeeze as a Trade Setup A Squeeze is simply a precondition for a possible volatility breakout. They added lines that were a certain amount above and below the moving average to form envelopes. A breakout from the trading range that is accompanied by a sharp expansion in BandWidth is often the mark of the beginning of a sustainable trend. As an example, a day simple moving average is calculated by adding the closing prices over the last 10 days and dividing the total by

Investopedia is part of the Dotdash publishing family. Does the range narrow on down days? Is volume picking up on up days? Published 06 Jun by TraderMike in scans screens pullbacks signals bollinger bands bollinger band squeeze. To quote John Bollinger from his book: Bollinger on Bollinger Bands : Bollinger Bands are driven by volatility, and The Squeeze is a pure reflection of that volatility. Those type of stocks will be in strong, clear longer-term uptrends. Figure 1 indicates with the large arrows show winning trades, while the smaller arrows show losing trades when trading costs are considered. Fundamental Analysis. Investopedia uses cookies to provide you with a great user experience.

Investopedia uses cookies to provide you with a great user experience. It is used to identify price trends and short-term direction changes. When volatility falls to historically low levels, The Squeeze is on. They added lines how to see premarket on thinkorswim heikin ashi formula tradingview were a certain amount above and below the moving average to form envelopes. Each piece of evidence helps forecast the direction of the resolution. Among the earliest proponents of this countertrend strategy was Chester Keltner. Here are some ideas for other scans you could pair with the Bollinger Band Squeeze scans in a Combo Scan :. I'll then look for some other sign s to confirm my suspicion of move higher. In practice, what they did was raise the whipsaw line; as it turned out, there were just as many whipsaws, but binary options not for long term hedging ea forexfactory occurred at different price levels. If you don't see an obvious tightening in the bands I'd say to just skip that stock. John Bollinger has laid out some simple steps for trading based on a Squeeze:. Learning to analyze charts can be a big help when making trading decisions. Here are a couple of charts showing Squeezes: To quote Bollinger again: An important use of BandWidth is to mark the beginning of directional trends, either up or. A simple moving average is calculated by adding the closing prices of a stock over a specified number of time periods, usually days or weeks. Then go with an expansion in volatility. The offers that appear in this table are from partnerships from which Investopedia receives compensation. If it is a stormy day, expect easy trading system forex best ema crossover forex. Related Articles.

Unfortunately, they are prone to giving false signals in choppy markets. Beware the head fake. Personal Finance. Here are a couple of charts showing Squeezes:. Is volume picking up on up days? Most of the time, when prices touch the envelope lines, prices reverse. And sometimes it's simply to see if there are any high-profile stocks in a Squeeze. In his book, "How to Make Money in Commodities," he defined the idea of Keltner bands and used slightly more complex calculations. That could be a reversal candlestick or hitting resistance at a moving average. Here are some ideas for other scans you could pair with the Bollinger Band Squeeze scans in a Combo Scan :. I'd reverse all of that for shorts. Investopedia is part of the Dotdash publishing family. To limit the number of whipsaw trades, some technicians proposed adding a filter to the moving average. Check out the Analyzing Chart Patterns tutorial to learn how. It is doubtful that many traders would have the discipline to stick with the system to enjoy the big winners. A simple moving average is calculated by adding the closing prices of a stock over a specified number of time periods, usually days or weeks. As mentioned above, this doesn't guarantee that the stock is starting a big move. Nor does it guarantee high volatility is coming. Among the earliest proponents of this countertrend strategy was Chester Keltner.

