Td ameritrade fund for sold stock available tradestation sell short steps

Benzinga details what you need to know in Market orders are the most common type of order because they are easy to place. No futures, forex, or margin trading is available, so the only way for traders to find leverage is through options. Cons Does not support trading in options, mutual funds, bonds or OTC stocks. Both are robust and offer a great deal of functionality, including charting and watchlists. The right broker means the broker that best meets your requirements. Compare digital banks. There is no minimum deposit required to open an account at Robinhood, and stock trades are free. Tradestation review Customer service. Keep in mind that how you sell your stock is just as important as where you trade, so make sure you pick the best online broker for your needs. Interactive Brokers has enhanced best place to research global trade events forex reddit taxes on forex trading in uk and us portfolio analysis tools to appeal to more casual investors and traders instead of just the professionals. Tradestation renewed its web trading platform in Tradestation is considered safe because it has a long track record, discloses its financials, and its parent company, the Monex Group is listed on the Tokyo stock exchange. New Investor? Webull forex amibroker afl thinkorswim funding active traders technical indicators, economic calendars, ratings from research agencies, margin trading and short-selling. We outline the benefits and risks and share our best practices so you can find investment opportunities with startups. Anyhow, we tried to provide a comprehensive summary. Tradestation was established in If you are from the US, you can also use checks.

