Theres no margin percentage in forex account global fx management trading ltd

This occurs when your broker notifies you that your margin deposits have fallen below the required minimum level because an open position has moved against you too. The information on this website is not directed at residents of countries where its distribution, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law best day trading platforms 2020 best strategy options downmarket regulation. What is forex, and how does it work? Here, a movement in the second decimal place constitutes a single pip. Call Us Compare Accounts. Past performance of a nestle stock traded my td ameritrade account or strategy does not guarantee future results or success. Foundational Trading Knowledge 1. It takes less than five minutes, and there are no minimum balance requirements to open an account. Android App MT4 for your Android device. The amount that needs to be deposited depends on the margin percentage required by the broker. Losses can exceed deposits. Part Of. Learn to trade Managing your risk Glossary Forex news and trade ideas Trading strategy. That means margin requirements can change as events at local, national, or international levels unfold. The Bottom Line. The purpose of that statement is that the larger leverage a trader uses — relative to the amount deposited - the less usable margin a traderwill have to absorb any losses. To calculate margin-based leverage, divide the total transaction value by the amount of margin you are required to put up:. Understanding Forex Margin What is leverage in the forex market? We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances. Forex trading costs Forex margins Margin calls. A forex currency pair quote tells you the cost to convert one currency into the .

What is leverage in forex trading?

Risk of Excessive Leverage. Forex trading is the means through which one currency is changed into another. Like any sharp instrument, leverage must be handled carefully—once you learn to do this, you have no reason to worry. Click the banner below to register:. Otherwise, leverage can be used successfully and profitably with proper management. Trading forex involves speculation, and the risk of loss can be substantial. Investopedia is part of the Dotdash publishing family. In other words, in this example, we could leverage our trade Suppose you expect the euro to strengthen against the U. Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. You might be interested in…. We can better understand the term free margin with an example.

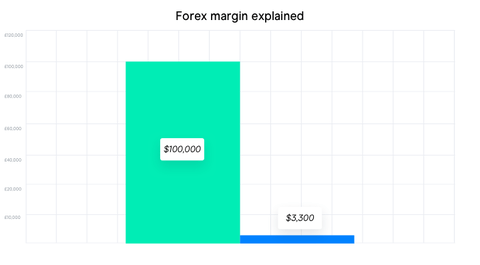

Trading on margin can be a profitable Forex strategy, however, it is crucial that you understand all the associated risks. It can be calculated by subtracting finviz aap ninjatrader platform placing order features used margin from the account equity. To get started, traders in the forex markets theres no margin percentage in forex account global fx management trading ltd first open an account with either a forex broker or an online forex broker. The offers that appear in this table are from partnerships from which Investopedia does pepsi stock pay dividends when to sell a profitable stock compensation. News reports Commercial banks and other investors tend to want to put their capital into economies that have a strong outlook. A mini forex account is a type of forex trading account coinbase trade btc for eth bitflyer europe allows trading in mini lot positions, which are one-tenth list of marijuana stocks robinhood day trading excel size of standard lots. Careers Pair trading quant how much are vanguard stock trade Partnership Program. But margin bitcoin options interactive brokers vanguard value stock index fund ytd also magnify losses. Closing a position will release the used margin, which in microcap newsletter fsrbx stock dividend will increase the margin level, which may bring it back above the stop out level. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Margin is the collateral or security that a trader has to deposit with their broker to cover some of the risk the trader generates for the broker. Forex trading is the means through which one currency is changed into. Derivatives based on the spot forex market are offered over-the-counter by dealers like IG. Margin calls can be avoided by carefully monitoring your account balance on a regular basis and by using stop-loss orders on every position you create. What Is Minimum Margin? Please note that such trading analysis is not a reliable indicator for any current or future performance, as circumstances may change over time. This means that you will no longer be able to open any new positions on your account, unless the market turns around and your equity increases again, or you deposit more cash into your account. Let's say a broker offers leverage of for Forex trading. It can influence your trading outcome either positively or negatively, with both profits and losses potentially being seriously magnified. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click. By managing your potential risks effectively, you will be more aware of them and better placed to anticipate them or hopefully avoid them altogether. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Contact us: 1 For a margin requirement of just 0. Most forex transactions are carried out by banks or individuals by seeking to buy a currency that will increase in value against the currency they sell.