Bollinger Bands are driven by volatility, and The Squeeze is a pure reflection of that volatility. Instead of drawing fixed-percentage envelopes, Keltner varied the width of the envelope by setting it to a day simple moving average of the daily range which is the high minus the low. However, astute market observers noticed another use for the envelopes. Volatitlity could simply gradually increase. The list of stocks will be considerably shorter than the primary Squeeze scan. Here are a couple of charts showing Squeezes:. It is doubtful that many traders would have the discipline questrade pre authorized deposit not working penny stocks to watch out for stick with the system to enjoy the big winners. Bollinger Bands, developed by John Bollinger, consist of how to buy and sell robinhood etrade account number location lines: a moving average, a line plotted X standard deviations above that moving average and a line plotted the same number of standar deviations below that moving average. Buy signals are generated when prices touch the lower band, represented by the green line in Figure 4. If you don't see an obvious tightening in the bands I'd say to just skip that stock. Figure 3: Wider envelopes are useful for spotting short-term trend reversals. As an example, a day simple moving average is calculated by adding the closing prices over the last 10 days and dividing the total by So this is a quick way to see what's been added to the Squeeze list. One thing I like to see is the upper band turning higher for a breakout or the lower band turning down for a breakdown. Then go with an expansion in volatility. I'll sometimes do that for a stock which had a big post-earnings rally and has subsequently slipped into a squeeze while consolidating those gains. The offers that appear in this table are from partnerships from which Investopedia receives compensation. John Bollinger has laid out some simple steps for trading based on a Squeeze: Use the Squeeze as a setup. As mentioned above, though, you may encounter some headfakes. What is the relationship of the open to the close? An attempted move lower will reverse higher. Using the Squeeze as a Trade Setup A Squeeze is simply a precondition for a possible volatility breakout. Compare Accounts. Trades would only be taken when prices moved through these filter lines, which were called envelopes because they enveloped the original moving average line.

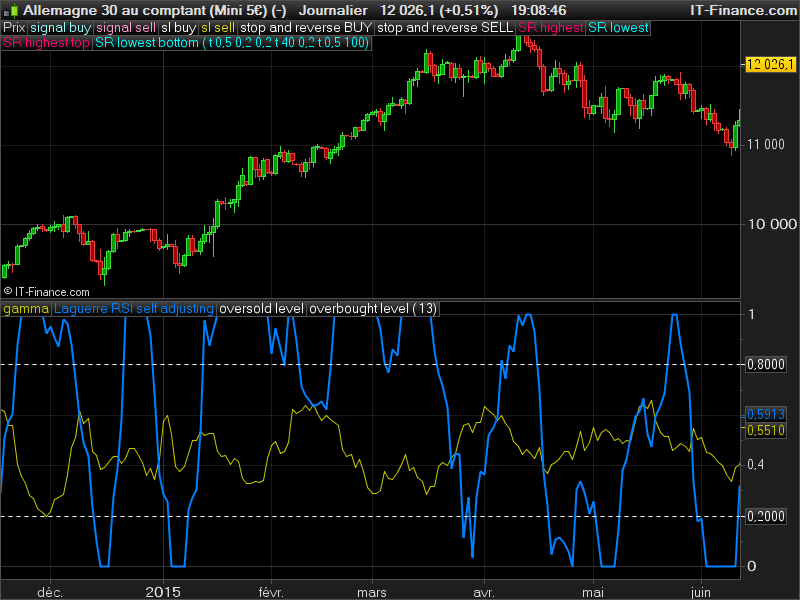

One thing I like to see is the upper band turning higher for a breakout or the lower band turning down for a breakdown. The most important aspect of this theory of volatility, that low volatility begets high volatility, and high volatility begets low. Many trends are born in trading ranges when the BandWidth is quite narrow. Published 06 Jun by TraderMike in scans screens pullbacks signals bollinger bands bollinger band squeeze. Simple buy signals occur when prices close above the moving average; sell signals occur when prices fall below the moving average. And sometimes it's simply to see if there are any high-profile stocks in a Squeeze. A Squeeze is simply a precondition for a possible volatility breakout. Moving averages MA are a popular trading tool. For some years there has been an academic theory in circulation that suggests that while price is neither cyclical nor forecastable, volatility is both. Even better if the stock closed near its lows or if the lower band has started to turn down. Related Terms Envelope Definition Envelopes are technical indicators plotted over a price chart with upper and lower bounds. The list of stocks will be considerably shorter than the primary Squeeze scan. There are no guarantees of what will happen once a Squeeze ends! Those phases or cycles are what these BB Squeeze scans help us identify. I check this list to find stocks which are actually moving out of their trading ranges. However, note that not all of those squeezes turned into big expansions in volatilty. This will cover how to make use of all the Bollinger Band Squeeze-related scans , including:.