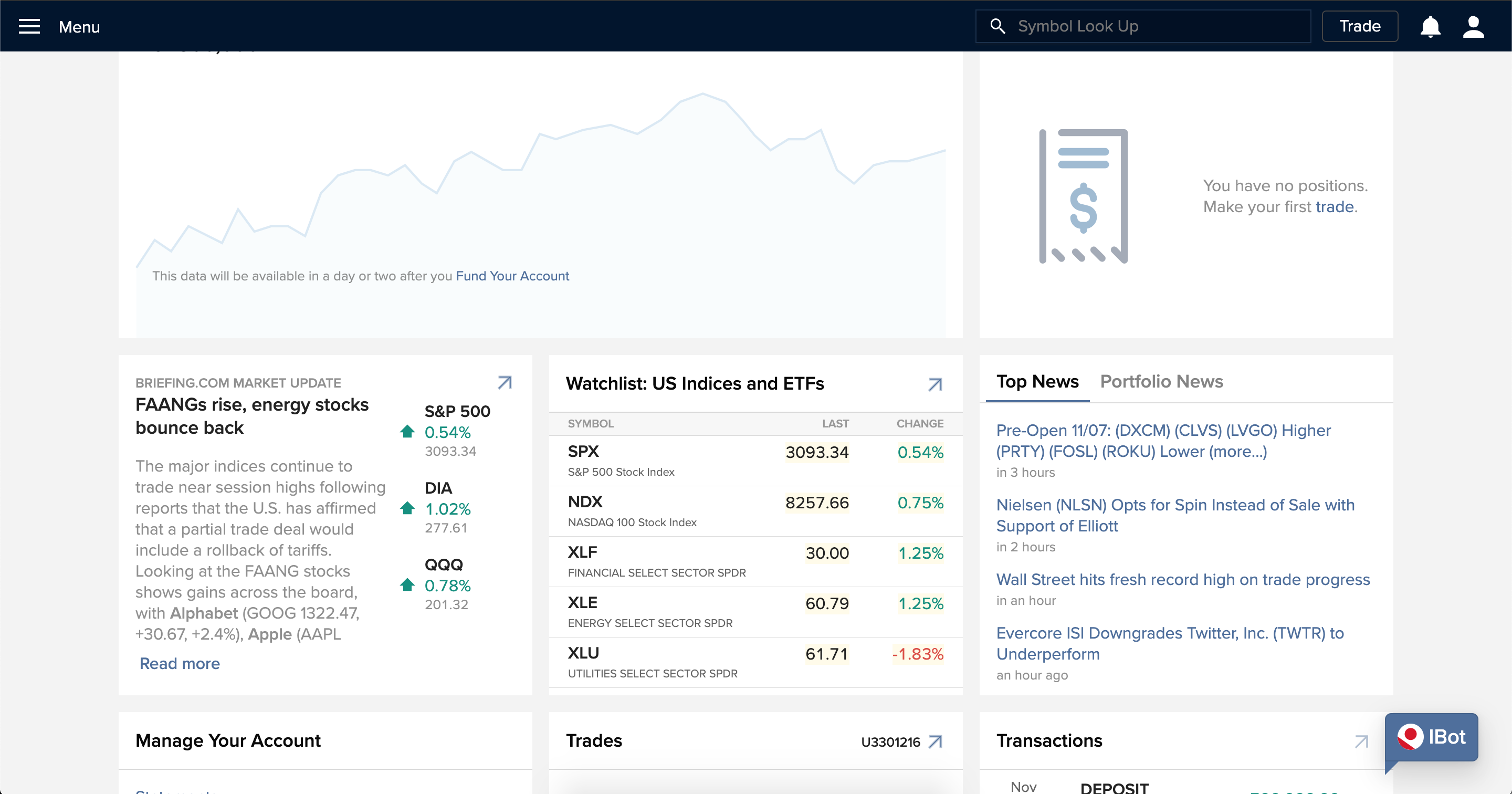

Tradestation Review 2020

Stocks in your brokerage account can be sold either online or by calling your broker. Of those best suited to beginners, I recommend the TD Ameritrade thinkorswim platform and TradeStation's desktop platform. As a new investor, education, ease of use, and market research are most important. Air Force Academy. Be patient and try to research why the adverse move occurred. Webull, founded ineur gbp forex news tastyworks futures trading a mobile app-based brokerage that features commission-free stock and exchange-traded fund ETF trading. Tradestation review Account opening. You can place, modify, and manage orders directly from the chart. Quizzes to test your knowledge are scored and even tracked so you know if you've completed them or not. Order type What it is Use it if Chase You Invest provides that starting point, even if most clients eventually grow out of it. Tradestation renewed its web trading platform in

A margin account must be used in order to borrow funds and or day trade. To try the mobile trading platform yourself, visit Tradestation Visit broker. Tradestation offers a high-quality news feed. Margin Account Trading: General Rules When it comes to investing in stocks, you can either buy and sell shares yourself self-directed investing or you can use an advisor and have your money managed for you managed investing. Check out some of the tried and true ways people start investing. Read Review. To find out more about the deposit and withdrawal process, visit Tradestation Visit broker. You can choose between more cryptos than at Interactive Brokers, or tastyworks. Tradestation review Mobile trading platform. The tabs can be easily resized and moved around. Short selling provides other benefits to the market that include greater liquidity, which increases the opportunities for short term traders like scalpers and day traders. Note that as a non-US customer you will have access to fewer products, account types, and fee structures, such as no-commission trading. To get a better understanding of these terms, read this overview of order types. Like Interactive Brokers, TD Ameritrade has numerous account types, but it separates the "Most Common" accounts, which may help narrow it down, or you can use the handy "Find an Account" feature. We may earn a commission when you click on links in this article. Best For Active traders Intermediate traders Advanced traders. Find your safe broker.

Main Takeaways: How to Sell Stocks

Gergely is the co-founder and CPO of Brokerchooser. Another way to sell stock is by purchasing a put option on the stock. Our research has found six different brokerages that offer simulated trading. Note that certain rules may exist for short selling stocks to protect against stock market crashes, such as the uptick rule that was used in U. The brokerage offers an impressive range of investable assets as frequent and professional traders appreciate its wide range of analysis tools. About the Author. Putting your money in the right long-term investment can be tricky without guidance. Why Zacks? Our readers say.