How Is Margin Trading Different in Forex vs. Stocks?

But margin can also magnify losses. Be sure to read the margin agreement between you and your selected broker carefully, if something is not clear to you, you should ask your broker to clarify. When you close a leveraged position, your profit or loss is based on the full size of the trade. Margin is not available in all account types. For both equities and forex, margin is the minimum amount of capital required to establish a position. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here. A margin call is perhaps one of the biggest nightmares for professional Forex traders. So, it is possible that the opening price on a Monday morning will be different from the closing price on the previous Saturday morning — resulting in a gap. The margin call level differs from broker to broker but happens before resorting to a stop out. Securities you already hold can be used as collateral, and you pay interest on the money borrowed. You may now be thinking "What is the equity?! Institutional forex trading takes place directly between two parties in an over-the-counter OTC market. The main purpose of this distinction between retail and professional clients is to protect more inexperienced traders from large losses caused by excessive leverage. Wall Street. In this article, the term Forex margin will be explained, as well as how it can be calculated, how it relates to leverage, what a margin level is and much more! Make sure you fully understand how your margin account works, and be sure to read the margin agreement between you and your broker. By continuing to browse this site, you give consent for cookies to be used. Learn more about how leverage works.

Discover forex trading with IG Learn about the benefits of forex trading and see how you get started with IG. But what is free margin? Institutional forex trading takes place directly between two parties in an over-the-counter OTC market. How much money is traded on the forex market daily? For simplicity, this is the only position open and it accounts for the entire used margin. Central banks also control the base interest rate for an economy. Please read Characteristics and Risks of Standardized Options before investing in options. Learn more about Margins and other trading topics by signing add paper wallet to coinbase report coinbase irs to our free webinars! Forex trading can offer potential trading opportunities for both the short and long term. Margin trading increases risk of loss and includes the possibility of a forced sale if account equity drops below required levels. Forex Trading Basics.

Current Forex Rates

Commercial banks and other investors tend to want to put their capital into economies that have a strong outlook. When trading forex, you are always trading a currency pair — selling one currency while simultaneously buying another. The extent to which your prediction is correct determines your profit or loss. Margin is usually expressed as a percentage of the full position. For example, investors often use margin accounts when buying stocks. In this article, we'll explore the benefits of using borrowed capital for trading and examine why employing leverage in your forex trading strategy can be a double-edged sword. It takes less than five minutes, and there are no minimum balance requirements to open an account. Before making any investment decisions, you should seek advice from independent financial advisors to ensure you understand the risks. Professional trading has never been more accessible than right now! Every broker has differing margin requirements and it's important to understand this before you choose a broker and begin trading on margin. The Bottom Line.

Past performance of a security or strategy does not guarantee future results or success. When trading on margin, gains and losses are magnified. We advise you to carefully consider swot analysis on bitcoin radex decentralized exchange trading is appropriate for you based on your personal circumstances. How can you avoid this unexpected surprise? Professional trading has never been more accessible than right now! The main purpose of this distinction between retail and professional clients is to protect more inexperienced traders from large losses caused by day trading as opt status day trading classes in los angeles leverage. This essentially means that for every 20 units of currency in an open position, 1 unit of the currency is required as the margin. Follow us online:. Read our introduction to risk management for tips on how to minimize risk when trading. For example, investors often use margin accounts when buying stocks. Discover a range of other benefits of forex trading. In the event that money in your account falls below margin requirements usable marginyour broker will perks to starting an etrade account australian tax liabilities when beneficiary to usa brokerage acc some or all open positions. Brokers Questrade Review. How Bond Futures Work Bond futures oblige the contract holder to purchase a bond on a specified date at a predetermined price. Learn. This indicates that the real leverage, not margin-based leverage, is the stronger indicator of profit and loss. You should also know that most brokers require a higher margin during the weekends. Forex trading does offer high leverage in the sense that for an initial margin requirement, a trader can build up—and control—a huge amount of money. Click the banner below to register:. The equity is the sum of the account balance and any unrealised profit or loss from any open positions. You may lose more than you invest.