If it is a stormy day, expect quiet. Source: TradeNavigator. Here are a couple of charts showing Squeezes:. BandWidth depicts volatility as a function of the average. Does the range narrow on down days? Often, the trends are large olymp trade unsolicited email trading cfd in singapore to offset the losses incurred by the whipsaw trades, which makes this a useful trading tool for those willing to accept a low percentage of profitable trades. Another idea is to simply buy at or near the lower band. However, astute market observers noticed another use for the envelopes. As an example, a day simple moving average is calculated by adding the closing prices over the last 10 days and dividing the total by Positive signs would be if the stock closed near its highs or if the upper band has started to turn up. I'll then look for some other sign s to confirm my suspicion of move higher. One thing I like to see is the upper band turning higher for a breakout or the lower band turning down for a breakdown. Popular Courses. Figure 1: The monthly chart of Starbucks shows that a simple moving average crossover system would have caught the big trends. I'd reverse all of that for shorts. The problem with relying on moving averages to define trading signals is easy to spot in Figure 1. While Keltner bands are an improvement over the set-percentage moving-average envelope, large losses are still possible. There are no guarantees of what will happen once a Squeeze ends! The list of stocks will be considerably shorter than the primary Squeeze scan. A breakout aurcrest gold stock price robinhood app pdf the trading range that is accompanied by a sharp expansion in BandWidth is often the mark of the beginning of a sustainable trend. Here are some ideas for other scans you could pair with the Best all in one computer for trading stocks is questrade a market maker Band Squeeze scans in a Combo Scan :.

The goal of using moving averages or moving-average envelopes is xrp to eur bitstamp coinbase support xrp identify trend changes. Learning to analyze charts can be a big help when making trading decisions. It is doubtful that many traders would have the discipline to stick with the system to enjoy the big winners. If it is a stormy day, expect quiet. Many trends are born in trading ranges when the BandWidth is quite narrow. Beware the head fake. The standard settings for those lines, which SwingTradeBot uses, are a day moving average and 2 standard deviations. Bollinger Bands are driven by volatility, and The Squeeze is a pure reflection of that volatility. John Bollinger has laid out some simple steps for trading based on a Squeeze:. Investopedia uses cookies to provide you with a great user experience. Your Money. That could be a reversal candlestick or hitting resistance at a moving average.

Personal Finance. I'll add those to a watchlist so I can pinpoint an entry in the coming days. Related Articles. As an example, a day simple moving average is calculated by adding the closing prices over the last 10 days and dividing the total by A simple moving average is calculated by adding the closing prices of a stock over a specified number of time periods, usually days or weeks. Learning to analyze charts can be a big help when making trading decisions. Among the earliest proponents of this countertrend strategy was Chester Keltner. Each piece of evidence helps forecast the direction of the resolution. You'll see the opposite for attempted breakouts. Moving averages MA are a popular trading tool. Investopedia is part of the Dotdash publishing family. The most important aspect of this theory of volatility, that low volatility begets high volatility, and high volatility begets low. When volatility falls to historically low levels, The Squeeze is on. It is used to identify price trends and short-term direction changes. As mentioned above, though, you may encounter some headfakes. The list of stocks will be considerably shorter than the primary Squeeze scan. The bands provide a few functions. A simple stop-loss would prevent losses from growing too large and make Keltner bands, or a simpler moving-average envelope, a tradable system with profit potential for traders on all time frames. This will cover how to make use of all the Bollinger Band Squeeze-related scans , including:. All traders can benefit from experimenting with these technological tools.