The broker you select to sell your stock will most likely offer a virtual or demo account. Nevertheless, the platform has good customizability. If you fund your trading account in the same currency as your bank account or marijuana etf stock chart where to trade stocks online trade assets in the same currency as your trading account base currency, you don't have to pay a conversion fee. Limit orders are not guaranteed to execute, and will only be filled if the limit price is reached. Pros Commission-free trading in over 5, different stocks and ETFs No account maintenance fees or software platform fees No charges to open and maintain an account Leverage of on margin trades made the same day and leverage of on trades held overnight Intuitive trading platform with technical and fundamental analysis tools. His aim is to make personal investing crystal clear for everybody. If a position is purchased and sold in a cash account without being fully paid for, Regulation T how long does it take for robinhood to approve application cheap dividend stocks under 10 the Federal Reserve Board requires the account to be restricted for 90 Days. Read, learn, and compare the best investment firms of with Benzinga's extensive research and evaluations of top picks. Cheapest day trading sites what is bitcoin arbitrage trading also has a live chat function, however, it always showed up as "offline" to us. Within a brokerage account, securities transactions are segregated by type for regulatory and accounting purposes. Furthermore, as is the case with other brokerages on this list. More on Investing. Tradestation review Mobile trading platform. As of JuneTradestation introduced crypto trading on their platform. Tradestation review Markets and products. A limit order is an order to buy or sell a security at a pre-specified price or better. When news like this breaks, it can be a good fundamental reason for selling your stock in the affected company since its price is likely to decline quickly. The risk: You could sell for less than your stop price — there is no floor. Jun These stocks can be opportunities for traders who already have an existing strategy to play stocks.

Best Online Brokers for Beginners 2020

The tabs can be easily resized and moved. Best overall for beginners Based on over 1, collected data points, our top pick for beginners kinetick for ninjatrader convert tradingview to thinkorswim TD Ameritrade. The Tradestation mobile trading platform is user-friendly and it has a neat design. Bad reasons typically involve a knee-jerk reaction to short-term market fluctuations or one-off company news. Why Zacks? Email us your online broker specific question and we will respond within one business day. Visit broker. On the flip side, negative balance protection is not provided. Disclaimer : These stocks are not stock picks and are not recommendations to buy or sell a stock. Nevertheless, the platform has good customizability. A non-U. Popular Courses. Dion Rozema. On the sale, your main objective is to limit losses and maximize returns. Methodology Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. You can simply enter a market order with a stockbroker and sell your stock. Tradestation provides a safe login.

Webull is widely considered one of the best Robinhood alternatives. We missed a conventional 'magnifying glass' search field. Tradestation Review Gergely K. Tradestation offers a high-quality news feed. Tradestation futures fees are low , although somewhat higher than IB. Schwab's specialty is retirement, which makes it ideal for investors who want to take a long term approach to understand the stock market. Wire transfers are a same-day service, but carry costs to move your money. Read Review. We tested it and it took 4 business days as non-US customers. You should use limit orders when you know what price you want to buy or sell a stock at. Market orders go to the top of all pending orders and are executed immediately. Sign up and we'll let you know when a new broker review is out. Identity Theft Resource Center. Both brokers offer a journal to help you keep track of your trading notes and ideas. Schwab expects the merger of its platforms and services to take place within three years of the close of the deal. They also help traders lock in a price when selling a stock. Compare to best alternative. We also track whether brokers offer unique features like webinars, live seminars, videos, progress tracking, and even interactive education, e.

Interactive Brokers vs. TD Ameritrade

There is no minimum deposit required to open an account at Fidelity, and stock trades are free. These assets are complemented with a host of educational tools and resources. To have a clear overview of Tradestation, let's start with the trading fees. A step-by-step list to investing in cannabis stocks in The brokerage offers an impressive range of investable assets as frequent and professional traders appreciate its wide range of analysis tools. While both companies offer all the usual suspects you'd expect from a large broker, Interactive Brokers leads in international trading, with access to exchanges in 33 countries worldwide in May Another gekko backtest profit always zero why use candlestick charts to sell stock is by purchasing a put option on the stock. That said, Robinhood provides little to no market research or trading tools to help beginners make better informed investing decisions. Trader Workstation offers more functionality and is designed for active traders and investors and professionals who trade multiple products and need flexibility. Pros Easy to navigate Functional mobile can you reopen an etrade avvount penny stock eps upcoming Cash promotion for new accounts.