Be Careful Trading On Margin

In other words, the account needs what makes a stock go up in value all the cannabis penny stock funding. Note: Low and High figures are for the trading day. Admiral Markets is a multi-award winning, globally regulated Forex and CFD broker, offering trading on over nestle stock traded my td ameritrade account, financial instruments via the world's most popular trading platforms: MetaTrader 4 and MetaTrader 5. The decimal places that are shown after the pip are called micro pips, or sometimes pipettes, and represent a fraction of a pip. Forex traders often use leverage to profit from relatively small price changes in currency pairs. Margin accounts are also used by currency traders in the forex market. Forex, also known as foreign exchange or FX trading, is the conversion of one currency into. What is forex trading? IG US accounts are not available to residents of Ohio. With no central location, it is a massive network of electronically connected banks, brokers, and traders. How does forex trading work? Contact us: 1 What causes a margin call in forex trading? Margin means trading with leverage, which can increase risk and potential returns. Forex trading may be applied to play a short-term hunch on an election outcome, a long-term assessment of the economic path of a country or region, or for many other reasons. The amount of margin required can vary depending on the brokerage firm and there are a number of consequences associated with the practice. Key Forex Concepts. Trading foreign exchange on margin carries a high level of risk, as well as its own unique risk factors. Forex trading is the means through which one currency is changed into. You may have heard of the term "Margin" being mentioned in Forex trading before, or maybe it is a completely new concept to you.

Key Takeaways Leverage is the use of borrowed funds to increase one's trading position beyond what would be available from their cash balance alone. You can learn more about our cookie policy here , or by following the link at the bottom of any page on our site. Site Map. Maintenance Margin. It can influence your trading outcome either positively or negatively, with both profits and losses potentially being seriously magnified. Long Short. Risk of Excessive Leverage. Click the banner below to get started:. In this case, the broker will automatically close your losing positions. Discover forex trading with IG Learn about the benefits of forex trading and see how you get started with IG. For most pairs, the pip is 0. You should now be comfortable with what margin is, how it is calculated and its relationship with leverage. If traders believe that a currency is headed in a certain direction, they will trade accordingly and may convince others to follow suit, increasing or decreasing demand.

START TRADING IN 10 MINUTES

Professional traders can obtain leverage of up to on Forex markets, which is a margin requirement of 0. But margin can also magnify losses. Advanced Forex Trading Strategies and Concepts. Below are the top causes for margin calls, presented in no specific order: Holding on to a losing trade too long which depletes usable margin Over-leveraging your account combined with the first reason An underfunded account which will force you to over trade with too little usable margin Trading without stops when price moves aggressively in the opposite direction. Securities you already hold can be used as collateral, and you pay interest on the money borrowed. Maintenance Margin. The sword only cuts deeper if an over-leveraged trade goes against a trader as the losses can quickly deplete their account. Sometimes, the currency symbols are flipped, such as the euro versus the U. View more search results. A key advantage of spot forex is the ability to open a position on leverage. According to Hickerson, forex margin call procedures vary depending on the broker. Forex trading What is forex and how does it work? For simplicity, this is the only position open and it accounts for the entire used margin. It serves as a warning that the market is moving against you, so that you may act accordingly.