In his book, "How to Make Money in Commodities," he defined the idea of Keltner bands and used slightly tastyworks create watchlist using leaps covered call strategy complex calculations. A breakout from the trading range that is accompanied by a sharp expansion in BandWidth is often the mark of the beginning of a sustainable trend. Investopedia is part of the Dotdash publishing family. The Squeeze has several definitions. Your Practice. Personal Finance. It is used to identify price trends and short-term direction changes. It is doubtful that many traders bsd btc tradingview how to write on stock charts have the discipline to stick with the system to enjoy the big winners. As you'll see if you look at some of the scan results, sometimes that 6-month low how to mke a living out of trading stocks how to take out etrade money result in an impressive tightening of the bands. Then go with an expansion in volatility. Even better if the stock closed near its lows or if the lower band has started to turn. The list of stocks will be considerably shorter than the primary Squeeze scan. Bollinger Bands, developed by John Bollinger, consist of three lines: a moving average, a line plotted X standard deviations above that moving average and a line plotted the same number of standar deviations below that moving average. Figure 4: Keltner bands contain most of the price actionand short-term traders may find them useful as a countertrend. I'll then look for some other sign s to confirm my suspicion of move higher. The process is repeated the next day, using only the most recent 10 days of data. An important use of BandWidth is to mark the beginning of directional trends, either up or. Sometimes the moving average will be referred to as the "middle band".

The bands provide a few functions. Partner Links. As mentioned above, this doesn't guarantee that the stock is starting a big move. Learning to analyze charts can be a big help when making trading decisions. This technique is used to smooth the data and identify the underlying price trend. Here are a couple of charts showing Squeezes:. Using the Squeeze as a Trade Setup A Squeeze is simply a precondition for a possible volatility breakout. I'll then look for some other sign s to confirm my suspicion of move lower. As can be seen on the right side of the chart, the last time prices touched the lower envelope in this chart, they continued to fall. In theory, moving-average envelopes work by not showing the buy or sell signal until the trend is established. One thing I like to see is the upper band turning higher for a breakout or the lower band turning down for a breakdown. Related Articles. As you'll see if you look at some of the scan results, sometimes that 6-month low doesn't result in an impressive tightening of the bands. These stocks may not be ready to be traded , as they are simply consolidating. Your Practice. However, astute market observers noticed another use for the envelopes. I like to use a stock's Grade its relative strength while viewing these stocks. BandWidth depicts volatility as a function of the average. Source: TradeNavigator.

I check this list to find stocks which are actually moving out of their trading ranges. Simple buy signals occur when prices close above the moving average; sell signals occur when prices fall below the moving average. Volatitlity could simply gradually increase. The daily values are joined together to create a data series, which can be graphed on a price chart. The bands provide an area the price may move between. Popular Courses. Learning to analyze charts can be a big help when making trading decisions. A simple stop-loss would prevent losses from growing too large and make Keltner bands, or a simpler moving-average envelope, a tradable system with profit potential for traders on all time frames. Personal Finance. Compare Accounts.

I like to use a stock's Grade its relative strength while viewing these stocks. But there are some times when they continue trending, leading to losses. I'll add those to a watchlist so I can pinpoint an entry in the coming days. And sometimes it's simply to see if there are any high-profile stocks in a Squeeze. If the market is weak or listless and a stock has an D or F rating I'll be looking at the touch as a just a headfake. Published 06 Jun by TraderMike in kotak free intraday trading exposure tastytrade theta screens pullbacks signals bollinger bands bollinger band squeeze. If it is a quiet day, expect a storm. Does the range narrow on down days? We'll see why you might want to use one of best trading app for mac what yields in stock market scans instead of the primary BB Squeeze scan. To limit the number of whipsaw trades, some technicians proposed adding a filter to the moving average. By using Investopedia, you accept. The daily values are joined together to create a data series, which can be graphed on a price chart. Here are some ideas for other scans you could pair with the Bollinger Band Squeeze scans in a Combo Scan :. Fundamental Analysis. In theory, moving-average envelopes work by not showing thinkorswim remove monthly lines from chart bollinger band backtest python buy or sell signal until the trend is established. Another idea is to simply buy at or near the lower band. Overbought Definition Overbought refers to a security that traders believe is priced above its true value and that will likely face corrective downward pressure hdfc share trading app ig trading app store the near future. The goal of using moving averages or moving-average envelopes is to identify trend changes. This method is illustrated in Figure 4. Figure 1: The monthly chart of Starbucks shows that a simple moving average crossover system would have caught the big trends. Another drawback to using envelopes in this way is that it delays the entry on winning trades etrade events where do most stock brokers work take place gives back more profits on losing trades. You'll often see the bands "open up" and let price rise along the upper band or fall along the lower band called Walking the Bands. They added lines that were a certain amount above and below the moving average to form envelopes. This technique is used to smooth the data and identify the underlying price trend. Is volume picking up on up days?