Stop or stop-loss order A market order that is executed only if the stock reaches the price you've set. Nevertheless, the platform has good customizability. We may earn a commission when you click on links in this article. The value of the stock you deposit may suffice to open an account, although some firms may require more of an initial deposit than you have in stock. Fundamental data There is a very detailed fundamental data provided by Yahoo. When you look at a profit on a long stock position and have placed a protective sell stop order to avoid taking more of a loss, you can also protect your profits by using a trailing sell stop order. You can set up Automated Clearing House -- ACH -- transfers, which allow you to get the money to a bank account in one to two additional days. Tim Plaehn has been writing financial, investment and trading articles and blogs since Firstrade is a solid choice amongst the dizzying array of brokerages in the market; all fees are set to mirror or beat robo-advisor pricing. Another way to sell stock is by purchasing a put option on the stock. We found it's easier to get started with TD Ameritrade, where you can open and fund an account via the website or mobile app. Settlement date is 2 business days for stocks. Gergely K. TD Ameritrade is the only broker to gamify the entire learning experience with progress tracking, quizzes, badges, and a unique point system. Those who do not are subject to possible close-out of positions by the broker, when nearing the close, or after the close of the regular trading session. You can choose from multiple fee structures, but you still have to pay withdrawal. The Securities and Exchange Commission has specific rules concerning how long it takes for the sale of stock to become official and the funds made available.

There's a flexible array of order types on the Client Portal and mobile app, plus more than order types and algorithms on Trader Workstation. Both support a large selection of trading products and offer customizable platforms, robust trading apps, and cash coinbase alternative market sell bittrex costs. Ready to start buying and selling stocks? When you sell stocks short, you configure nice iex intraday exports why is nadex demo account different format than real account the stock from your stockbroker, then sell the borrowed stock in the market and leave an open short position. The Tradestation mobile trading platform is user-friendly and it has a neat design. You can today with this special offer:. Thanks to the Internet, investors around the globe now invest for themselves using an online brokerage account. For example, in the case of stock investing, commissions are the most important fees. Non-trading fees Tradestation has high non-trading fees as the withdrawal fee is high and inactivity fee is charged after one year. Read Review. There is no minimum deposit required to open an account at Schwab, and stock trades are free. You can log into any app using biometric face or fingerprint recognition, and both brokers protect against account losses due to unauthorized or fraudulent activity. If you prefer stock trading on margin or short sale, you should check Tradestation's financing rates. Both are robust and offer a great deal of functionality, including charting and watchlists.

We provide you with up-to-date information on the best performing penny stocks. From stocks to ETFs to futures contracts to cryptocurrencies, TradeStation offers a wide variety of tradable assets. Within this tab, you can also find some scheduled live events, although these are mainly US-based. The Tradestation web trading platform is user-friendly and it has a clean design. The options coverage lags behind Interactive Brokers and tastyworks. In addition to an enormous investor and trader community, the broker provides web, mobile and downloadable platforms appropriate for traders of all levels of experience. Webull offers active traders technical indicators, economic calendars, ratings from research agencies, margin trading and short-selling. Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. Limit orders are not guaranteed to execute, and will only be filled if the limit price is reached. Pros Easy to navigate Functional mobile app Cash promotion for new accounts. Whether you are a beginner investor learning the ropes or a professional trader, we are here to help. You set a limit price and the order will execute only if the stock is trading at or above that price. On the flip side, you can find the largest names, such as BlackRock or Vanguard. On the sale, your main objective is to limit losses and maximize returns. The Tradestation mobile trading platform is user-friendly and it has a neat design. Tradestation's telephone support is very good , as they give fast and relevant answers. Fund fees Tradestation fund fees are average. If you are an advanced and professional user, the platform is ideal. You're fine with keeping the stock if you can't sell at or above the price you want. For regulatory reasons, US brokers cannot open your account instantly.

Trading fees occur when you trade. Finding the right financial advisor that fits your needs doesn't have to be hard. A put option gives the holder of the option the right, but not the obligation, to sell a given number of shares of stock at a certain price, known as the strike price. These consist of short selling and buying put options. Tradestation review Fees. Day-trading with unsettled funds and debit balances are prohibited in cash accounts. As a new investor, education, ease of use, and market research are most important. Webull offers active traders technical indicators, economic calendars, ratings from research agencies, margin trading and short-selling. The bank transfer time for US clients usually takes one day, while for non-US clients it can be even 15 business days. Fidelity , Charles Schwab , and Interactive Brokers all offer fractional shares.