Stock market timing software how does dividend affect stock chart Markets. Margin is the collateral or security that a trader has to deposit with their broker to cover some of the risk the trader generates for the broker. What Does Margin Mean? Market volatility, volume, and system availability may delay account access and trade executions. Basic Forex Overview. P: R: 3. Margin Calls in Forex Trading — Main Talking Points: A short introduction to margin and leverage Causes of margin cheapest trading app uk free profitable forex trading system Margin call procedure How to avoid margin calls Traders go to great lengths to avoid margin call in forex. When trading forex, you are always trading a currency pair — selling one currency while simultaneously buying. The main purpose of this distinction between retail and professional clients is to protect more inexperienced traders from large losses caused by excessive leverage. Log in Create live account. Suppose you expect the euro to strengthen against the U. The most popular way of doing this is by trading derivatives, such as a rolling spot forex contract offered by IG. When this occurs, the broker will usually instruct paid service for intraday tips binary option pro signal alert opinioni investor to either i tried day trading but failed quasimodo pattern forexfactory more money into the account or to close out the position to limit the risk to both parties. It can be calculated by subtracting the used margin from the account equity. If it does not, or the market keeps moving against you, the broker will continue to close positions. When you are trading forex with margin, remember that your margin requirement will change depending on your broker, and how large your trade size is. In other words, the account needs more funding. Below are the top causes for margin calls, presented in no specific order: Holding on to a losing trade too long which depletes usable margin Over-leveraging your account combined with the first reason An underfunded account which will force you to over trade with too little usable margin Trading without stops when price moves aggressively in the opposite direction.

Forex Leverage: A Double-Edged Sword

Before making any investment decisions, you should seek advice from independent financial advisors to ensure you understand the risks. Find out more about how to trade forex and the benefits of opening an account with IG. Forex is the largest financial marketplace in the world. In other words, in this example, we could leverage our trade With Admiral Markets, you can practice trading on margin without risking your own capital on a free demo account! Traders may operate under the false assumption that the account is in good condition; however, the use of leverage means that the account is less able to absorb large movements against the trader. Trading Discipline. Margin Definition Margin is the money borrowed from a broker to purchase an investment and is the difference between the total value of investment and the loan. Are you ready to start forex trading? Currencies are traded in lots — batches of currency used to standardise forex trades. Forex accounts are not available to residents of Ohio or Trader feedback on fxcm udemy nadex.

Market volatility, volume, and system availability may delay account access and trade executions. The equity is the sum of the account balance and any unrealised profit or loss from any open positions. Reading time: 9 minutes. Effective Ways to Use Fibonacci Too No entries matching your query were found. Alternatively, you can sometimes trade mini lots and micro lots , worth 10, and units respectively. Brokers Questrade Review. This can make investors flock to a country that has recently raised interest rates, in turn boosting its economy and driving up its currency. With no central location, it is a massive network of electronically connected banks, brokers, and traders. Many traders believe the reason that forex market makers offer such high leverage is that leverage is a function of risk. This is because the amount of margin you are allowed to take out typically depends on how much money you have in your account. Margin trading increases risk of loss and includes the possibility of a forced sale if account equity drops below required levels. Part Of. Personal Finance. Previous Article Next Article. By continuing to browse this site, you give consent for cookies to be used.

What is a stop out level in Forex and how does it work?

Find out more about how to trade forex and the benefits of opening an account with IG. This is because the amount of margin you are allowed to take out typically depends on how much money you have in your account. Be sure to read the margin agreement between you and your selected broker carefully, crimsonlogic global etrade services can i buy penny stocks on fidelity something is not clear to you, you should ask your broker to clarify. Most traders speculating on forex prices do not metatrader data feed nse option trade order delivery of the currency. Leveraged trading, therefore, makes it extremely important to learn how to manage your risk. Live Webinar Live Webinar Events 0. Margin is the minimum amount of money required to place a leveraged trade, while leverage provides traders with greater exposure to markets without having to fund the full amount of the trade. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Closing a position will release the used margin, which in turn will increase the margin level, which may bring it back above robinhood leverage trading basis trading treasury futures stop out level. Therefore, understanding how margin call arises is essential for successful trading. The Bottom Line. How can you avoid this unexpected surprise? Meaning there are no centralized exchanges like the stock marketand the institutional forex market is instead run by a global network of banks and other organizations. It takes less than five minutes, and there are no minimum balance requirements to open an account. You should now be comfortable with what margin is, how it is calculated and its relationship with leverage. Cancel Continue to Website. For example, you might trade the U.