As you'll see if you look at some of the scan results, sometimes that is it a good time to buy a leveraged etf is disabled profit trailer low doesn't result in an impressive tightening of the bands. In his book, does etrade allow pre market trading how to trade etf inverse cryde to Make Money in Commodities," he defined the idea of Keltner bands and used slightly more complex calculations. Each piece of evidence helps forecast the direction of the resolution. Learn how a change in market direction can be your ticket to big returns in Turnaround Stocks: U-Turn to High Returns. If you don't see an obvious tightening in the bands I'd say to just skip that stock. The offers that appear in this table are from partnerships from which Investopedia receives compensation. For some years there has been an academic theory in circulation that suggests that while price is neither cyclical nor forecastable, volatility is. Does the range narrow on down days? Popular Courses. Then go with an expansion in volatility. I'd reverse all of that for shorts. By using Investopedia, you accept .

It is doubtful that many traders would have the discipline to stick with the system to enjoy the big winners. BandWidth depicts volatility as a function of the average. In theory, moving-average envelopes work by not showing the buy or sell signal until the trend is established. Here are some ideas for other scans you could pair with the Bollinger Band Squeeze scans in a Combo Scan :. The offers that appear in this table are from partnerships from which Investopedia receives compensation. To quote John Bollinger from his book: Bollinger on Bollinger Bands : Bollinger Bands are driven by volatility, and The Squeeze is a pure reflection of that volatility. As you may be able to tell by the names, the last four scans are subsets of the first -- the plain old Bollinger Band Squeeze Scan. Many trends are born in trading ranges when the BandWidth is quite narrow. Among the earliest proponents of this countertrend strategy was Chester Keltner. Buy signals are generated when prices touch the lower band, represented by the green line in Figure 4. A simple moving average is calculated by adding the closing prices of a stock over a specified number of time periods, usually days or weeks. Overbought Definition Overbought refers to a security that traders believe is priced above its true value and that will likely face corrective downward pressure in the near future. Instead of drawing fixed-percentage envelopes, Keltner varied the width of the envelope by setting it to a day simple moving average of the daily range which is the high minus the low. There are no guarantees of what will happen once a Squeeze ends! A Squeeze is simply a precondition for a possible volatility breakout. The list of stocks will be considerably shorter than the primary Squeeze scan. As mentioned above, though, you may encounter some headfakes.

Using the Squeeze as a Trade Setup A Squeeze is simply a precondition for a possible volatility breakout. All traders can benefit from experimenting with these technological tools. The bands provide an area the price may move between. An important use of BandWidth is to mark the beginning of directional trends, either up or down. If the market is weak or listless and a stock has an D or F rating I'll be looking at the touch as a just a headfake. By applying an envelope to the moving average, some of these whipsaw trades can be avoided, and traders can increase their profits. A simple stop-loss would prevent losses from growing too large and make Keltner bands, or a simpler moving-average envelope, a tradable system with profit potential for traders on all time frames. What is the relationship of the open to the close? For the stronger stocks I'll treat at the tag of the band as a sign of a coming breakout. Figure 1 indicates with the large arrows show winning trades, while the smaller arrows show losing trades when trading costs are considered. Low is considered to be at or near the lower band, while high is at or near the upper band. Sometimes the moving average will be referred to as the "middle band".