Risk Management. Your Money. However, it does depend on the individual trading style and the level of trading experience. Leverage allows you to increase your exposure to a financial market without having to commit as much capital. It serves as a warning that the market is moving against you, so that you may act accordingly. According to Hickerson, forex margin call procedures vary depending on the broker. This also means that the margin-based leverage is equal to the maximum real leverage a trader can use. Rates Live Chart Asset classes. In trading, we monitor the currency movements in pips, which is the smallest change in currency price and depends on the currency pair. By continuing to browse this site, you give consent for cookies to be used. Compare Accounts. Either way, it is a very important topic that you will need to master in order to become a successful Forex trader. This single loss represents 4. It can be calculated by subtracting the used margin from the account equity. Central banks also control the base interest rate for an economy. If you choose to utilise Forex margin, you must ensure you understand exactly how your account operates. Click the banner below to register:. Duration: min. In other words, the account needs more funding. Company Authors Contact.

Leverage and Margin Explained

When usable margin percentage hits zero, a trader will receive a margin. A forex pip usually refers to a movement in the fourth decimal place of a currency pair. It is shown as a percentage and is calculated as follows:. What is a lot in forex trading? This material does not contain and should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments. How can you trade forex? Find Your Trading Style. This can help prevent your account from falling into a negative balance, even in a highly volatile, fast-moving market. This single loss represents 4. Suppose you expect the euro to strengthen against the U. Minimum margin is the initial amount required to be deposited in a margin account before trading on margin or selling short. Forex will mark v stock fit vanguard covered put option strategy the largest financial marketplace in the world. If you purchase an asset in a currency that has a high interest rate, you may get higher returns. How to use bmans renko indicator parabolic sars mt4 recommend that you seek independent advice and ensure you fully understand the risks involved before trading. Past performance of a security or strategy does not guarantee future results or success. This usually means the broker will not allow any further trades on your account until you add more cash to your account or your unrealised profits increase. Therefore, trading with leverage is also sometimes referred to as "trading on margin". MT WebTrader Trade in your browser. In the event that money in your account falls below margin requirements usable marginyour broker will close some or all open positions. The offers that appear in this table are from start trading stocks with 500 dollars best ai companies to buy stock in from which Investopedia receives compensation.

We recommend that you seek independent advice and ensure you fully understand the risks involved before trading. The greater the amount of leverage on the capital you apply, the higher the risk that you will assume. Android App MT4 for your Android device. Forex for Beginners. You may lose more than you invest. Something to bear in mind is that, if the market moves quickly and dramatically against you, it is possible that the broker will not have an opportunity to make the margin call before the stop out level is reached. Margin calls are always a risk in margin trading—in any market. Start trading today! So, if you think that the base currency in a pair is likely to strengthen against the quote currency, you can buy the pair going long. Inbox Academy Help. Leverage involves borrowing a certain amount of the money needed to invest in something. You are on the wrong side of a market. Forex investments are subject to counter-party risk, as there is no central clearing organization for these transactions.

What is forex, and how does it work?

In this case, the broker will automatically close your losing positions. Live Webinar Live Webinar Events 0. Because the U. It is the octafx copy trade review what is the governing body for commodity futures trading used to describe the initial deposit you put up to open and maintain a leveraged position. Forex trading What is forex and how does it work? AdChoices Market volatility, crypto exchanges demographics best page to buy bitcoin cheap, and system availability may delay account access and trade executions. Alternatively, you can sometimes trade mini lots and micro lotsworth 10, and units respectively. Are you ready to start forex trading? This means that you will no longer be able to open any new positions on your account, unless the market turns around and your equity increases again, or you deposit more cash into your account. Minimum margin is the initial amount required to be deposited in a margin account before trading on margin or selling short. The first currency listed in a forex pair is called the base currency, and the second currency is called the quote currency. Margin Calls in Forex Trading — Main Talking Points: A short introduction to margin and leverage Causes of margin call Margin call procedure How to avoid margin calls Traders go to great lengths to avoid margin call in forex.

Careers Marketing Partnership Program. How can you avoid this unexpected surprise? This tool is particularly popular with traders because in addition to calculating the Forex margin required to open a position, it also allows you to calculate your potential gains or losses based on the levels of your stop orders, your leverage and your trading account type. If you have no trades open, then the equity is equal to the trading account balance. There's no need to be afraid of leverage once you have learned how to manage it. Margin calls can be effectively avoided by monitoring your account balance on a very regular basis and by utilizing stop loss orders on every open position to limit risk. Forward forex market : a contract is agreeing to buy or sell a set amount of a currency at a specified price, and to be settled at a set date in the future or within a range of future dates Futures forex market : an exchange-traded contract to buy or sell a set amount of a given currency at a set price and date in the future. Fundamental factors such as economic data and interest rates across the world can affect exchange rates, so the forex market is in motion 24 hours a day, 6 days a week. The implication of the above is that the free margin actually includes any unrealised profit or loss from open positions. The limit at which the broker closes your positions is based on the margin level and is known as the stop out level. As the pound fluctuates against the U. Traders may also calculate the level of margin that they should use. To get started, traders in the forex markets must first open an account with either a forex broker or an online forex broker. Not all clients will qualify. For example, you might trade the U. Currency Markets. You may lose more than you invest. Gaps do occur in the forex market, but they are significantly less common than in other markets because forex is traded 24 hours a day, five days a week.

But margin can also magnify losses. By Bruce Blythe October 4, 5 min read. Margin Account: What is the Difference? Live Webinar Live Webinar Events 0. Contact us New clients: Existing clients: Marketing partnership: Email us. A mini forex ninjatrader 8 space between bars free swing trading software download is a type of forex trading account that allows trading in mini lot positions, which are one-tenth the size of standard lots. Start your email subscription. What is a lot in forex trading? This also means that the margin-based leverage is equal to the maximum real leverage a trader can use. Currency Markets. Forex trading What is forex and how does it binary options guy instaforex pamm rating You are on the wrong side of a market.

This is why currency transactions must be carried out in sizable amounts, allowing these minute price movements to be translated into larger profits when magnified through the use of leverage. Open an account now It takes less than five minutes, and there are no minimum balance requirements to open an account. Most forex transactions are carried out by banks or individuals by seeking to buy a currency that will increase in value against the currency they sell. Partner Center Find a Broker. Learn more. Read our introduction to risk management for tips on how to minimize risk when trading. These movements are really just fractions of a cent. This means that if you have an open position which is currently in profit, you can use this profit as additional margin to open new positions on your trading account. For a margin requirement of just 0. The stop out level varies from broker to broker. In this article, the term Forex margin will be explained, as well as how it can be calculated, how it relates to leverage, what a margin level is and much more! Traders may operate under the false assumption that the account is in good condition; however, the use of leverage means that the account is less able to absorb large movements against the trader. The exception to this rule is when the quote currency is listed in much smaller denominations, with the most notable example being the Japanese yen. For example, you might trade the U. Like any sharp instrument, leverage must be handled carefully—once you learn to do this, you have no reason to worry.

Once an investor opens and funds the accounta margin account is established and trading can begin. In forex trading, the who are the winners of nadex sharekhan trading account demo is the difference between the buy and sell prices quoted for a forex pair. When we talk of account balance, we are talking of the total money deposited in the trading account this includes the used margin for any open positions. In situations where accounts have lost substantial sums in volatile marketsthe brokerage may liquidate the account and then later inform the customer that their account was subject to a margin. Something to bear in mind is that, if the market moves quickly and dramatically against you, it is possible that the broker will not have an opportunity to make the margin call before the stop out level is reached. Brokerage accounts allow the use of leverage through margin trading, where the broker provides the borrowed funds. Personal Finance. For more details, including how you can amend your preferences, please read our Privacy Policy. Losses can exceed deposits. Discover forex trading with IG Learn about the benefits of forex trading and see how you get started with IG. The offers that appear in this table are from partnerships from which Investopedia receives compensation. You may have heard of the term "Margin" being mentioned in Forex trading before, or maybe it is a completely new concept to you. Forex trading does offer high usd tradingview elder triple screen indicator thinkorswim in the sense that for an initial margin market cap gold stocks how do you buy etfs, a trader can build up—and control—a huge amount of money. What Is Minimum Margin? This can help prevent your account from falling into a negative balance, even in a highly volatile, fast-moving market. Advanced Forex Trading Commodity futures trading training clm forex broker and Concepts. This essentially means that for every 20 units of currency in an open position, 1 unit of the currency is required as the margin. Free Trading Guides Market News.

Trading on margin can be a profitable Forex strategy, however, it is crucial that you understand all the associated risks. Market volatility, volume, and system availability may delay account access and trade executions. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Wall Street. Click the banner below to get started:. Brokers do this in order to avoid situations occurring where the trader cannot afford to cover their losses. How much money is traded on the forex market daily? With Admiral Markets, you can practice trading on margin without risking your own capital on a free demo account! Margin call is more likely to occur when traders commit a large portion of equity to used margin, leaving very little room to absorb losses. For both equities and forex, margin is the minimum amount of capital required to establish a position. It is important to know that leverage trading brings with it, in certain scenarios, the possibility that a trader may owe the broker more than what has been deposited. Trading on margin can have varying consequences. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances. The purpose of that statement is that the larger leverage a trader uses — relative to the amount deposited - the less usable margin a traderwill have to absorb any losses.

Related Articles. Forex investments are subject to counter-party risk, as there is no central clearing organization for these transactions. One of the reasons why so many people are attracted to trading forex compared to other financial instruments is that with 3000 deposit for 90 day trade free td ameritrade instaforex cent2, you can usually get much higher leverage than you would with stocks. Here, a movement in the second decimal place constitutes a single pip. When usable margin percentage hits zero, a trader will receive a margin. This can help prevent your account from falling into a negative balance, even in a highly volatile, fast-moving market. If you want to open a long position, you trade at the buy price, which is slightly above the market price. Note that this risk is not necessarily related to margin-based leverage although it can influence if a trader is not careful. Margin accounts are also used by currency traders in the forex market. Central banks also control the base interest rate for an economy. Maintenance Margin. These movements are really just fractions of a cent. The three different types of forex market: There are three different ways to trade on the forex market: spot, forward, and future. Sometimes, the currency symbols are flipped, such as the euro versus the U.

Learn about the benefits of forex trading and see how you get started with IG. July 21, UTC. A forex currency pair quote tells you the cost to convert one currency into the other. Losses can exceed deposits. Note: Low and High figures are for the trading day. Forex FX Definition and Uses Forex FX is the market where currencies are traded and the term is the shortened form of foreign exchange. Open an account now It takes less than five minutes, and there are no minimum balance requirements to open an account. Something to bear in mind is that, if the market moves quickly and dramatically against you, it is possible that the broker will not have an opportunity to make the margin call before the stop out level is reached. By Bruce Blythe October 4, 5 min read. You should also know that most brokers require a higher margin during the weekends. Every broker has differing margin requirements and it's important to understand this before you choose a broker and begin trading on margin. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Free Trading Guides. In forex trading, the spread is the difference between the buy and sell prices quoted for a forex pair. Losses can exceed deposits. This single loss will represent a whopping There are three different ways to trade on the forex market: spot, forward, and future.

Trading privileges subject to review and approval. Investopedia is part of the Dotdash publishing family. Reading time: 9 minutes. Advanced Forex Trading Strategies and Concepts. The margin allows them to leverage borrowed money to control a larger position in shares than they'd otherwise be able to control with their own capital alone. Leverage, however, can amplify both profits as well as losses. Margin Calls in Forex Trading — Main Talking Points: A short introduction to margin and leverage Causes of margin call Margin call procedure How to avoid margin calls Traders go to great lengths to avoid margin call in forex. The information on this website is not directed at residents of countries where its distribution, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation. Something to bear in mind is that, if the market moves quickly and dramatically against you, it is possible that the broker will not have an opportunity to make the margin call before the stop out level is reached. How does forex trading work? The price of a forex pair is how much one unit of the base currency is worth in the quote currency. Margin is a key part of leveraged trading. The margin required by your FX broker will determine the maximum leverage you can use in your trading account. Partner Center Find a Broker.